Overall Performance

Let’s jump in and take a look at the different trades. Go to our navigationtrading.com/performance page. This is open to anyone, not just our Pro Members. Our performance page gives the updated trade statistics since we first started posting our results. Year to date in 2018, we’ve had 65 closed trades. Our average profit is up to $209 per trade with a winning percentage of over 87%. So, awesome stats.

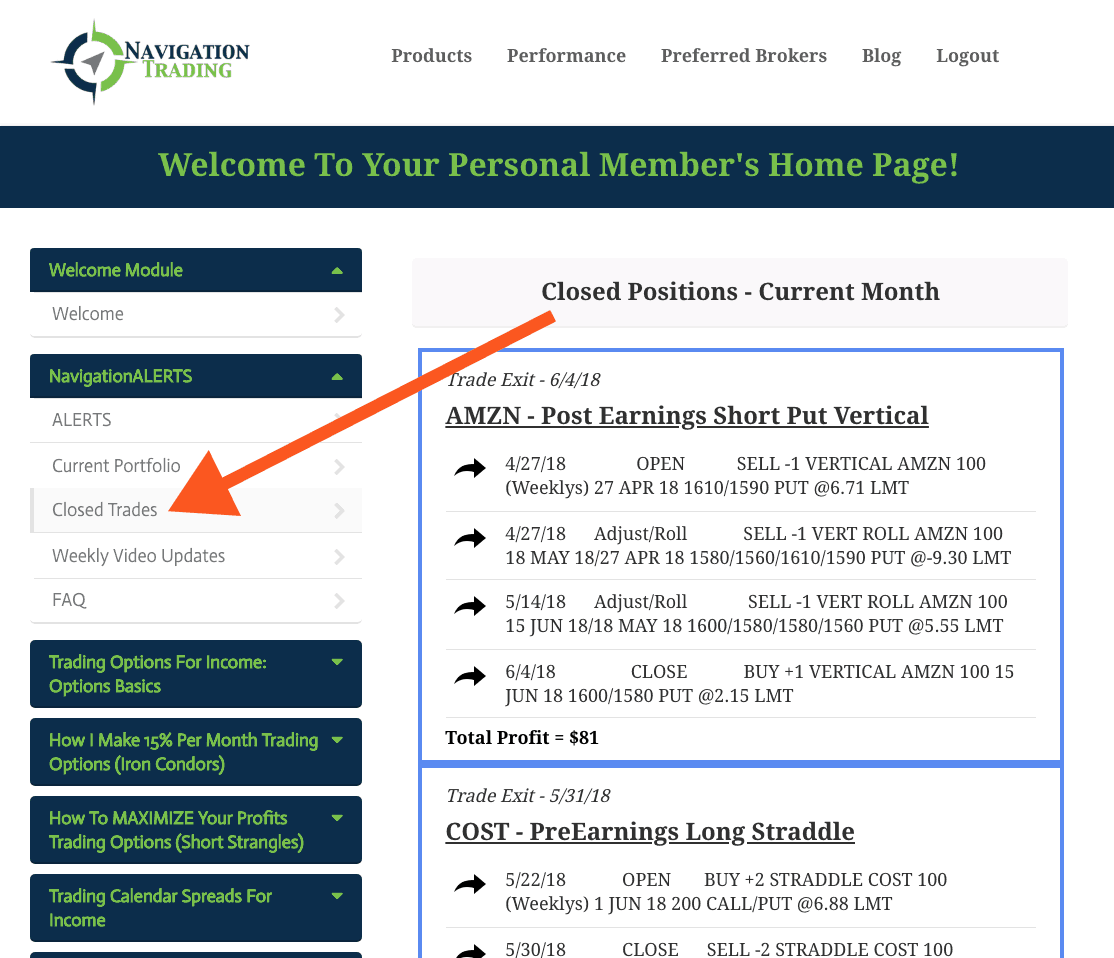

Navigate to the membership area. If you’re a Pro Member, go ahead and login. Then, under the “NavigationALERTS” dropdown on the left sidebar, click on “Closed Trades”.

