Hey NavigationTraders!

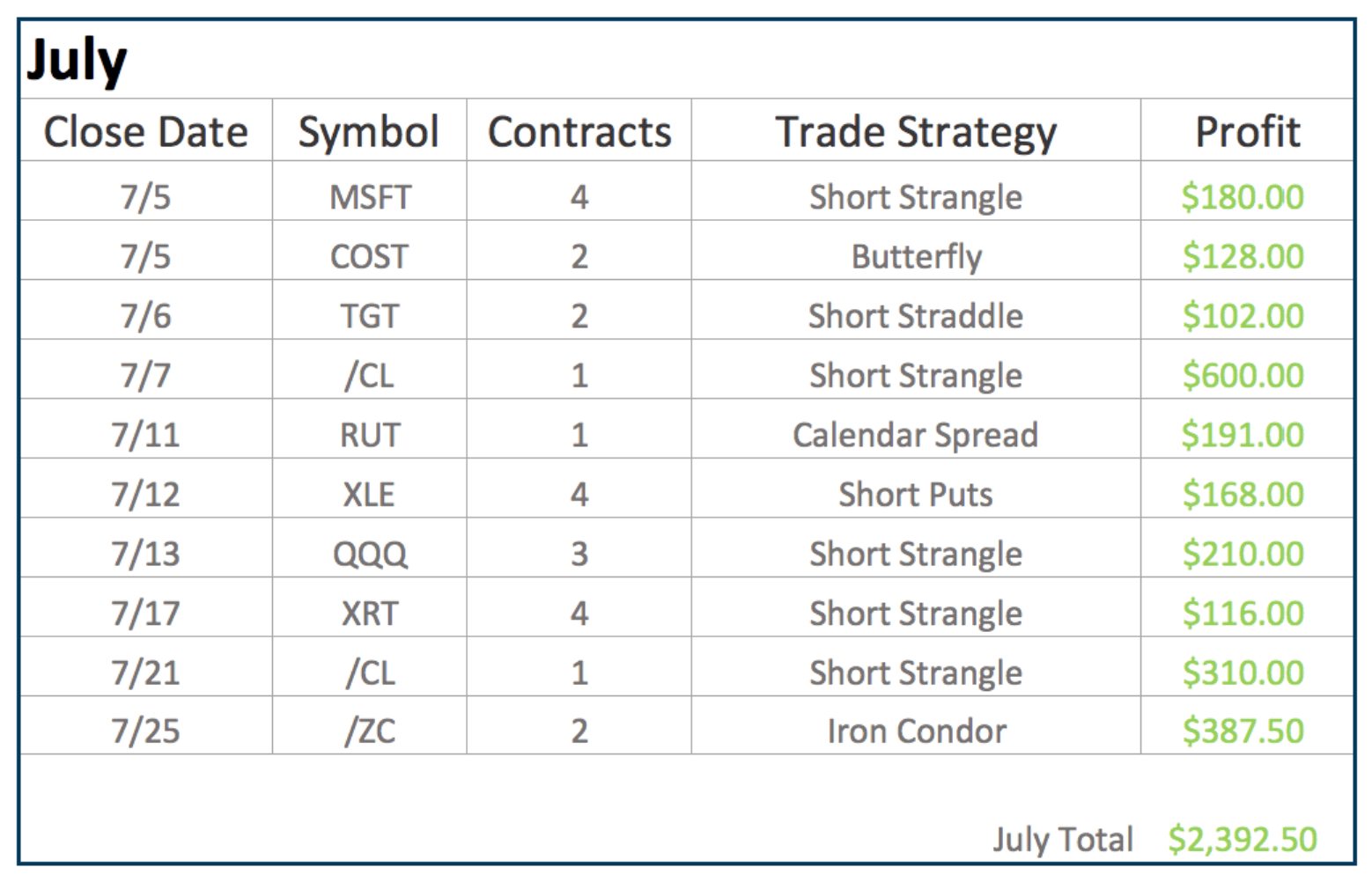

I just wanted to give you a quick update for all closed trades in the month of July. We had 10 closed trades, all of which were winners. Our total profit came to $2,392.50.

