Hello NavigationTraders!

In this lesson, we’re going to go over the Short Call Vertical.

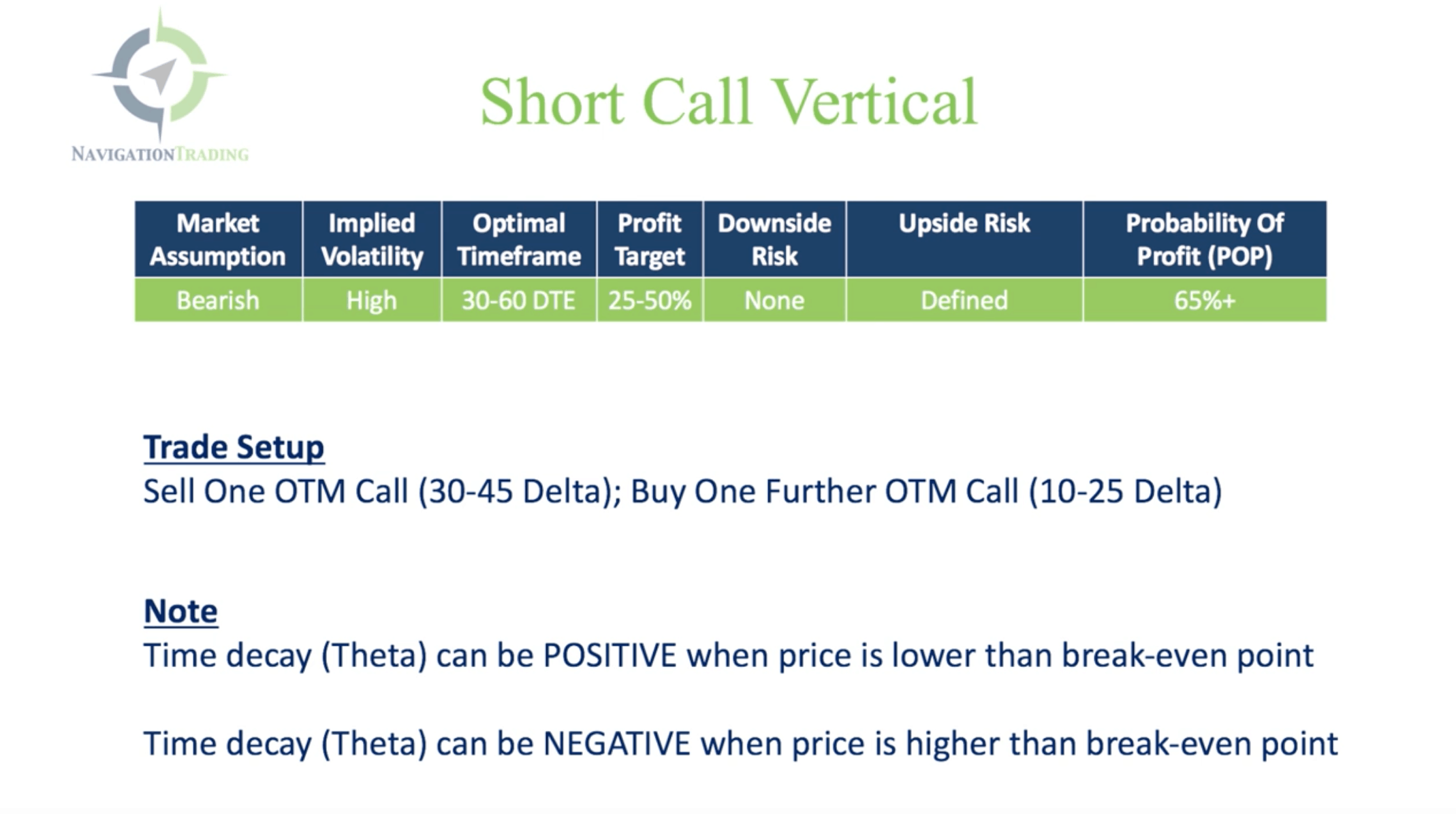

Short Call Vertical Specs

-

- This is a bearish strategy.

-

- We want to put this trade on when implied volatility is high.

