Welcome back to another lesson from NavigationTrading!

In this video I want to show you how to enter an Iron Condor in tastytrade.

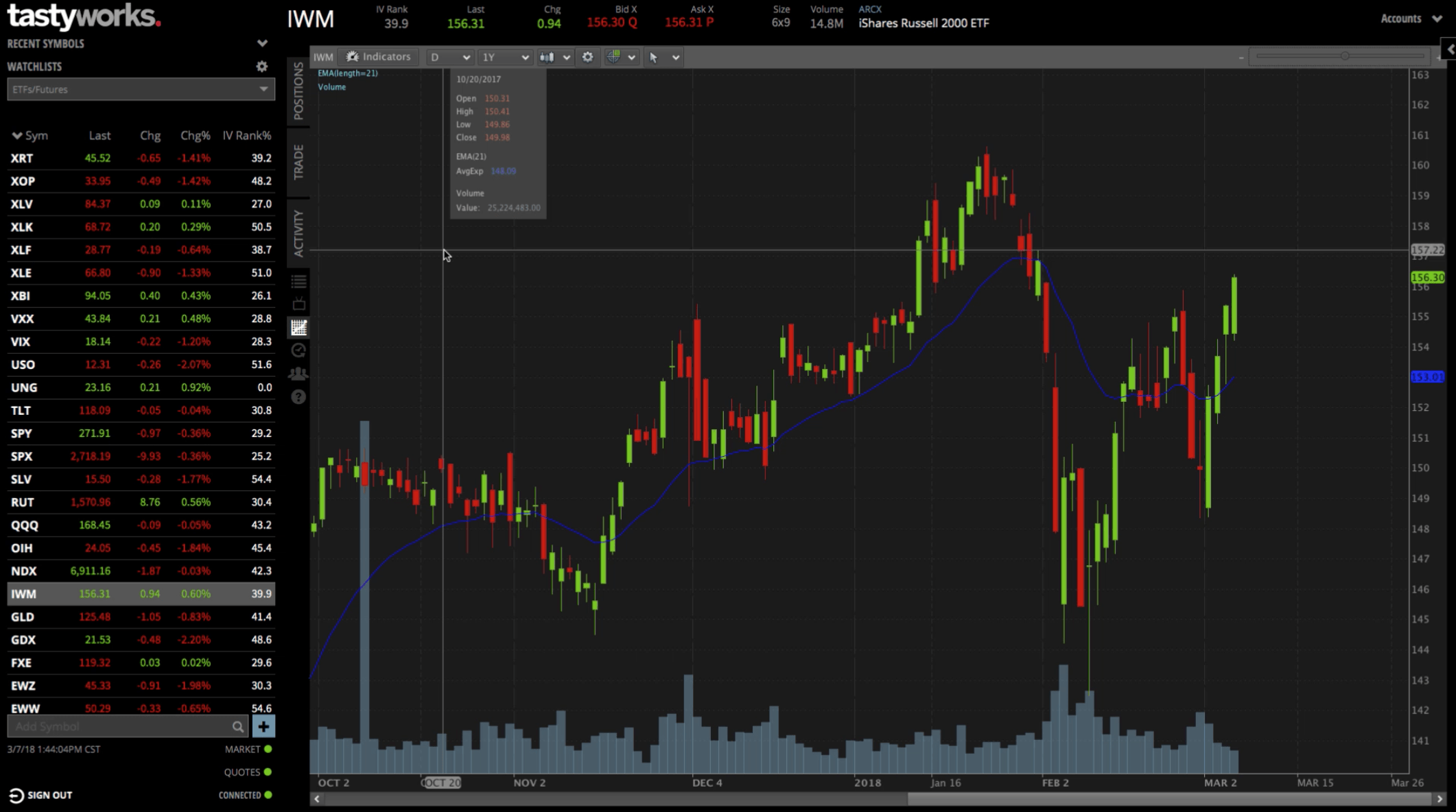

