Happy New Year NavigationTraders!

I hope 2018 was an awesome year for you all, and I really look forward to a great year of trading in 2019.

In this post, I want to go through our trades for the month of December, and take a deeper look at all of our trades for the year of 2018.

Let’s jump in!

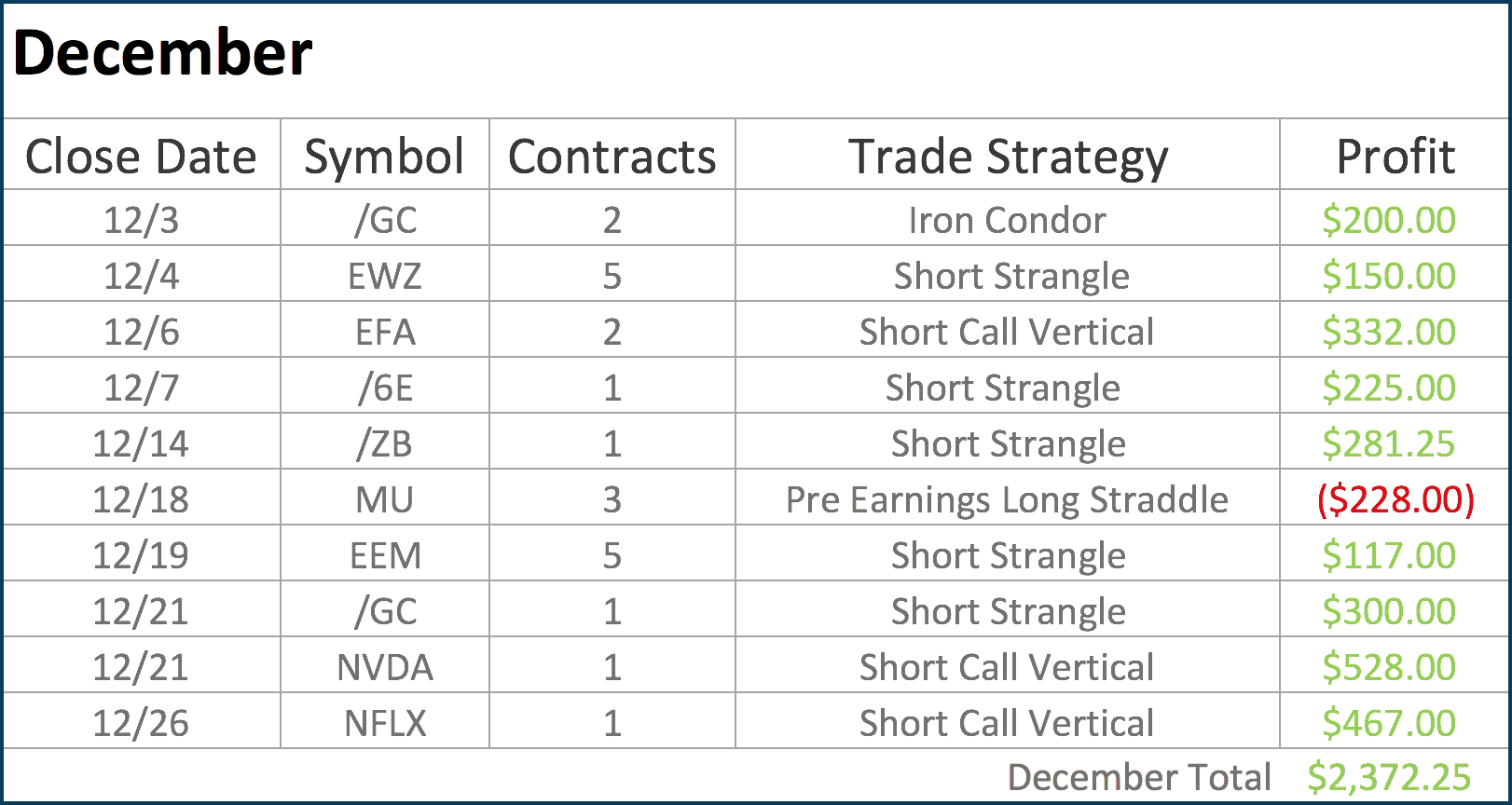

December 2018 Performance

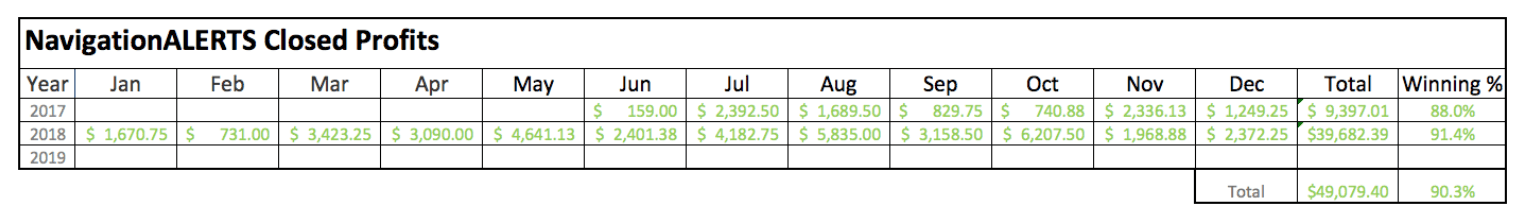

In December, we had a total profit for our closed trades of $2,372.25, giving us an average profit per trade of $237.23. We had nine winners and one loser, giving us a winning percentage in December of 90%.

For our Strategies, we used Short Strangles, an Iron Condor, Short Call Verticals, and a Pre-Earnings Long Straddle.

Member’s Area

If we jump into the Member’s Area. For those Non-Pro Members, this is where all of your training is accessible. We don’t just GIVE you the fish, we want to TEACH you how to fish as well. For every strategy that we trade, we have a step-by-step video training course that teaches you exactly how and why we make the trades that we do.

In addition to our NavigationALERTS being sent immediately to you by text message and email, they are also posted right in your Member’s Area.

In-Depth Look at Our Trades from December

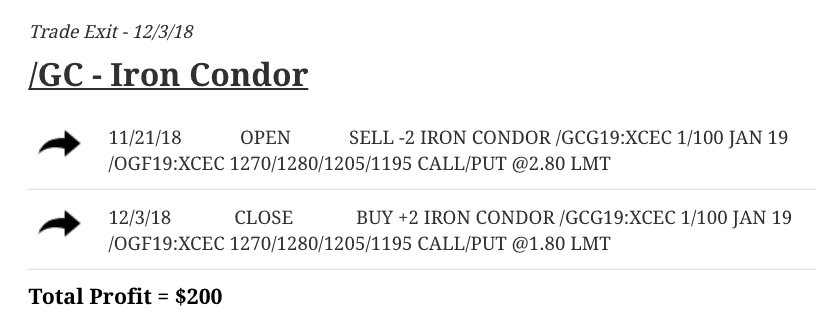

Let’s go over our closed trades from December. We’ll start with our first trade that we closed in the month, which was on December 3rd, where we closed an Iron Condor in /GC.