-

- The optimal timeframe is between 30-60 days left to expiration.

-

- It has the same profit target of 25-50% of max profit as the Short Naked Call.

-

- There’s no downside risk because we’re making money as it goes down.

-

- The upside risk is defined. I’ll show you guys an example of that further into the lesson.

- The probability of profit is in that 65%+ range.

For our trade setup, we’re going to sell an out-of-the-money Call in that 30-45 delta range. Then we’re going to buy a further out-of-the-money Call in that 10-25 delta range.

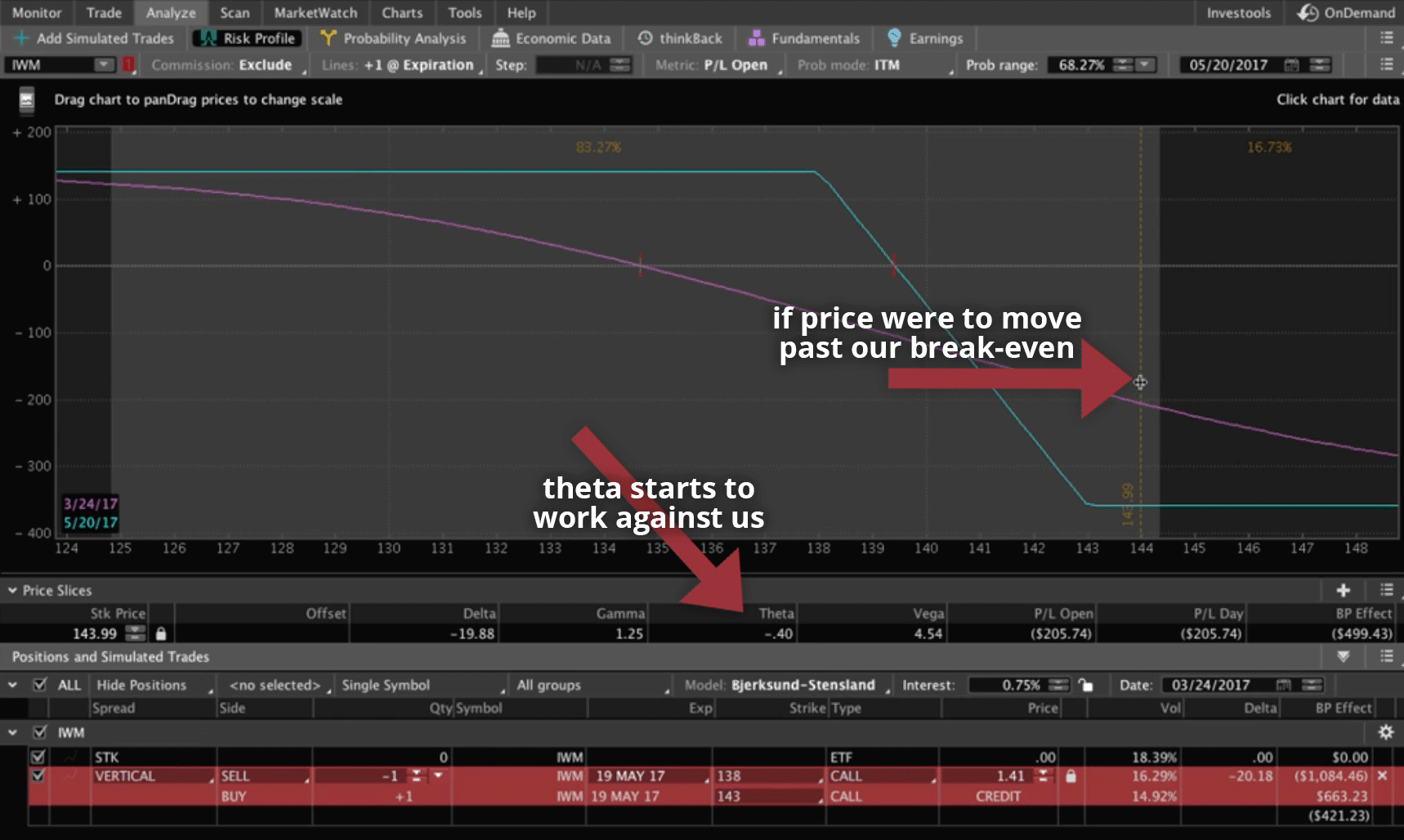

The time decay, or theta, can be positive if price is lower than your break-even and can be negative when price is higher than your break-even.

