Hey everyone!

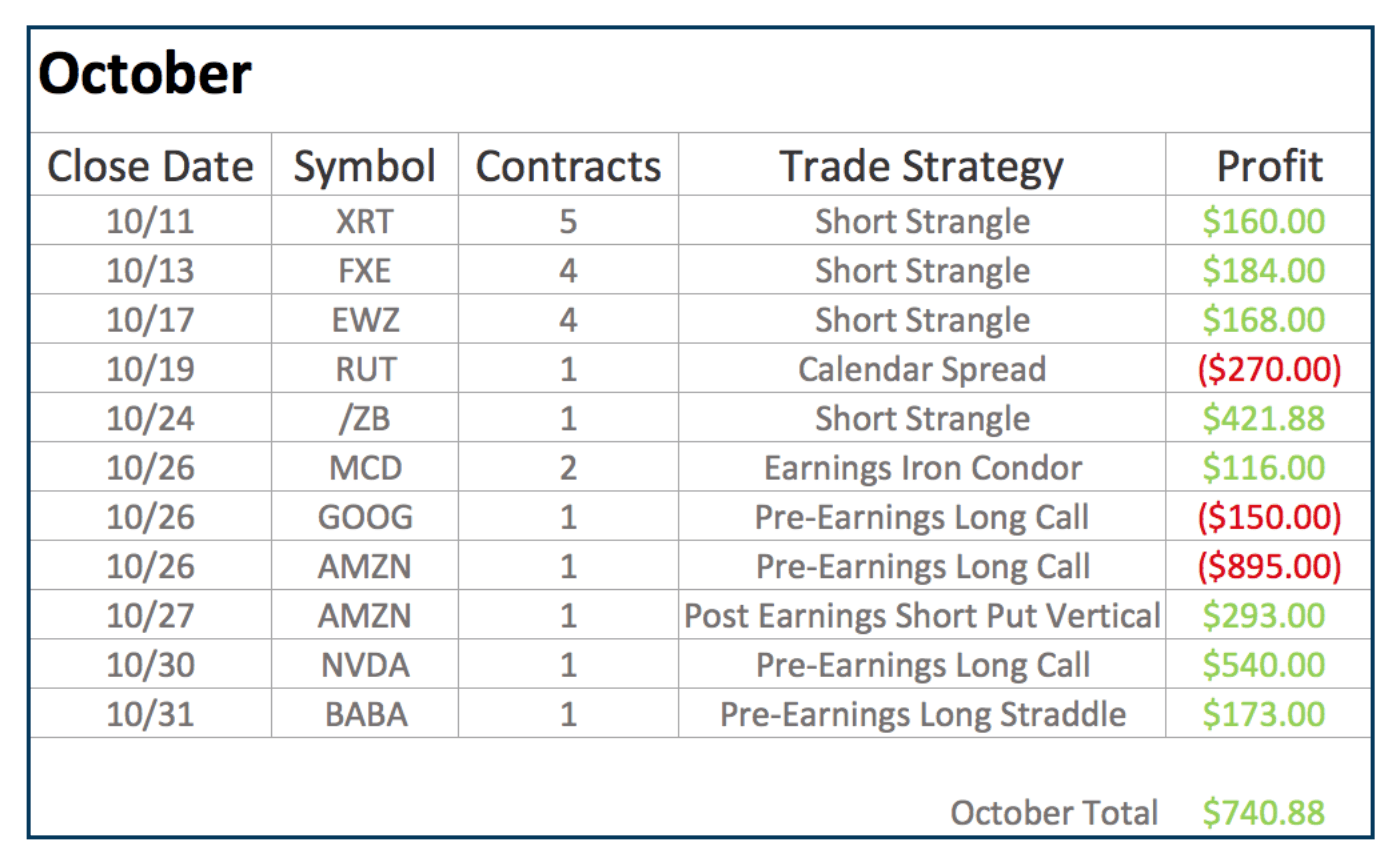

Another month in the books, and I wanted to go over our closed trades for the month of October.

We had 11 closed trades, 8 of those were winners, giving us a total profit of $740.88.

