Put Option Basics

Check out this short video covering the basics of put options, or “puts” for short! If you are a beginner, this is a great place to start.

Happy Trading!

Transcript

Hi everyone, welcome to NavigationTrading’s Put Option Basics video! This should be an introductory level course, meaning that no prior knowledge of options is needed. However, a basic knowledge of financial markets and stock trading is helpful. As with all these lessons, further research is going to be necessary in order to really understand and master these topics.

So what will we be covering and what do we want you to learn today? First, we’re going to look into how put options work. We’re going to jump right into how to buy put options in the TDAmeritrade platform. We’re going to look at some profit, loss, break even scenarios in real life. We’re going to look at put option terminology. Then we’re going to dive into put options versus short selling or shorting stocks or equities. We are going to look into scenarios where put options make sense, factors that affect put option prices, and some of the risks that are associated with put options, and also some of the research and due diligence that you should be completing as part of your learning. Finally, we’ll end with some further learning and exploration.

First, how do put options work? Well, put options or commonly just called puts, give the right but not the obligation for the holder of a financial contract to sell a specified quantity of an underlying asset at a predetermined price within the specified period.

Buying puts is similar to shorting or short selling, which we’ll get to later. For the purpose of this video, we will mostly be looking at a situation where you would be the buyer of a put option contract.

Right now we’re looking at TDAmeritrade’s thinkorswim platform. I’ve pulled up the trade tab, all products, and then pulled up the options chain, which is collapsible with this caret here. Right here at the top left, there’s going to be the underlying that you’ll be looking at. SPY is actually an ETF following the S&P 500. I think you can see that… usually you can.That’s what we’re looking at for this example.

The options chain is sorted by days to expiration for the options contract. That’s going to be noted here in the parentheses. The date of the actual options expiry will be on the left and this 100 just signifies that each contract represents 100 shares of the stock.

I’m going to expand the 28 days expiration contract chain. The strike price is going to be the stock price that we’ll be looking at and where we think we want to place our speculation around. So today SPY closed at 459. You’ll see the at-the-money, which is closest to the actual stock price, is between 59 and 60 here. You’ll see the strike price. You will see a bid and ask so the ask price is what it costs to buy each one of these contracts and the bid price is what it costs to sell. Open interest is how many people are currently in that contract at the moment.

We’ll look at the 450 strike price for a put and we will look at buying that for 28 days out. That’s going to show the 29th here of December. 450 strike price. The put buy plus one to open and we’re going to confirm and send and just look at this for a second. Your max loss here is going to be the premium that you pay, which is $2.51. Remember $2.51 times 100. The max profit is quite a bit more than the max loss on this one.