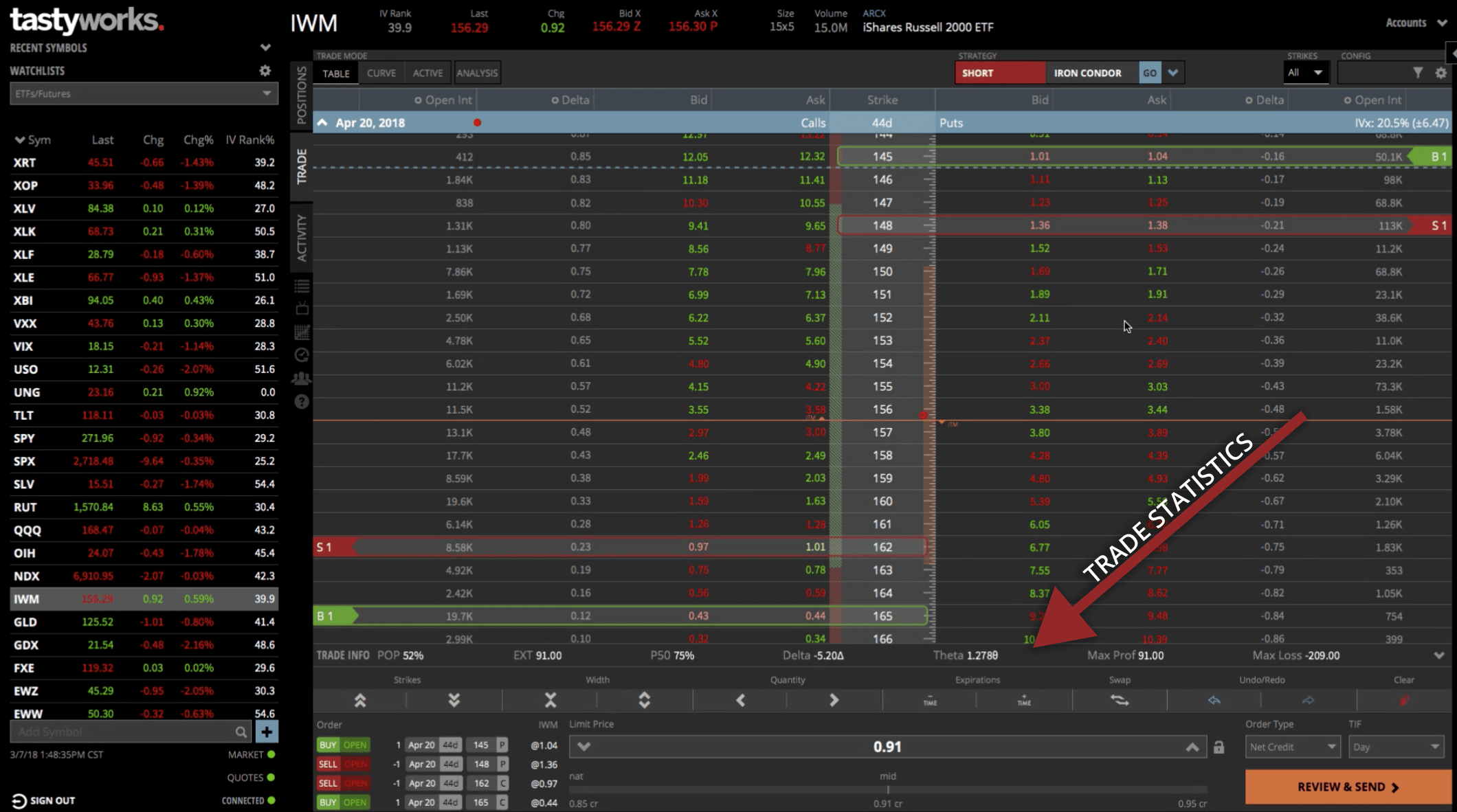

We’re on the “Chart” tab in the platform looking at the symbol IWM. IWM is the Russell Small Cap ETF.

