Short Put vs. Long Put Options: Understanding the Basics

Learn the fundamental differences between short put options and long put options. This guide explores the mechanics, risk profiles, and strategic implications of these key options trading strategies!

Introduction

Hey everyone, welcome to today’s video where we’ll delve into the fundamental differences between short put options and long put options in options trading. Whether you’re a beginner exploring the world of options or an experienced trader, understanding these concepts is crucial for building a strong foundation in options trading strategies.

Exploring Short Put and Long Put Options

Short put options involve selling a put option, while long put options involve buying put options. This distinction plays a significant role in determining your trading strategy and risk profile.

Short Put Options

When you sell a put option, you’re taking a bullish stance, expecting the underlying asset’s price to rise. This strategy involves collecting a premium upfront but comes with the obligation to buy the asset at the strike price if assigned.

Long Put Options

On the other hand, buying a put option reflects a bearish outlook, anticipating a decline in the asset’s price. While your potential loss is limited to the premium paid, you have the right to sell the asset at the strike price if the market moves in your favor.

Risk Analysis and Strategy

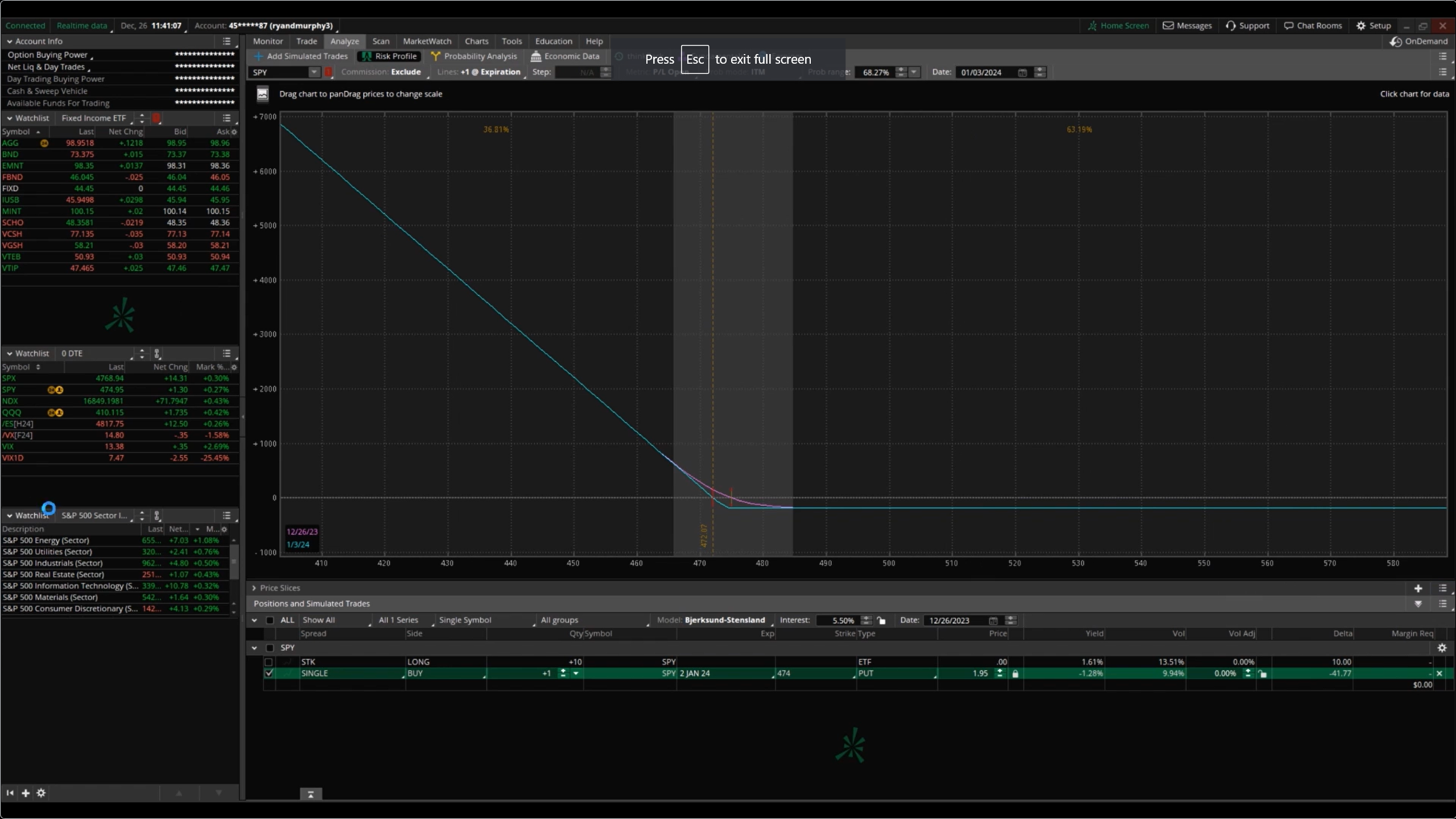

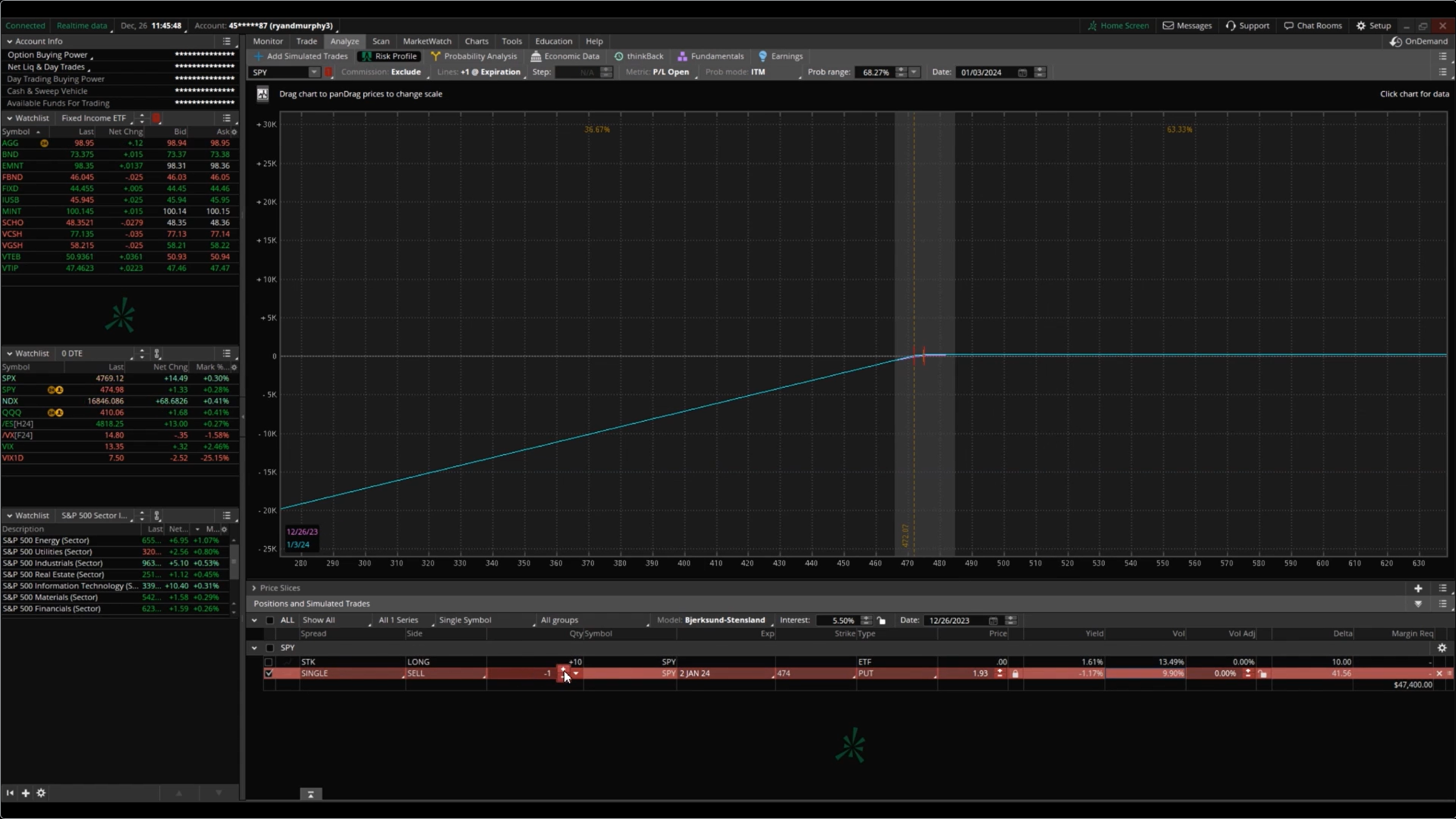

Analyzing the risk profile of short put options and long put options is crucial. This tool is incredibly useful in pointing out things such as:

– Maximum gain, maximum loss, and break-even points for each strategy

– Considerations for managing risk and adjusting strategies based on market conditions

– Comparing the strategies’ risk-reward profiles and suitability for different market scenarios

Risk profile graph of a long put.

Risk profile graph of a short put.

Conclusion and Further Exploration

In conclusion, short put options and long put options offer distinct opportunities and risks in options trading. It’s essential to understand their mechanics, risk profiles, and strategic implications before implementing them in your trading portfolio.

For more in-depth discussions on options trading strategies, check out our other videos in this series.

Follow