Hey NavigationTraders!

It’s another month in the books, and another great month for NavigationTraders.

I want to take some time to give you an update on the trade performance of our NavigationALERTS for the month of August.

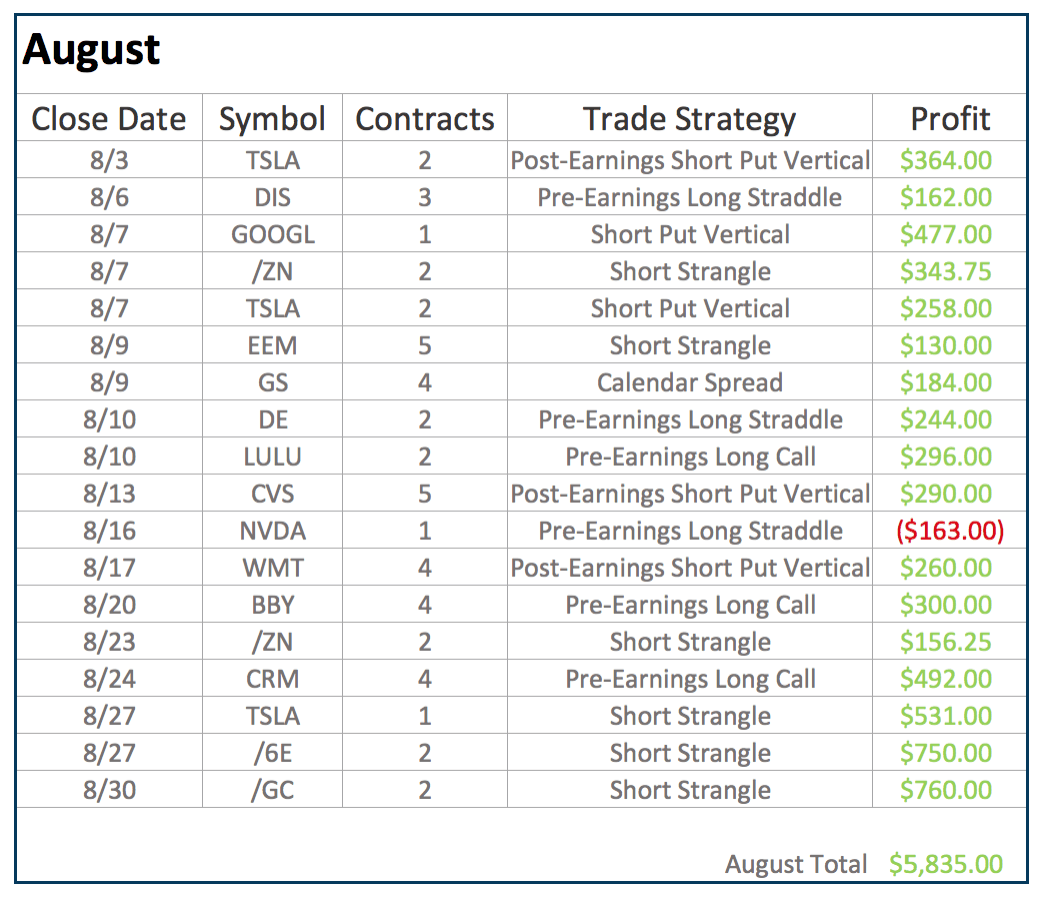

This past month we had 18 closed trades. This is more trades closed in one month than we’ve had in our entire history of recording these alerts.

17 of our closed trades were winners, making a total profit of $5,835. This is another record as far as dollar amount booked profit. So, we continue to have these awesome returns.

And remember, we’re trading these alerts portfolio with relatively small size, anywhere from one to five contracts at the max.

We have a lot of members doing five or 10 times that amount. Obviously, if you’re more experienced and have a larger account, you could be multiplying these profit numbers significantly.

We keep it small because we want to make sure that you understand even with a smaller account, you can provide consistent monthly income, trading the strategies that we teach.

The amount of capital that we’re using in the account is anywhere from $30,000-$35,000 of buying power. We typically use anywhere from one to a few thousand dollars in buying power per trade.

Depending on your experience and your account size, you can really scale this to any level that you want.

If you are interested in receiving our NavigationALERTS daily, just go to https://navigationtrading.com/pro-trial. We have a Pro Membership 14-day trial for just $1. Check it out to see if it’s right for you!