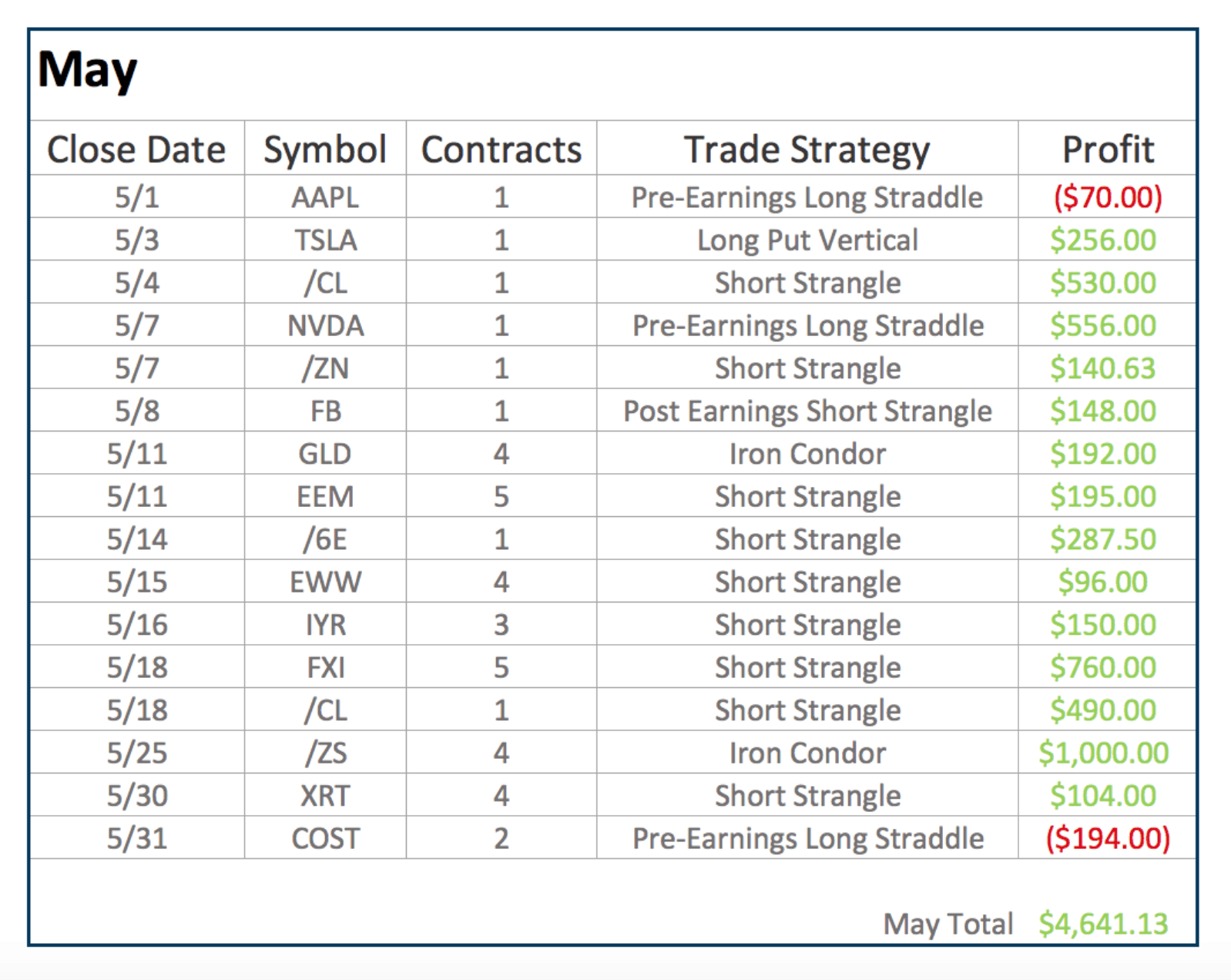

May Breakdown

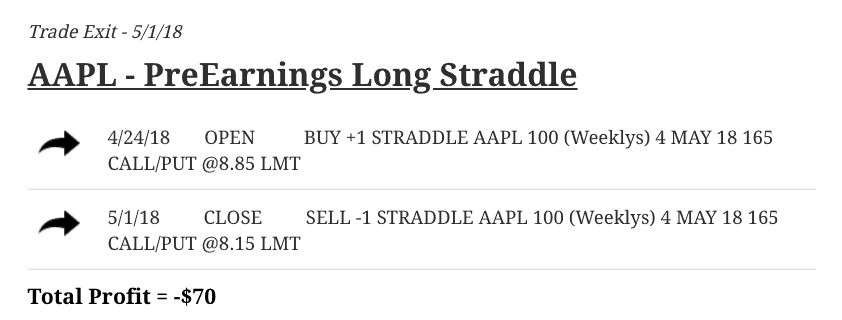

Now let’s breakdown the different trades that we made throughout the month of May. May 1st was the first exit where we did an Apple Pre-Earnings Long Straddle. We took a loss $70 on this trade. We just didn’t get the expansion of implied volatility or the movement we needed.

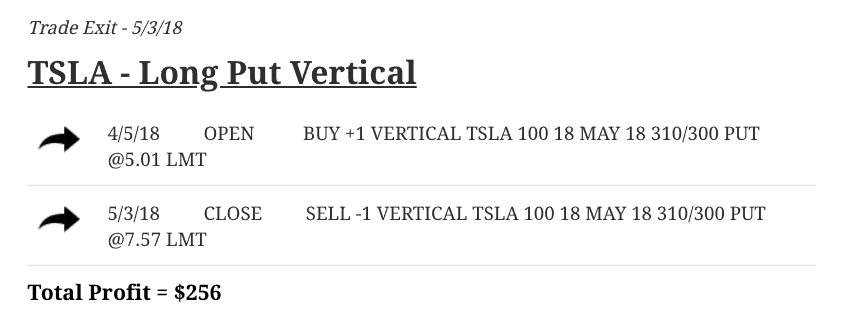

We did a Long Put Vertical with Tesla, which worked out nicely. We booked a profit of $256.

