Hey everyone, welcome back to another NavigationTrading tastytrade tutorial!

In this video, we want to show you how to trade a Short Call Vertical Spread in tastytrade.

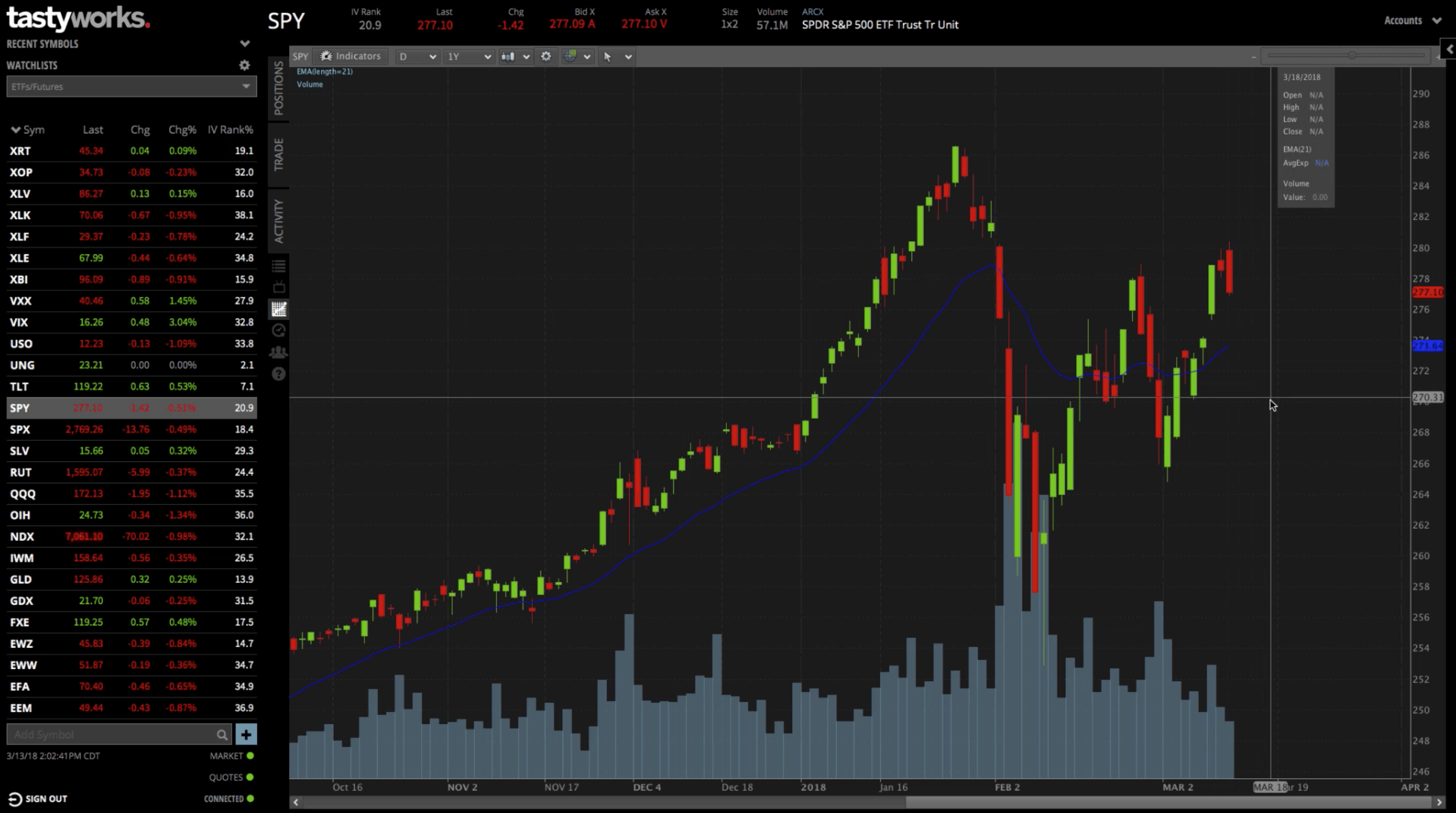

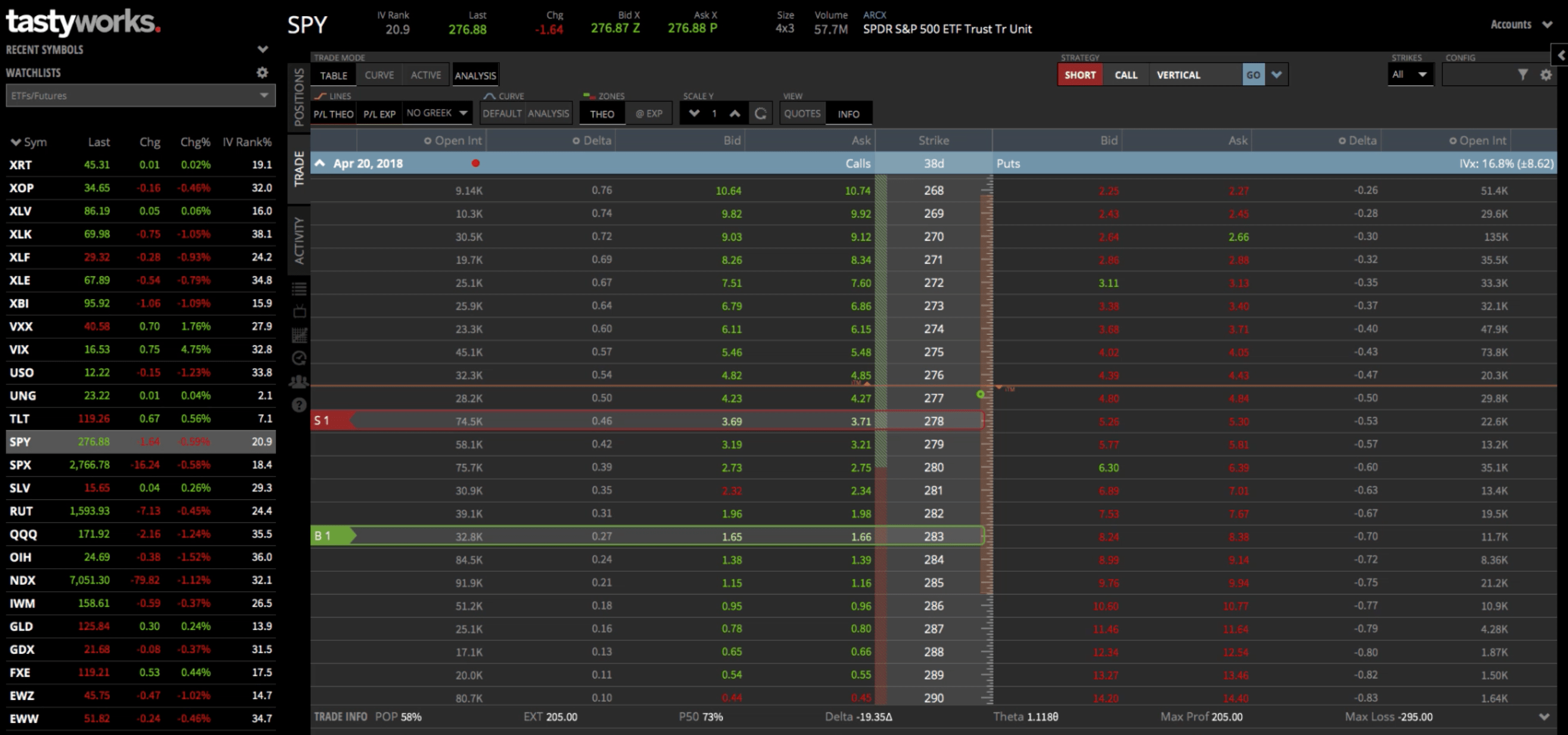

We’re looking at a chart of SPY, the S&P 500 ETF.

