Welcome to another lesson from NavigationTrading.com!

In this lesson, we are going to discuss the difference between a Short Put Vertical and a Long Call Vertical, both of which are bullish strategies.

If you’re bullish on a stock, have you ever been confused as to whether you should trade a Short Put Vertical or a Long Call Vertical? Both are bullish positions, but there are slight nuances between them.

Platform Examples

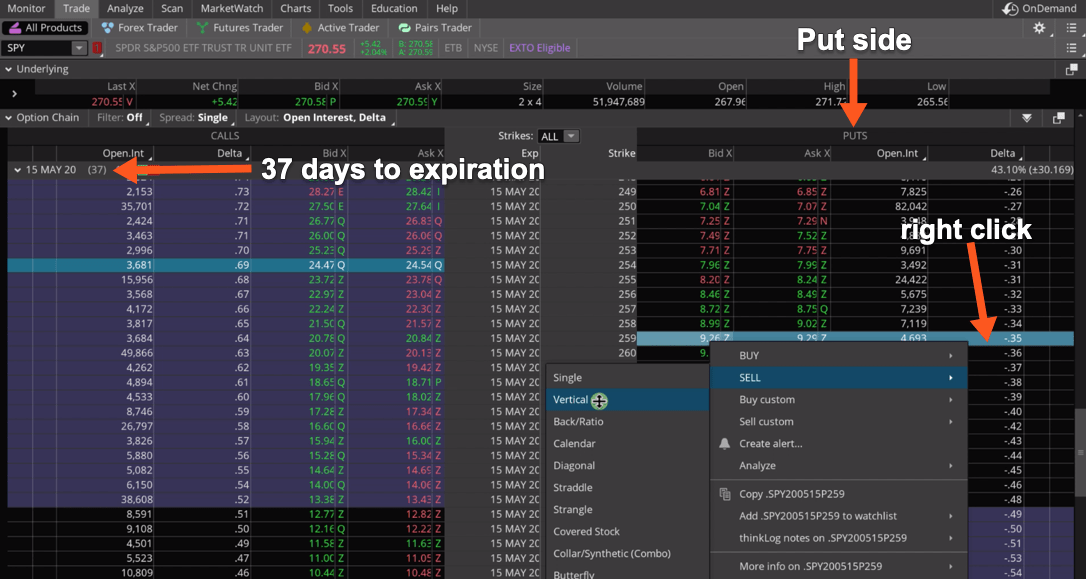

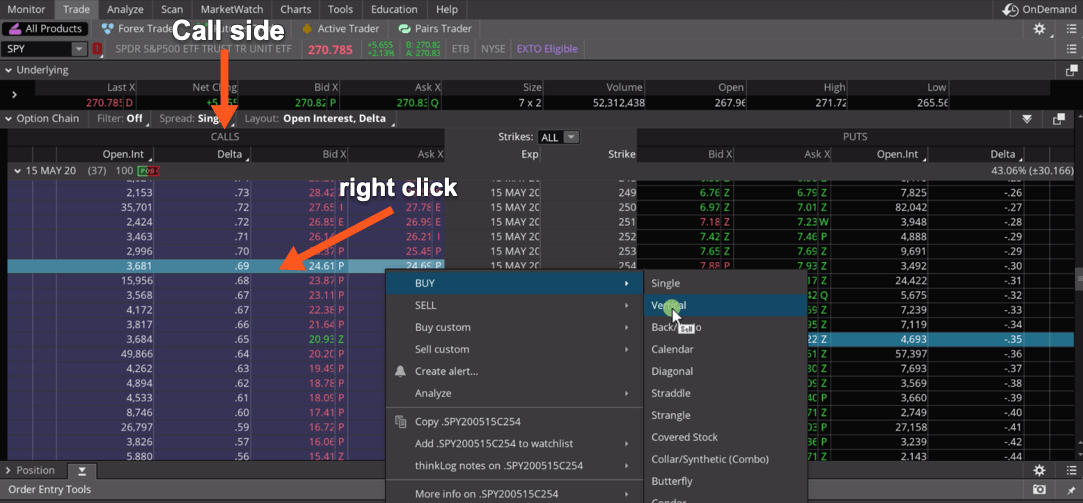

Let’s look at an example in SPY. If you go to the trade tab in ThinkorSwim, this will populate the options chain. In this example, I am looking at the 37 days to expiration cycle. Let’s start on the Put side and discuss the Short Put Vertical.