/GC is the Gold Futures, and we booked a profit of $200 on that trade.

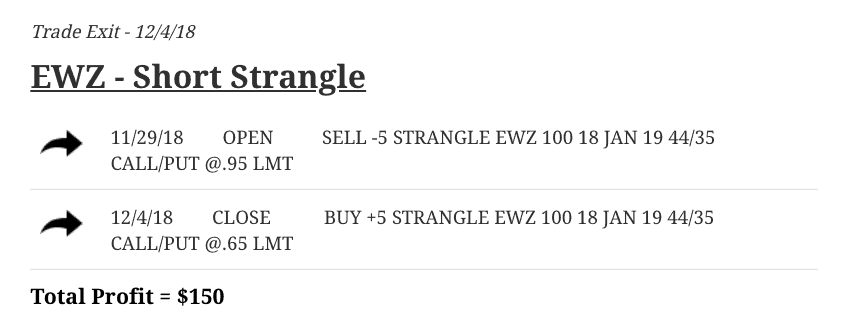

We did a Short Strangle in EWZ, and booked a profit of $150.

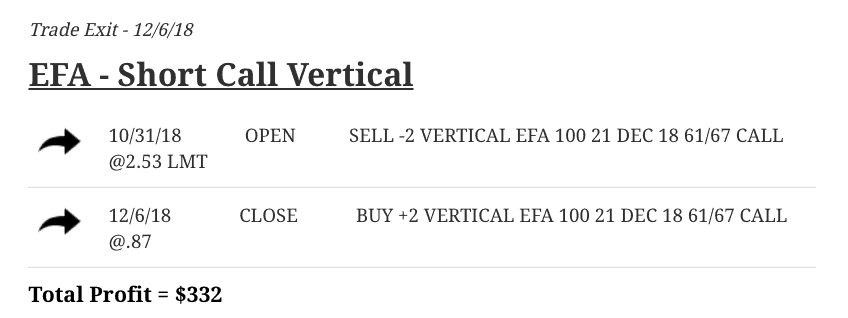

In EFA, which is the International Index, we did a Short Call Vertical, booking a profit of $332.

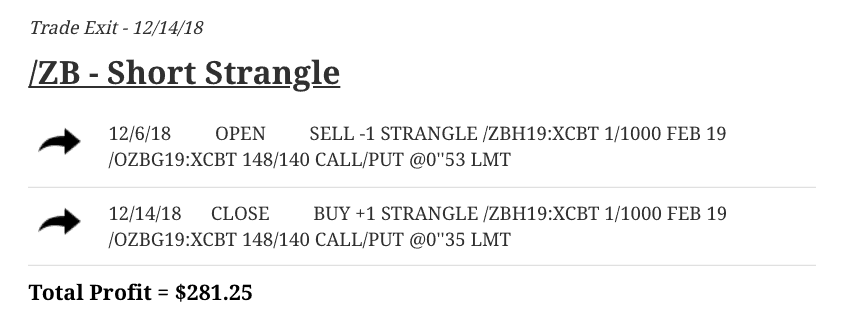

In /ZB, which is Bonds, we booked a profit of $281.25.

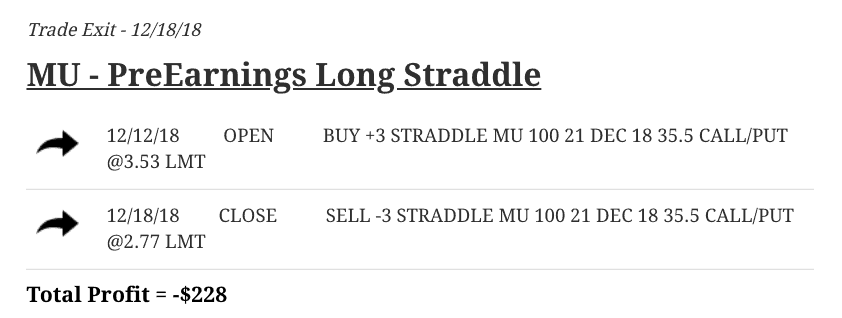

Our one loser in December was a Pre-Earnings Long Straddle in Micron Technology, symbol MU, where booked a loss of $228.

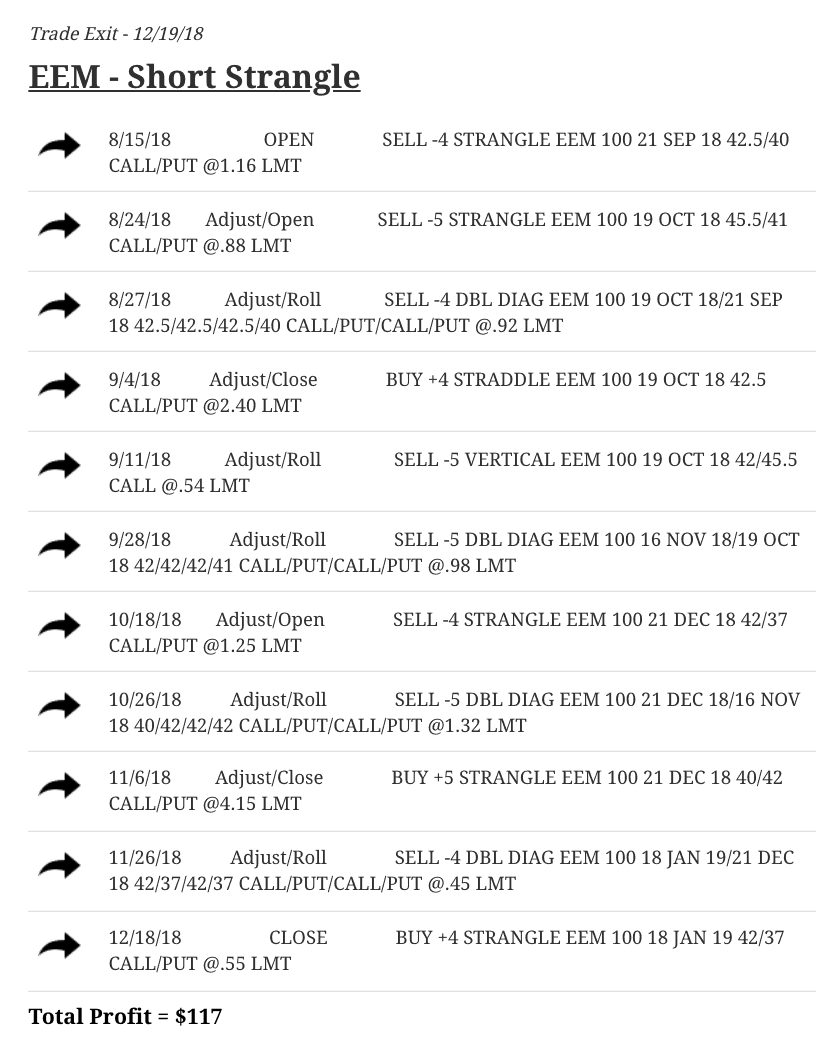

In EEM, we did a Short Strangle. As you can see, we had to do multiple adjustments and a few rolls, but ended up coming out with a profit of $117. That just shows you the power of our strategy. If you stay consistent and mechanical with your adjustments, you can turn a losing trade into a winner, which is exactly what we did here.