Remember, we’re trading these alerts with a fairly small sized account. We try to keep each position somewhere between $500 and a couple thousand dollars per trade. At NavigationTrading, we want to make sure that you understand that you can trade these types of strategies, with any size account.

If you had a larger account, and you’re a more experienced trader, you could be trading 10 times the contracts that we’re trading in our alerts portfolio. Or, if you have a smaller account, you can still trade for consistent profits.

You’ll notice this month we had some different strategies, primarily due to the fact that we are in the heart of Earnings Season. Every quarter, all the stocks have to come out and announce their numbers, their revenue, their sales, their debts, their good and their bad. Therefore, there are specific strategies that we utilize around earnings to profit from these events.

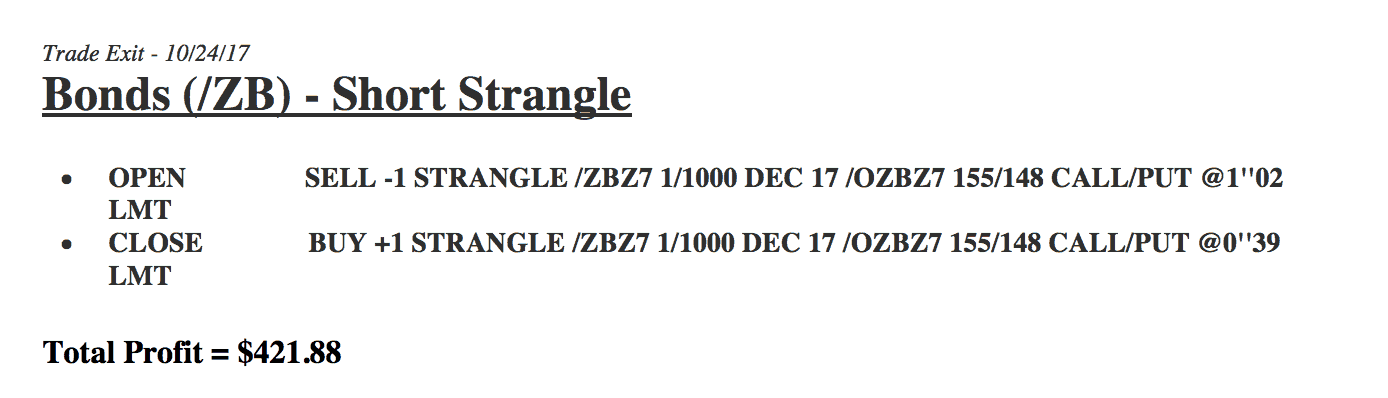

You can see we traded several Short Strangles.

