What’s up NavigationTraders?!

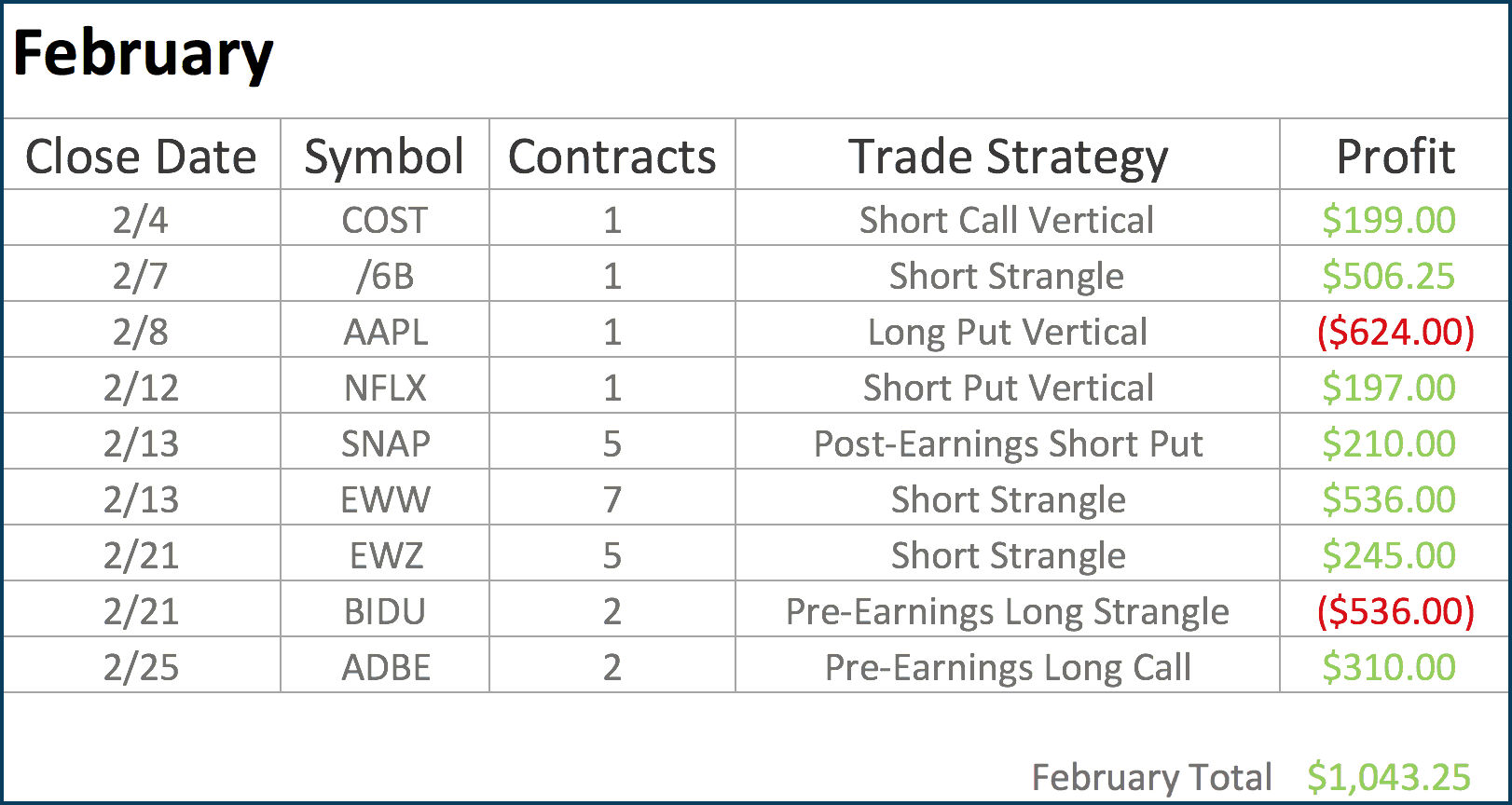

February is over and another month is in the books, so I wanted to take some time to give you a recap of the trades we closed this month. This month, we had nine closed trades, seven of which were winners, and a profit of a little over a thousand dollars.

