What’s up NavigationTraders?!

We wanted to give you a quick update on our performance for December 2017.

This year is in the books, and we’re looking forward to another great year of trading in 2018!

Let’s jump into the alerts for December!

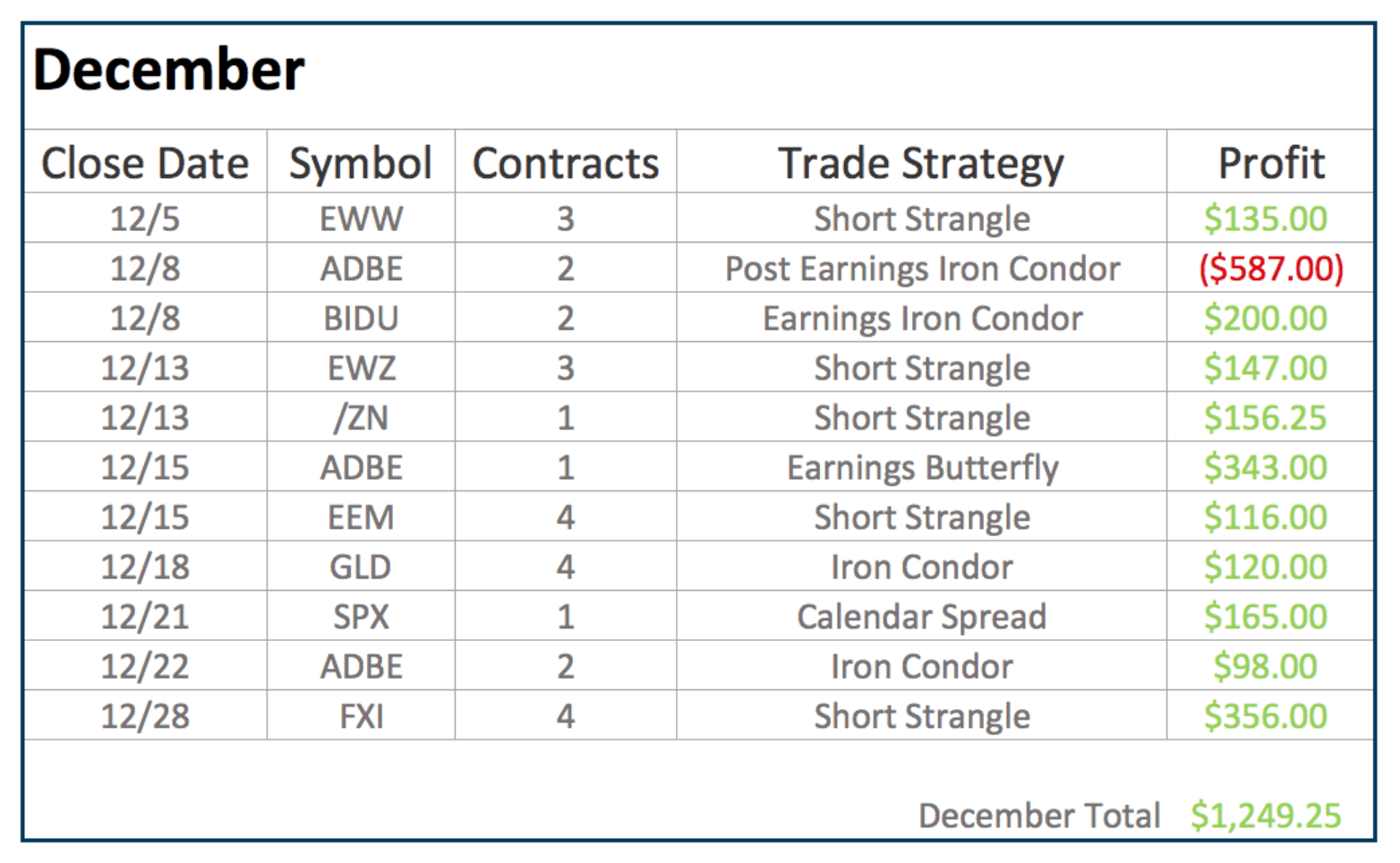

We had 11 closed trades, 10 of which were winners. We continue to trade really well.

We had a total profit of $1,249.25.

We traded six different strategies: Short Strangles, Iron Condors, Calendar Spreads, an Earnings Iron Condor, an Earnings Butterfly, and a Post-Earnings Iron Condor.

