Hello NavigationTraders!

In this tutorial, I want to show you how to enter a Long Call Vertical Spread.

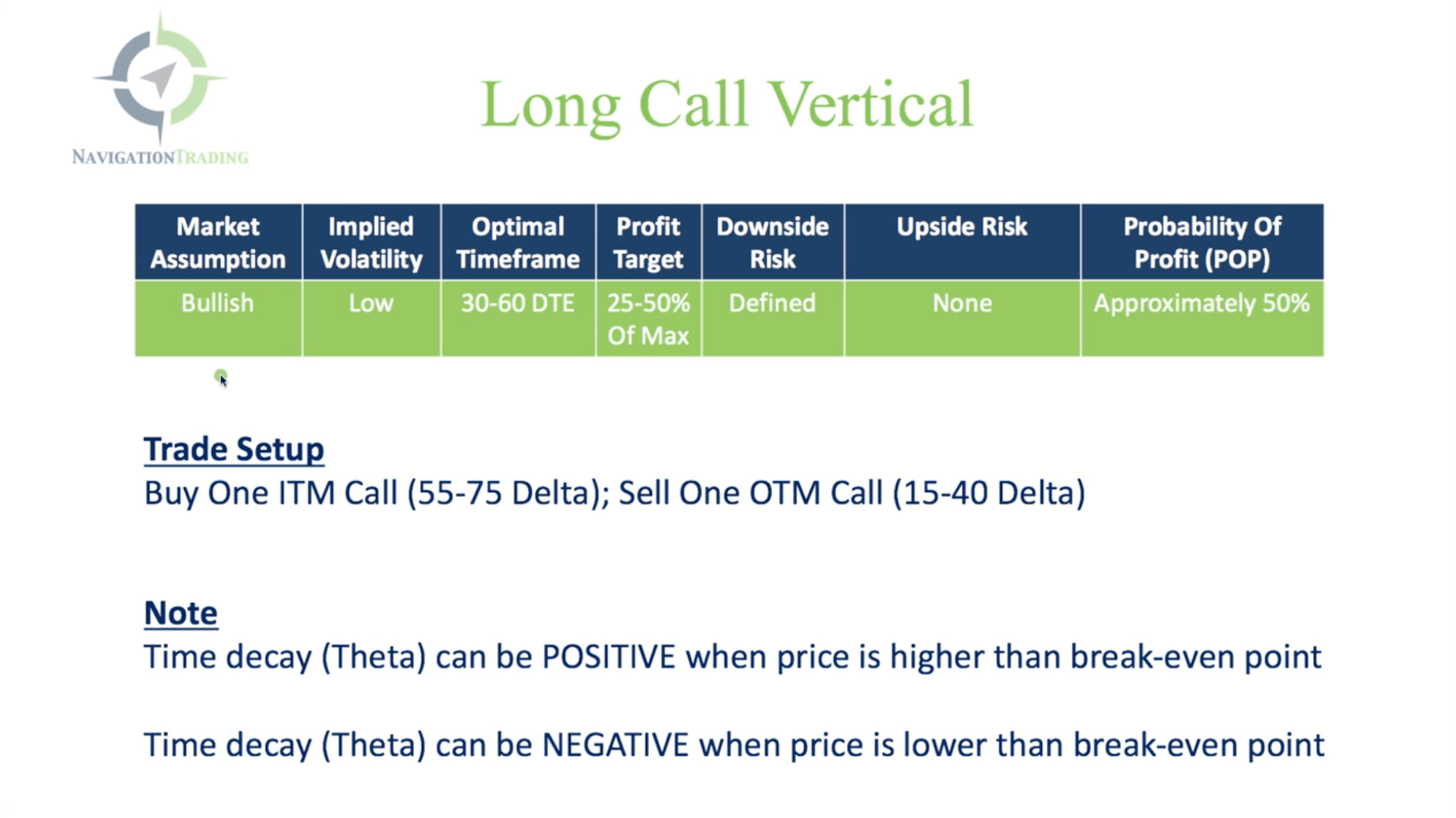

Long Call Vertical Specs

-

- Our market assumption when we put on this trade is bullish, meaning we want the stock to go up.

- It’s best to put these on when implied volatility is lowThe optimal time frame to put on a Long Call Vertical is 30-60 days to expiration, just like most of our trades.

- We’re looking for a profit target of about 25-50% of max profit. We want to manage this trade, and we don’t want to wait until it goes to expiration. We want to manage it at a percentage of max profit.

- The downside risk is defined. We’ll know exactly what that is when we put the trade on.

- This is bullish, so there’s no risk to the upside. It’s only profit to the upside.

- The probability of profit on these trades is about 50 percent.

These are purely directional trades. You’re not gaining the high winning percentage like you are on some of our other strategies. However, you can use this trade if you have a strong directional assumption that you think the stock is going to go up.

You can also think of it as a stock replacement. Instead of putting up a ton of capital to buy the stock, you can simply get in the trade for a lower amount of buying power reduction by using this strategy.

For the trade setup, we’re going to buy one in-the-money Call, anywhere in the 55 to 75 delta range works well. And then we’re going to sell one out-of-the-money Call in that 15-40 delta range.

We really want these strikes to be equal distance away from where price is currently trading. We’ll get into that on the platform and I’ll show you what I mean.

Theta can be positive if price is higher than the break-even point. And theta can be negative when price is lower than the break-even point. I’ll also show you what I mean by that on the platform as well.

