What’s up NavigationTraders?!

I want to take a minute to give you our trade results for the month of November 2017.

At the end of each month we post all of our closed trades so you know exactly how we performed, winners and losers.

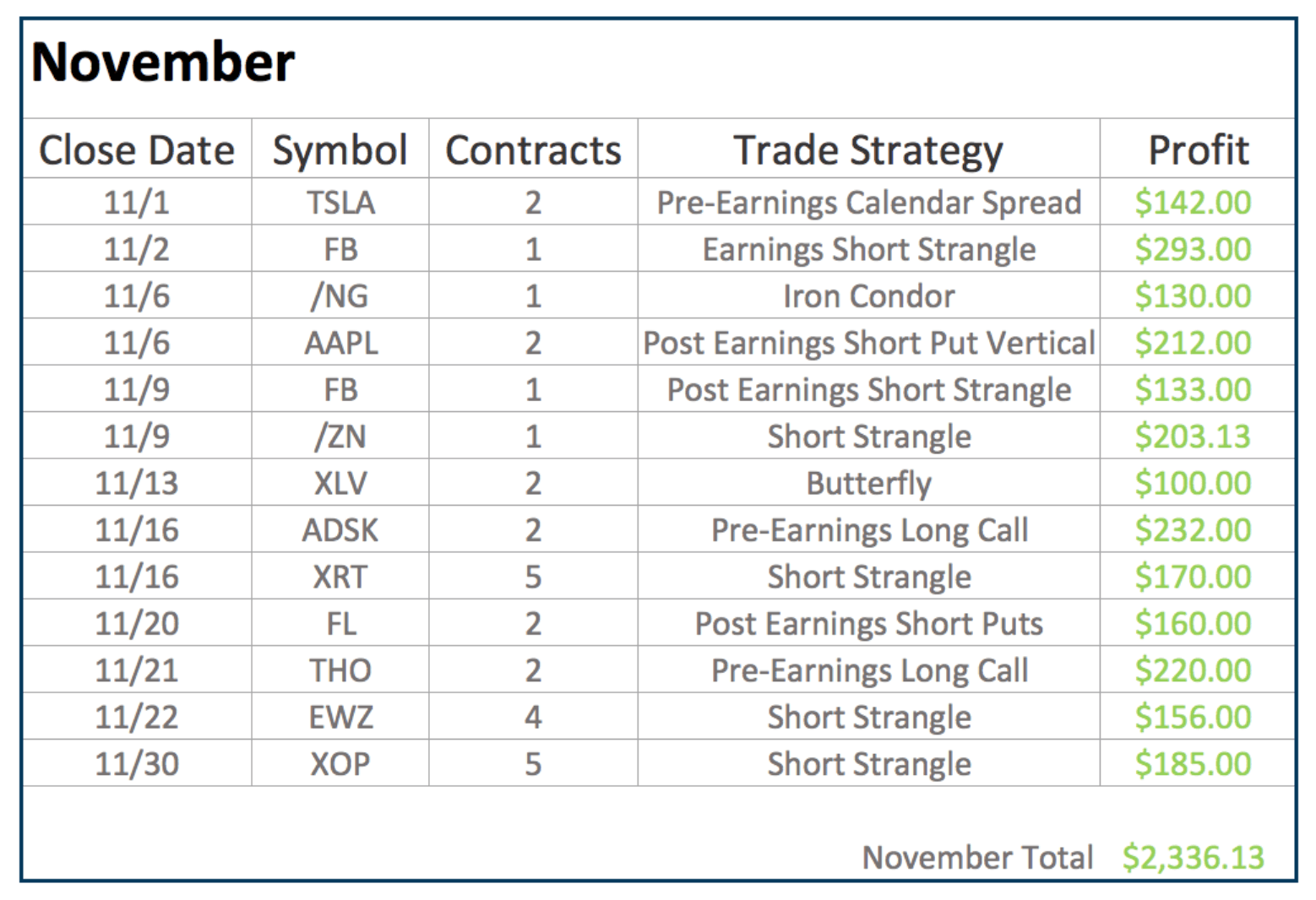

November was another great month. We had 13 closed trades, all of which were winners, making a total profit of $2336.13!