Looking at the chart, this is not necessarily a trade that I would make, but we’re just using this as an example.

Let’s say you’re looking at this chart and you decided that you had a short directional bias in SPY, meaning that you thought over the short term that you might see a bit of a downward move from where it’s currently priced. What you can do is sell a Short Call Vertical Spread.

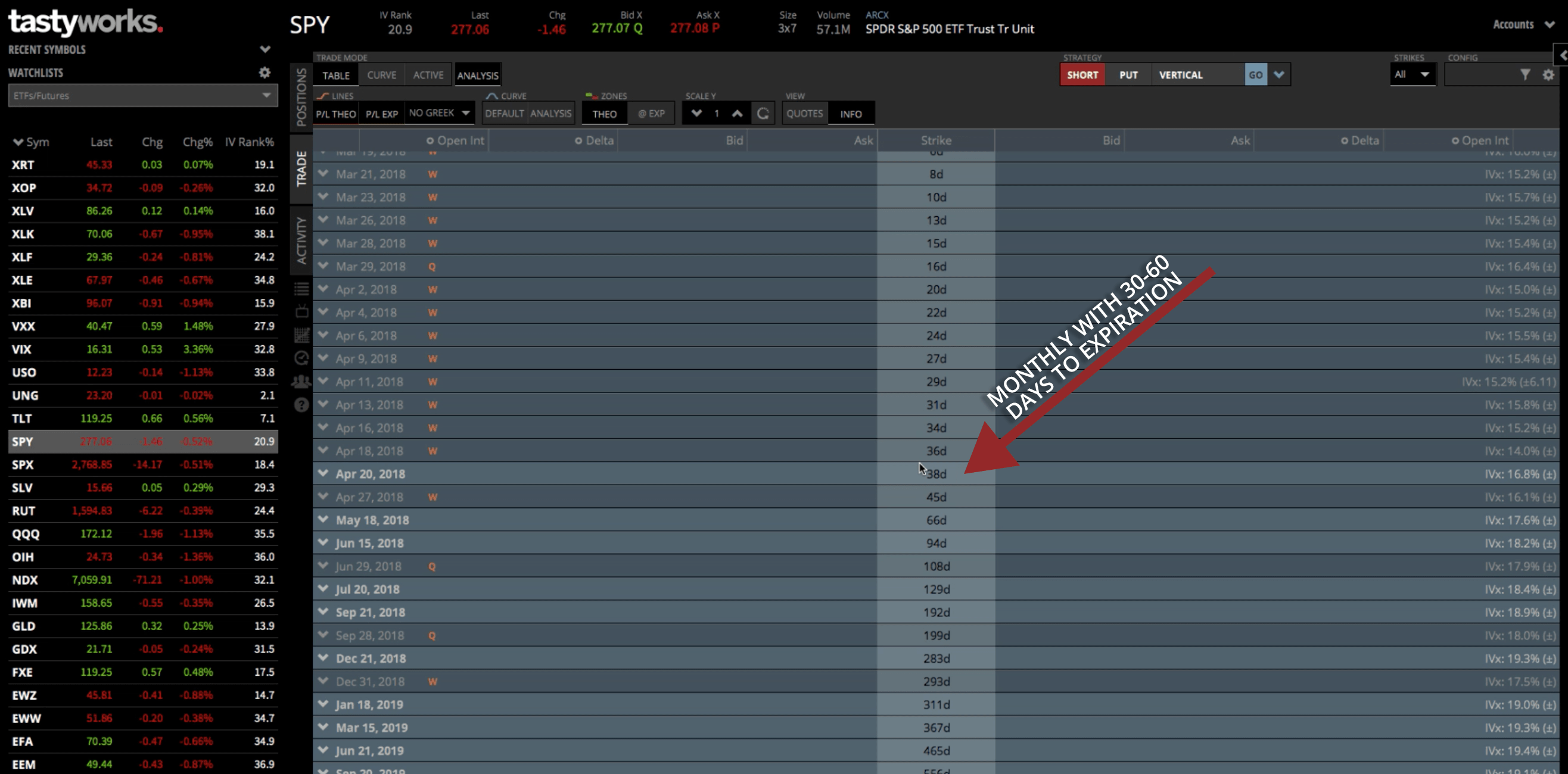

Setting Up Your Position In The Trade Tab

To do that, you just go to the “Trade” tab, and within the option chains, you can see you have the different expiration cycles. We like to stick with the monthlies, they’re the most liquid. We also like to stay between 30-60 days to expiration. In this case, we’ll be looking at the monthly with 38 days to expiration. Just click the little arrow to pop open the option chain.