Next trade was another Short Strangle in /GC, where we booked a profit of $300.

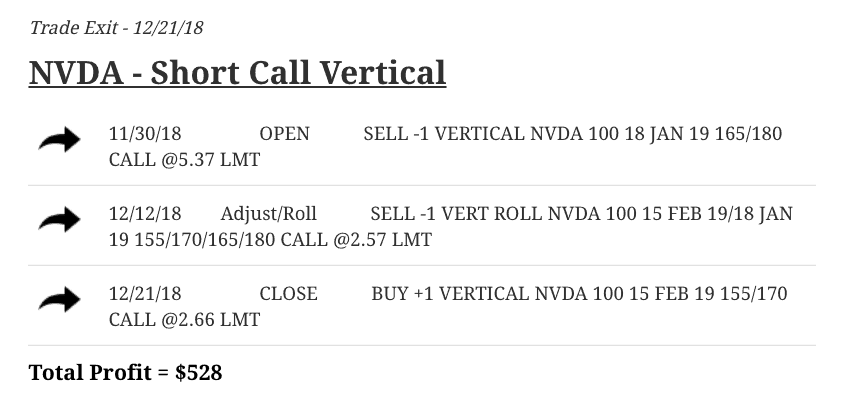

In NVDA, we did a Short Call Vertical, booking a profit of $528.

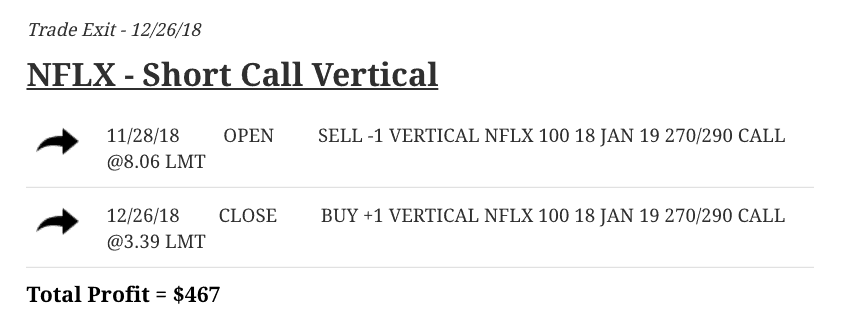

Lastly, in Netflix we did another Short Call Vertical, booking a profit of $467.

And that wraps up our closed trades for the month of December.

Overall 2018 Performance

If we go over to our performance page at navigationtrading.com/performance, you’ll notice that We’ve added a cumulative running total of our profits.

You can see we started back in June of 2017, and I just give a quick summary of all those closed profits year to date. We’ll be updating this at the end of each month.

If you look at the 2018 trade statistics, you can see for the total year we closed 151 trades, had an average profit per trade of $263, with an outstanding winning percentage of 91.4%.

And as always, if you scroll down, you can see the details of each month and the different symbols, contracts and strategies that we traded along with the amount of profit that we booked.

Depending on the strategy or opportunity, you’ll see that we use a different number of contracts, typically anywhere from one to five contracts. Typically, we’re using anywhere from, at the minimum, $500 of buying power for a trade all the way up to several thousand dollars for each position.

Profits by strategy in 2018

Let’s breakdown of our profits per strategy throughout the entire year of 2018.

It’s no surprise that Short Strangles was our best performing strategy. There’s a lot of heightened implied volatility across the board. We had just over $23,000 in profit from our Short Strangles and an average profit per trade of $347.33. We had 67 winners and zero losers, making a 100% winning percentage in Short Strangles. Keep in mind, we still have some Short Strangles open, so we’ll see if those end up closing for winners as well.

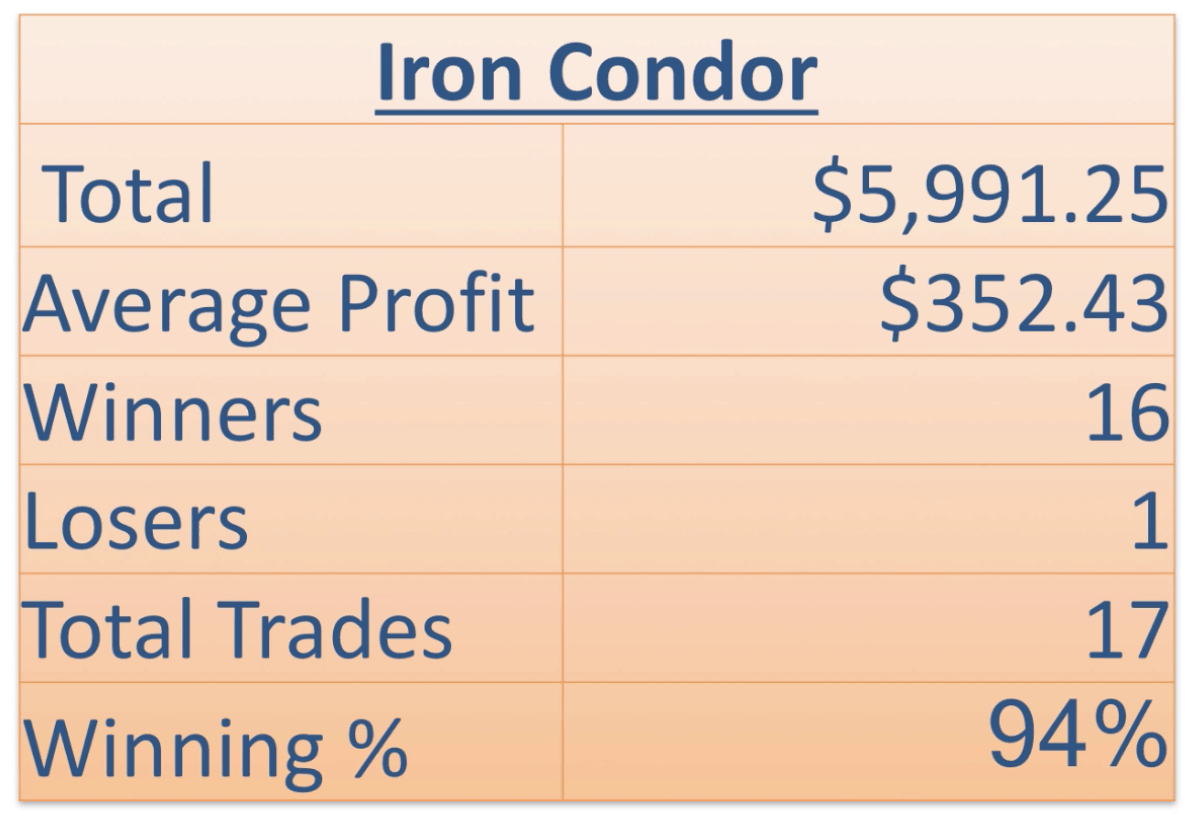

For our Iron Condors, we had a total of $5,991.25 in profit and an average profit of $352.43. We had 16 winners and just one loser giving us a winning percentage of 94% on our Iron Condors.