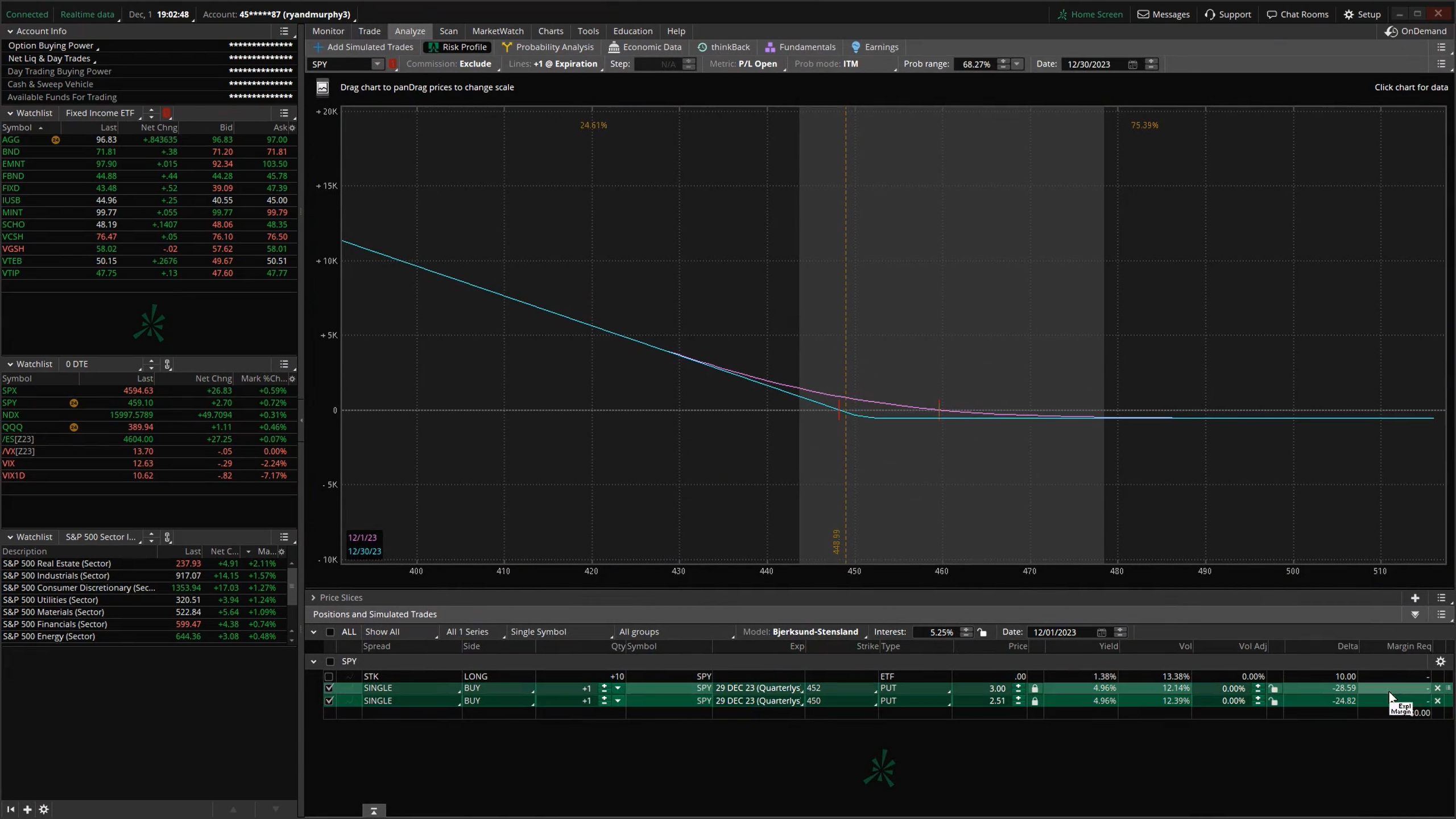

I’m not going to send that right now, but I want to take a look at the analyze tab. Let’s see… so I’m going to set the break even to the day of expiration and I’m going to make that match here. I want to break this down a bit in the next slide, but just to show you while it’s up, the Y axis here is going to be profit and loss in the thousands. X axis is going to be the strike price, and right now the break even is 447. These grayed out lines here are going to represent a standard deviation from where the price of the stock is currently. Right here, this is going to be the chance that you will break even percentage wise, that’s 21%. Right now buying this option, you have a 78 percent chance of being underwater by the time this ends or losing somewhere between zero and $250.

I think one thing I forgot to mention on that last slide was the teal line is going to represent your profit and loss at expiration. The purple line here represents at the current time noted in this date below. We’re usually looking at this teal line where we’re following where our profit and loss is going to be in the thousands here, depending on where the price of the security is on the x axis.