Short Put Vertical Example

We’re going to start with some options out of the money. Let’s select the 35 delta. This should give us close to the range we want. Just right click, select “SELL”, and then “Vertical”.

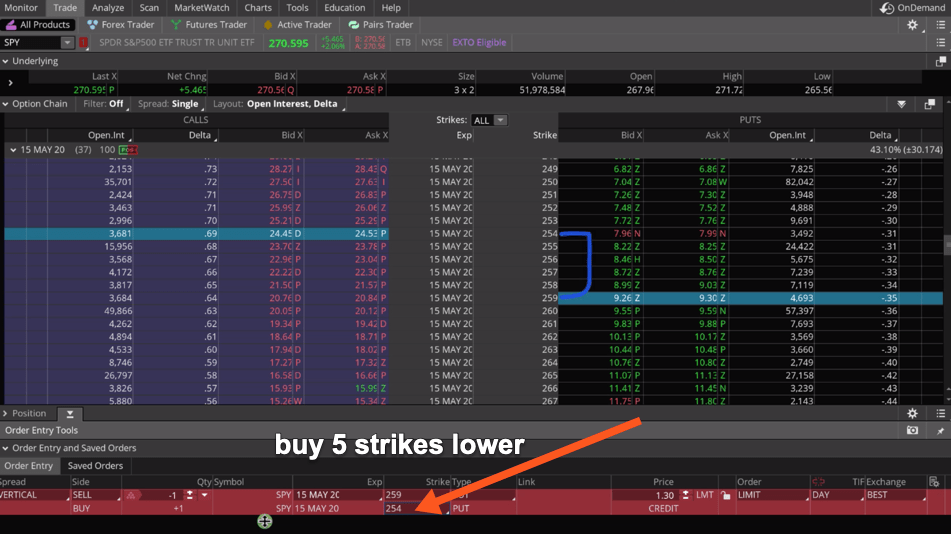

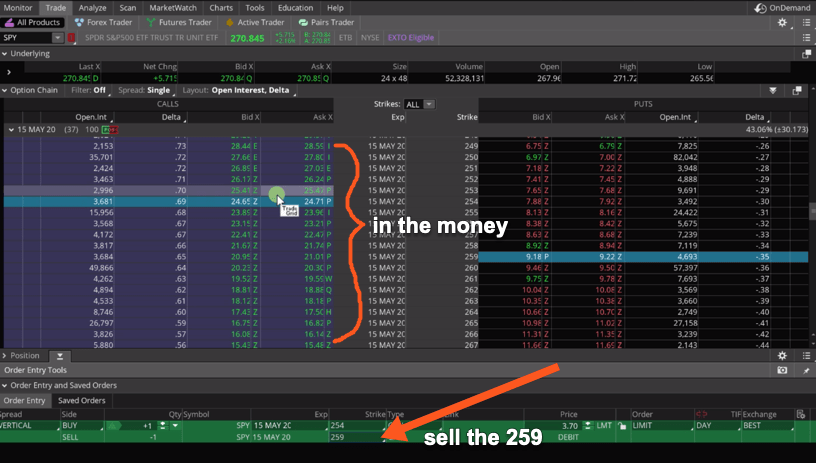

So, we’ll sell the 259 and we will buy five strikes lower, which is the 254.