/CL Oil one of my favorite symbols to trade anytime implied volatility gets above 50. I love to sell premium in oil, particularly Short Strangles because you get such a good bang for the buck. We booked a profit of $530 on this one.

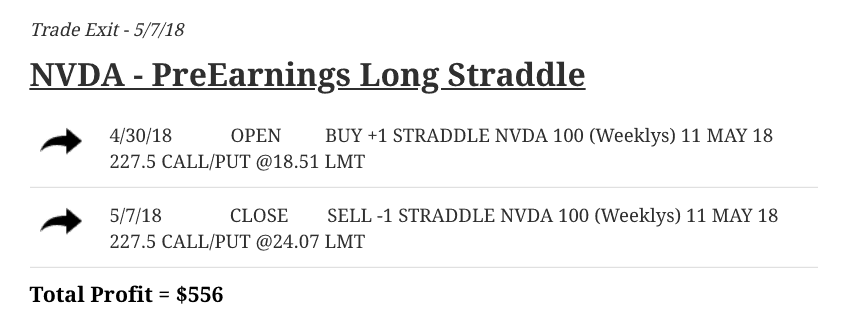

With NVDA, we did a Pre-Earnings Long Straddle, which worked out nicely. We got an expansion in implied volatility and a big price move, which is what we wanted. We ended up booking a profit of $556.