Not only will you receive NavigationALERTS throughout the week, you’ll also have instant access to our VIP courses, indicator package, NavigationTrading Watch List, and our eBook, The Trade Hacker’s Ultimate Playbook.

One of the keys to our consistent profits is not only the diversity of the symbols we trade and the amount of time we spend in the trade, but also the different strategies we trade.

We had six different strategies this month. We traded Short Strangles, Short Put Verticals, and a Calendar spread. We were in the thick of Earning Season, so we did some Pre-Earnings Long Calls, Pre-Earnings Long Straddles, and Post-Earnings Short Put Verticals.

Performance Page

Let’s go to our performance page at https://navigationtrading.com/performance. This is where we keep track of all of our statistics for you, which are updated each month.

For the calendar year of 2018, we’ve now closed 108 trades, our average profit per trade is $241, and our winning percentage is over at 90.7%.

If you scroll down, you’ll see each months’ specific performance, going back to the beginning of 2018, and then also the trade stats for 2017, where we started in June of last year.

You can see all the performance numbers, winners and losers, going all the way back since we started. We believe in total transparency, our goal is to be completely transparent, we have nothing to hide, and we want to show you everything, the good and the bad.

Let’s navigate to the Member’s Area. If you’re a Pro Member, this is what your membership area looks like.

Under the NavigationALERTS tab, you’ve got access to all of our alerts, our current portfolio, and our closed trades. Beneath the NavigationALERTS tab, you’ll see Pro Members get access to all of our VIP course training.

In-Depth Look into Our August Trade Results

I want to go through and break down each trade from August.

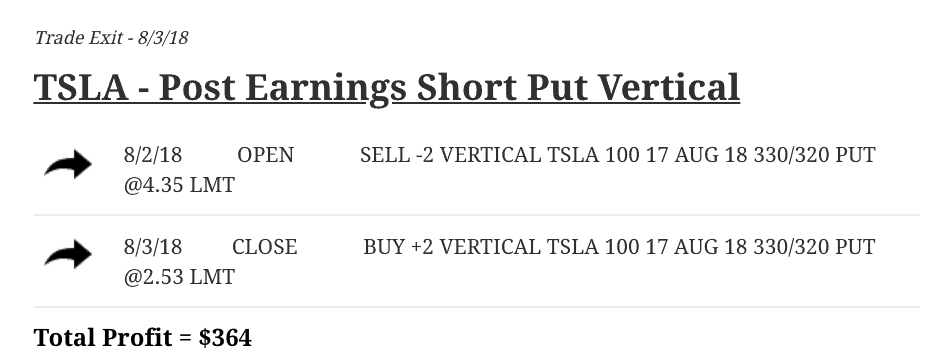

Scrolling down to the beginning of August, the first trade was in Tesla. We did a Post-Earnings Short Put Vertical textbook trade just like we teach in our earnings course, and booked a profit of $364.

In Disney, we did a Pre-Earnings Long Straddle, trying to take advantage of that Pre-Earnings IV expansion. It ended up working out nicely for $162.

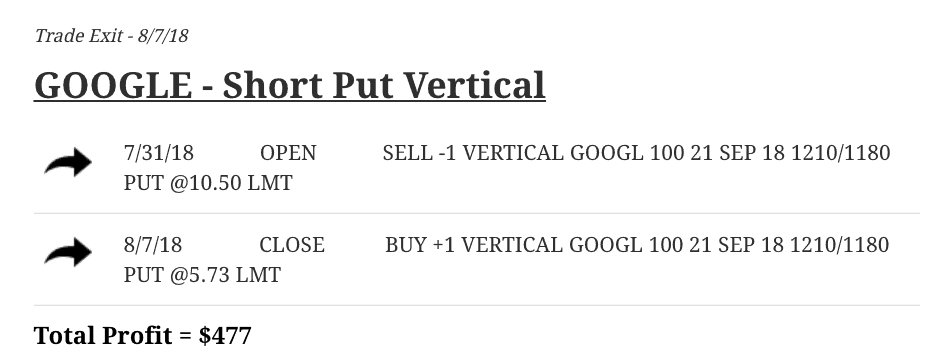

In Google, we did a Short Put Vertical. We got bullish on Google for this play, and made $477.

