Hello NavigationTraders!

In this lesson, we’ll be reviewing how to trade Long Calls. This is a very simple strategy, where you’re essentially just buying a Call on the underlying symbol.

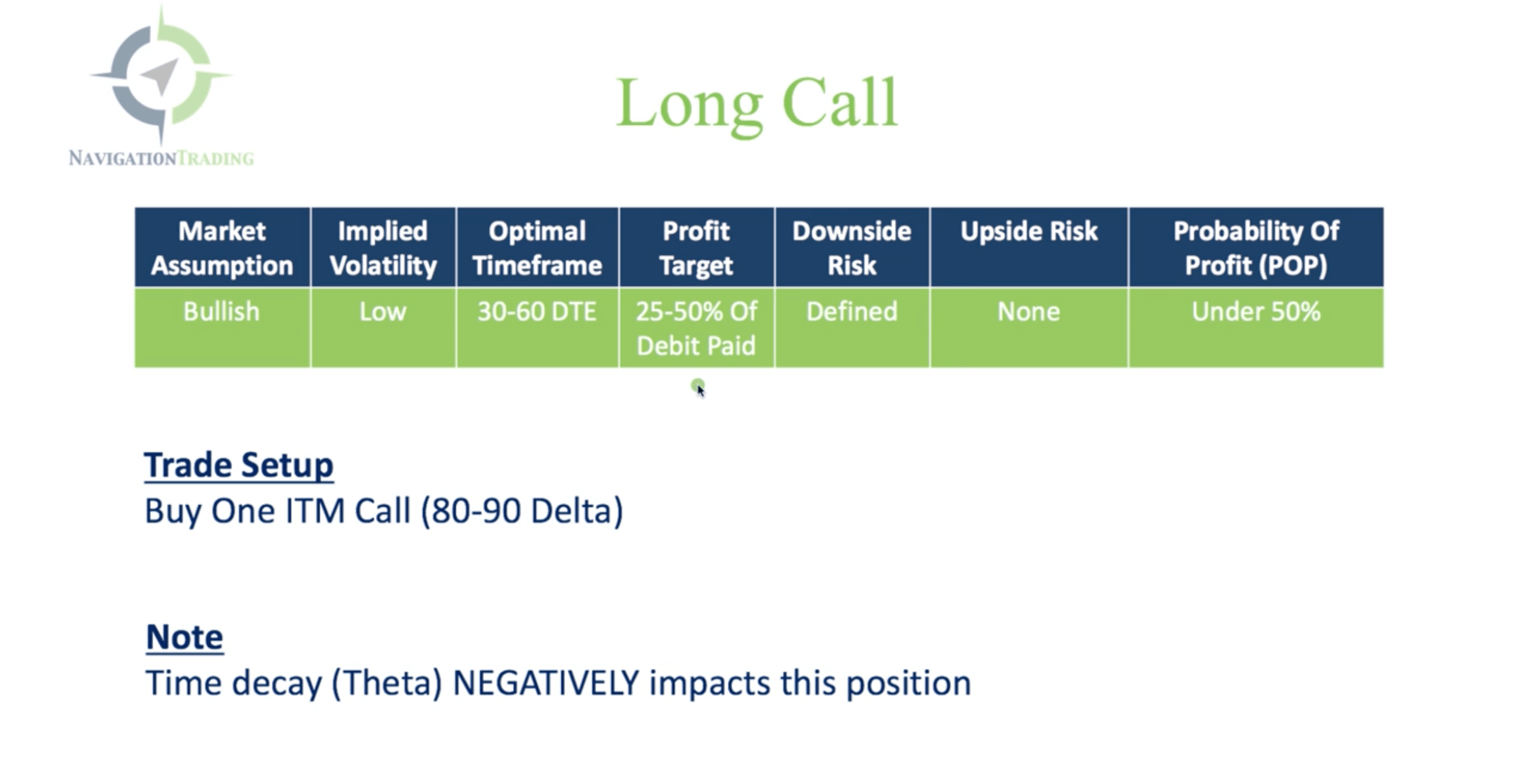

Long Call Specs

Your market assumption is bullish, so you’re hoping the stock goes up.

You want to do this when implied volatility is low (or there is an expectation of IV expansion), because an expansion in implied volatility will help your position.