Let’s jump into the member’s area and go through the details.

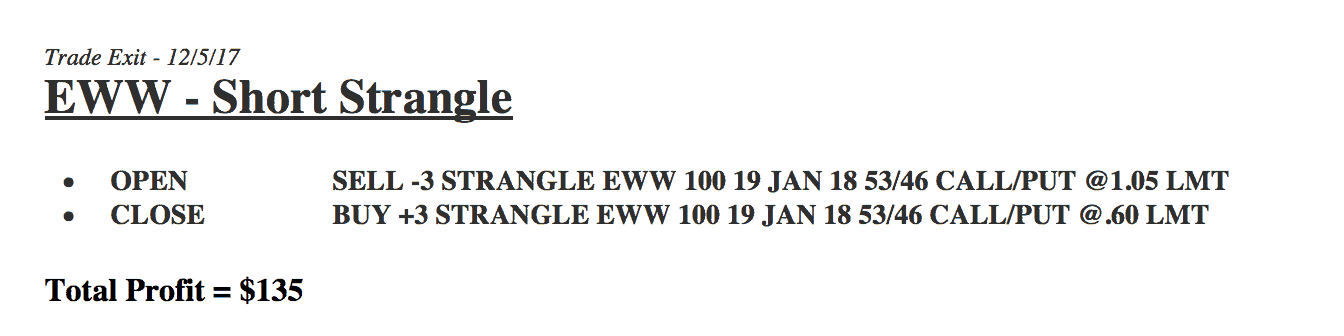

If we start at the beginning of December, we had a Short Strangle in EWW. We closed that with a profit of $135.