Platform Example

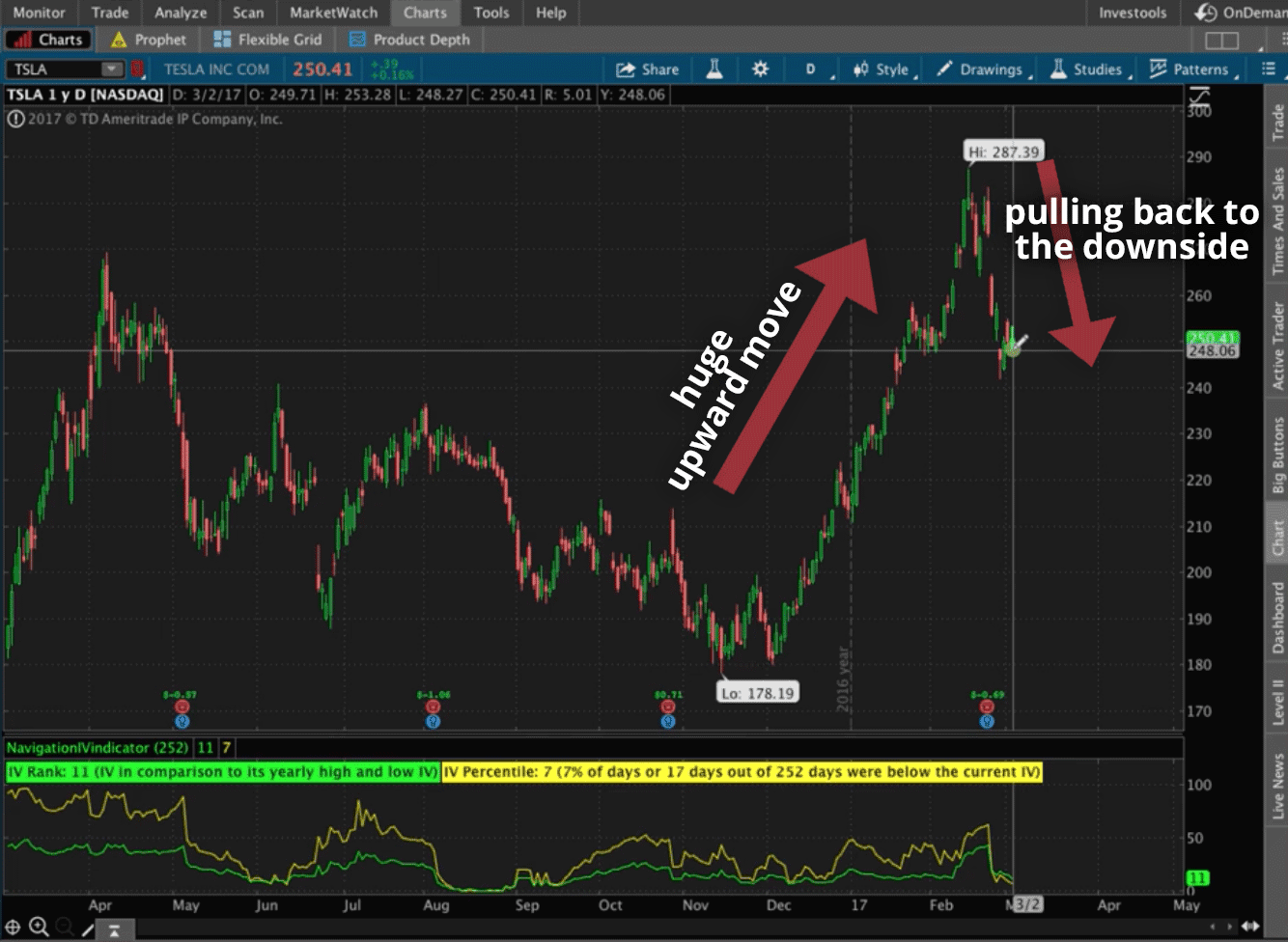

Let’s go to the thinkorswim platform and take a look at an example. The example we’ll look at is Tesla. As you can see, Tesla had a huge upward move and now it’s since pulled back. That will happen sometimes when stocks make huge runs like that. The stock takes “a breather” and traders need to take profits. The stock may not be done running to the upside, especially when it was so strong.

It could also very well keep going to the downside. There’s nothing to say that it can’t. But to me, this looks like a good entry point. After a strong stock, makes a little bit of a pullback, a lot of times it’ll continue on to the upside.

What the trade is basically saying, is that sometime between now and expiration, price is going to trade a little bit higher. That would be a good bang for our buck. There’s no other technical analysis, no trend lines, support, resistance or those types of things that only work about half the time. We don’t use those at NavigationTrading. This is really about just adding this position to our portfolio.

The other reason I like this trade, is because I want some long delta in our portfolio. I want some bullish directional exposure. And so, this is a good stock to choose potentially.

