Hey NavigationTraders!

Welcome back to another trading lesson from NavigationTrading!

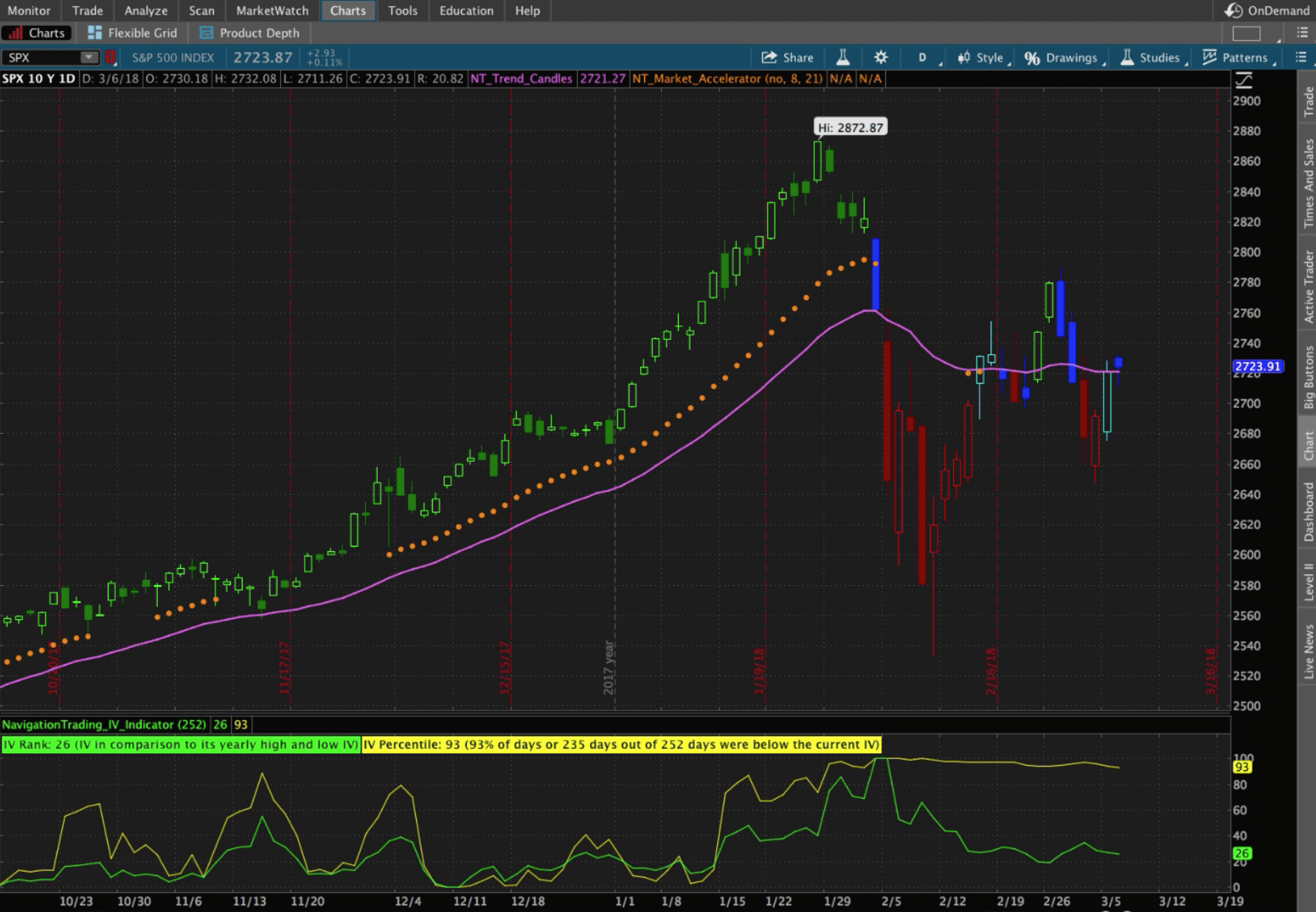

In this lesson, I want to talk to you about Calls versus Puts and what the differences are. The chart below is of SPX – The S&P 500 index.

Long Calls

I want to look at both the Calls and Puts from the Long and Short side, to give you an idea of what the difference is.