For our next strategy, we’ll look at the Butterfly Spread. We only did one Butterfly all year, which kind of surprised me as I went back over these stats. We made $120 on our one Butterfly trade.

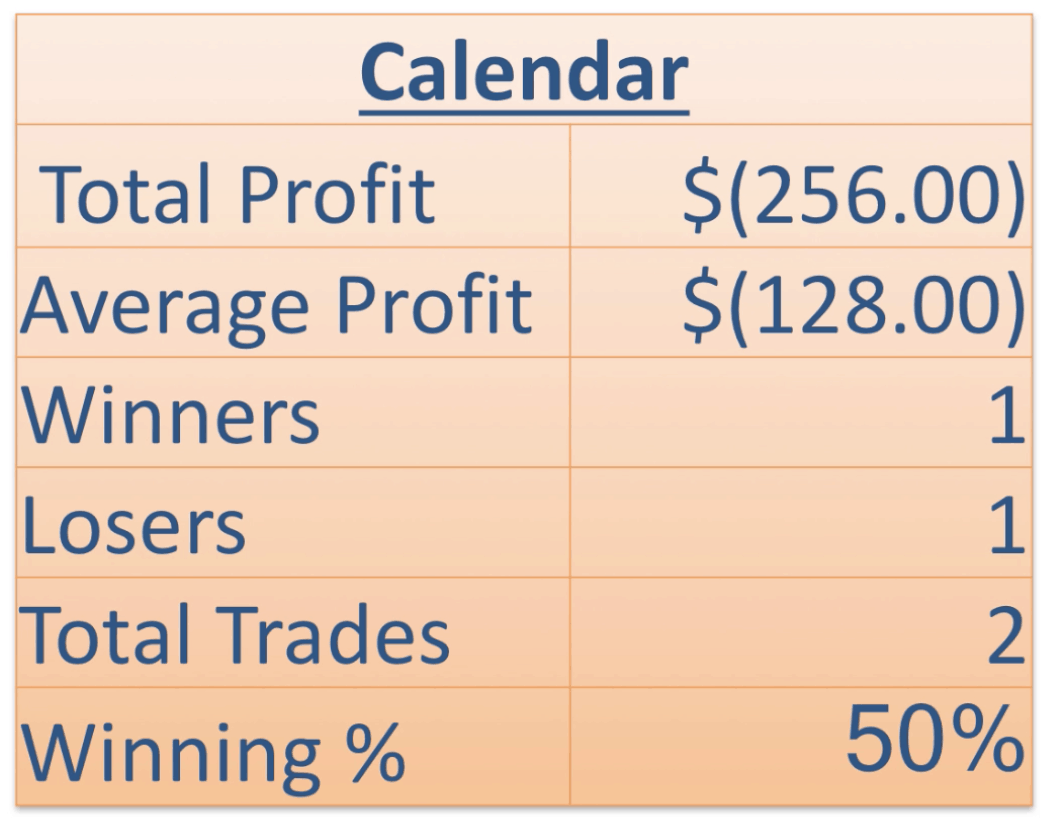

For Calendar Spreads, we only did two. This makes more sense, because we are in a period of high implied volatility. We like to do Calendars when implied volatility is low. We had one winner and one loser, making a total profit of -$256 on our Calendar Spreads.

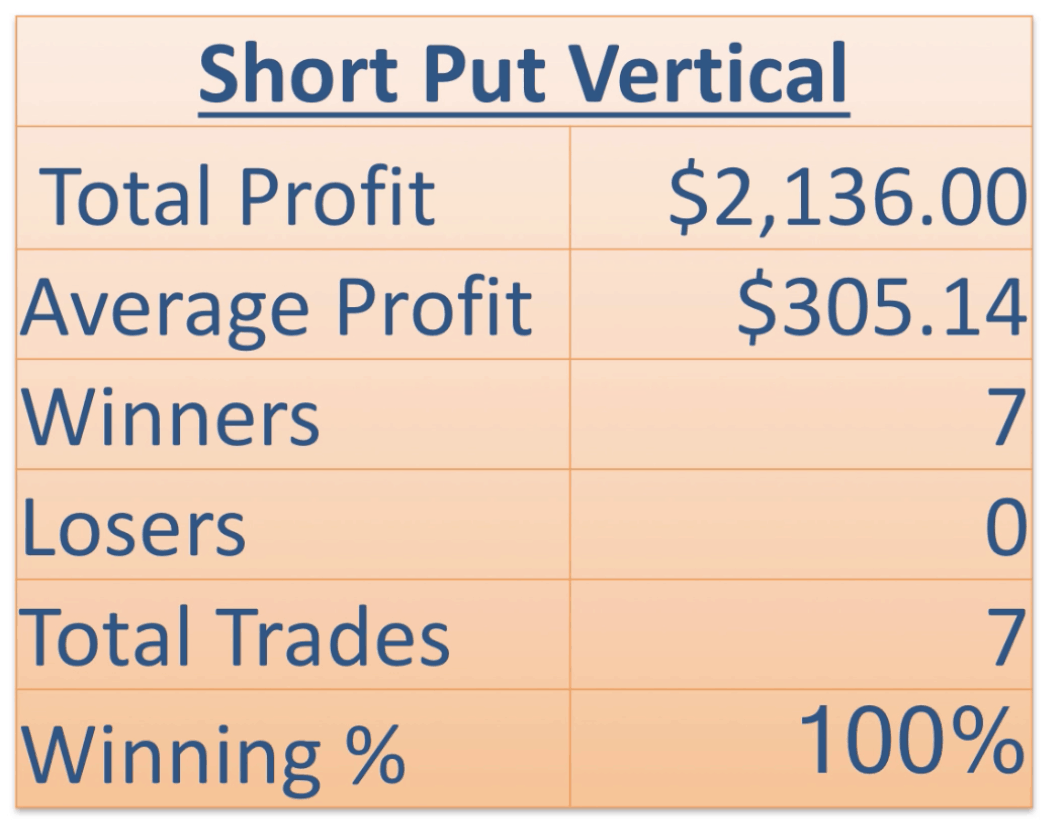

With our Short Put Verticals, we had a total profit of a little over $2,100. We had seven winners and zero losers.