We traded quite a few different strategies this month, including:

- Short Strangles

- A Short Call Vertical

- A Short Put Vertical

- A Long Put Vertical

We were in Earning Season, so we had a few Earnings-related trades as well, including:

- A Post-Earnings Short Put

- A Pre-Earnings Long Strangle

- A Pre-Earnings Long Call

We send out our live trade alerts immediately via email and text to our Pro Members. If you want to follow along and receive NavigationALERTS, just visit NavigationTrading.com/Pro-Member to sign up. We are currently taking new members.

Performance Page

2019 Stats

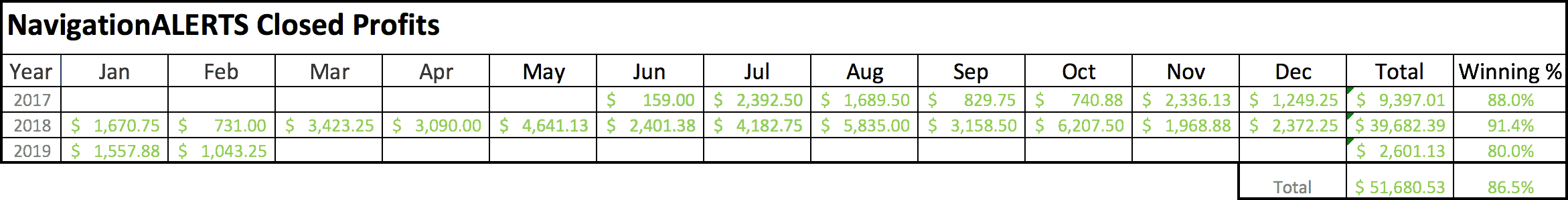

Let’s jump over to the Performance page to give you a quick update. Year-to-date in 2019 after two months, we have closed 20 trades, our average profit per trade is $130, and our winning percentage is right at 80%.

Cumulative Stats

If you click on the cumulative running total image that we have up at the top of the page, it shows our cumulative results since we started posting our alerts back in June of 2017. Our total profits are over $51,000 with a winning percentage of 86.5%. As a side note, you can click this image, when you’re on our Performance page, and it will expand making the image easier to see. This image is great, because it allows you to see how NavigationTrading is doing over time.

Monthly Stats

If you scroll down, we provide details of each month and the trades that we close. You can see the number of contracts that we do for each position is a pretty small number depending on the size of the underlying symbol. Typically, we use anywhere from a thousand dollars to a few thousand dollars of buying power per position, so you can kind of get an idea of what we’re doing. Here are the stats from February:

2018 Stats

For the year of 2018, we closed 151 trades, our average profit per trade was $263, with a winning percentage of 91.4%.

In-Depth Look at Our Trades from February

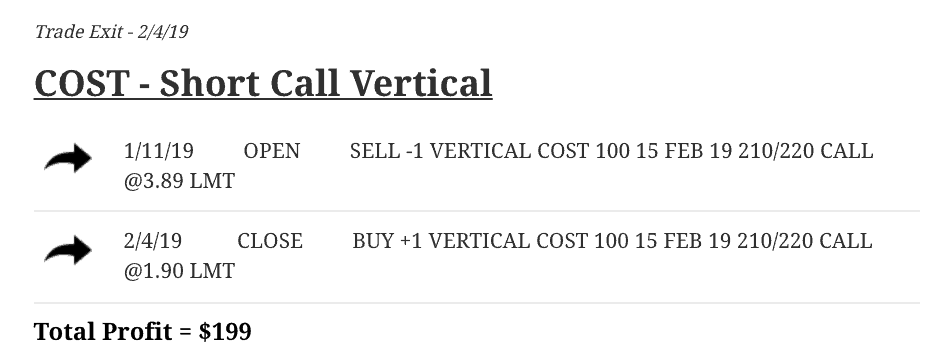

Let’s navigate to the Member’s Area and go through our closed trades from February in more detail. We’ll start with the first trade we closed, which was Costco. We did a Short Call Vertical, and booked a winner of $199.

