In this lesson, we discuss the difference between Margin and Buying Power, specifically as it relates to trading options. You may have heard the term “margin” used in a different capacity, such as the ability to buy stocks on margin or sell stocks on margin. That’s not what we’re talking about here. In this specific case, margin simply refers to the amount of capital required in your account to trade a specific strategy or position.

Defined Risk Strategy Example

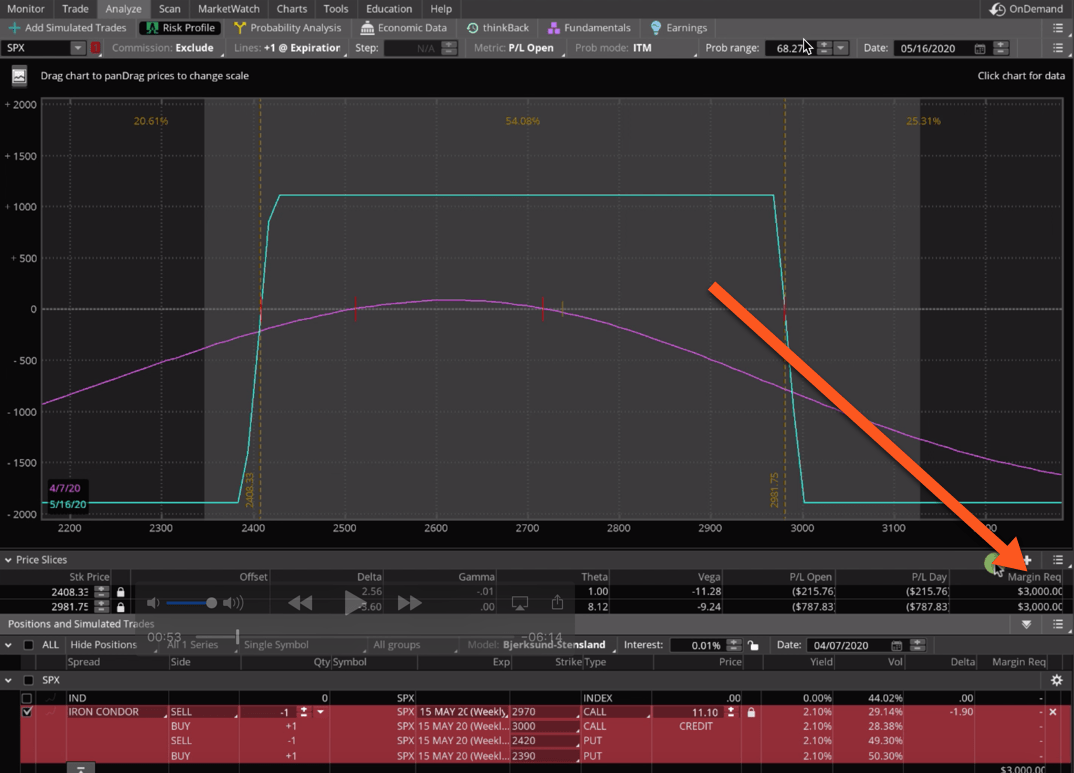

Below is a risk profile graph for an iron condor. You’ll see on ThinkorSwim, in the bottom right hand corner, it says margin required. The amount displayed is $3,000.

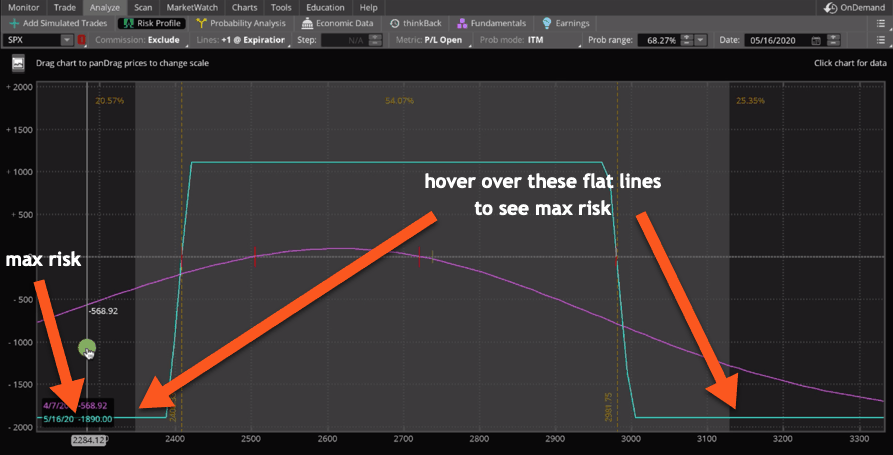

The max risk on this trade is $1,890. This is a defined risk trade.

