Source: Robinhood

Everyone knows the classic story of Robin Hood right? Take from the rich and give to the poor…

Well, with the brokerage firm known as Robinhood, this idea actually plays out. Unfortunately, not in the favor of the investor or trader.

First let’s take a deeper look at their trading platform.

Free Commissions

Robinhood burst on to the scene by marketing commission free stock trades.

When you consider the alternative, it seems very attractive on the surface. In comparison, some of the leading online brokers offer stock trades at the following rates.

- TD Ameritrade – $6.95 per trade

- Fidelity – $4.95 per trade

- Charles Schwab – $4.95 per trade

- E*Trade – $6.95 per trade

- tastytrade – $5 to open. Zero commissions to close

You Can’t Afford Free

So, the question is…If Robinhood charges no commissions, then how the heck do they make money?

There are three main ways that Robinhood makes money. Let’s discuss each one.

-

- Premium Package Upgrades

They offer an “upgraded” package called Robinhood Gold which has a monthly cost from $6 per month, all the way up to $200 per month for accounts over $50,000. The premium service allows customers to:

- Premium Package Upgrades

-

-

- Start trading with deposits immediately. Free members must wait three days to access deposits over certain amounts.

- Trade pre-market and after-hours stock trading. The normal stock market hours are Monday through Friday from 9:30am to 4:30pm Eastern Standard Time. Pre-market trading happens 30 minutes prior to the opening bell. After-hours trading goes on for two hours after the market closes each week day.

- Buy stocks on margin, or borrow money to buy stocks over the value of your account

-

Most brokerages offer margin accounts for qualified customers. Typically, you are charged a disclosed interest rate on any borrowed funds.

The difference with Robinhood, is that they charge the monthly Gold fee, whether you borrow the money or not. Oh, and if you borrow more than $50,000, then you get charged a 5% interest rate. Taking from the rich and giving to the poor, right?….Orrrr, in this case… giving to Robinhood!

- Interest on your cash

Most brokerages work very similar to any other “holder of your money” i.e. your bank. They can lend out cash that has not been invested to earn interest on your cash. Robinhood does not pass on this interest to you, the customer. The interest might amount to $200 per year on a $10,000 account which might not seem like much. But, when you consider the millions and millions of dollars in customer accounts, this is a huge profit source that goes straight to the poor…Ooops, I mean straight to Robinhood’s bottom line.

- Payment for order flow

When a customer places a trade, there are multiple high frequency trading (HFT) firms involved in routing the order to different exchanges. These HFT firms pay Robinhood for these trades. This is not an uncommon practice among brokerages, and there are definitely some valid claims as to why this system is beneficial for the liquidity of our markets, and ultimately the customer.

Here’s the issue.

We reviewed multiple SEC Rule 606 Disclosures, for Robinhood and other brokerages such as TD Ameritrade, Charles Schwab and E*Trade.

Most brokerages disclose their High Frequency Routing Partners payouts on a per share basis. However, Robinhood reports these payouts per dollar.

Why is that important, you might ask?

Well, because when you look at the numbers closely, you will realize that Robinhood is getting paid over 10 times as much for order flow as the other major brokerages.

For example, TD Ameritrade disclosed that they held client assets of approximately $1.2 Trillion in the second quarter of 2018. They were paid almost $119 million in order flow payments. If Robinhood were to have the exact same amount of assets, they would make over $1.19 billion…That’s BILLION with a capital B!

Don’t get me wrong, I’m a huge fan of capitalism, and making an honest buck. But, this is a huge conflict of interest. This means that the HFT firms are making larger spreads on customer orders from Robinhood, than they are from other brokers. Which ultimately means the prices that customers are getting filled at are much worse than that of other brokers. This directly reduces customer profits.

That my friend is NOT good business. At least not for you as an individual trader.

Ahhh…good ‘ol Robinhood…taking from the poor, and making themselves rich! Oh wait…that’s not how the story was supposed to go 😠

Robinhood Options Trading Is A Joke

As of the end of 2017, Robinhood announced options trading on their platform. As a professional options trader, I was very interested to see their platform capabilities. Unfortunately, I was extremely disappointed in their offering.

