What’s up, NavigationTraders!?!

I want to review our trades for the month of October. It was a wild and crazy month, with a lot of volatility!

Before I jump into reviewing our trades, let’s go to the platform and go over what exactly happened this past month.

October Crash

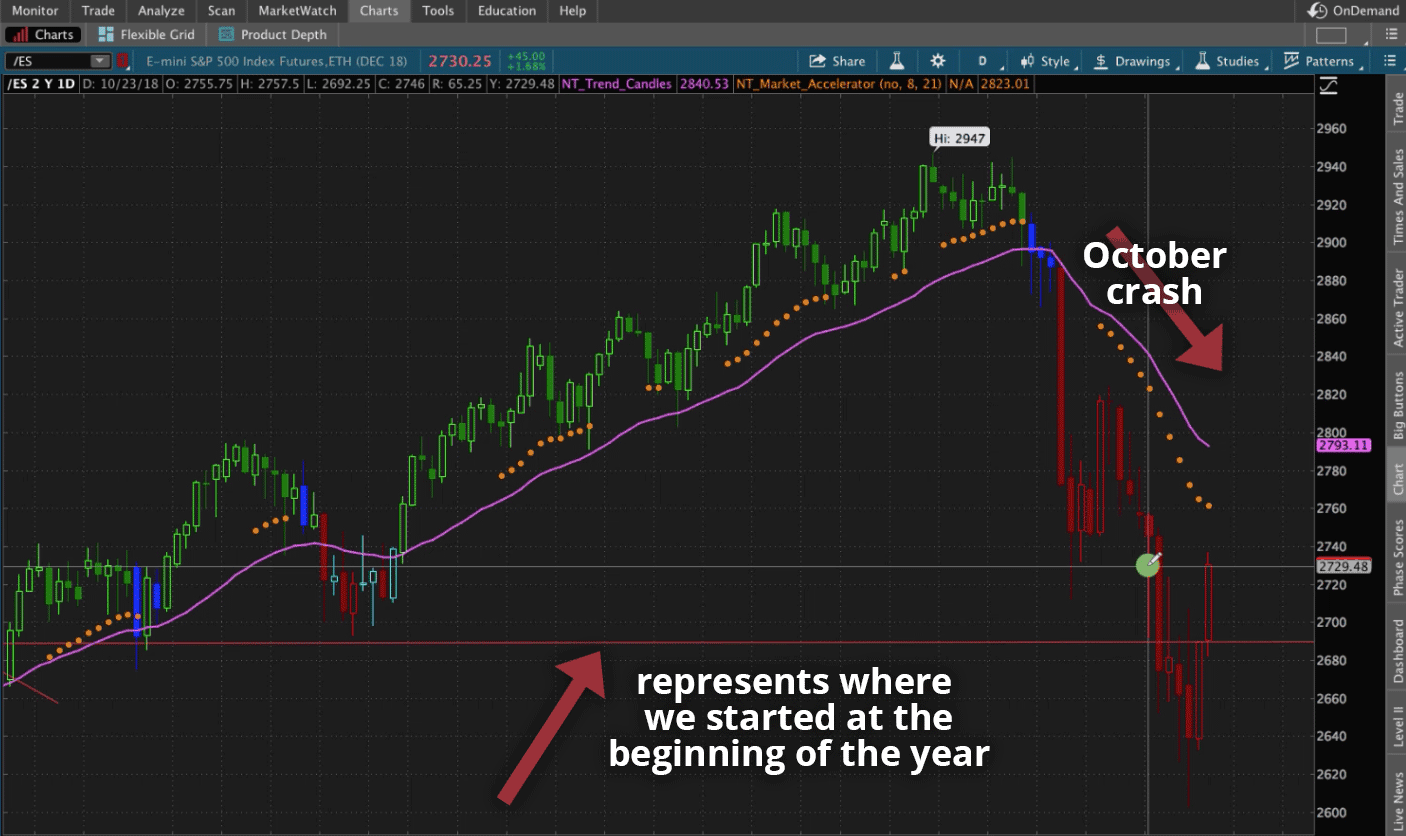

S&P 500

This is a chart of the S&P 500, and the red line represents where we started January 1st of this year.

The market was up about 10% or so for the year, and then it came crashing down in the month of October. It’s slightly above that now, but think about this. If you were invested in an S&P 500 index fund, you’re returns are basically flat for the year.

