What’s up NavigationTraders?!

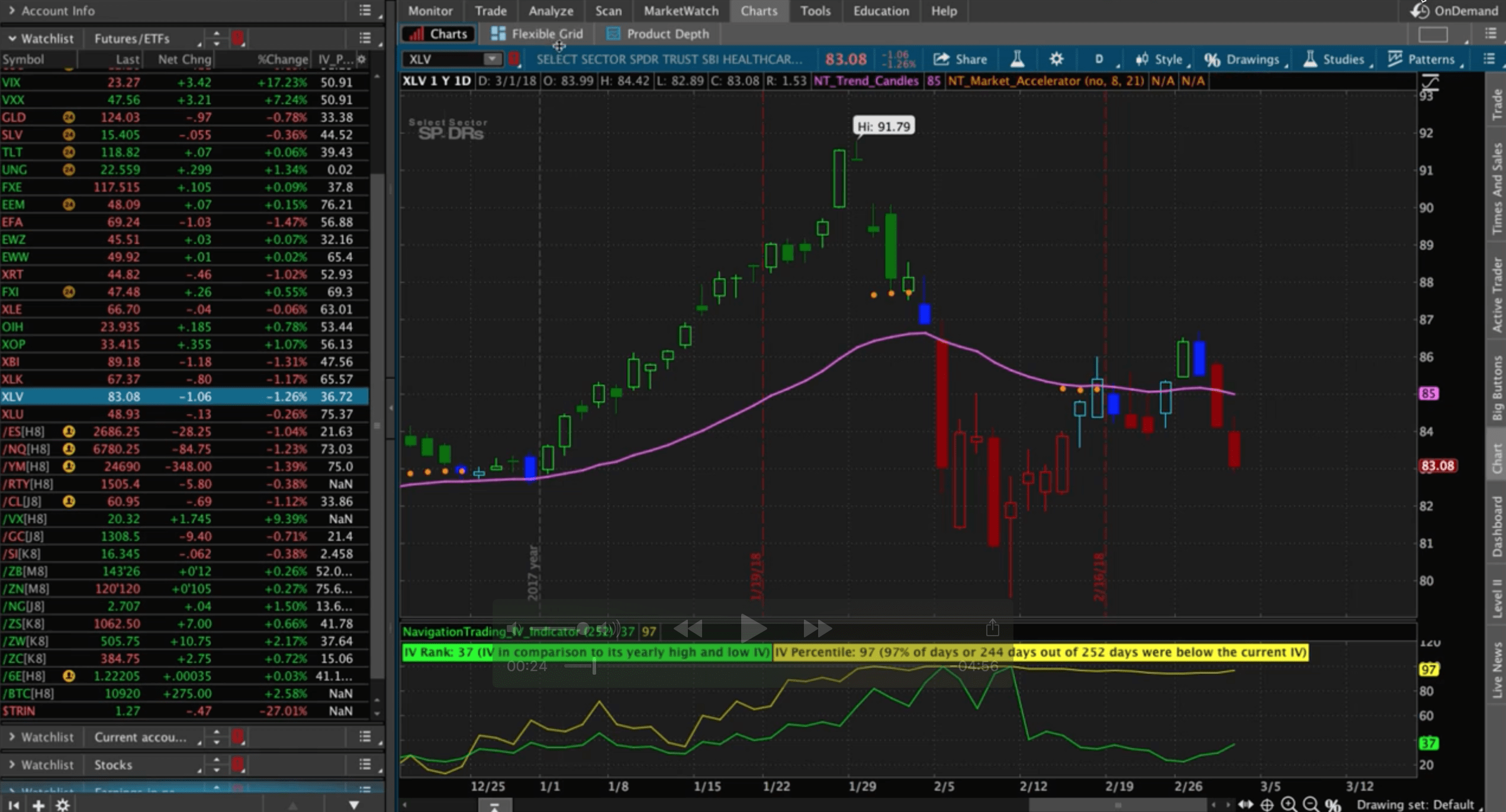

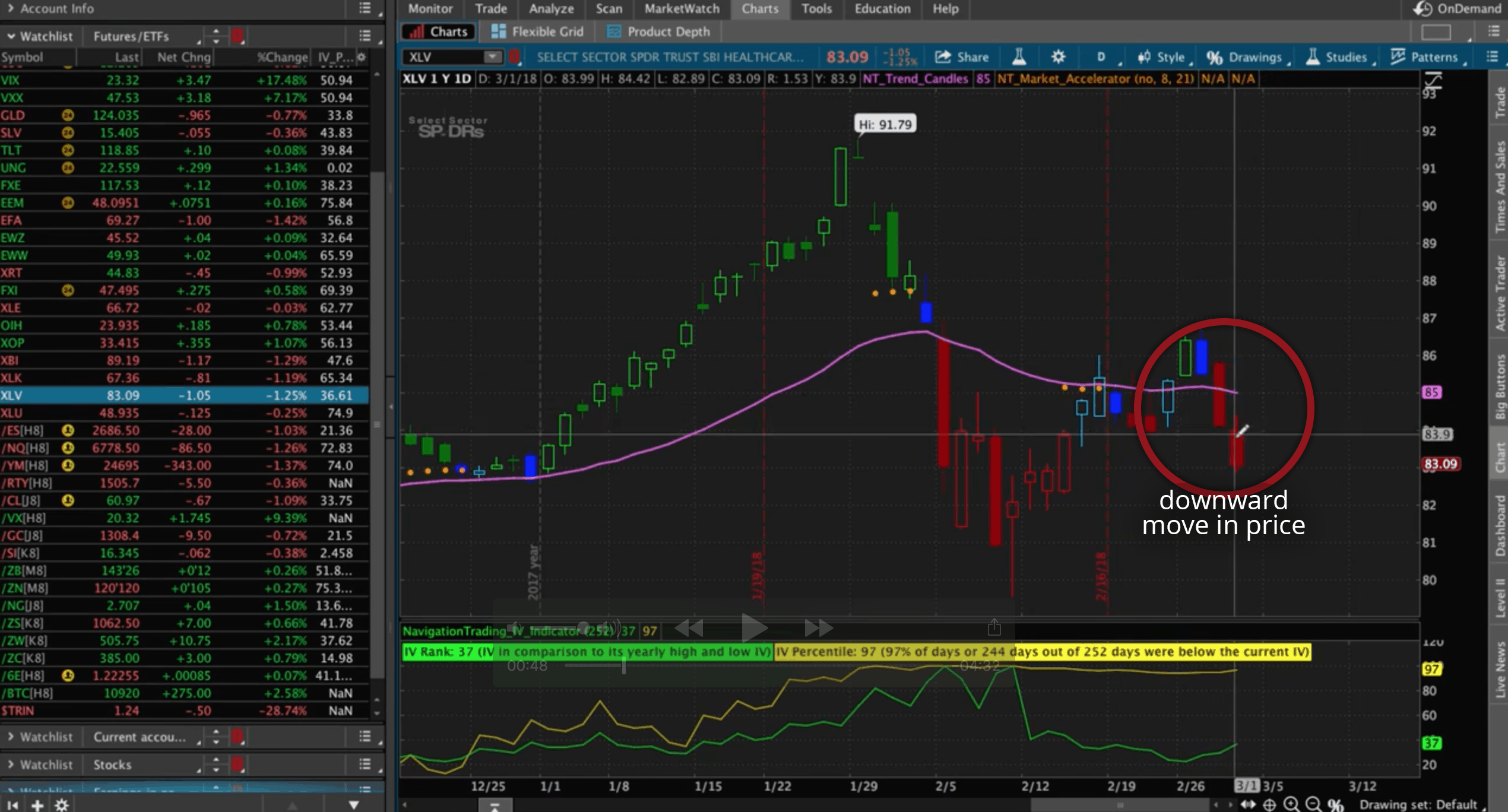

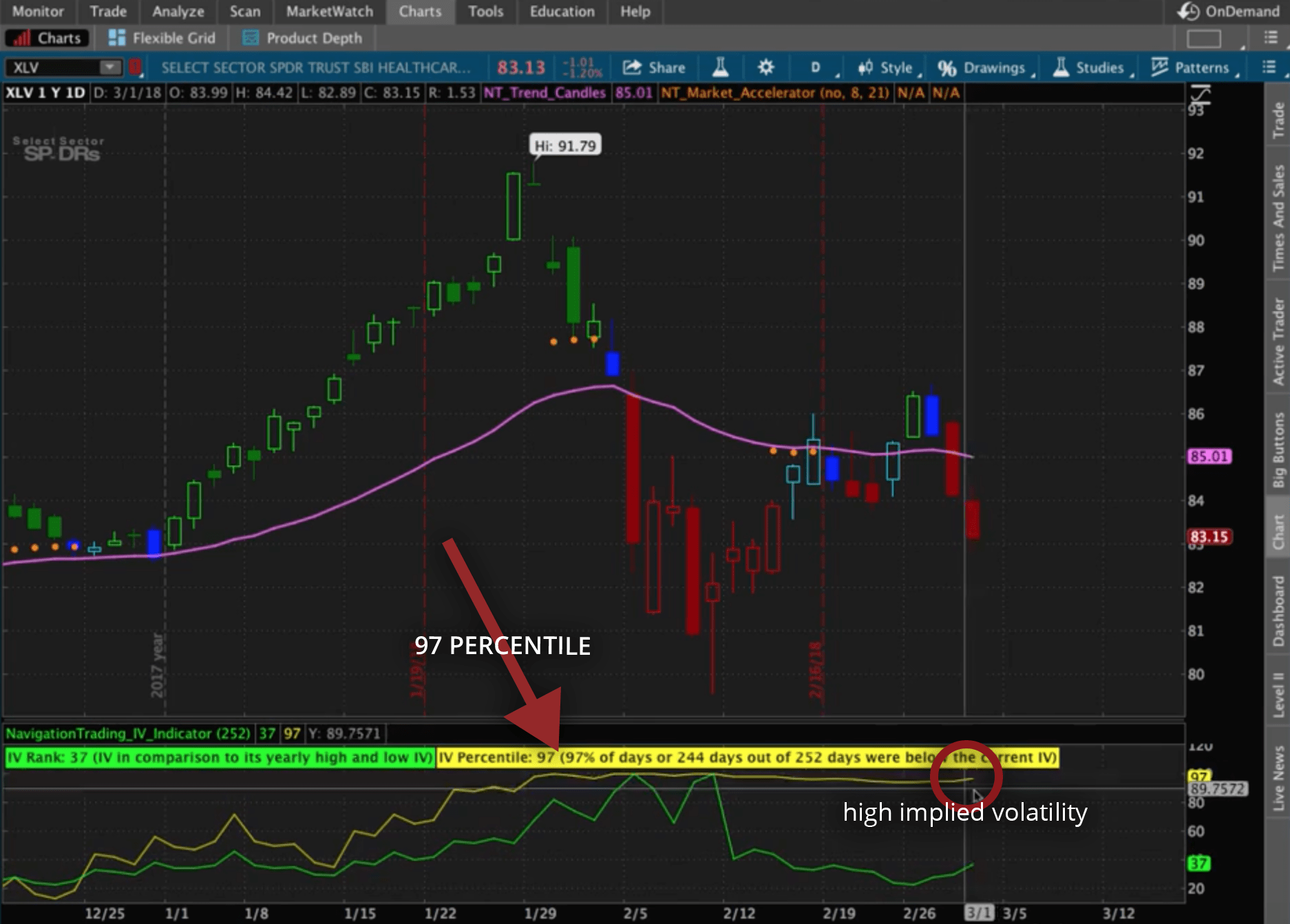

In this tutorial, I’ll be going over a trading strategy that we used on XLV – Healthcare ETF. You can see by the chart below, it followed the market fairly well with a huge downward move, and kind of bounced around a bit.