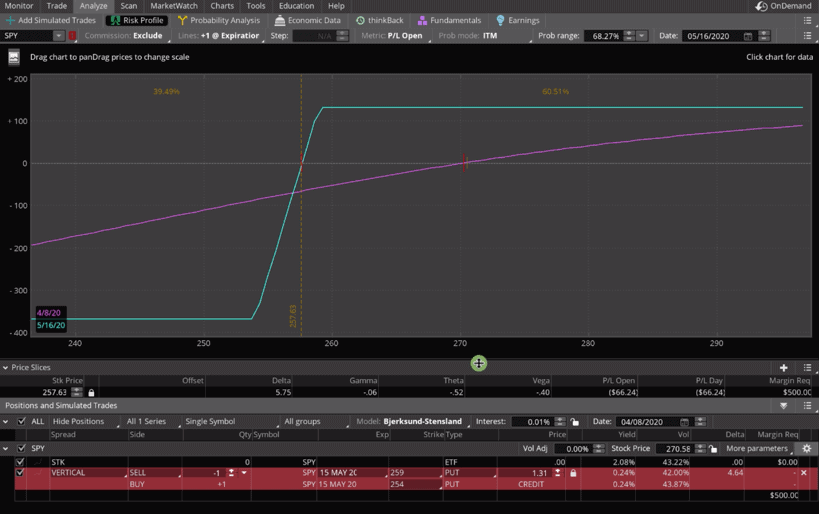

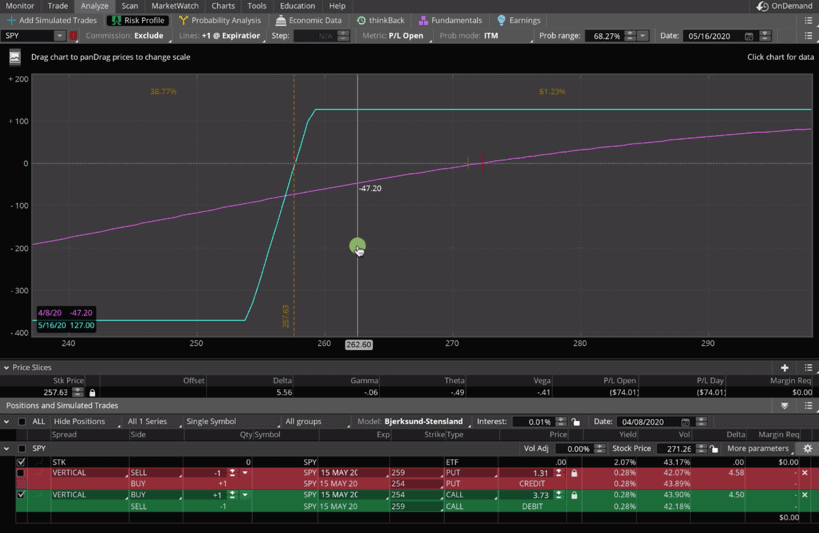

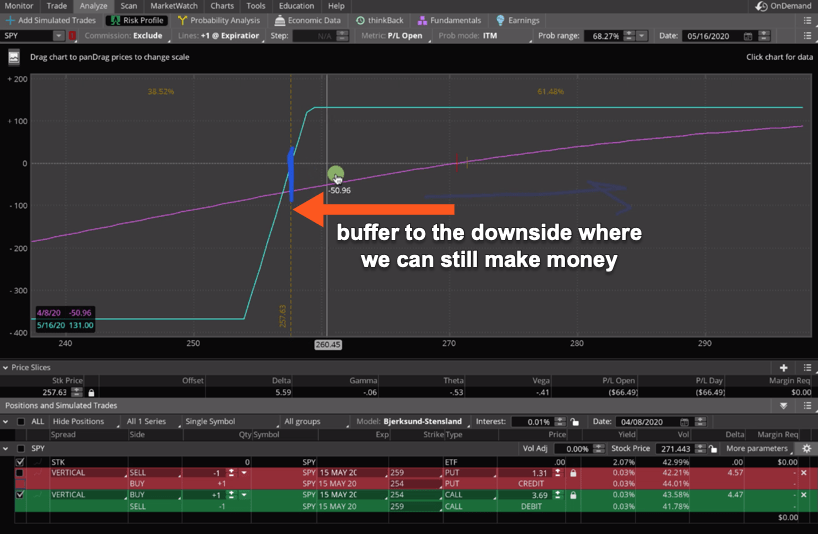

If we take this over to the Analyze tab in ThinkorSwim, this is what the risk profile graph looks like.

When we set these up, we like to set them up with about a 60% or so probability of success. So, you’ve got about a 60% chance, at expiration, that this will be profitable, and about a 40% chance of loss. I also like to make sure that my max loss, which in this case, is $369, is not more than three times what my max profit is. So, I’ve got a max profit of $131 and a max loss of $369.

As mentioned, this is a bullish position. We want the price of the stock to go up, but it can also come all the way down to our break-even point, and we can still make money on the trade. That’s one of the beauties of vertical spreads.

Long Call Vertical Example

Let’s go back to the option chain and over to the Call side. We’re going to look at the same strikes. We’re going to do the 254. So, we’re going to buy a vertical on the Call side.

We want to keep our strikes five points wide as well. We’ll be selling the 259 strike. You’ll notice these options are in the money. So, is there a risk of assignment? Yeah, it’s very slim, but you do have the risk of assignment. If you do get assigned, you simply close out the trade and move on. It’s not that big of a deal. But the bottom line is we’re typically out of these trades way before expiration. So, the chances of us getting assigned are very slim and it rarely happens.