Bonds

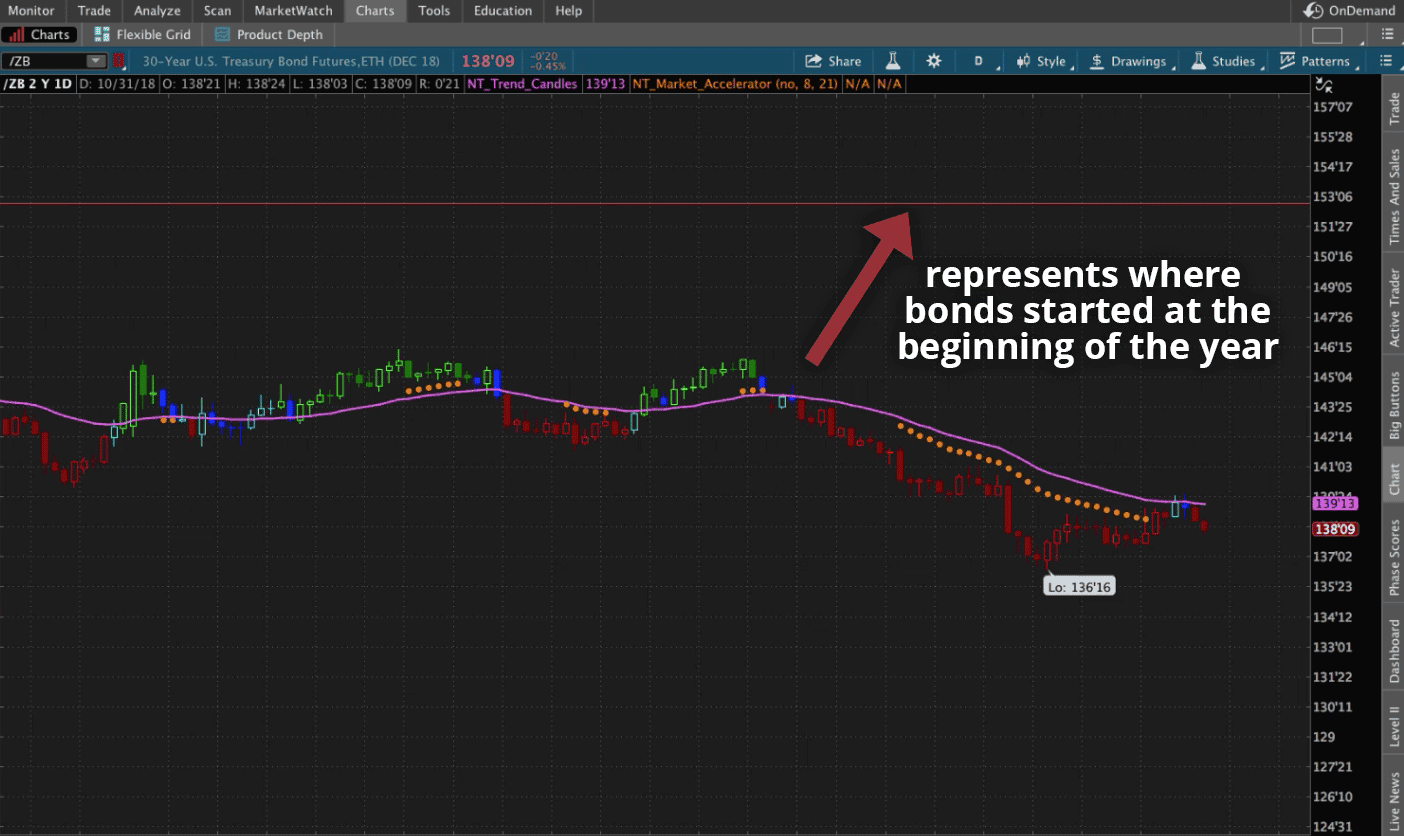

Let’s look at bonds, because a lot of people are invested in them as well. Advisors will put their clients in a traditional stock and bond portfolio, maybe you have 70% stocks, 30% bonds or something similar.

Look at where bonds are trading!

The red line represents where we started in the 30-year bonds at the beginning of the year. You can see that bonds are down for the year.

A lot of people, in traditional investing, think that bonds are safe, and a lot of times don’t realize that they could actually go down. Those people are seeing their bond portfolio down significantly for the year.

If you have a mix of stocks and bonds, there’s a good chance that your portfolio is negative on the year.

But, if you’re a NavigationTrader, that is not the case. Our portfolio is up almost 40% year to date!

Let’s jump into our October trades to give you an idea of our performance this month.