In a previous, we went over the Short Naked Call, which has UNDEFINED risk to the upside. The difference here is that the Short Call Vertical has DEFINED risk. If you’re not comfortable with that undefined risk component, or if you’re in an IRA, where Short Naked Calls are not eligible, you could do a Short Call Vertical.

When you define your risk, you give have a smaller probability of profit. That’s the main difference between the Short Call Vertical and the Short Naked Call.

As I mentioned in our past lesson on Short Naked Calls, the Short Naked Call is simply just the Call side of a Short Strangle. You can think of the Short Call Vertical as the Call side of an Iron Condor. Hopefully that helps you conceptually visualize the Short Call Vertical.

Let’s go to the platform, and I’ll explain.

Platform Example

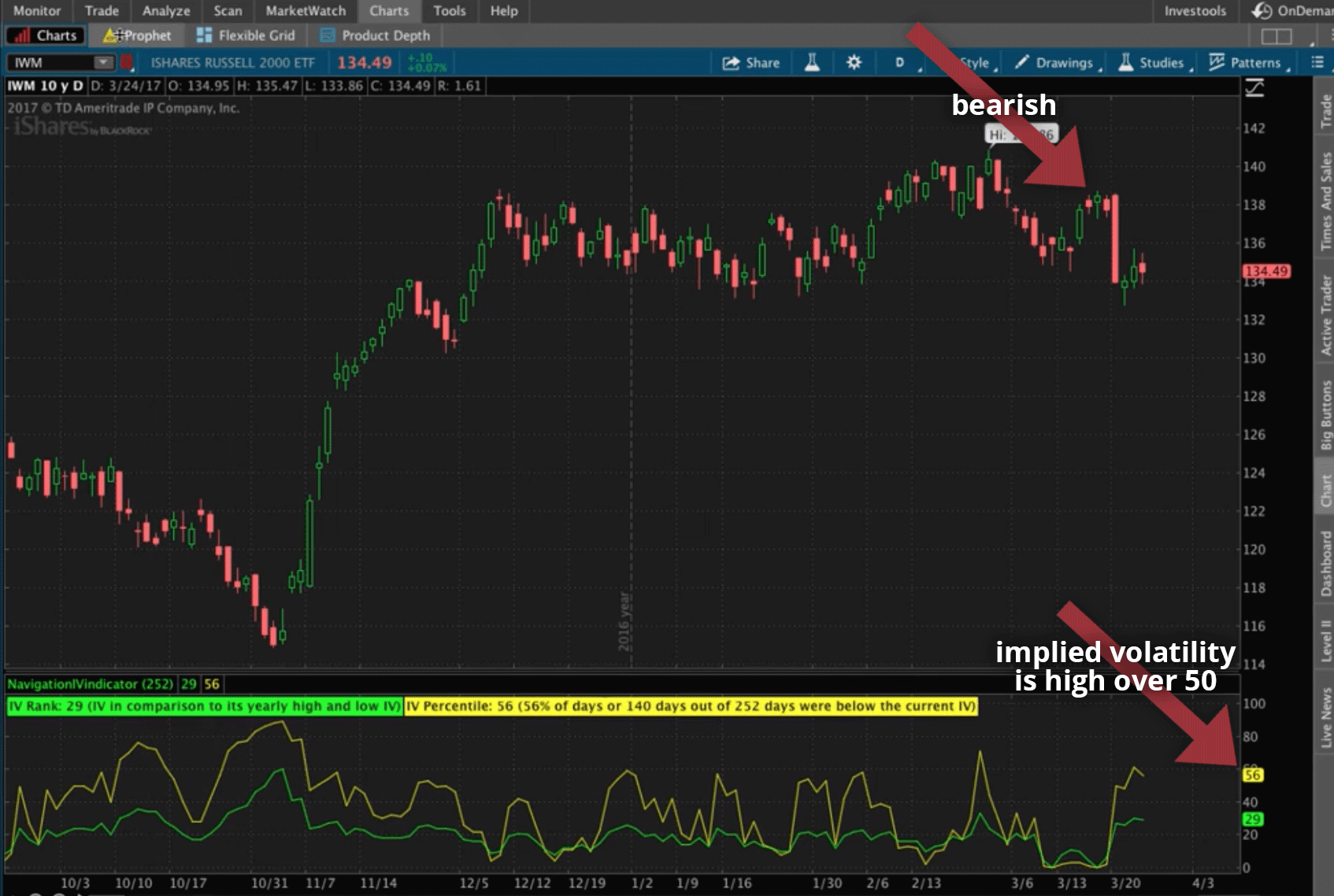

We’re looking at IWM. We’re bearish on IWM and implied volatility is high, over that 50 mark.