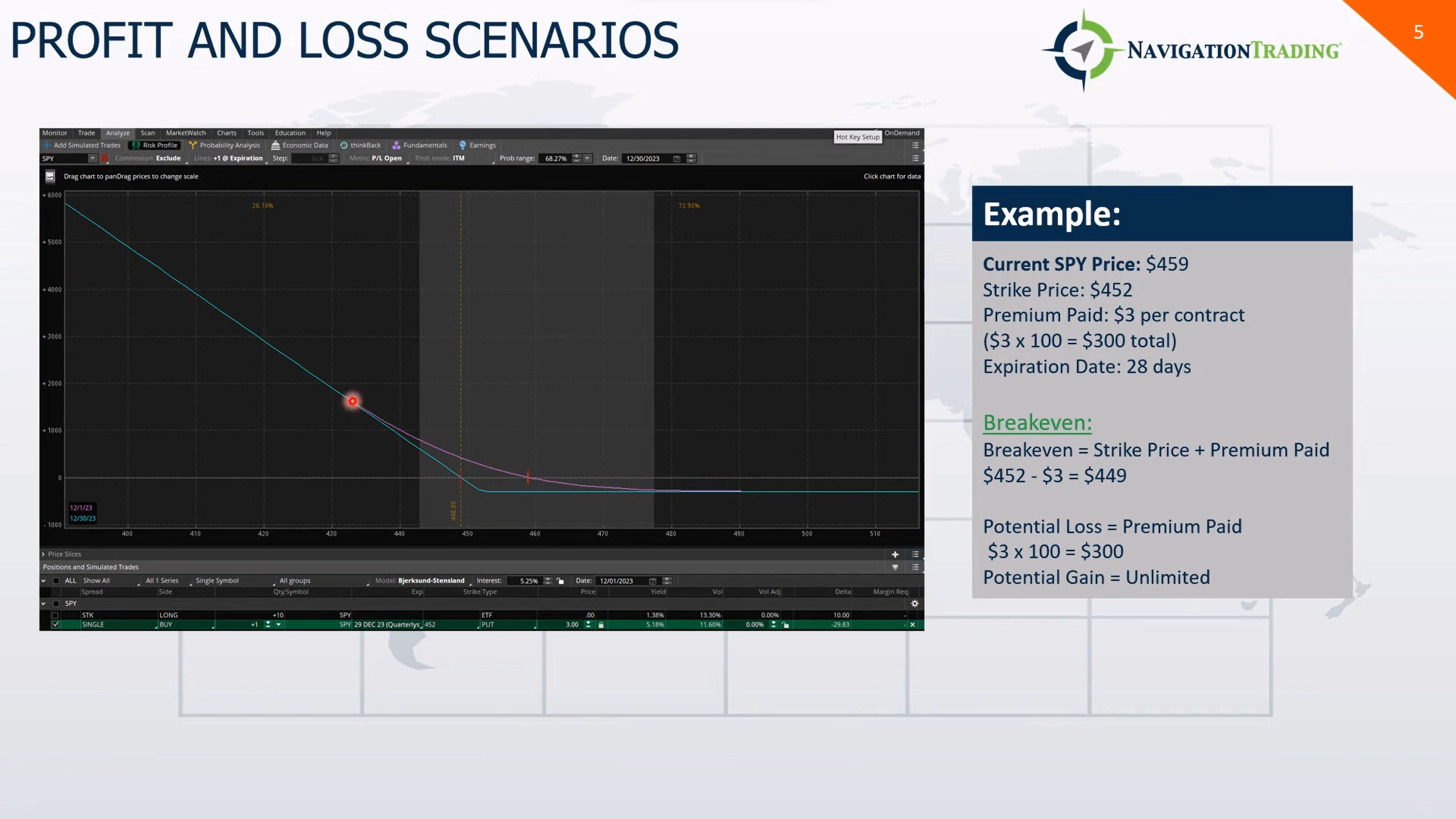

Breaking down this example, the current price of SPY at the beginning of December is 459. We’re going to be buying a put option with a strike price of 452. We’re paying $3 per contract there. $3 times 100 is $300 total. This contract expires at the end of December, 28 days from now. Where do you need to break even? How do you figure that out? Well, what you do is take the strike price minus the premium paid. That is 449. That’s represented by this price slice here. Every dollar that you see SPY go below 449 represents $100 in profit. Your potential loss here is always going to be just that premium paid times 100. So anything over 449 you’re going to lose, but anything below, you start to gain in the $100 increments as we go up to the left here.