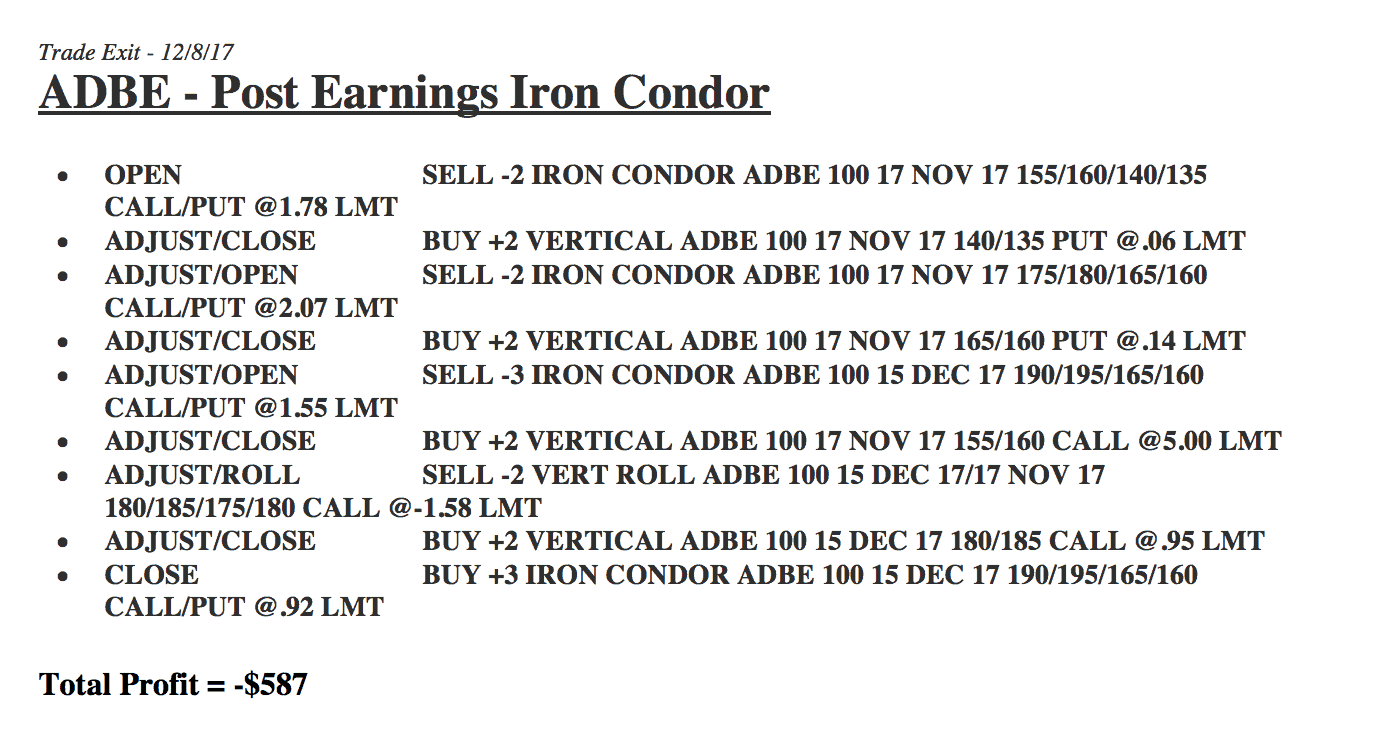

Our one loser was a Post-Earnings Iron Condor in Adobe. They came out with a surprise announcement. We ended up making several adjustments to reduce our loss, but ended up just booking a loss here of $587.

Not every trade’s going to be a winner, and when you have such a huge move, a surprise announcement by a stock like this, the best you can do is stay mechanical, make your adjustments, reduce your losses, and then cut it loose when you think you can’t get any more out of it.

So, we ended up taking a loss, but we made up for it with our other winners.

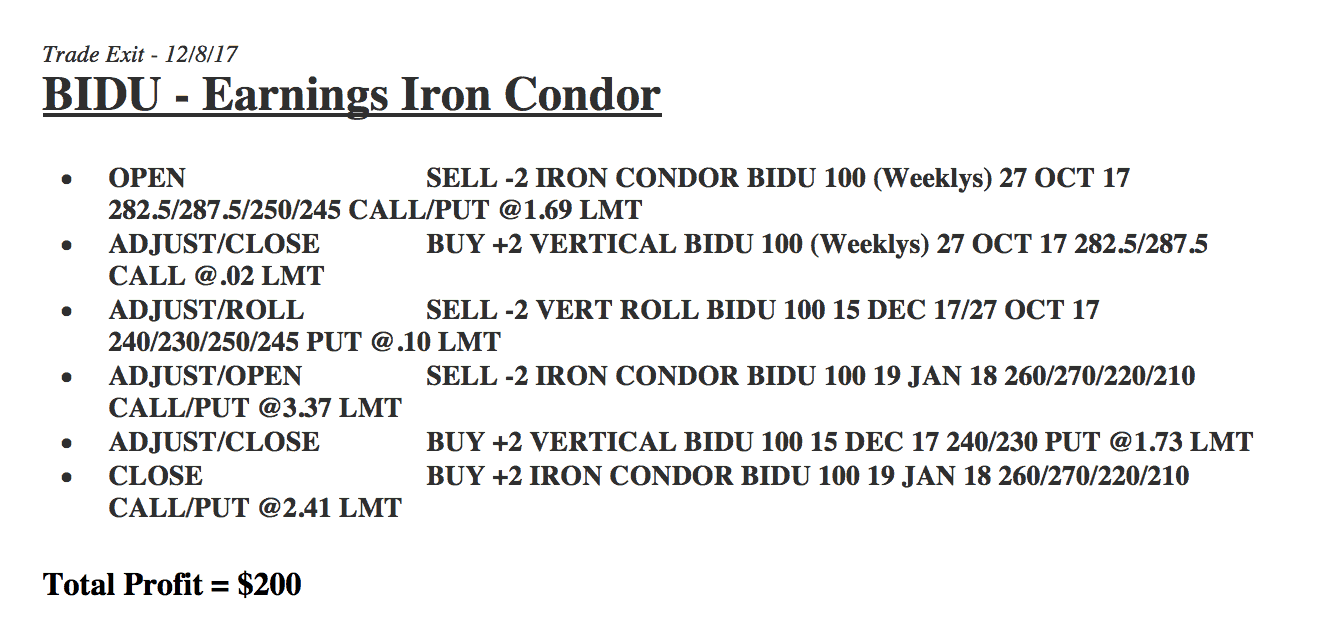

In BIDU we had an Earnings Iron Condor, booking a profit of $200.