Your optimal timeframe is entering between 30-60 days until expiration. Your profit target is 25-50% of what you pay for that Call.

Your downside risk is defined, so you know exactly what your risk is on the position when you put it on.

There is no upside risk. If the underlying symbol moves up, you’re going to be in the profit. That upside is undefined, so theoretically, there’s unlimited upside potential. Keep in mind, nothing is going to go up infinitely, so that’s why we manage these trades at a percentage debit paid, because we want to book that profit and then move on to the next trade.

Buying calls give you a probability of profit under 50%, which I’ll show in a platform example.

The trade setup is simple. You’re going to buy an in-the-money Call. I would strongly recommend staying away from buying out-of-the-money calls. Due to the fact that time decay, or theta, negatively impacts this position, and even more so on out-of-the-money Calls.

We want to buy in-the-money Calls in that 80-90 delta range, because that’s going to minimize that theta decay component on the trade. It’s going to act more like buying stock, and it’s not going to have that time decay working against us as much.

Platform Example

Let’s go to the platform and take a look.

SPY

I don’t typically buy Long Calls in a stock index. The reason being, if you buy a call in SPY for example, you want the market to go up. The problem is, when the market goes up, almost always, implied volatility goes down. So, it’s going to have to make a pretty significant move up for you to profit, because that time decay is working against you.

If I’m going to buy a Call in something, which I very rarely do to begin with, but if you’re going to do it, I like to do it in a commodity, for example in gold, oil, soy beans, wheat, or something like that. Because more often than a stock, when you buy a Call in one of those commodities, when that underlying symbol goes up, you also get an expansion in implied volatility, so both of those are working in your favor.