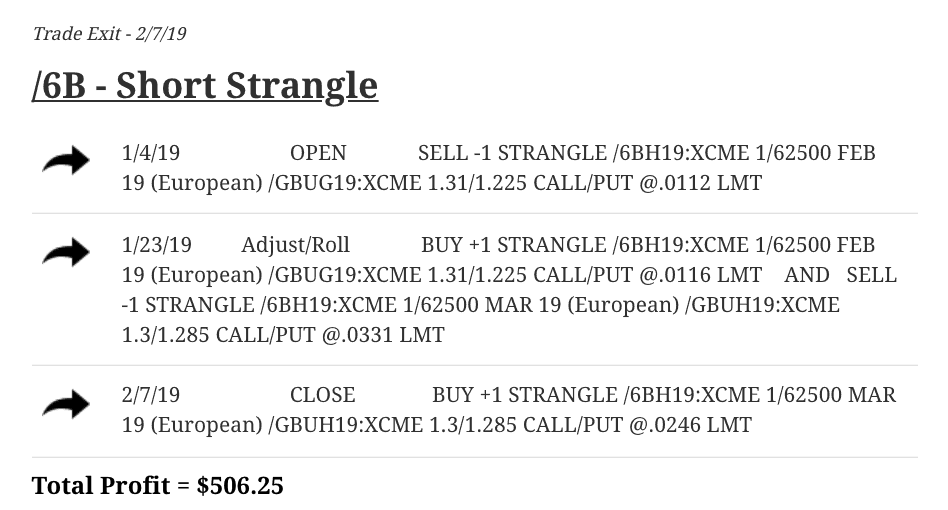

Our next trade was in /6B, which is the British pound. We had to make one little adjustment, but by staying mechanical, we booked a nice profit of over $500.

