Hey NavigationTraders!

In this lesson, I want to discuss the best way to buy stocks using options. We’re going to go over five strategies and then we’ll go to the platform and take a look at a real example.

- Just buy stock (Long Stock)

Advantage

There’s no expiration date. We know that options always expire at some point in the future, but if you’re simply buying stock, there’s no expiration date. You can hold it as long as you want.

Disadvantages

The disadvantages are that it requires a lot of capital. You’ve got to put up margin from your account to hold the stock. If you have a margin account, it can take less capital, but you’re still putting up a good portion of the full amount to buy that stock.

There’s also the risk. The risk is the amount that you paid for the stock. Theoretically, the stock could go to zero, so that’s your ultimate risk. It’s really just a 50/50 bet. You’re not gaining any probabilities on your side by simply buying stock.

And because it has no expiration date, there’s no premium decay. There’s no theta to give you that daily time decay that you get with options.

- Buy a call (Long Call)

Advantages

There’s minimal capital required compared to buying the stock outright.

You can trade it in an IRA or a margin account. The upside profit potential is undefined. Now we know that stocks don’t go up forever, but theoretically there’s undefined, unlimited, upside potential. Then the downside risk is defined, so you know exactly what you’re risking on the trade when you buy that call at order entry.

Disadvantages

There’s negative theta. The premium decay is working against you, so every day you’re in that trade, you’re losing money unless it’s moving quickly in your favor.

When you buy a Call, it’s really less than a 50/50 bet. Whereas, a stock is about a 50/50 bet, a Long Call is actually less than that because of that negative theta, because of that premium decay.

- Buy a Call Vertical (Long Call Vertical)

Advantages

There’s minimal capital required.

You can trade these in an IRA or a margin account.

The downside risk is defined, so you know exactly what your risk is at order entry. And you set these up so that they’re higher probability than simply buying the stock.

Disadvantage

The upside is also defined, so you’re giving up that unlimited upside potential for a higher probability of success.

- Sell a Put (Short Put)

Advantages

There’s minimal capital required compared to buying the stock.

You can trade these in an IRA or margin account. Keep in mind, that if you sell Puts in an IRA, that’s going to be a cash secured transaction. This means that you’re going to have to put up just as much capital as you would buying the stock, but you’d get a higher probability of profit than if you simply buy the stock.

You get positive theta. You get that premium decay working in your favor.

Disadvantages

The upside is defined. You’re capped on what you can make on the upside as far as profit.

The downside risk is basically the amount you paid for the stock plus the credit you receive for the put. If the stock went to zero, just like buying a stock, you’re going to lose that capital, but you still get to keep the credit you got for the put. So, a little bit more advantageous there.

- Sell a Put Vertical (Short Put Vertical)

Advantages

There’s minimal capital required, you can trade it in an IRA or a margin account.

Your downside risk is defined, so you know exactly what it is at order entry, and you get a higher probability than shorting stock if you set it up correctly.

Disadvantage

Your upside is capped.

Platform Example

Let’s go to the platform and take a look at how these really look on an example stock. The stock that we’re looking at is Costco, ticker COST. The reason I want to show this is Costco’s really gotten beaten down. It’s at a huge pullback recently, at the time of this recording on July 24th. So, this might be a candidate where you say, “Okay, it’s really gotten beaten up, maybe it’s a time to get long Costco.”

What would be the best strategy to go about getting long? Let’s look at the possibilities of doing each one of the 5 strategies I just went over.