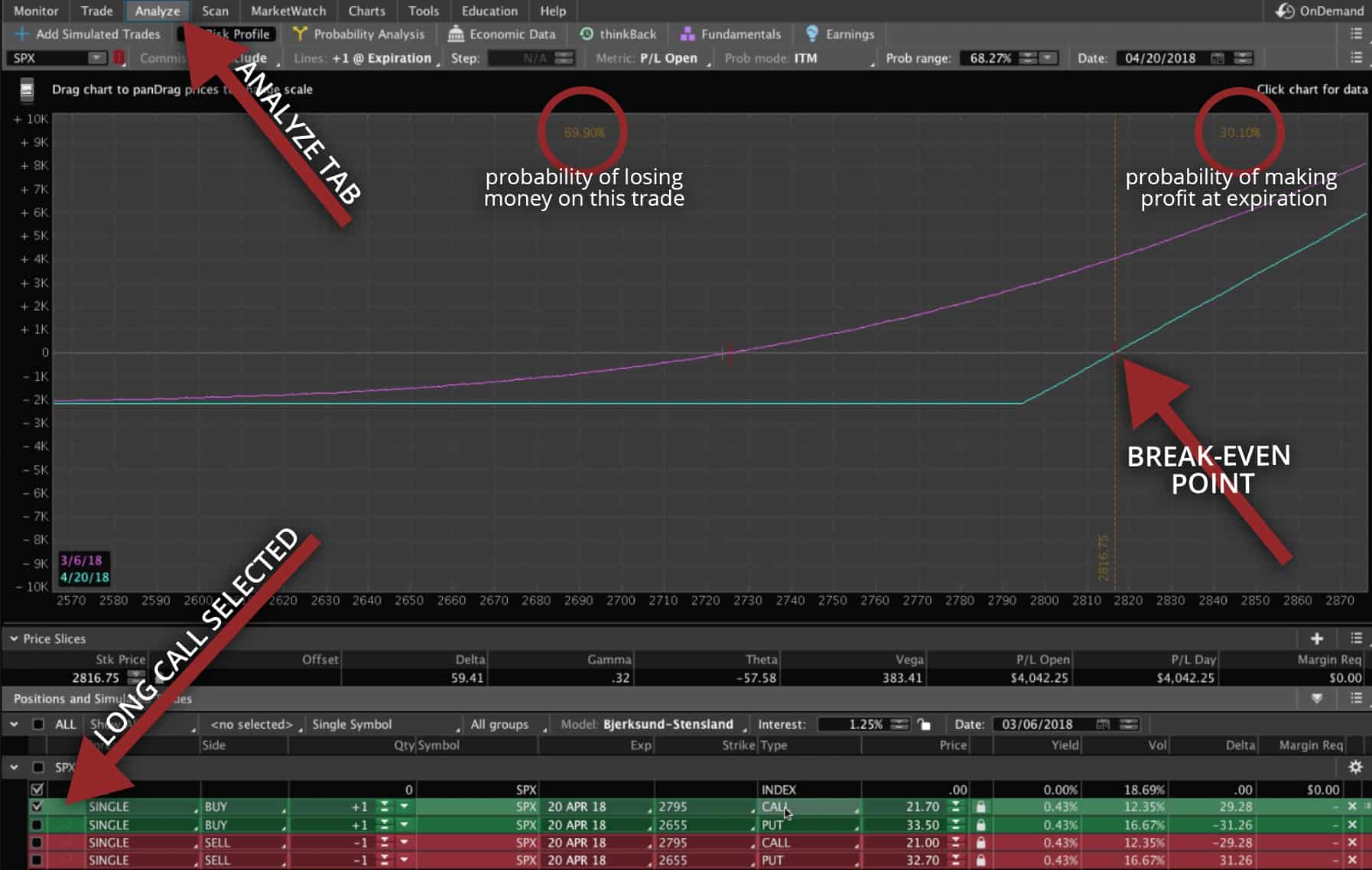

If we go to the “Analyze” tab, you can see the Long Call option is selected at the bottom of the platform. I did these options right around the 30 Delta.

What you’ll notice on this Long Call, is that I’ve set this price slice right at the break-even point at expiration. The break-even point is represented by the dotted vertical line.

There’s about a 70% probability of losing money on this trade and about a 30% probability of making money at expiration. These aren’t very good probabilities, right?

This is because when you buy options, time decay is working against you. The date of this recording is 03/06/18. I’m showing these options at an expiration cycle of about 45 days out. So, on April 20th is when they would expire.