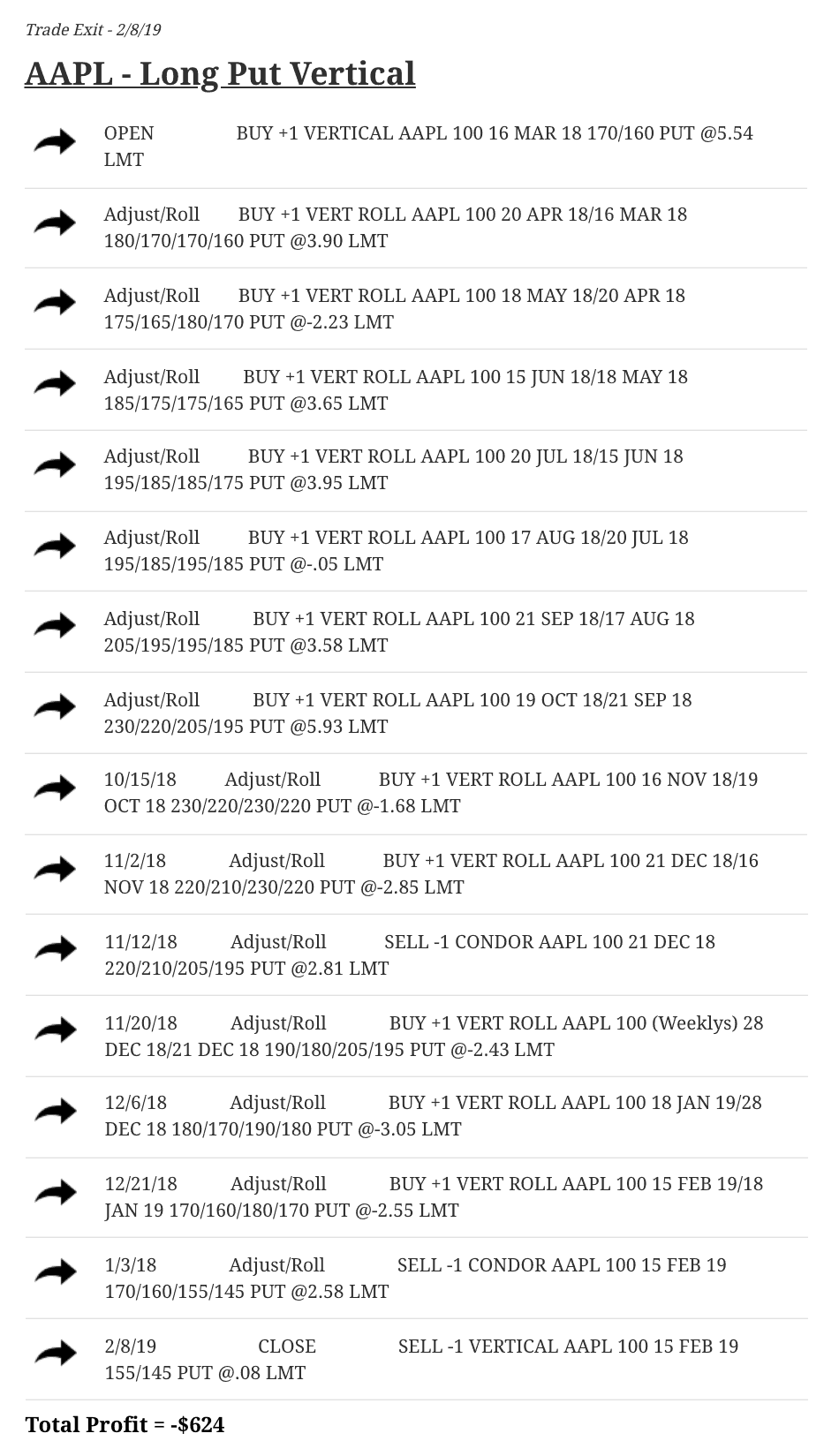

Next, we had our Apple trade. This is one that we had on for quite some time and we continued to adjust, roll and extend duration. Really, we were just using this as a hedge. It got to the point where we didn’t anticipate any further downside on Apple, so we went ahead and just cut our losses. We ended up losing $624 on this trade.

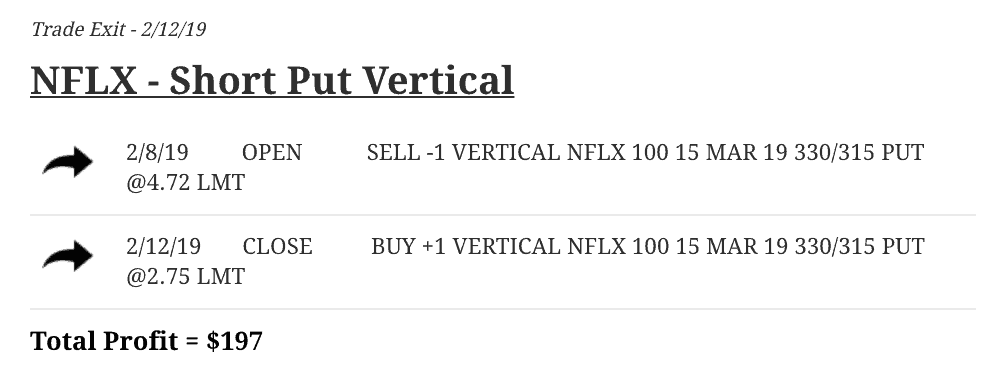

For our next trade, we did a Short Put Vertical in Netflix. It was a bullish position, and we booked a profit of $197.

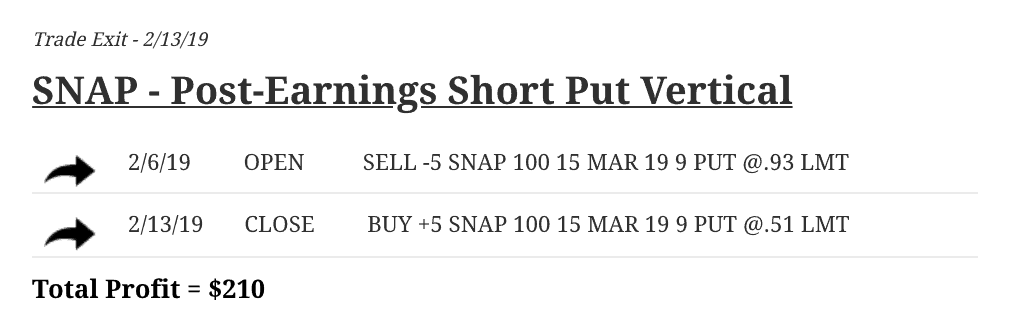

In Snapchat, we did a Post-Earnings Short Put, just like we teach in our Earnings course, and booked a profit of $210.