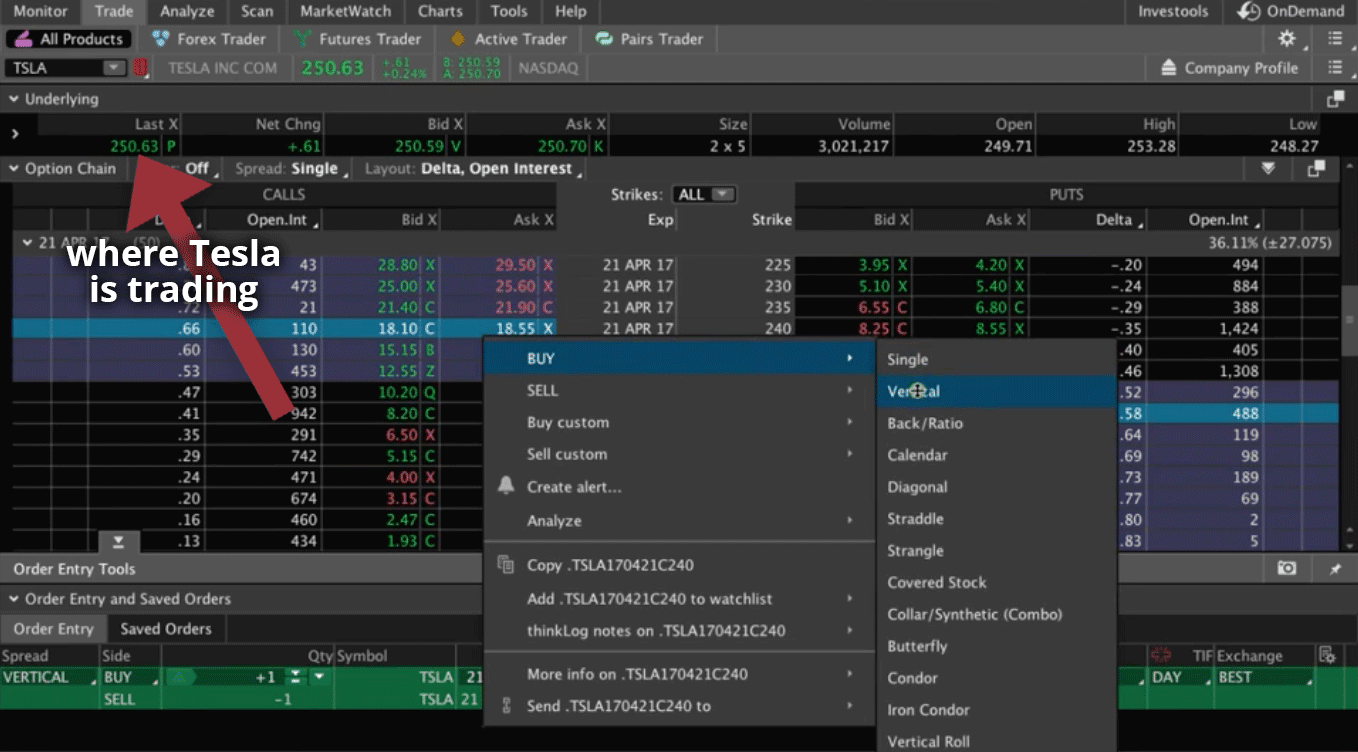

Let’s look at the Trade tab.

We’re looking at the Call side on the right. Price is currently trading at about $250. We want strikes that are an equal distance away that are in-the-money, and equal distance away that are out-of-the-money. If it’s trading at $250, let’s look at the 240 and the 260 strikes. That would be 10 points away on either side.

You’d right-click the 240 strike and select “BUY”, and then select “Vertical”.

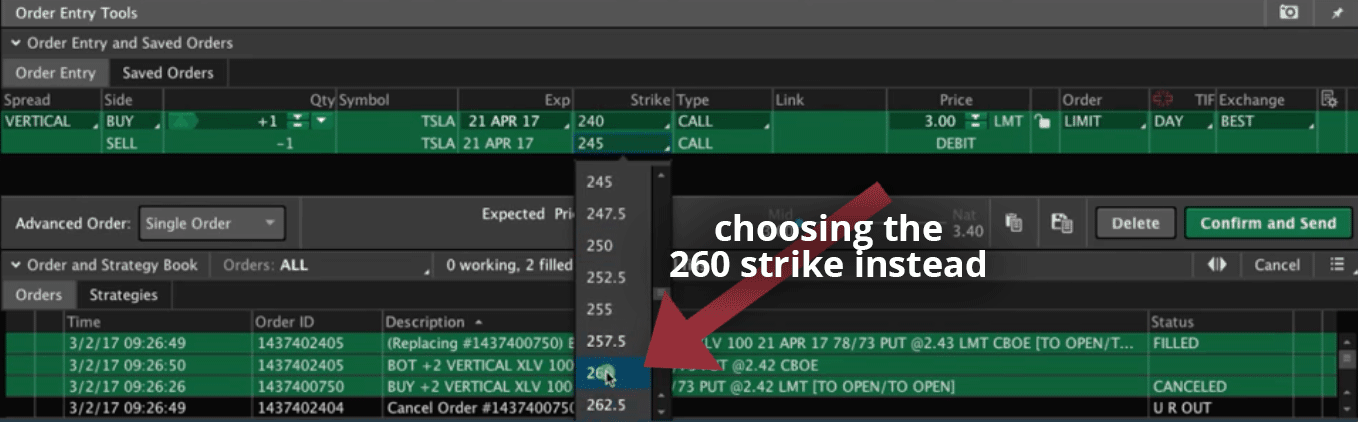

This isn’t so definitive. I could do the 245 and the 255 strike if I wanted to. Once you’ve analyzed the trade, then you can make a better determination of which exact strikes you want to be in. Really the key up front, is just making sure that you are an equal distance away to the downside, and an equal distance away to the upside. We’ve chosen the 240 and 260 strikes, so let’s right-click and select “Analyze trade”.

