Hey NavigationTraders!

In this lesson, I want to talk about why your opinion doesn’t matter as it relates to trading options. Not only does your opinion not matter, but nobody’s opinion matters. There is so much garbage out there in the financial media that continues to spew opinions, recommendations, analyst upgrades, and price projections; and it’s all just garbage. It really is.

When I say, “your opinion doesn’t matter”, I’m saying that you need to trade YOUR strategy, and not listen to opinions of others.

NavigationTrading Philosophy

If you have been following NavigationTrading, you know by now the philosophy that we follow. It’s all about strategic positions, utilizing implied volatility as an indicator to enter and exit positions, along with all of the other insights that we teach throughout our courses.

But, what I want to really drive home today is the point that you shouldn’t listen/rely on other people’s opinion. That goes for me, that goes for economists, that goes for the talking heads on CNBC, and that goes for the articles that you read in Money Magazine. Their opinions do not matter as it relates to your trading.

Platform Example

We’re going to walk through an example, and I want to make sure that you understand the point that I’m trying to get across. It’s not that I think, “I was right, they were wrong”. That’s not the point I’m trying to convey.

The point I’m trying to convey, is that you need to choose your strategy, be strategic around that, use high probability trades, understand implied volatility and how that effects your position, and don’t worry about what anybody else is saying.