October Performance

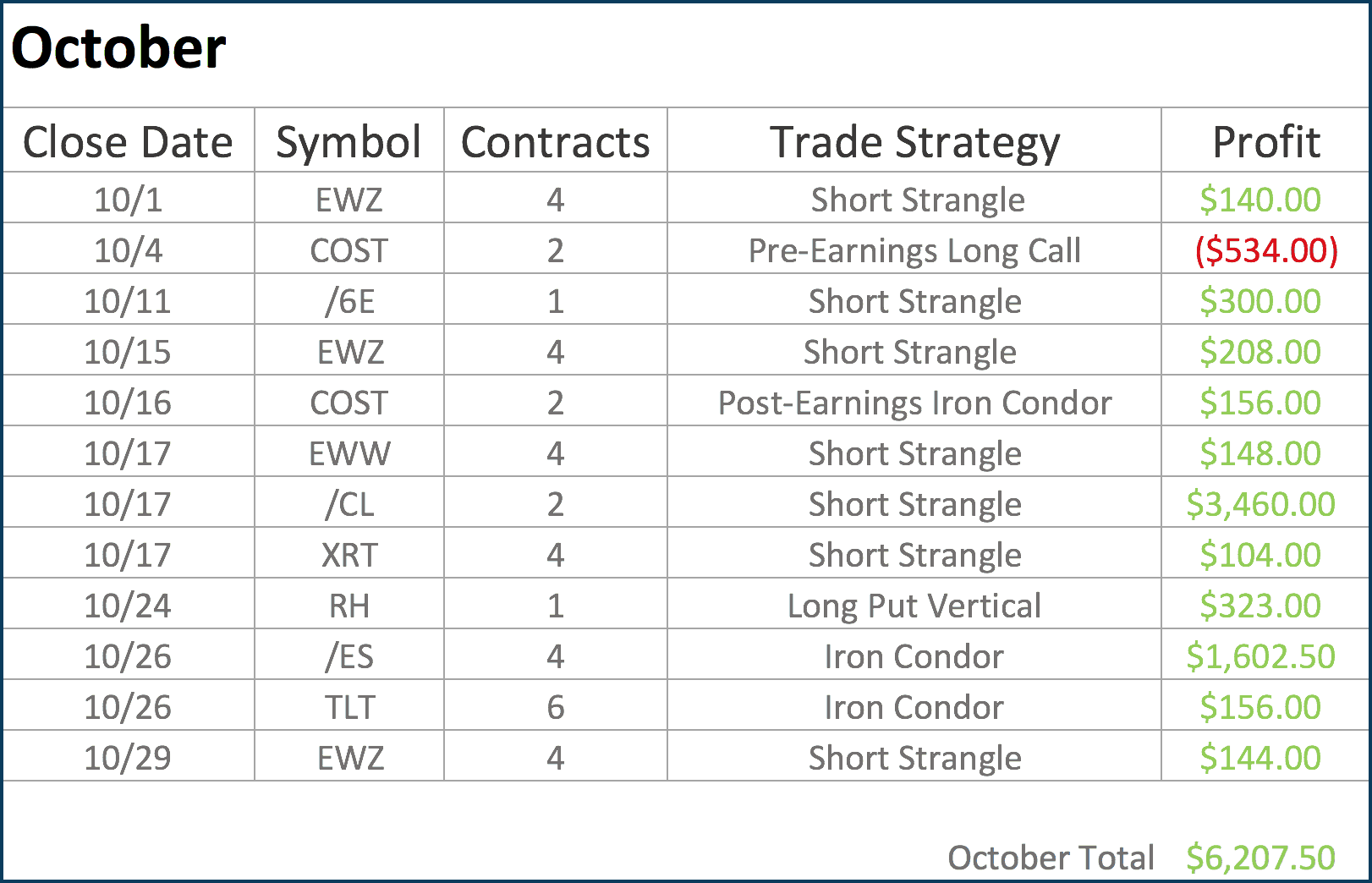

We had 12 closed trades, 11 of which were winners.

Our total profit came in at just over $6,200.

That makes this the largest, most profitable month that we’ve had to date since we started posting our alerts.

Profit just continues to get better with volatility. There’s no better time to be trading the strategies that we teach than right now. We LOVE, LOVE, LOVE volatility.

Here are the different strategies that we traded in October:

- Short Strangles

- Iron Condors

- Long Put Vertical

- Pre-Earnings Long Call

- Post-Earnings Iron Condor

Overall Performance

You can jump over to our performance page, and take a look at where NavigationTrading’s performance is year to date.

So far in 2018, we’ve closed 130 trades. Our average profit per trade is $272, with a win rate of over 91.5%. That’s better than nine out of ten trades are winning!

When you’re on our performance page, you can scroll down to each past month’s performance. They go all the way back to June of 2017, which is when we first started posting these trades. We haven’t had a losing month yet.

In-Depth Look at Each Trade from October

Let’s take a look at the trades from October.

As you can see, we had 12 closed trades in October. We had just one loser, which was in Costco. We’ll go over each of those trades in a little bit more detail from inside the Member’s Area.