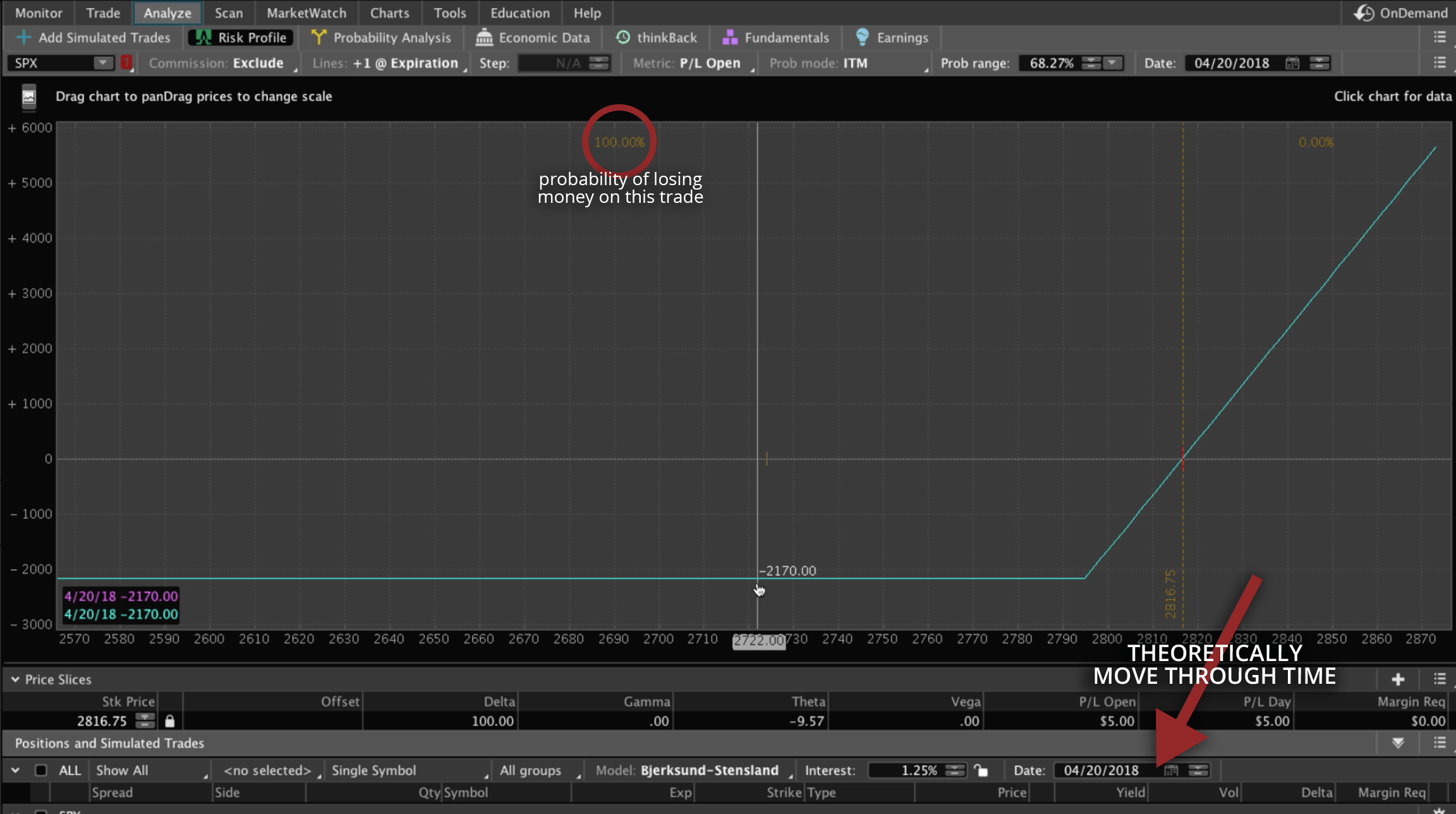

What if we took this position through a theoretical time warp and just clicked on the days going upward until we reached expiration?

Look what happens to the pink profit line, it literally goes away. You can see if price stayed relatively stable, if it stayed in the same spot, by the time you got to expiration on 04/20, you would have lost your entire investment. In this case, one contract controls 100 shares. We’re looking at an index here.

The bottom line is one contract is worth $2,170, and you would have lost that entire amount had you kept it all the way until expiration and price just stayed level.