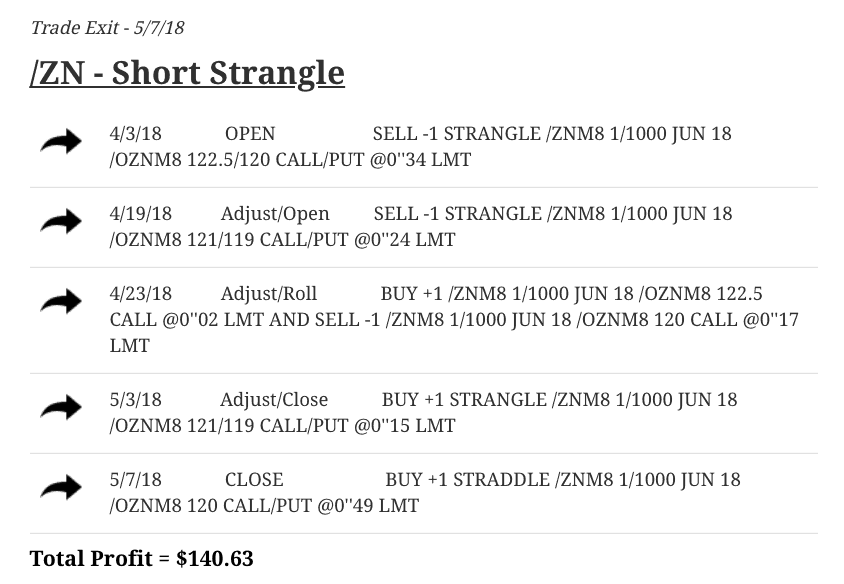

In /ZN, which is the ten-year note, we did a Short Strangle. See how we had to do a couple of adjustments, but stayed mechanical, and booked a profit of over $140.

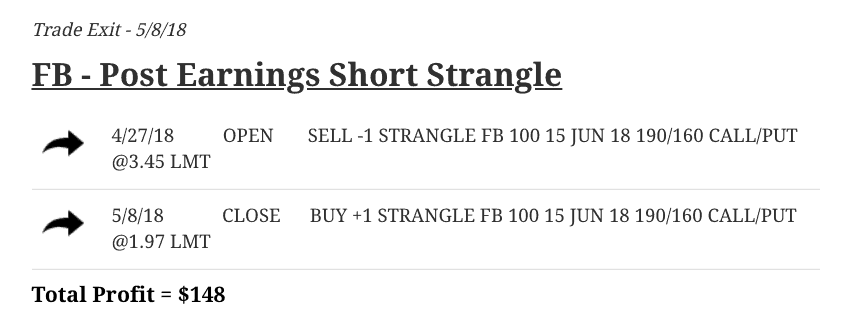

In Facebook, we did a Post-Earnings Short Strangle that worked out nicely for $148.

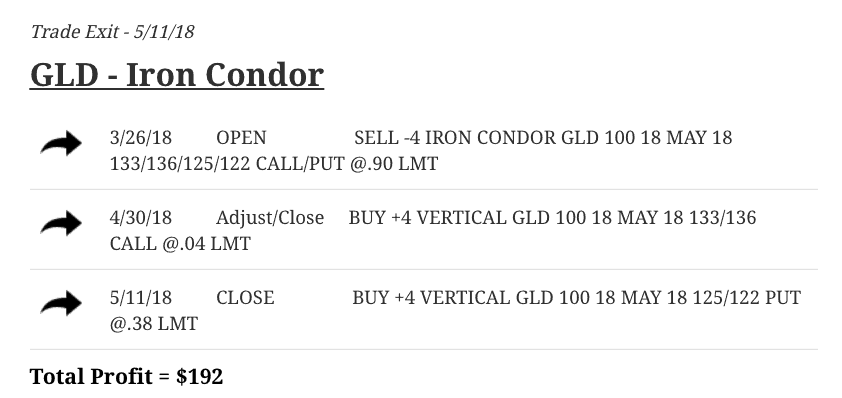

In GLD, the gold ETF, we booked a profit of $192. We did have to make one adjustment, but by doing so, we were able to come out with a profit.