The question is…If our max risk is $1,890, why does it display the margin requirement as 3,000?

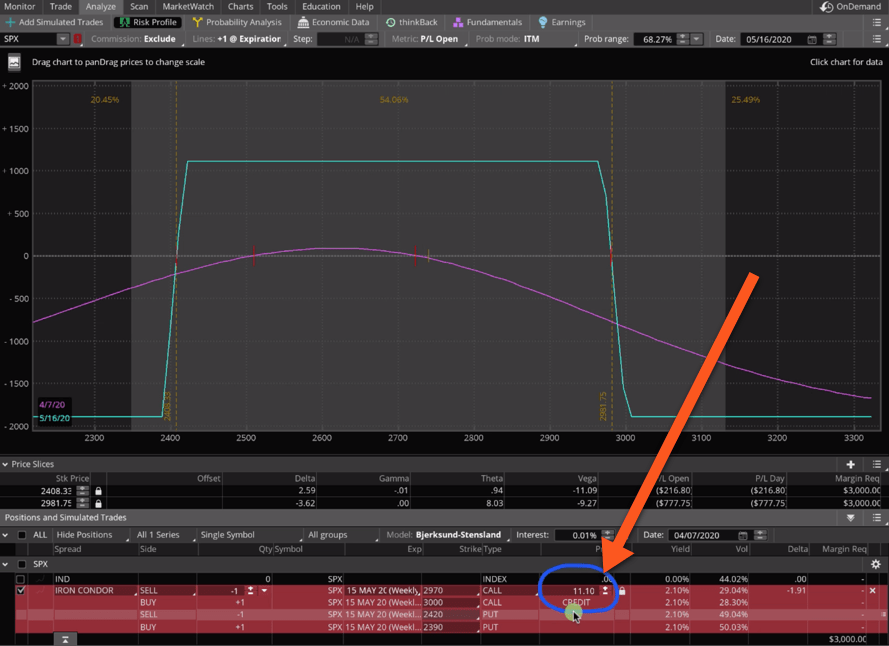

Remember when we are net sellers of options (in this case we’re selling an Iron Condor to open the trade), we are actually collecting a credit for that trading strategy.

Below, you’ll see the credit that we’re collecting is 11.10, or in option speak, you’ve got to multiply that times 100 so the net credit is $1,110.

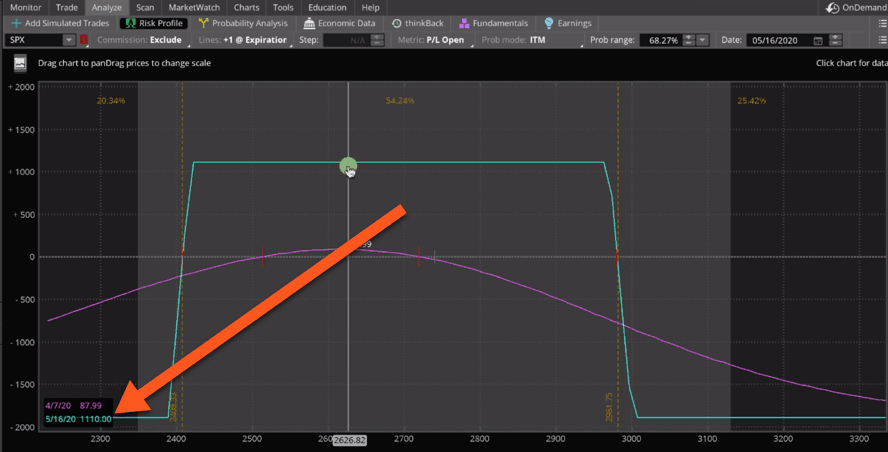

That’s also noted as the teal number in the bottom left corner, if you hover over anywhere around the max profit. You’ll see that it’s showing $1,110.

To figure the difference between the margin required and the actual buying power required, you’d need to take the margin minus the credit received. The margin is $3,000. Subtract the credit received, which is $1,110 and that gives you $1,890.

Your max risk is $1,890. On a defined risk spread like this, that is also the amount of buying capital required in your account to place this trade. So remember, it’s just the margin required minus the credit received on the trade.

This is a defined risk strategy, so that’s pretty easy to figure out. But what if you’re trading an undefined risk strategy, like a Short Straddle or a Short Strangle?