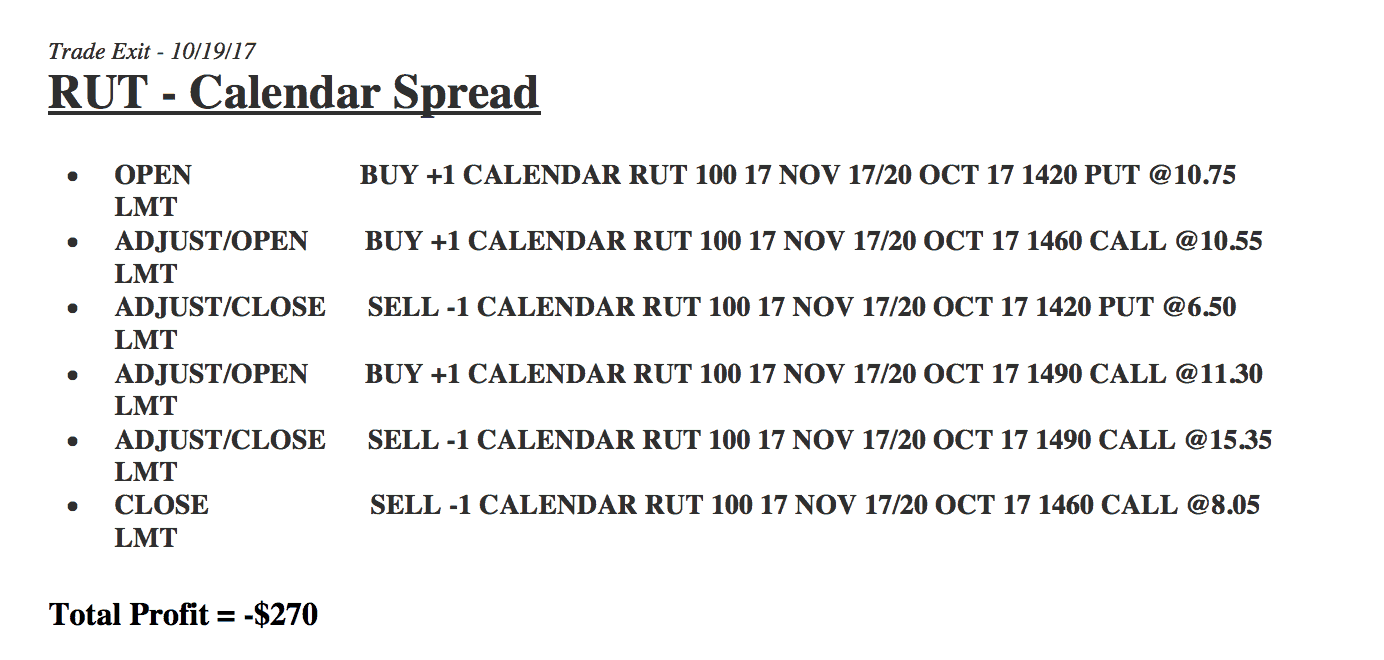

We traded one Calendar Spread.