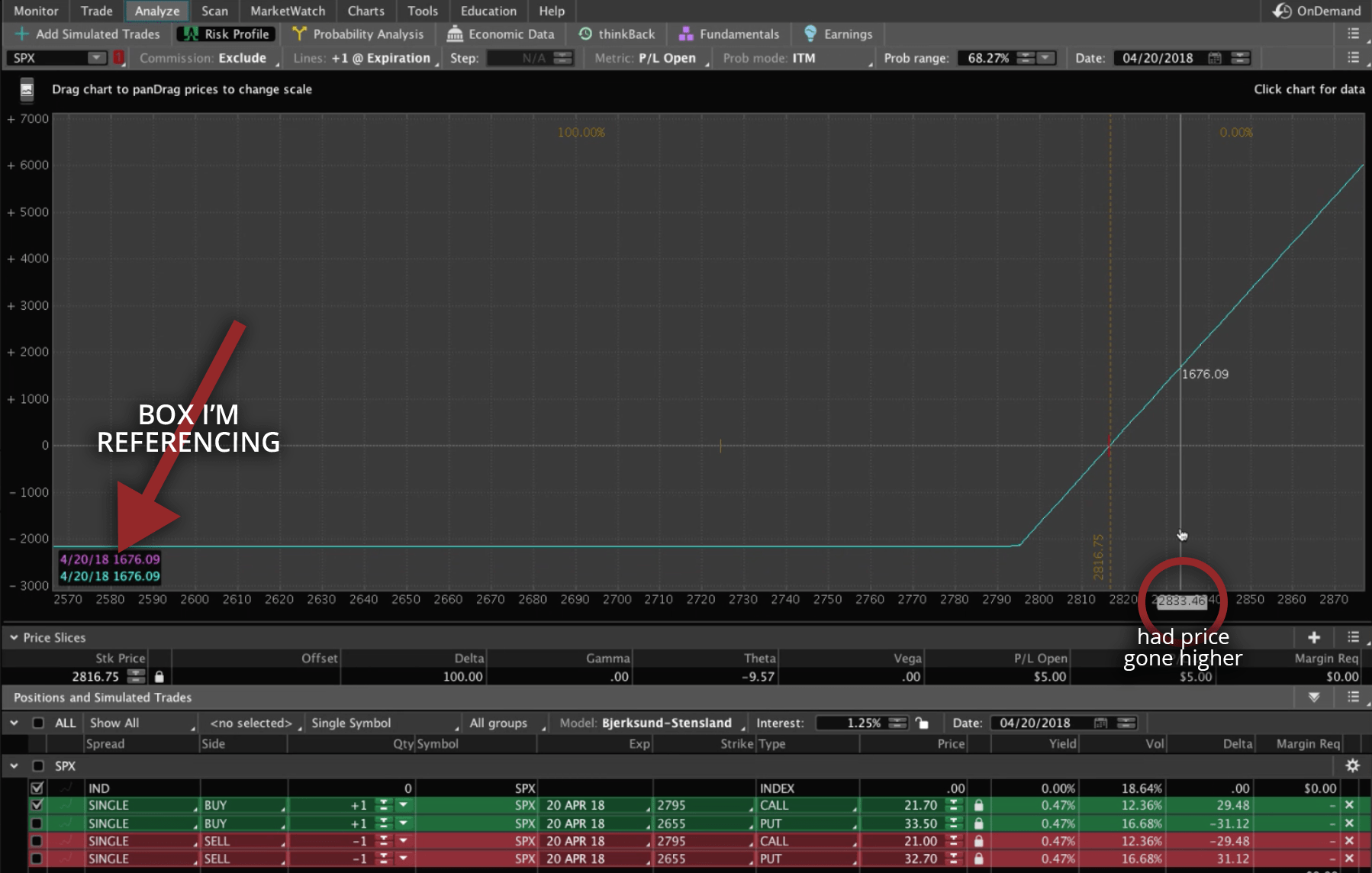

Price would have had to move all the way up past $2816.75, for you to start making money. If you watch the box in the bottom left corner of the graph as you hover, you can see how much you would have made had it crossed that line and continued higher.

So, the probabilities of buying, in this case, a 30 Delta Call are very low when it comes to profiting.

Long Puts

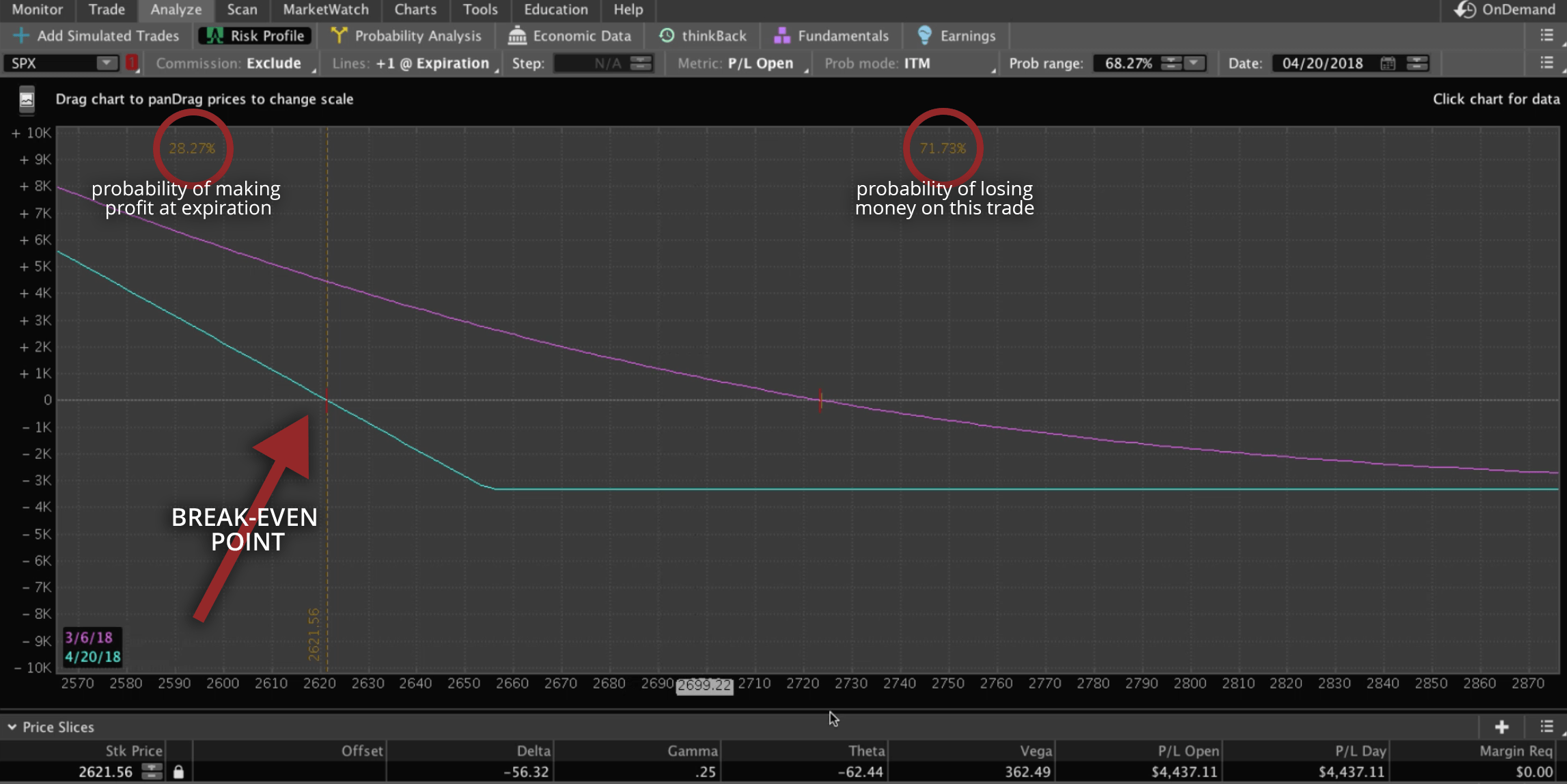

Let’s take a look at a Long Put. I’m going to make sure the Long Put is selected at the bottom of the platform, and uncheck the Long Call.