Analyzing the Trade

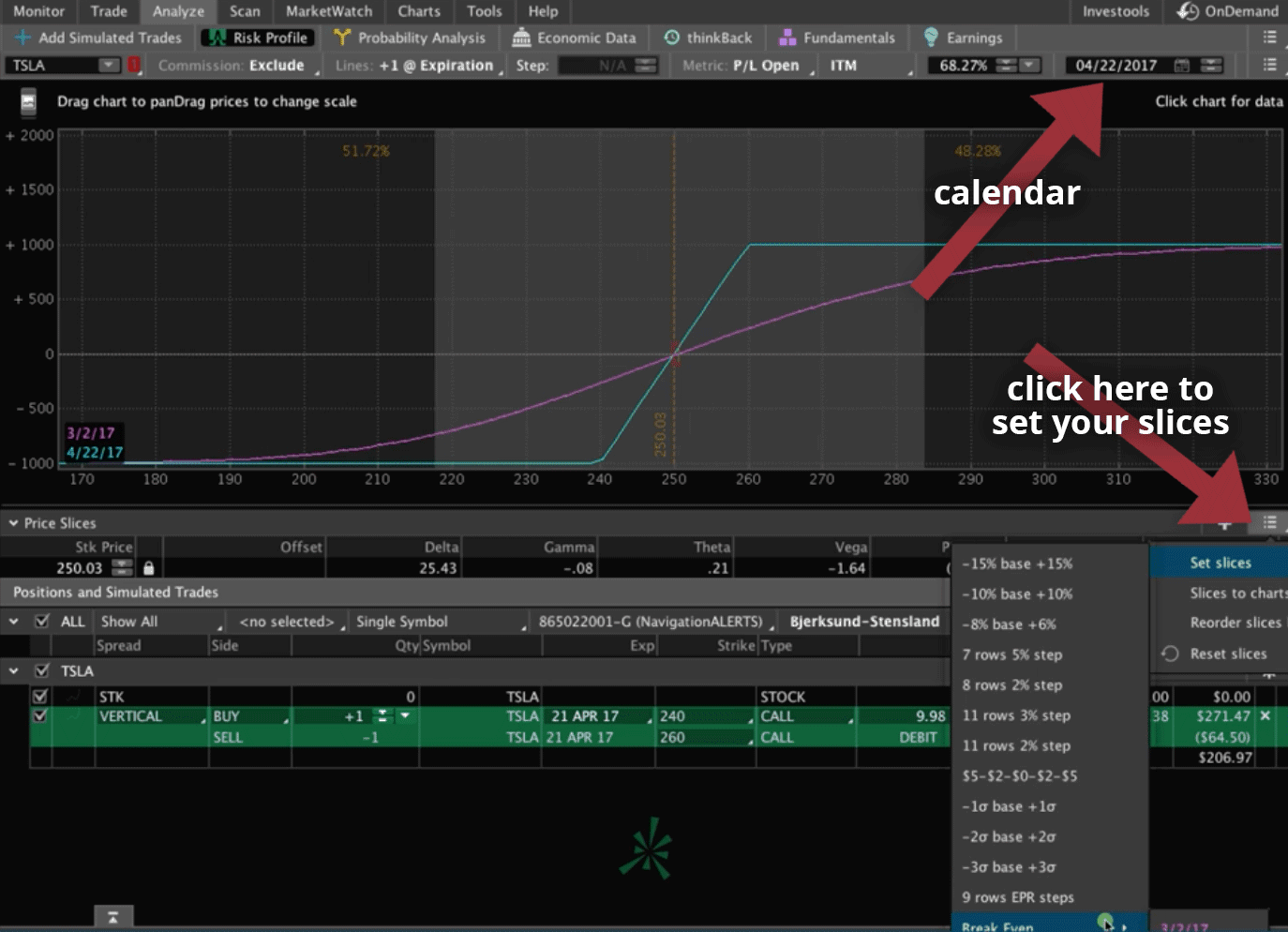

The first thing we like to do is set our price slices to the break-even point.

Then, make sure our calendar matches the expiration date. In this case, 4/22/17.

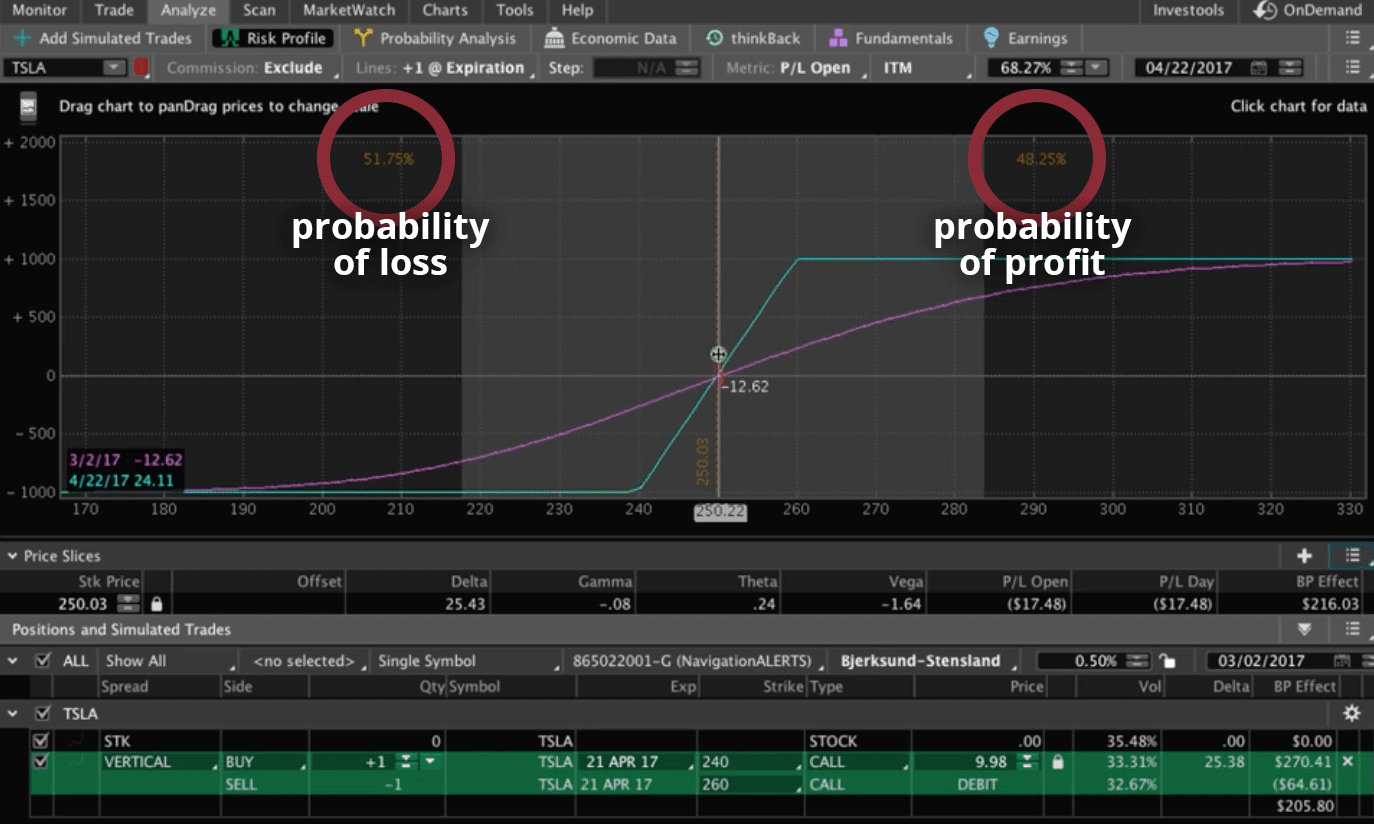

You can see the probability of profit is around 50%, and the probability of loss is around 50%. Our max loss with just one contract is $998, and our max profit is a little over $1,000. It’s pretty much a 50/50 bet. We’re hoping that the stock goes up and we can capture that for a percentage of max profit.

