We’ll discuss why we think index funds are extremely dangerous right now.

For the purpose of this lesson, I want to focus on the S&P 500 Index. It’s one of the most widely known indexes in the world.

What Is the S&P 500?

It’s made up of 500 of the largest U.S. companies. It’s weighted by market cap (the size of the company within the index), and the companies are actually chosen via a committee that votes on whether or not a company will be inducted into the S&P 500.

Index funds have gained a ton of notoriety, a ton of publicity, and a ton of popularity in the last decade or so, partly because they are low cost. Investors are starting to realize that these so-called “professional money managers” or actively managed funds very rarely even beat the performance of the S&P 500. So, the amount of money invested in index funds is astronomical compared to what it was just 10 years ago.

The attraction, as I mentioned, is the low cost, and being able to invest in what appears to be a diversified, broad market index. They think it’s a way of passively investing. They’re just putting money in these funds, using advisors, investing in their 401ks, and piling huge amounts of money into these index funds.

The Danger Associated with Index Funds…

Here is why I think this is a very dangerous proposition for retail investors. To start with, the investors who invest in index funds, I don’t think, have any idea of what they’re really investing in. In their mind they’re thinking that they are diversified and they’re in a broad market index.

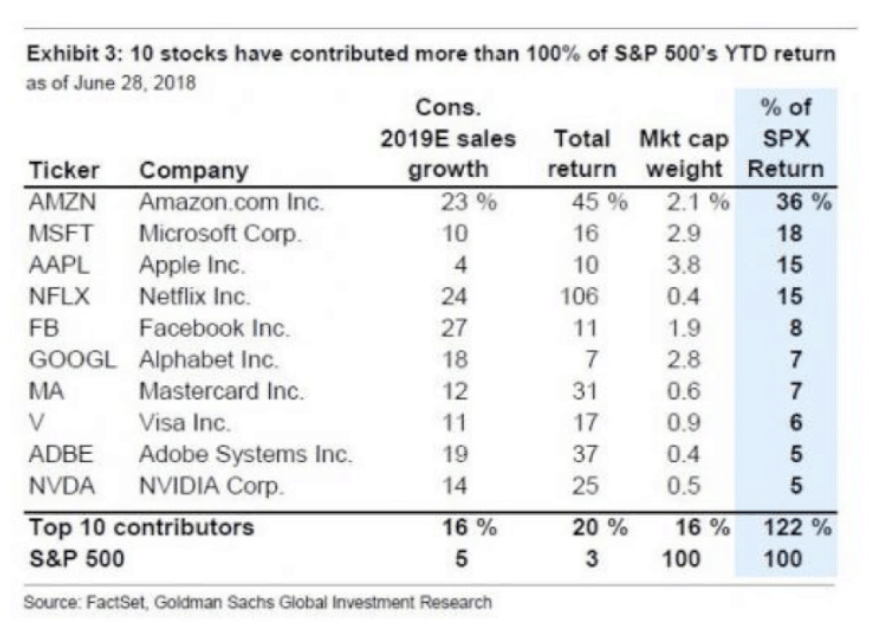

Here’s the problem. Take a look at the chart below.

As of the end of the second quarter in 2018, Amazon had accounted for 36% of the S&P 500’s return year-to-date in 2018. If we look at the top four — Amazon, Apple, Microsoft, and Netflix. They’re responsible for 84% of the S&P 500’s upside in 2018!

The top 10 have contributed 122% of the returns of the S&P 500.

Take a look at these different names: Amazon, Microsoft, Apple, Netflix, Facebook, Google, and then we’ve got MasterCard and Visa, which I will exclude from this lesson. Adobe and NVIDIA round out the top 10.

What’s similar about these eight stocks? Well, they’re all technology companies, right? So, when you invest in the S&P 500, are you really investing in a broad market index, or is this really a technology fund?

Now, there’s nothing to say that technology isn’t going to continue to lead the market as far as returns go, but I would be really careful about that, because there’s so much technology in the S&P 500 that if things turn around in technology, the entire market could go down significantly.

With the popularity of index funds and ETFs, low cost index funds, so many people are investing in these, and the actual make-up of these indexes is really just a handful of technology stocks.

If you understand that, and you’re okay with it, and that’s really what you want to be invested in, then all power to you. Go ahead and invest in your index fund. But, I think very few people understand what their S&P 500 Index fund is actually made up of.