The Long Put works very similar to the Long Call, except it’s the opposite. If you buy a Put, you want the price of the symbol to go down.

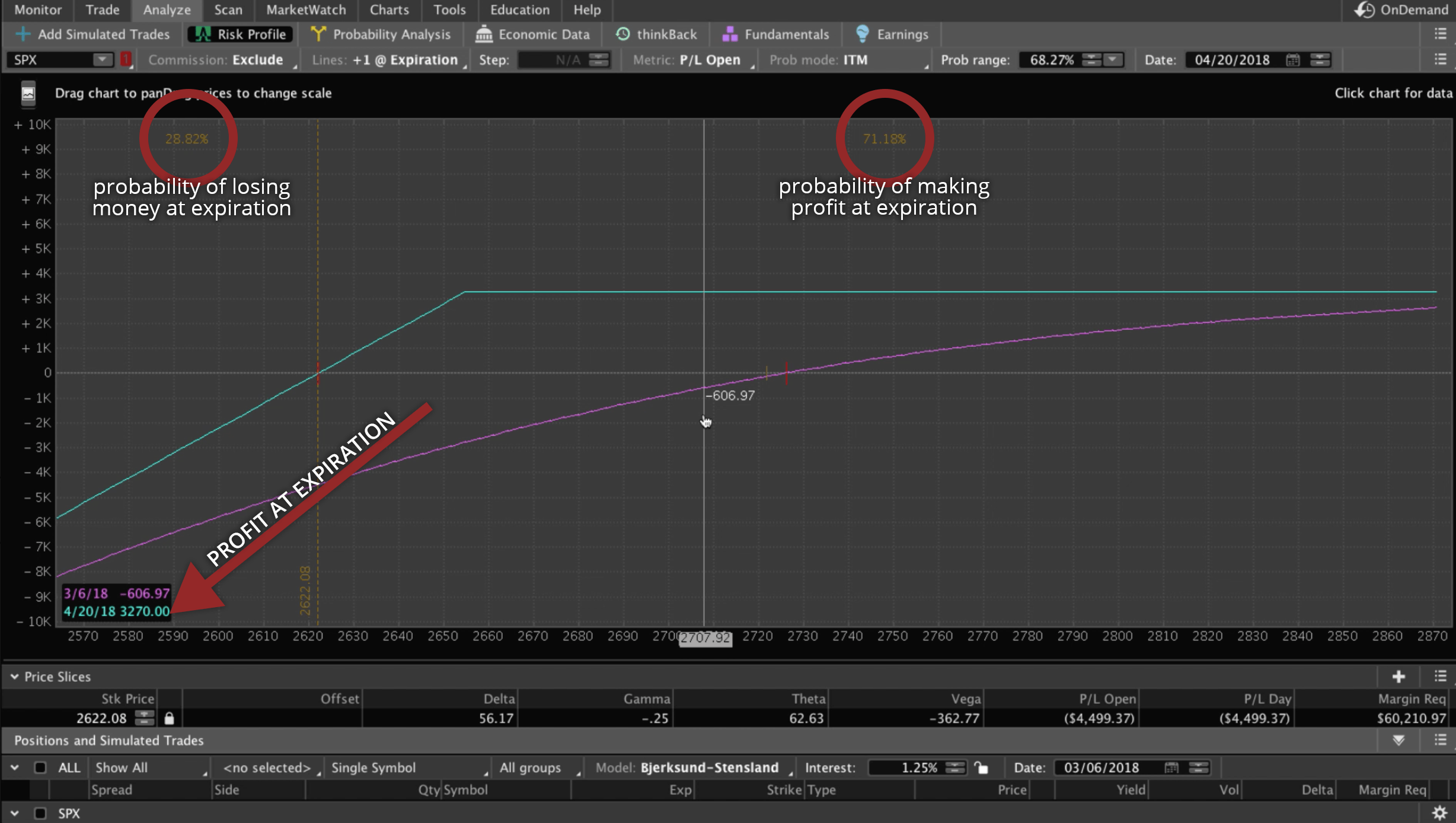

I moved my price slice over to the left to the break-even point on the Put side, and what you’ll see is that it’s relatively similar. We’ve got just over 71% chance that this trade is going to lose money and a little over 28% chance that it’ll actually make money at expiration.