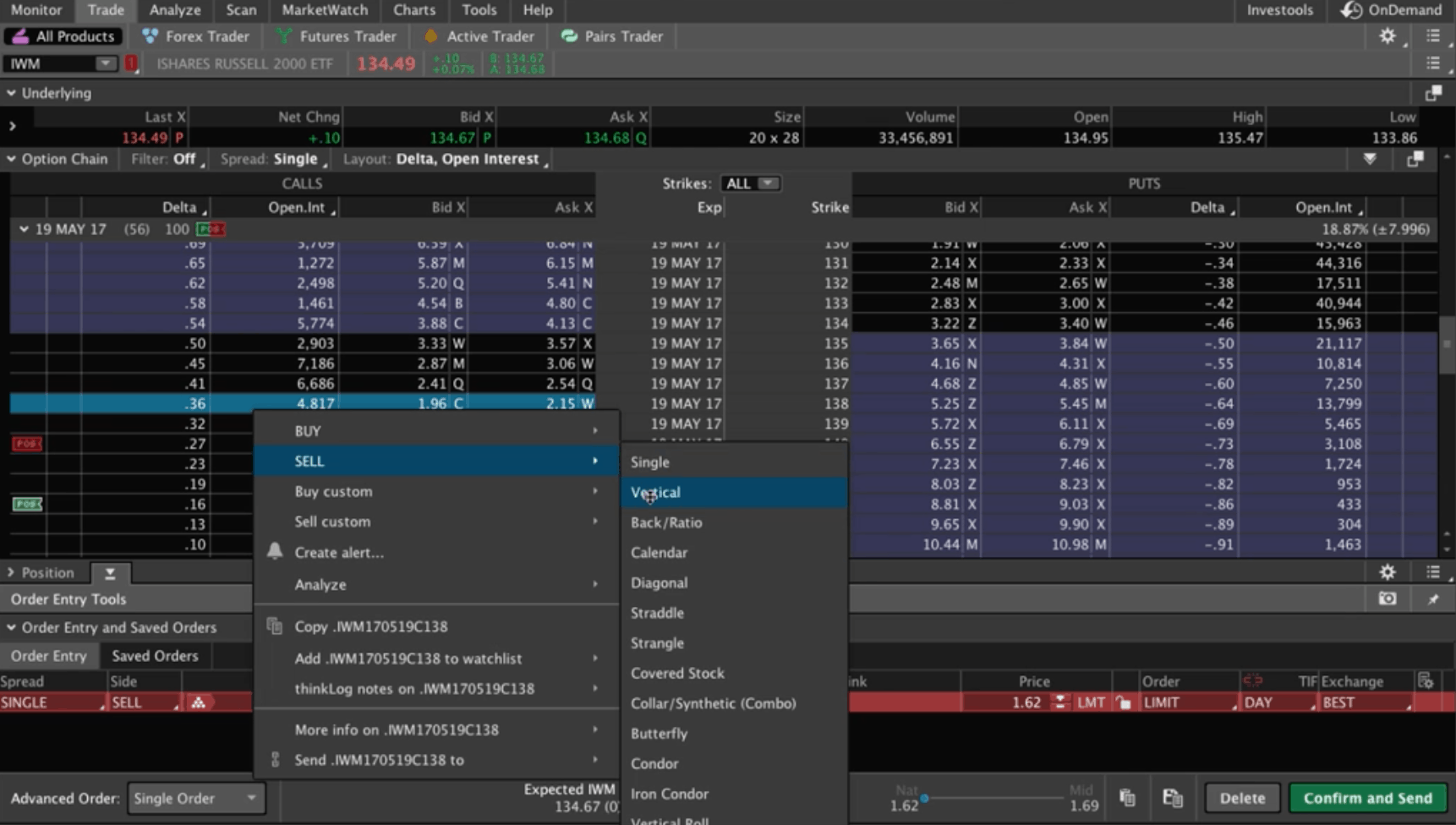

We’ll go to the Trade tab and look for a Call in that 30-45 delta range. Let’s pick one in the middle, and go with the 36 delta. All you have to do is right-click, select “SELL”, and then select “Vertical”.