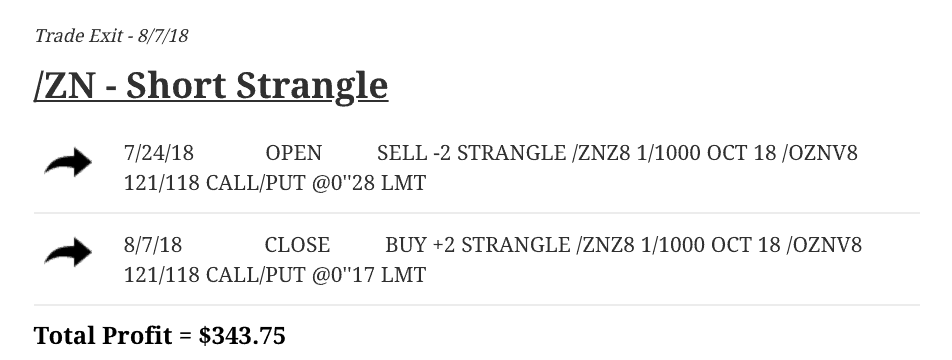

In /ZN, which is the 10-year note, we did a Short Strangle and booked over $343.

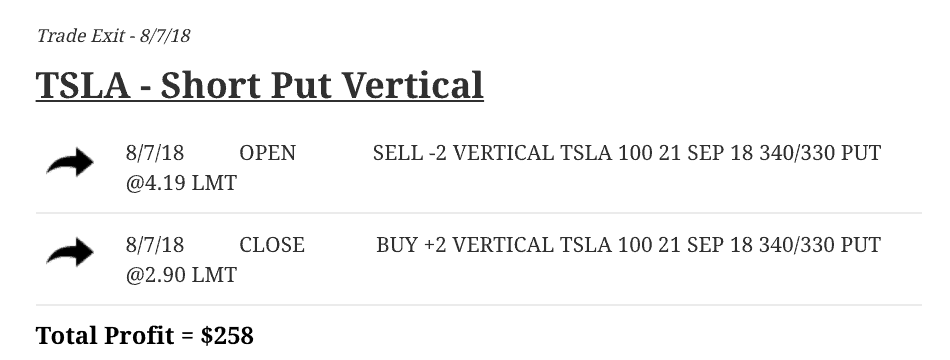

Again in Tesla, we did a Short Put Vertical and booked a profit of $258.

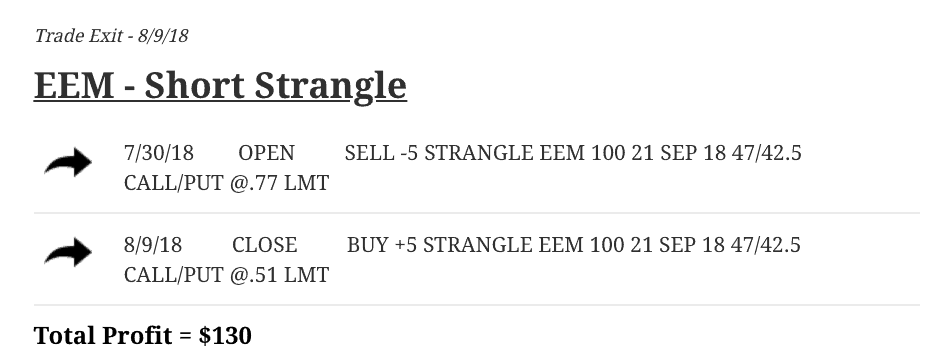

In EEM, we did a Short Strangle as well, booking a profit of $130.

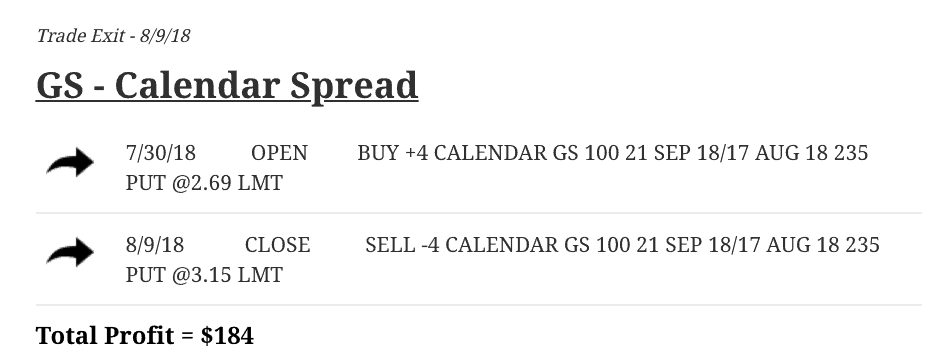

In GS, which is Goldman Sachs stock, we did a Calendar Spread. The Calendar Spread is another strategy that we teach to trade in low implied volatility environments. We booked a profit of $184.

