What’s up NavigationTraders?!

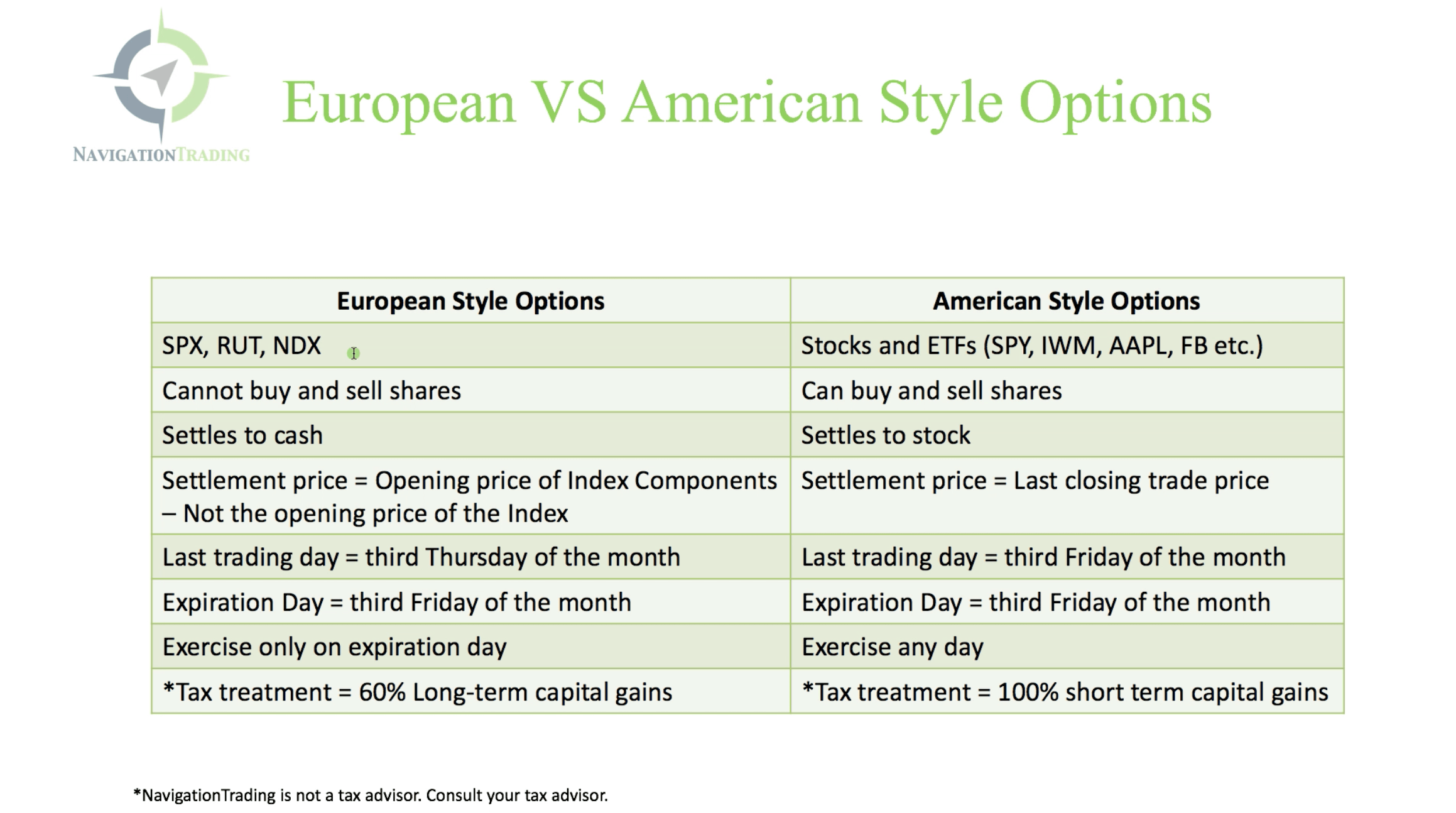

In this lesson, we’ll review what European and American style options are, as well as the differences between them.

European Style Options

A few examples of European style options are the S&P 500 Index (SPX), the Russell 2000 Index (RUT), and the Nasdaq (NDX). These are the three most liquid European style options, and that’s why we trade them at NavigationTrading.

American Style Options

Some examples of American style options would be SPY, IWM and QQQ which are ETFs that track those indices. They are not specific indices; they just track them. All stocks and ETFs like SPY, IWN, Apple, Facebook etc., are all traded as American Style Options.

The Differences

-

- Capability of buying and selling shares

With European style options, you cannot buy or sell shares. These are simply the indexes. You can trade options on the index, but you can’t buy and sell the actual shares.

With stocks and ETFs, you can buy and sell the shares, and trade them as a normal stock.

-

- Settlement

European style options settle to cash. When they expire, if you’re holding options in those positions, they simply settle to cash.

American style options settle to the actual underlying stock.

-

- Settlement price

With European style options, the settlement price equals the opening price of the index components, not the opening price of the index.

The settlement price of the American style options settles to the last closing trade price on expiration day.

-

- Last trading day

The last trading day for European style options is the third Thursday of the month.

The last trading day for the American style options is the third Friday of the month.

-

- Expiration

European style options expire on the third Friday of the month.

American style options also expire on the third Friday of the month.

-

- Exercising your options

European style options can only be exercised on expiration day.

American style options can be exercised on any day.

-

- Taxes*

The tax treatment for European style options is a little bit more favorable as they receive the IRS Section 1256 tax treatment. Which means that 60% of the gains can be counted as long term capital gains, which would be at the lower 15% rate. 40% of your profit would be taxed as ordinary income.

American style options are taxed as 100% short term capital gains. Depending on your overall income, and tax bracket, the taxes owed on profits would be added as ordinary income.

*We are not tax advisors. Consult your tax advisor before placing any trades.

I hope this was helpful in understanding the difference between European and American style options!

If you’d like to learn more about the different strategies we teach at NavigationTrading, check out our 14-day Pro Membership Trial. You’ll have instant access to our V.I.P. courses, Navigation Watch Lists, and our special indicator package.

You’ll also receive our NavigationALERTS, which are trade alerts sent to you via email and text. You’ll get to “look over our shoulder” as we place live trades in our own brokerage account.

We look forward to seeing you on the inside.

Happy Trading!

-The NavigationTrading Team

Follow