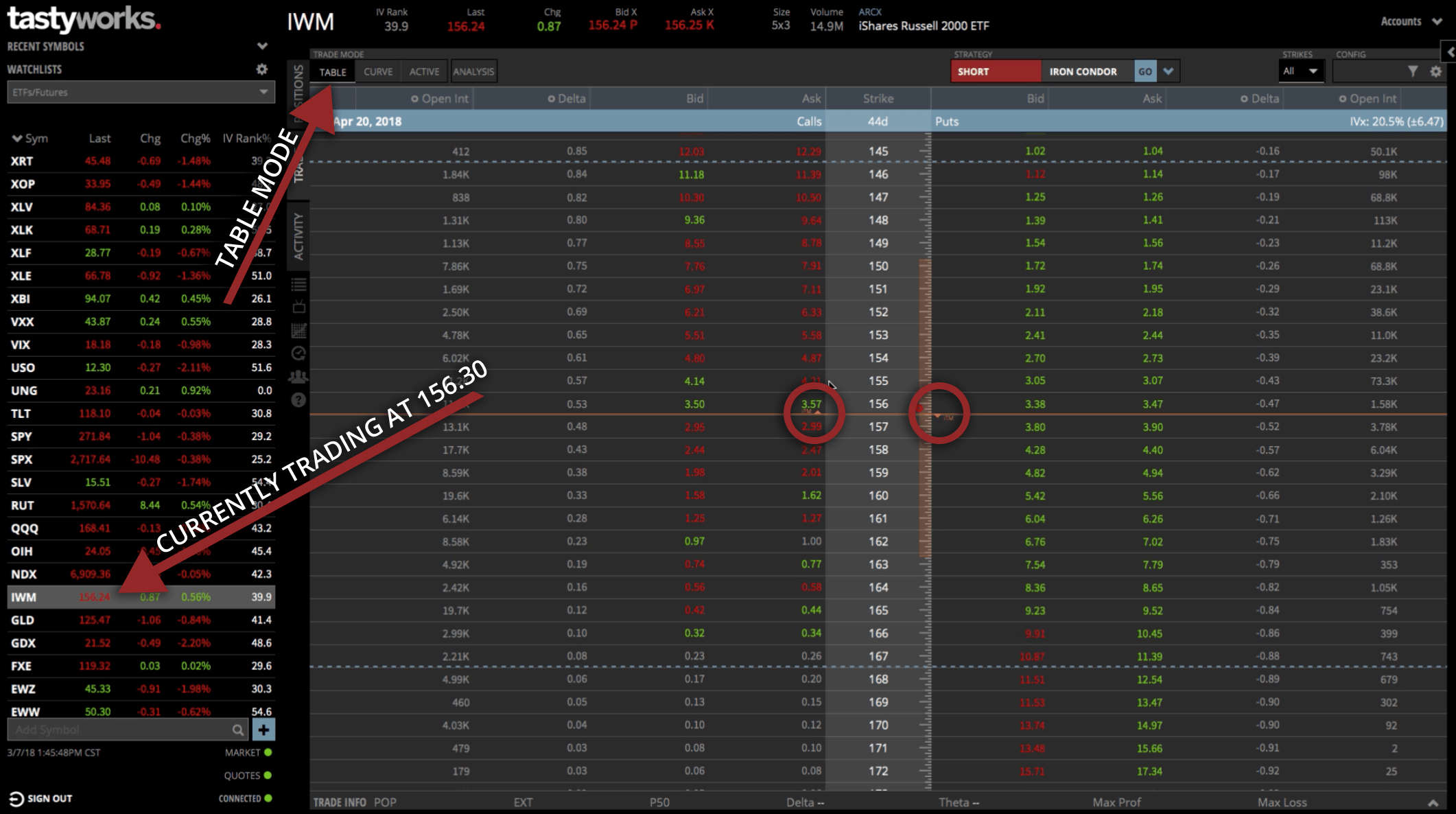

Table Mode

We’re going to go to the “Trade” tab…there are four different modes that you can look at. We’ll start with the “Table” mode.