Theta

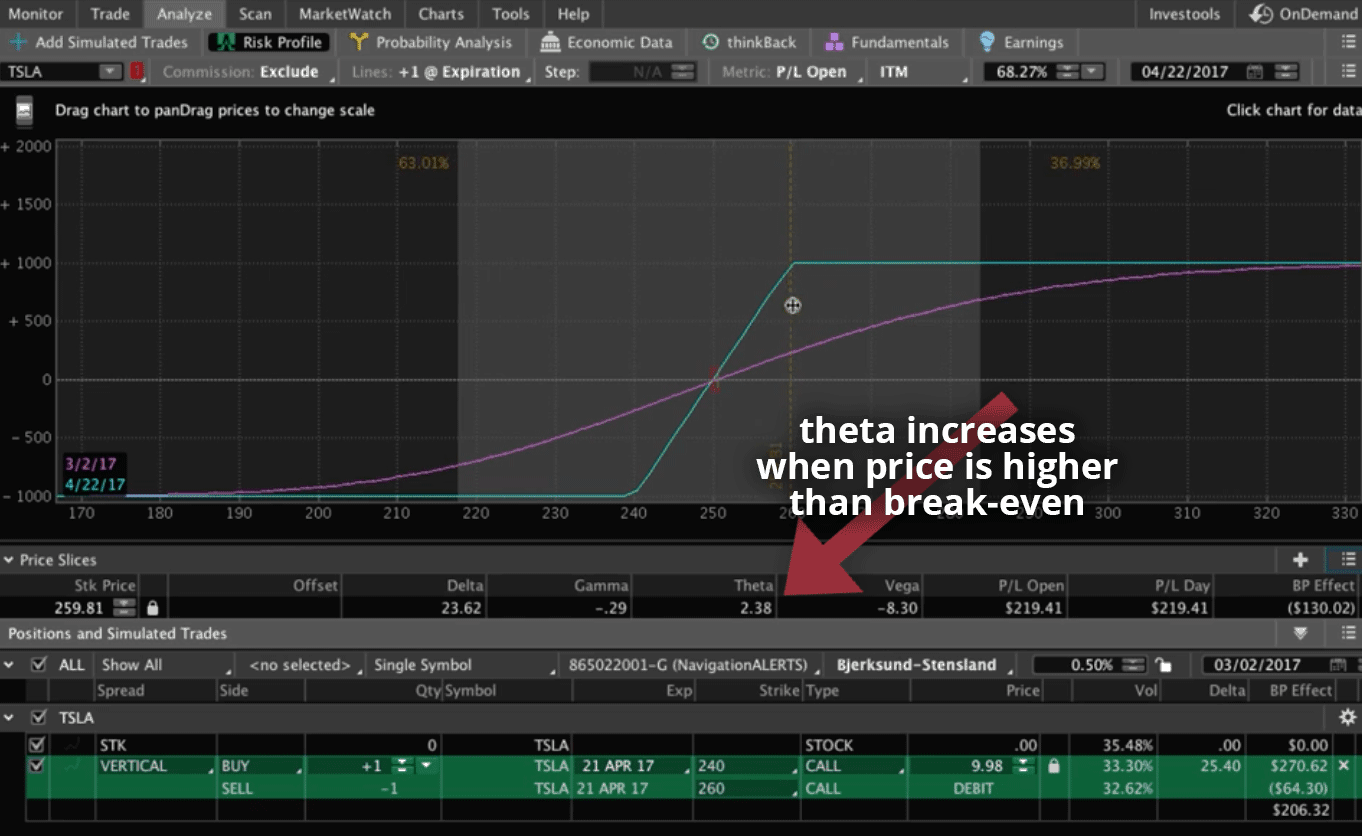

The other thing I want to mention, is that theta can be positive when price is higher than the break-even.

If we click and drag the hash mark off to the right, watch the theta number. It will start going positive. Meaning every day that price is above our break-even, we’ll be collecting that theta. So theta is working in our favor, just like in Iron Condor or a Strangle, or any of our other income strategies.

If price moves down below the break-even, you’ll see that theta gets negative, because then theta is working against us at that point.

Theta will be positive if you’re winning in the trade. It will be negative if you’re losing. So that’s really important just so you understand how it works in conjunction with all of your other positions. You always want to be net positive theta in your overall portfolio, so that you’re earning income as the options get closer to expiration.

Placing the Trade

Let’s go ahead and place the trade. I like to click the little lock box in the order, just to see where the current price is trading because the market is open.

