Hey NavigationTraders!

I hope you had a great month of trading in July!

I want to take some time and share with you our results this month at NavigationTrading. We had 16 closed trades, 15 of which were winners, and a total profit of $4182.75.

Keep in mind, we are trading this portfolio with minimal contracts because we want you to understand that you can achieve successful results even with a smaller account.

We do have members who are trading 5-10 times the number of contracts that we’re showing. You can just simply multiply your profits depending on your account size.

One of the keys to our success is the different strategies that we trade and the diversification of those strategies. We’re not only diversifying our symbols and the time in our trades, but we’re also utilizing different strategies.

We had a great mix this month of Short Strangles, Iron Condors, Long Calls, Short-Put Verticals, Pre-Earnings Long Calls, Pre-Earnings Long Straddles, Post-Earnings Short Put Verticals, and Post-Earnings Short Strangles.

If those names don’t mean much to you, don’t worry. We teach all of these strategies step-by-step in our Pro Membership. Just go to navigationtrading.com/pro-member to check that out, and see it’s for you. If you want to test it out, we have a trial going on for just $1!

Before we jump into specific trades from the month, I want to recap where we’re at for the year of 2018. So far, we have closed 90 trades. Average profit per trade, including winners and losers, is $224. We’re currently at a 90% winning percentage. So, of those 90 closed trades, 81 of them were winners. Only nine losers so far this year. Every month we post all winners and losers going back to the beginning of when we first started posting, which was in June of last year. We continue to have excellent profitable months, month-after-month. If you want to check that out, just go to navigationtrading.com/performance.