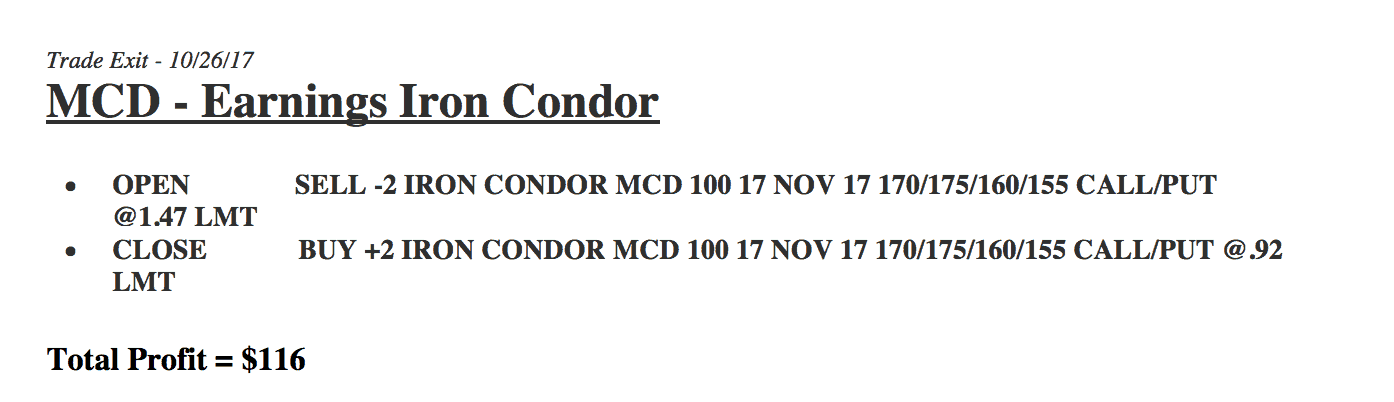

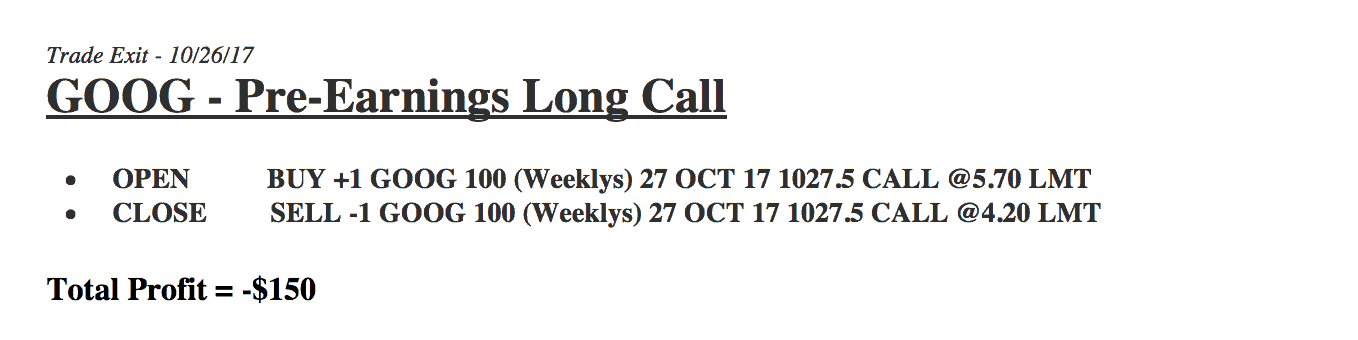

We also traded what’s called an Earnings Iron Condor, a few Pre-Earnings Long Calls, a Post-Earnings Short Put Vertical, and a Pre-Earnings Long Straddle. If you’re not familiar with these strategies specific to earnings announcements, we have a full step-by-step course on how to trade options around these earnings events.

If you’re interested in checking out our VIP courses and receiving NavigationALERTS daily, go to https://navigationtrading.com/pro-trial to learn more about our $1 two-week trial.

Breaking Down Each Trade from October

Let’s jump into our Member’s Area and take a deeper look into each individual trade. Once you’re logged into your account (If you’re a Pro Member), just click on the NavigationALERTS tab, and select “Closed Trades”. You can access past months’ closed positions by scrolling all the way to the bottom of the page.

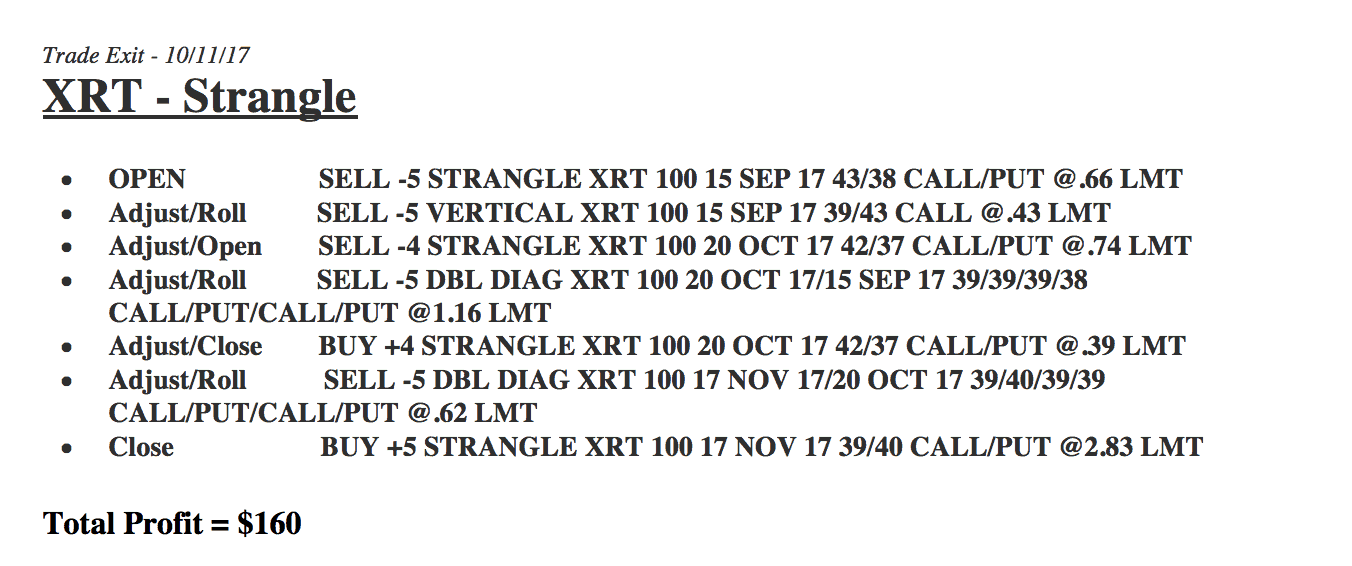

If we look at the trades in the order that we took them, we can see our first closed trade was a Strangle in XRT. We had to adjust this trade several times, but by staying mechanical and making the necessary adjustments, we came out with a profit of $160.