This brings up the traditional option chains that you see on most platforms. There’s an orange line running through the middle of the option chains that signifies at the money options.

You can see that IWM is currently trading at about 156.30.

At the money is right between the 156 and 157 strikes. In really small letters, located on the orange line, you can see the acronym “ITM” with an arrow pointing either up or down.

On the Put side to the right, the arrow points downward. This indicated that everything below the orange line, on the Put side, is in the money.

Everything above the orange line, on the Put side, is out of the money. Same thing goes for the Call side, which on the left. The arrow is pointing up, so everything above the orange line, is in the money. Everything below would be out of the money calls.

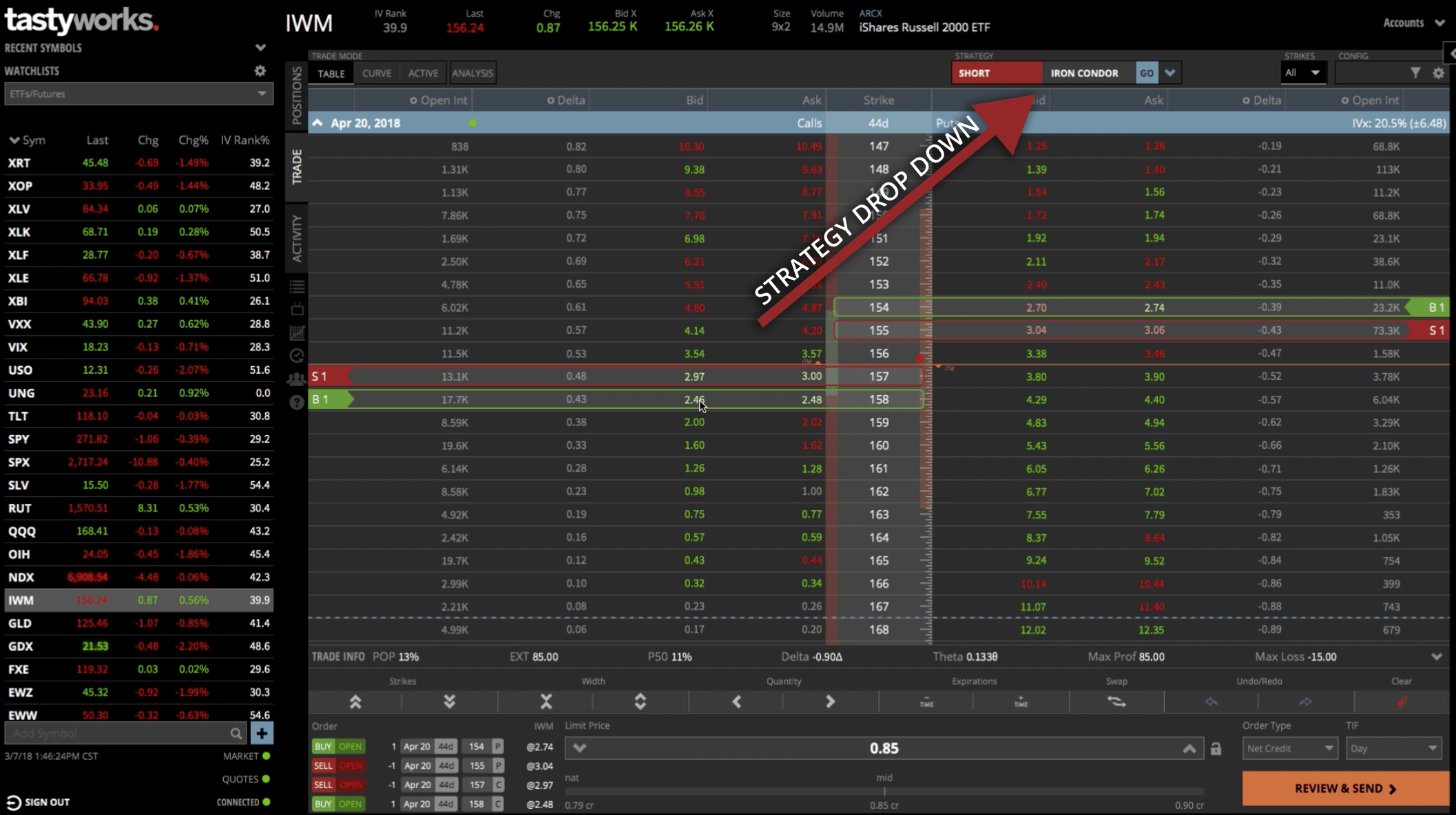

Strategy Drop Down Method

I want to show you two different ways to set up an Iron Condor on the platform. To begin, if you look towards the top of the platform, you’ll see the “Strategy” dropdown menu.

The Short Iron Condor is one of the options from the dropdown. If you click “Go” next to the Short Iron Condor option, that populates and will automatically put an Iron Condor on the platform.

When we set up an Iron Condor, we typically like to have our short strike be about the 20 delta and the long strike three strikes away for the wing width to be three strikes wide.

But, you can see above where the Strategy dropdown just defaults to the nearest strike. The great thing about this platform is you can just click and drag these boxes to where you want them.

Focus on the “Delta” column. We want to click on the call side (left side) so that we’re selling the 20 delta, out of the money.

In this case, there’s the 19 or the 23. We opt for the higher delta. Then, we can click and drag the long option three strikes away from the 23 delta. So, that would be the 165 strike.

We do the same thing on the put side. We’re going to take our short strike and get it up to about the 20 delta. Then we’re going to take the long strike and make that three strikes lower, so that’d be the 145 strike. That populates the exact Iron Condor that we want to trade on the platform.