As we say all the time, “not only should you diversify the underlying symbols you trade, but also diversify the strategies”.

This month, we did a few Short Strangles, an Iron Condor, a Butterfly Spread, and a variety of earnings related trades. All of these strategies are taught step-by-step in each one of our courses.

Keep in mind for these trades, we’re trading anywhere from one to five contracts. This is just to show that you can still participate and make consistent income trading the strategies that we teach, even if you do have a smaller sized account.

That said, many of our members are using 5-10 times the number of contracts that we do. So instead of $2300, if you’re doing 10 times the number of contracts, you’d be looking at over $23,000 in profit. You can trade these alerts at any level.

If you’re interested in receiving our NavigationALERTS, live as they happen, via text message and email, just go to https://navigationtrading.com/pro-trial. Our Pro Membership is only $1 right now guys!

It lasts for 2 weeks and you’ll have instant access to our NavigationALERTS, VIP courses, our indicators, the NavigationTrading Complete Watchlist, as well as our Ebook, The Trade Hacker’s Ultimate Playbook.

November Trade Results In-Depth

For those who are already members, all of our closed trades can be found in your personal member’s homepage. Once you’re logged in, just go to the NavigationALERTS tab, and click on “closed trades”. If you scroll down to the bottom of this page, you can access closed positions from past months.

Let’s jump in to our trades from November.

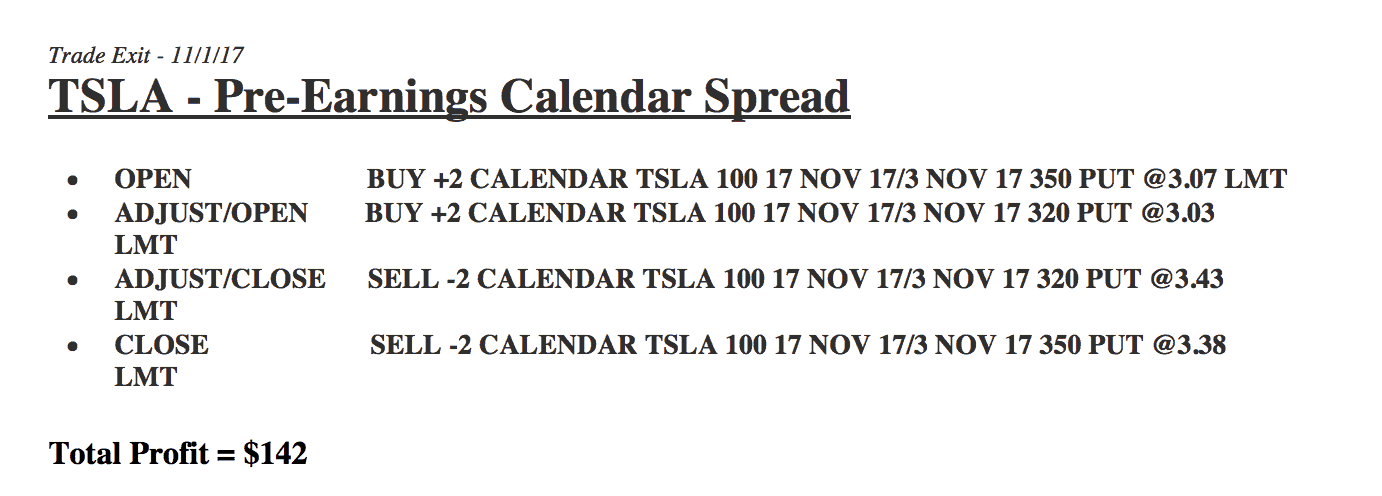

Starting with Tesla, we did a Pre-Earnings Calendar Spread. This is a trade that we use to exploit the way that the implied volatility acts before earnings. We ended up with $142 profit on this trade.