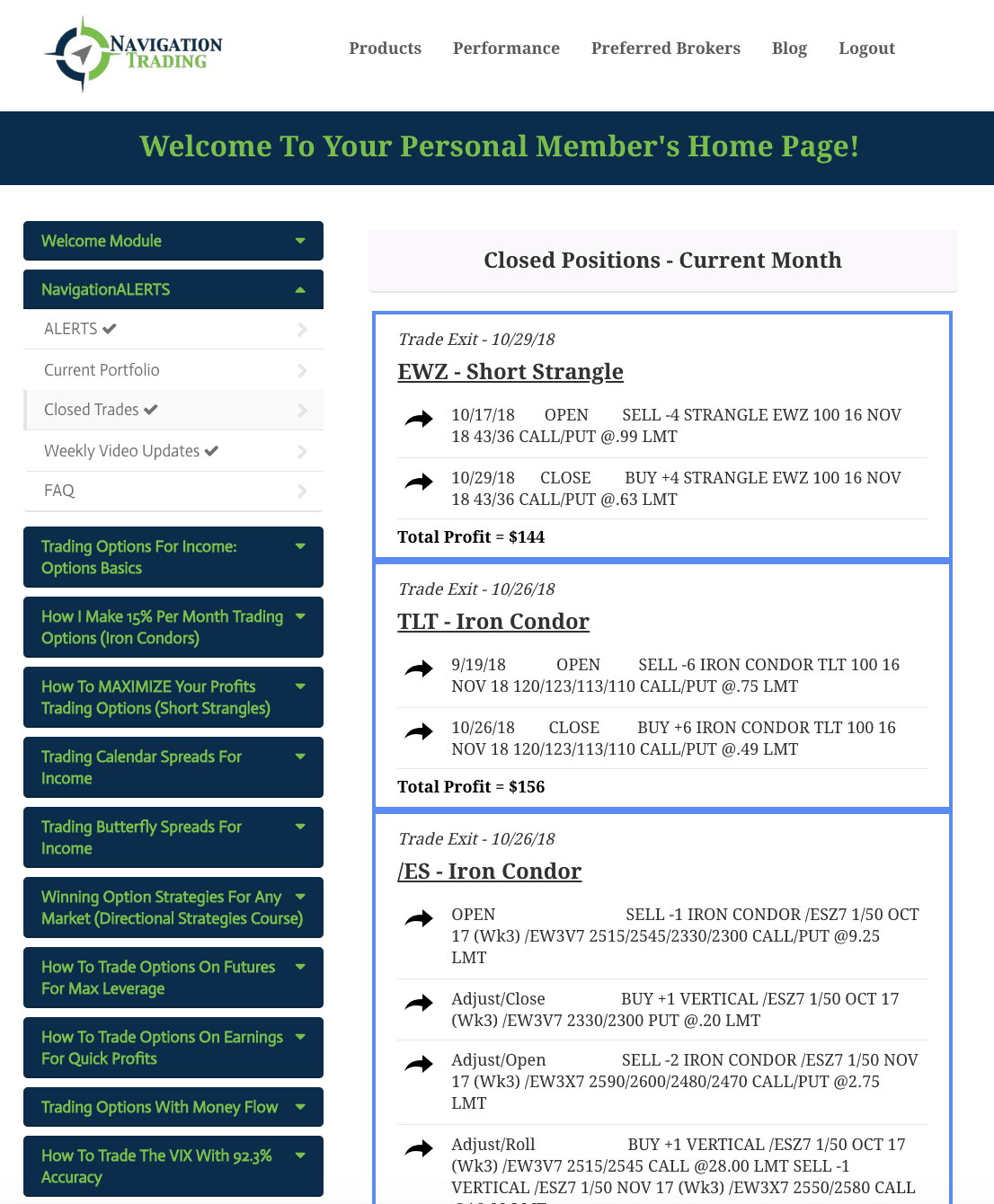

If you are a Pro Member, this is what your Member’s Area will look like.

From the Member’s Area, you have access to all of our VIP course training, from Iron Condors to Short Strangles, Calendar Spreads, Butterflies, Directional Earnings and so on.

You also have access to the NavigationALERTS tab, where we post all of our trade alerts on top of sending them to our Pro Members via email and text message.

You have access to our current portfolio, and our closed trades.

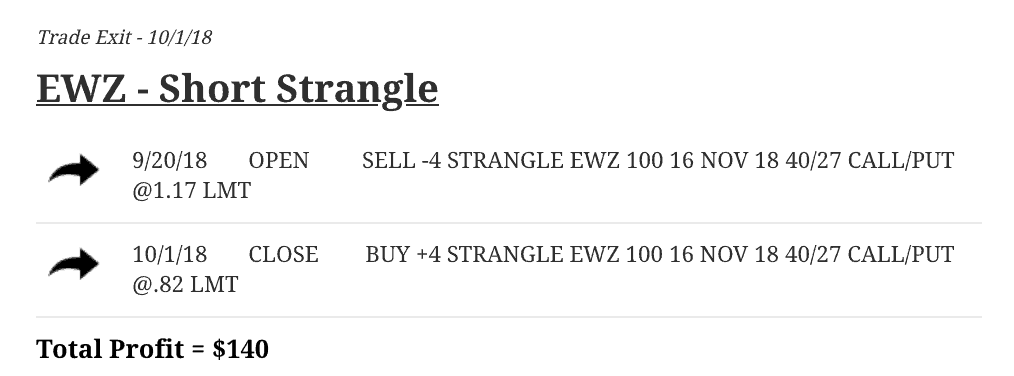

Our first trade of the month was a Short Strangle in EWZ. We had this on for about 11 days, and booked a profit of $140.