In DE, John Deere, we did a Pre-Earnings Long Straddle, booking a profit of $244.

What you’ll notice this month, is that we traded a lot of different individual stocks as opposed to as many ETFs. When implied volatility is really high, we’re doing premium selling strategies in some of these ETFs and broad market type symbols. If implied volatility is a little bit lower, or we’re doing earnings related trades, you’ll see us do a lot more trades on individual stocks.

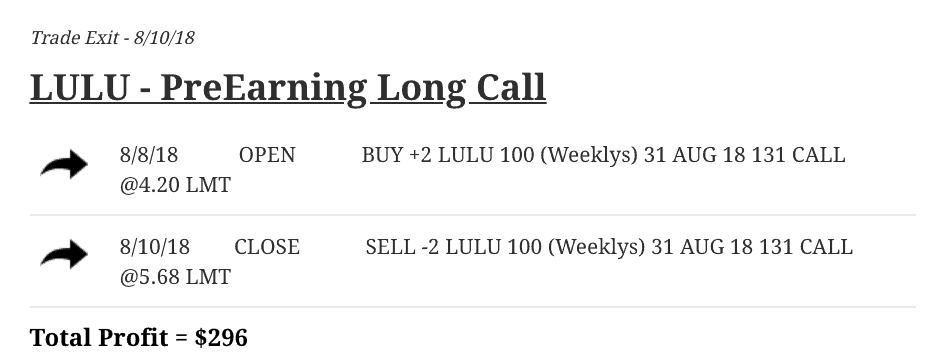

With Lululemon, we did a Pre-Earnings Long Call, booking a profit of $296.

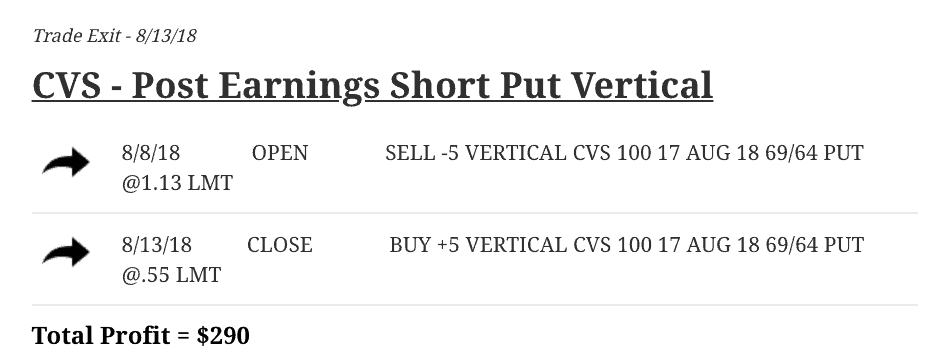

In CVS, we did a Post-Earnings Short Put Vertical and booked profit of $290.

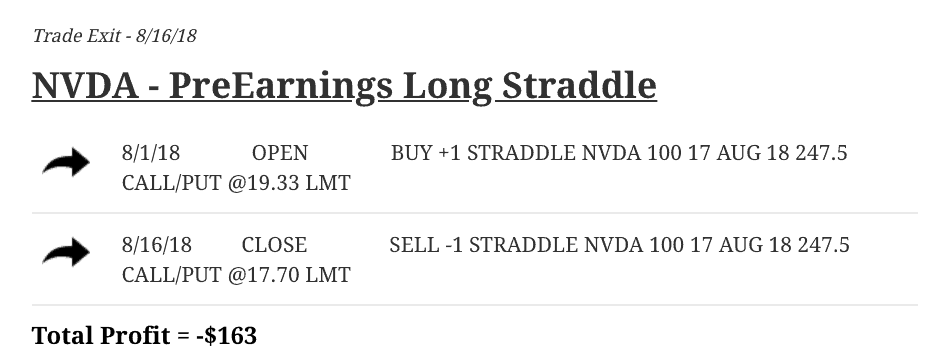

Nvidia was our only loser in August. We did a Pre-Earnings Long Straddle. It just didn’t quite work out for us leading up to the earnings announcement, and we closed it out for a small loss of $163.