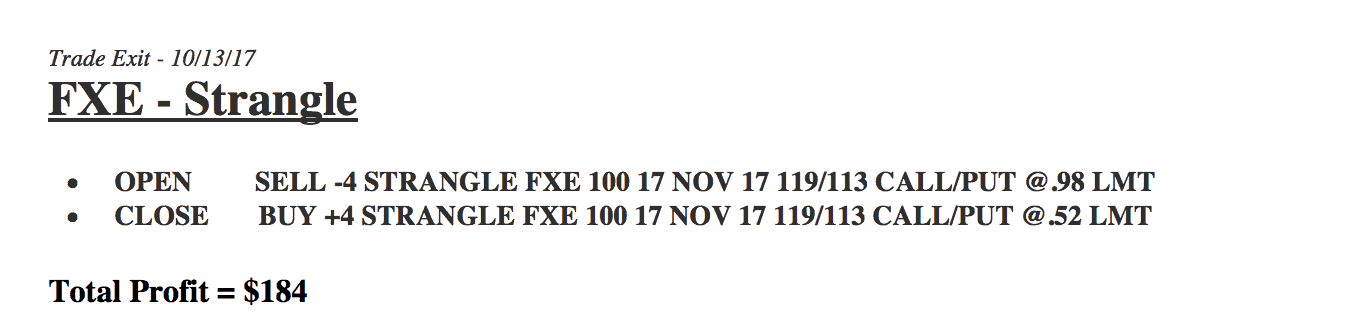

Our next trade was in FXE. It was also a Strangle. This one was easy; we didn’t have any adjustments. We just put it on, took it off, and booked a profit of $184.

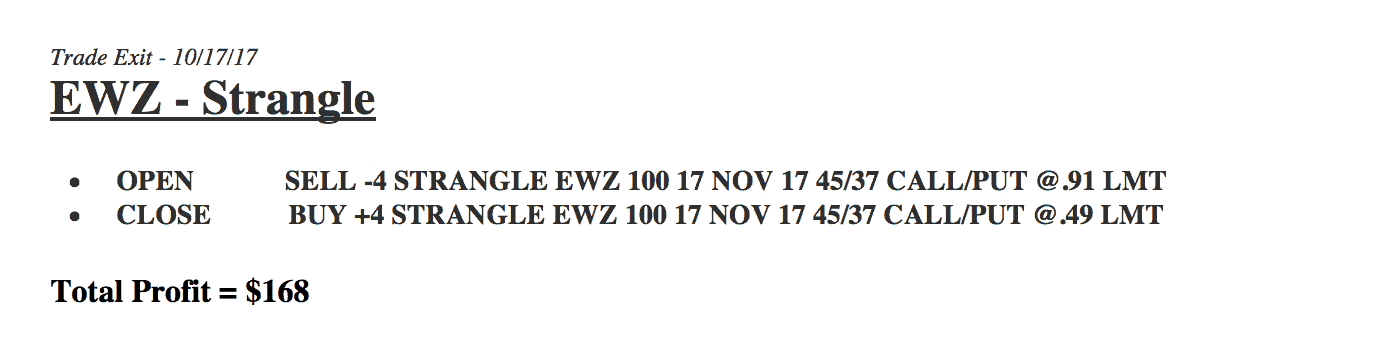

In EWZ, we did another Short Strangle and booked a profit of $168.

The next trade was in RUT. We did a Calendar Spread. As you can see, we did make several adjustments. However, we were not able to get back the losses incurred. We lost $270 on that trade.