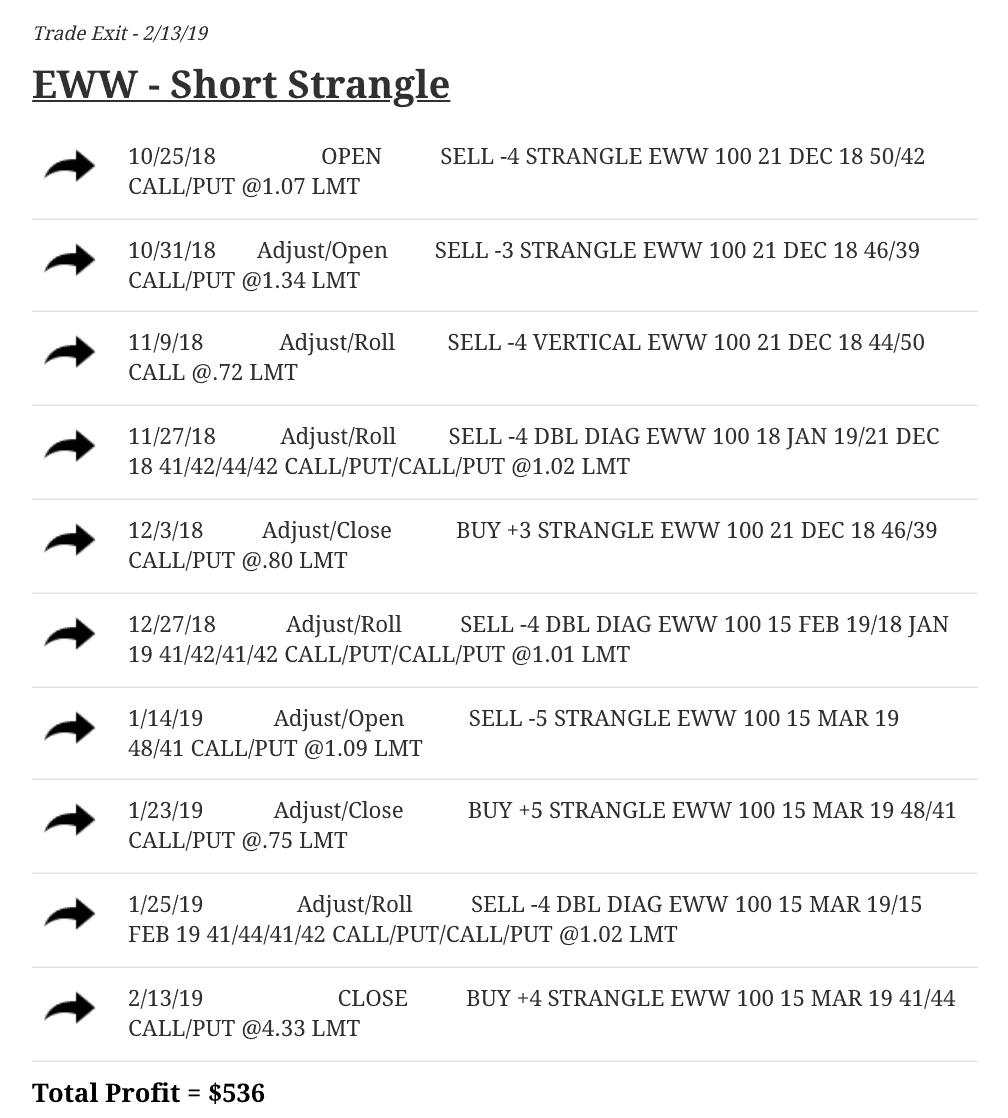

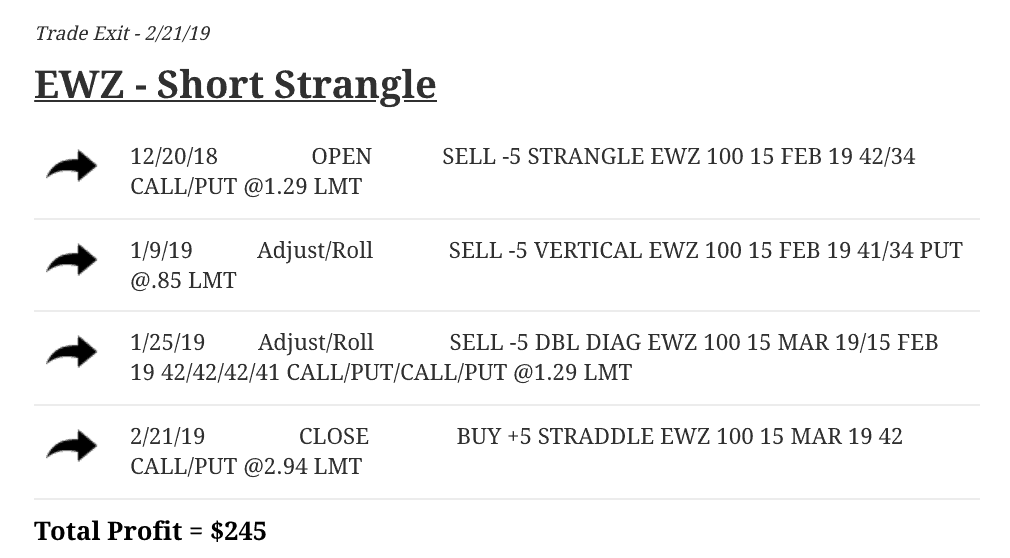

We had a nice trade in EWW where we had to make several adjustments, but by staying mechanical, we booked a nice profit of $536.

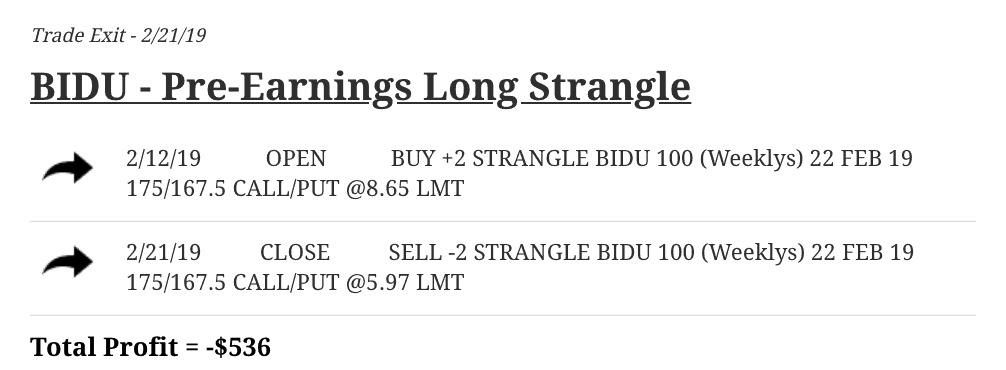