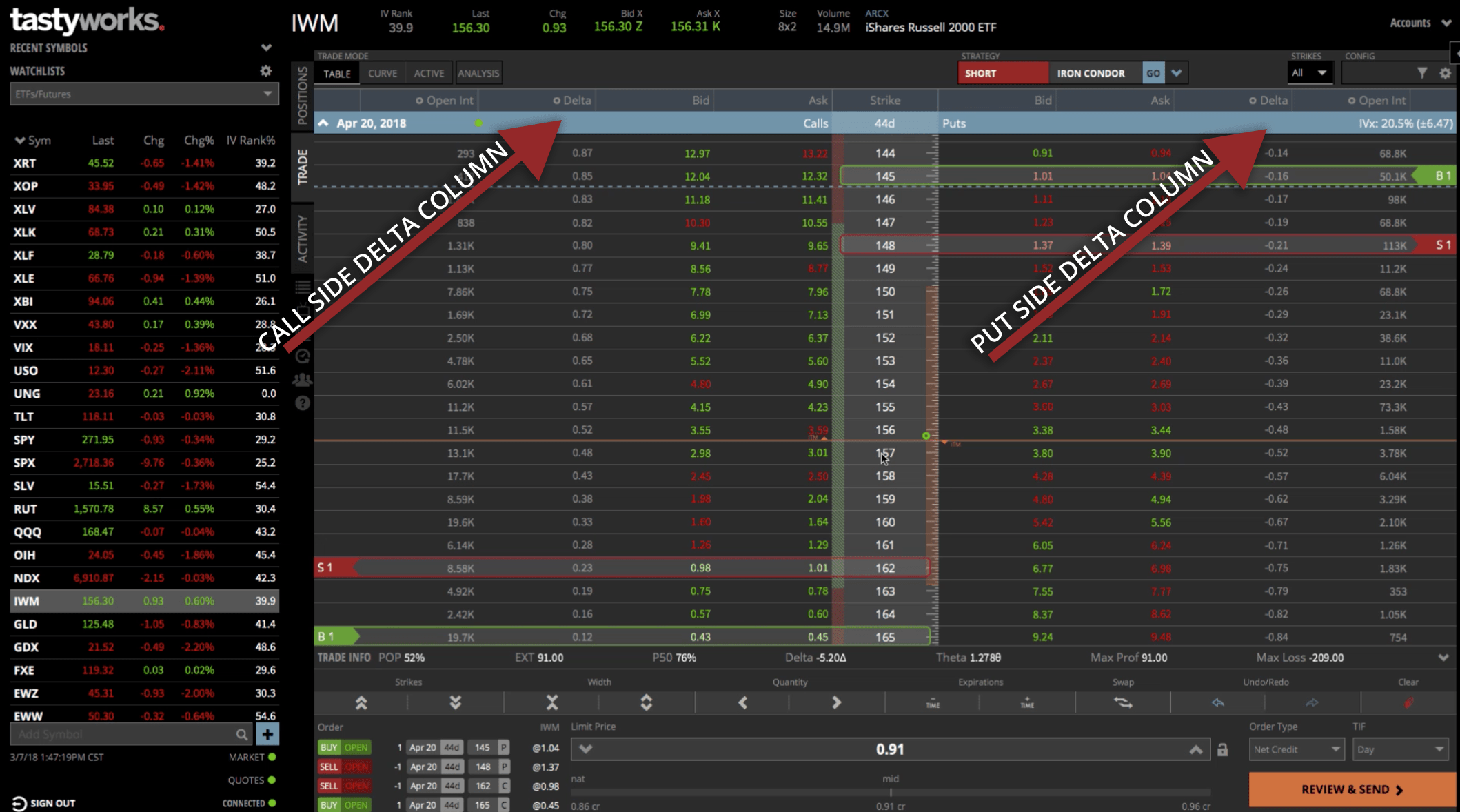

Not Sold On The Strategy Drop Down? Try This…

I’m clearing off my position to show you the next option you can use to set up your trade. It’s super simple, all you need to do is click on the bid and the ask.

Go to the 23 delta, on the call side. Just click on the bid and that populates your short strike. You can go over to the ask, go three strikes wide, click on the ask and that will populate your long strike.

Same thing goes for the put side. Just go to the delta that you want, in this case, a little over 20. We’re going to click on the bid and then go three strikes away and click on the ask. That sets up your Iron Condor the same way that we had it positioned using the Strategy dropdown method.

The other cool thing about the tastytrade platform is if you look down towards the bottom, you’ve got some really cool statistics like the Probability of Profit (POP), which is 52%. If you held the trade all the way to expiration, it’s got a 52% probability of profit. It shows the extrinsic value.

The other thing it displays, that no other platform has, is what’s called this P50. That just means the probability of you making 50% of max profit. So, you’ve got a 75% chance of making a 50% of max profit on this trade.

The trade information shows you the delta and your theta. It gives you your max profit and your max loss on the trade.

If you’re happy with your trade stats and your selection, you can go ahead and hit the “Review & Send” button to shoot that off to your broker.