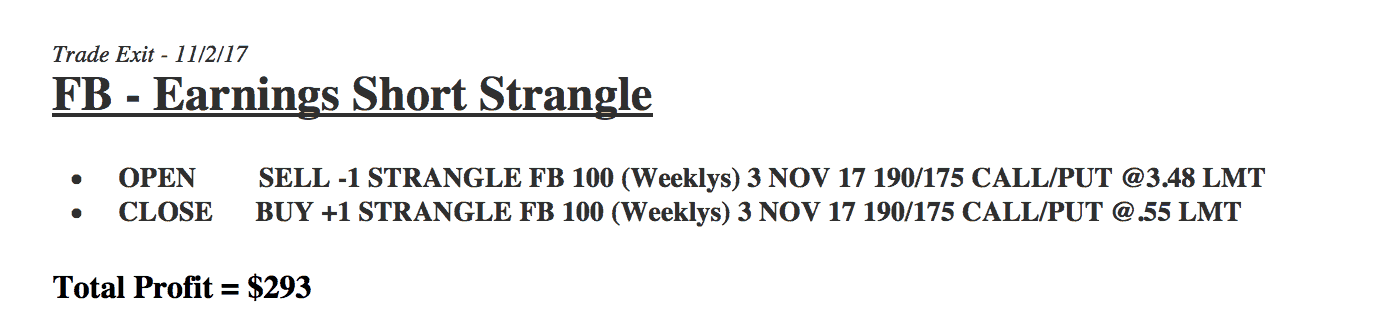

We did a Facebook Earnings Short Strangle. This is one that we put on the day before earnings and we took it off the day after. So, we were in this trade for less than 24 hours and made $293 in profit.

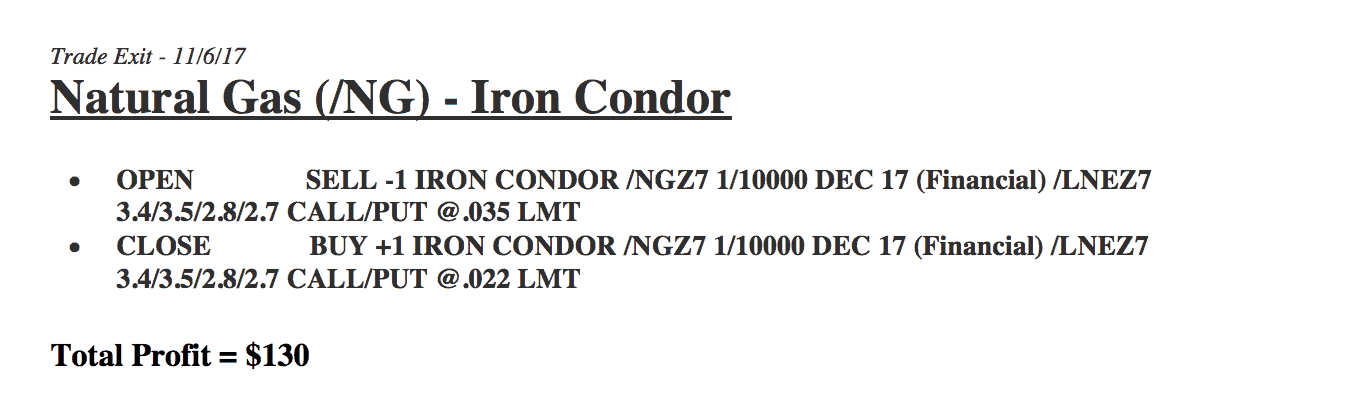

In Natural Gas, we put on an Iron Condor, and made $130.