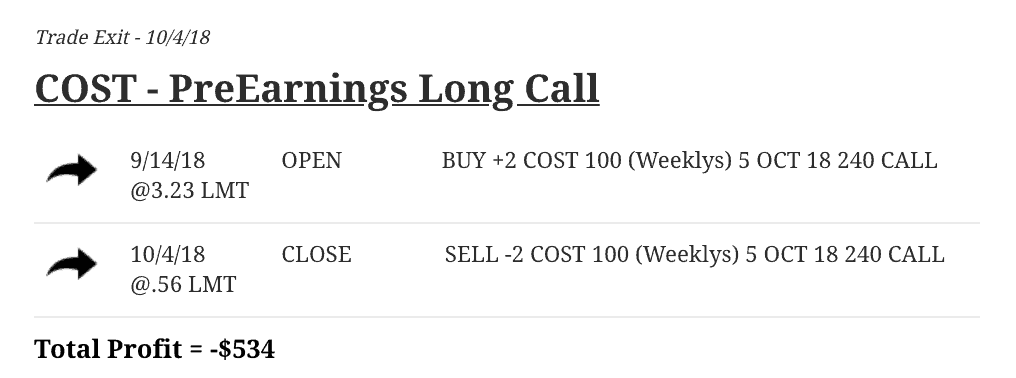

The next trade that we closed was in Costco on 10/4. It was a Pre-Earnings Long Call. This trade just did not work out for us. We were in this trade for almost three weeks and lost $534 on that trade. That was our one loser for the month.

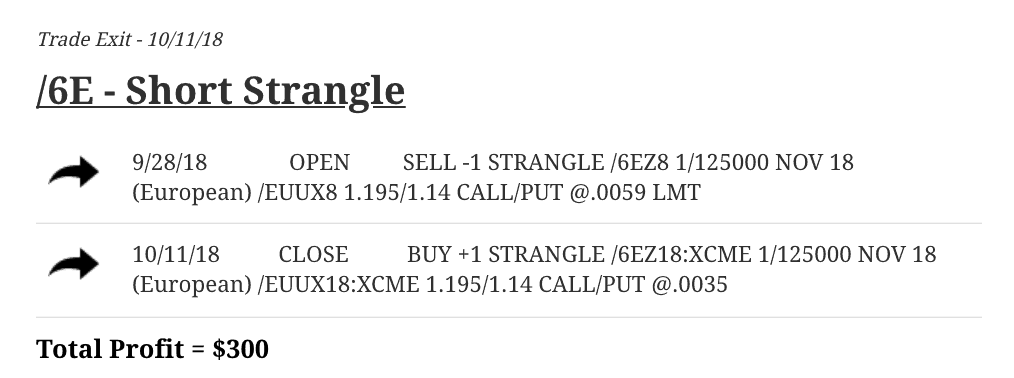

In /6E, which is the Euro, we did a Short Strangle. We were in this trade for about two weeks, and made right at $300.

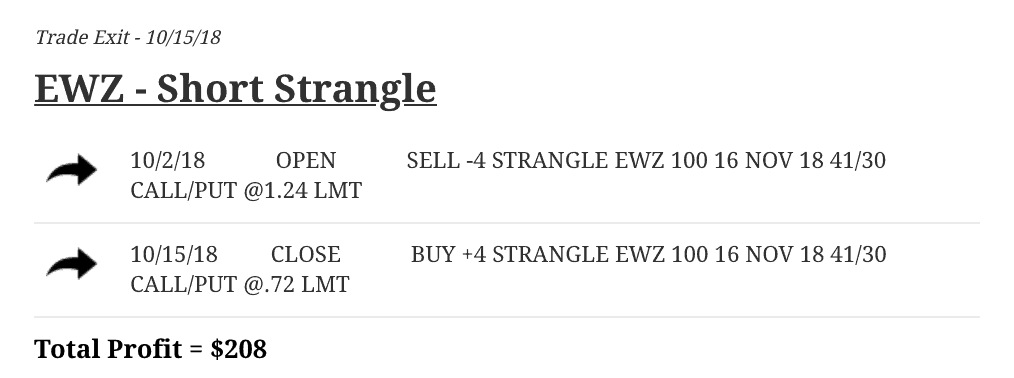

In EWZ, we traded another Short Strangle. We were in this trade for just a couple of weeks, and made a profit of $208.