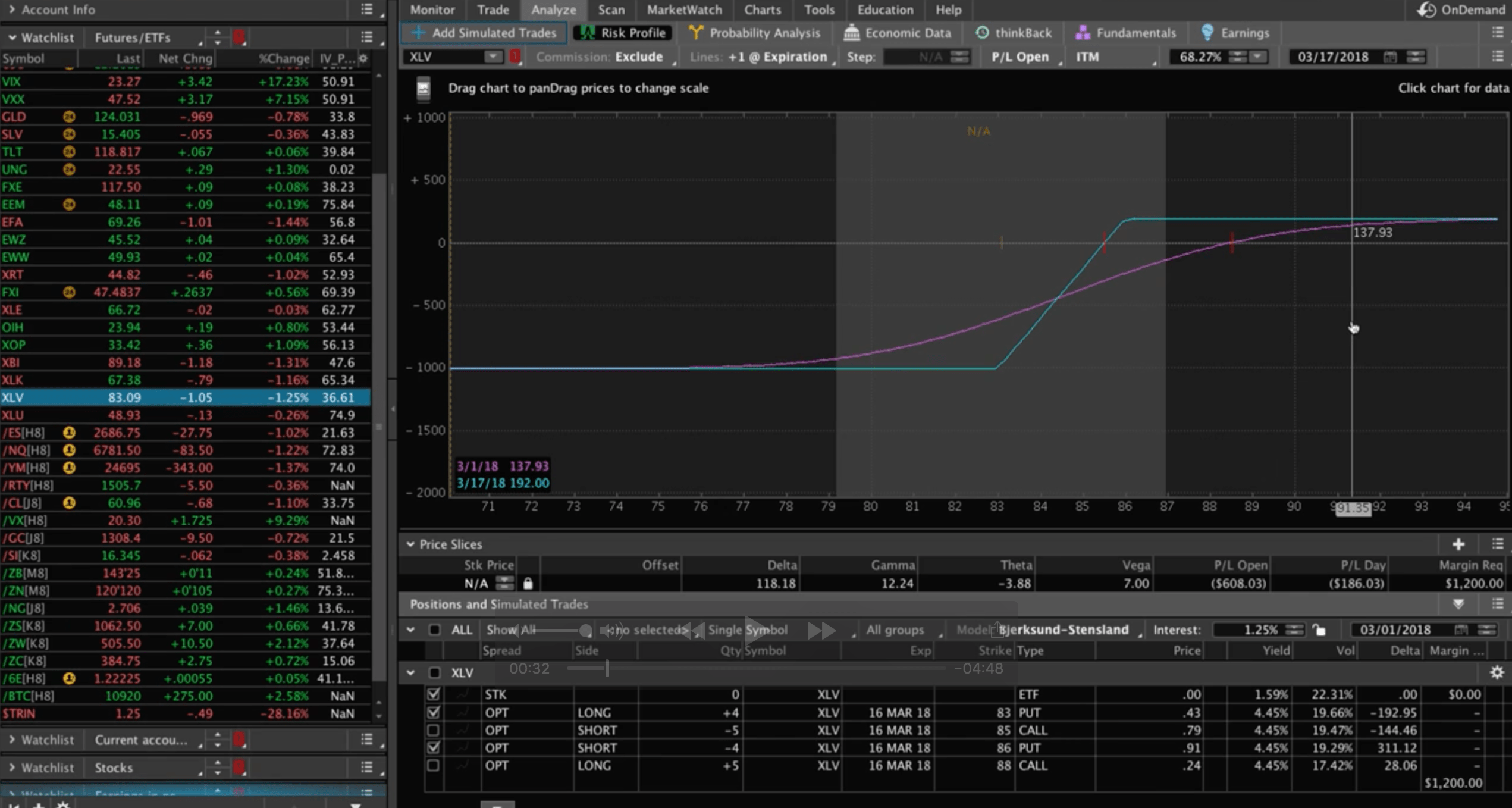

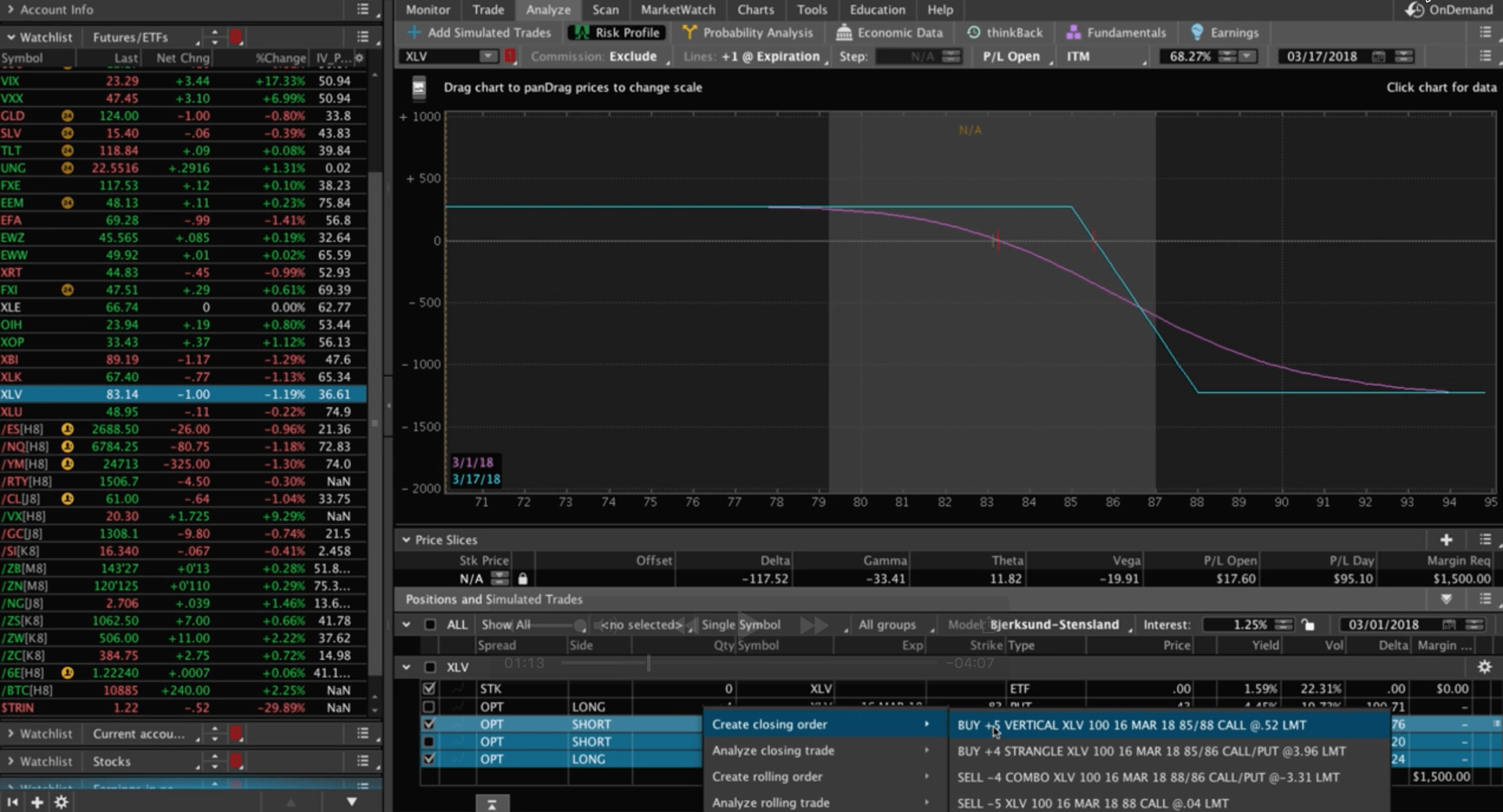

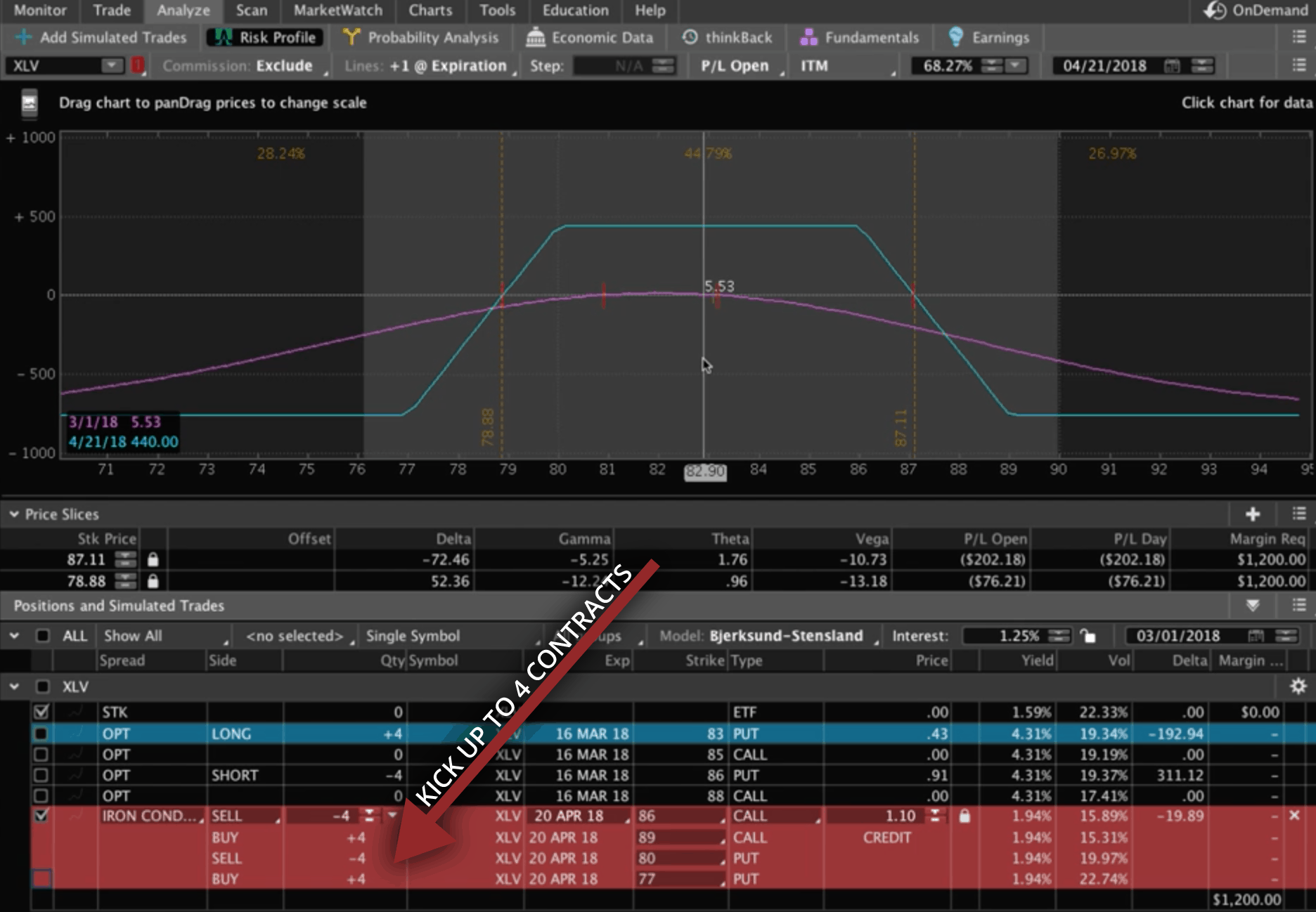

We ended up having a couple of different Iron Condors on in XLV. In this one, it came down, moved through our break-even, so we closed out the untested side like we always do.

We had another Iron Condor where we closed out the untested side when price breached through the upside.

Prices then came all the way back down into our range with this downward move.