GLD

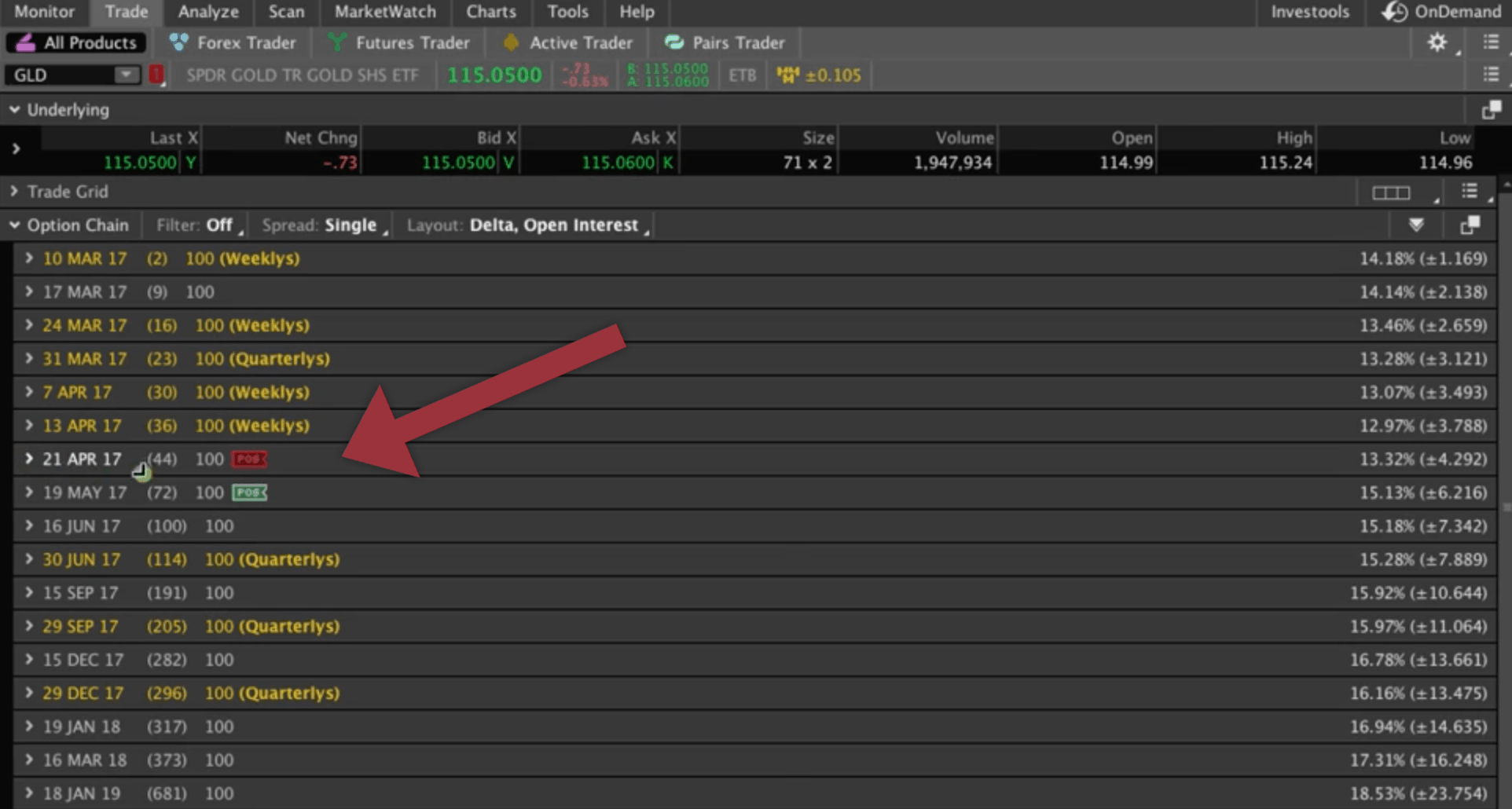

Let’s take a look at an example in GLD. Gold had a nice upward move, and now it’s price has pulled back. My assumption is that it may reverse and continue to the upside. This would be a candidate that I would look to potentially buy a Call in. You can do other strategies as well that will work nicely in GLD, but this would be a candidate you could also buy a Call on.

Let’s go to the Trade tab, and go to the option chain with 44 days to expiration.