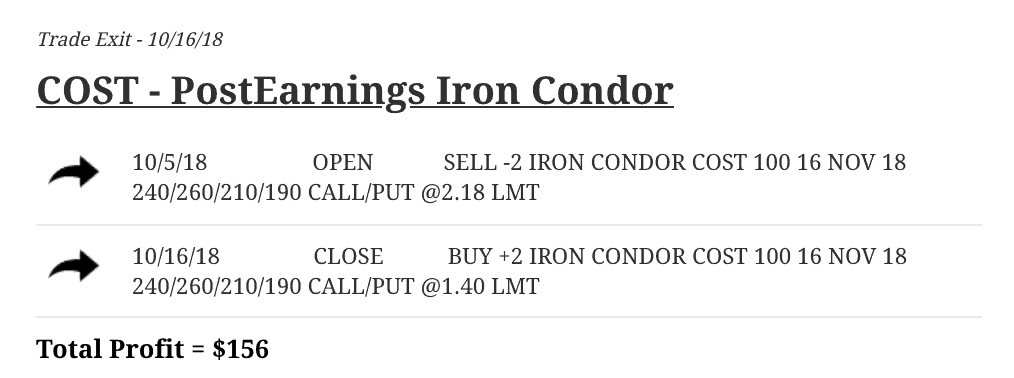

In Costco, we got some of our money back with this trade. We were in this trade for less than two weeks, and booked a profit of $156 on a Post-Earnings Iron Condor trade.

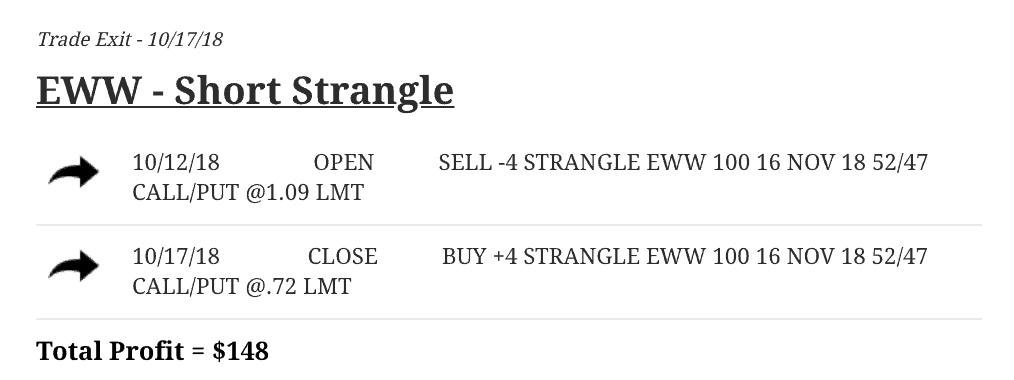

Then in EWW, which is the Mexican ETF, we did a Short Strangle, and booked a profit of $148.