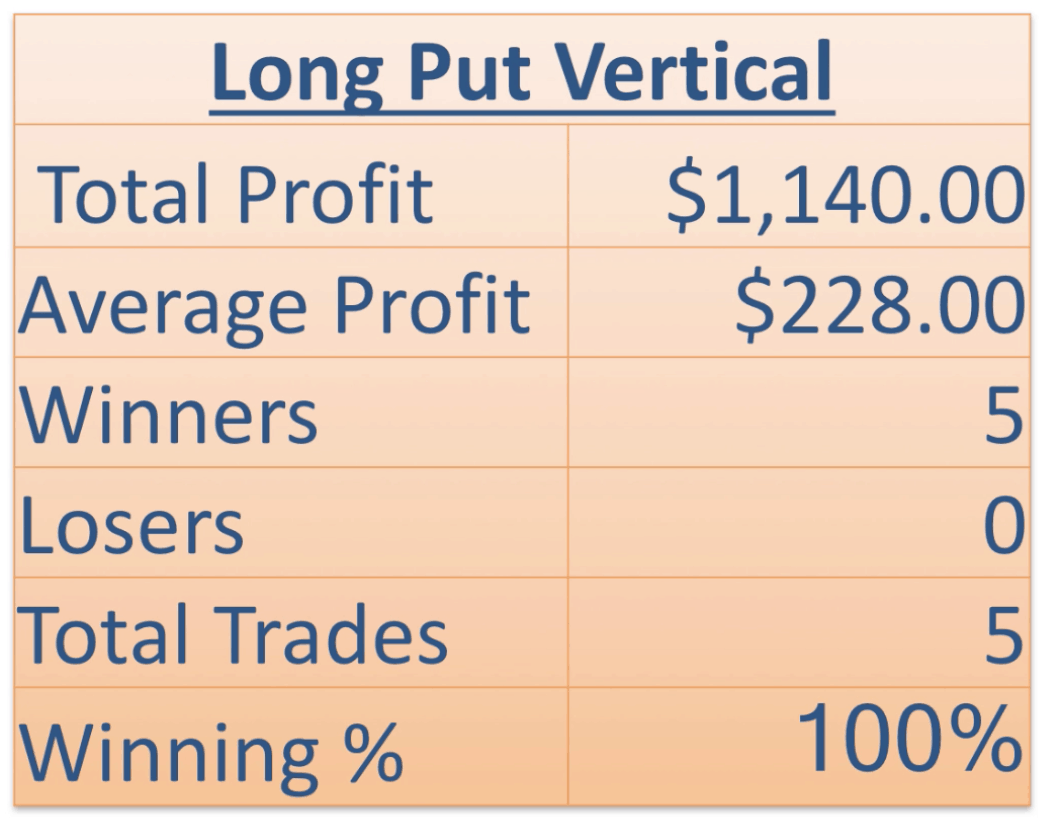

On our Long Put Verticals, we made a little over $1,100, had five winners and zero losers on that strategy.

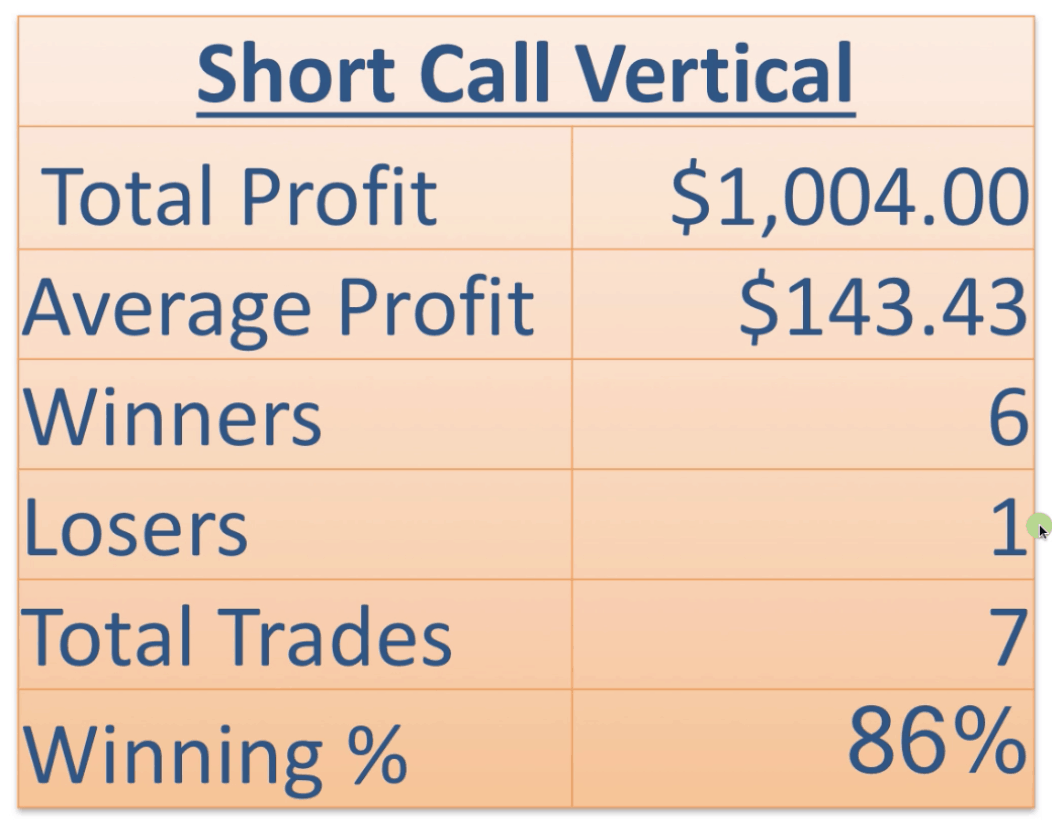

With our Short Call Verticals, we had a total profit of just over a $1000, with an average profit of a little over $143 for each trade. We had six winners and just one loser.

On our Long Calls, we closed one for a profit of $380 on that strategy.

Now we’ll start getting into the earnings related strategies.