I really want to emphasize, the reason that I trade the size that I do, is because I want you to understand that you can make these trades even in small accounts. We never took more than a couple thousand dollars’ worth of buying power on any one trade, and we got a total profit of almost $2,400. If you had a larger account, you could literally trade 10 times the number of contracts that I traded for the alert, and now you’re looking at $24,000 a month.

There is so much power of the strategies we teach at NavigationTrading. Look at the diversification in the different strategies that we’ve traded in July.

This July has been a perfect example of the way that we diversify our symbols and strategies. Some of our trades had undefined risk. Some had defined risk. Some were directional. Some were more delta neutral. As a successful trader, you’ve got to be able to diversify and mix it up the way that we have. This is one of the keys to consistent profitability over the long term.

In-Depth Look at Trades from July

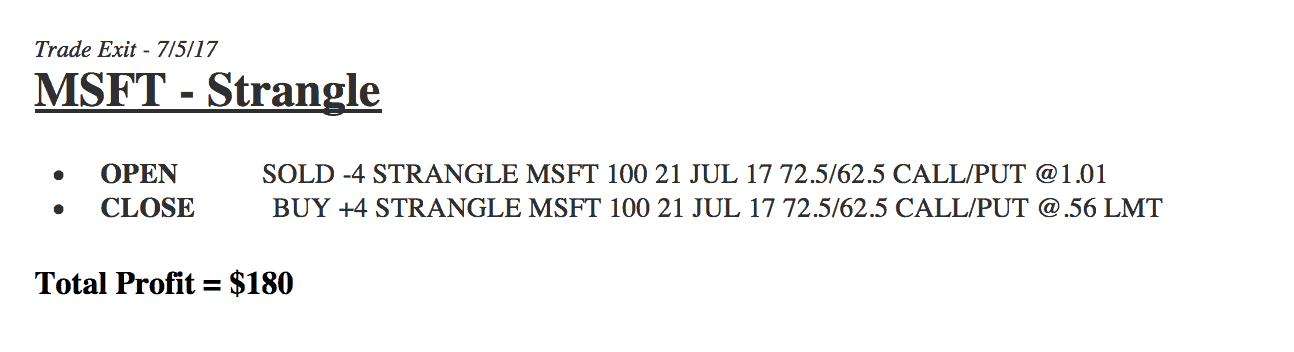

If we go to the Member’s Area and take a look at a breakdown of the trades that we made starting at the beginning of the month, our first closed trade was in Microsoft. We did a Strangle, and closed it out for $180 profit.

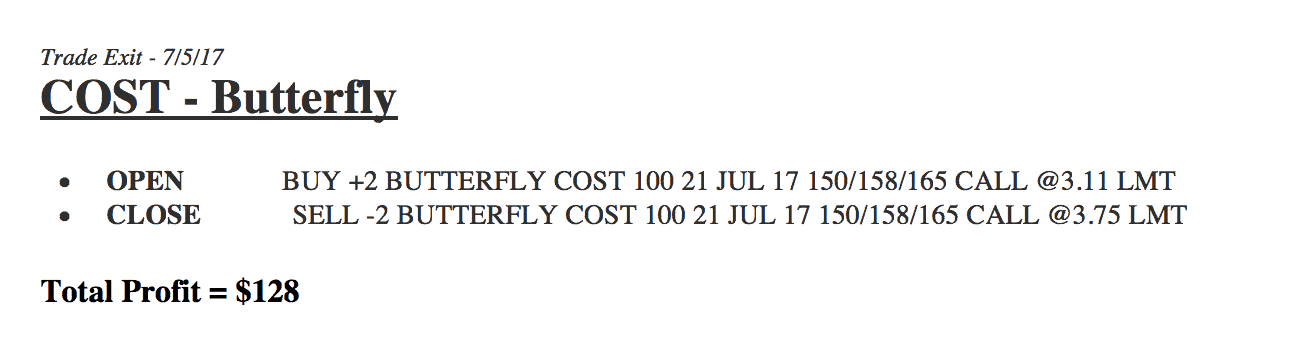

Next trade was a Butterfly Spread in Costco, ticker COST. We put that on and closed it out for $128.

