Welcome back!

In this blog post, I want to show you how to sell a Short Put Vertical in tastytrade.

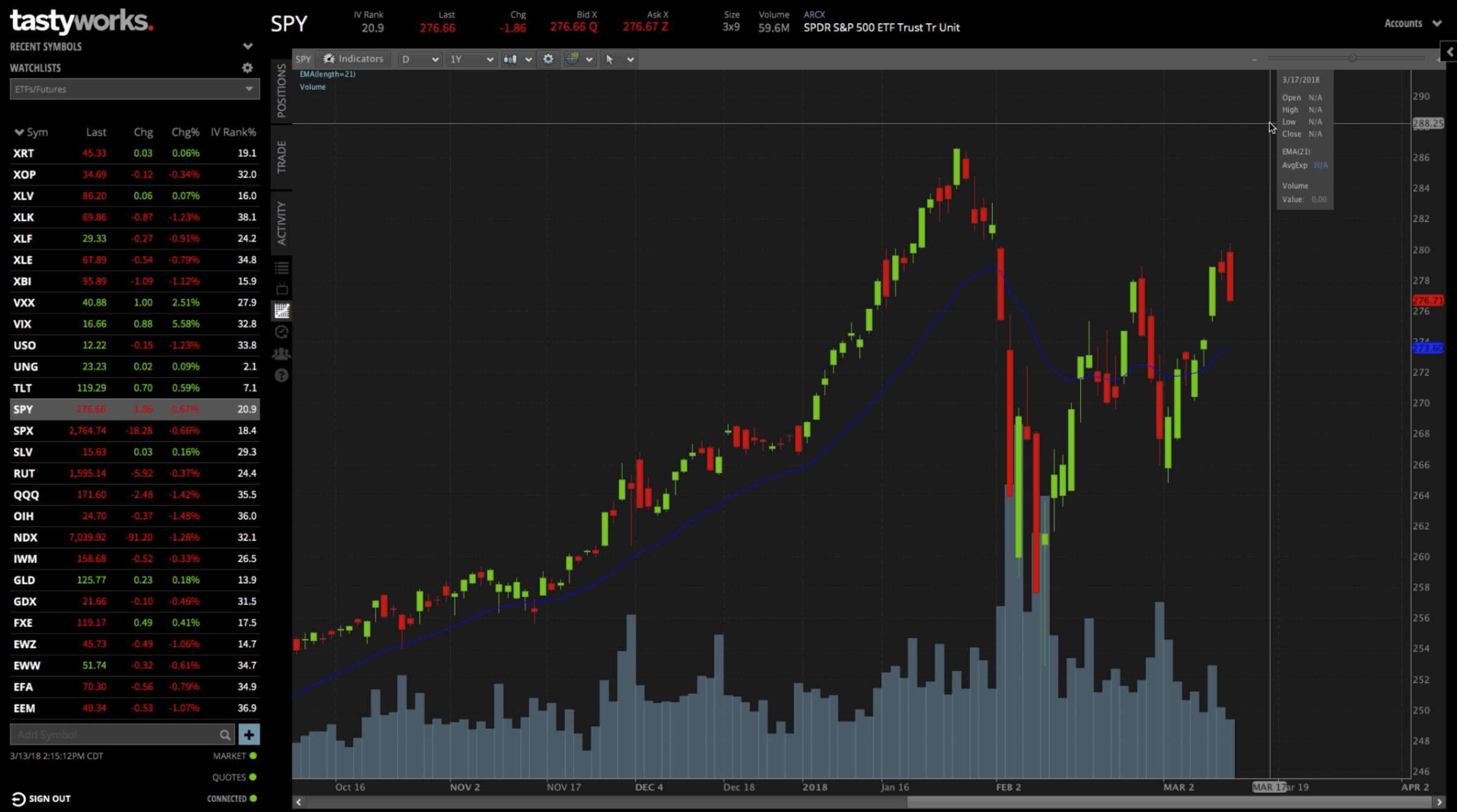

We’re looking at a chart of SPY, and let’s say that your assumption is that you thought that SPY was going to continue to go higher. You’d want to put on a bullish position. You decided that a Short Put Vertical Spread was the way to go.