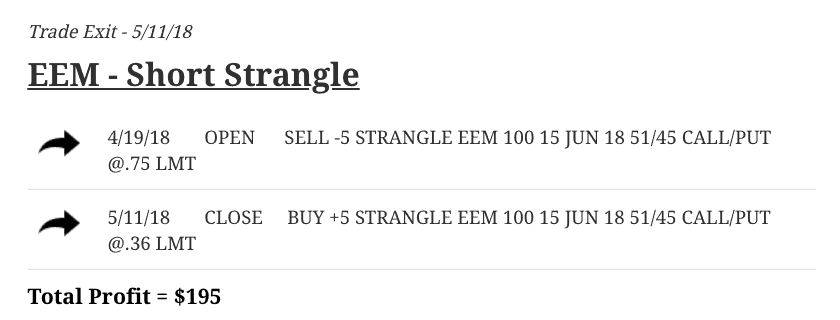

In EEM, we did a Short Strangle. We were in and out for $195.

In /6E, which is the Euro Future, we traded options and booked a nice profit of over $287.

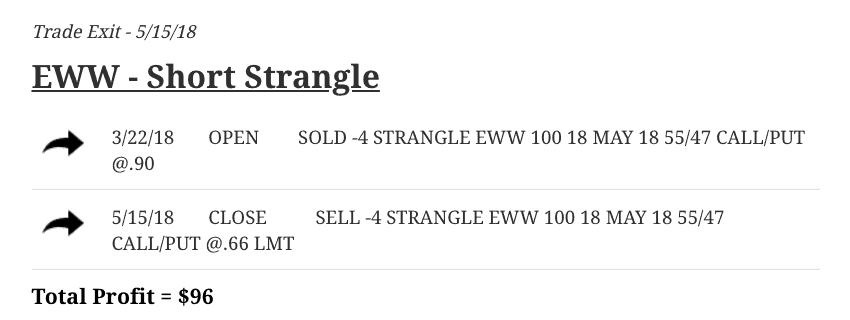

In EWW, the Mexican ETF, no adjustments were needed. We booked a quick profit of just under $100.

In IYR, which is the Real Estate ETF, we booked a profit of $150.