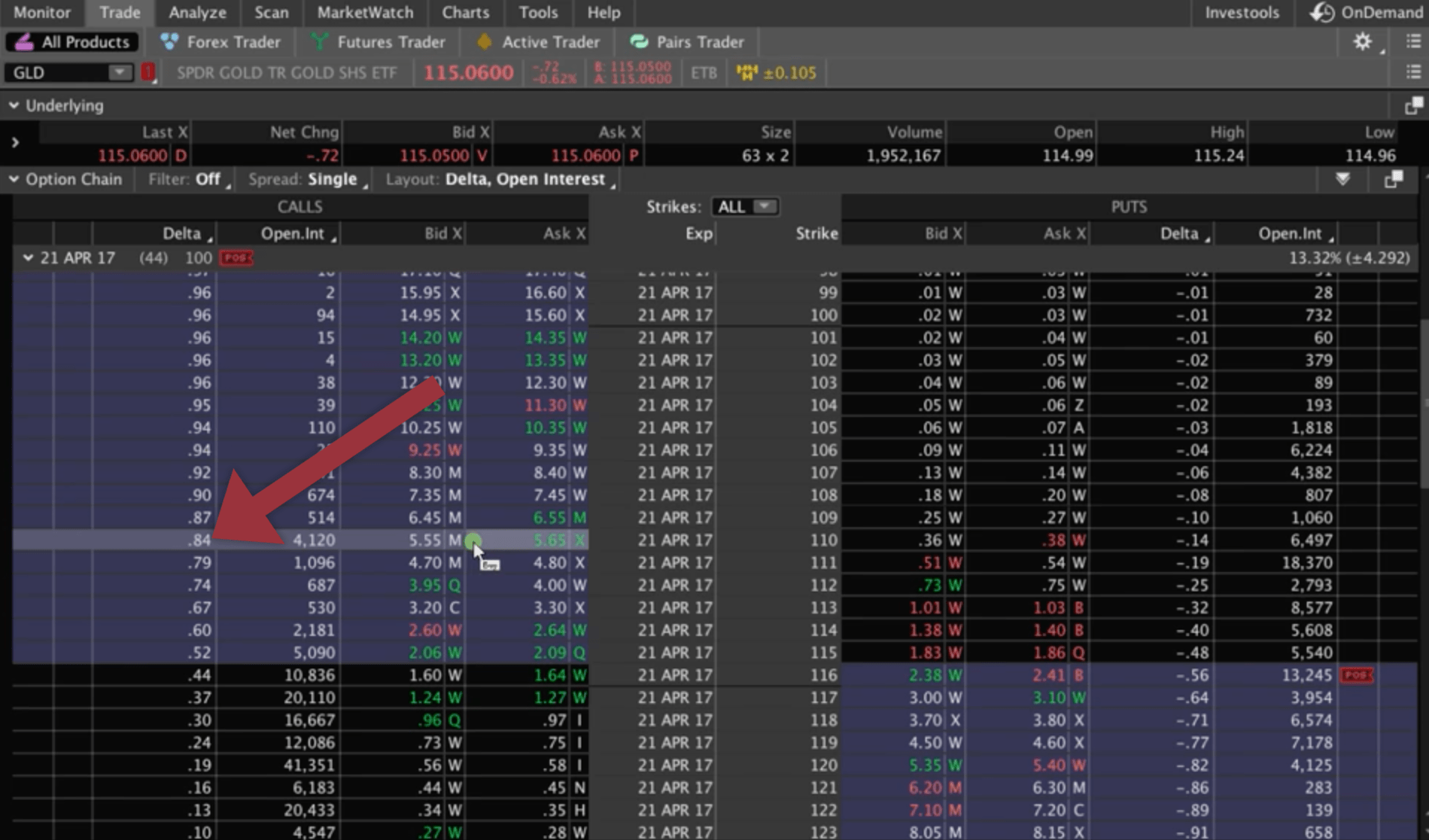

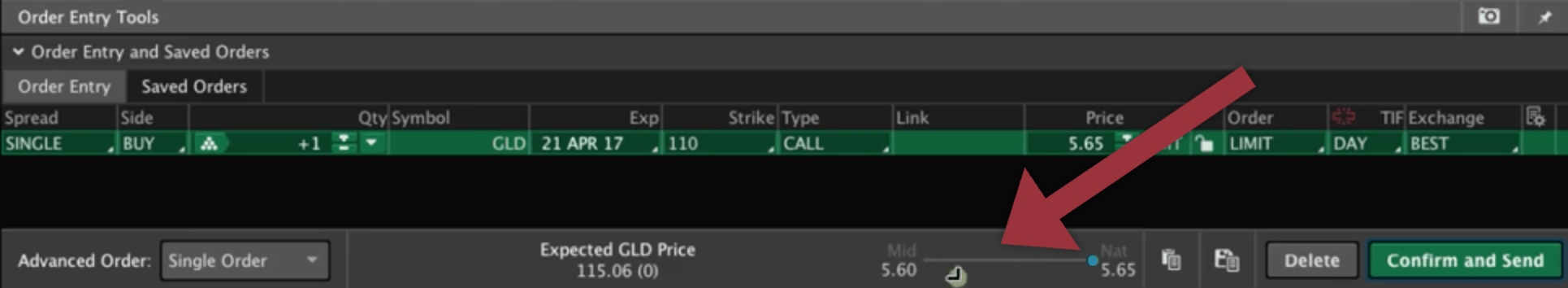

Then, like I mentioned earlier, we want to buy a deep in-the-money Call. The Call side is over on the left. If you look at the delta column, you’ve got .80, .84, .87, and .90. Somewhere in that range would be the one that I would buy. Let’s just go in the middle, and pick the .84 delta. The bid is at $5.55 and the ask is at $5.65. We’d probably get filled somewhere around $5.60.