Setting Up Your Position

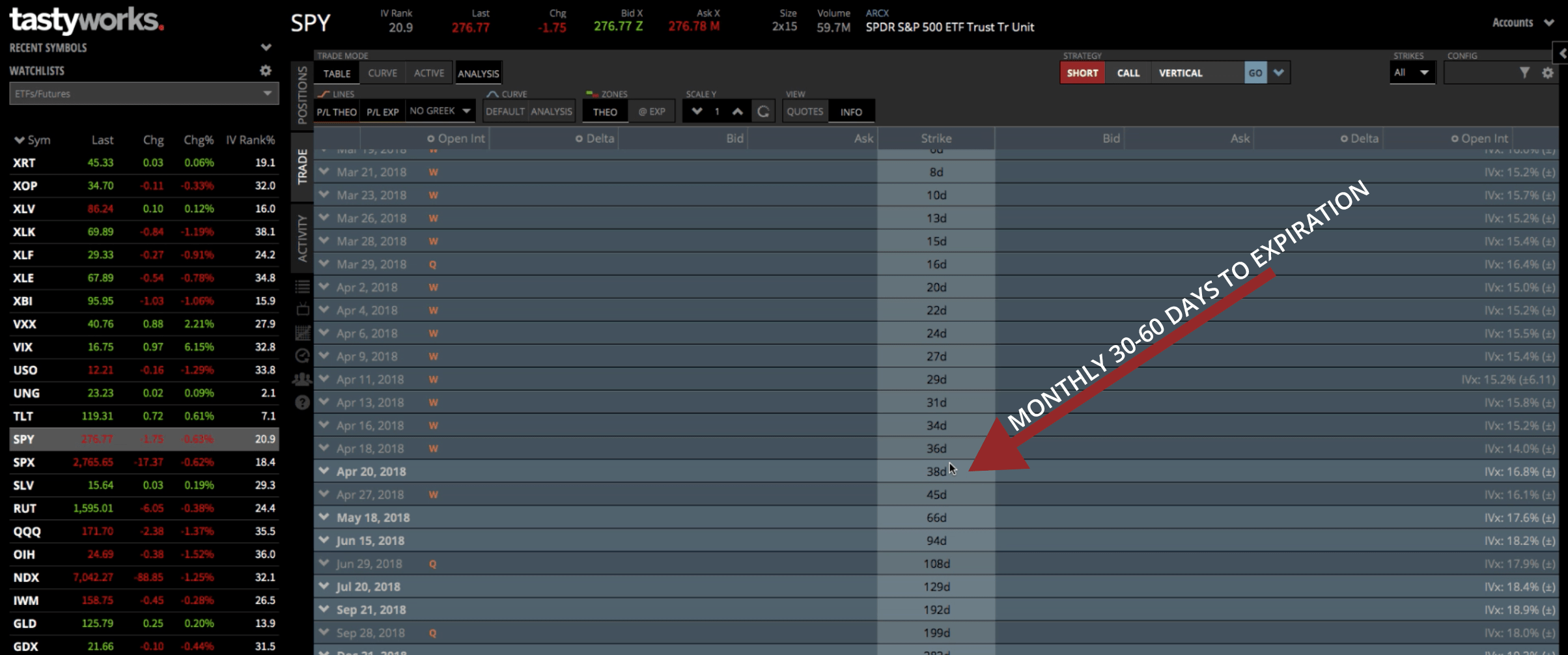

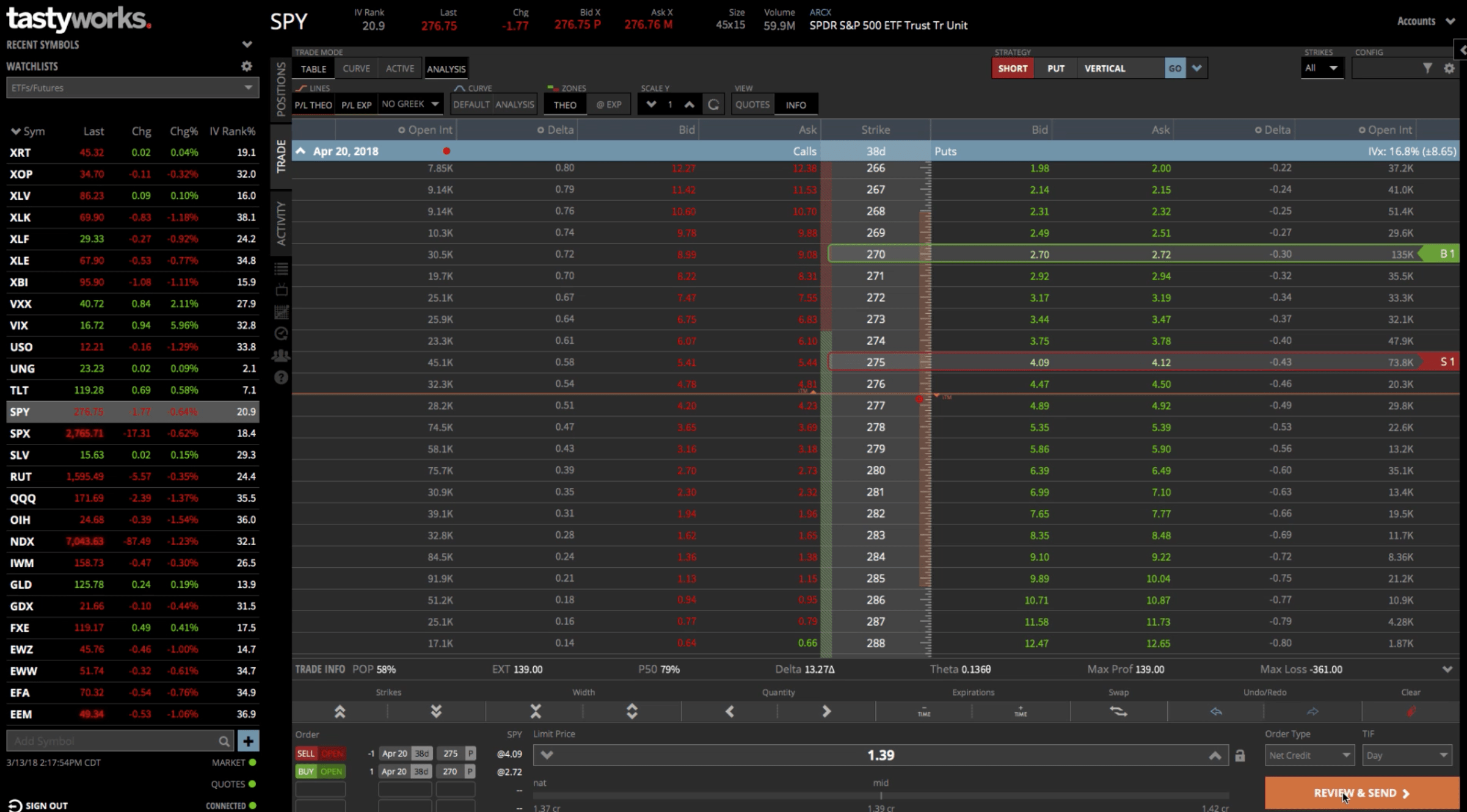

All you’ve got to do is go to the “Trade” tab, and you’ll see the option chains populate when you’re in the “Table” mode.

We always want to stay in the monthly option cycles, because they are the most liquid.

Just to clarify, the monthly options are annotated by the bolded white text. You can see the weekly and quarterly option cycles have an orange “W” or “Q” next to them.

The monthly cycle with 30-60 days to expiration is where we like to put the trade on. You can see the April 20th option cycle has 38 days to expiration.