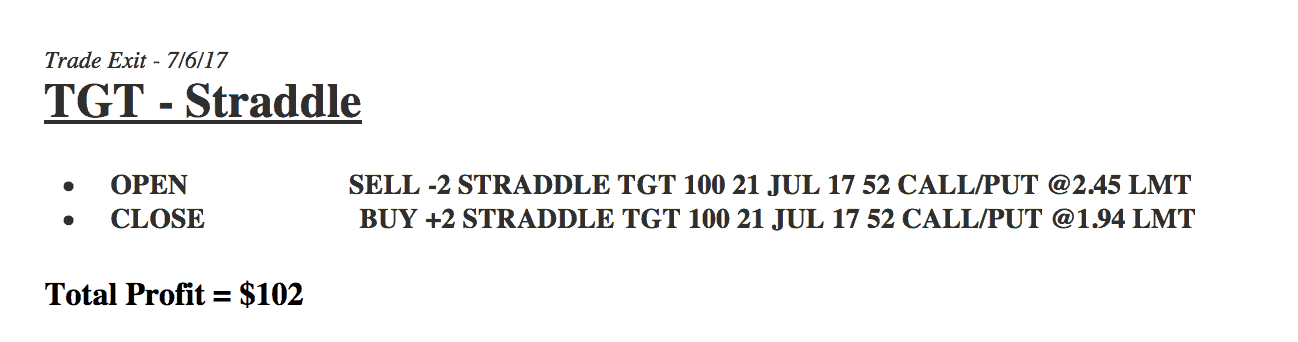

We did a Straddle in Target for a profit of $102.