Disruption

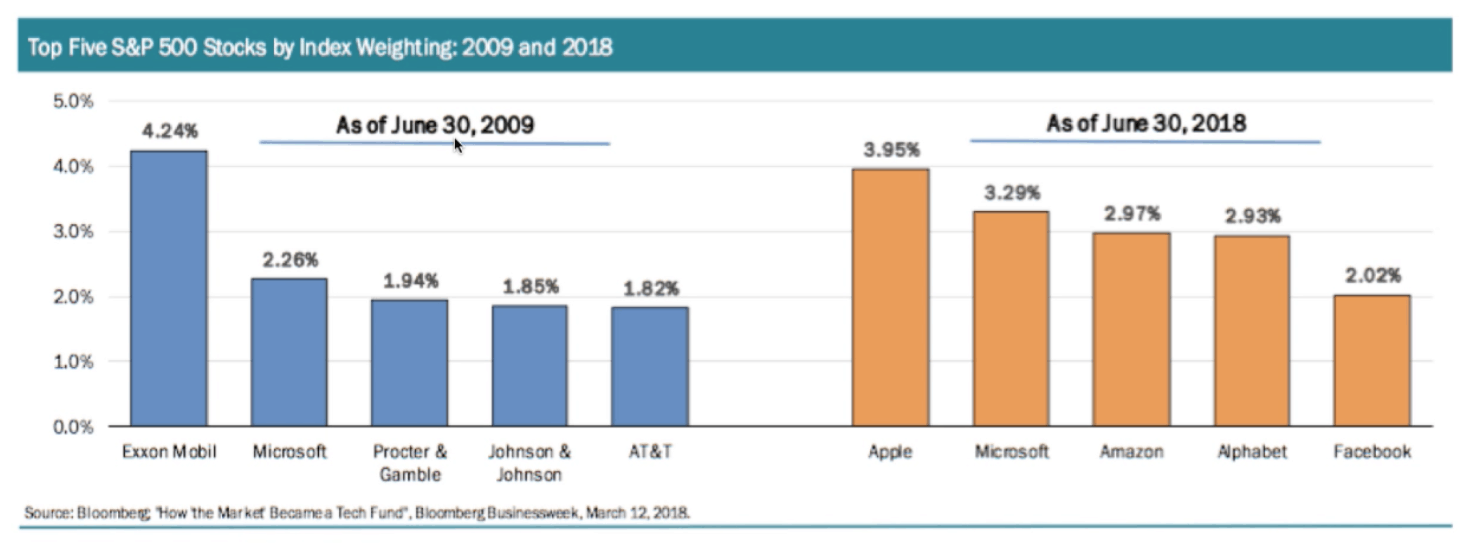

Another reason this makes me nervous for those invested in index funds is this. Take a look at the top five capitalization stocks by weighting back in June 30th of 2009. About 10 years ago, Microsoft was the only company in the top five that is still there today.

The other top five companies have completely changed. If we were to look at the top five companies 10 years prior to that, so in 1999, what you would see, is that it’s a totally different list of top five companies in the S&P 500.

If you can remember back to 2009, if you were investing at that time, you thought ExxonMobil was this world-beater, too large to fail. Not that they’ve failed, but they’re definitely not anywhere in the top five at this point. Microsoft has hung in there. Procter & Gamble, Johnson & Johnson, AT&T, all of these huge, massive companies that you thought, at that point, would always be there.

I think we have the same mindset today. If you look at Apple, they’re dominating their space. Microsoft continues to be a big player. Amazon, in the retail online marketplace, are dominating as well, not to even mention their data industry. Then Alphabet, which is Google, is dominating the online search. Facebook is dominating in advertising and social media. We look at these companies and think, these companies are going to go on forever. They’re going to dominate the marketplace forever.

But the reality is, that there are always disruptors. There are always changes in the economy. There are changes in law. There are changes in what people want, and there are going to be companies that come up and disrupt these top five companies ten years from now.

Not only are these index funds heavily weighted in these categories, but because these are the top liquid stocks available, almost every hedge fund out there is invested in these top names. Every actively managed mutual fund, hedge fund, index funds are now completely loaded with this handful of technology names, because that’s where the liquidity is.

Takeaways

The bottom line is this. I’m not calling for a market top. I’m not saying that we’re going to crash tomorrow. But what I am saying is, I don’t want you to blindly invest in index funds, because I don’t feel like they are a broad market, safe, diversified portfolio that most people think they are.

Secondly, you need to take control of your account. Be strategic with your investments. At NavigationTrading, we are all about using probabilities and statistics to be strategic with our trading. We’re not just blindly following any “guru”. We’re not just blindly following any index fund. You have to be strategic with your money.

Lastly, don’t follow the herd. If everybody else is doing it, I’m inclined to go the opposite direction, and I think that you should too.

Anytime you have this massive consolidation in just a handful of stocks and just a handful of names, and everybody’s just buying, buying, buying…The reality of a capitalistic market, once it gets to a point that there’s no more buyers in that area, and something happens, and it turns to the downside, guess what? Those buyers that continue to push this thing higher, are the ones that always get hurt when the market reverses.

BE STRATEGIC with your investments. Join us at NavigationTrading, where we are strategic with our trades, and we can make money whether the market goes up, down, or sideways, because it’s not going to go up forever, and you don’t want to be one of the ones caught at the top when this thing turns south.

Happy trading!

-The NavigationTrading Team

Follow