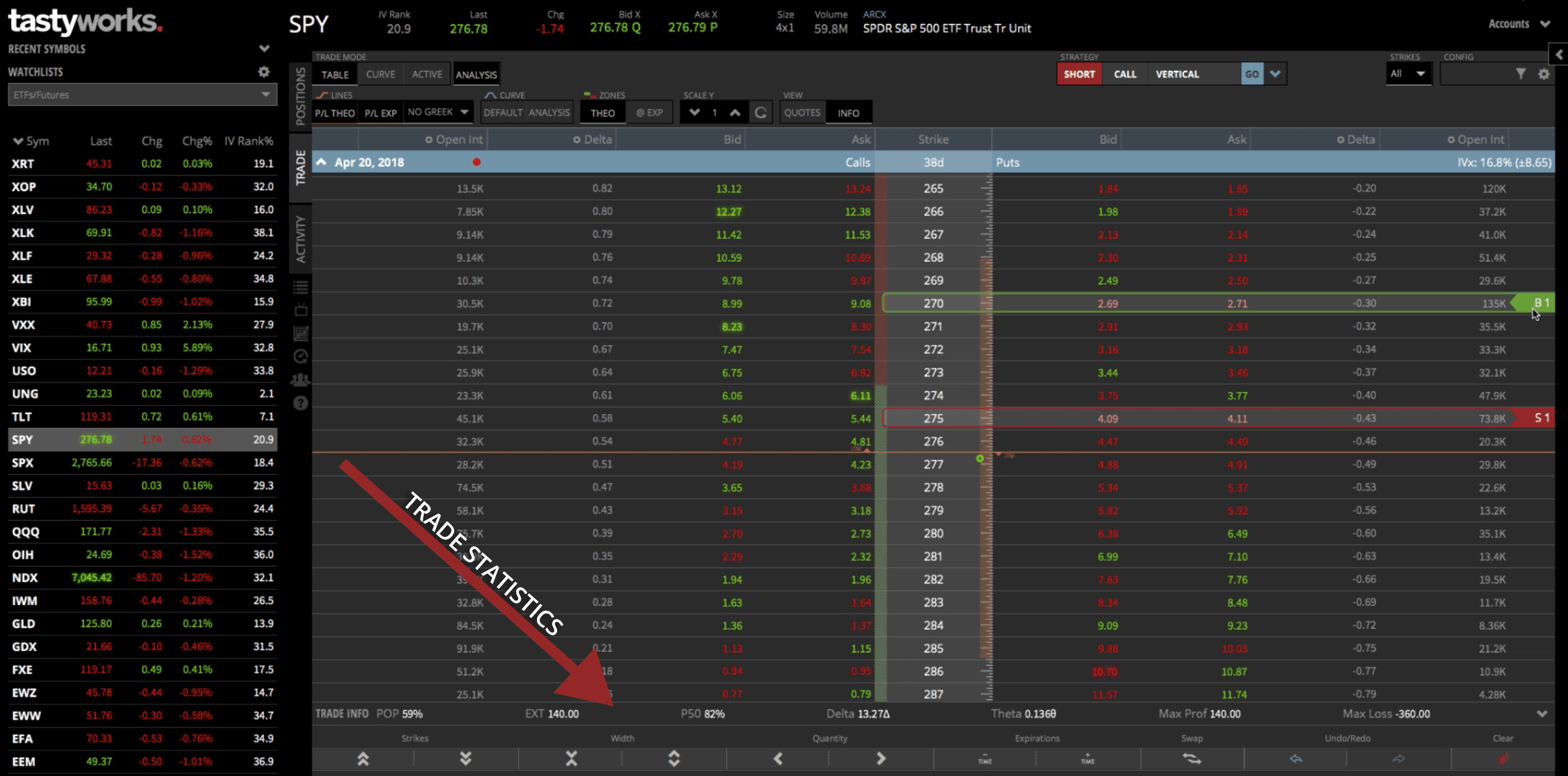

Open that up, and it brings up the option chain. Then what we’re going to do is sell a Put Vertical.

There’s a couple of different ways to do that. You can piece it together by clicking on the bid and the ask.

Remember, on the put side, the in the money options are below the orange line. The out of the money options are above the orange line.

When we’re selling a Put Vertical we typically like to start out of the money.

Let’s say we wanted to sell at the 275 strike. We would then want to buy the strike five points away, which would be the 270.

To buy, you’d just click on the ask for the 270 strike. The red outline and “S1” label indicate that you’re selling.

The green outline and “B1” label indicate that you’re buying.

So, we’ve got a five point wide Put Vertical.

You can look down at your statistics to see that your probability of profit (POP) is 59%, probability of making 50% (P50) is 82%.

You can see your delta is positive. Obviously, because this is a bullish trade, we want the stock to go up.

You can see your theta, max profit and max loss for the trade.