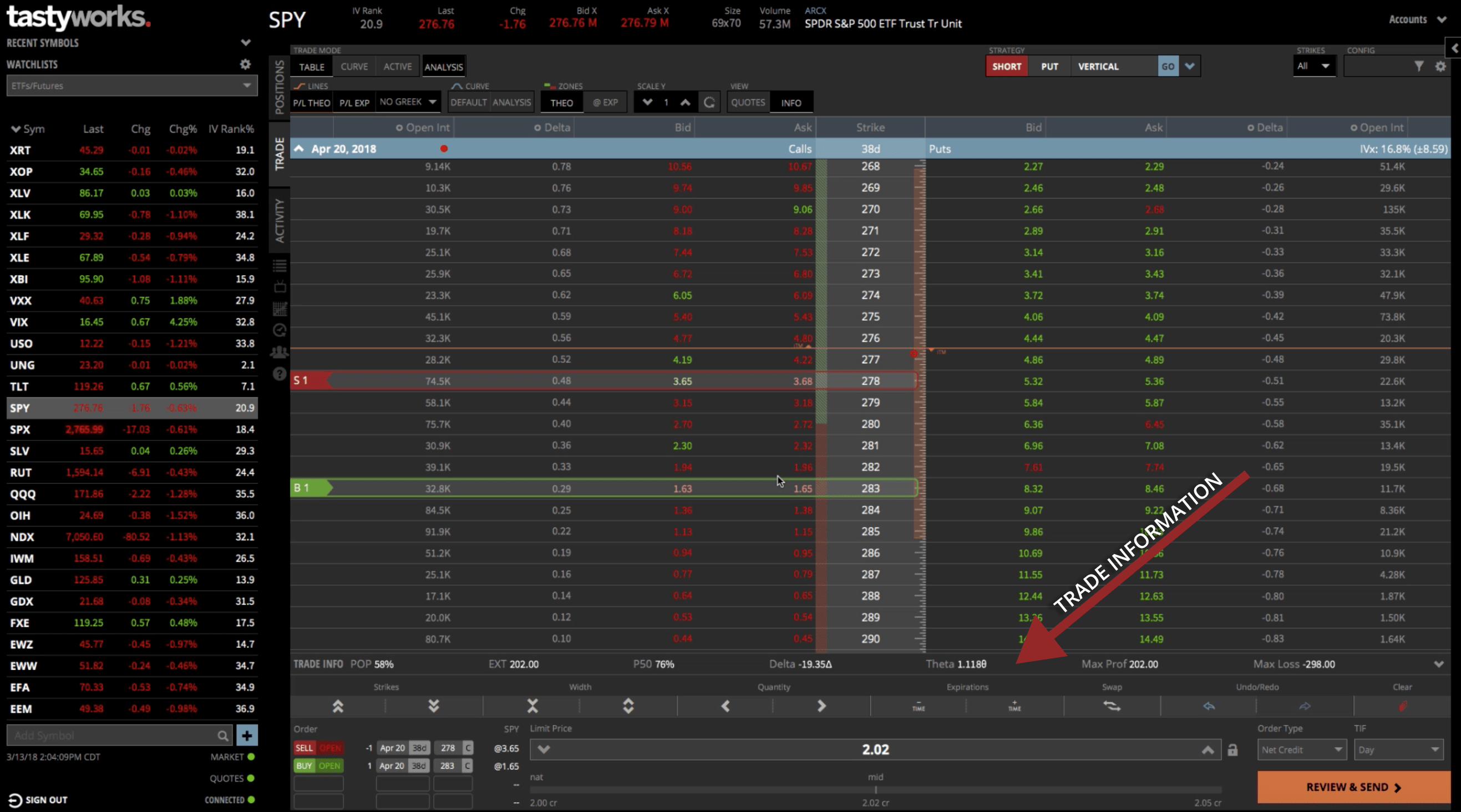

There’s a couple of different ways to sell a Short Call Vertical, or to implement a Short Call Vertical. One is to just click on the bid and the ask of the desired strikes that you want. Make sure you’re looking at the left side of the platform, because that’s the call side.

Let’s say we wanted to sell a slightly out of the money Call Vertical Spread. If you look at the orange line running horizontally through the platform, you can see there’s a little arrow that points to the in the money strikes. We’re doing out of the money on the call side, so focus on the bottom left quadrant of the platform. Let’s choose the 278, clicking on the bid to sell that strike. Say we wanted to go five strikes wide, we would just click on the ask of the 283 strike to buy. So we’re selling the 278, and buying the 283 to define our risk at that point.

Now you’re all set to go, and you can check your trade information down at the bottom. As you can see, there’s a probability of profit (POP) of 58%. Probability of making 50% (P50) is at 76%. You can see the delta. Obviously, it’s negative. We’re anticipating the stock to go down if we’re right on the trade. You can see your theta, max profit, and max loss as well.