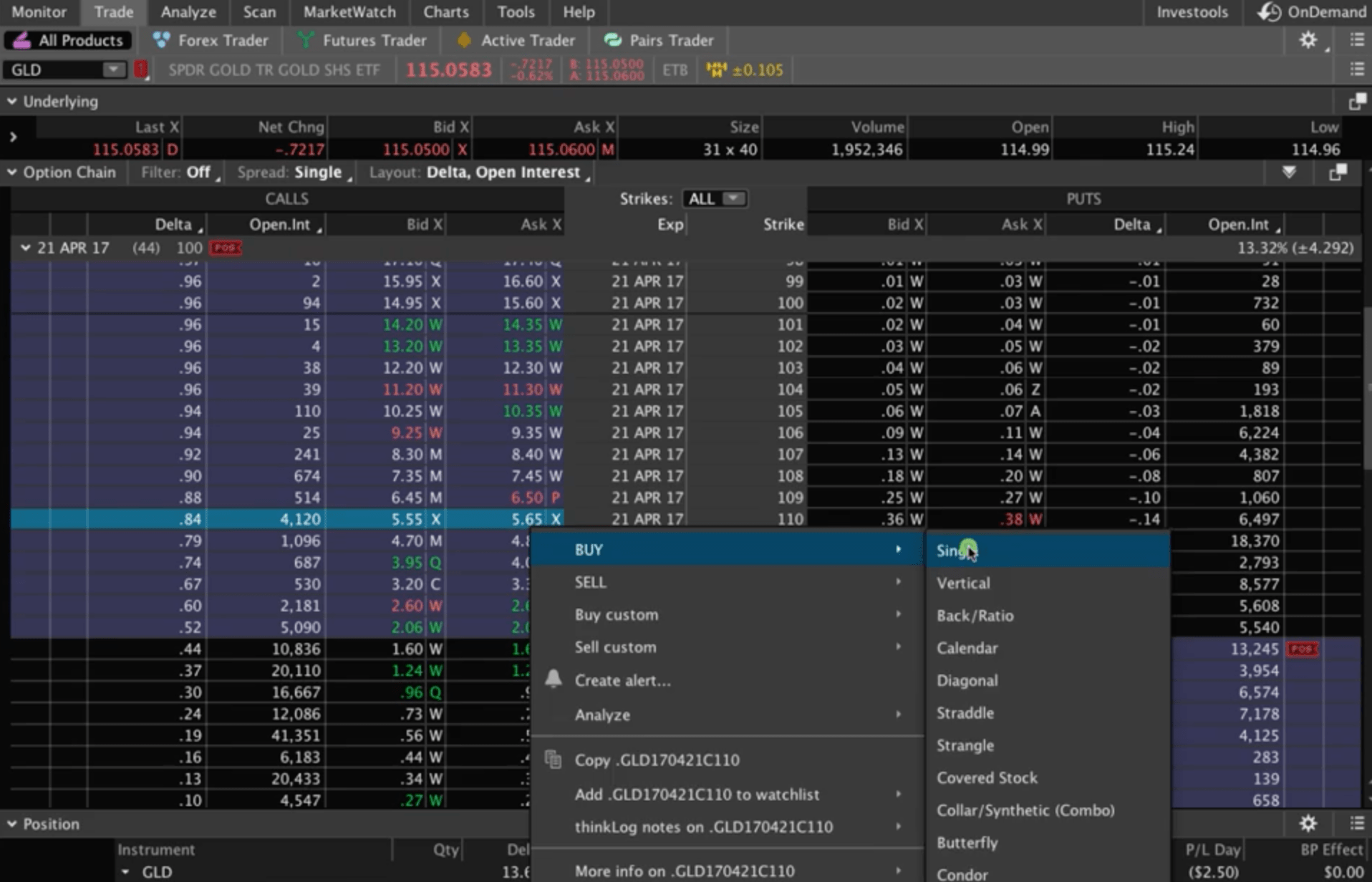

Now just right-click on that Call, select “BUY”, and then select “Single”.

That’s going to populate down in the Order Entry Tools area.