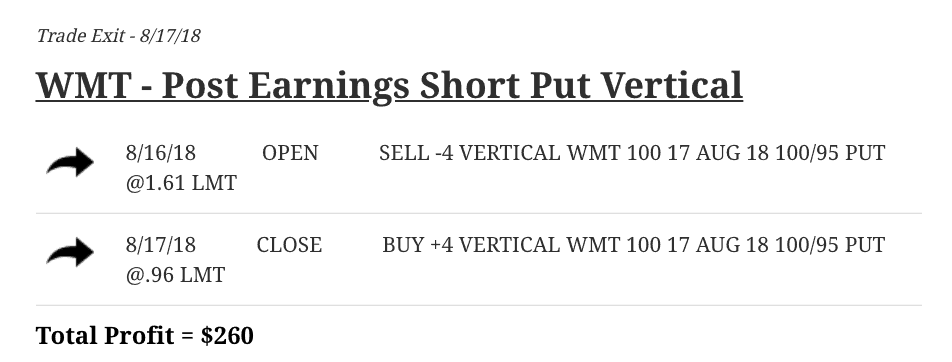

In Walmart, we did a Post-Earnings Short Put Vertical, booking a profit of $260.

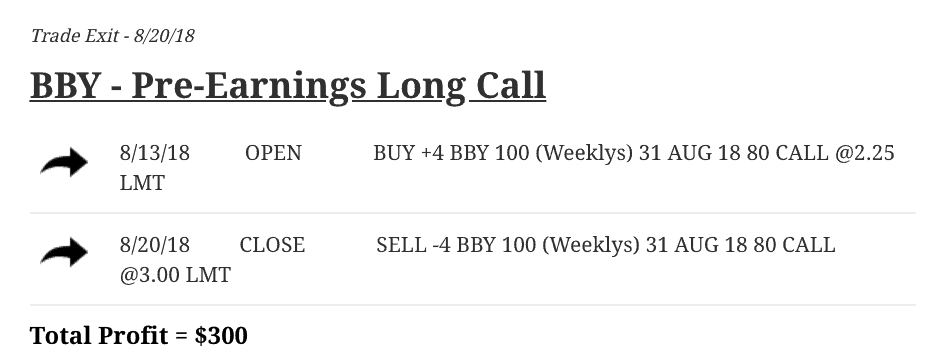

In BBY, which is Best Buy, we did a Pre-Earnings Long Call, booking a profit of $300.

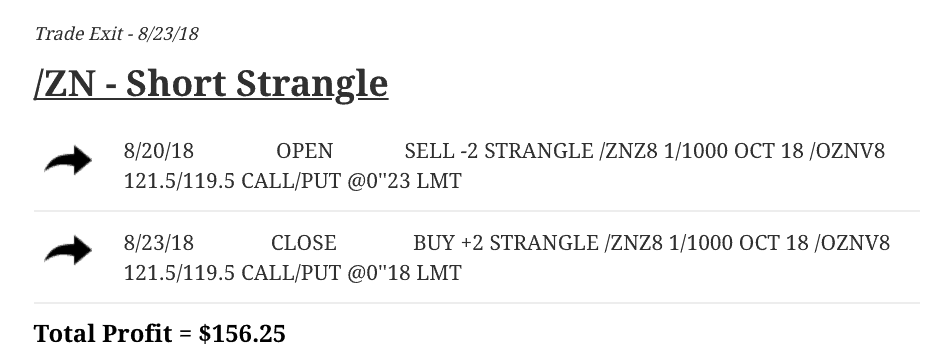

Back in /ZN, the 10-year note, we did another Short Strangle, booking a profit of $156.25.