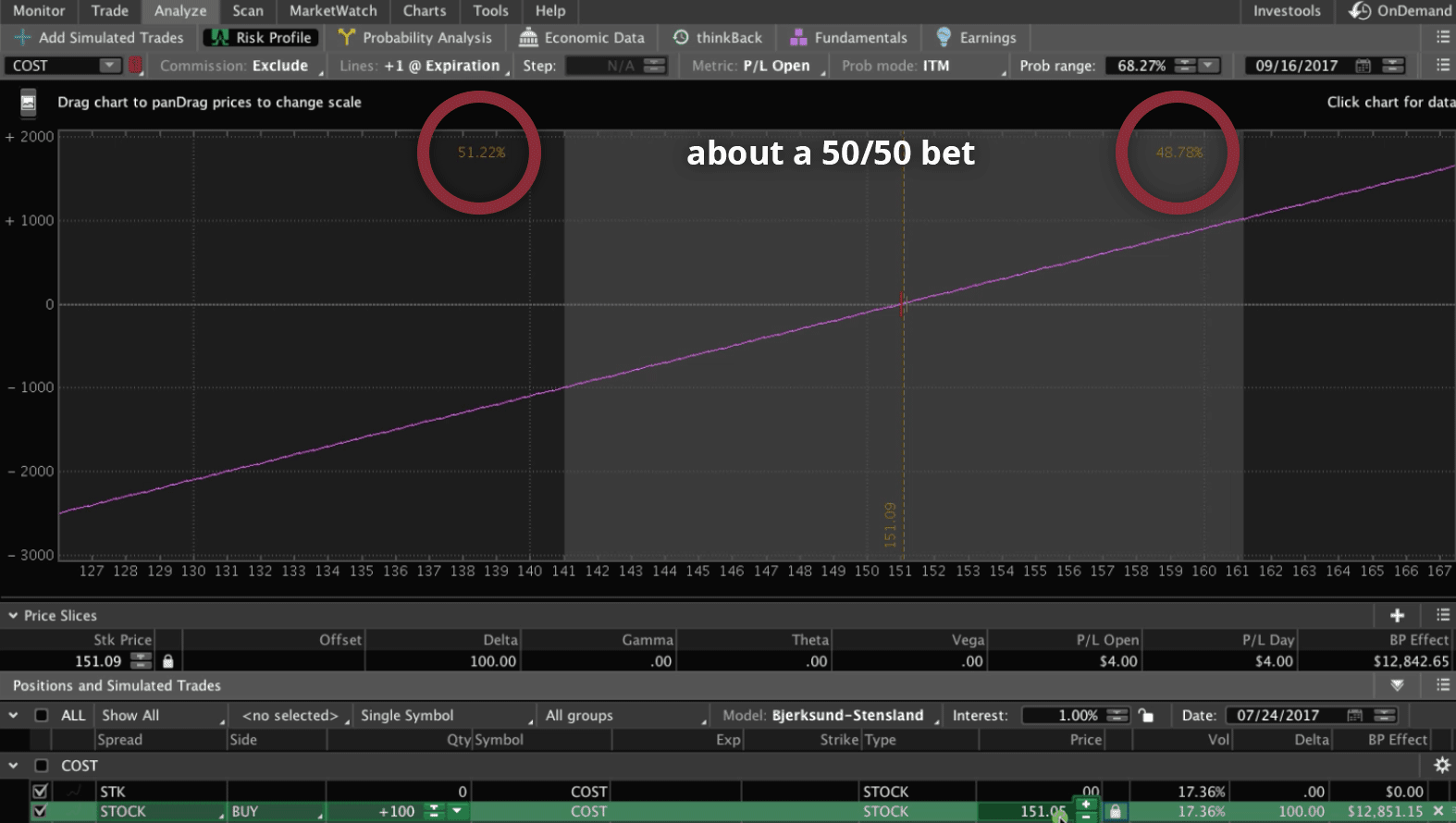

Strategy #1 Buying the Stock

We’ll start with just buying the stock. Costco’s currently trading at $151.05. Let’s take our hash mark, and move it to exactly where price is trading. If you look at the probabilities, you can see this is basically a 50/50 bet. Buying a stock is about a 50/50 bet. As far as the amount of capital you have to put up, because it’s trading at $151.05, you’d be putting up $15,105 in capital to buy the stock. Now if you have a margin account, you can put up a portion of that. However, it’s still a lot of capital just to buy 100 shares of the stock.