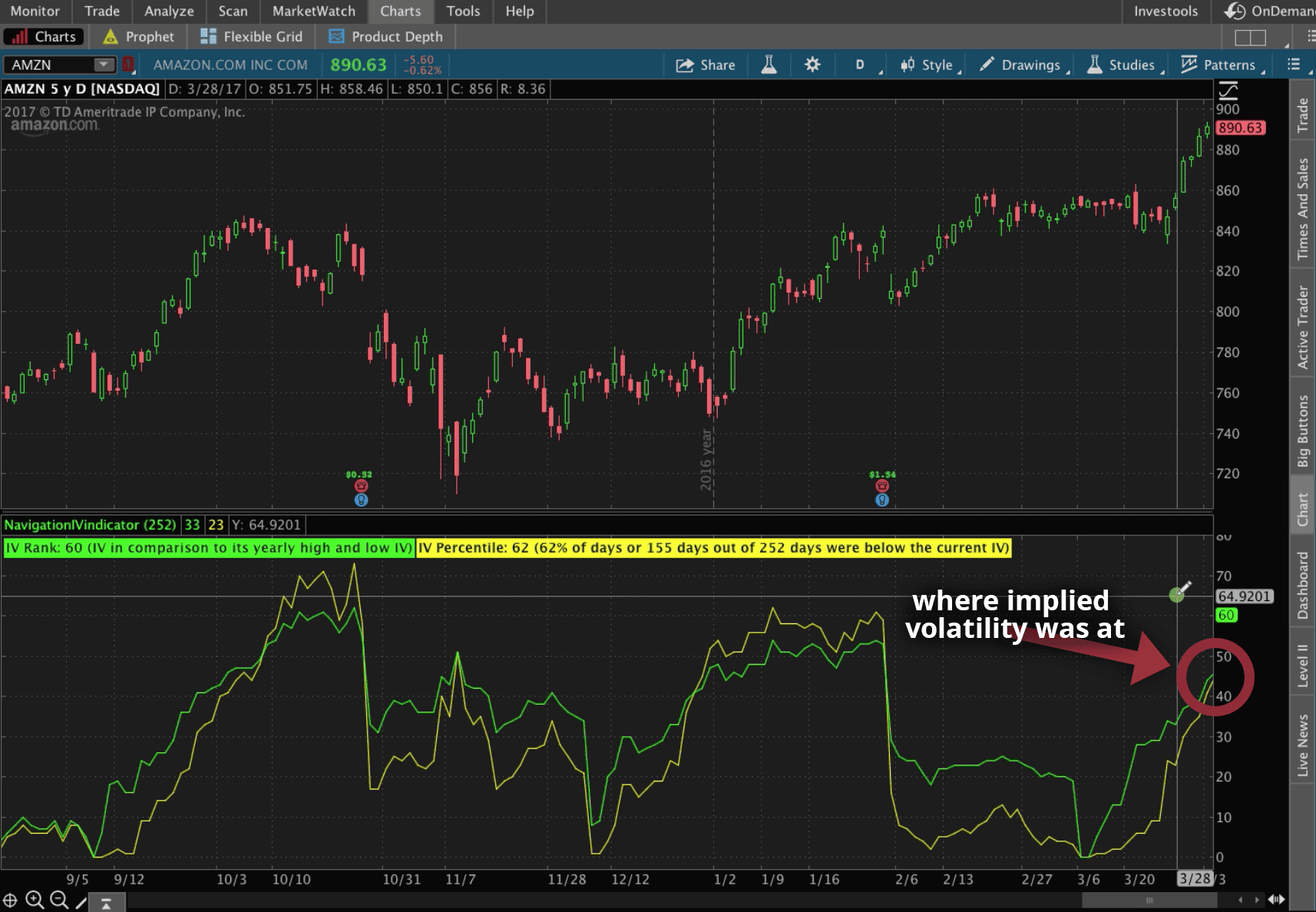

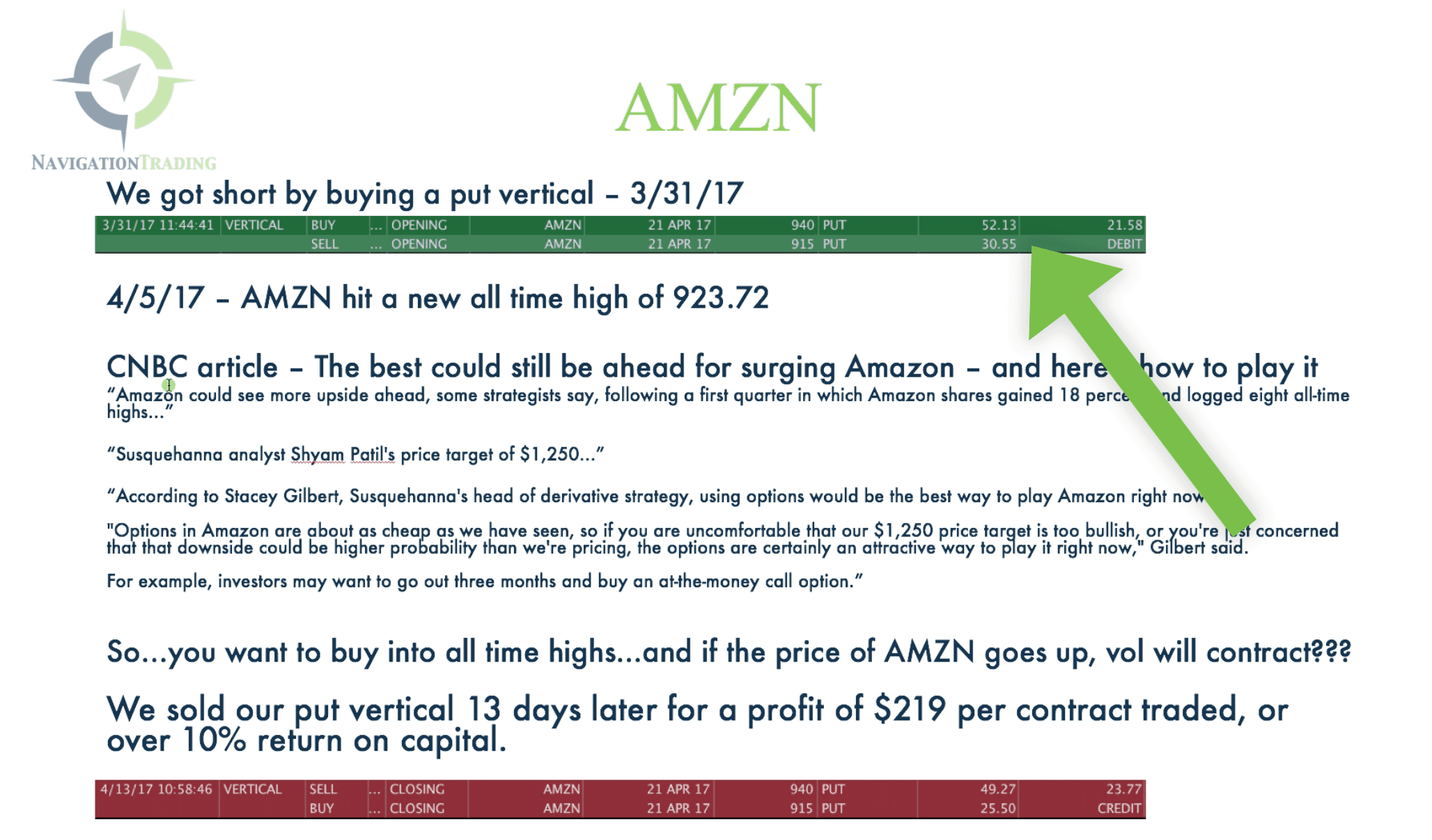

We’re looking at ticker symbol AMZN, and the date that I put this trade on was April 3, 2017. I bought a Long Put