We were at a point where we could take this off and book a profit in one of those Iron Condors. We could take off our Call Vertical Spread, and book a profit in that Iron Condor. So that’s what we did first, we highlighted the trade, selected “create closing order”, and we bought the one with five contracts back.

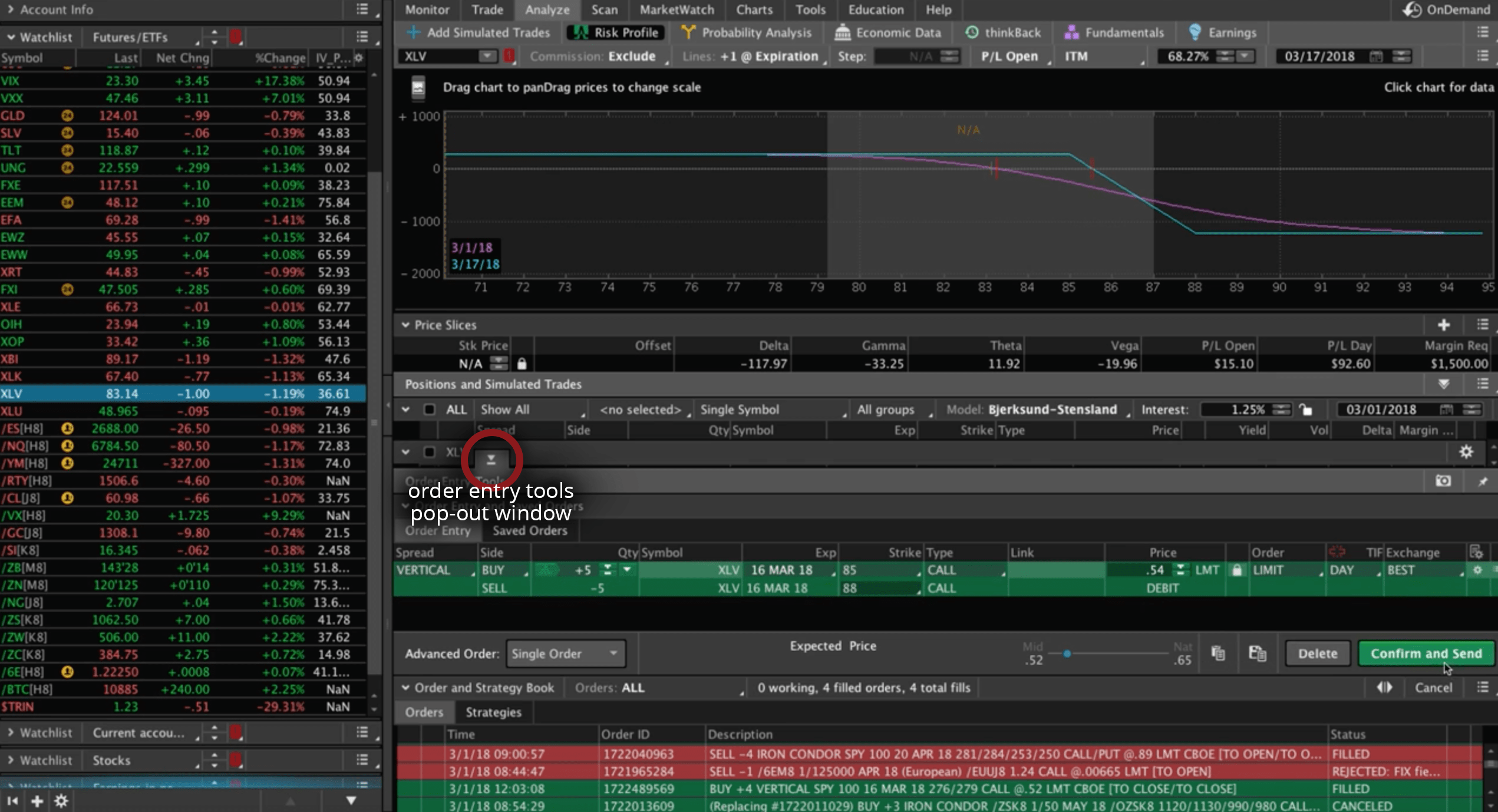

In this case, we bought back the 85 Call and sold the 88 Call, as you see below. We were thinking we could probably do this for 54 cents.