Analyzing The Trade

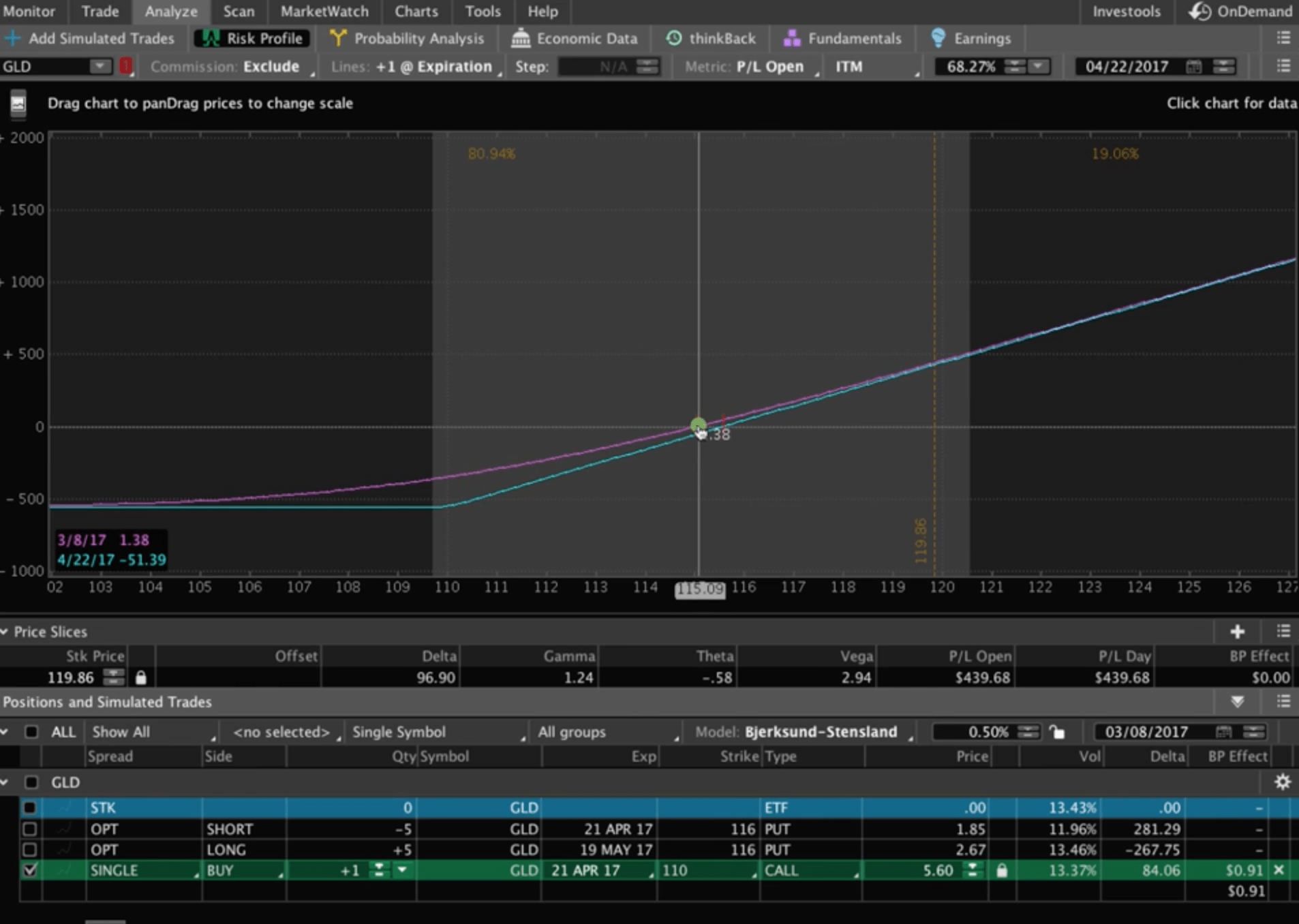

In-the-Money

You can see from the graph where price is. Look at the difference between the teal line, which is your expiration, and the purple line, which represents today. There’s not a whole lot of difference between those two at your entry. This just means the theta decay, or the time decay is very minimal as far as it working against you.

If price just stayed right where it’s at, between now and expiration, theoretically you could lose around $55. The max you can lose is that debit you paid of $560.