Vertical. I had a couple of reasons for doing this.

-

- If Amazon turns around and starts going down, implied volatility is going to continue to rise.

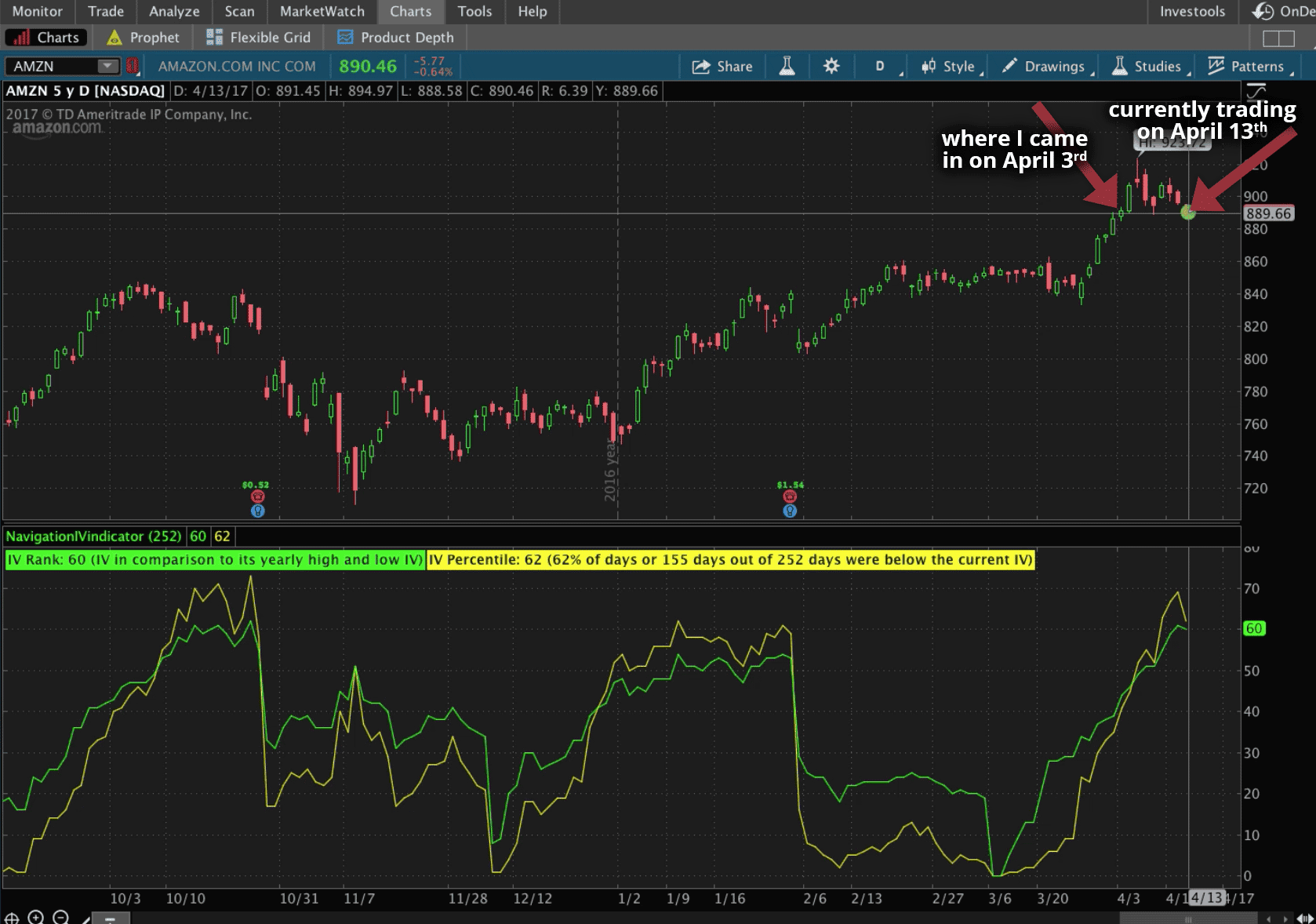

- Implied volatility was under 50. If you follow NavigationTrading, you know that we’re net sellers of premium when implied volatility is over 50. We want to buy verticals when implied volatility is under 50.

