Short Call vs Long Put: Understanding Options Trading Strategies

Learn the fundamental differences between short call options and long put options. This guide explores the mechanics, risk profiles, and strategic implications of these key options trading strategies!

Short Call vs Long Put: Understanding Options Trading Strategies

Welcome to today’s discussion on short call options versus long put options. In this introductory video, we’ll delve into the core differences between short calls (selling a call option) and long puts (buying put options). This is part of a series aimed at demystifying options trading strategies, focusing on foundational concepts like call options, put options, and trading strategies.

Exploring the Options Chain

To start, let’s navigate through the options chain using the SPY ETF as an example. Understanding the layout of an options chain is crucial, with calls typically on the left and puts on the right. Key elements like open interest, delta, bid/ask prices, and volume play a significant role in decision-making. Liquidity, indicated by open interest, is vital for smooth trading experiences.

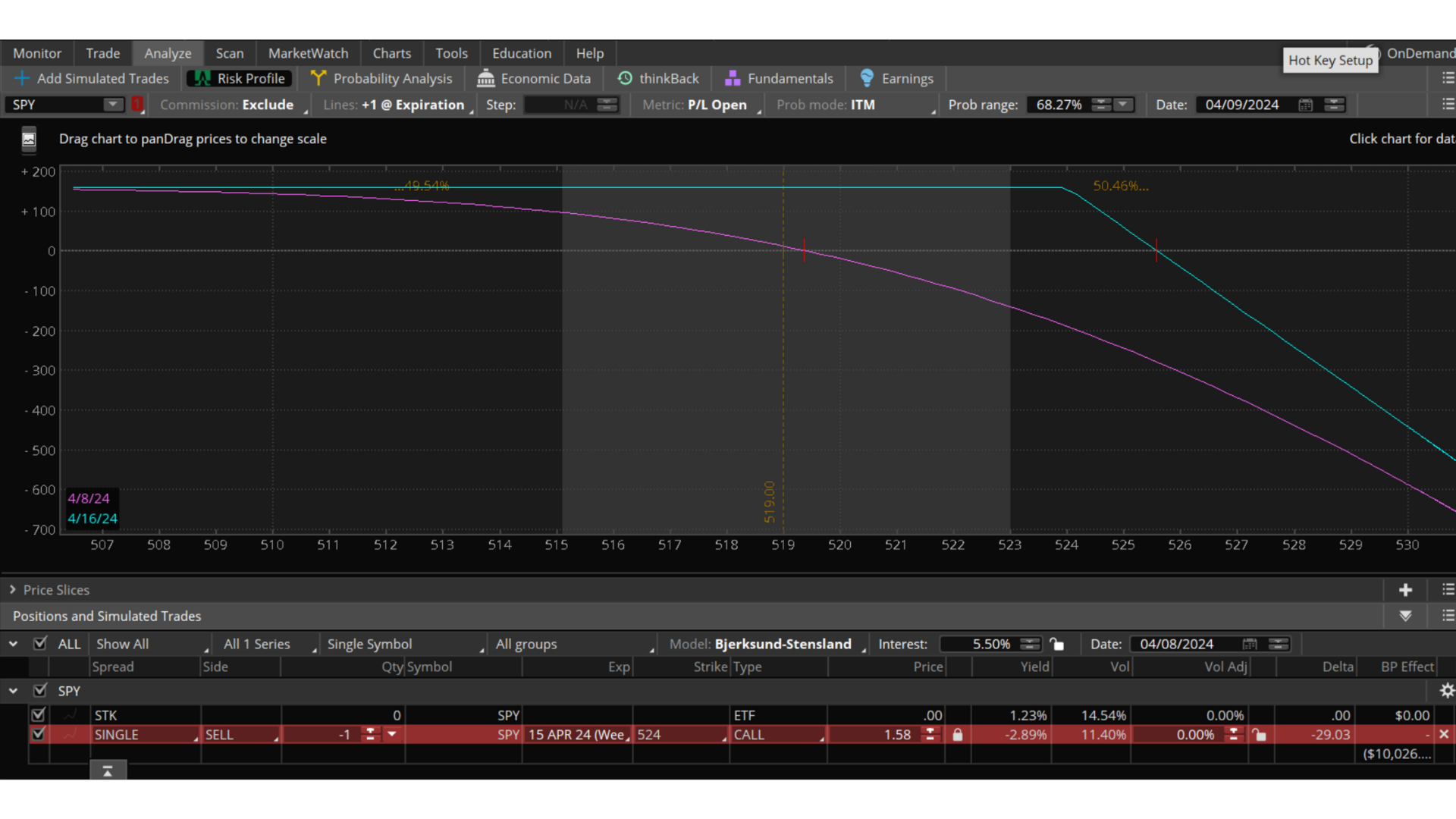

Short Call Option

Let’s compare two strategies with a bearish bias: short call versus long put options. A short call involves selling a call option, indicating a bearish outlook. This strategy carries unlimited risk if the underlying asset moves against expectations but offers a capped profit at the premium collected. Analyzing the risk profile is essential here, with break-even points and probabilities influencing decision-making.