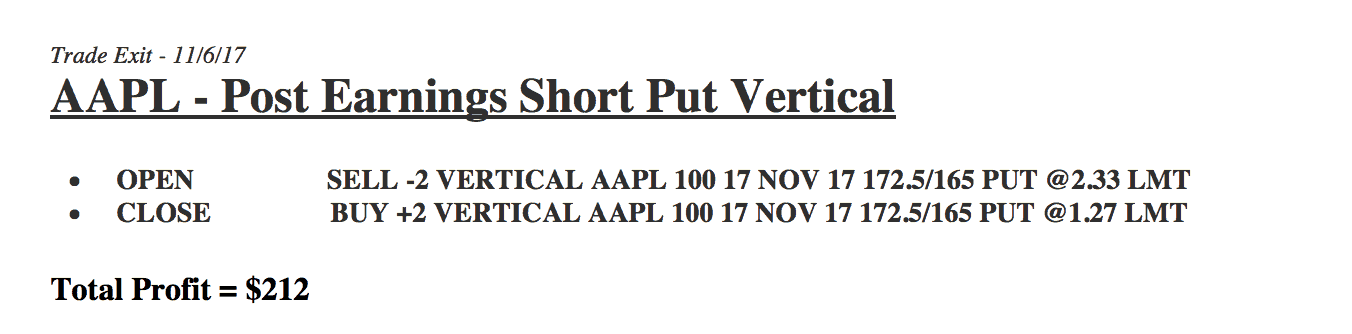

In Apple, we did a Post-Earnings Short Put Vertical. There are very specific things that happen after a stock announces earnings to where the Short Put Verticals can have a pretty high probability of making a profit. We made a quick $212 with this trade.

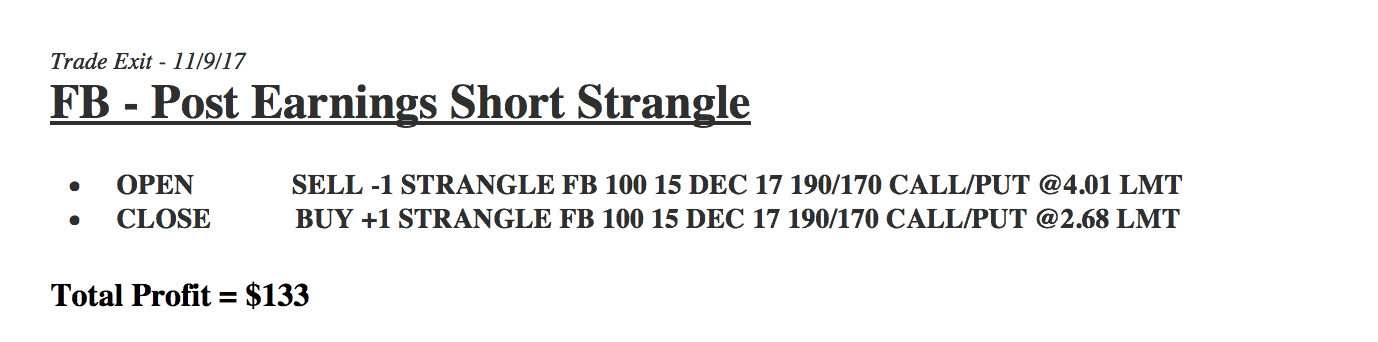

In Facebook, we did a Post-Earnings Short Strangle, which is another strategy we teach in our Earnings course. We ended up with a profit of $133.

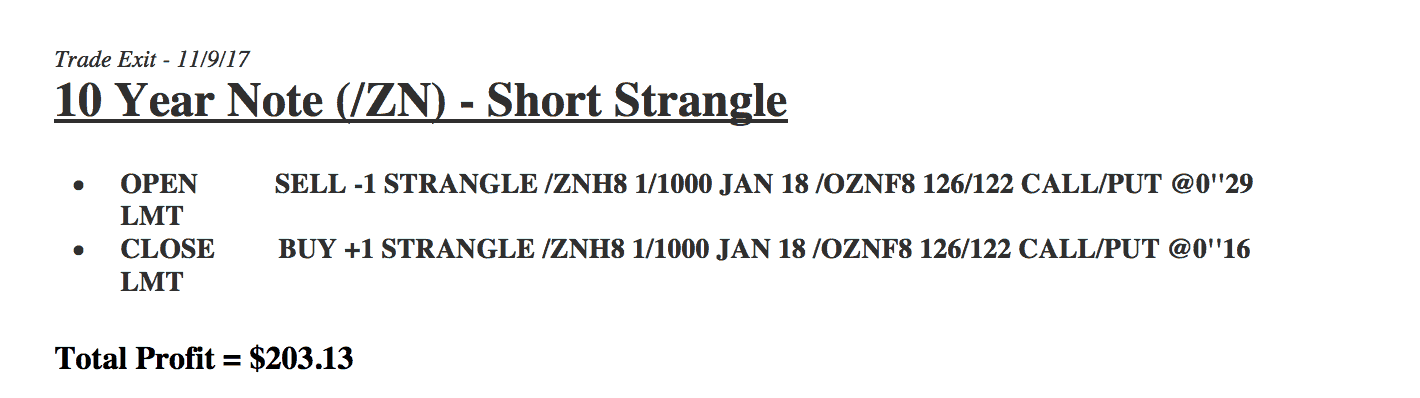

In the Notes, the /ZN, we did a Short Strangle, making a little over $200 in profit.