My Assumption

Implied volatility at this point was under 50. However, we know that typically when stocks go down, implied volatility goes up. We’d be taking a bearish position on this. My assumption was that Amazon had been on a massive upward run the last few days and at some point over the next 30 to 45 days, we would see a reversal or a little bit of a pullback. That was my strategy.

Again, DON’T follow my opinion. You can follow my strategies, but don’t follow just my opinion.

I put on a Long Put Vertical here on 4/3. Then, on the next day, Amazon shot up again. It had a pretty massive move and I thought, “That’s interesting. This thing’s on a nice tear to the upside”. I was taking a little heat in my position at that point.

I thought, “I should read up on Amazon stock, just to see what people are saying”. I’d like to point out that it’s okay to read articles on positions, on stocks, and on the financial markets. It’ll help you understand what’s going on. But, don’t read articles for opinions or trade suggestions.

Article Example

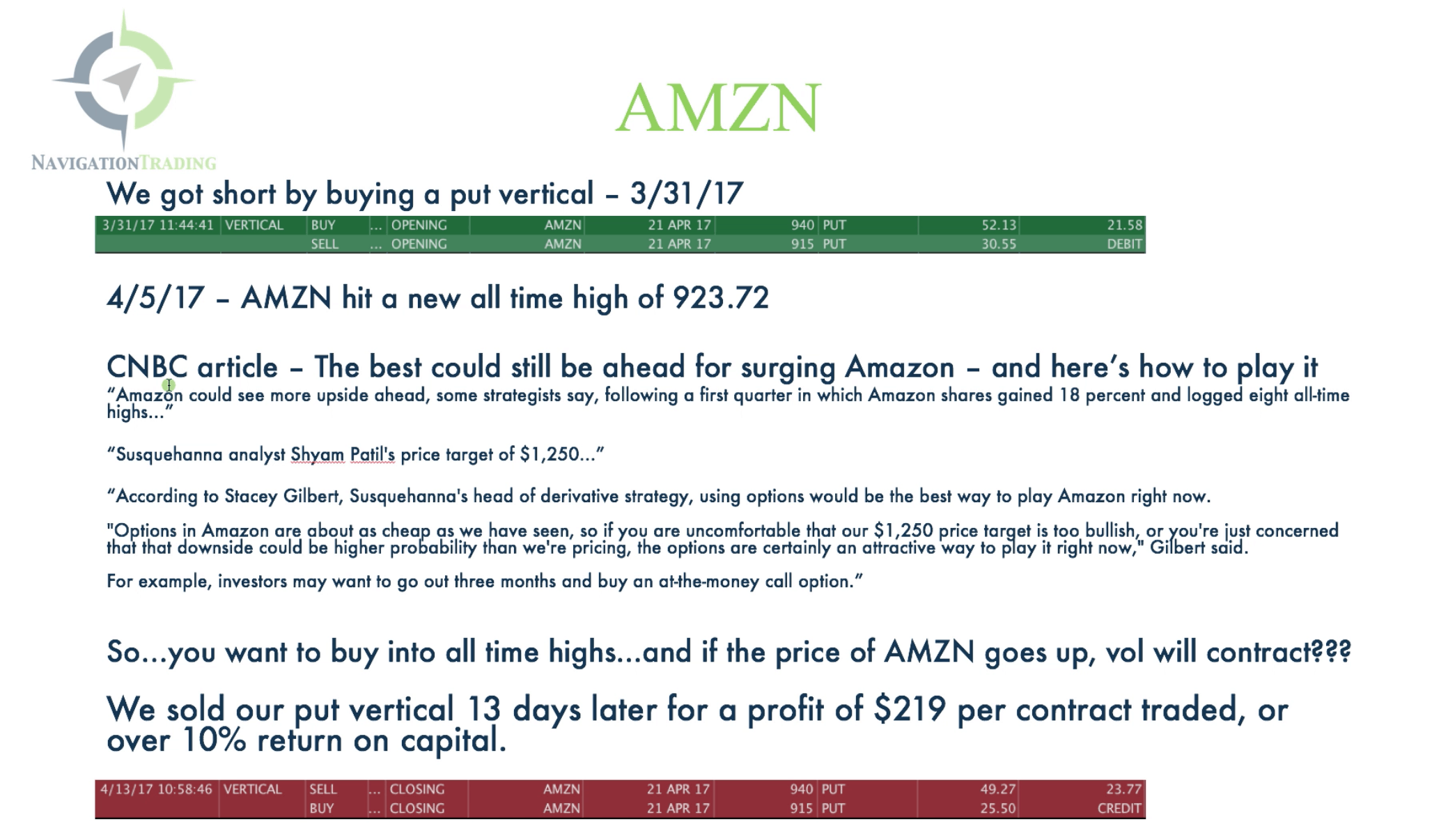

I read an article on CNBC online on 3/31/17. The title of the article was The Best Could Still Be Ahead for Surging Amazon – and Here’s How to Play It. I thought, “Okay. This is interesting. I can’t wait to hear what they have to say”…Do you sense my sarcasm?

Here are a couple of quotes from the article:

- “Amazon could see more upside ahead some strategists say, following a first quarter in which Amazon shares gained 18% and logged eight all-time highs.”

Keep in mind, on this date, Amazon hit a new all-time high. At the time of this recording, it was $923.72.

- “Susquehanna analyst Shyam Patil’s price target of $1,250…”

If you’ve ever read articles and tracked analysts’ projections, they try to jump on where it’s going. If it’s skyrocketing upwards, they’re always going to be putting price targets ahead. If it starts to reverse and fall, they’re going to start putting price targets below. It’s just a follow-the-leader, copycat system and there’s absolutely no merit to it. If you can internalize that, and understand not to follow that stuff, it’ll serve you very well in your trading.

- “According to Stacey Gilbert, Susquehanna’s head of derivative strategy, using options would be the best way to play Amazon right now.”

I’m an options trader. So, I was like, “Okay. Let’s see what this analyst has to say.”