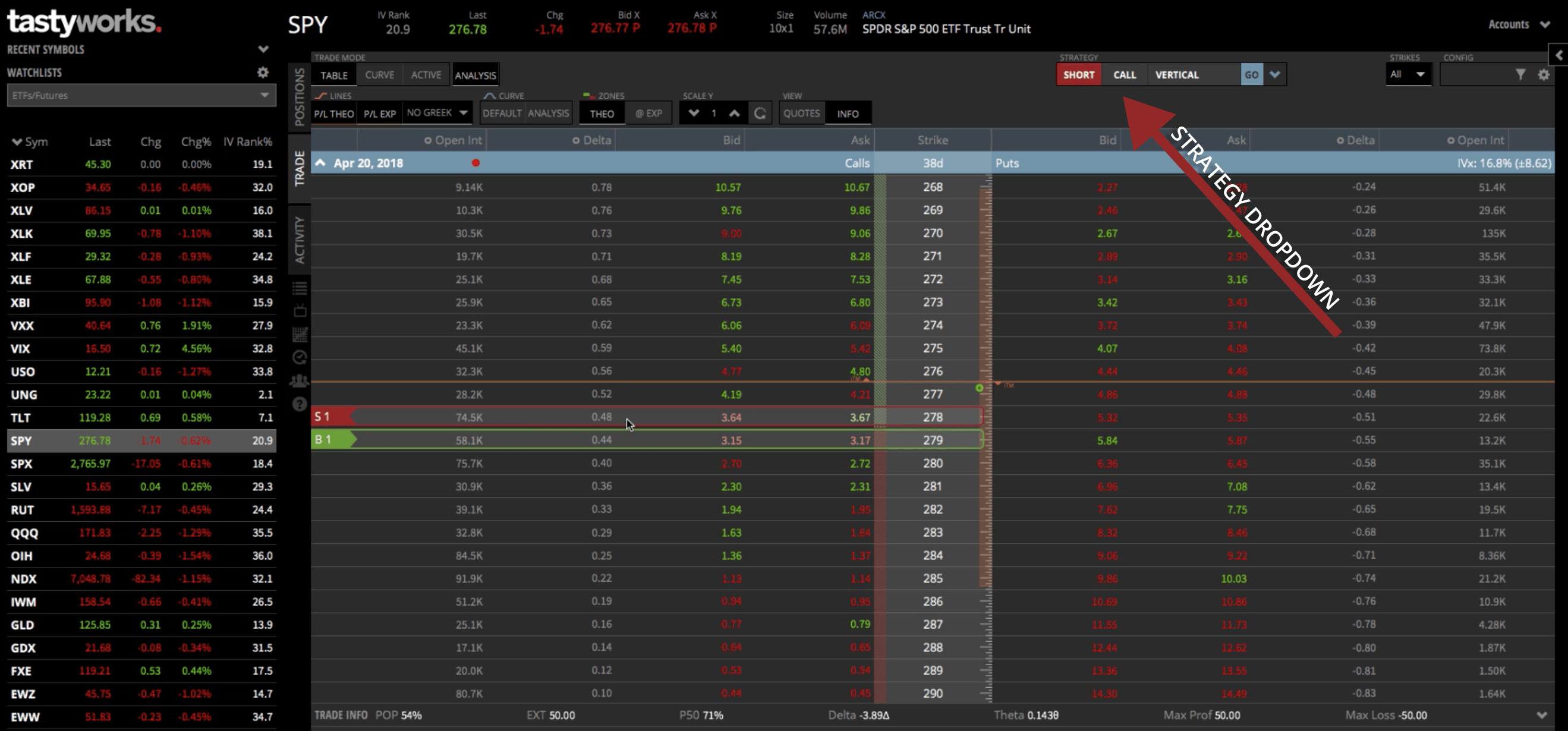

Strategy Dropdown Method

So, the “Trade” tab is one way to set up your position. The other way would be to utilize the “Strategy” dropdown menu.

Be sure to hit the little eraser in the bottom right-hand corner to clear off your recent position.

One thing to notice, is that the first two little boxes under the menu toggle. Make sure the first box is toggled to “Short” and the second is toggled to “Call”. Then select “Vertical” from the dropdown and hit “Go”. That automatically populates your chart.

You can see, it automatically went close to the money. That 278 strike is actually the same one that we chose earlier for our short strike, but our long call defaults to the very next strike. We don’t want that.

We want to click and drag that long call five points away to the 283. Boom! You get the same trade info, with 58% probability of profit and 73% probability of making 50%. The delta, theta, max profit, and max loss are all the same.

So, that’s just another way to set up your position on the tastytrade platform.