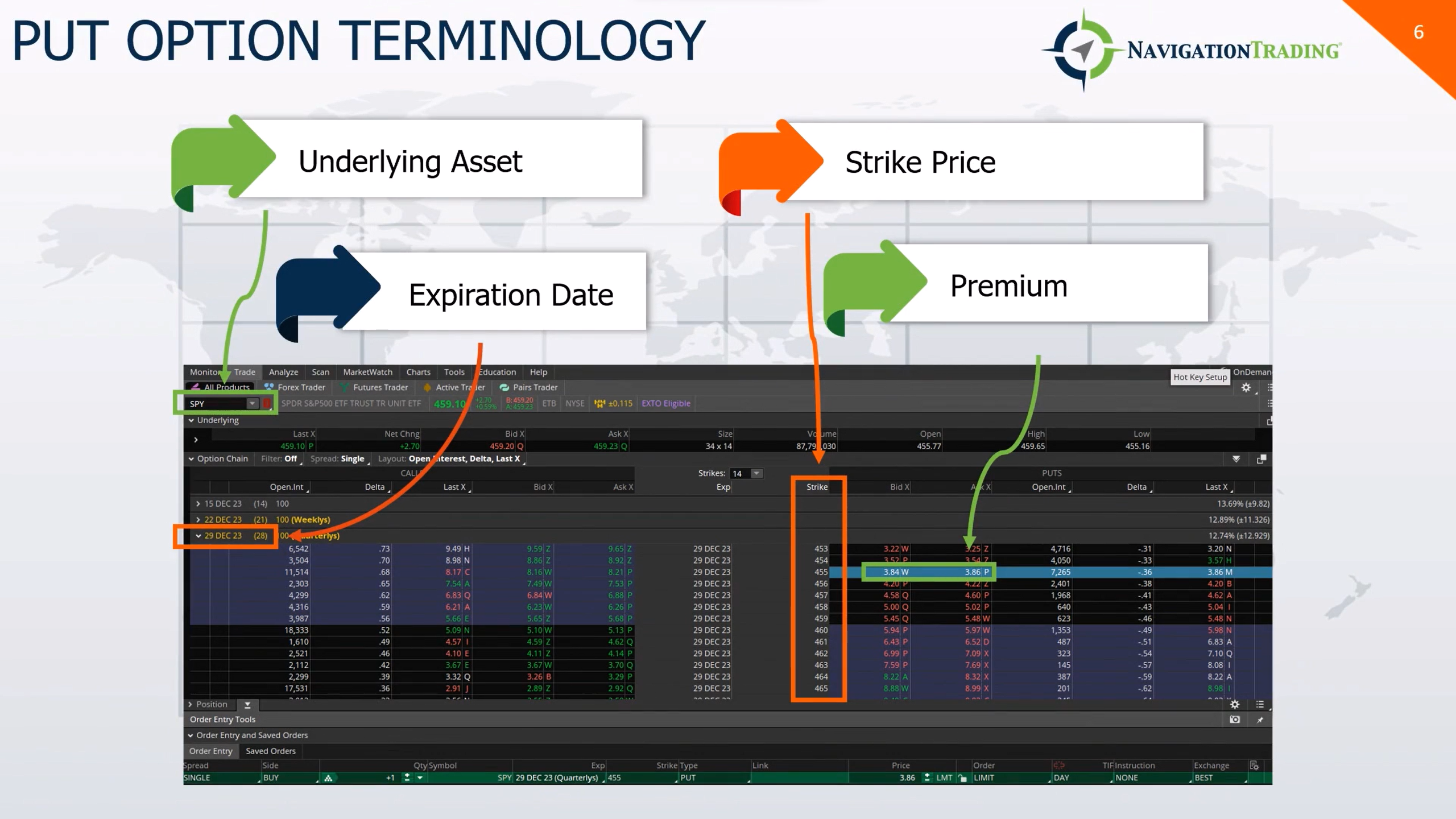

A couple slides ago when we defined what a put option is and we showed what it’s like to buy a put option in real life in the thinkorswim platform, we actually did show you what some of these terms mean in real life. Now we will be bringing you through the terminology and just illustrating and breaking down exactly what each means.