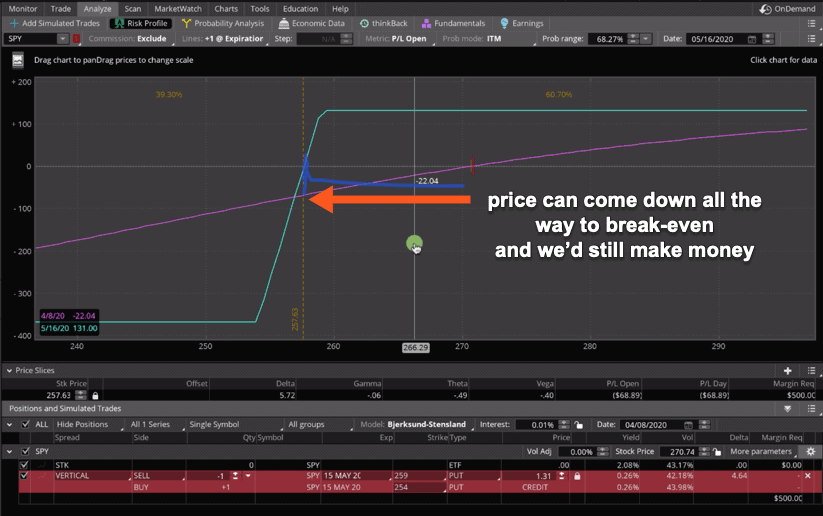

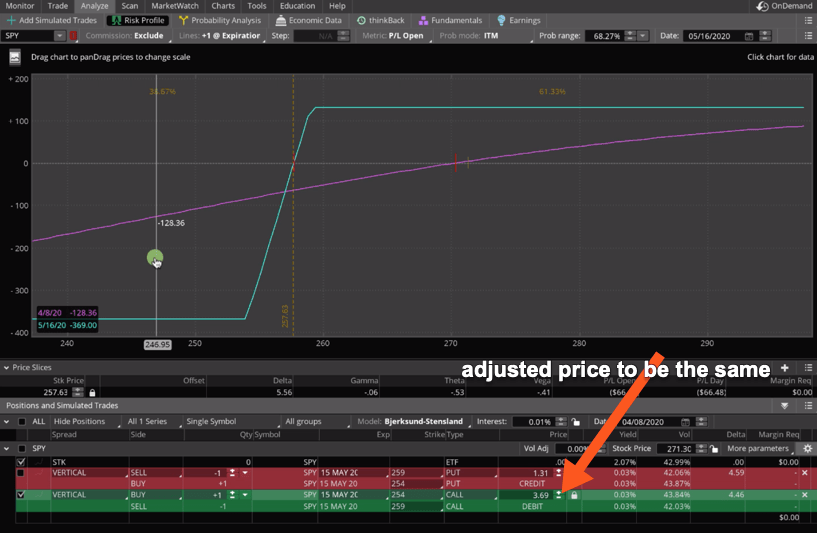

Let’s take this trade over to the Analyze tab so we can compare. As you can see, it’s almost identical.

We’ve got a max profit of $131 and a max loss of $369. That’s the exact same as the Short Put Vertical.

They have the same max profit and same max loss. Both of the trades are bullish. We want the price to go up, but we have this buffer to the downside, where we can come all the way down to here and still make money.

Summary

The two strategies are almost identical. The only nuance between the two is the effect of implied volatility. If we are buying a Long Call Vertical and the price goes up (in our preferred direction). Typically, implied volatility is going to be contracting. So, that’s actually going to work slightly against us.

Whereas, if we’re selling a Put Vertical and the price is going higher, typically implied volatility is going to be contracting and that’s going to work slightly in our favor.

When I say slightly, I mean VERY SLIGHTLY. These trades are almost identical. If you’re trading one contract, you might be getting an advantage of a $1-2 difference from that implied volatility, depending on how much it contracts or expands of one versus the other. So, it’s not a big deal.

Remember, it works both ways. If price goes against you (lower) then typically implied volatility is going to be expanding, which is going to benefit the Long Call Vertical just ever so slightly. So, if you’re bullish on a stock and you want a higher probability of success with defined risk, a vertical spread works in both a Long Call Vertical and a Short Put Vertical. They’re equally good options.

We hope this lesson was helpful! If you have any questions, feel free to drop us a line in our TradeHacker Community.

Happy Trading!

-The NavigationTrading Team

Follow