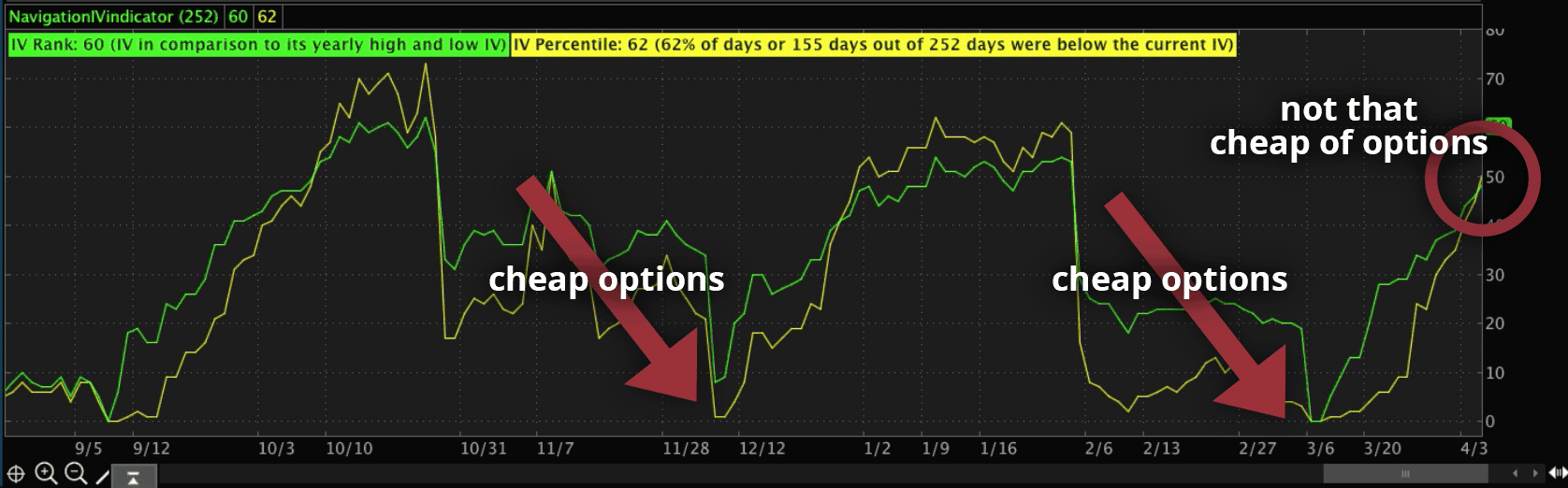

- “Options in Amazon are about as cheap as we have seen them.”

Really? Because if you look at the chart below, you’ll see that’s not true. Look at where the arrows are pointing. Those would be much cheaper options. But right now, really? They’re the cheapest options you’ve seen? Interesting.

- “So if you’re uncomfortable that our $1,250 price target is too bullish, or you’re just concerned that the downside could be higher than we’re pricing, the options are certainly an attractive way to play it. For example, investors may want to go out three months and buy an at-the-money call option.”

Okay. You’re telling us that you want us to buy Calls? First of all, we’ve got earnings coming up in a couple of weeks. If you understand what happens to the options after the earnings announcements, volatility gets crushed. This kills the value of a Call.