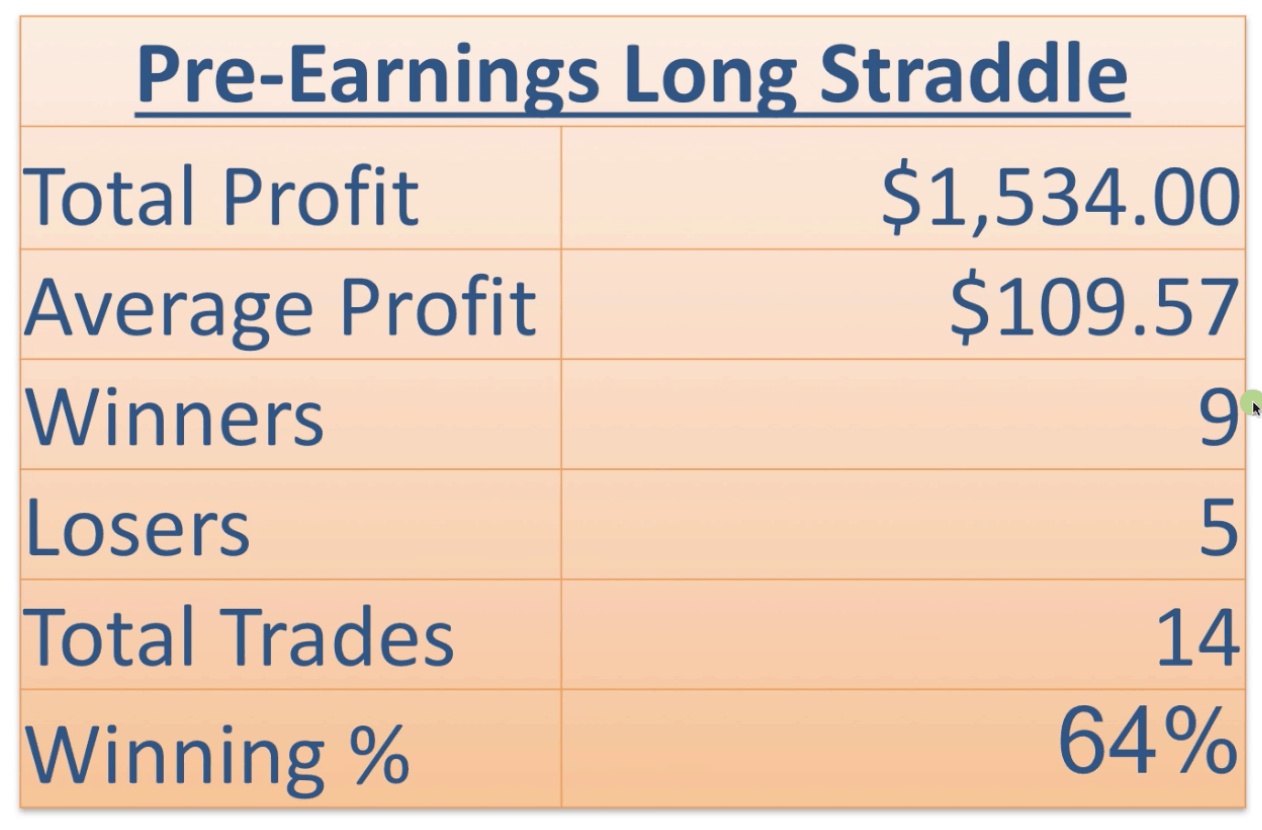

We did 14 Pre-Earnings Long Straddles. Nine of those were winners, five were losers, making our total profit a little over $1,500 for Pre-Earnings Long Straddles.

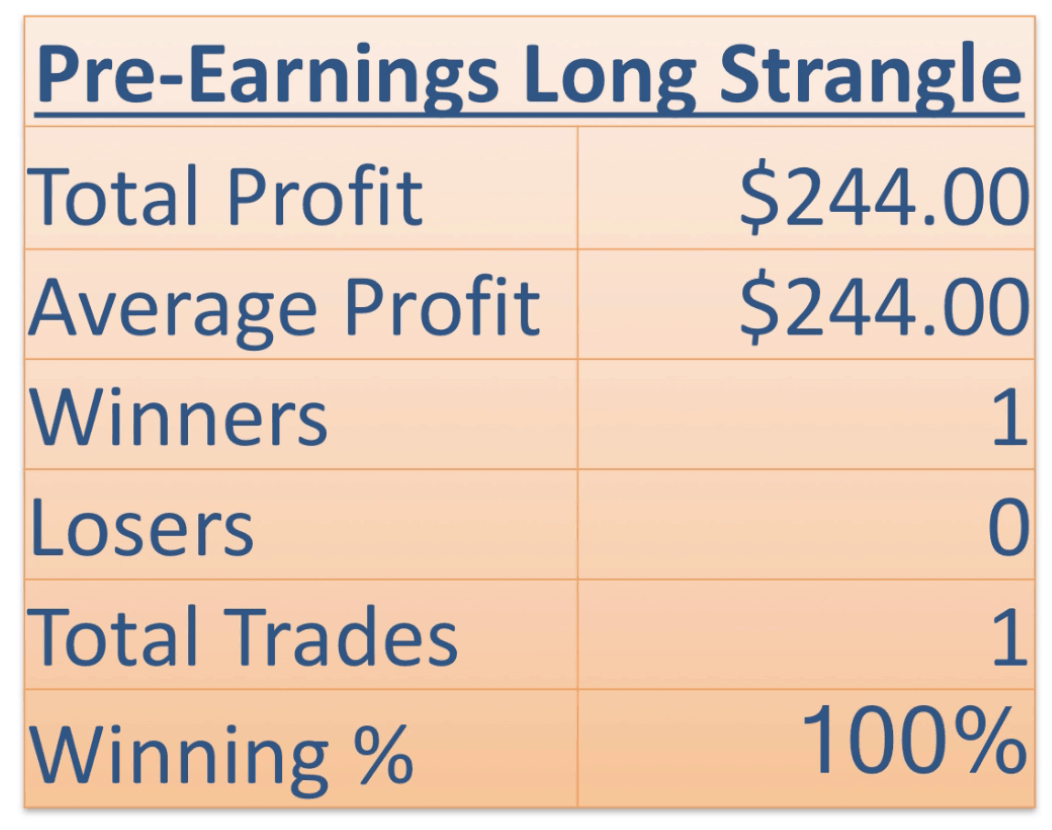

We did one Pre-Earnings Long Strangle, which is just widening those strikes, and had a total profit of $244.