July 2018 In-Depth Trade Results

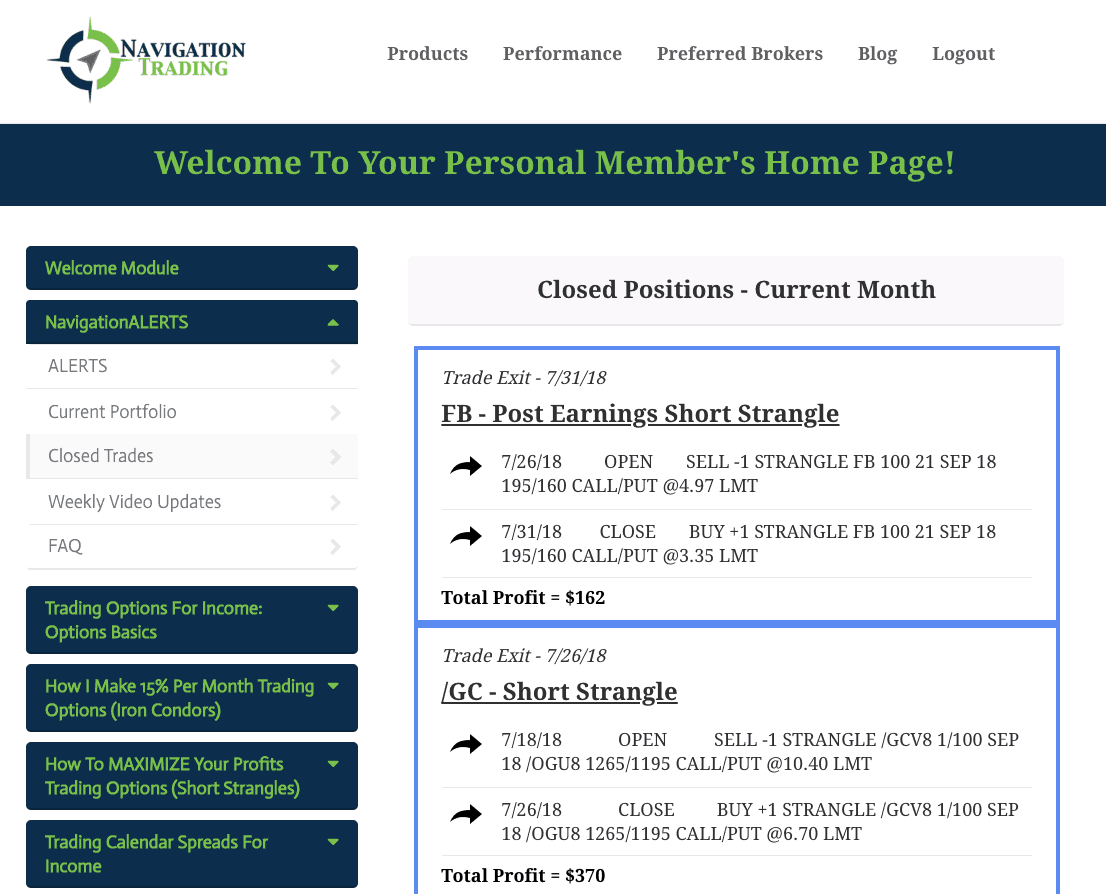

Let’s jump into the trades from this month and I’ll give you a little recap of what happened. We’re going to navigate to the Member’s Area, click on the “NavigationALERTS” dropdown menu on the left sidebar, and then select “Closed Trades” We’re going to scroll down until we reach the beginning of July.

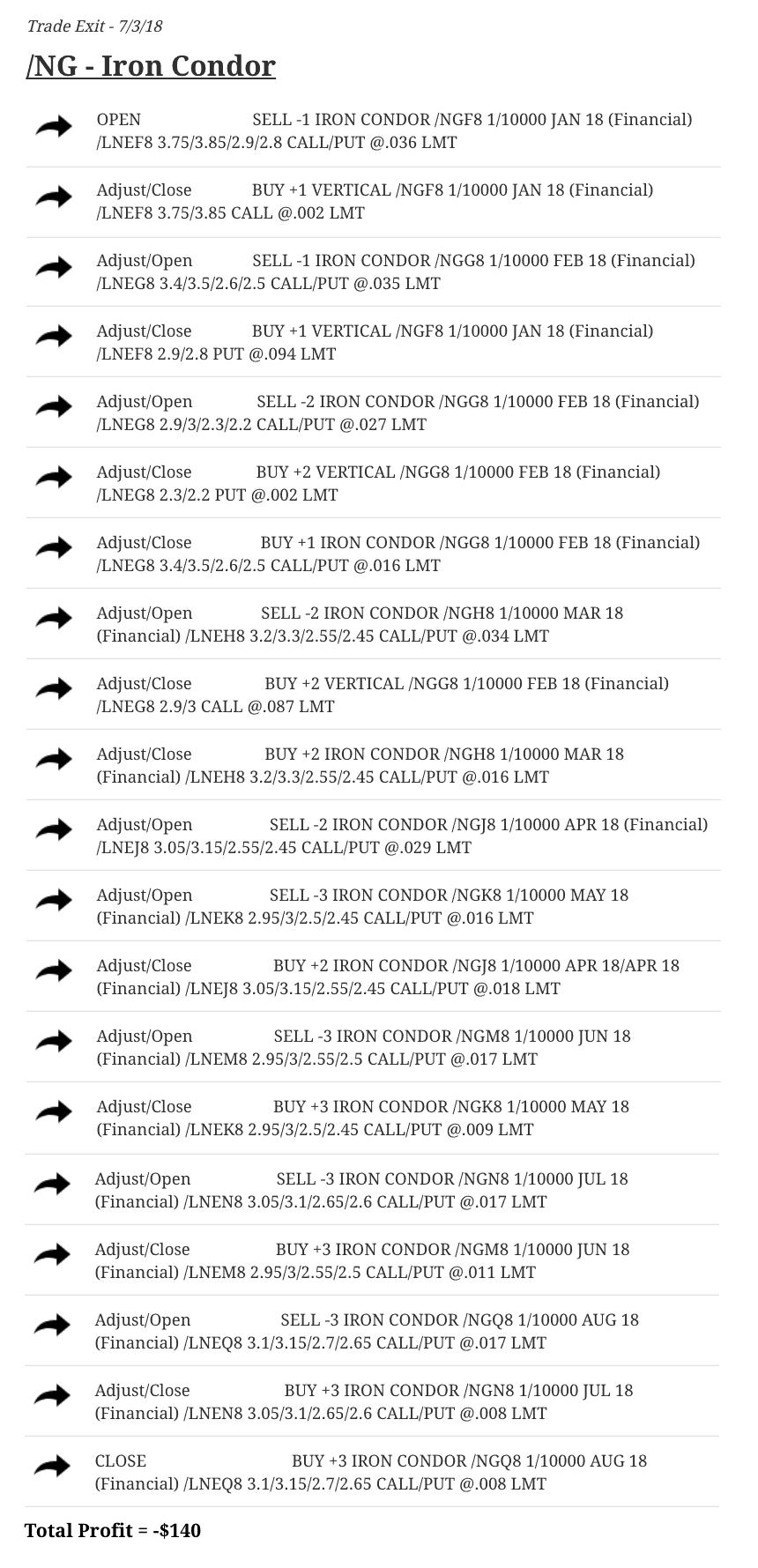

Our first trade was a natural gas Iron Condor. This is one we had been in for several months and were kind of battling, managing, rolling, opening, closing trades. This ended up being our one loss for the month at $140.