Out-of-the-Money

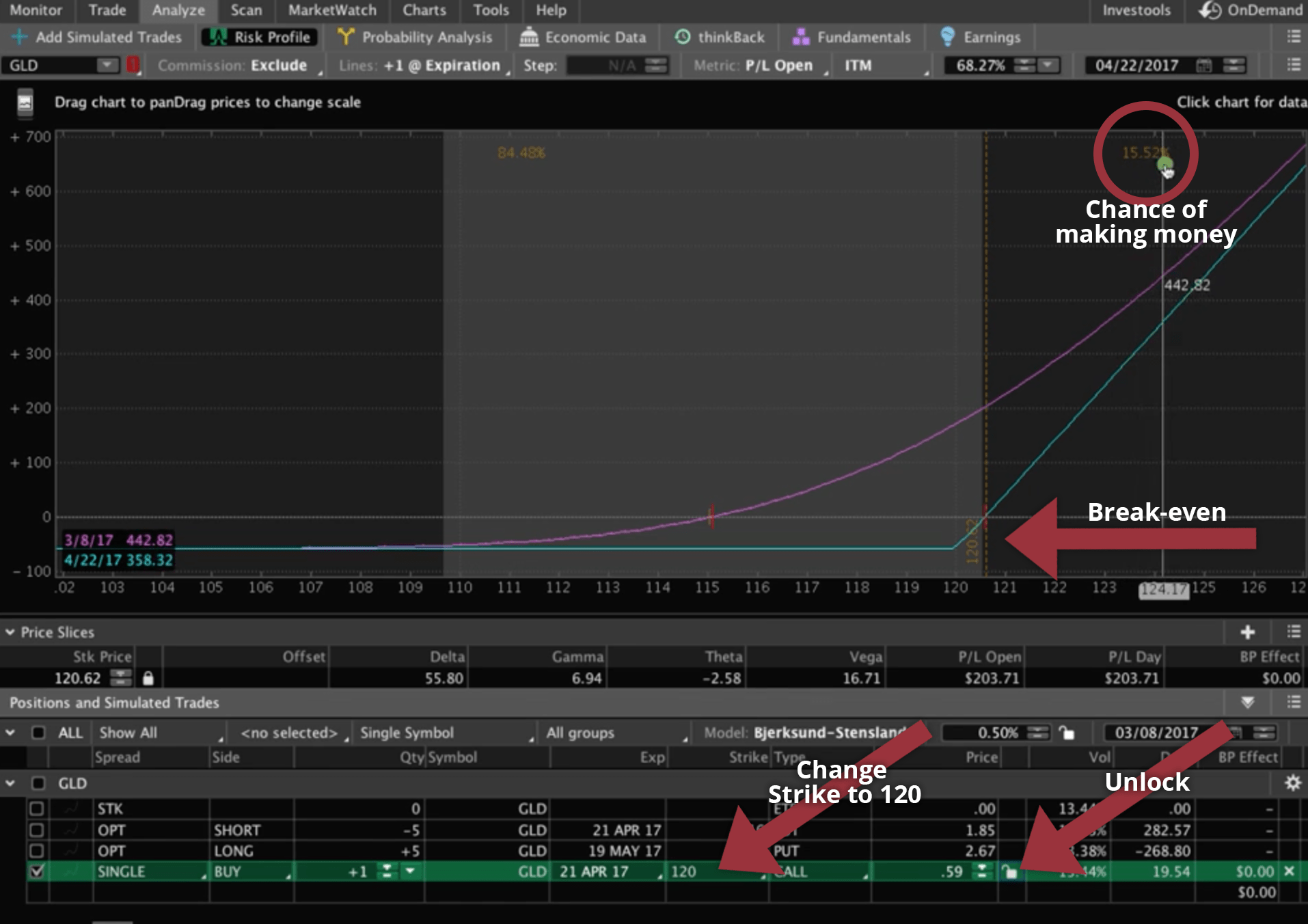

Sometimes it’s tempting to say, “Well, why would I pay $5.60 for this, when I could do one of these cheaper options, and do something out-of-the money, like the 120 strike, and only pay .56 cents?”.

Let’s take it to the Analyze tab. If you change your strike from the 110 to 120, and look at that out-of-the-money call (make sure you unlock the little lock icon), this is what the risk profile graph will look like.

Look at the difference between the in-of-the-money strike to the out-of-the-money strike. If price stays where it is, or trades all the way up to that $120 break-even line in GLD, but nothing above that, you’re going to lose the full $59. You’re paying .59 cents for this, so it has to trade all the way up past $120 at expiration for you to make money.

If it does that upward move quicker, you can make money, but the probabilities are working against you. You only have a 15.5% chance of making money on that trade if you buy an out-of-the-money Call. That’s the reason why you buy these in-the-money Calls, the probabilities are much higher for you.