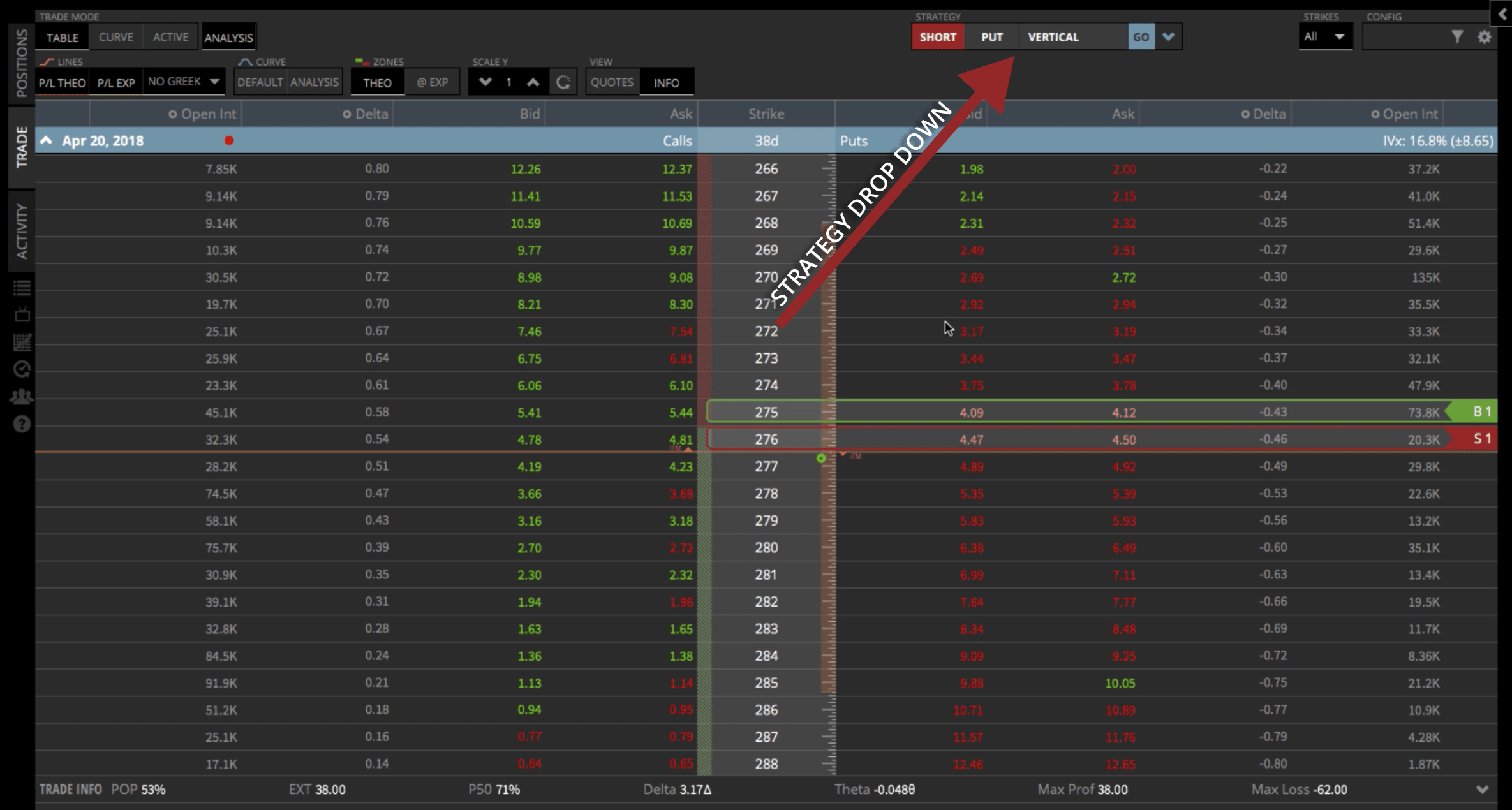

Strategy Dropdown Method

If you clear off your recent position, the other way you could set up a Short Put Vertical, would be to use the “Strategy” dropdown menu. Make sure that the menu is toggled to “Short” and to “Put”. Be sure and choose the “Vertical” option from the dropdown. Then, you just click “Go”, and the trade will populate on the platform.

It automatically populates; however, and we’d want to adjust these strikes. We had the 275 and the 270, so we can just drag these to where we want them. It’s that easy. You can see the trade statistics down below is exactly the same. If you’re ready to go, just click “Review & Send” to send the trade off to your broker to get filled.