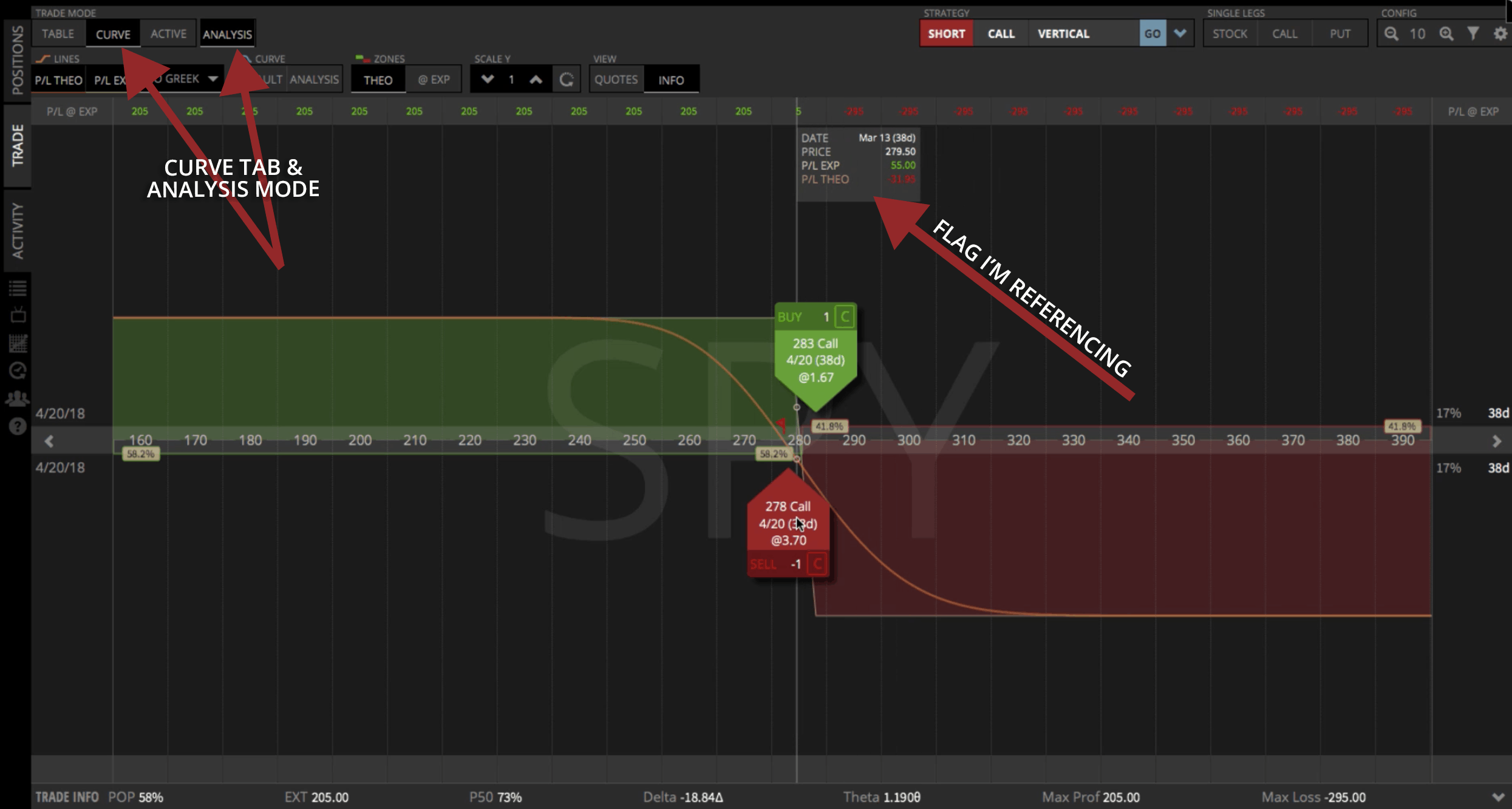

For The Visual Traders

I’m a visual trader, so I like to take it over to the “Curve” tab, making sure the “Analysis” option is selected. This will bring up a visual representation of your graph.

You can see in the green area of the graph where you’re making a profit. There’s a max profit of $206, which you can see from your trade info down at the bottom.

The flag that moves around with your cursor will also show you your P/L (profit/loss) at expiration. If you move your cursor over the red area, you can see your P/L at expiration to be -$295. $295 would be your max loss and your buying power requirement.