We hit “Confirm and Send”. We actually ended up getting filled at 46 cents, so price improved quite a bit. At this point, we’re out of that trade, so now we have this losing piece in the other Iron Condor.

This one was in March and had 15 days left to expiration. So what we did to collect more credit and give ourselves more time to be right, is we added on another Iron Condor. In this case, in the next cycle out, the April cycle with 50 days left to expiration.

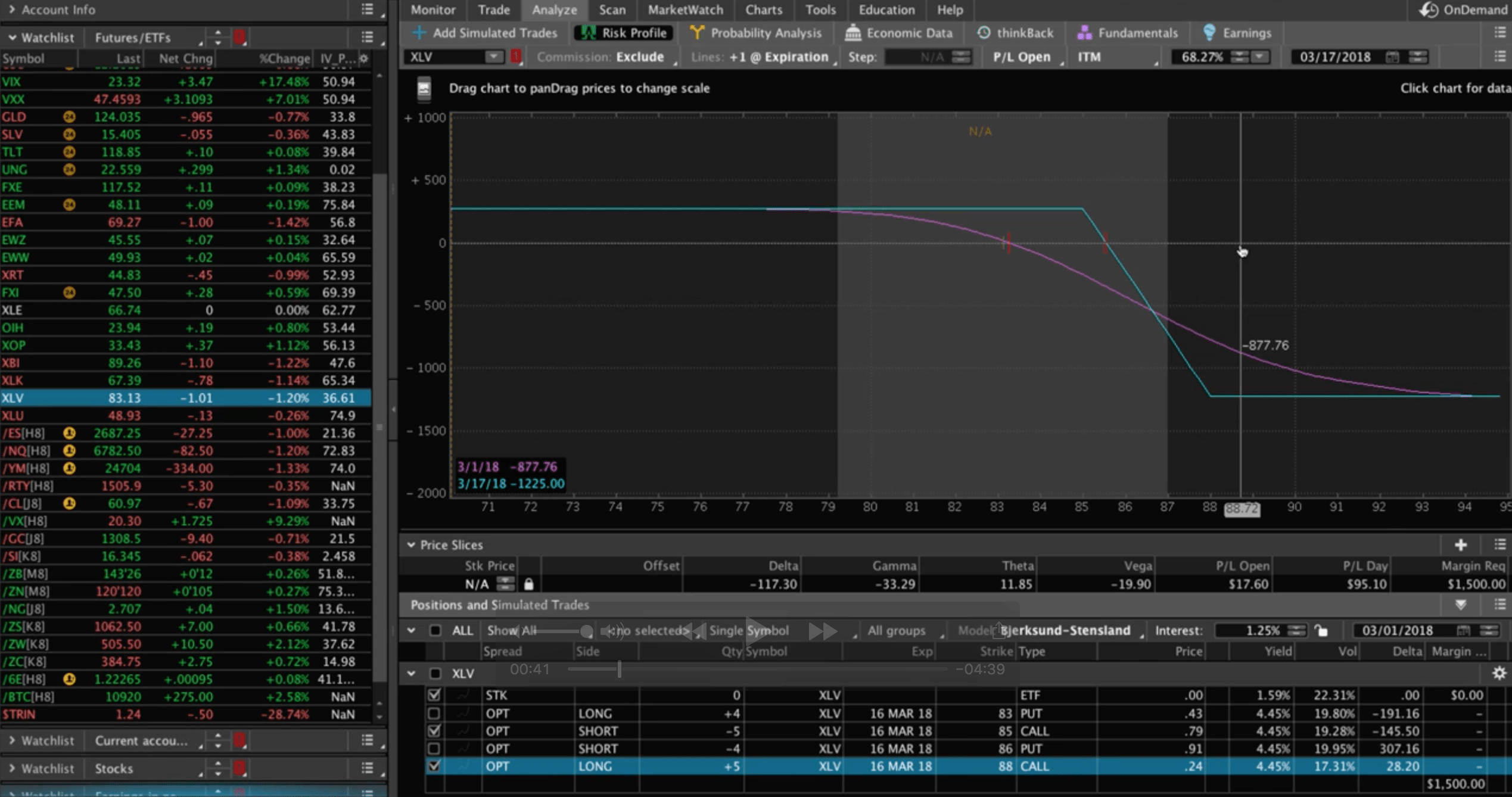

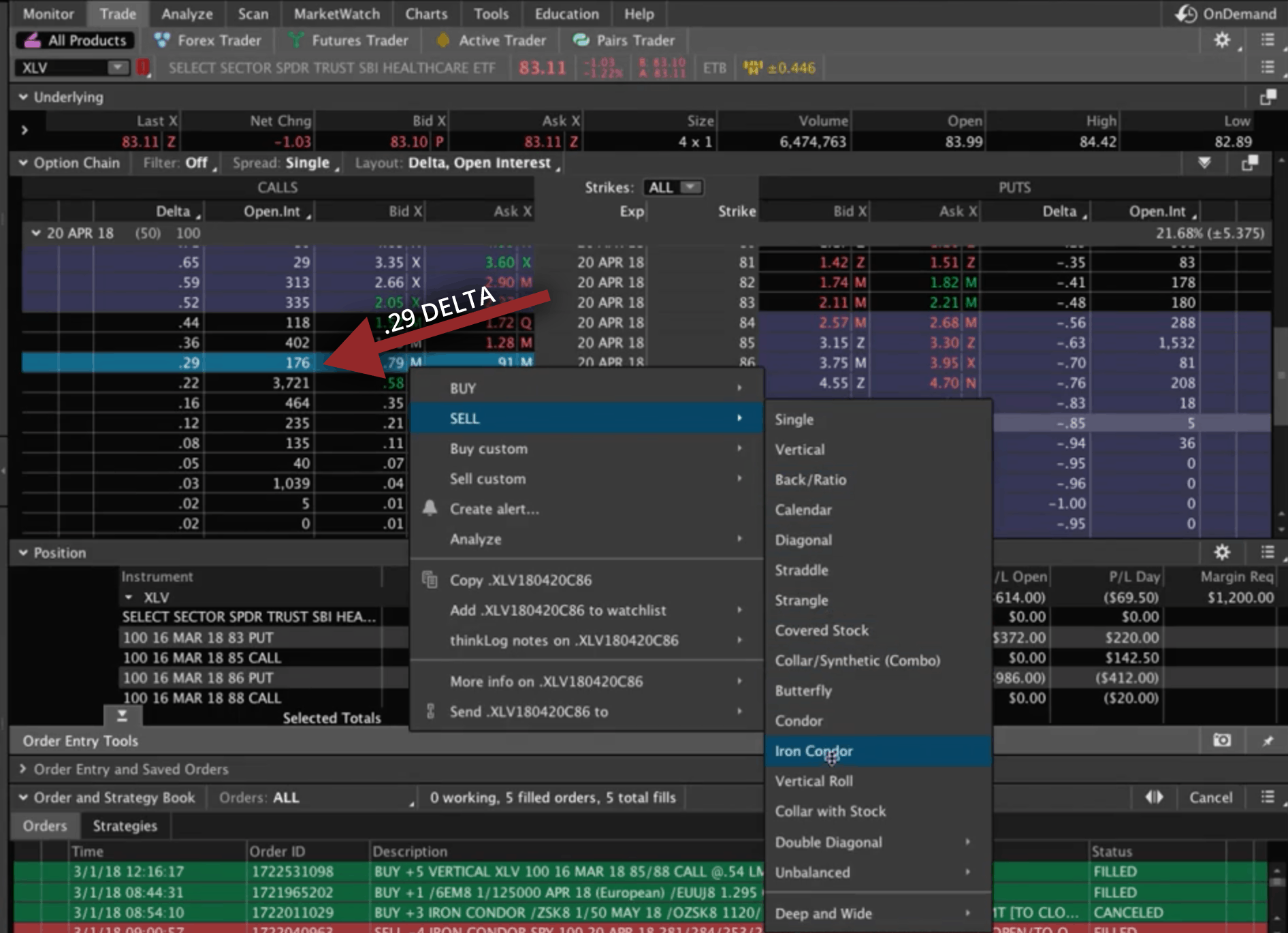