Want A Visual Representation of Your Trade? Try The Curve Mode

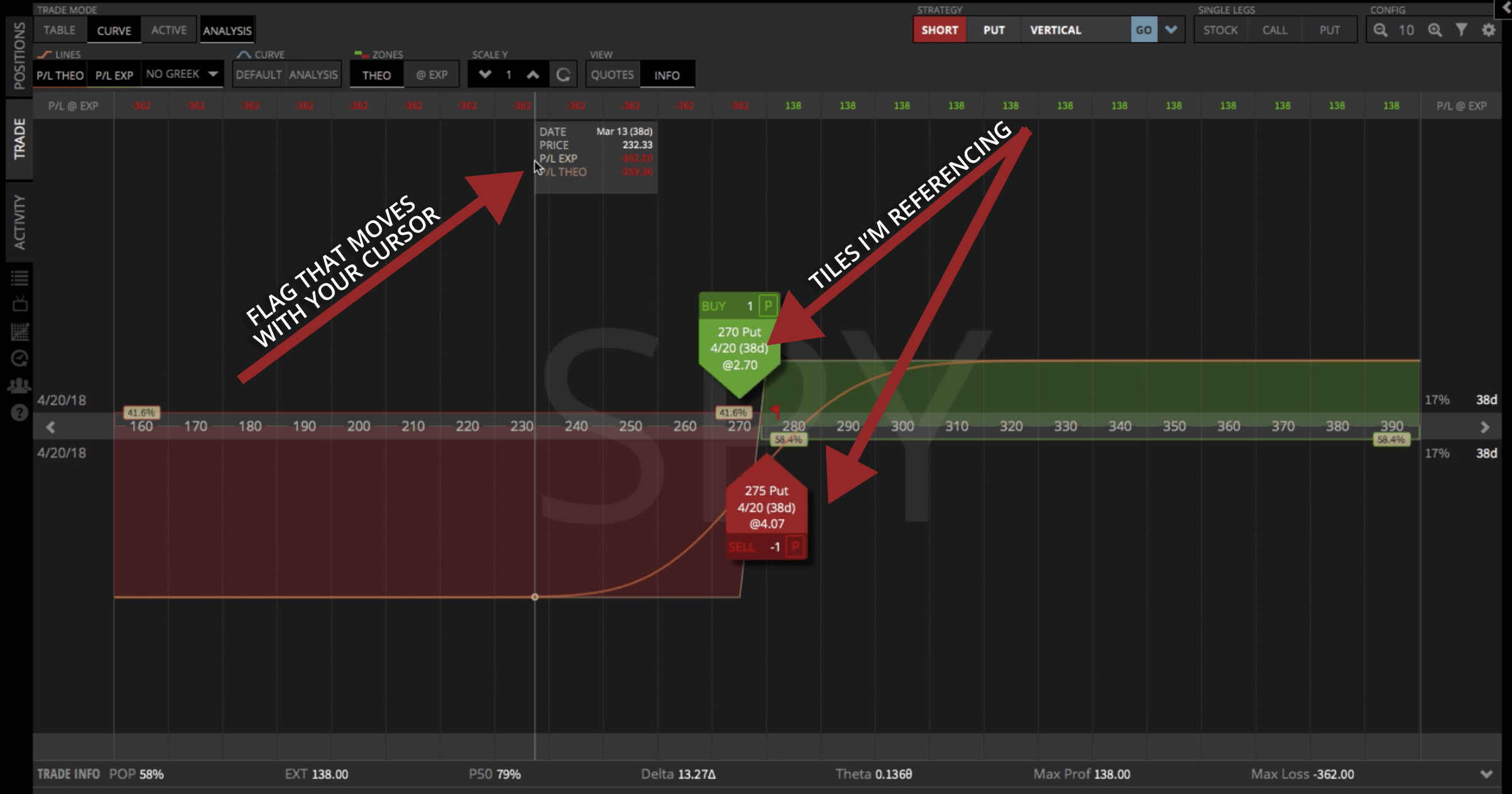

Or if you’re like me, and you’re a visual trader, I like to open up the “Curve” mode. Make sure “Analysis” is selected as well. This mode gives you a visual representation of the trade.

You can see up at the top as you move your cursor over the green area, there’s a little flag that shows you your profit and loss at expiration (which is the same as your max profit).

You can do the same thing to the red area of the graph. The values on the flag are obviously negative when you’re hovering over the red area, because that’s when you’d start to lose money on the trade.

You’ve got everything you need in the “Curve” mode.

All the trade statistics are still down below.

If you decide you want to change your strikes, you don’t have to go back to the “Table” mode. You can actually click and drag on the tiles, and that will adjust your potential profit, potential loss, and give you an idea of your probabilities. You can just click and drag those tiles until you get the desired PNL and risk reward that you’re looking for on the trade.

Once you’re done and ready to go, hit “Review & Send” to send that into the broker to get filled.

Hope that was helpful in showing you how to trade a Short Put Vertical in tastytrade.

See you in the next lesson!

tastytrade, Inc. (“tastytrade”) was previously known as tastyworks, Inc.

Follow