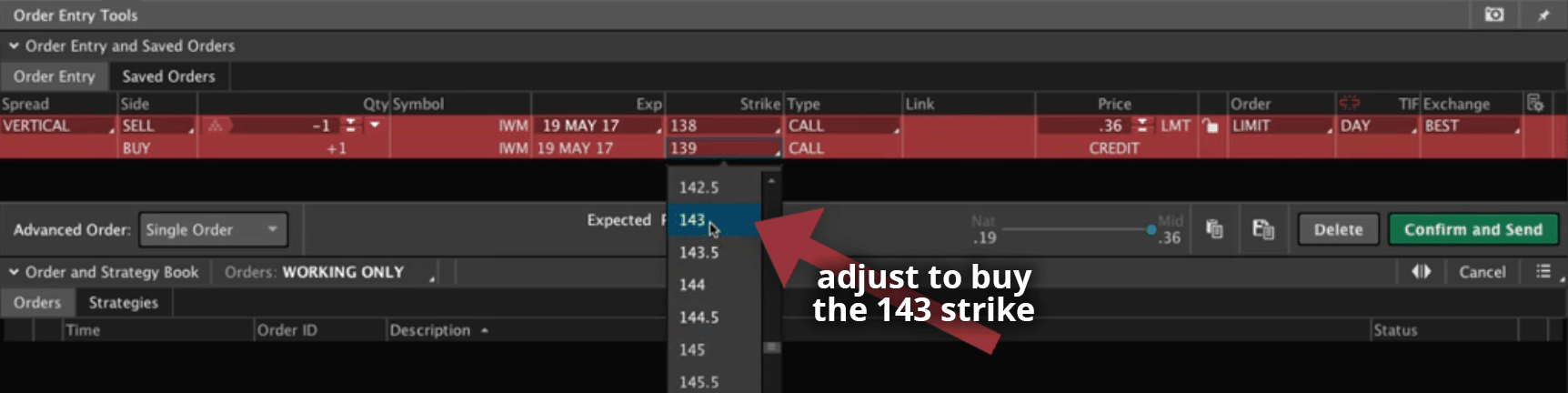

Remember, we’re selling a Call Vertical, and then we want to buy a further out-of-the-money Call, in that 10-25 delta range. Let’s just choose the 16 for the sake of this example. So, we’d be buying the 143 strike.