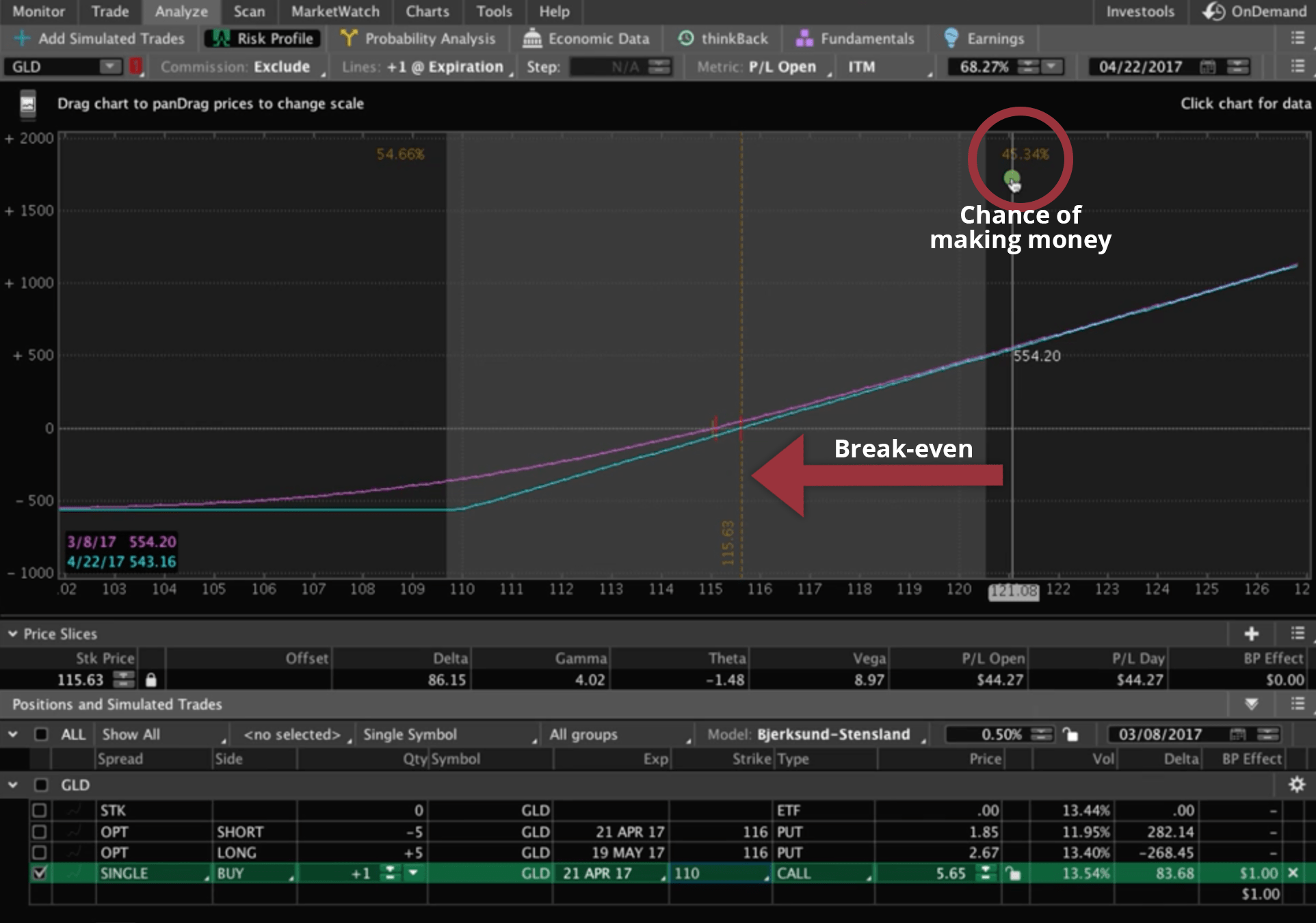

Going back to the in-the-money Call on the Analyze tab, If you move that hash mark to the break-even point, now you’ve got over a 45% chance of making a profit, and you don’t have that time decay, that theta decay working against you.

It’s still under a 50/50 probability on this trade, but again, if you can get a quick move to the upside, you could bank a quick profit.

We’re trying to manage this so that we take this off at 25-50% of the debit paid. If the total risk, or debit paid is $560, we’re going to take this off when we have a profit of somewhere around $250. All it has to do is move about a $1.75 for us to bank that profit at 50%. It would be even less if we bank at 25% of max profit.

That’s how you trade a Long Call. To fill that order, just right click, and select “Confirm and send”.

I hope this lesson has been helpful!

Happy Trading!

-The NavigationTrading Team

Follow