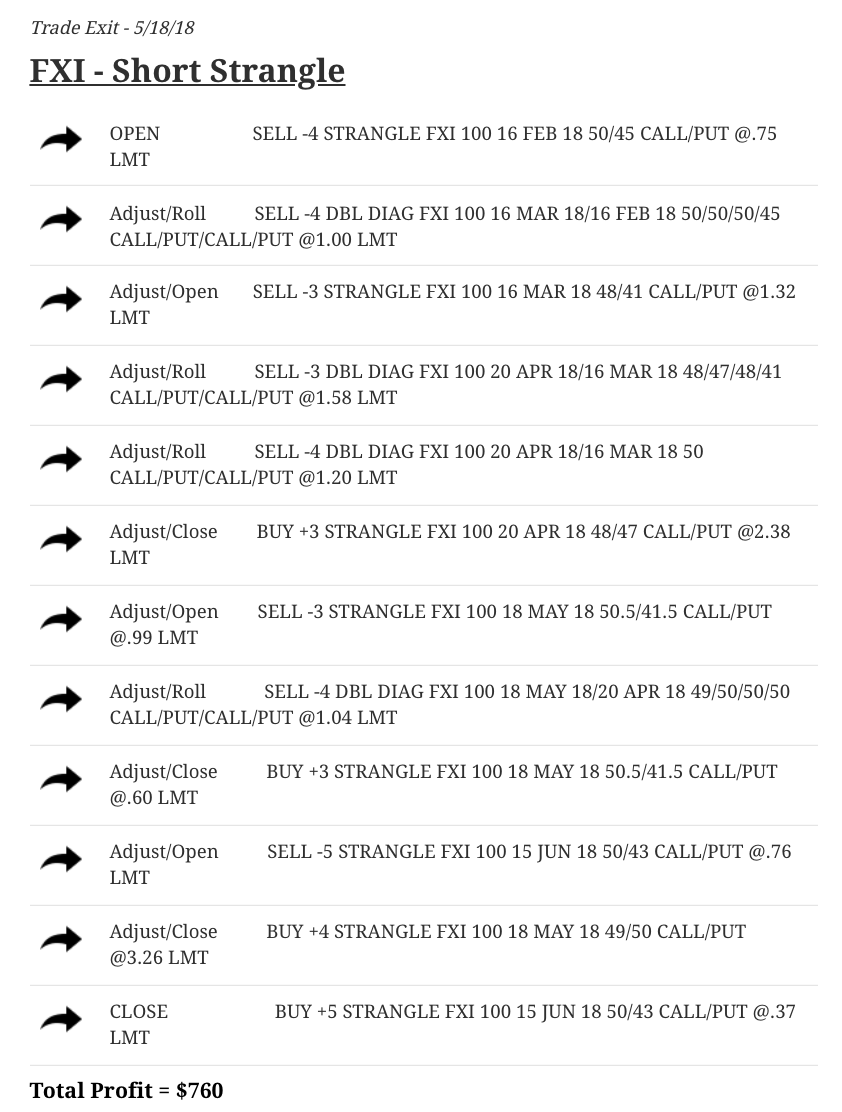

We had a couple of positions come in that we closed. One of which being FXI, which we had been in for quite some time. You can see the different adjustments and rolls we had to do. By staying mechanical, extending duration, continuing to adjust exactly like we teach in our course, we booked a profit of $760. FXI was a great trade!

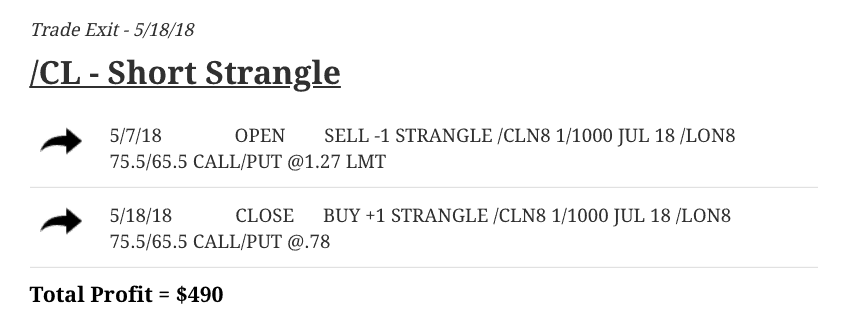

/CL was another oil trade. Booked another profit of $490 there.