BIDU was our other losing trade. We did a Pre-Earnings Long Strangle and this one just never gave us the chance to take a profit. We ended up taking a loss before the Earnings announcement of $536.

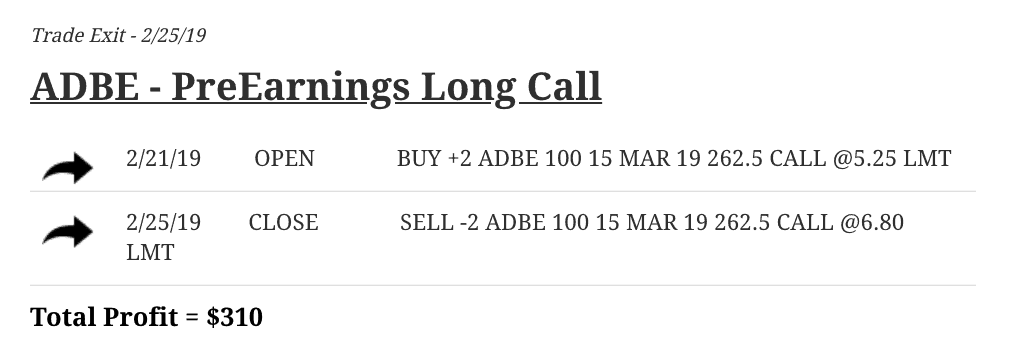

Lastly, we did a Pre-Earnings Long Call in ADBE and booked a nice profit of $310.