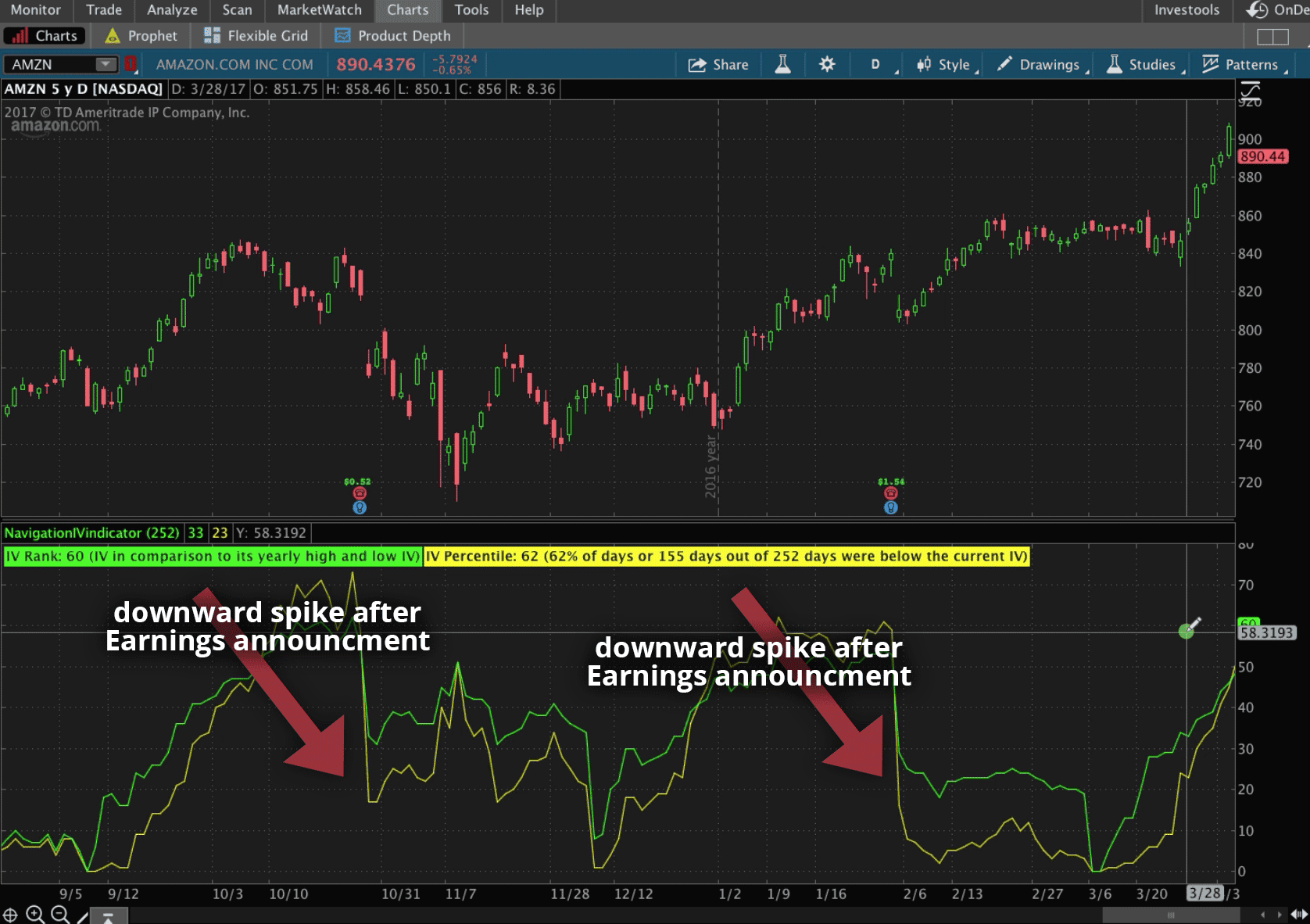

See the graph below. We get a crash right after earnings are announced. That happens after every earnings announcement. They’re telling us we need to buy an at-the-money Call and prior to earnings announcements? Interesting.

I read through this article and I’m just like, “This person obviously has no idea how implied volatility effects options, but yet they’re the head of derivative strategies for a huge investment firm?”.

So, they want us to buy a Call into all-time highs, and if the price of Amazon goes up, volatility will contract. That will hurt our position. You want us to do it ahead of earnings where volatility will contract. That will HURT our position.

Unless Amazon has a two standard deviation move to the upside, on top of trading at all-time highs, that’s really the only way you’re going to profit from this at-the-money Call that they’re recommending in this article.

From the article example, you can see I’m short Amazon. I’ve got a Long Put Vertical Spread that I placed on 3/31. Let’s see what happened to Amazon in the next few days.

Amazon went up again initially. It started topping out and then it started to go down. It didn’t go down by all that much. Look at where we’re at today, April 13th. I got in on 4/3. I took some heat in the beginning, but Amazon did come back down.

It’s basically trading at the very same area that I entered. I was bearish and it didn’t even go below where I put the trade on. I did take the trade off today. I sold my vertical. I originally bought it for $21.58 and sold it at $23.77 thirteen days later for a profit of $219 per contract traded. If you traded 10 contracts, that’s almost $2,200. That’s over a 10% return on capital in 13 days.

Again, the point of this lesson is not to say, “I’m right, they’re wrong”. Because guess what? This price target of $1,250, that could still happen. That at-the-money Call that they’re recommending, that could still be profitable. It’s definitely not the strategy I would take even if I thought the stock was going up.

However, who knows? This analyst could be right over the next few months. I’ll have to check it and see what ends up happening just out of curiosity.

Recap

The point of this lesson is, their opinion doesn’t matter. Had I had this position on, read this article two days later and took it seriously, I may have thought, “Oh my gosh, this expert says that Amazon’s going to $1,250. I must’ve made a mistake. I’m going to get out of this trade and take a loss”. Well, I didn’t do that, right? Their opinion doesn’t matter, so I did not take their advice. I stuck with my position. I stuck with my strategy and placed a position that benefited from implied volatility.

Like I said, the price of Amazon didn’t even go down and I put on a bearish position, yet I made over 10% return on capital in less than two weeks.

I hope this lesson has been helpful! I want you guys to get in the mindset of really taking to heart the saying “your opinion doesn’t matter”. Economist’s opinion’s do not matter, analyst opinion does not matter, other trading gurus who make these price projections and market predictions, their opinion does not matter. I know I’ve beaten a dead horse with that saying, but if you can internalize that and get strategic around your positions like we teach at NavigationTrading, it’s going to benefit you in the long run.

If you’d like to learn more about the different strategies that we use to make consistent returns, sign up for our $1 14-day Pro Membership trial. You’ll have instant access to all Pro Member resources. This includes all of our VIP course training and our NavigationALERTS sent via email and sms text message. You’ll get the Navigation Watch List, which is a list of the most profitable symbols to trade for each type of strategy. You’ll have access to our indicator package, plus so much more. There’s incredible value in our Pro Membership, and we want to prove that to you guys with our $1 Pro Membership trial offer.

We look forward to seeing you on the inside!

Happy Trading!

-The NavigationTrading Team

Follow