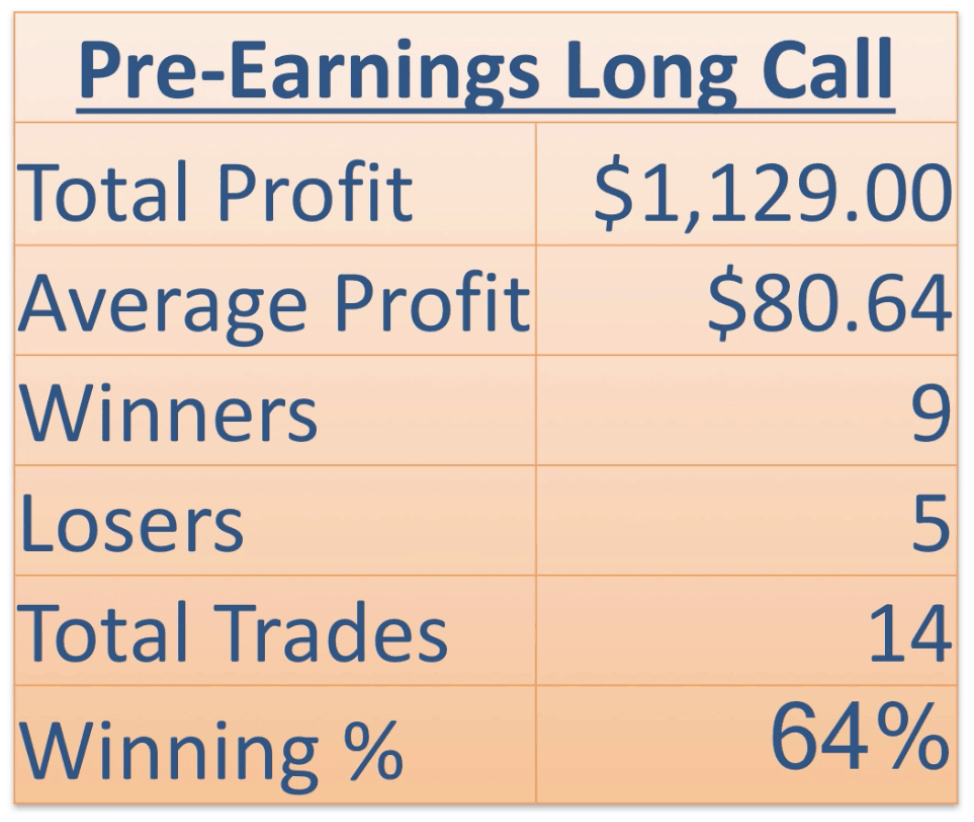

For our Pre-Earnings Long Calls, we had 14 of these trades, nine of which were winners, five were losers, making a total profit of a little over $1,100.

For our Earnings Short Strangles, which are Short Strangles that we’re holding over the earnings announcement, we had a total profit of $324. We just did two of these, both of those were winners.

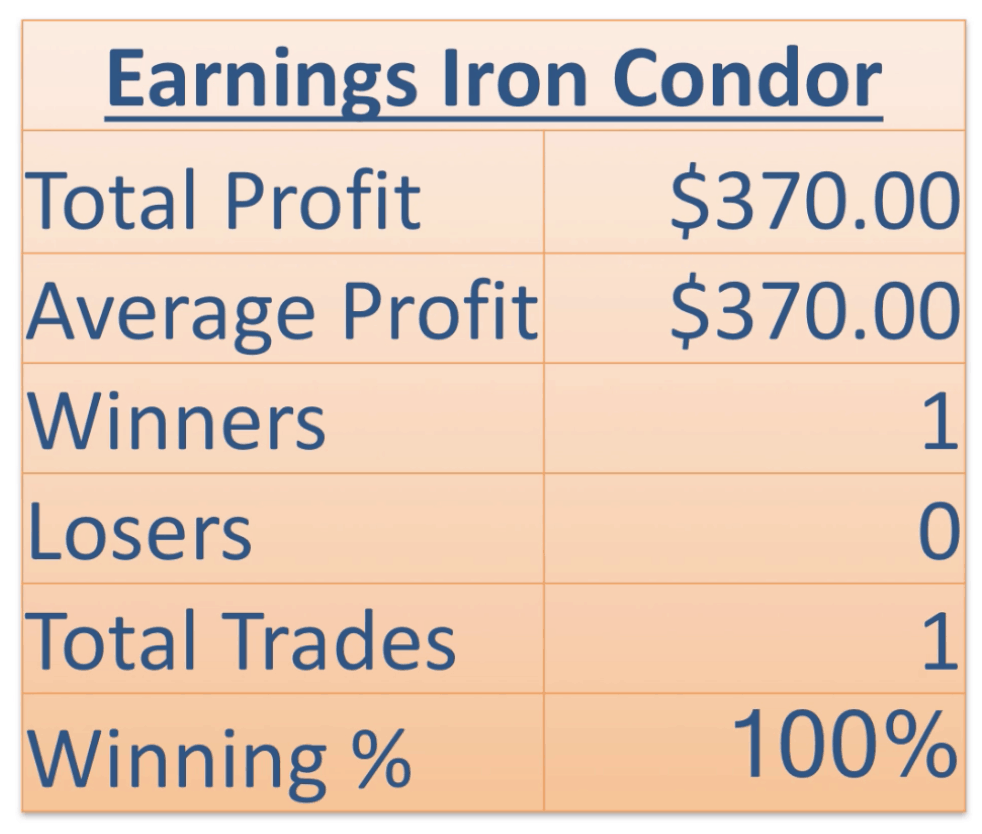

We only did one Earnings Iron Condor, making a profit of $370.

We did one Post-Earnings Short Straddle, booking a profit of $27.

We did two Post-Earnings Short Strangles. Both were winners for a total profit of $310.

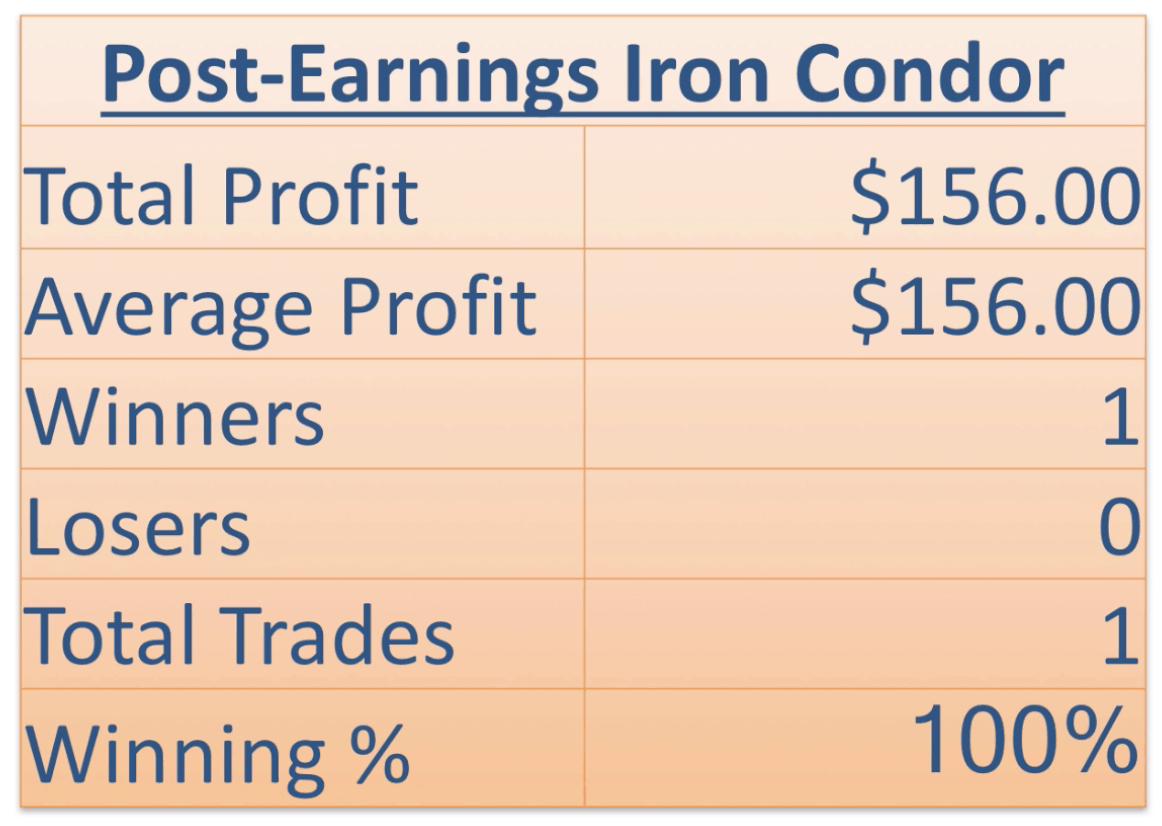

We had one Post-Earnings Iron Condor, booking a profit of $156.