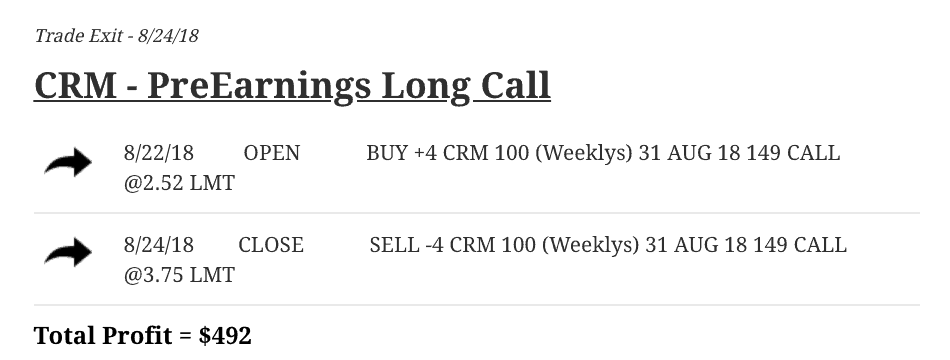

In CRM, which is Salesforce, we booked a profit of $492, doing a Pre-Earnings Long Call.

Dipping back into Tesla, we did a Short Strangle, booking a profit of $531.

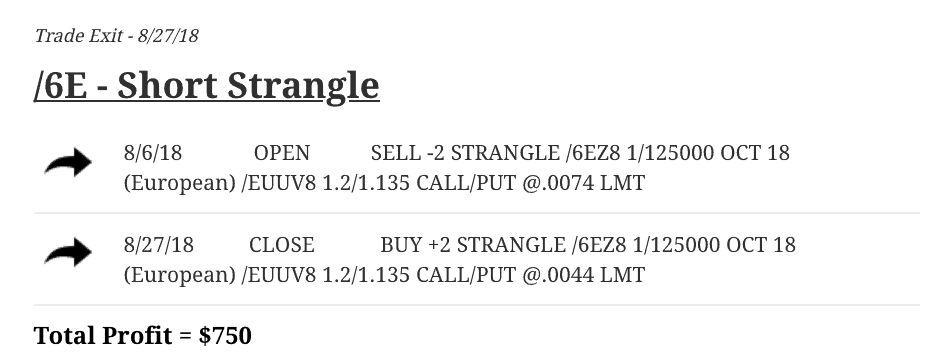

In /6E, which is the Euro Futures, we did a Short Strangle and booked a profit of $750.

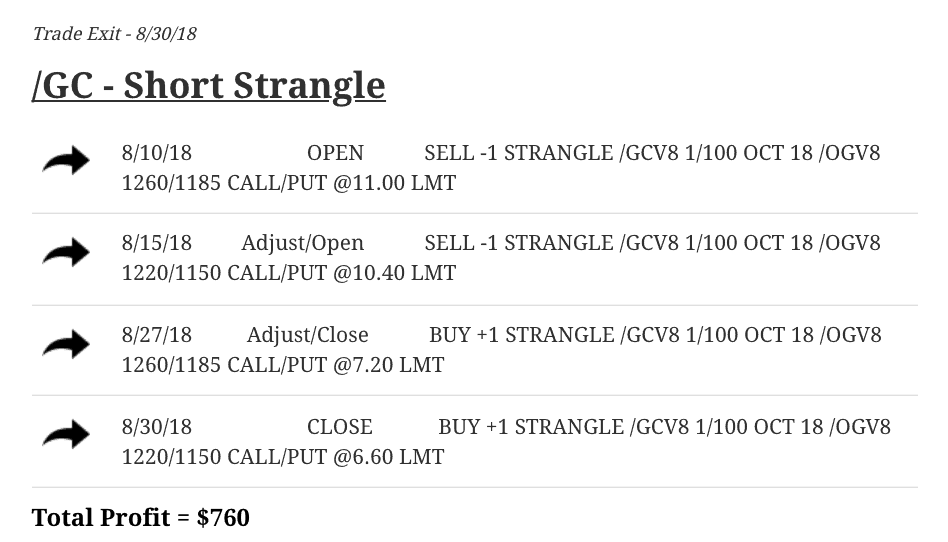

And finally, we ended the month with a Short Strangle in /GC, which is Gold, booking a profit of $760.

So, those were all the trades for the month of August.

Again, if you’re interested in checking out our pro membership, just go to https://navigationtrading.com/pro-trial.

Once you’re a Pro Member, you’ll start receiving our NavigationALERTS via email and text. Plus, you’ll get instant access to all our VIP courses and training you saw in the Member’s Area.

We look forward to seeing you on the inside!

Happy trading!

-The NavigationTrading Team

Follow