Hello!

In this lesson, I want to teach you about Contango and Backwardation, and how that’s relevant to trading futures and options on futures. This is a subject that’s a little confusing for newer traders, but hopefully I can simplify it, so it will make sense.

Lesson highlights:

- What is VIX Contango and Backwardation?

- Platform Examples in /CL and VIX

Contango Definitions

What is Contango?

Contango refers to when the price of the further expiration futures are HIGHER than the price of the near term expiration futures.

Most futures are typically in Contango, meaning that the price of the futures in further dated expirations is higher than that of the near term.

What is Backwardation?

The opposite of Contango is Backwardation. That’s when the price of the further expiration futures is LOWER than the price of the near term expiration futures.

Like I just mentioned, most futures are usually in Contango, but futures may go into Backwardation when volatility spikes higher. You will find most futures are in Contango about 85% of the time.

Trading Platform Examples

Let’s go to platform and take a look at some examples.

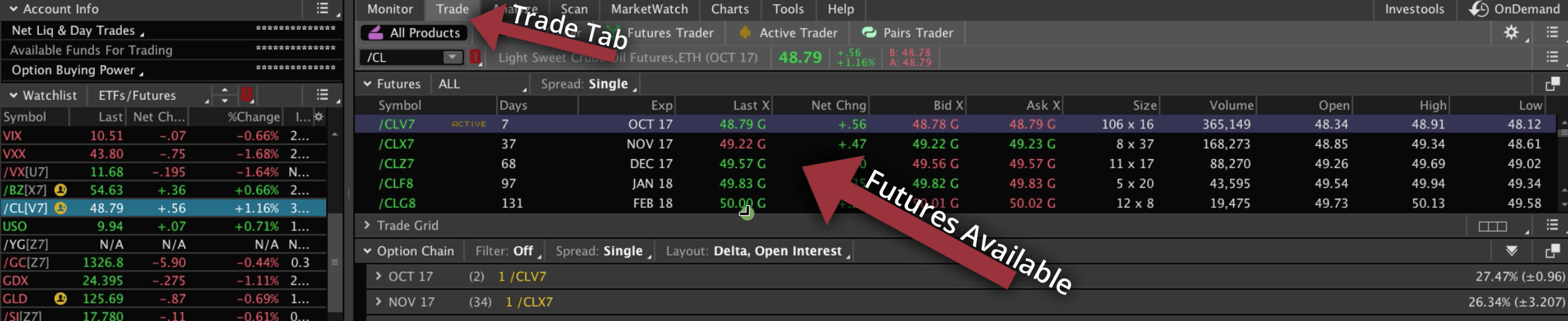

/CL

First, we’ll look at oil (/CL). We’re on the Trade tab in thinkorswim, and you can see all the different futures that are available with the different expiration cycles. The future highlighted in blue, is the active future with seven days left. The price of oil right now is $48.79.

If you look at the future with 37 days to expiration, it’s priced at $49.22. The future with 68 days to expiration, is a little bit higher, at $49.57. The future with 97 days to expiration is at $49.83, and then the future with 131 days left is at $50. You can see that the price of the future, the further out you go, increases.

If you said, “You know what, I think oil is really low right now, I’m just going to buy oil and hold it for the next year”, you wouldn’t be doing yourself any favors. It’s not as easy of a trade as you might initially think. That is because you wouldn’t just be buying it at $48.78. The furthest these futures go out is 131 days. Instead of buying it at $48.78, you’re actually going to be buying it for $50.

You would always want to stay in the active month. The longer you’re in the trade, you’re incurring that cost of carry. Just remember, there are no free lunches.

VIX

You’ll notice it even more if you take a look at a futures contract like the VIX.