Next trade we did was a Short Strangle in bonds. It was another easy one. We just put it on and took it off for a profit of $421.88.

The first of our earnings trades was an Earnings Iron Condor in McDonald’s. We sold an Iron Condor and took it off just a few days later to book a profit for $116.

We did a Pre-Earnings Long Call in Google, and that one did not work out for us. We ended up losing $150.

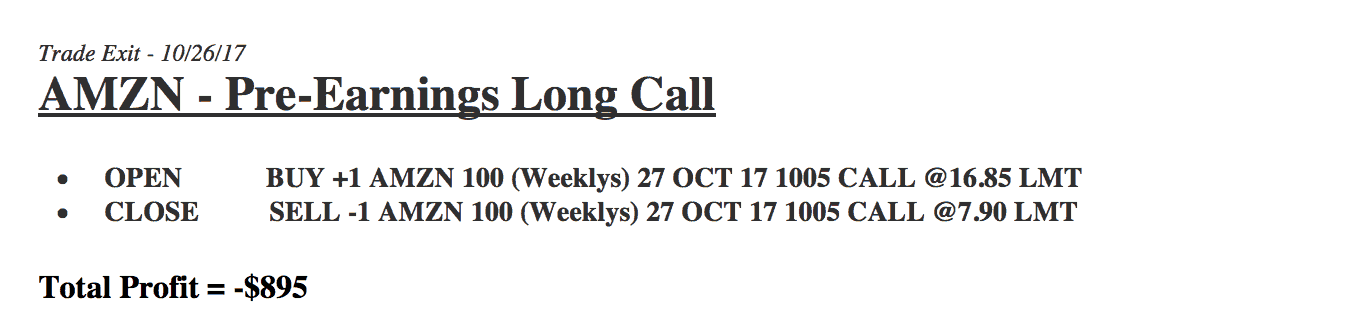

The trade that really hurt us was in Amazon, which was another Pre-Earnings Long Call. If you’ve taken our earnings course, you know that this is a fairly high probability play, with the anticipation of upside momentum going into an earnings announcement. But in this case, Amazon did not participate and we took a loss of $895.

Looking back on this, because we always look at our losers and usually learn more from them than we do our winners, I probably would have gone smaller with this. We only traded one contract, however; we could have used a lower delta and would have had less of a loss.

You’ve got to be really careful about playing the “hindsight game” though, because had this trade gone well for us, we probably would’ve wished we would have traded more contracts. We do show all of our winners and all of our losers, and unfortunately we had to take a decent sized loss on this one.

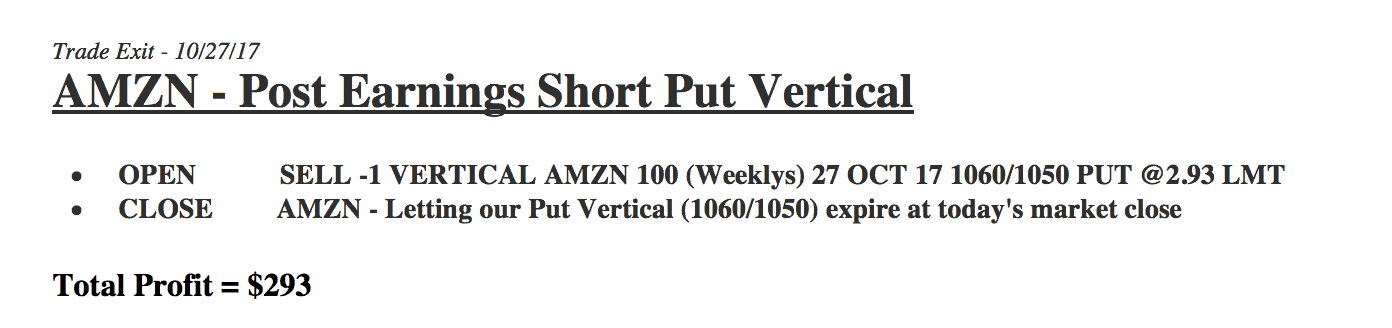

The next day, we did get an opportunity in Amazon to get some of that money back. We did one of our core earnings strategies, the Post-Earnings Short Put Vertical and we were able to make $293 on that trade.