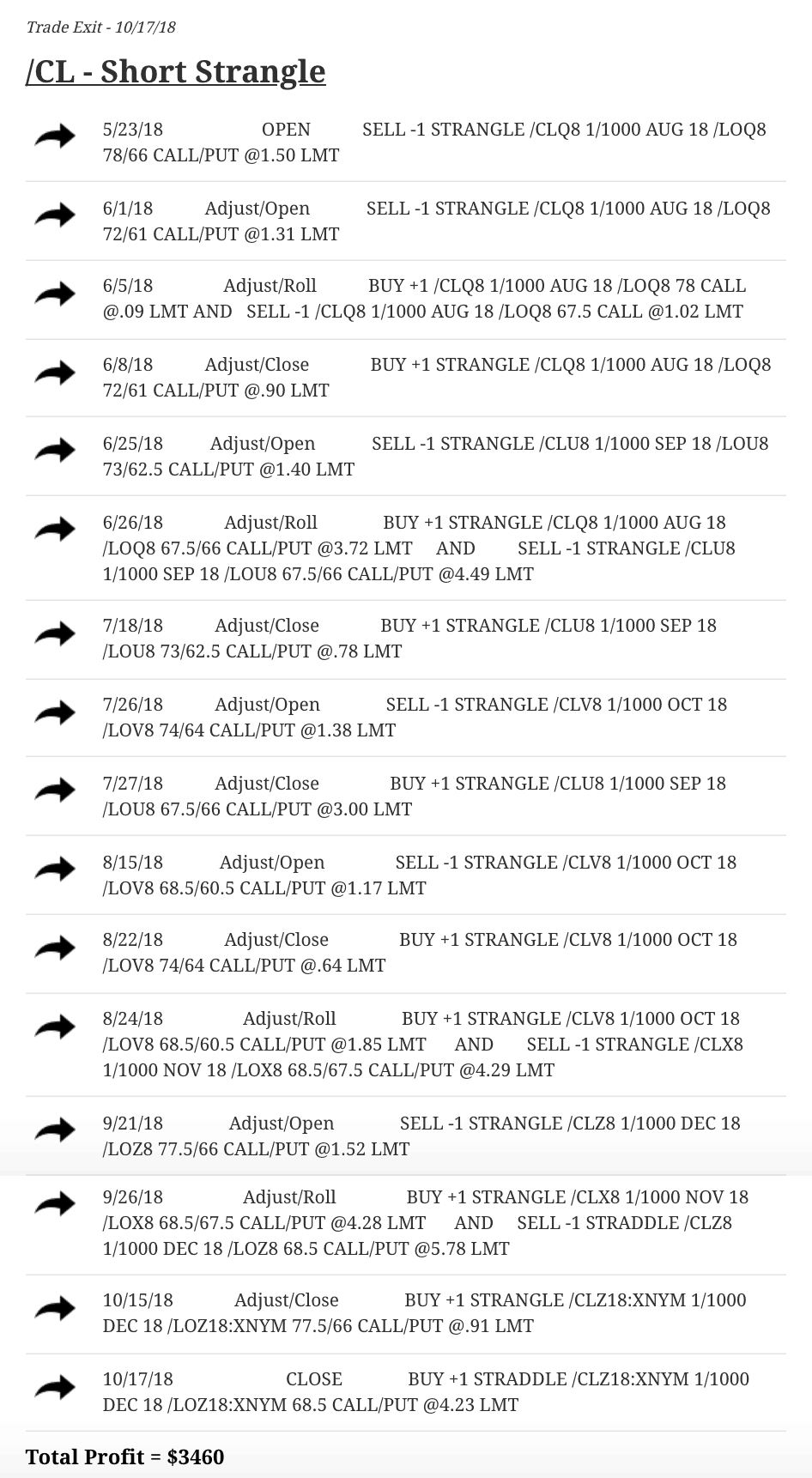

Our biggest winner was in oil, with a profit of $3,460.

This was a Short Strangle, and we actually first entered this trade back at the end of May. We never had more than two contracts on at any given time, but price would move and we’d add another one, and price would move back and we’d book a profit on the other one. Price just kept bouncing around, and we kept adding and taking off pieces of the trade.

Again, we never had more than two contracts on at any given time, which equates to less than $4,000 of buying power.

Just by staying mechanical, we booked an incredible profit of $3,460 on this trade.

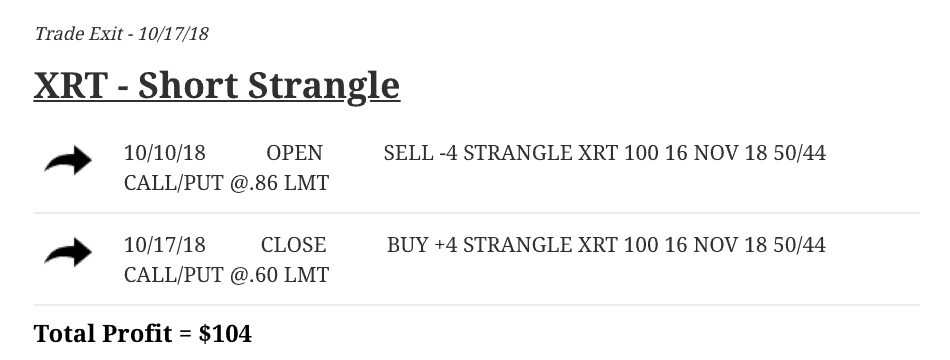

Our next trade was a Short Strangle in XRT. It made $104.

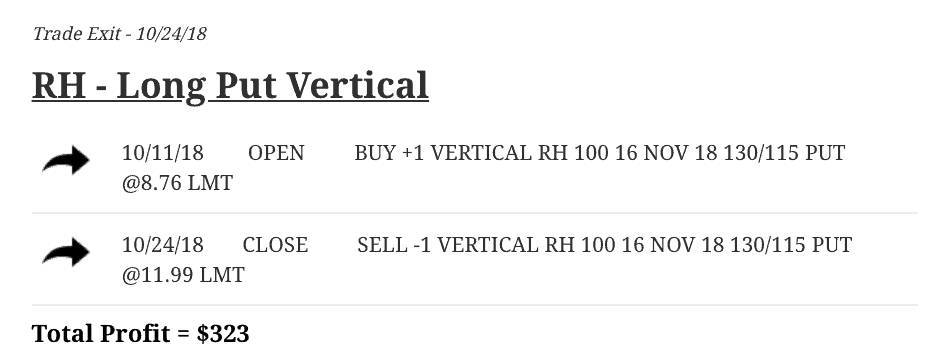

In RH, which is Restoration Hardware, we did a Long Put Vertical, and booked a profit of $323.