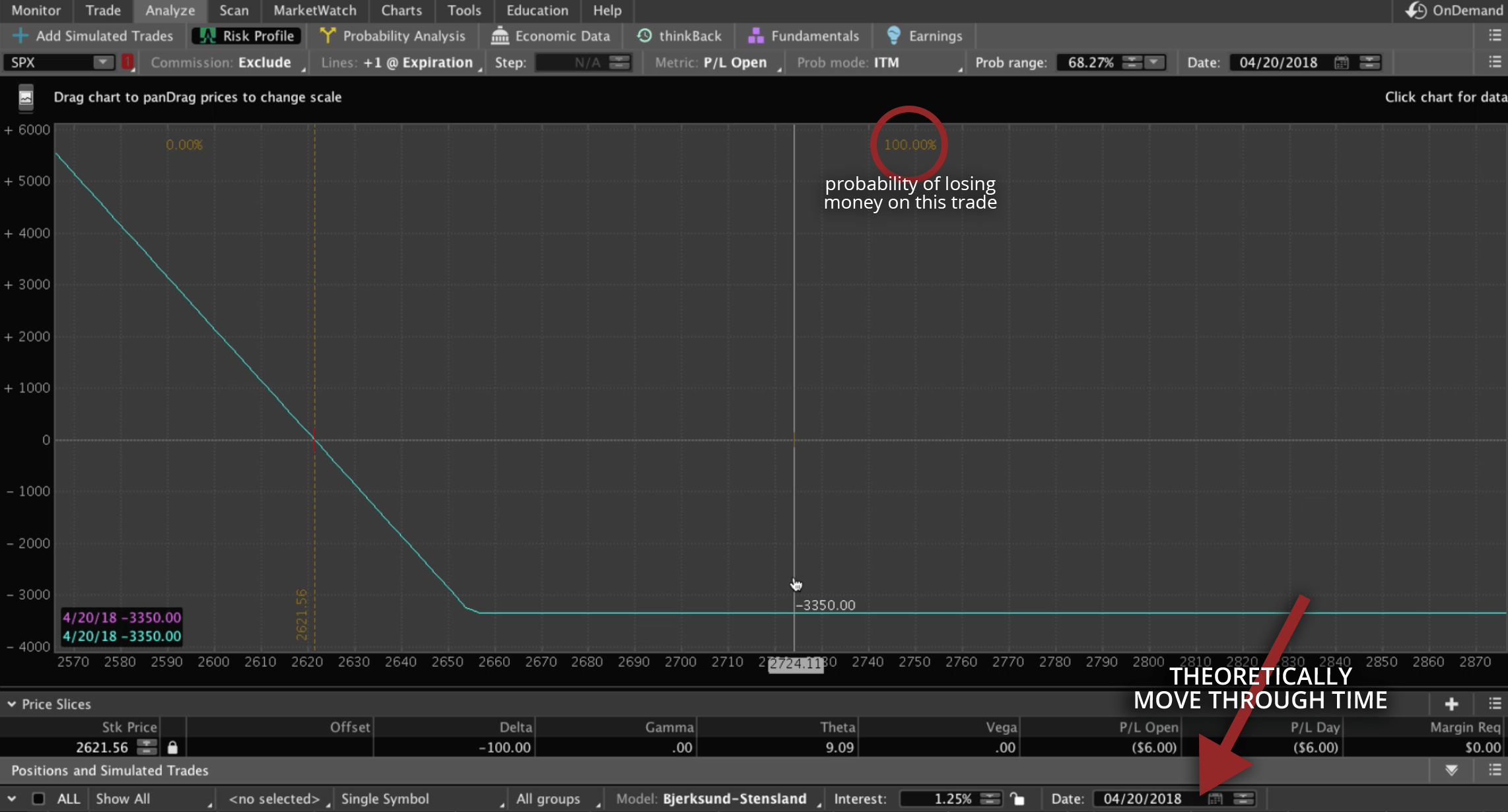

We do the same as before, and we theoretically move through time. You can see that the profit line just continues to go downward, and if we don’t cross over that break-even point at some point pretty quickly, we have a good chance of losing and a decent chance of losing the whole amount.

In this case, the Puts are actually worth a little bit more. You would have had to pay $3,350, and if it continues all the way to expiration without getting across that break-even point, you would have lost the entire amount of $3,350.

We are typically not buyers of out-of-the-money Puts or Calls. Now there are very specific times that it can be a profitable trade around Earnings, but I’m not going to get into that in this lesson.

We do a whole course on Earnings trades and how to profit from those, and buying directional options is one of those strategies. You can access that course at navigationtrading.com/earnings. Our Pro Members already have access as part of their membership.

As it relates to trading, ETFs and broad markets, typically buying out of the money options is not a very good idea.