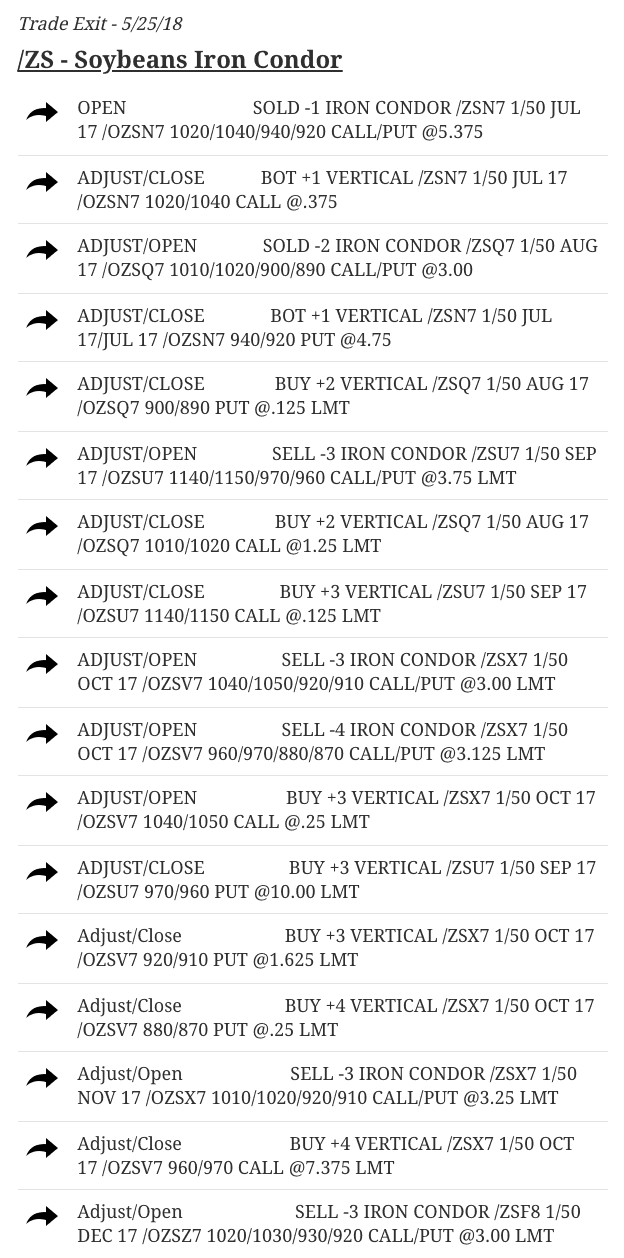

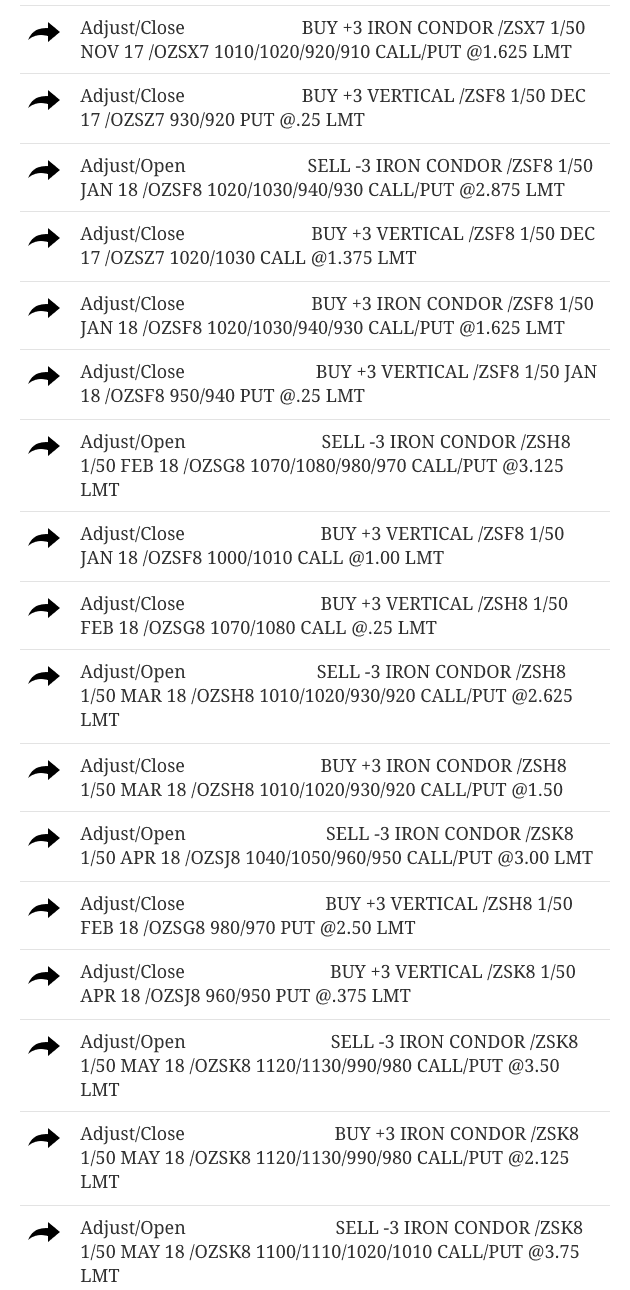

Look how long this list is in our Soybeans trade. This trade was one we’d been in for almost a year. When we first got into the trade, it went immediately against us. We had to extend duration and roll and adjust. Just like we teach in the course, if a trade goes against you, that typically just means you’re going to be in that trade longer than the typical one cycle, in and out trade. You can see we made a ton of adjustments; and because of those, we came out with a total profit of exactly $1000. It was a great test study on staying mechanical with your adjustments and a great trade to learn from for those of you who followed along the whole time, which I know there were several of you.