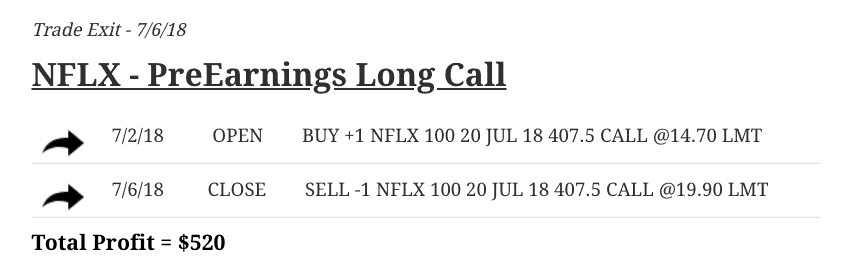

Our next closing trade was in Netflix. This was a Pre-Earnings Long Call. We did exactly what we teach in our course (https://navigationtrading.com/earnings) and booked a quick profit of $520 in just four days.

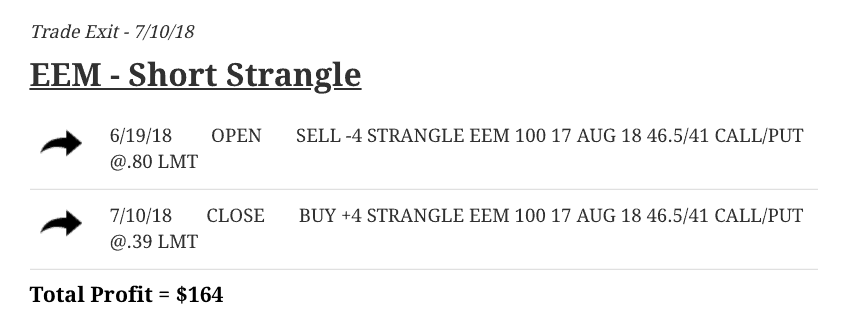

We had a Short Strangle in EEM, which is an emerging market’s ETF. We booked a nice profit of $164.

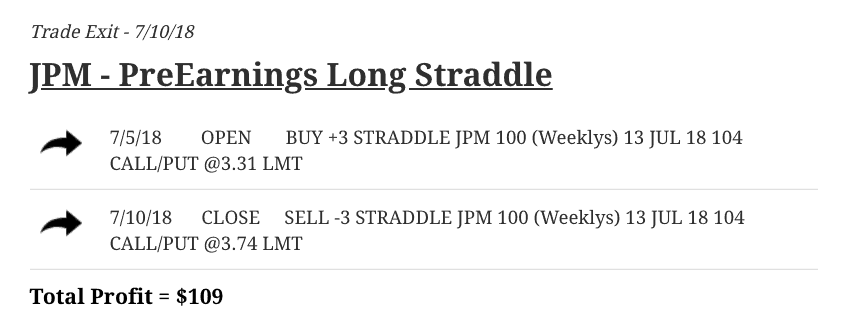

JPMorgan was getting ready to announce earnings, so we did a Pre-Earnings Long Straddle where we were taking no directional risk and no earnings risk. We were in this trade for just five days and booked the winner of $109.

In /6E, which is the euro, we did a Short Strangle and booked a nice profit of $325.

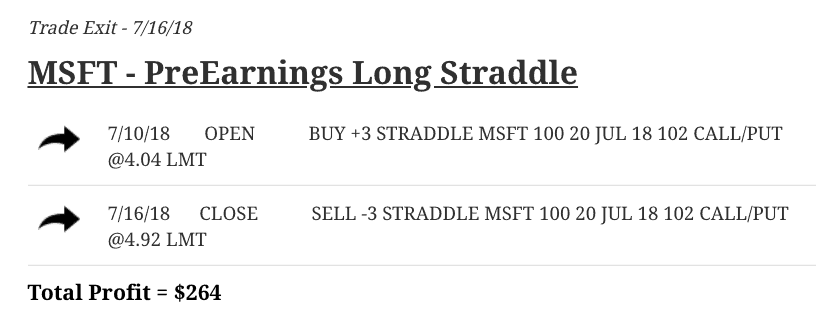

In Microsoft, we did a Pre-Earnings Long Straddle, booking a profit of $264.