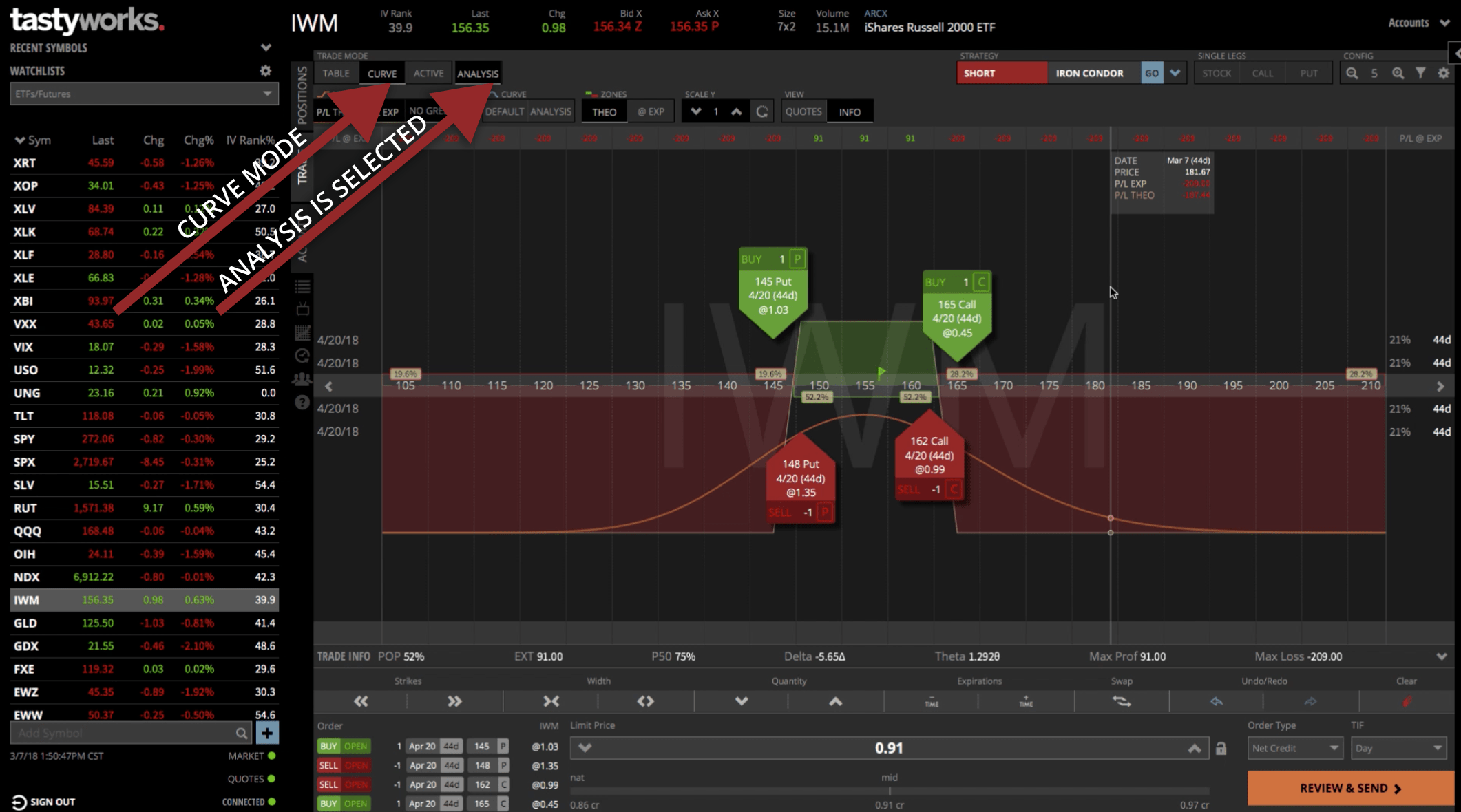

Need A Visual?

If you’re a visual person like I am, I like to look at my position on a graph. To do this, click on the “Curve” option from under “Trade Modes” up at the top of the platform. Make sure that “Analysis” is selected as well. This will bring up an analysis tab similar to what we’re used to on the thinkorswim platform.

You can zoom out of this a little bit to make it wider. You can make it a little bit narrower, but this gives you that visual representation so you can see exactly where your breakeven points are on the trade. You can see your profit, which is represented by the green. You can also see when the trade starts to be a loser, which is represented by the red.