Strategy #2 Buying a Call

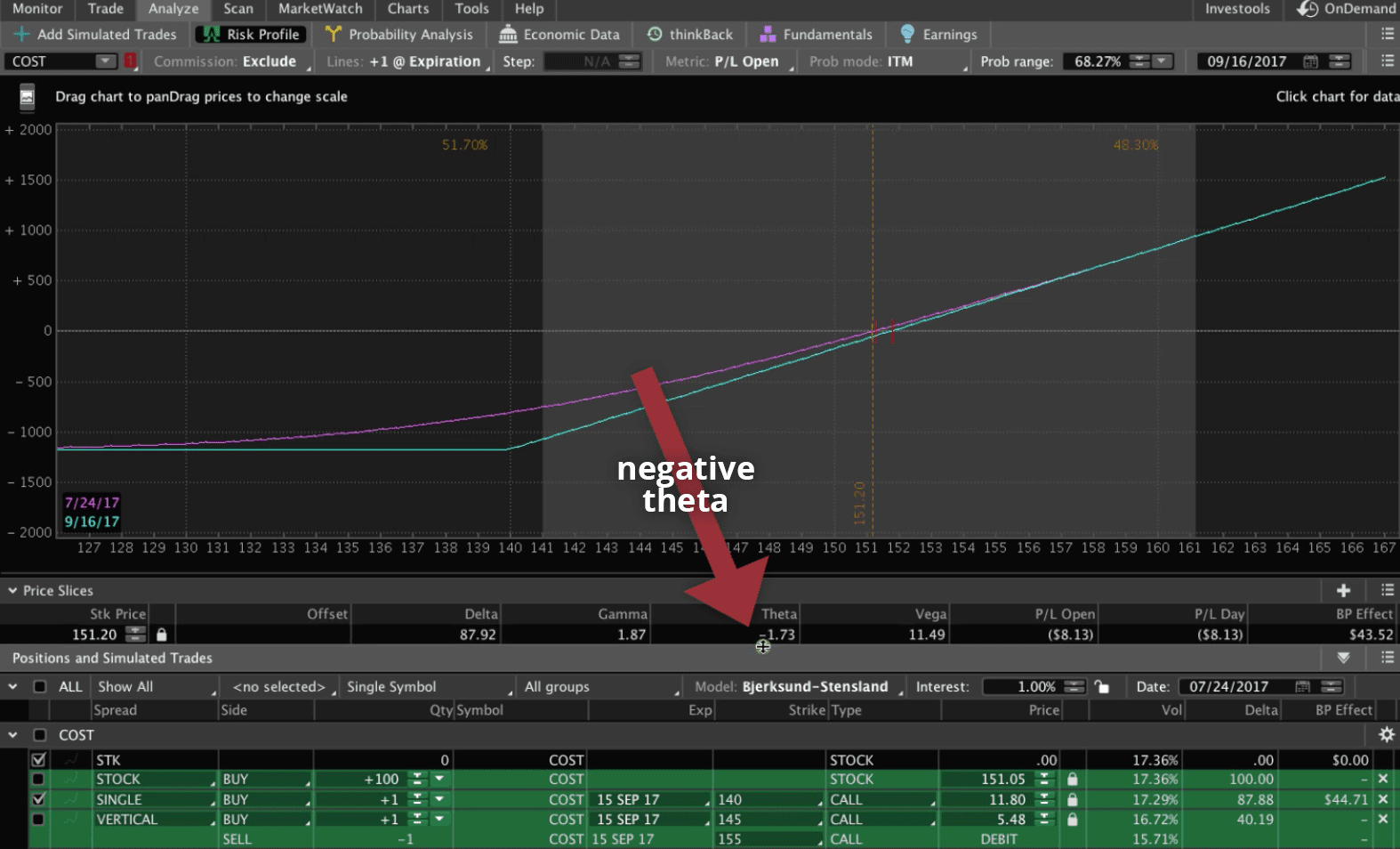

The next strategy is to buy a Call. We’ll show you an example of a deep in-the-money Call. If we’re going to buy a Call at all, it’s going to be deep in-the-money to minimize theta decay. And you can figure out what that theta decay is by just taking a look at the difference between the teal line, which is the expiration date, and the pink line, which is the current profit level.

We haven’t entered this trade, so obviously the current profit level is zero. But, if the stock were to sit right where it is, you can see that theta is negative, so you’re losing $1.73 for every day that it just sits here. And of course, the further against you it goes, the more theta decay that you have between now and expiration. You have to have a move in your direction pretty quickly for a Long Call to make sense.