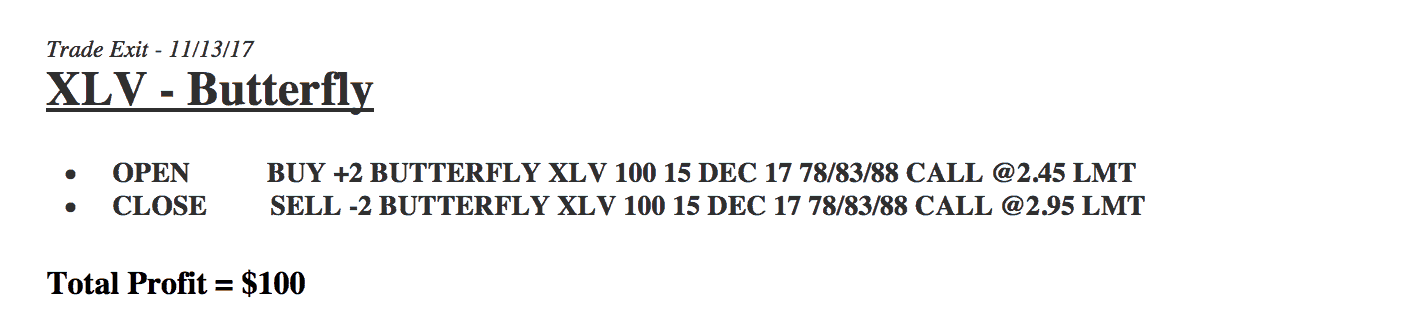

In XLV, which is the Healthcare ETF, we did a Butterfly Spread and made $100 profit.

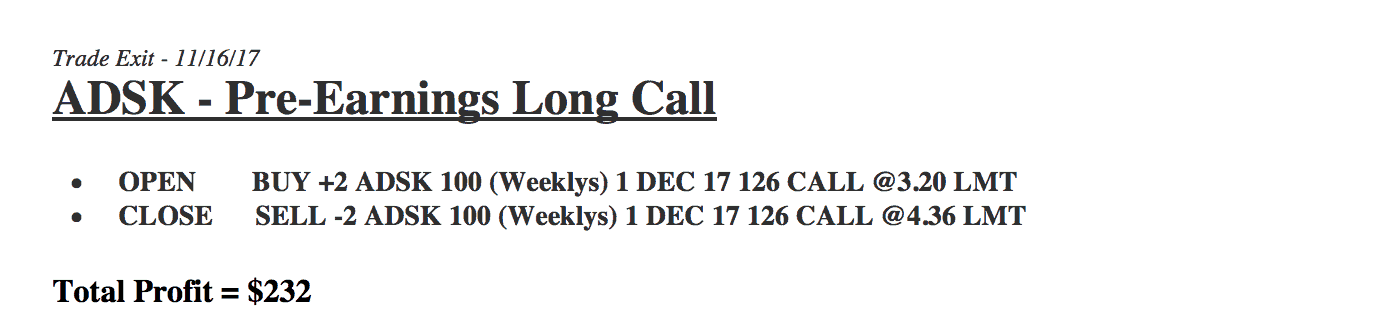

In ADSK, we did a Pre-Earnings Long Call, looking for some momentum and expansion of implied volatility leading up to an earnings announcement. We took no earnings risk through the actual announcement, this is just done before the stock actually even announces earnings. We made $232.