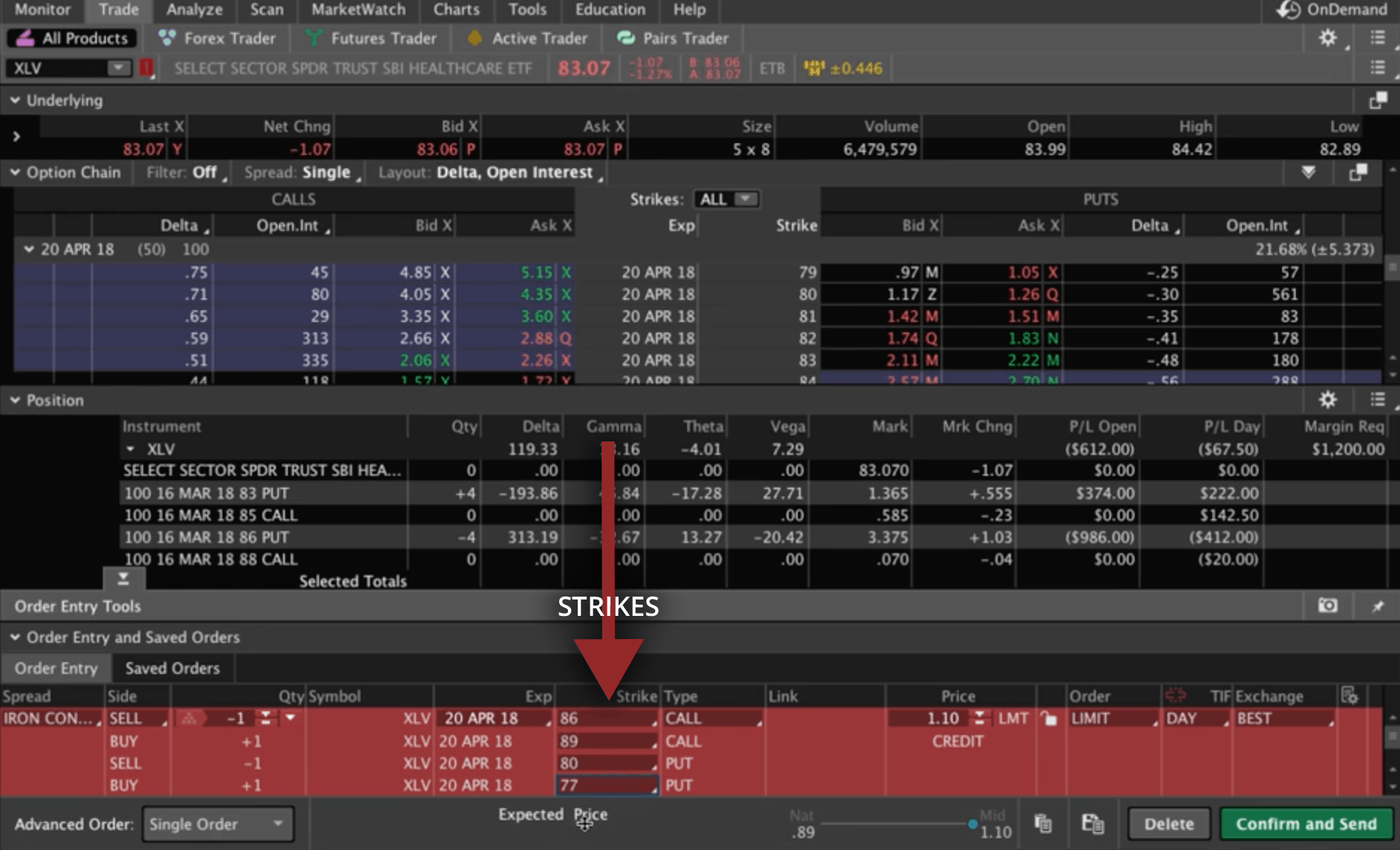

We opened up the trade tab from the April cycle shown above, and we entered an Iron Condor.

Because it was only an $84 symbol, we needed to be a little bit closer to the money. We didn’t want to go all the way down to the .20 delta, but we tried the .29 to see what that looked like. We just right clicked on the .29 delta, then selected “sell”, and then “Iron Condor”.

We’d adjust the strikes later, but initially we just chose to go three points wide. So we were selling the 86 Call, and buying the 89 for protection.