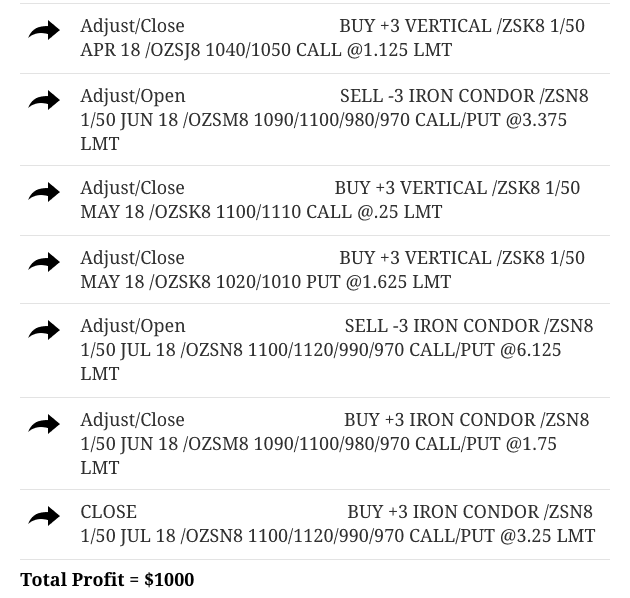

In XRT, we did a Short Strangle and booked a quick profit of $104.

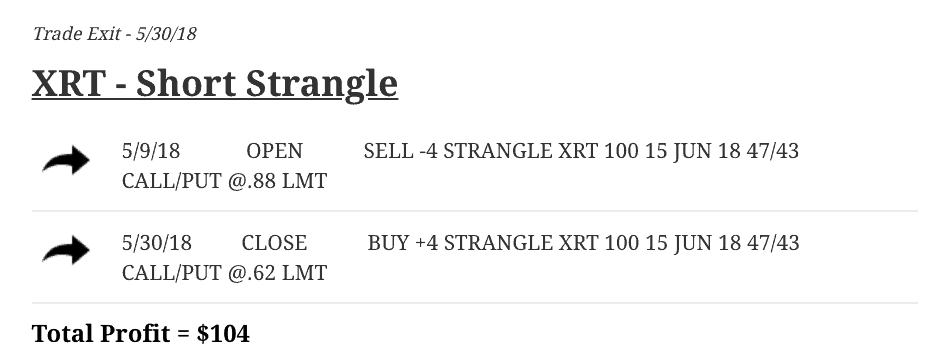

In Costco, we did a Pre-Earnings Long Straddle. We didn’t get the move or expansion in implied volatility that we wanted and took a loss of $194.

Those were all the trades we did in May. We’re only trading one contract on most of these trades. At the most, we did five contracts on some of the lower priced symbols.

With a total profit of over $4,600, if you’re trading more contracts, just multiply the profit by the number of contracts you trade. We have some members trading 5-10 times the number of contracts we put on.

You can trade these types of strategies in any size account. We like to show a relatively small number of contracts, so that you understand that you can do this with a relatively small account, or you can do this with a massive account. We have members with small accounts, but then we also have members with multiple seven figure accounts.

Implied volatility is still relatively high in quite a few symbols, which bodes well for the type of trading that we do. We’ve had some good two-sided action, so this continues to be a great time to trade these strategies.

Our Pro Membership Is Open To New Members!

If you’re interested in checking out our Pro Membership where you get our NavigationALERTS, just go to navigationtrading.com/pro-member. You can find all the details about our Pro Membership on this page.

We also have a Pro Membership Trial. If you’d like to sign up, just click navigationtrading.com/pro-trial. We just recently opened our Pro Membership back up to new members. We had closed our membership down for a few months because of such a huge inflow of members. We are now caught up and ready to accept additional members.

Follow