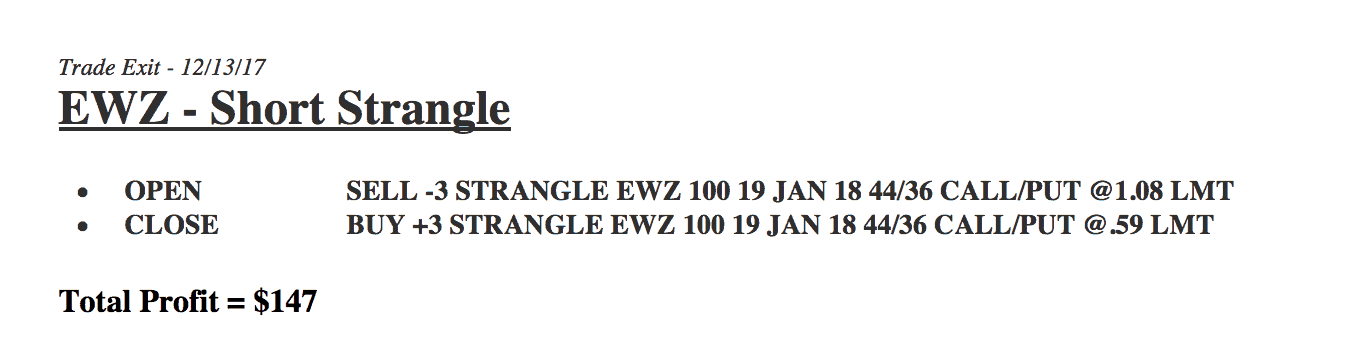

In EWZ, we did another Short Strangle for $147.

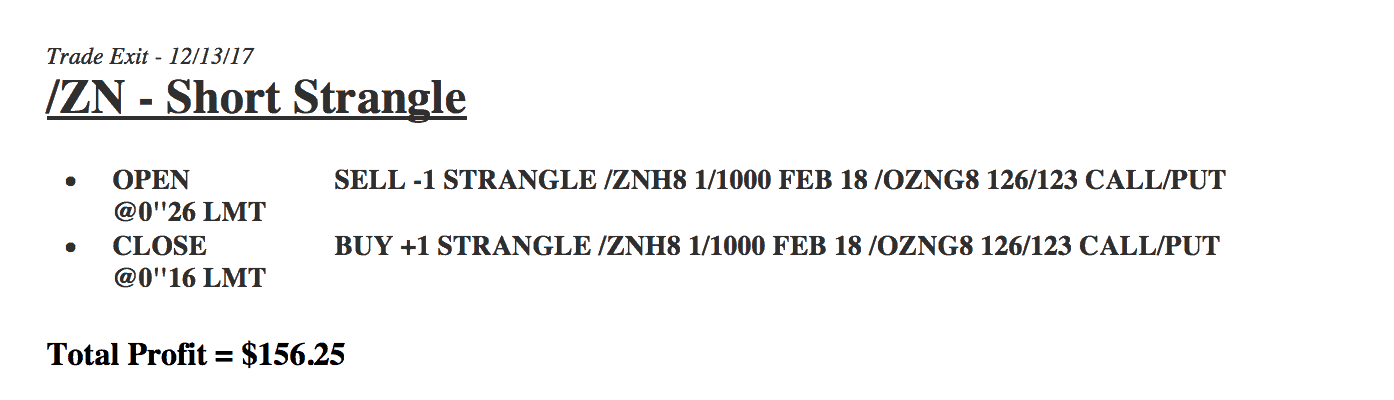

In the 10 Year Note, we did a Short Strangle and booked a profit of $156.25.