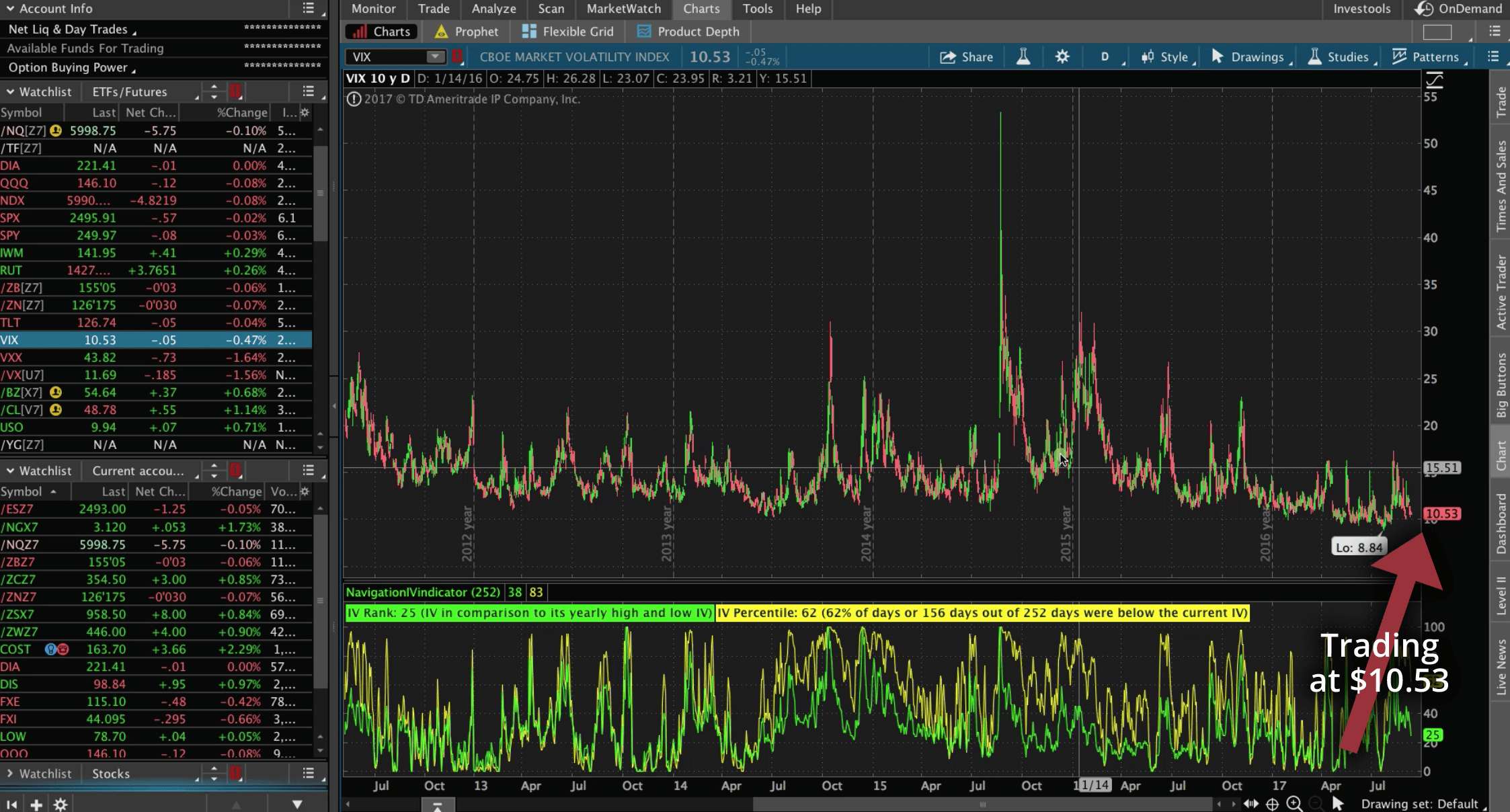

This is a trap that a lot of newer traders fall into it. They look at the VIX, long-term chart. They can see, for example, now at the time of this recording, the VIX is at $10.53. If they look over time, that’s a relatively low reading compared to the rest of the chart, so why wouldn’t they just buy VIX and wait for it to go up?

Here’s why, because you can’t just buy shares in the VIX, it’s an index. You have to use the underlying ETF or the futures.

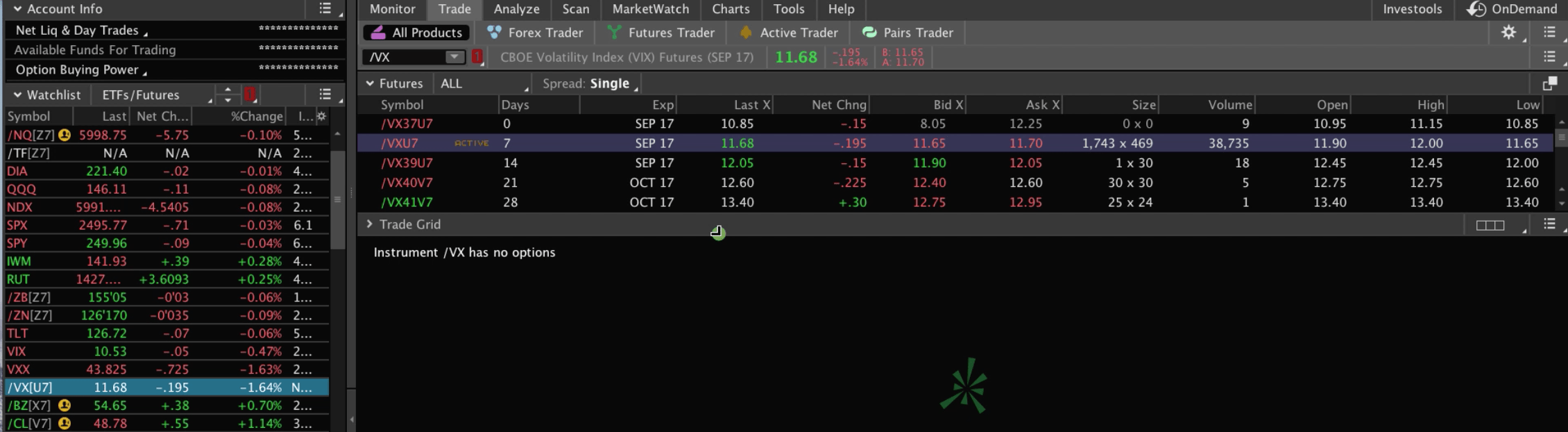

If you buy the future, take a look at the cost of carry. You can see right now the VIX future is trading at $11.68, even though the VIX spot price is $10.53.

If you were to hold it long-term, even just going out 28 days, you can see the VIX futures are trading at $13.40. That’s almost a full $2.00 higher than what you’re seeing prices at right now. That’s why you can’t just buy these and hold them for long-term, because you’ve got that cost of carry. You’ve got that drag built in, because they are priced differently over time.

Vix Trader Summary

Make sure that if you are buying futures outright or selling them outright, you understand whether that future is in a period of Contango or Backwardation. And it doesn’t necessarily affect the options as much until you start rolling those options on the futures, so this is really just to describe the situation on the underlying futures contract.

Hopefully that makes sense for you. It doesn’t come into play a lot for the type of trading that we do. However, I wanted to give you this information to make sure that you understand the difference between Contango and Backwardation, and how that affects the price of the underlying futures contract.

To learn more about the VIX, visit “How To Trade The VIX With 92.3% Accuracy”. This is a course that’s already available to you if you’re one of our Pro Members, and you can access that in your Member’s Area.

If you’d like to read another blog post related to the VIX, here’s one you might like, “Why Inverse VIX ETFs Are Dangerous”.

Happy Trading!

-The NavigationTrading Team

Follow