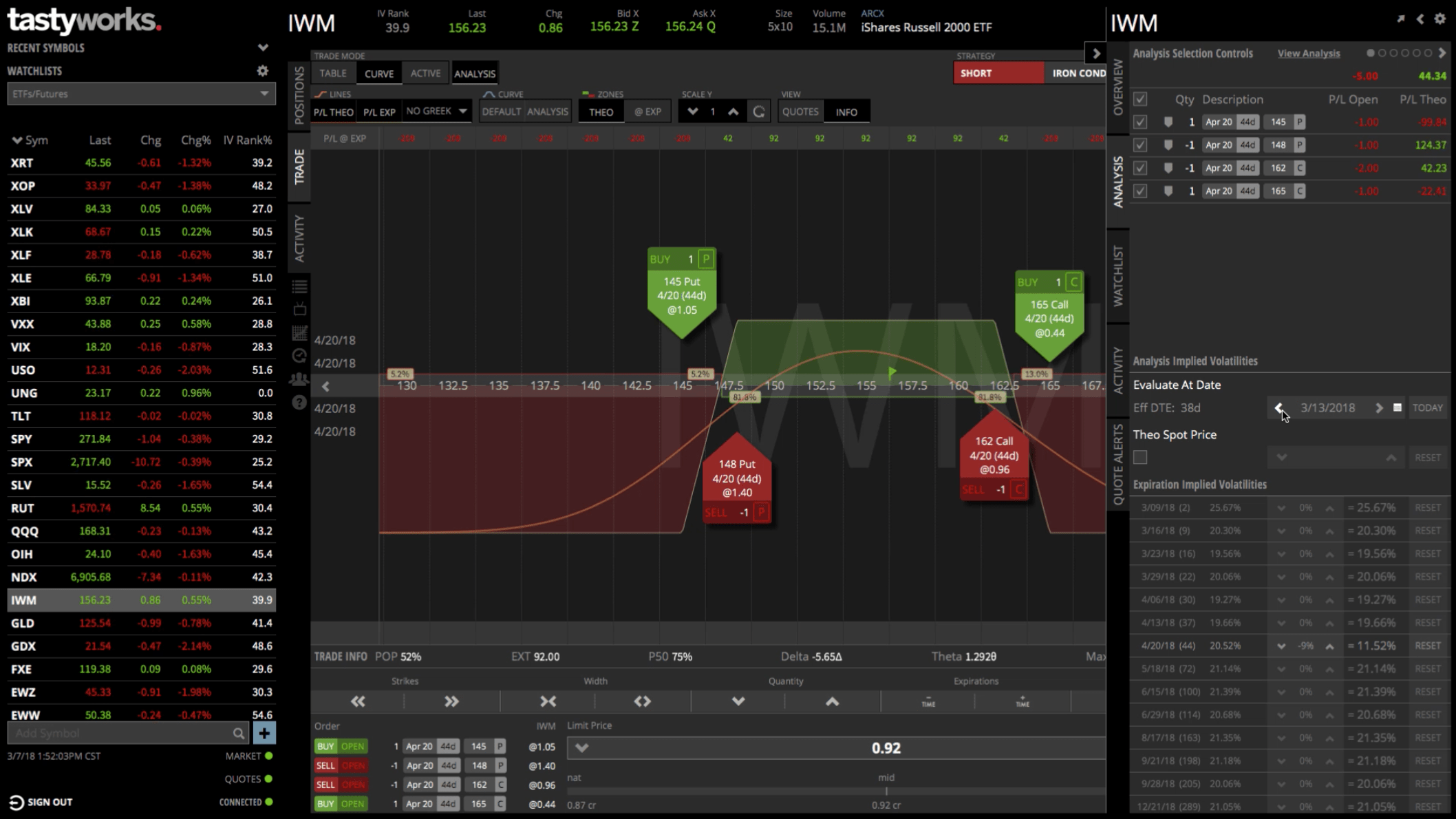

By opening up this window on the right-hand side, there are some metrics that you can play with, with some theoretical positions.

You could increase implied volatility and you could see the profit line goes down. Obviously, if we put on an Iron Condor, we want a contraction in implied volatility, which would increase our profits.

You can move the date around to see where you think the profit might be on a specific date, after you’ve been in the trade for a while.

You can play around with the theoretical variables to get an idea of how the position will work, based on various factors. When you’re happy with the position you’ve created, collapse that window, go down to the bottom, and click on “Review & Send”. This will send your order into the broker to get filled.

I hope this video was helpful in showing you how to set up an Iron Condor in tastytrade and I look forward to our next lesson!

Happy Trading!

tastytrade, Inc. (“tastytrade”) was previously known as tastyworks, Inc.

Follow