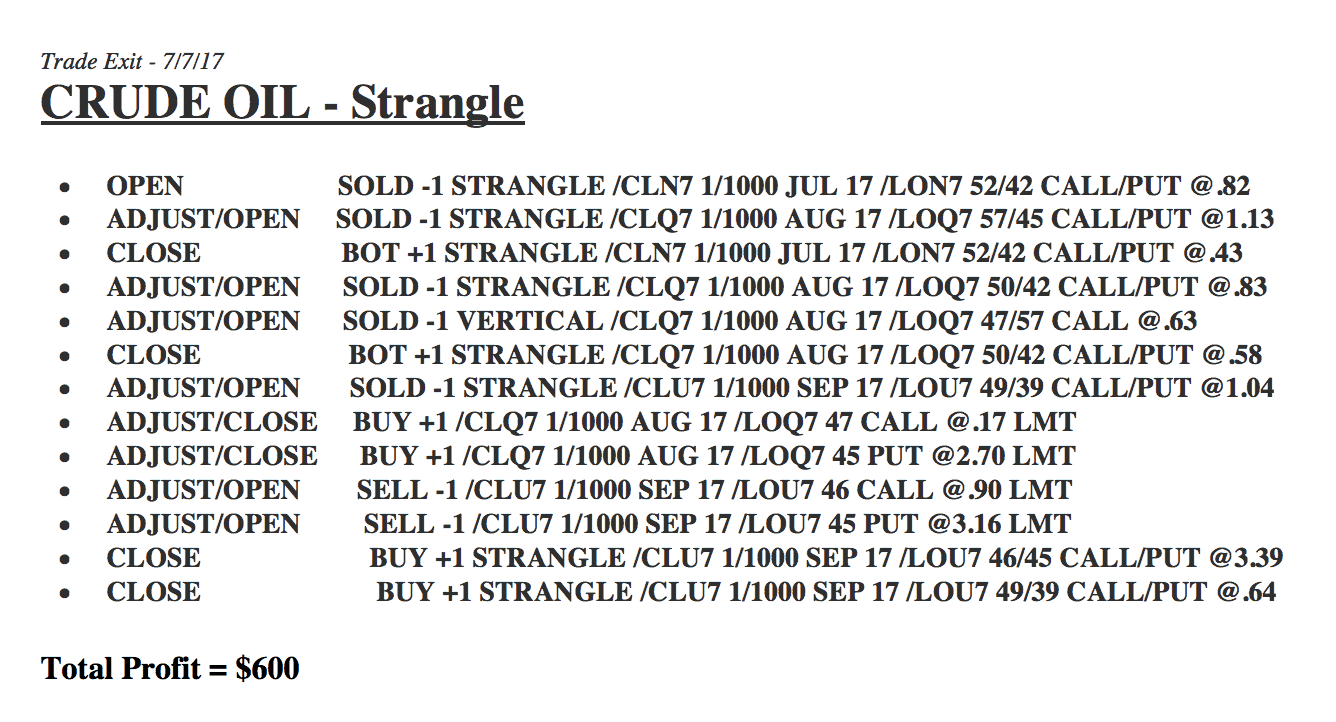

They’re not all that easy. If you take a look at crude oil, we had several adjustments that we did throughout the trade, but by staying mechanical and doing what you’re supposed to, we booked a profit of $600.

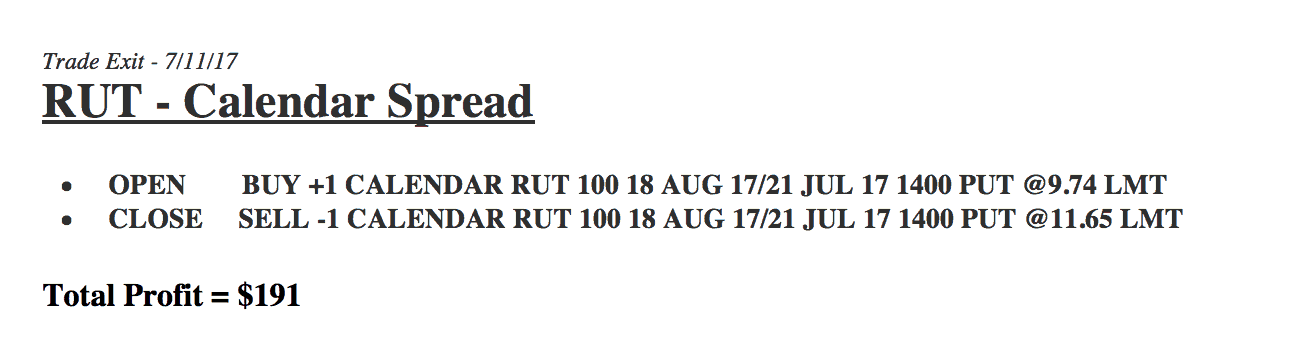

Next trade was a Calendar Spread in the Russell 2000. We booked a profit of $191.

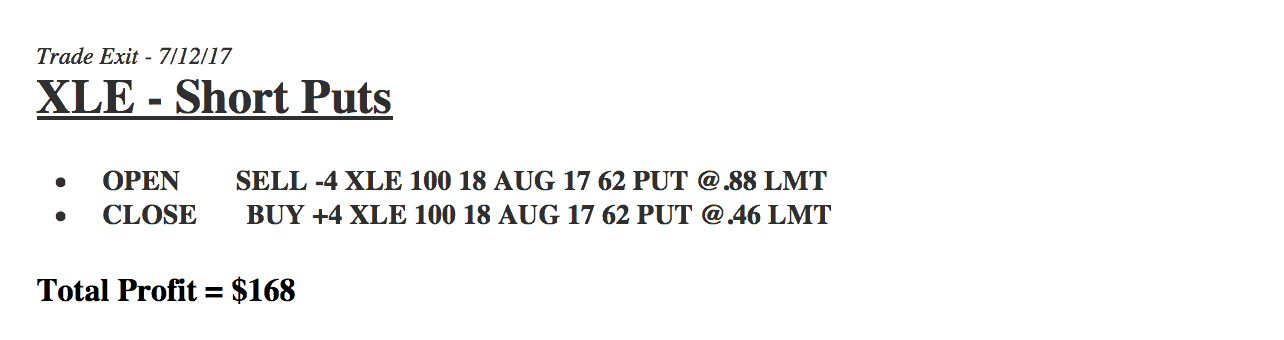

In XLE, implied volatility was high. We wanted to get a little bit more directional, so we just sold Puts. Booked a profit of $168 there.