Undefined Risk Strategy Example

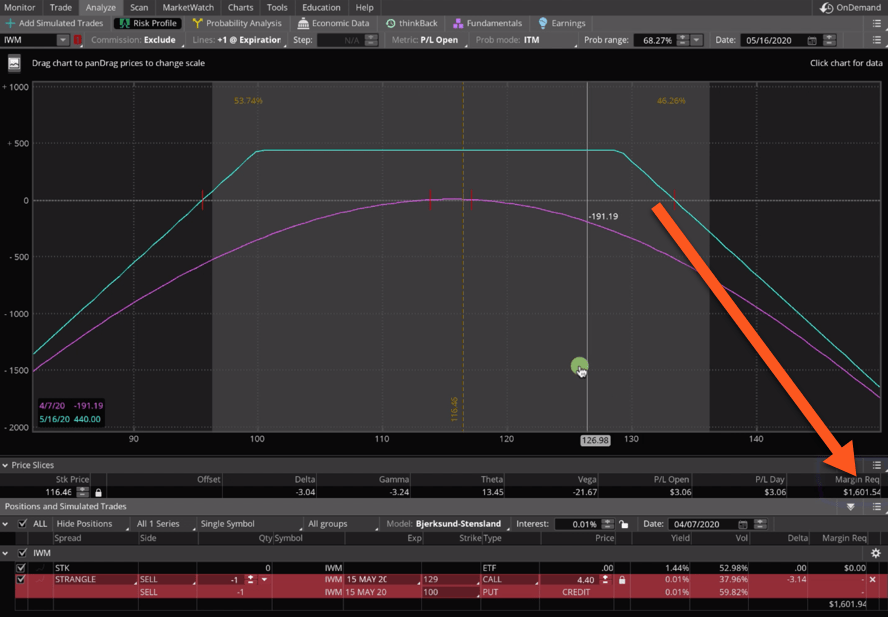

Let’s take a look at another example. This one is in IWM, the Russell 2000 ETF. We’ll be looking at an example of a Short Strangle. We have undefined risk on each side, so how does the broker determine what your margin requirement is?

Based on where the price is today, they are saying that the margin required is about $1,600 on this trade.

When it comes to an undefined risk trade, that margin requirement can change throughout the life of the trade.

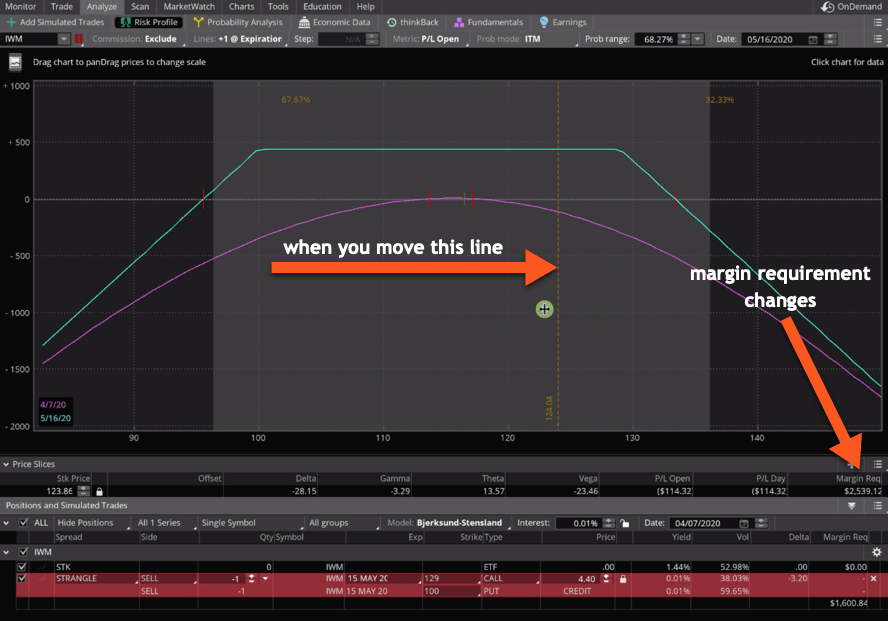

If I click and drag the vertical line, look at how the margin requirement changes. If price moves to a point where you start to lose money, you’re going to see that margin requirements start to expand.