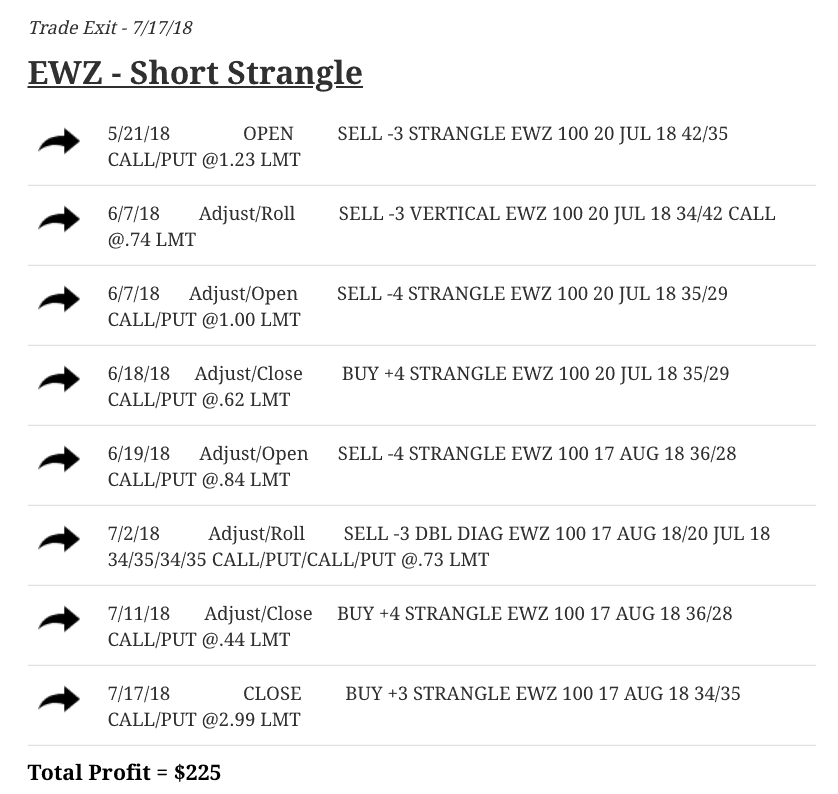

In EWZ, we had a Short Strangle, which required several adjustments. We were in this particular trade since May. Because we stayed mechanical and did the necessary adjustments exactly like we teach in our course (https://navigationtrading.com/strangles-course), we were able to book a nice profit of $225. How to take a trade that goes significantly against you from the beginning, and by tweaking and making the necessary adjustments turn that losing trade into a nice winner is a key thing we teach at NavigationTrading. That was a great trade for July.

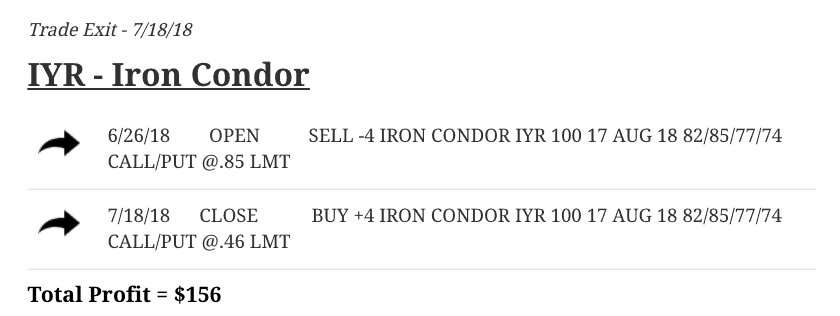

In IYR, the real estate ETF, we did an Iron Condor and booked $156.

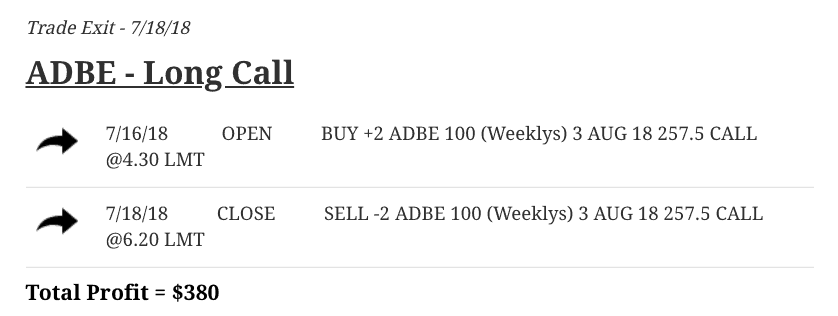

In Adobe, we traded a Long Call looking for some quick upside momentum. We were in this trade for just two days and booked a profit of $380.