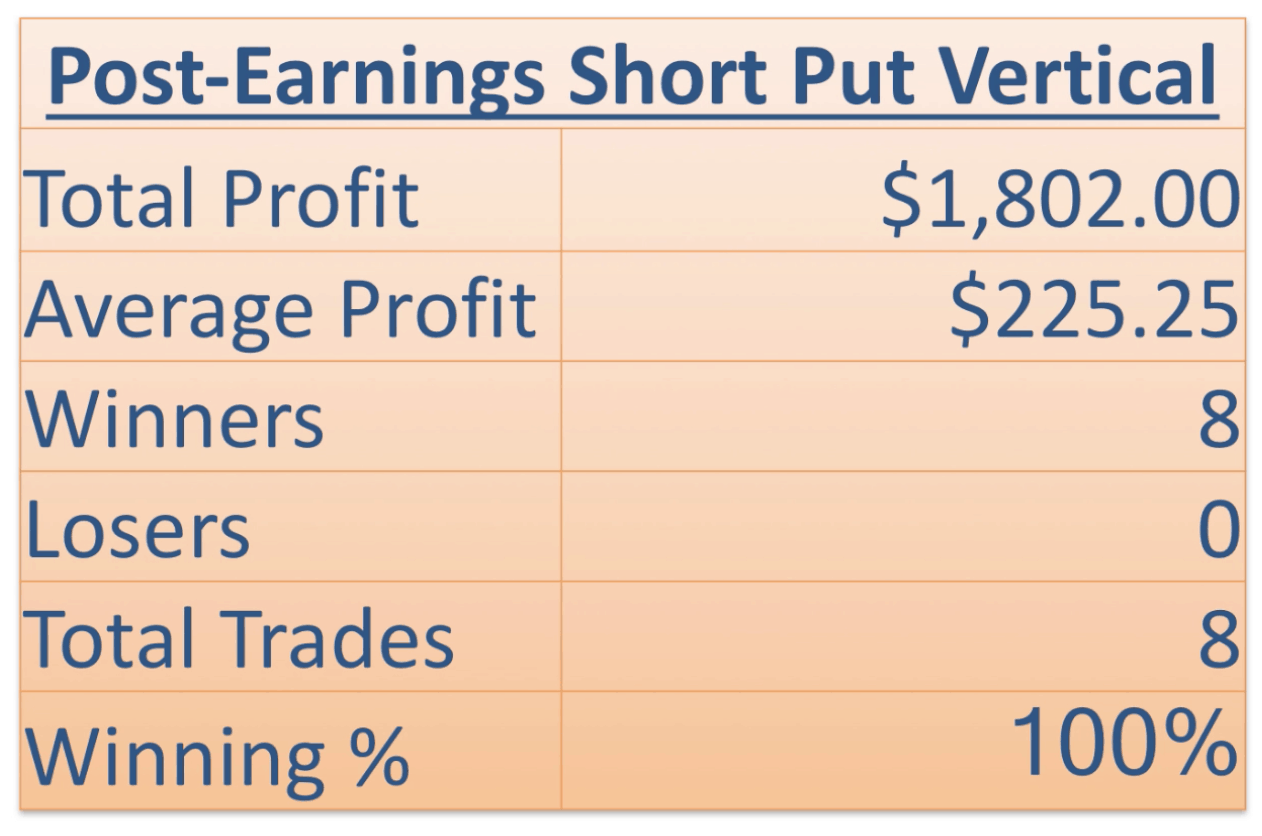

We had eight Post-Earnings Short Put Verticals, all of which were winners, booking a profit of a little over $1,800.

With all strategies combined, our total profit came to $39,682.39, with an average profit of $262.80. We closed a total of 151 trades, 138 of which were winners and just 13 which were losers. This gave us a winning percentage in 2018 of 91.4%.

Don’t feel overwhelmed by all the different strategies if you’re not even sure exactly what they are. We provide step-by-step details so you can learn exactly how to trade each of these strategies.

We have some members that just focus on a couple of our strategies, and we have some members that trade all of the different strategies, just like us.

Trade at Any Level

You can trade our methodology at any level.

At the beginning of 2018, we had about $68,000 in our alerts portfolio. We’re never using all of that money in our positions. We usually use anywhere from 20% to 50% of our buying power for all the positions at any given time.

We have members that start off with just a few thousand dollars and then we have members who have million dollar accounts that trade many more contracts than what we do at NavigationTrading. Obviously, you can just multiply your profits by the number of contracts that you’re trading.

Implied volatility continues to stay high and I don’t see it slowing down in 2019. Right now continues to be the best time to be trading these strategies that we teach.

Think about how these types of profits could affect you financially. To illustrate this point, I was messing around with a very simple savings calculator from bankrate.com. Think about this, if you have $50,000 in your account and you make 20% per year for the next 10 years, that’s $309,000.

What if you made 30% and run the calculation again? Now we’re talking about $689,000 in your account after 10 years.

If you make 40%, now we’re talking about one point $1.4 million.

You can see how these high returns can really accumulate, and get you to a large account balance extremely quickly. And that’s talking about just starting with $50,000, and not making any monthly deposits.

What if you had started with $50,000 and we’re contributing $1,000 a month into the account with those returns? Think about how quickly that can snowball.

Compound interest is one of the most powerful things that we have at our disposal if you know how to utilize it.

If you’re ready to join our community, just click on the orange button below this post to sign up for our 14-day Pro Membership Trial. You can try out our NavigationALERTS and get 100% access to our VIP course training. You can cancel any time during your trial if you don’t think NavigationTrading is for you.

There is no better business, that I’m aware of, that you can get this type of return on investment without employees, without equipment, without anything except your personal computer and your knowledge.

This is a lifetime skill that you can pass on from generation to generation.

We’d be so excited to have you as part of our community.

We can’t wait to watch you all grow as traders. 2019 is going to be an amazing year of trading and we can’t wait to see you on the inside!

Happy trading!

-The NavigationTrading Team

Follow