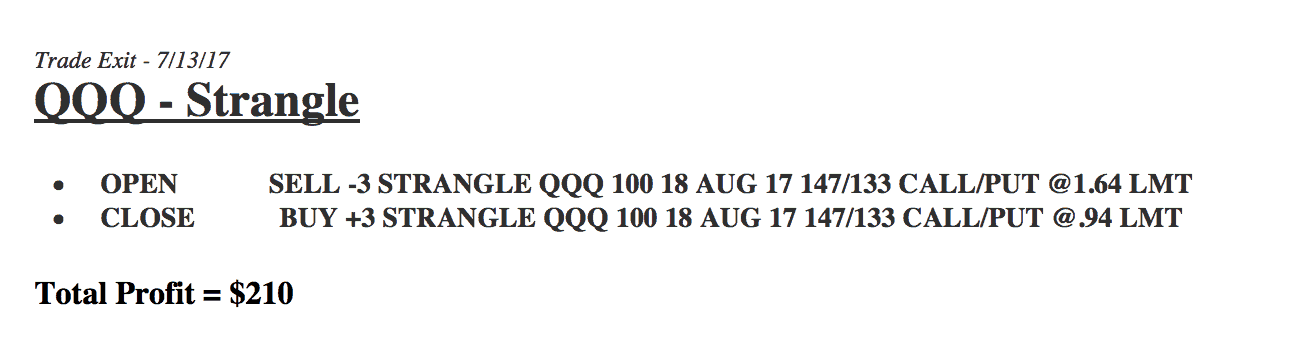

In the QQQ, we did a Strangle. Profit came to $210.

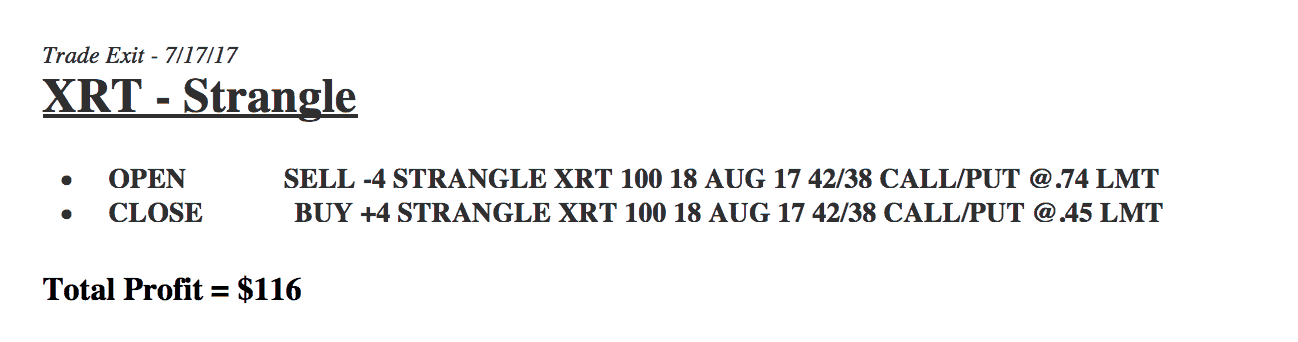

In XRT, we did a Strangle.