The first one we’re going to look at would be the underlying asset. Circled here, SPY, this is going to be the financial instrument or security that the contract is based on. This could be stocks, commodities, indices, ETFs… In this example, it’s an ETF with the SPY.

The next one we wanna look at is the expiration date. We talked about in the options chain, all of the different contracts being sorted by expiration date on the left here. The one we looked at, December 29th, that’s the date that the contract becomes invalid. After that date, the option holder loses the right to buy or sell the underlying asset.

The strike price we talked about here, that’s right in the middle. That’s going to be the predetermined price at which the holder of an option can sell in the case of a put option or buy in the case of a call option, that underlying asset.

Finally, the premium. That term paying a premium, well, that’s put into play here. That’s going to be the price that’s paid by the buyer of the option contract to the option seller. That’s going to be influenced by a number of factors, which obviously include the underlying assets price at the time of the sale, but also volatility and time to expiration in the contract. We’ll get to some of those terms later in the slideshow.

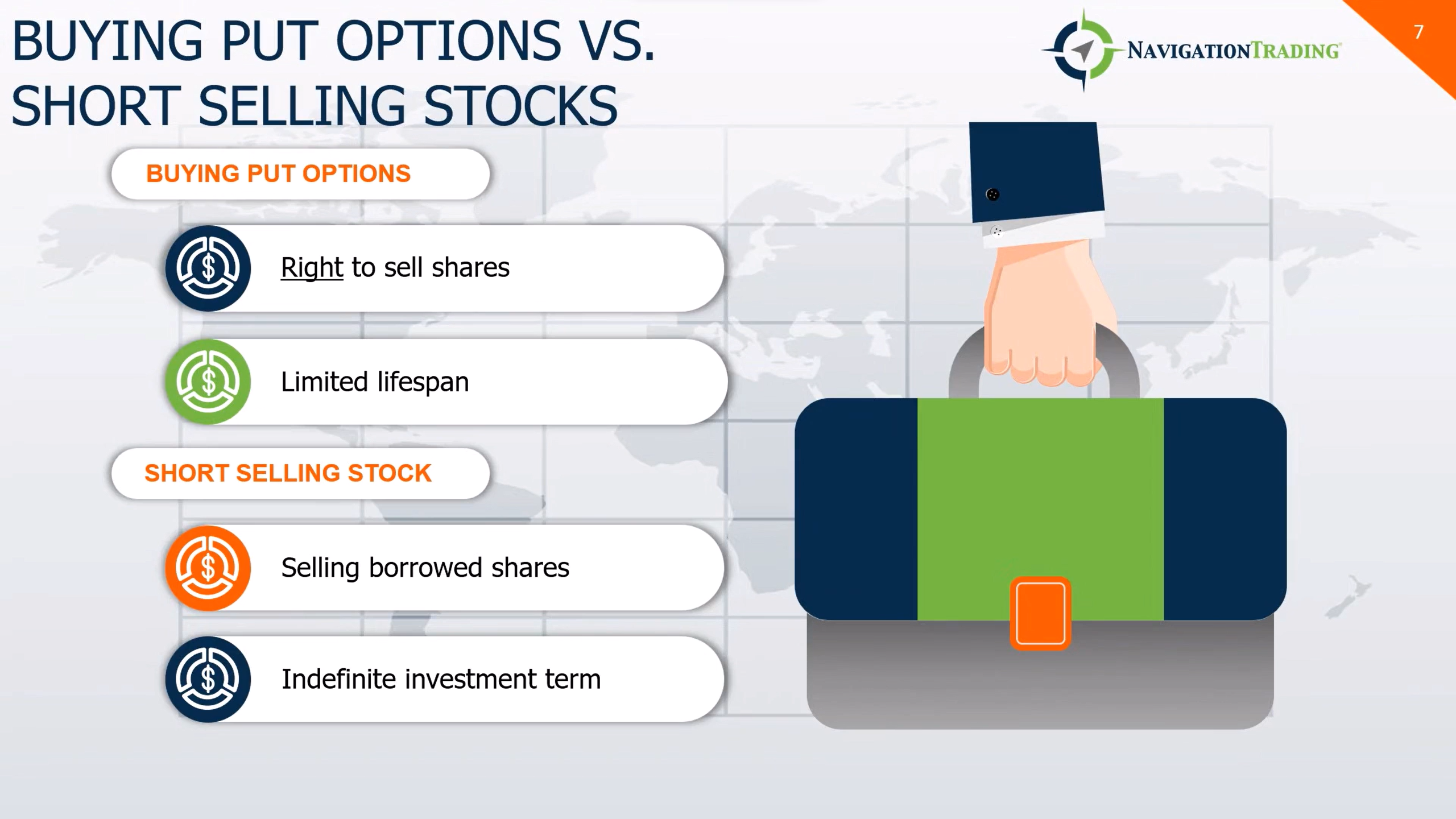

Let’s talk about the differences between options and stocks when it comes to buying put options. In this situation for buying put options, the most equatable strategy for stocks is actually going to be short selling stock. Let’s look at what those two things are… buying put options and short selling stock. Buying a put option is gaining the right but not the obligation to sell shares of an underlying at the asset’s strike price. You gain that right by paying a premium.

Short selling stock. You may have heard of shorting. So what is this? That’s going to be when you are selling borrowed shares with the intent of buying them back later at a lower price. In buying put options and short selling stock, you’re still going with the bias here of a stock actually falling and that is how you benefit from either of these strategies.

What’s different about these two strategies, buying put options and short selling a stock? One, the lifespan of the investment. The buying of put options is a limited lifespan. Put options do have that finite lifespan. It’s going to be until the expiration date of that contract. Where in the situation of short selling a stock, it doesn’t have a predefined expiration date. It’s an unlimited or indefinite lifespan and continues until the position is closed.