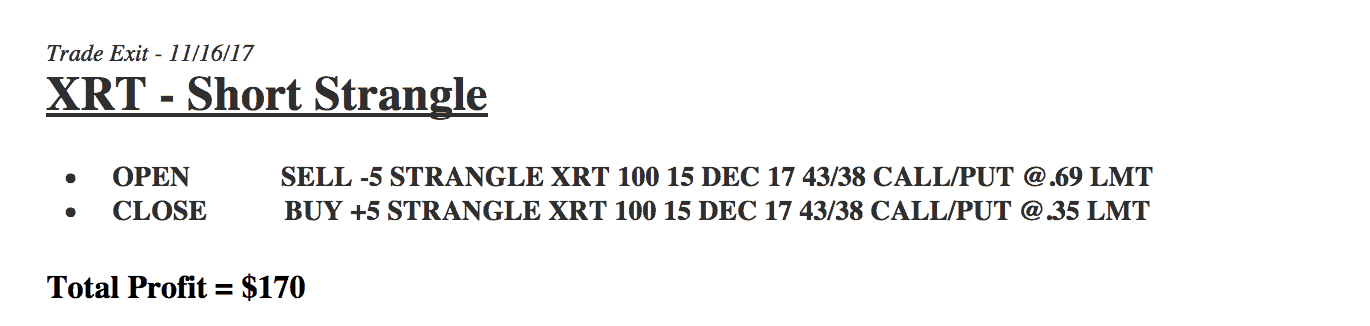

In XRT, the Retail ETF, we did a Short Strangle, and made $170.

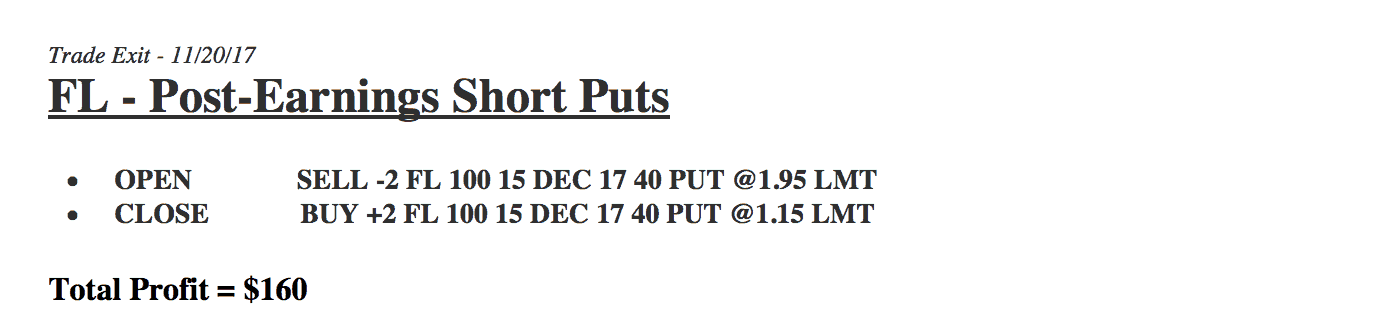

In Foot Locker, did Post-Earning Short Puts and made $160.

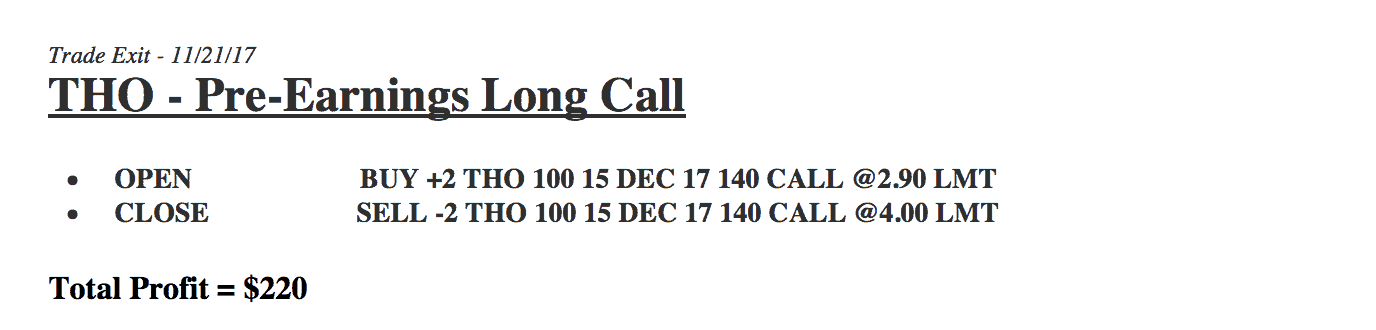

In THO, we did a Pre-Earnings Long Call, and made $220.