Short Calls

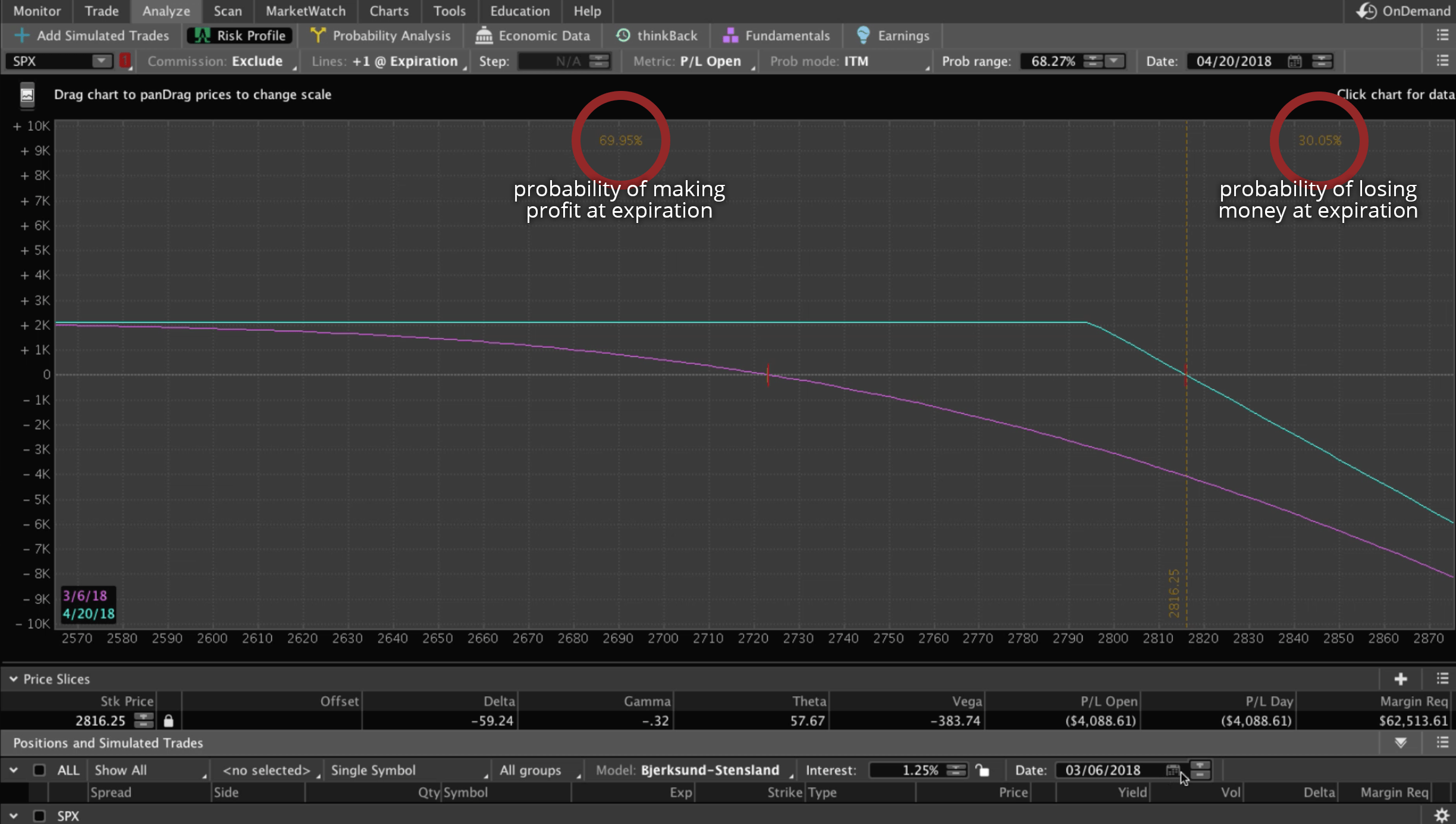

What if we don’t want to buy Calls and Puts? What if we’d like to take the opposite position, and we actually sell those same Calls and Puts? We’re selling around the 30 delta. So. we’re selling the out of the money options.

The first one we’ll look at is selling the 30 delta Call. I moved my price slice back to break-even. Now, what you’ll notice is that we’ve got over a 70% chance of making money on this trade and a little under 30% chance of losing.

So, when you sell options, the key to remember is that now you have that time decay working in your favor.

If we move through time and we use the theoretical calendar down at the bottom of the platform again, you can see the change from what we have been seeing in the profit line. As we move closer to expiration, the profit line continues to move upward.

If price stays in our range, meaning if it doesn’t have a huge move up and break out of that upside (which as I said, it had over 70% chance of staying below break-even between now and expiration), if it continues to stay there, you will collect and keep all of the credit that you sold it for.

If you go all the way to expiration on 04/20, you can see the total amount of credit you initially collected on this position was $2,100, and assuming it stays in this range, you will keep that entire $2,100. As long as it stays below your short strike (in this case it’s the 2795), you’ll keep the whole amount.

Between 2795 and the break-even point of about 2816, you’ll still keep a portion of that. If you move your mouse around, you can see what that amount would be, and anything below 2795, you’ll keep that $2,100.

Even if it crashed to the downside, you’re still going to keep that $2,100.

When you’re selling options, you’re putting the probabilities on your side. Time decay is working in your favor.

The downside is that your upside profit is capped. We’re capped at a total profit of $2,100, but that’s what we want to do. We want to put the probabilities on our side, cap the amount of profit and put that time decay in our favor.

In most of our strategies that we teach at NavigationTrading, we are net sellers of options. This is the only way to have consistent and successful trading profit over time.