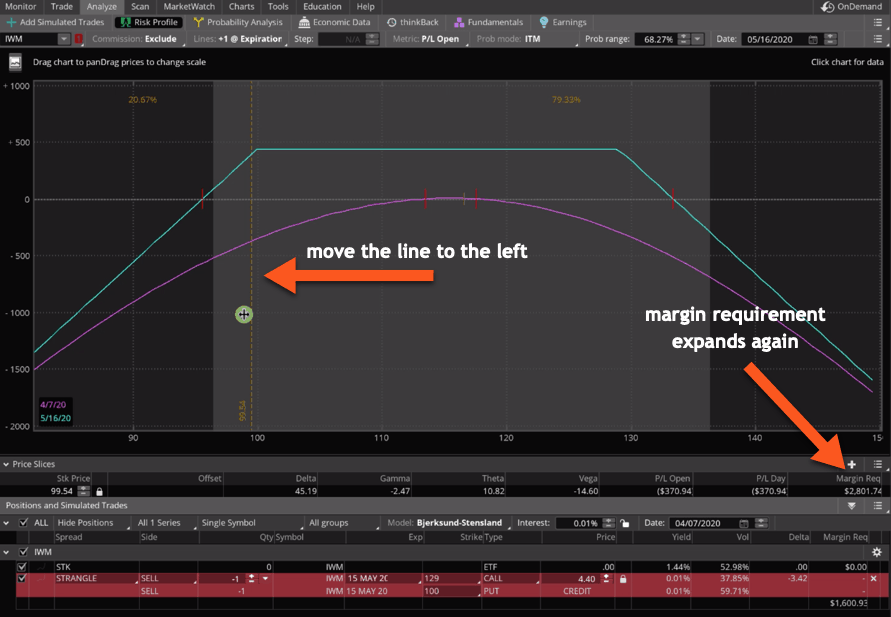

If we move the line further to the left, if we’re losing money on this side, you’ll see margin requirement starts to expand again.

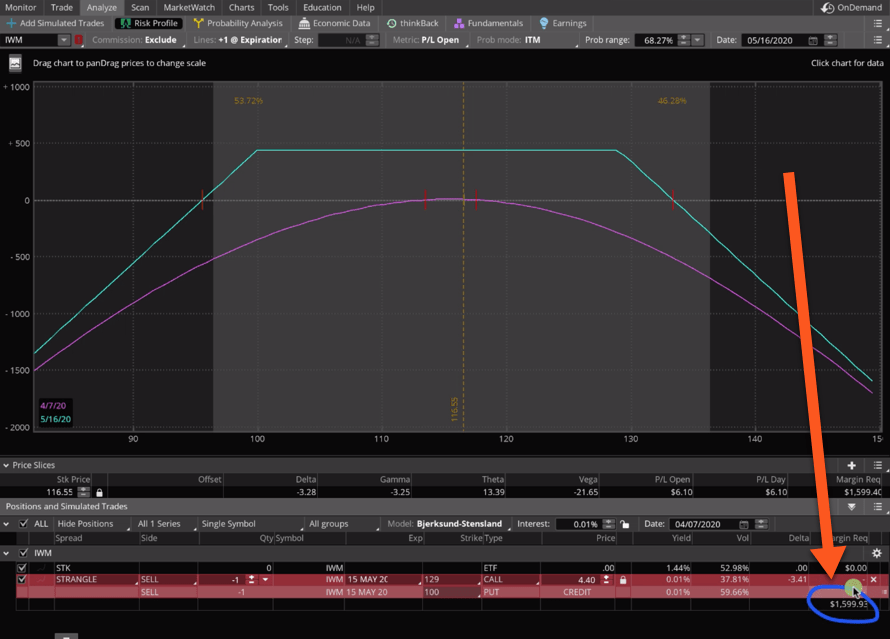

And when you look at the margin required on the actual strategy that we set up, you can see it’s about $1,600 and that’s where price is.

With an undefined risk trade, that margin requirement can change.

We’ve got a margin required of $1,600, but we’re collecting $4.40 or a max profit of $440. You would just take $1,600 and subtract $440, and that gives you $1,160. That would be the actual buying power. That’s the actual capital you need in your account to initiate this trade.

Summary

Just remember that options are leveraged instrument, so we want to re-iterate to keep your position size small, especially if you’re trading undefined risk trades. If you’re trading a defined risk spread, obviously you know what your max risk is on that trade.

With undefined risk, it’s undefined, so you have to create that safety net. You have to protect yourself by keeping your position size super small so that you can manage even if there is a massive move in the market.

One last point as it relates to margin requirement versus buying power…If you are trading options on futures, for example a Short strangle in /CL (Oil). The margin required minus the credit received is not necessarily the case if you’re trading options on futures. Futures options use a completely different calculation for determining your overall margin requirement when trading undefined risk trades.

We won’t get into it in this video because it’s beyond the scope of this video. We have an entire course dedicated to futures options because there’s so many different nuances and technicalities when it comes to figuring out what your margin requirement and buying power effect are when trading undefined risk trades on futures options.

I hope this lesson has been helpful! If you have any other questions, feel free to drop us a line in our TradeHacker Community.

Happy Trading!

-The NavigationTrading Team

Follow