Then we went over on the Put side, looking at about the same delta, the .29. That would be the 80 Put. So we’d sell the 80, and we’d buy three strikes lower so that would be the 77.

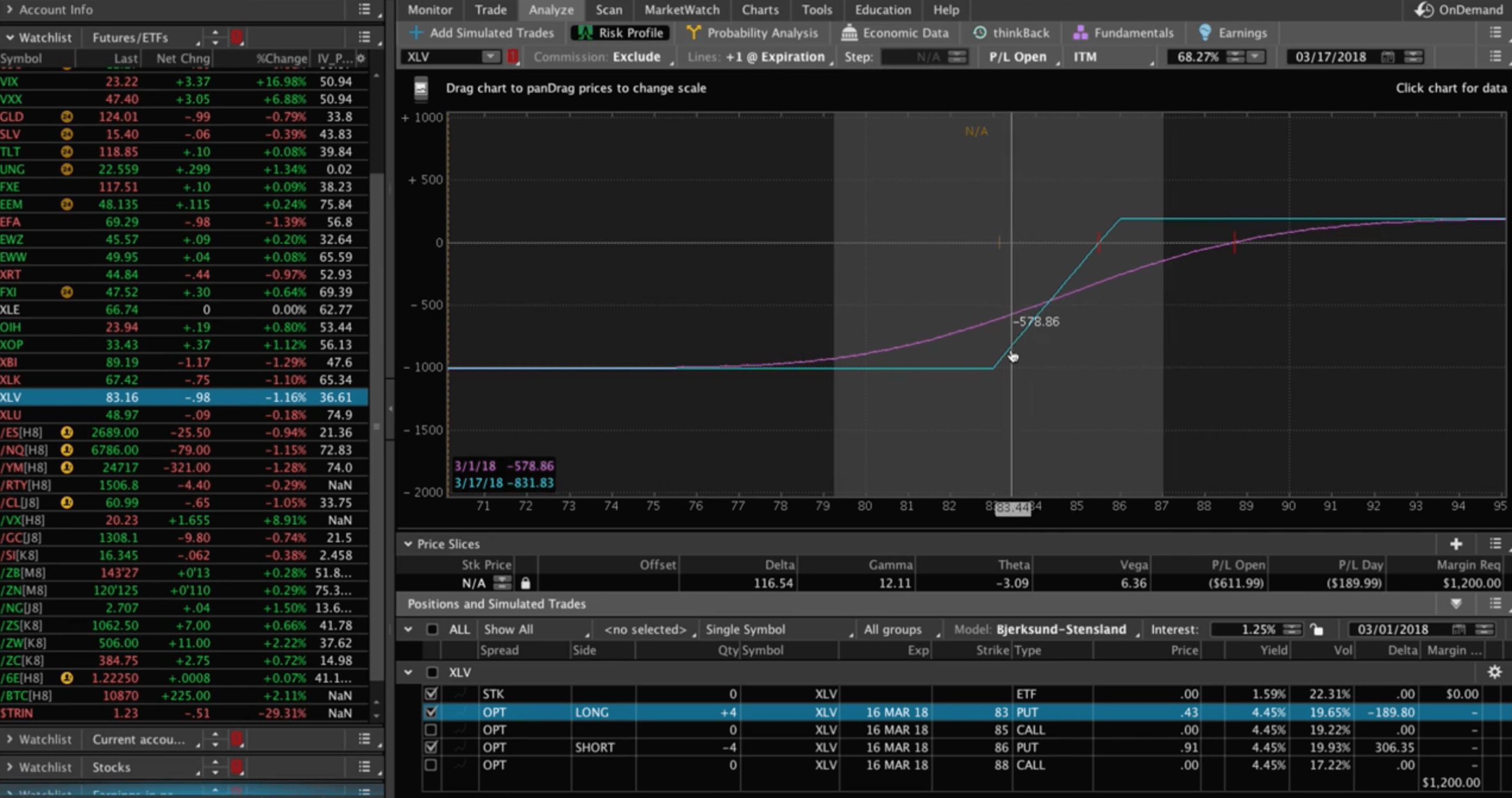

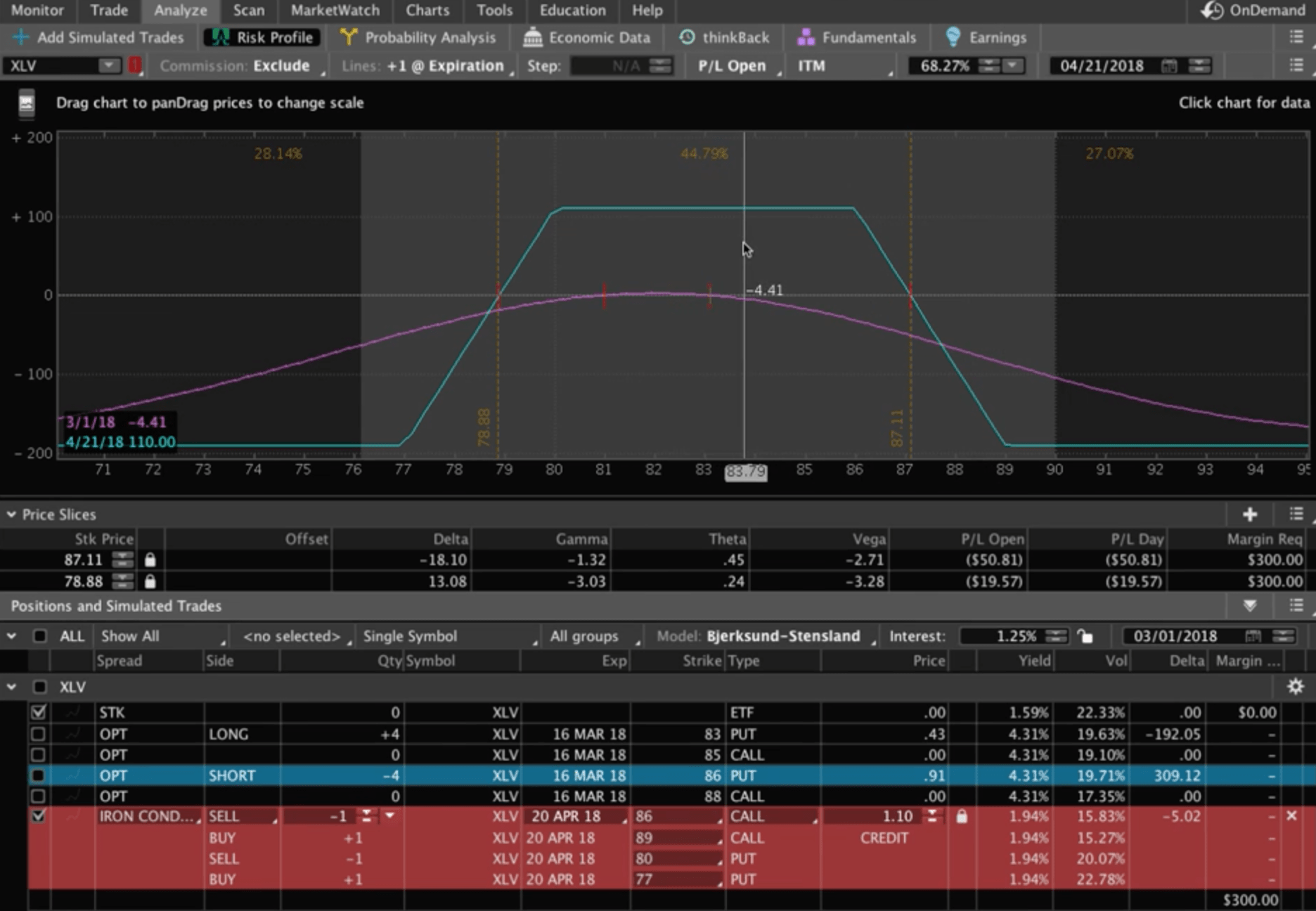

Then we took this over to the “Analyze” tab to see if this was what we wanted to do. As you do this, make sure to uncheck your current position.

You can see, it was a bit of a tight Iron Condor. Max profit was at $110, with a max capital usage of $190. That’s a good risk/reward ratio.

We set our slices to break even, and we moved through time to 4/21 just to make sure we got an accurate reading.

It was a little over 45% Probability of Profit (POP) if we held it all the way to expiration, which obviously we do not. We manage our trades early.

What this is going to do, is re-center around the current price. It’s going to take advantage of this high implied volatility. The IV percentile is in the 97th percentile, so the options were nice and expensive and a good time to sell. We added that credit so we could continue to manage.

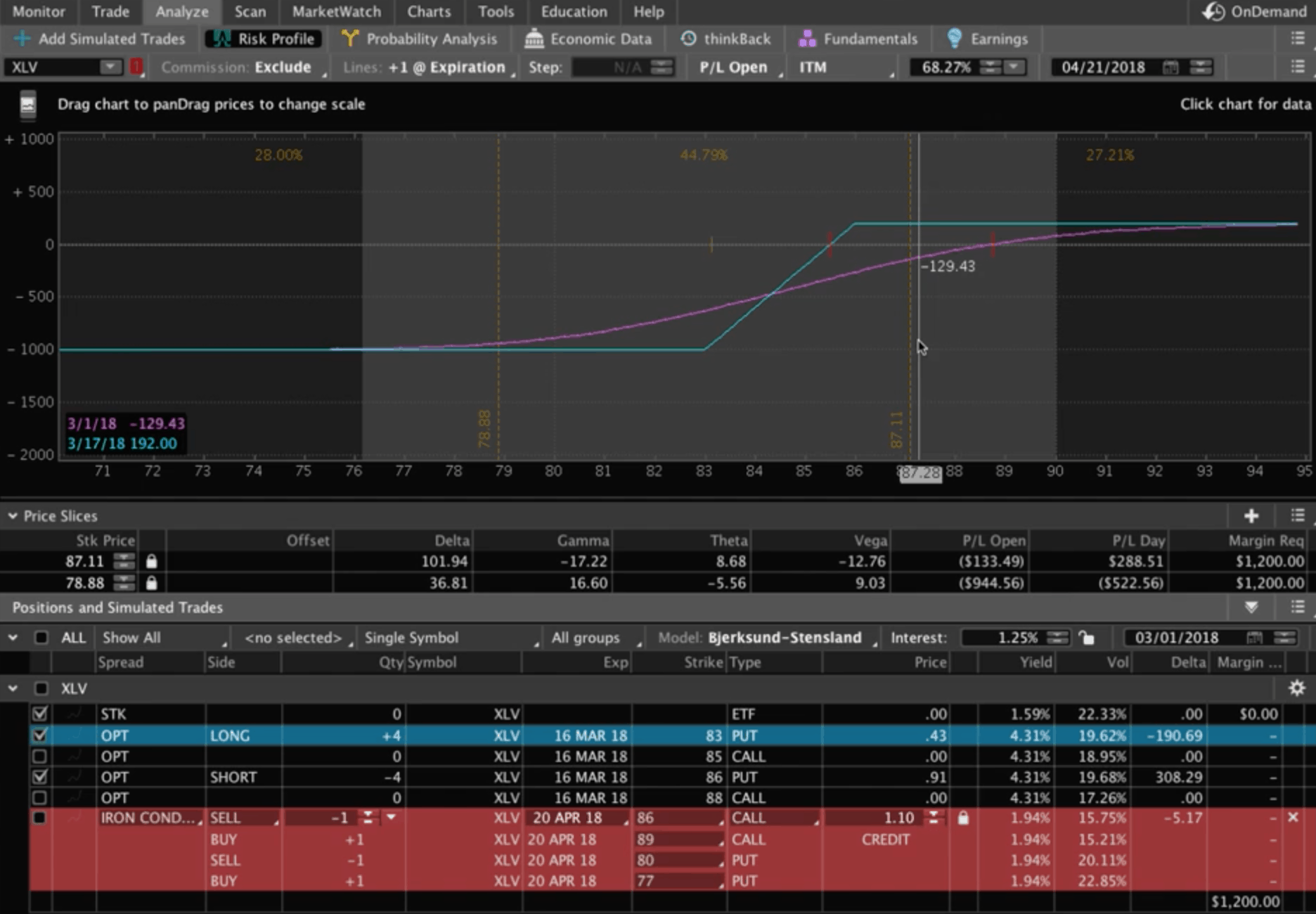

Let’s look at our other piece. Like I said, it was in a losing position. If we had gotten a little bit of a bounce back to the upside between then and the end of the March cycle (we still had 15 days left), then we’d go ahead and book that one.

We’d still keep this one on because we’ve got another 50 days to expiration, and that would give ourselves more time to be right.

We kicked this up a few contracts to kind of mirror the other one at four contracts. Now we’ve got a max profit of $440 with a capital usage of $760 dollars.

So that’s what we like to do with this type of trade. We continually add credits, reposition, and keep booking those profits until we make the profit that we’re looking for.

I hope that was helpful!

If you’d like to learn more about how we’ve taught over 12,000 members how to trade options for consistent income, just go to our homepage and click on the big orange “Get Started Now” button. We’ll give you immediate access to our flagship course Trading Options for Income.

We’ll also give you the NavigationTrading Implied Volatility Indicator that you see on our charts, along with the Watch List that we use to trade the most profitable symbols day in and day out.

All this is yours, no cost, just go to NavigationTrading.com and we look forward to seeing you on the inside.

Happy Trading!

-The NavigationTrading Team

Follow