There’s also a little bit of difference in the nature of ownership between these two different strategies. For a put option, holding that option does not equate to ownership in the company, but it provides you the opportunity to profit from potential price decreases without having to commit to long term ownership, as you would if you were buying or shorting a stock. When it comes to shorting a stock, the seller doesn’t actually own the shares, but it does borrow from a third party that does own the stock. It provides you the opportunity to profit from the potential price increases, but it does involve the obligation to repurchase those shares at whatever price they are trading for.

Looking at the risk and reward between buying options and short selling stock… For buying options, your risk is going to be limited to the premium paid for the option. That’s going to be the same for buying calls or puts. Your potential reward as we looked at in the break even analysis, can be substantial if the underlying assets price decreases significantly in the case of buying put options. When you’re looking at short selling, you’re looking at an unlimited potential on the downside is there’s no cap on how high the stock price can rise, especially the longer you are short selling that stock for. The potential reward is going to be your difference between the selling and the repurchasing price from opening and closing that short selling position.

Why buy put options or why use them in general? We talked about in the call video, options give you a strategic alternative to traditional positions in stock ownership. Put options in this case, give you an alternative for investors looking to benefit from a down move in an asset price and give you a more flexible tool to navigate those market downturns when you can predict them without the need for direct ownership. Again, you can benefit from market movements if you’re able to predict them with limited time frame and limited commitments. Like call options, using put options allow for investors to capitalize on market movements without that long term ownership. You can strategically position yourself for that downturn while maintaining flexibility in your overall portfolio.

Something we’ve been hinting at so far is put options that allow you to hedge against market declines. It’s a form of insurance for your portfolio or your positions, giving you a hedge against those potential declines. When in other positions, you might be looking for neutral or bullish positions. During periods of higher market volatility, the gains you can see from put options can offset losses in the broader portfolio where you’re owning stocks or equities that are losing at the time.

Creating these hedges against the market declines allows you to have an effective risk management strategy using these put options in your portfolio. It’s a protective move and you can strategically use them to mitigate the downside risk and safeguard your overall investment positions.