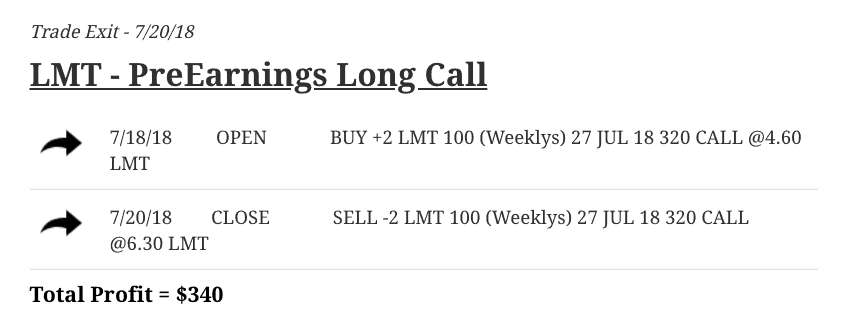

In LMT, we did a Pre-Earnings Long Call there, booking a profit of $340.

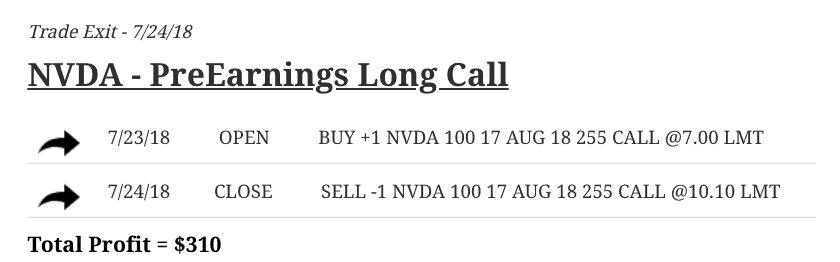

In NVDA, we did another Pre-Earnings Long Call and booked a profit of $310.

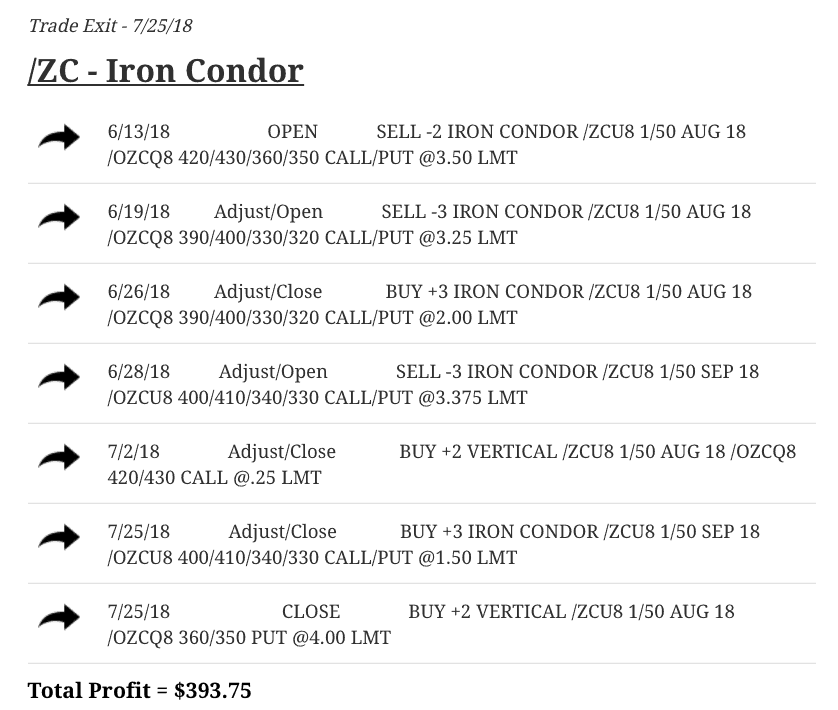

In Corn, /ZC, we did another Iron Condor, booking a profit of over $390.