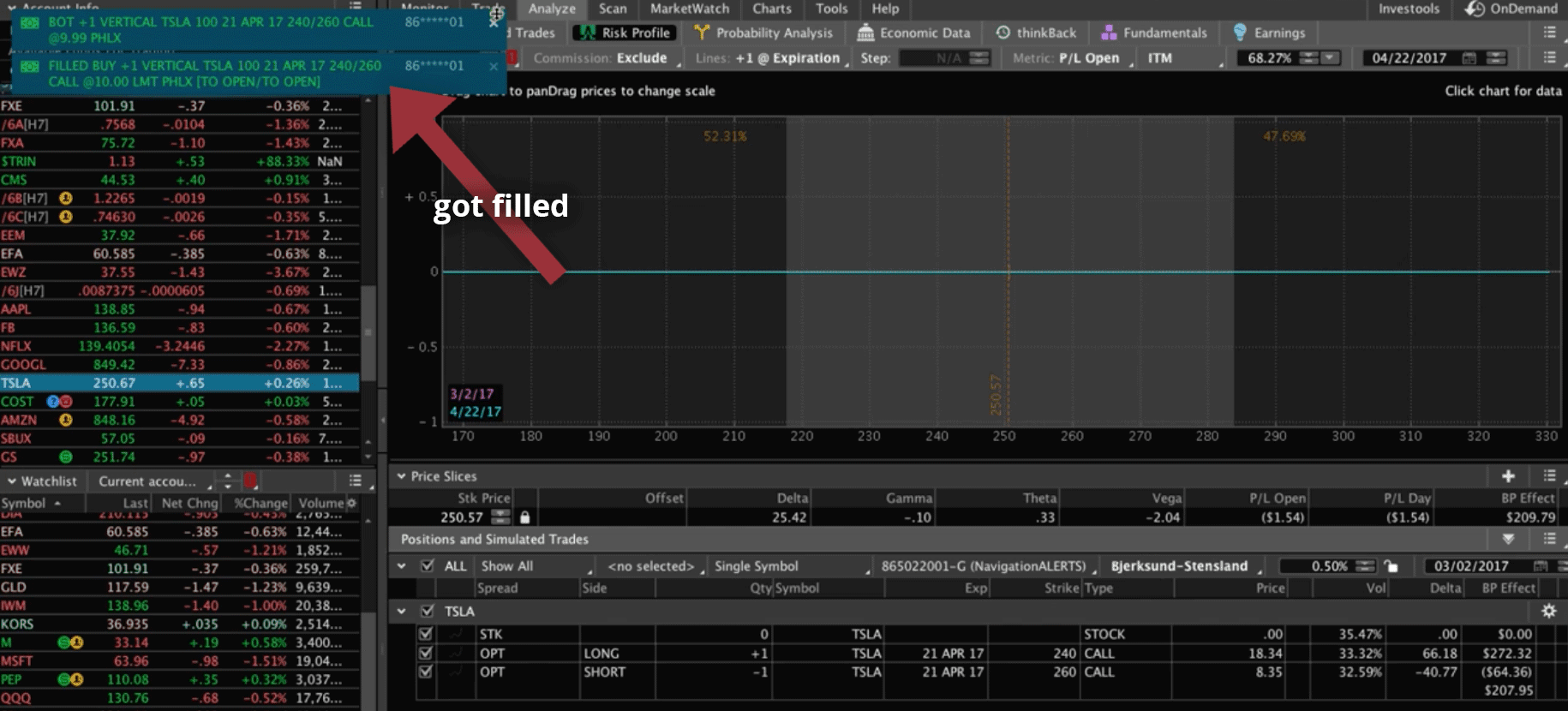

Then simply right-click our order, select “Confirm and send”, and then select “Send”.

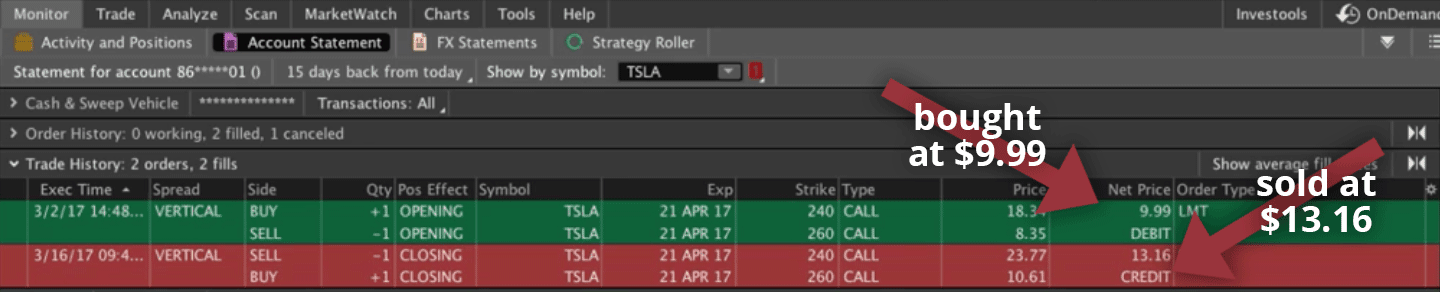

We got filled at $9.99.

Now we’re in the trade and we will wait to see if we can get an upward move in Tesla. If we do, we’ll manage it for a percentage of max profit. If it goes against us, we’re going to take the loss that it gives us. With defined risk trades there, we don’t really adjust them. We really need to be comfortable with the amount of risk that we have in the trade.

I’m comfortable losing $999 on this trade if Tesla goes against me, and that’s the mindset you need to have with defined risk trades. Because of transaction costs and other things, it doesn’t really make sense to do any adjusting strategy. We’re looking at this as simply a win or lose trade.

Closing a Long Call Vertical

Remember, we put on a Long Call Vertical in Tesla because we had a bullish assumption and implied volatility was low. We entered it with between 30 and 60 days left to expiration. Our profit target was between 25-50% of max profit. Downside risk was defined, so we knew exactly what our risk was when we put the trade on. And on the upside, obviously there was no risk because we’re making profit as the stock moves up. With a Long Call Vertical, it’s about a 50% probability of profit.

We trade Long Call Verticals when we’re looking for that directional position, and we’re looking at it to add long delta to our portfolio, or if we just have an assumption that that stock is going to move up. Let’s go to the platform and take a look.

We entered this trade on March 2nd. It’s now March 16th, so 14 days later.

If we take a look at the charts, you’ll see where I entered the trade. Tesla had a huge move up, then a bit of a pullback, and we were looking for a little bit of a continuation to the upside. There’s no technical reason to do this. I didn’t magically say at this point it’s going to reverse.

Based on some other positions in our portfolio, we were looking for some long positions. A lot of times after a huge movement and then the little pullback, a stock will continue on its way to the upside. And so that’s what we were looking for in this trade. And that’s what happened.