Member’s Area

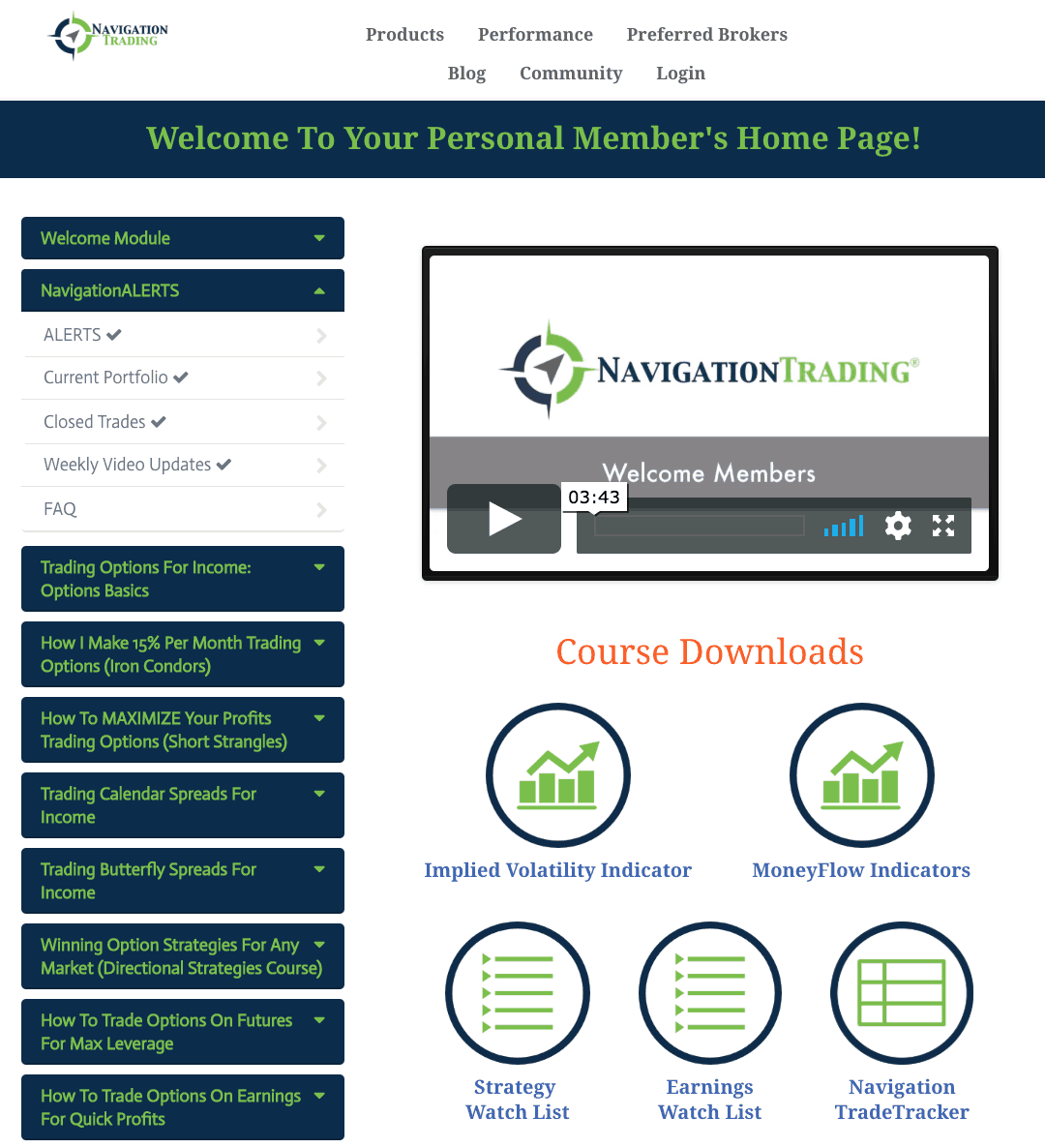

Those are all of our closed trades for the month of February. If you’re a Pro Member, you can find these closed trades in your Member’s Area, as well as our alerts and current portfolio.

As a Pro Member, you get access to our Weekly Video Updates every Friday to recap all trades from the week. You also have access to all of our strategy courses including:

- Iron Condors

- Short Strangles

- Calendar Spreads

- Butterfly Spreads

- Directional strategies

- Options on futures

- How to Trade Options on Earnings

- Money Flow

- VIX

- Option Assignment

You can go through these courses at your speed and refer back when you need to.

The TradeHacker Community

The other thing I wanted to show you is our TradeHacker Community. If you haven’t joined our community yet, this platform has really taken off. We’ve got a ton of members in there providing help and sharing trade ideas.

All you have to do is go to community.navigationtrading.com. It’s free to join and has been an exceptional resource for our membership. If you’re interested, go ahead and check that out!

That wraps up our February performance recap.

We’ll talk to you guys next month!

Happy Trading!

-The NavigationTrading Team

Follow