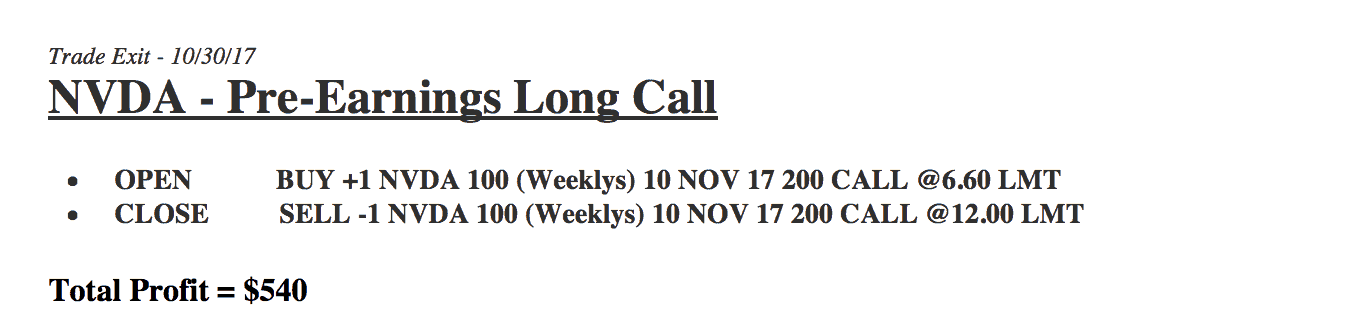

We did another Pre-Earnings Long Call in NVDA. This one did work out nicely for us, giving us a profit of $540.

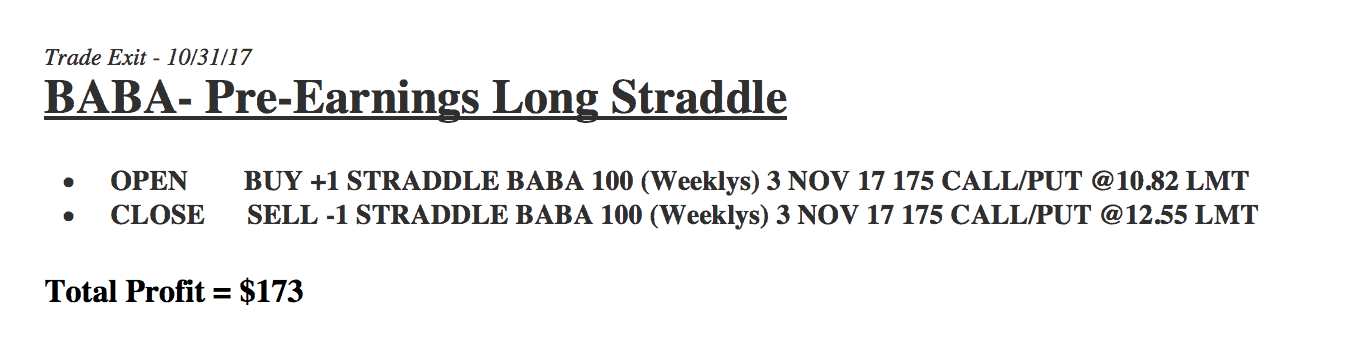

In Alibaba, we put on a Pre-Earnings Long Straddle, which worked out nicely for us. We booked a profit of $173.

All of these trade alerts are updated in real-time. Again, if you’re a Pro Member, just go to the NavigationALERTS tab in your Member’s Area, and select “closed trades”. Each month we archive all of our trades, winners and losers. Just scroll to the bottom of the page for access to past months.

If you’re interested in receiving all of our NavigationALERTS, the entries, the adjustments, and all closing trades via email and text message, just go to https://navigationtrading.com/pro-trial. For only a $1, you have access to our Pro Membership for two weeks.

I hope this in-depth look into our October trade results was helpful!

Happy trading!

-The NavigationTrading Team

Follow