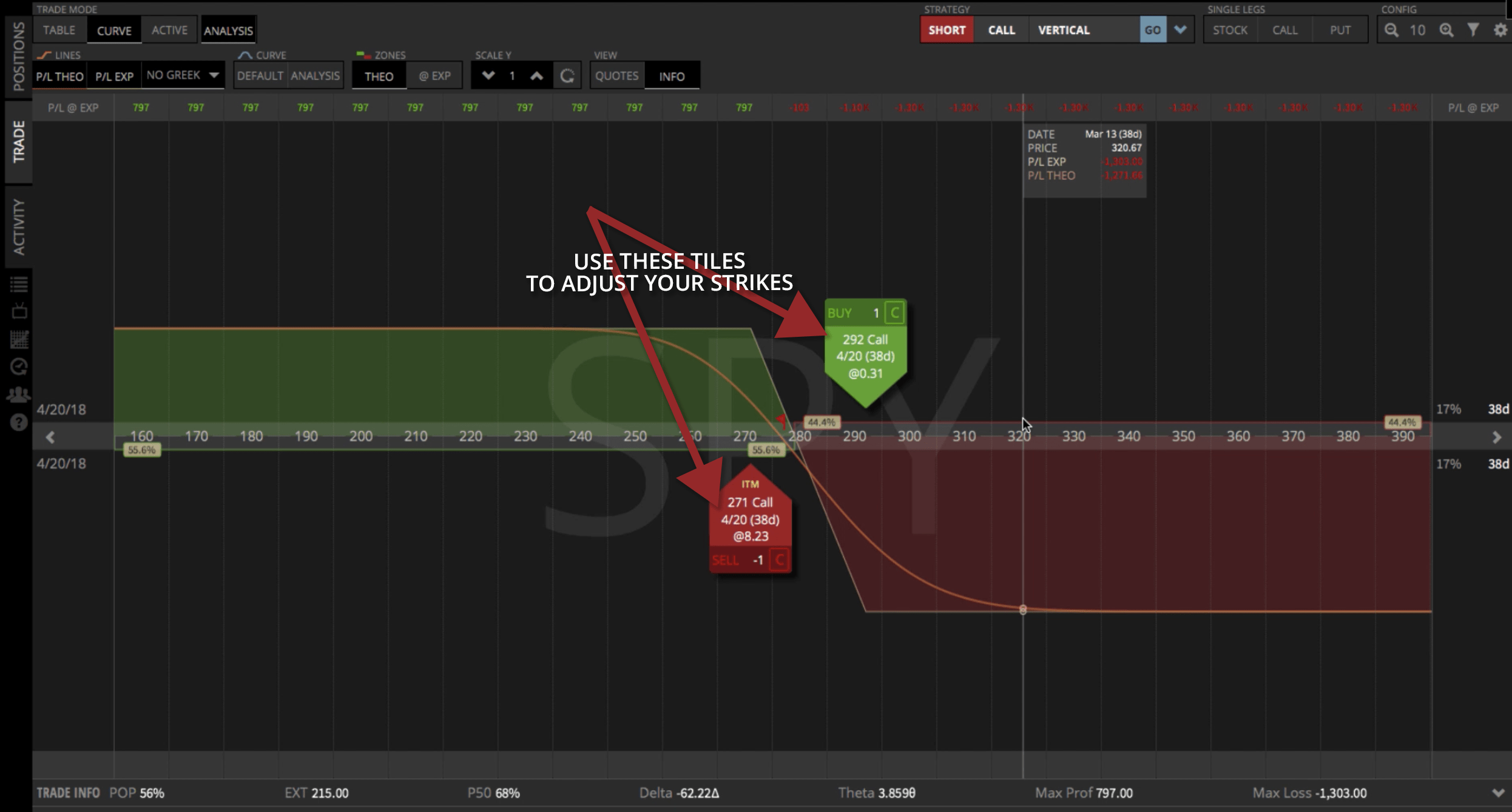

Now that you see the visual representation of your trade, you might say, “Maybe I don’t like it at five points wide. Maybe I want to widen it out”. All you would have to do is click and drag the green and red tiles.

Now the max P/L has changed to around $800 and max loss to about -$1300. By sliding these tiles back and forth, you can get an idea of exactly how you want the trade to look based on how it fits in your portfolio, and your overall assumption of the underlying symbol that you’re trading.

When you’re ready to go, just hit “Review & Send” to send it into your broker and wait to get filled.

I hope that was helpful in showing you how to trade a Short Call Vertical Spread in tastytrade!

We’ll see you in the next lesson.

Happy Trading!

tastytrade, Inc. (“tastytrade”) was previously known as tastyworks, Inc.

Follow