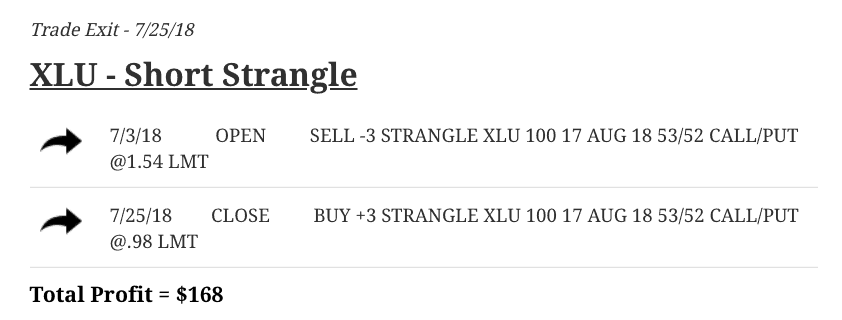

In XLU, the utility ETF, we did a Short Strangle and booked $168.

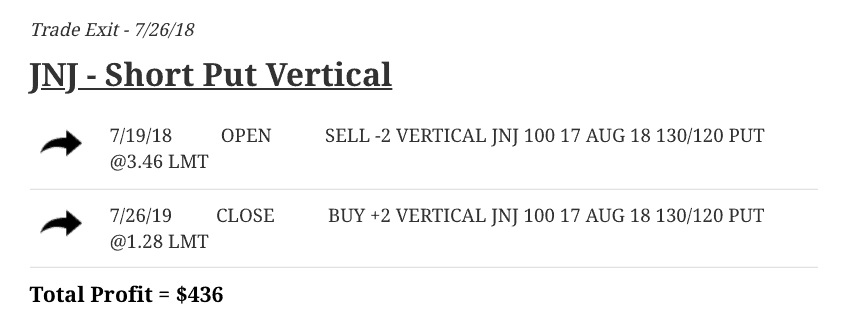

In Johnson & Johnson, we did a Short-Put Vertical, which was a little bit of a bullish trade. We were in the trade for just a week and booked a profit of $436.

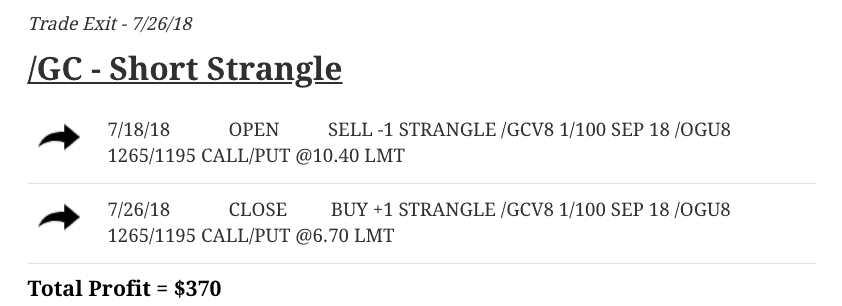

In Gold, did a Short Strangle, booking a profit of $370.

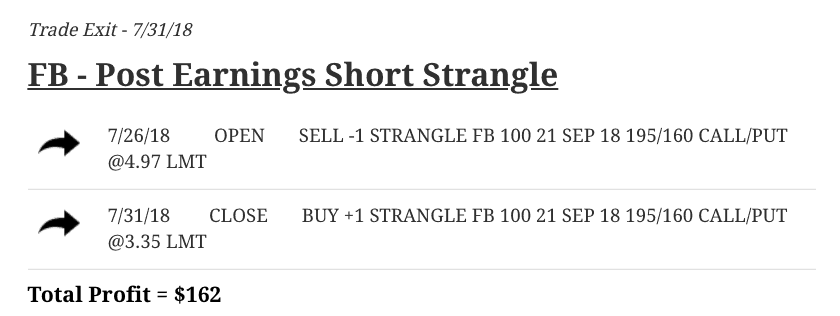

And finally, on the last day of the month we did a post during the Short Strangle in Facebook. We were in this trade for just five days, booking a nice profit of $162.

July was another phenomenal month of trading. If you are interested, and not a Pro Member already, just go to NavigationTrading.com/pro-member for more information about our Pro Membership. We are getting ready to put a ton of more resources into our Pro Membership, so the price will be most likely going up here in the next few weeks. We haven’t completely decided what that’s going to look like, but anyone who is already a member will be grandfathered-in at their current pricing structure.

Everyone have another great month of trading!

Follow