I won’t spend too much time on the factors that go into pricing options. I realize for a beginner, this might be a bit much at first, but there’s a couple of things that go into it. Just to skim the surface here… intrinsic value and time value. Intrinsic value is going to be the real option value that could be seen today to make money selling that option immediately. It’s going to be the difference between the option strike price and the current stock price. Time value is going to be the extra value that is put into a put option beyond its real value. It kind of represents that potential for the option to make money before the time it expires. It’s the value that’s tied to the potential moves that haven’t been realized yet or the implied volatility in that security.

What is implied volatility? It shows what the market thinks about the future price. If it could drop, if it could go up, if it could move in any way… It’s kind of like a weather forecast. Thinking that a storm could come or things are going to remain calm.

Finally, theta decay is something you’ll learn about in other courses here at NavigationTrading and really anywhere that you’re talking about options. Theta is a number that represents how much value an option is going to lose each day. As you get closer to the option’s expiration date, that loss or that gain is going to speed up as it gets closer. Theta decay or time decay speeds up at the end of an option cycle.

What are the risks associated with put options? Number one, market risk, right? It’s going to be tied to the stock price or the value of the option, I should say. That value of the put option is going to move depending on the stock price movement. If the stock doesn’t move as expected, your put option may not be profitable.

There’s also that time decay risk. We talked about options losing value over time. That happens especially fast as the dates get closer to expiration.

There’s also leverage risk, right? When we talked about using leverage with put options, that leverage that you gain with options can increase both potential gains and losses. Be cautious with that as higher leverage can mean bigger losses too.

What research do you need to do? What do you need to understand before being comfortable in buying call options? Number one, understand the underlying asset that you are taking a position with. If it’s an individual company, research that company, look into their financial health, consider how larger and smaller industry trends and market conditions can affect the success of your option.

If you’re buying an option… In this situation, we talked about buying a put option on SPY. Well, that’s the S&P 500… There’s a lot of factors that go into the movement and the speculation around that ETF. There’s a lot to be aware of and that in general reflects how equity markets are dealing at the moment.

That’s a good segue to the next one there. What else do you need to do? Analyze the market conditions of the overall market. That really affects any equity that’s going to be traded. Even if it’s a bond fund, for instance, or a bond ETF, right? Market conditions matter for that too. Stocks and bonds have an inverse relation typically. Being aware of the market in general, looking at volatility, economic indicators, and potential events that could impact the fund or stock or the equity that you’re looking in, that’s an important thing.

We talked about how option pricing works. Be aware of what goes into this to make sure that you are understanding how an option is priced. Then you can better judge if you are getting a fairly priced options contract. As you continue to learn more about options and how they’re priced, there are Greeks; Delta, Gamma, Theta, Vega… They give you better insight into how options behave in different market situations. We won’t get into that here, but that’s something to be aware of as you continue to learn.

Risk management strategies… This looks different for everyone and their risk tolerance, but you need to protect your investment somehow by implementing your own set of risk management rules. Create rules, use stop losses, and position size correctly so that you’re safeguarding your money and reducing your potential losses to a level where you’re comfortable.

You’ve learned a bit about put options. What’s next? Well, continuous learning is going to be key to really mastering stock options, put options, and any kind of options trading in general. Financial markets have a dynamic nature. Things are changing all the time. You need to stay informed. You need to stay updated. Ongoing learning about option strategies and the dynamics of markets in general is going to be vital.

How do you start to do this without having any risk? Paper trading is a great option for the inexperienced or learning options trader. You do get practical experience through this paper trading. We suggest using these simulated trading platforms before committing your own capital to options trading.

In addition to continuous learning, just continually watching the market. Just being informed and updated, taking those few minutes in the day to look at your favorite stock trading and financial market media is going to be important. While you’re always going to be using your own strategies and hopefully some of the strategies that we’re teaching here, staying updated on these market trends is going to be a huge success factor in making the trading decisions that you have in front of you.

Follow