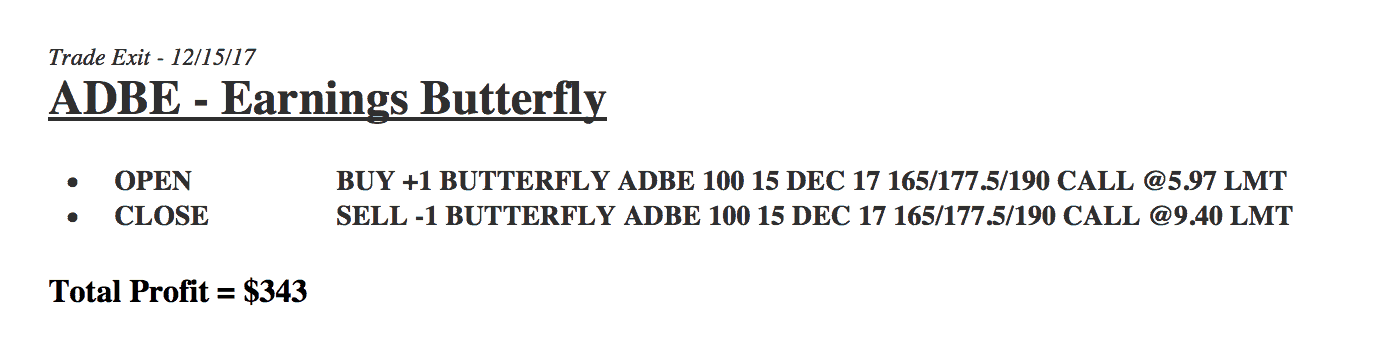

We did another trade with Adobe and got some of that money back that we lost earlier, making $343 on an Earnings Butterfly.

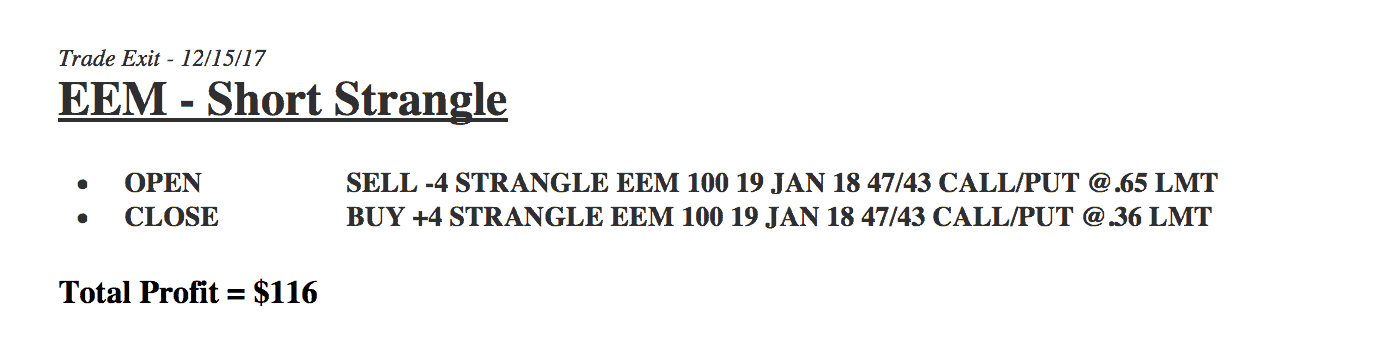

In EEM, we did a Short Strangle for $116.

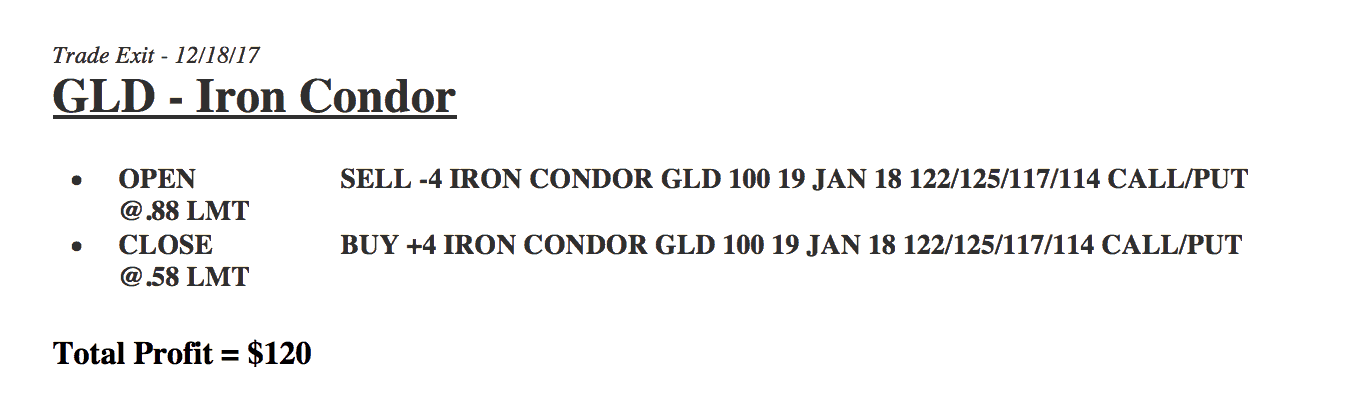

In GLD, we did an Iron Condor and booked a profit of $120.