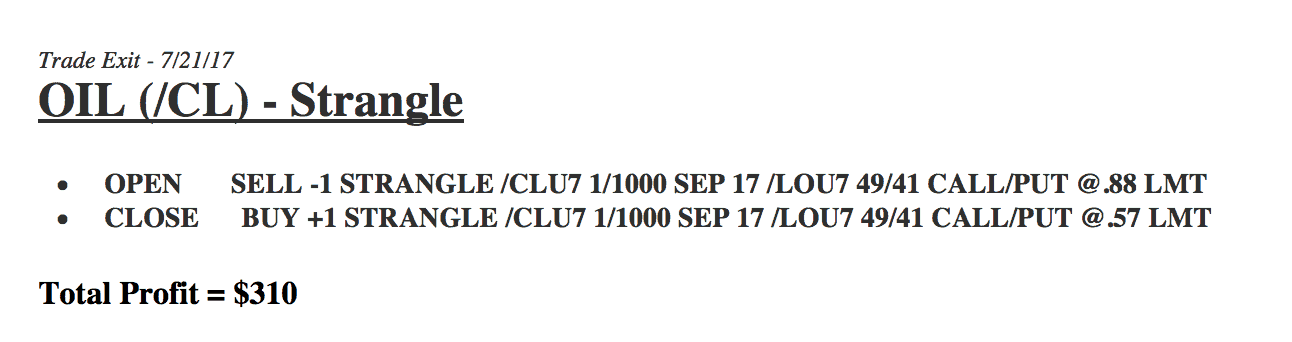

In oil, we did another Strangle.

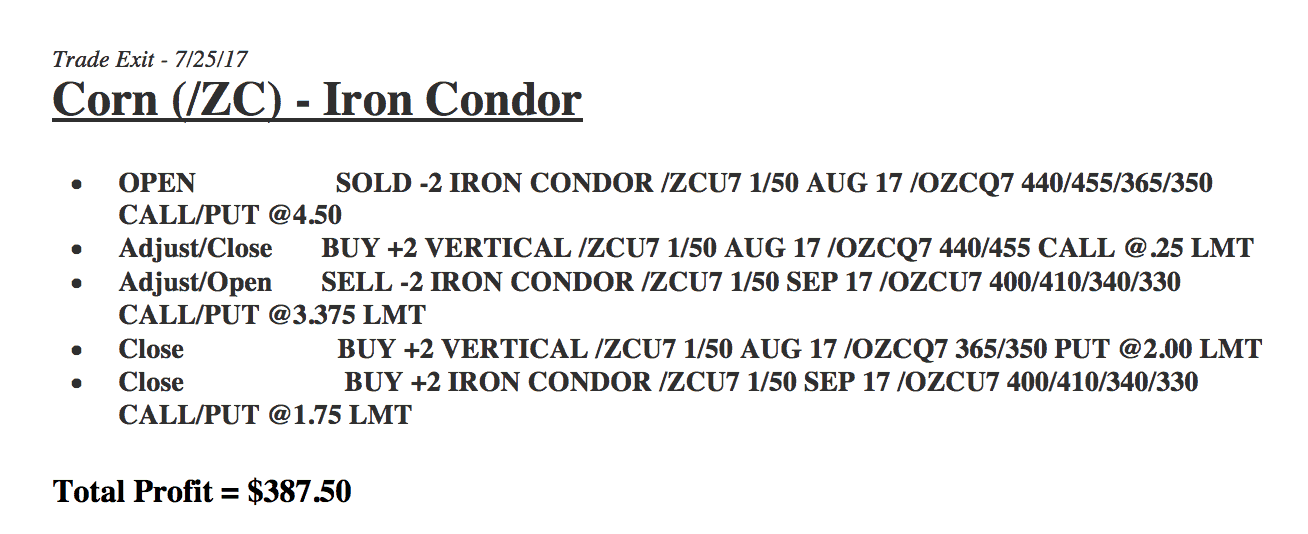

And finally, in corn, we did an Iron Condor for a profit of $387.50.

As this month has proven, just by staying mechanical with your adjustments and managing your winners the way that we teach in our courses, you can start getting consistent profits, even in a small account.

If you’re interested in learning the strategies that we teach at NavigationTrading, sign up for our 14-day Pro Membership trial. You’ll get instant access to our VIP course training, NavigationALERTS, watch lists, indicators, and more.

We look forward to seeing you on the inside.

Happy trading!

-The NavigationTrading Team

Follow