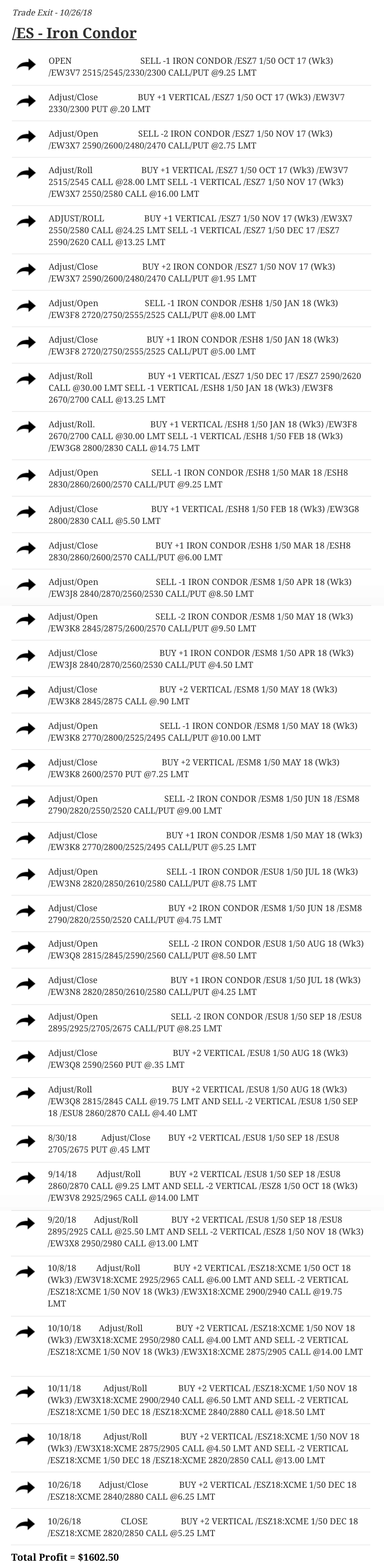

In the S&P 500, we had another big winner of over $1,600. This was an Iron Condor in /ES.

We’d been in this trade for over six months, but it’s kind of the same story as the oil trade. We never had more than four contracts on at any given time. You can see we started out with one, then added another piece with two, and then took off, added, took off, added, and continued to roll.

We got a nice move down in October, which helped our position, and we ended up booking a profit of over $1,600 on that iron condor. By staying mechanical with your adjustments, you can really accumulate these credits and book a really nice profit.

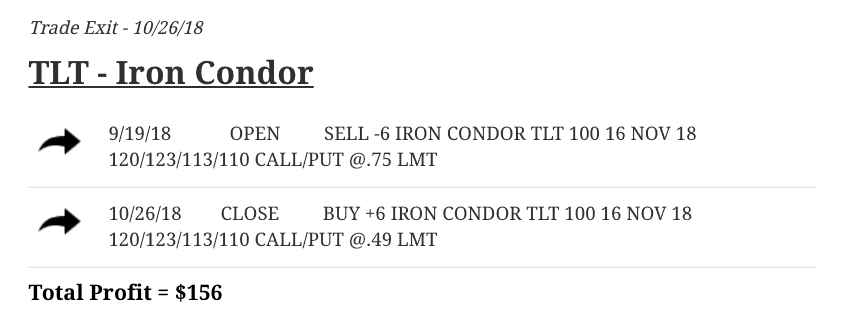

In TLT, we did an Iron Condor, and booked a profit of $156.

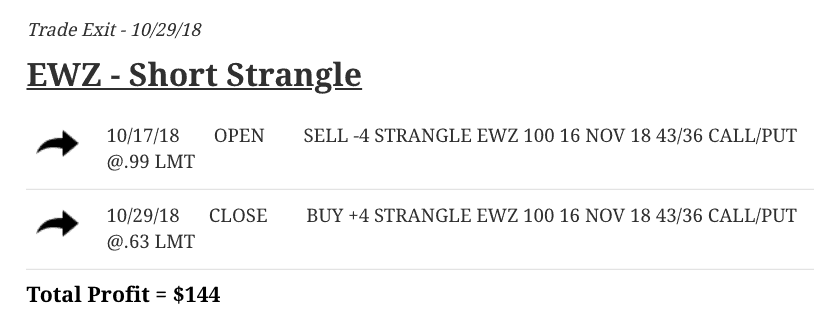

Lastly, in EWZ, we did a Short Strangle, and booked another profit of $144.

It’s been another phenomenal month of trading for our Pro Members!

We are open to new members right now, if you want to check it out just go to https://navigationtrading.com/pro-trial. Our 14-day Pro Membership trial is only $1 right now. You’ll get so much value out of this trial, and it’s only a dollar. Check it out!

Like I mentioned earlier, with implied volatility extremely high right now, there is no better time to be trading these strategies than right now. We hope to see you on the inside!

Happy trading!

-The NavigationTrading Team

Follow