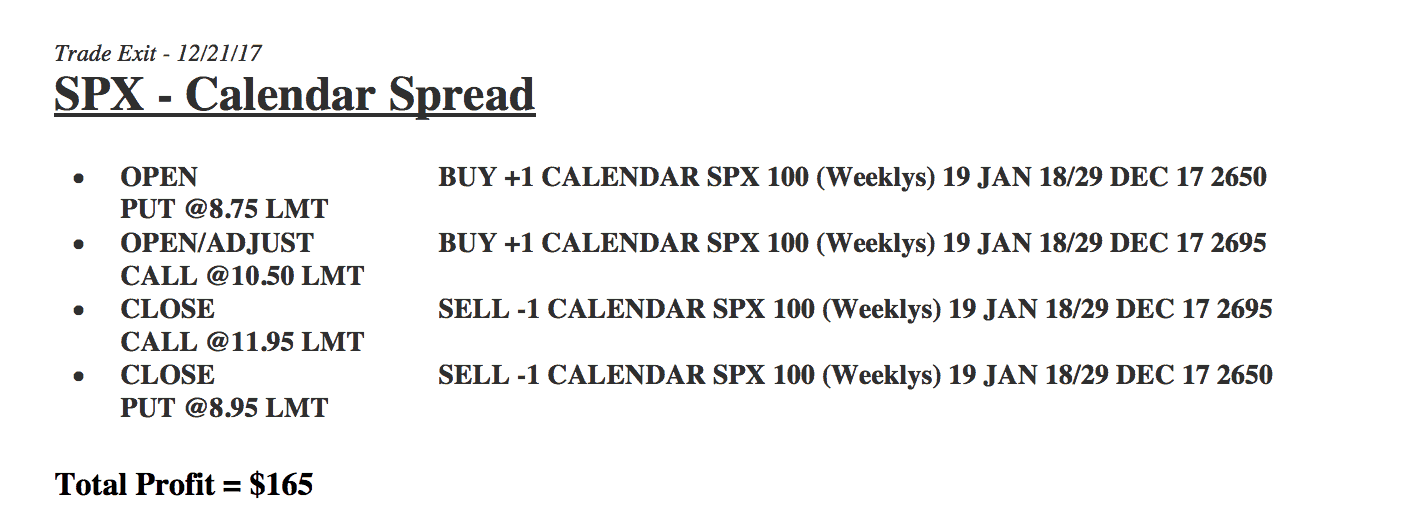

In SPX, we did a Calendar Spread, booking a profit of $165.

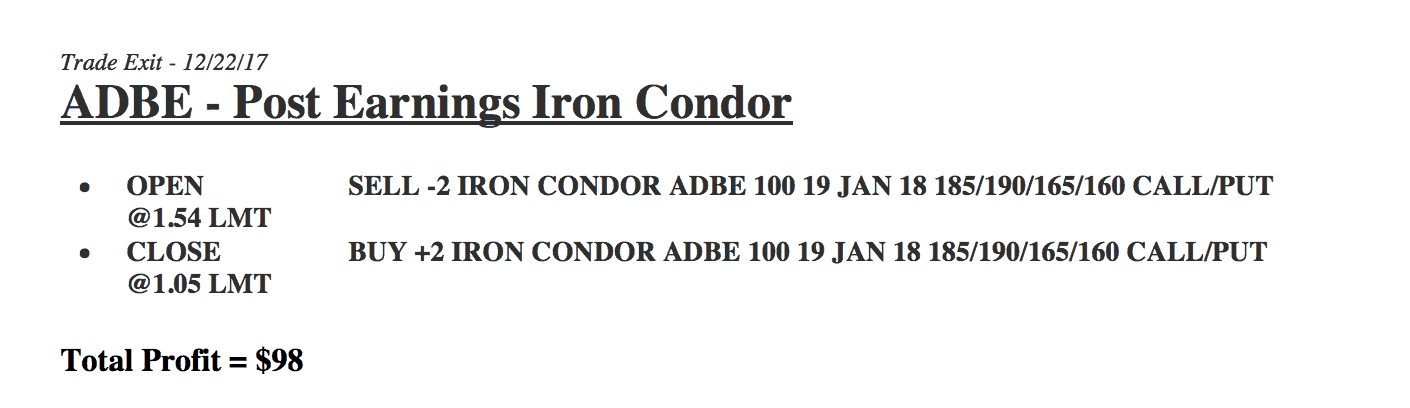

Dipping back into Adobe, we did a Post-Earnings Iron Condor and booked $98.