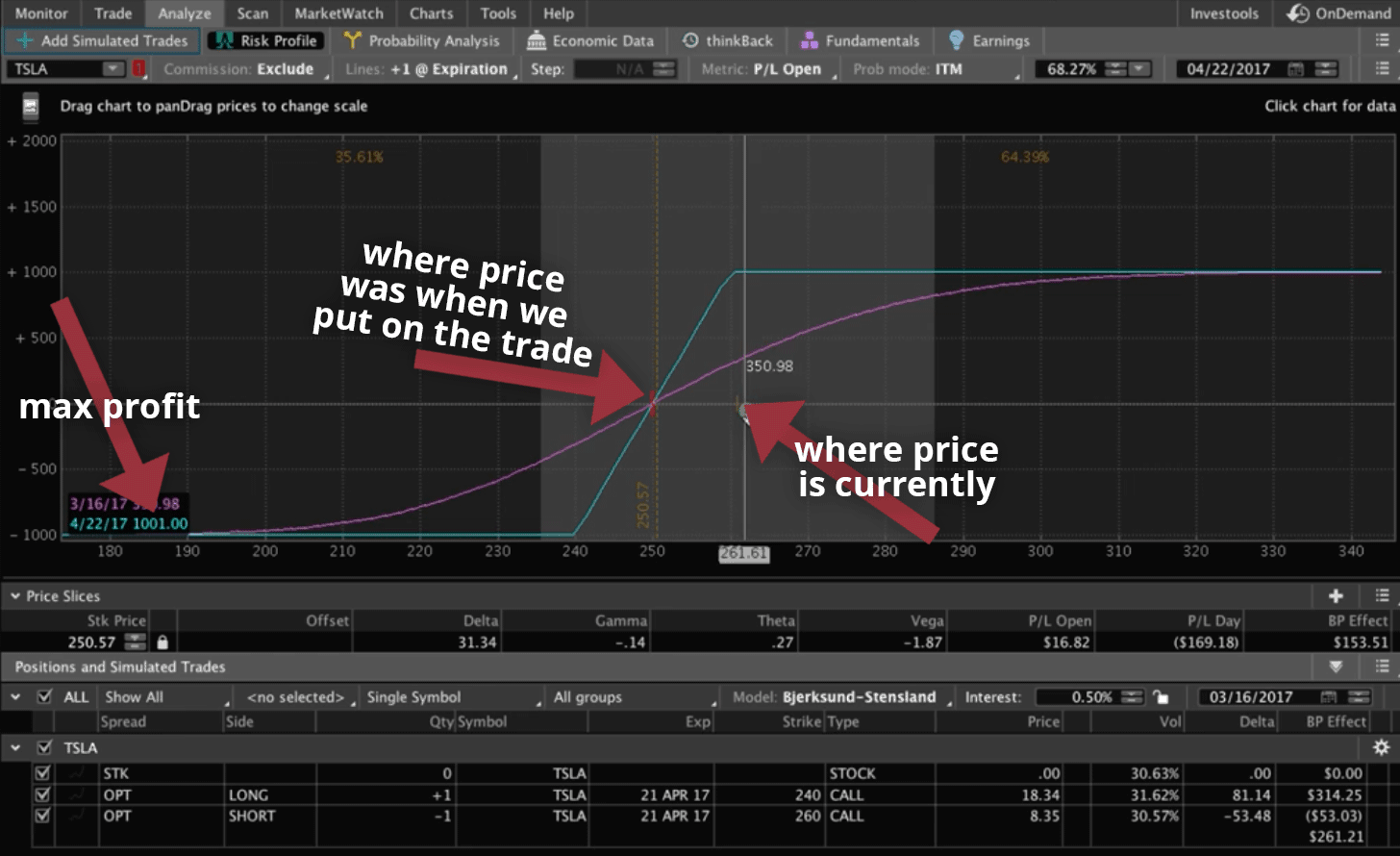

If we take a look at our Analyze tab, you can see where we’re at in the trade. From the graphic below, you can see where price was when we started, and where it’s moved since then. Our max profit is about $1,000.

We want to make anywhere from $250-$500 on this trade. That’s 25-50% of max profit. We’re at a profit of about $323. So that’s about a little over 32% of max profit. This is a good time to take this trade off. We’ll bank this profit, and we’ll redeploy that capital into another trade.