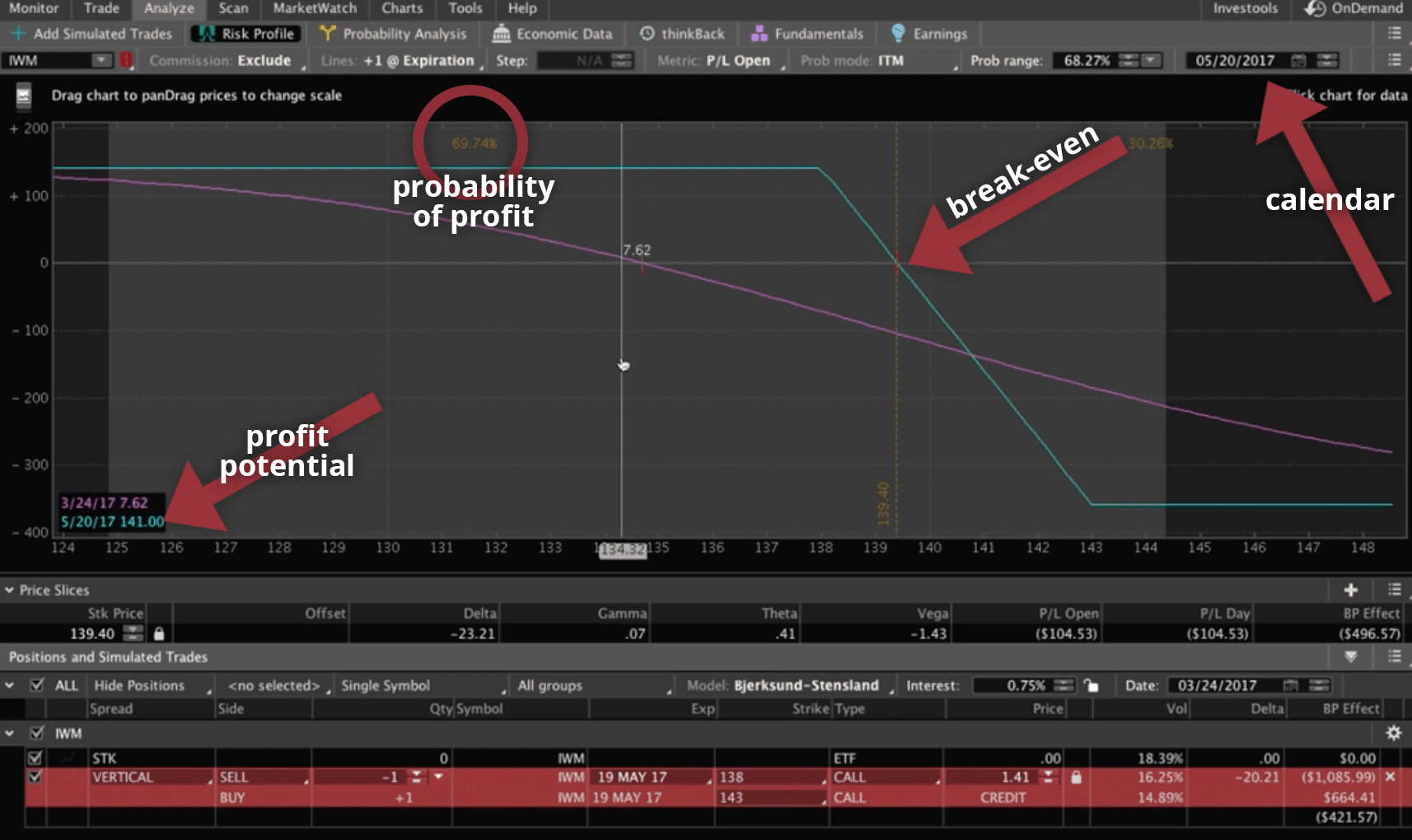

As you can see, we’re selling the 138 strike, which is closer to the money, and we’re buying the further out-of-the-money Call, which is the 143 strike.

Analyzing the Trade

If we right-click on the order, and select “Analyze trade”, a visual representation will populate. Like I was saying earlier, this looks like the Call side of an Iron Condor, which is exactly what it is.

I’ve moved our dash mark to the break-even point. I also check to make sure our calendar above the graph represents the expiration date, which is 5/20. As you can see, the probability of profit is a little over 69% on this trade between now and expiration.

We’re going to manage at that 25-50% level, which is giving us a much higher probability of success.

Our max profit, in this case, is $141, so we’re going to try to capture 25-50% of that.

Theta

At this point our theta is positive, but I want to show you what happens to theta when price moves past our break-even. From the graphic below, you can see that theta starts to go negative and work against us. Not only is it working against us from a price standpoint, but it’s working against us from the daily time decay or the theta component.

It is a bearish strategy, but if you like the idea of defined risk, or if you’re in an IRA and you can’t sell Naked Calls, you could do a Short Call Vertical instead. This is a great way to get short on an individual symbol. You can do this on futures, stocks, indexes, ETFs, or whatever you want. It’s kind of like a stock replacement with a theta component, and being able to define your risk.

I hope this lesson was helpful!

Happy Trading!

-The NavigationTrading Team

Follow