Let’s break it down.

Implied Volatility Tools

Simply stated…they don’t have any!

Understanding implied volatility (IV) is one of the most critical components to being a successful options trader. IV is a calculation that gives you an idea of the potential move of the underlying stock, over a specific period of time. Some stocks are more volatile than others.

Let’s look at a couple examples.

Example 1 – Currently NFLX is trading at $369, and has an IV of 50.9% over the next 30 days. Which equates to the potential that Netflix stock will most likely trade up or down approximately $40 during this time period.

Example 2 – XLU (The utility ETF) is much less volatile. Over the same 30 day period, XLU has an IV of 14.5% and an expected move of +/- $1.24

Let me be as direct as possible here. If you don’t understand implied volatility, then you will lose money trading options. Period.

IV continually expands and contracts. When IV expands, the options get more expensive. When IV contracts, the options get cheaper. Because of this, even if you are correct in choosing the direction of the underlying stock, you can still lose money buying calls or puts.

If this sounds complicated, don’t worry, most good options trading platforms do all the calculations for you, and bundle it up nicely in an easy to view format.

The issue with Robinhood, is that they don’t even display this critical data on their platform. This is a disaster waiting to happen. Especially for newer options traders who start trading on the Robinhood platform.

Analysis Tools

Again, this is non-existent on the Robinhood platform.

Being able to visually analyze a trade before you enter, removes much of the complexity, and allows you to visually see the trade before risking any capital. You would think as simplistic as Robinhood has made their software, that this would have been at the top of their features.

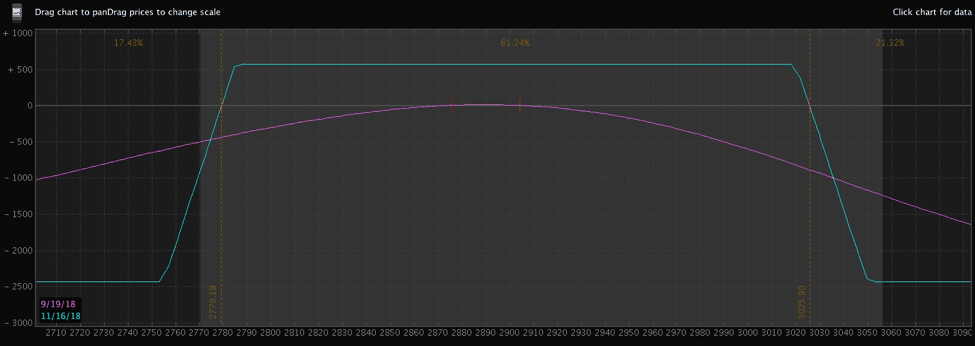

Below is an image of an iron condor on the TD Ameritrade thinkorswim platform. This gives you the visual details of the trade, including max profit, max loss and Probability of Profit (POP). Nearly everything you need to place the trade.

Robinhood provides no analysis tools. But, hey, they give you news updates. Woohoo!

Leverage For Selling Options

As options traders, we love leverage. This allows us to use a smaller amount of capital to control an asset like a stock or ETF, rather than putting up the full capital needed to buy it outright.

Leverage can be a wealth building machine when used correctly, but can be devastating if not used properly. Let’s assume that if you are reading this, that you understand leverage and will use it responsibly 🙂

When you sell options to open a position, your broker requires a certain amount of buying power to enter the trade.

For example, if I was bullish on AAPL, I could sell an at-the-money put option with 30 days to expire. Good brokers like TD Ameritrade or tastytrade will provide leverage. The amount of buying power capital needed is around $4200. And, the profit potential is around $550. This gives you a potential gain of around 13% Return On Capital (ROI).

But, if you try to place the exact same trade on Robinhood, they require $21,275 of buying power capital to place the trade. The profit potential stays the same, so your potential ROI would only be around 2.5%.

If you want to become a professional options trader, or even begin making a consistent income from trading options, then you owe it to yourself to use the best technology available. Robinhood is definitely not the solution.

The old saying holds true…You always get what you pay for.

tastytrade, Inc. (“tastytrade”) was previously known as tastyworks, Inc.

Follow