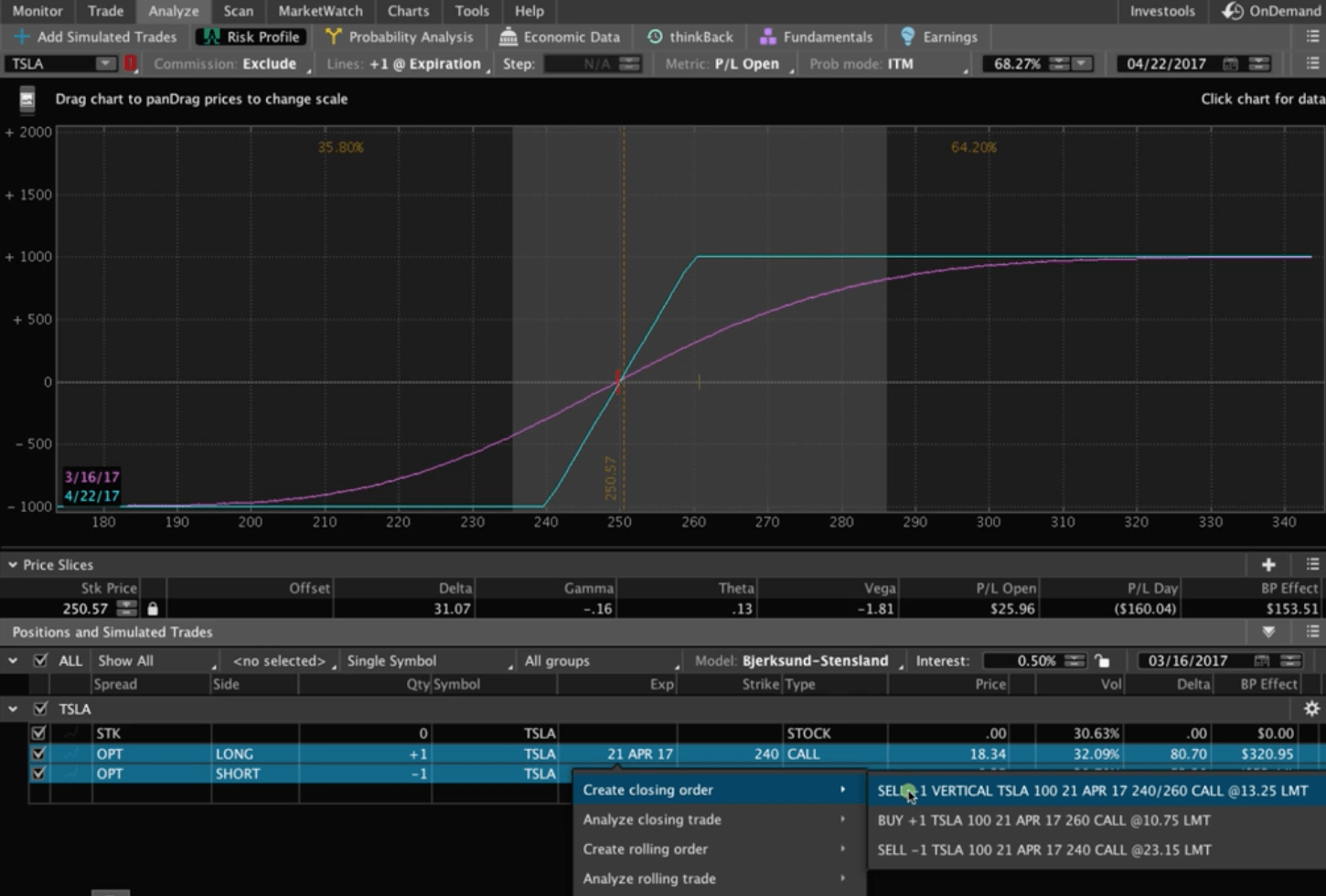

To close the trade, it’s really simple. You would click on the top Call row, push down your shift key, and highlight the entire position. Then right-click and select “create closing order”, and then we’re going to sell the call vertical because we bought it to enter. We’re going to sell it to exit.

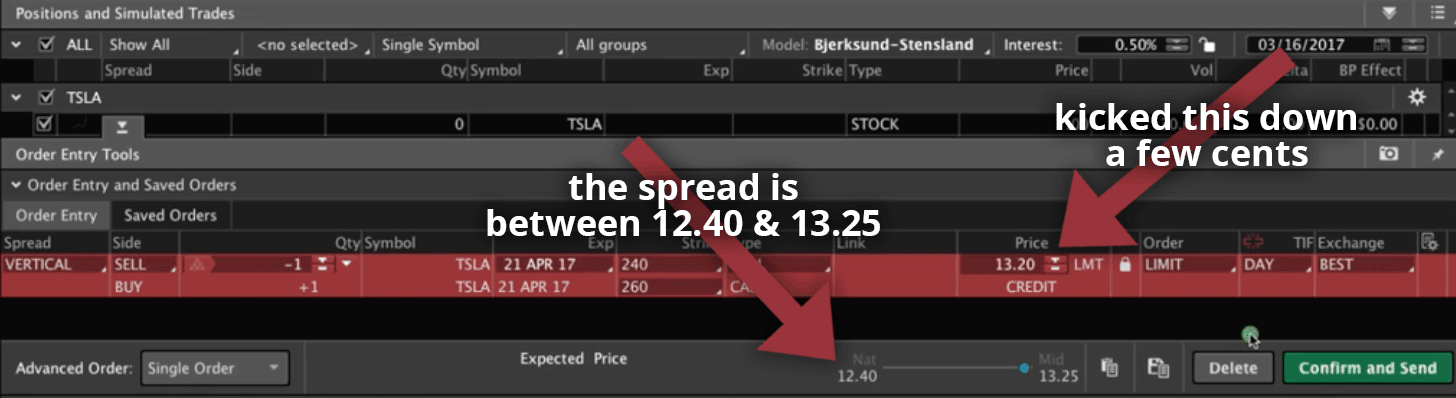

Your order queue will pop up. The spread is between 12.40 and 13.25, so we probably won’t get filled right at mid-price. Let’s kick this down a few cents. Hit “confirm and send”, and see if we can get filled at that point.

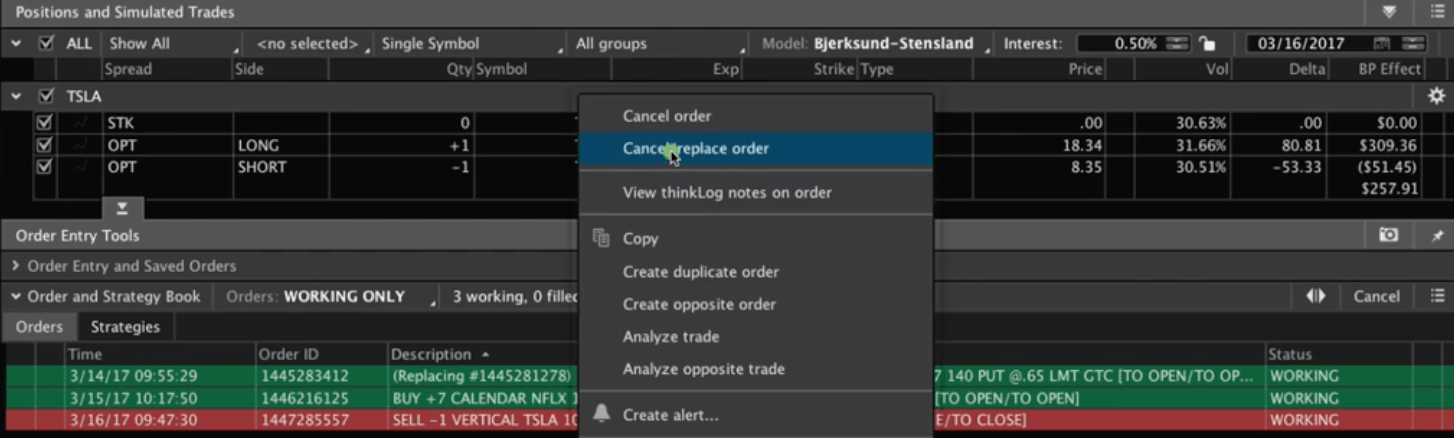

It looks like it’s not quite trading there either. So, we can right-click the Vertical order, and select “cancel/replace order”. Then let’s move it down to about 12.95.

We just did one contract in this example. So if you pull out your handy dandy calculator, all you’ve got to do is type in 13.16 minus 9.99. That gave us a profit of $3.17. Multiply that times 100 because each contract represents 100 shares. We ended up making $317 on this trade.

This was a good trade that took just a couple of weeks.

I hope that this was a helpful lesson for everyone. See you in the next lesson.

Happy Trading!

-The NavigationTrading Team

Follow