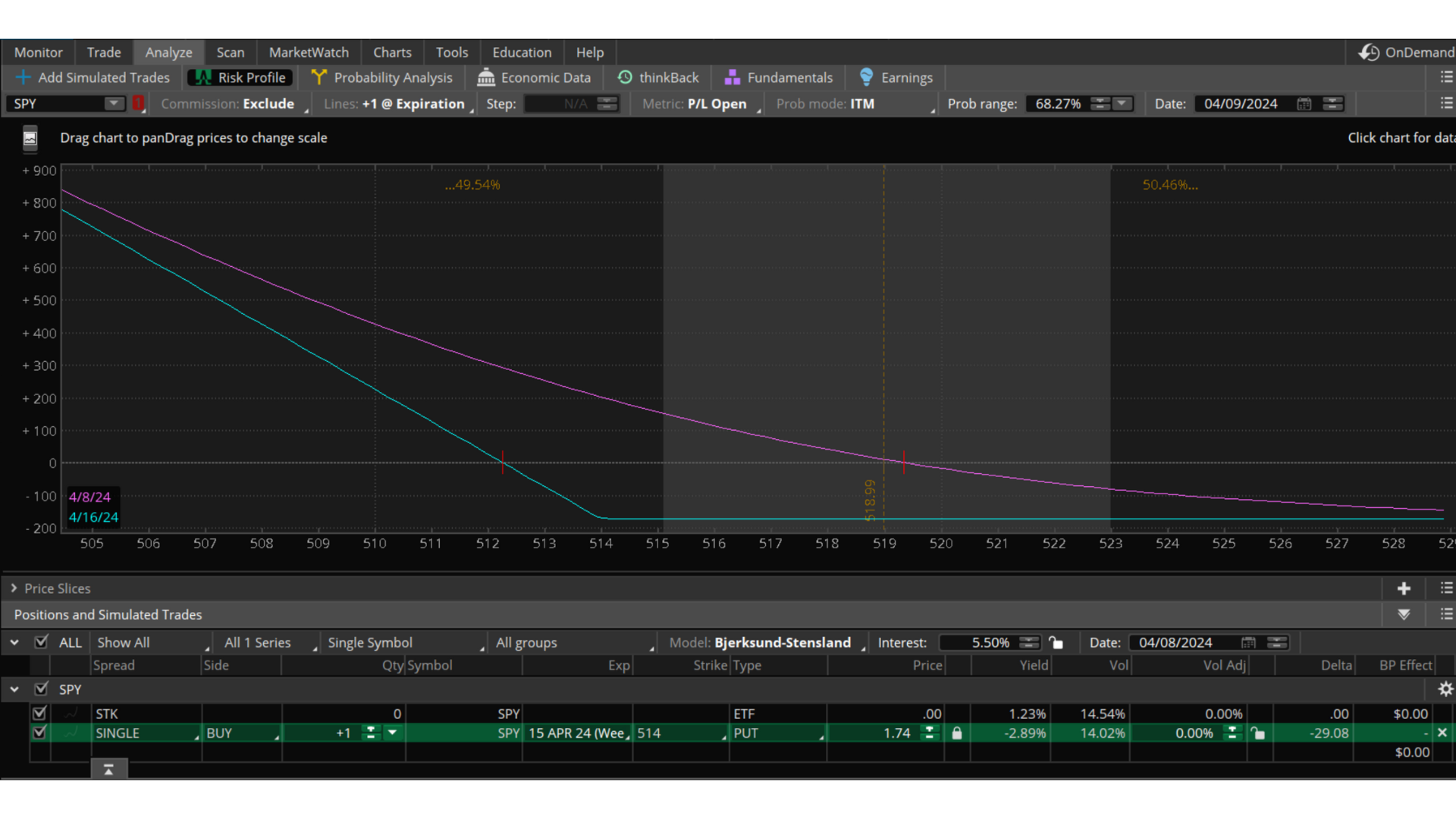

Long Put Option

On the other hand, a long put strategy involves buying a put option, aligning with a bearish market sentiment. While the potential loss is limited to the premium paid, the profit potential can be substantial if the asset’s price falls significantly. Risk analysis tools like the risk profile graph help visualize potential outcomes and probabilities.

Choosing the Right Strategy

Understanding the risk-reward dynamics of short call and long put options is crucial for options traders. Factors like strike price, expiration date, and market conditions impact decision-making. It’s essential to consider risk management strategies like cash-secured puts to mitigate potential losses and maximize returns.

Conclusion

In conclusion, grasping the nuances between short call and long put options is fundamental in mastering options trading strategies. Stay tuned for our upcoming videos exploring strategies like the wheel strategy, combining covered calls and cash-secured puts for a comprehensive trading approach.

For more insights on options trading, check out our video series and stay updated with the latest strategies and market trends.

Follow