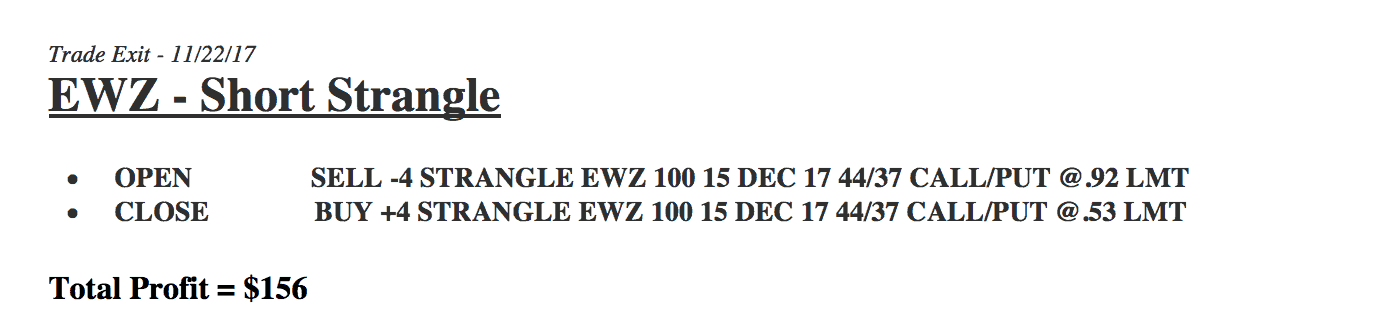

In EWZ, the Brazilian ETF, we did a Short Strangle, making $156 profit.

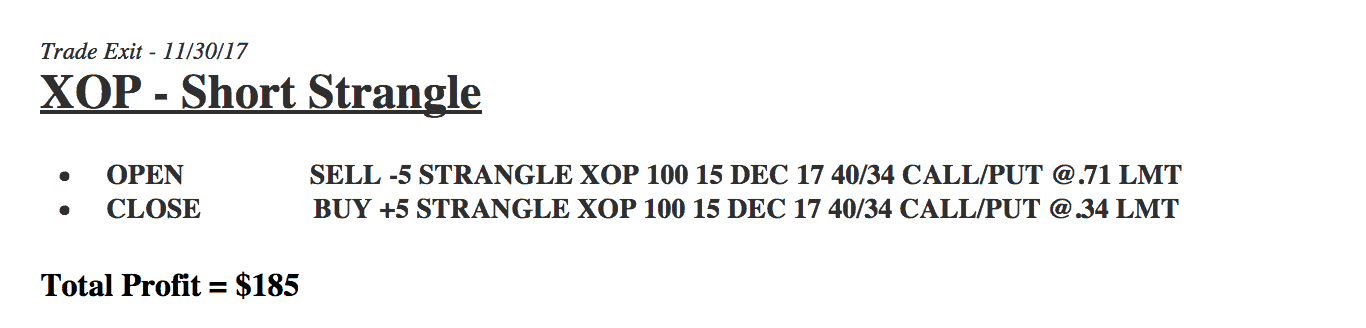

In XOP, we did another Short Strangle for $185 profit.

So what you’ll notice is that we’re doing anywhere from one to five contracts for each of these trades, so very small trades. Two contracts in Foot Locker, five contracts in some of the lower priced symbols, like XRT. Just one contract in the Notes, one contract in Facebook, two contracts in Apple so that the capital required to put on these trades is fairly minimal, anywhere from $500 to a couple thousand dollars per trade. You can really do these strategies in any size account.

You can see some of these trades took some adjustments before we were able to book a profit. Some of them we just put on and took off for a quick profit with no adjustments necessary. That’s the key component to understand…not only how to open these trades and close the trades, but how to make the necessary adjustments to be profitable and consistent trading these strategies.

I hope this was helpful!

Happy trading!

-The NavigationTrading Team

Follow