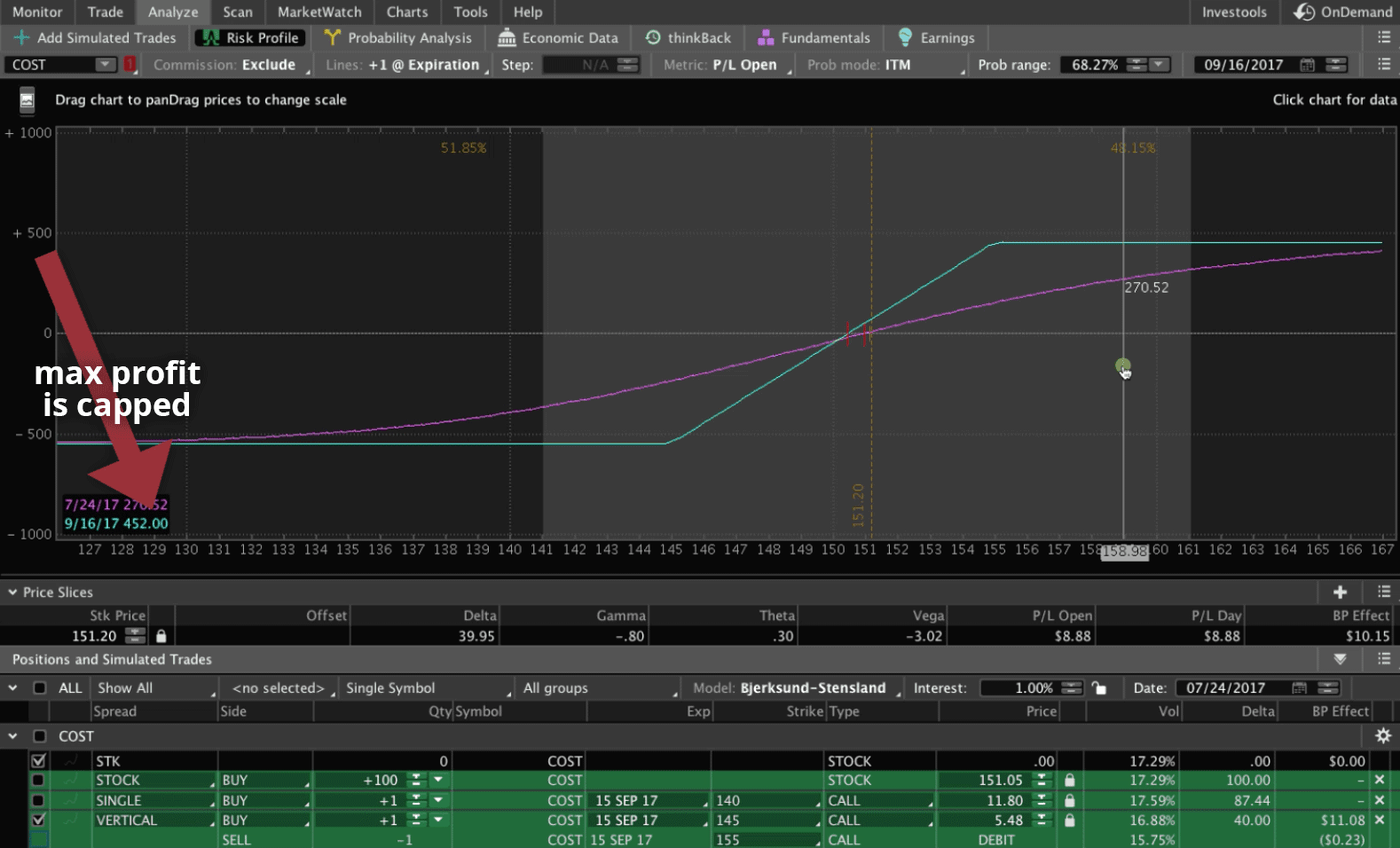

Strategy #3 Buying a Call Vertical

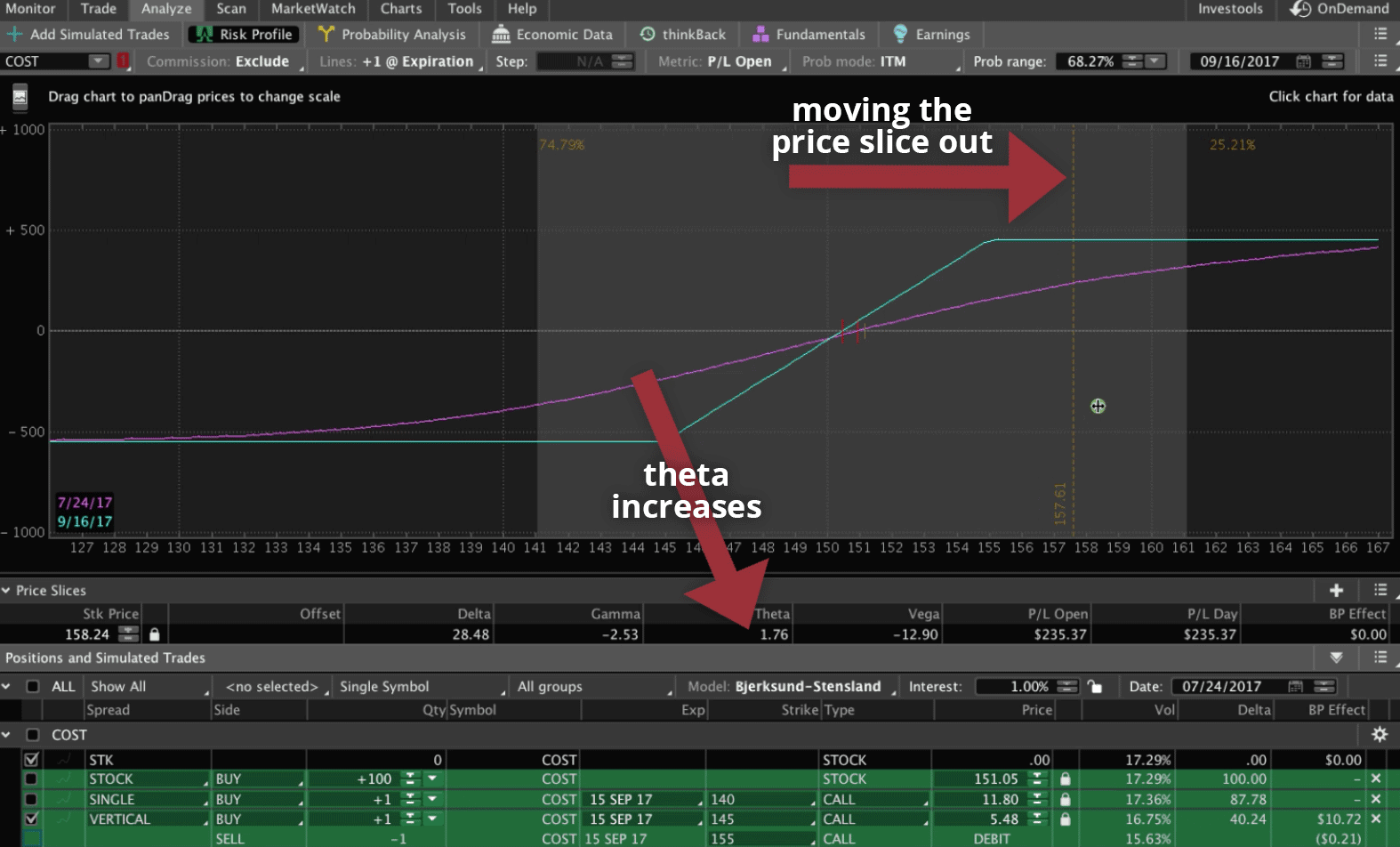

The next strategy is to buy a Call Vertical. This would be something you want to do at lower periods of implied volatility, because you’re expecting an expansion in implied volatility. This would be an example of a Long Call Vertical, so you can see the downside risk is capped. You’re risking about $548 on the downside. But your upside potential is capped too, at $452.

You could think of this as a long stock replacement, but you’re getting a little bit of a theta component as well. Look at the theta number when I move the price slice. You can see as price moves in your favor, that theta is increasing. That’s benefiting your position. However, if it moves against you, you’ll see that theta turns negative, and can work against you as well.