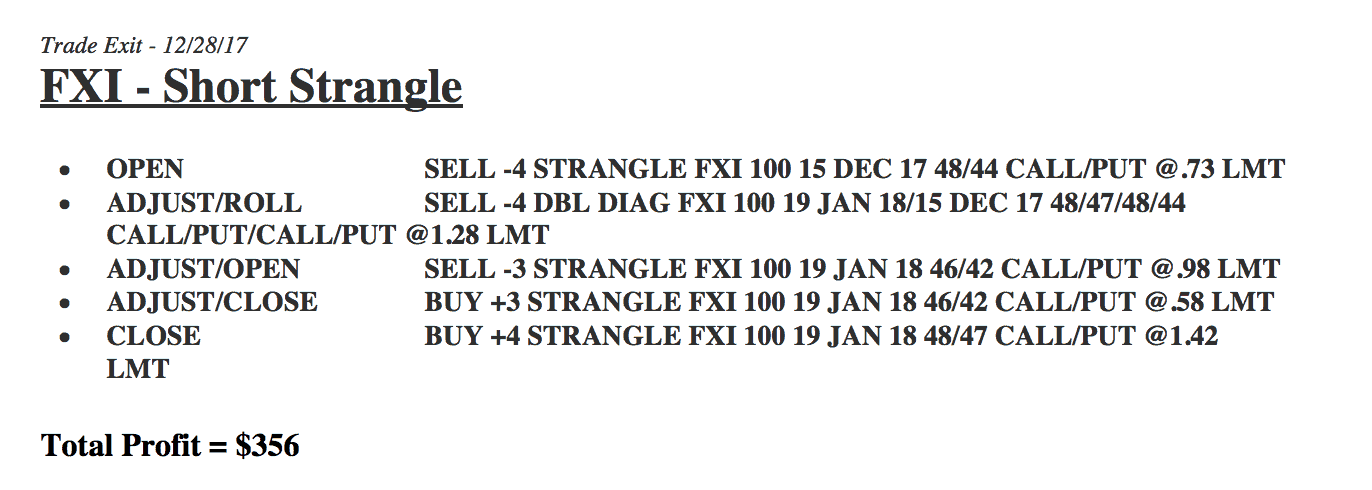

And in FXI, we did a Short Strangle for a nice profit of $356.

We’re only trading between one and five contracts in our alerts portfolio. On some of the lower priced symbols like EEM we did four contracts. We only did one contract in Adobe and in /ZN. We try to keep the buying power per trade between $500 and a couple thousand dollars.

You can trade these strategies in a small account, or scale up to larger contracts if you’re trading a larger account and you’re more experienced. The power of our methodology is just to keep your position size small, trade a lot of occurrences, and let the probabilities play out.

If you go to NavigationTrading.com/Performance, you’ll see all the trade statistics for 2017. We had a total of 75 closed trades, average profit was $140, with a winning percentage of 88%. If you scroll down the page, you can see we started recording our alerts in June of 2017. We post every trade, winners and losers.

You can see the close date, the symbol we traded, the number of contracts, the strategy, and the total profit for the month.

We’ll continue to update these at the end of each month so you know exactly what we’re trading, and how we’re doing. We want to be as transparent as possible so that you can see exactly how we are creating consistent income trading with our strategies.

If you’re interested in receiving NavigationALERTS, just go to https://navigationtrading.com/pro-trial to sign up for our $1 two-week Pro Membership trial.

Our Pro Membership trial also includes instant access to our VIP course training with all the different strategies we trade (Iron Condors, Short Strangles, Calendar Spreads, Butterfly Spreads, Directional Strategies, Options on Futures, How to Trade Options on Earnings, and Money Flow) and the Trade Hackers Ultimate Playbook, which is our 57 page eBook guide.

We hope this is helpful! We had a great year trading in 2017 and look for 2018 to be even better. We hope to see you on the inside.

Happy trading!

-The NavigationTrading Team

Follow