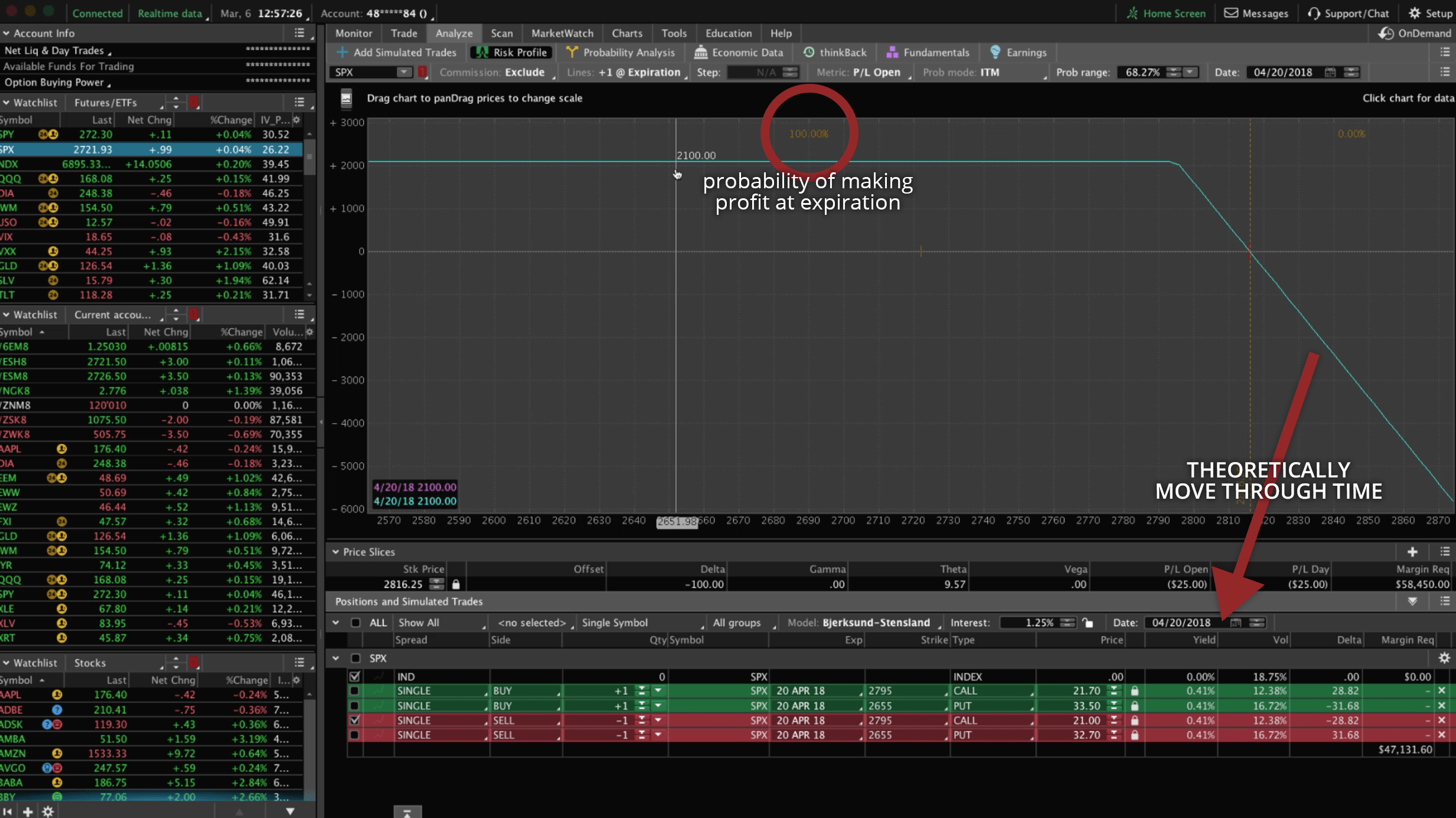

Short Puts

All right, so let’s jump over to the Put. If we’re selling the put, we can move our break-even slice over to the break-even point.

Remember, Puts are typically worth more, and what you’ll see is the total credit collected here is $3,270.

Assuming price stays above our Short Put strike (which is the 2655), then we will collect that entire $3,270 if we held it all the way to expiration.

Again, as we go through time, that profit line continues to move up, and we continue to make that money until we go all the way to expiration. If price is above that short strike, we keep the entire amount, in this case, $3,270.

Ending Notes

So, the key thing to remember is…When you sell options, time decay is working in your favor. You can set it up so that you have a very high probability of success.

When you’re buying options, you need a very sharp move in your direction in a very short period of time.

Not only do you have to be right on direction, but you have to be right on the timing of that trade to make a profit.

One last point about Puts and Calls, just to recap. When you buy a Call, you want the stock to go up. When you buy a Put, you want the stock to go down. When you sell a Call, you want the price to stay down, or steady. And finally, when you sell a Put, you want price to stay steady or go higher.

That’s the basics of Puts and Calls. I hope this tutorial was helpful!

If you’d like to learn more about how we’ve taught over 12,000 members how to trade options for consistent income, just click https://navigationtrading.com/free-member and we’ll give you immediate access to our flagship course, Trading Options for Income.

We’ll also give you the NavigationTrading Implied Volatility Indicator that you see on our charts, along with the watch list that we use to trade the most profitable symbols day in and day out. All this is yours at no cost.

We look forward to seeing you on the inside!

Happy Trading!

Follow