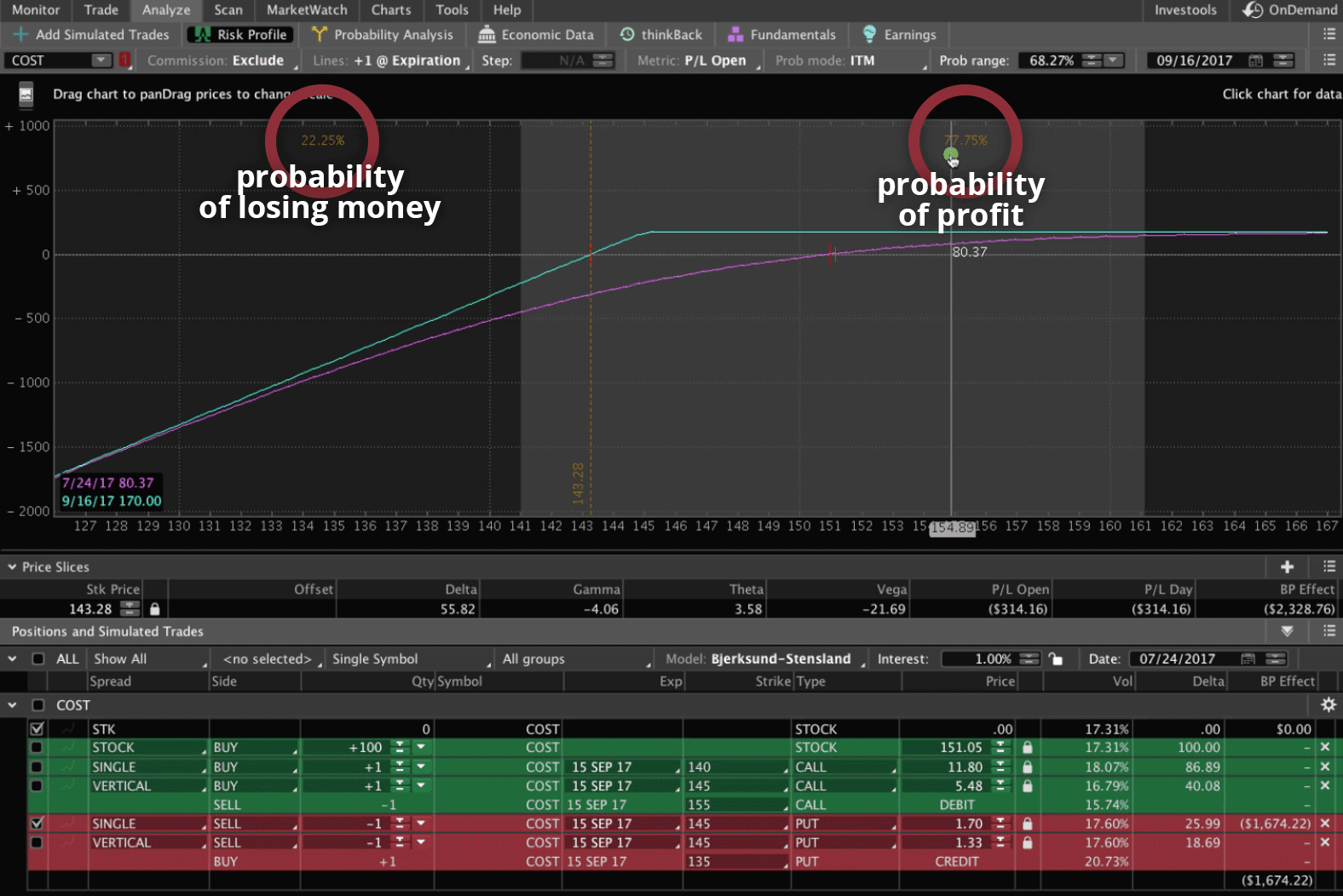

Strategy #4 Selling a Put

Another potential strategy would be to sell a Put. Here’s what the graph looks like if you sell a Short Put. We moved our price slice to break-even, so you can see what a high probability play this is. There’s over 77% chance that between now and expiration, that option will expire profitably.

The one downside to Short Puts is that you have this undefined risk. Just like buying a stock, if the stock were to make a catastrophic move down, or go to zero, you have to incur that loss.

