Short Call vs. Long Call

Watch this short video and read the blog post below to learn about the differences of Short Calls vs. Long Calls!

Short Call vs Long Call Options: A Beginner’s Guide

In this guide, we’ll explore the differences between short call options and long call options. Building on the insights from our “Short Calls vs Long Calls” video we aim to provide you with a clear understanding of these strategies, whether you’re new to options trading or looking for a refresher. Understanding these fundamental concepts is crucial for anyone starting their journey into options trading.

.

Options Trading Basics for Beginners

Before we delve into short and long call options, let’s establish a strong foundation for beginners in the world of options trading. Options trading primarily revolves around two core types of options: call options and put options. Within these categories, traders have the flexibility to either buy (go long) or sell (go short) these options.

.

Short Call Options: Going Bearish

Let’s begin our exploration with short call options, a strategy commonly associated with a bearish bias. When you sell a call option, you are essentially placing a bet that the underlying asset’s price will not significantly increase. Keep in mind that selling naked calls, meaning selling without protection, may not be allowed in some accounts due to the potential for unlimited losses.

.

Long Call Options: Embracing Bullishness

On the flip side, long call options represent a bullish approach. When you buy a call option, you express your belief that the asset’s price will rise. This strategy offers the potential for unlimited gains, although it requires you to pay a premium upfront.

.

Visualizing Your Trades

To help you grasp the dynamics of short and long call options, let’s visualize them on a graph, much like we did in our video:

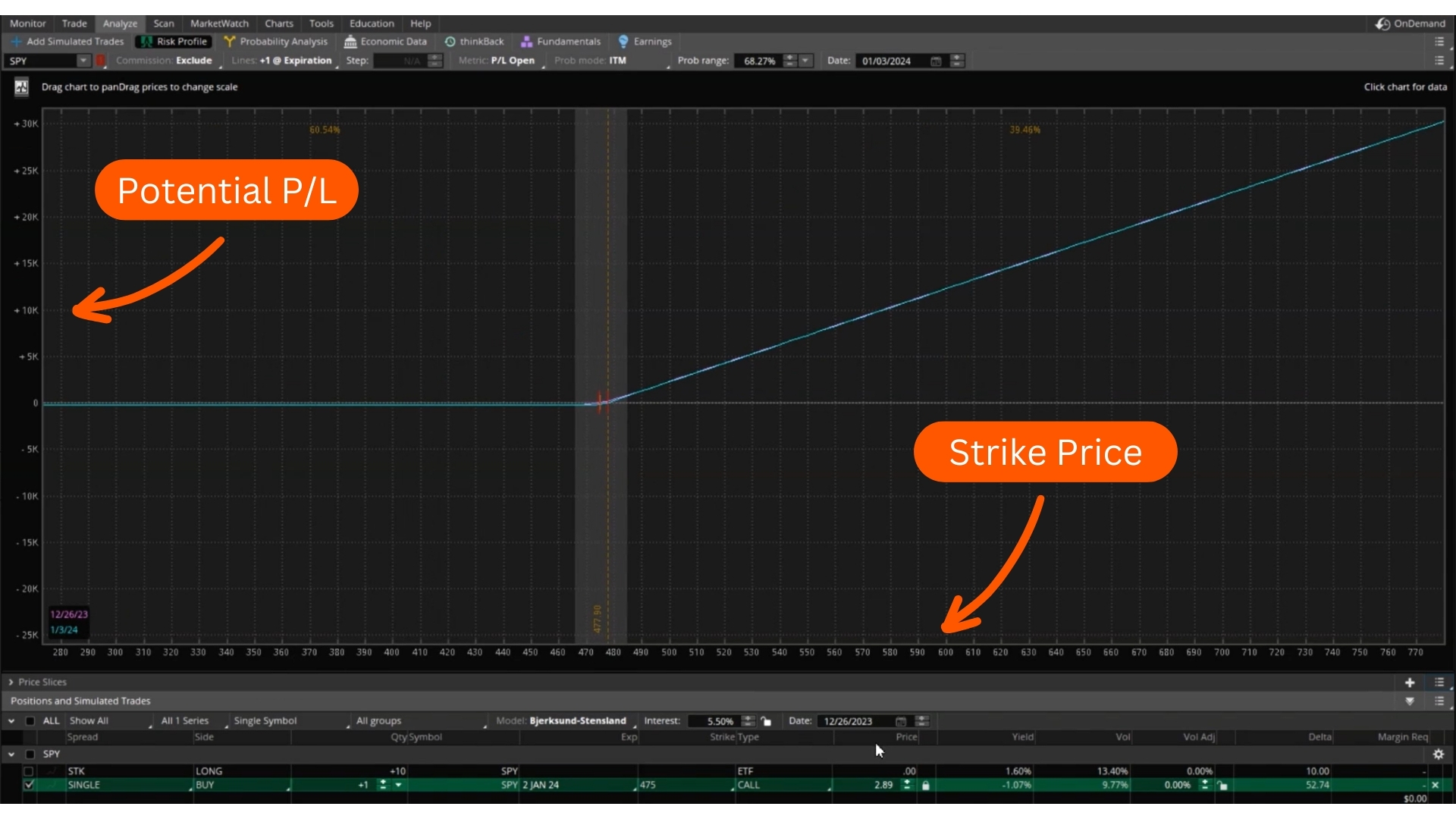

Long Call Example

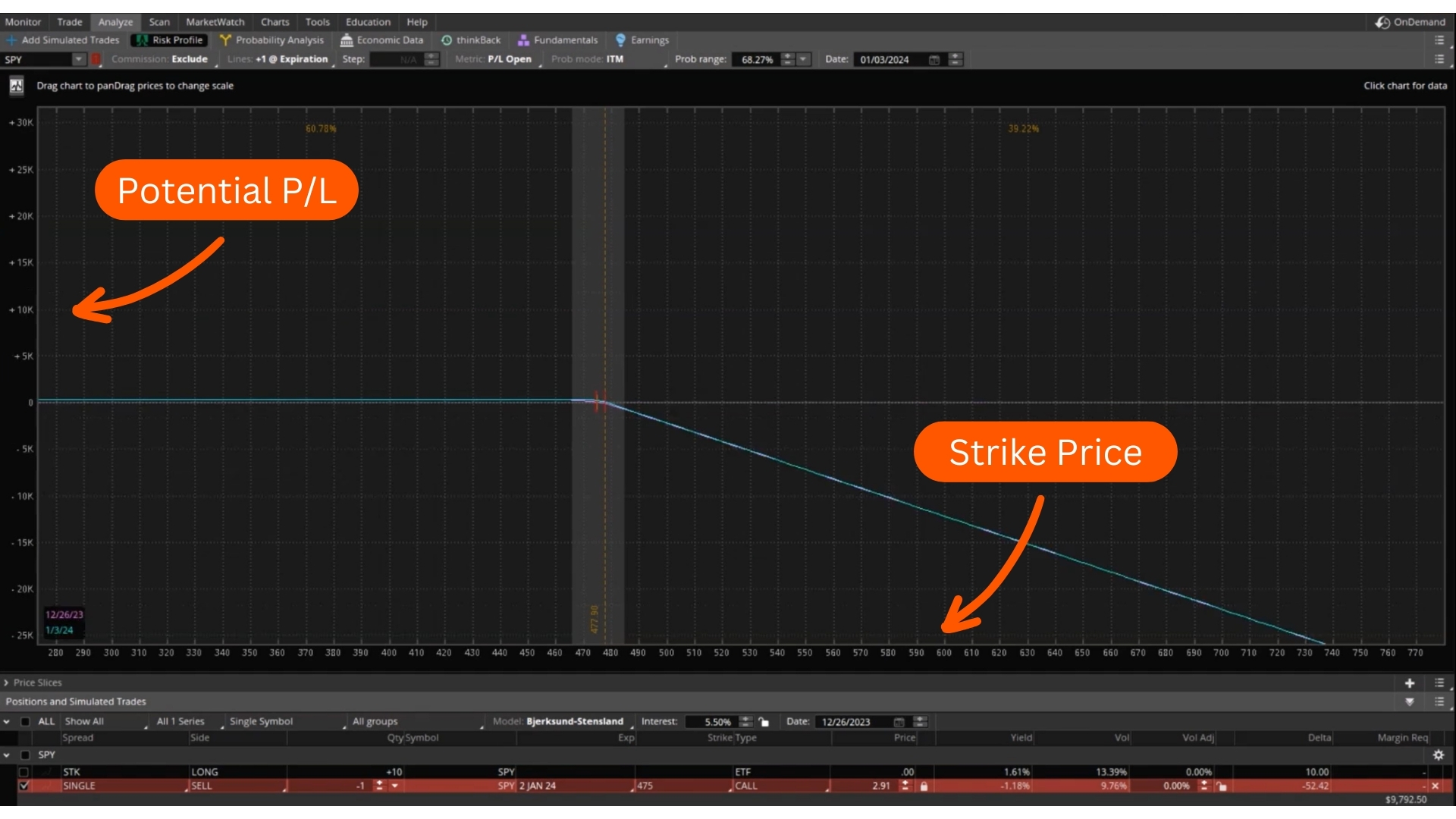

Short Call Example

.

These graphs illustrate potential profit and loss on the Y-axis, measured in thousands, and the strike price of the security on the X-axis. As you can see, short and long call options have distinct risk-reward profiles.

.

Risk Management Strategies

In the world of options trading, you have the power to manage your risk and reward. By employing strategies that cap your gains and losses within a specified range, you can align your trading approach with your risk tolerance and market outlook.

.

Conclusion and Next Steps

Options trading is a captivating realm offering a multitude of opportunities. Beyond grasping the nuances of short calls vs. long calls, there are numerous strategies and concepts to explore. As you continue your journey into options trading, it’s essential to understand your account’s trading privileges and your personal risk tolerance.

For more in-depth insights into options trading strategies, terminology, and practical applications, we invite you to join our vibrant Options Education Community. Our community is dedicated to providing valuable resources and fostering a supportive environment for both novice and experienced traders.

Thank you for joining us on this educational journey. Be sure to stay tuned for more valuable content and happy trading!

Follow