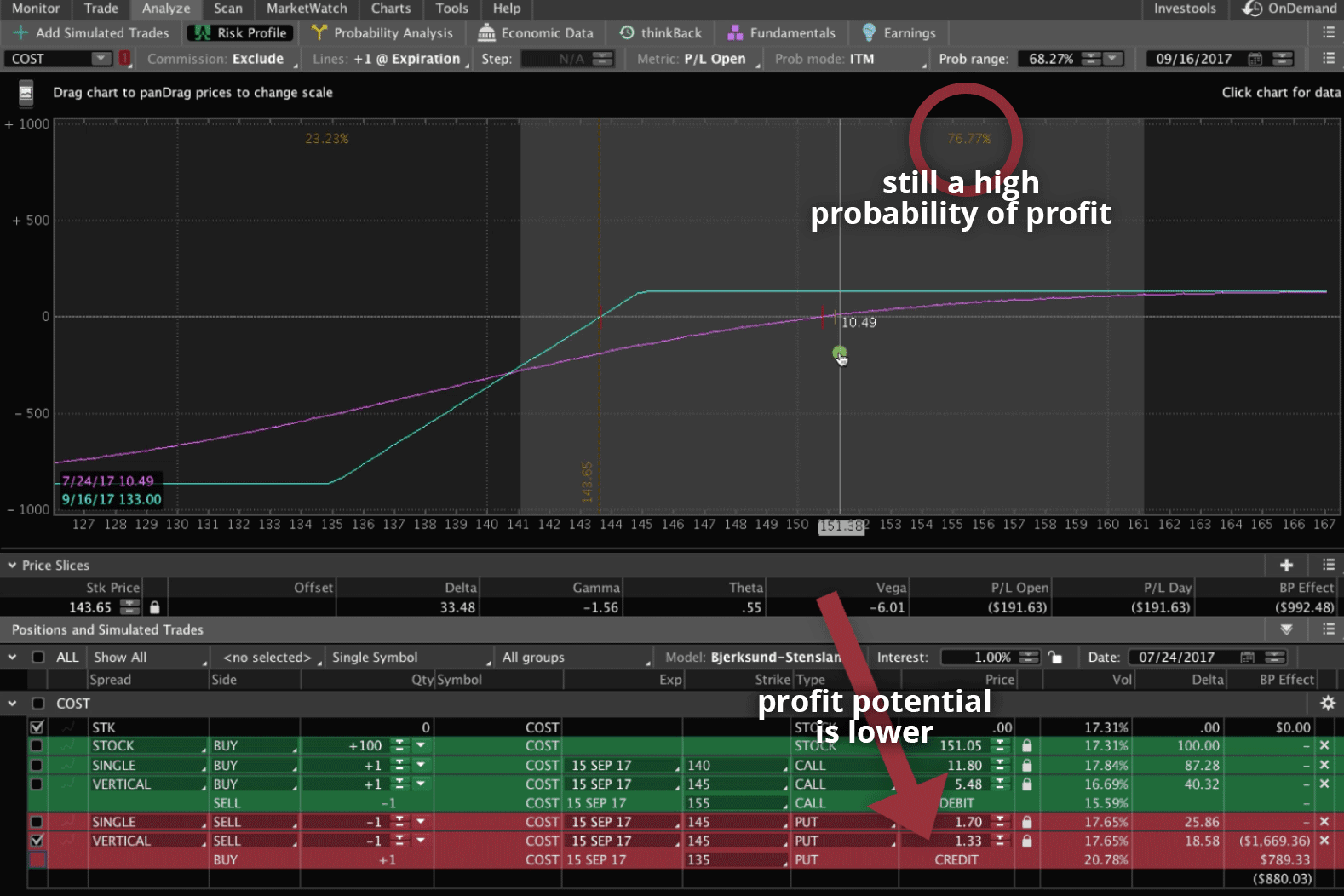

Strategy #5 Selling a Short Put Vertical

Another strategy that a lot of people like, is selling a Short Put Vertical. It’s still a bullish play, and you’ve still got a high probability chance of making money, over 76%. However, your downside is capped. You’re always giving up something for something else. If you’re going to limit your downside, you’re giving up some of that upside potential. As you can with the Short Put, you’re collecting a credit of $1.70; whereas with a Short Put Vertical, you’re only collecting $1.33. This affects your max profit.

Recap

So, those are the five strategies we use to buy stocks using options. There’s not a right way or a wrong way. We will use all these strategies at different times in different environments, depending on how it fits in our overall portfolio, and what strategy makes the most sense at the time, depending on if implied volatility is high, or implied volatility is low.

I hope this lesson has been helpful!

If you’d like to learn more about how we’ve taught over 10,000 members how to trade options for consistent income, just go to our site navigationtrading.com, click on the big orange button and we’ll give you immediate access to our flagship course, Trading Options for Income.

We also give you the NavigationTrading Implied Volatility Indicator, along with the watch list that we use to trade the most profitable symbols day in and day out. All this is yours at no cost.

We look forward to seeing you on the inside.

Happy Trading!

-The NavigationTrading Team

Follow