Welcome back!

In this lesson, we’re going to review the Covered Call Strategy.

I think this is a strategy that a lot of newer traders gravitate to in the beginning. This is because they’re used to the concept of buying and selling stock. This strategy has a stock component to it and it just adds on an option piece to the buying of stock.

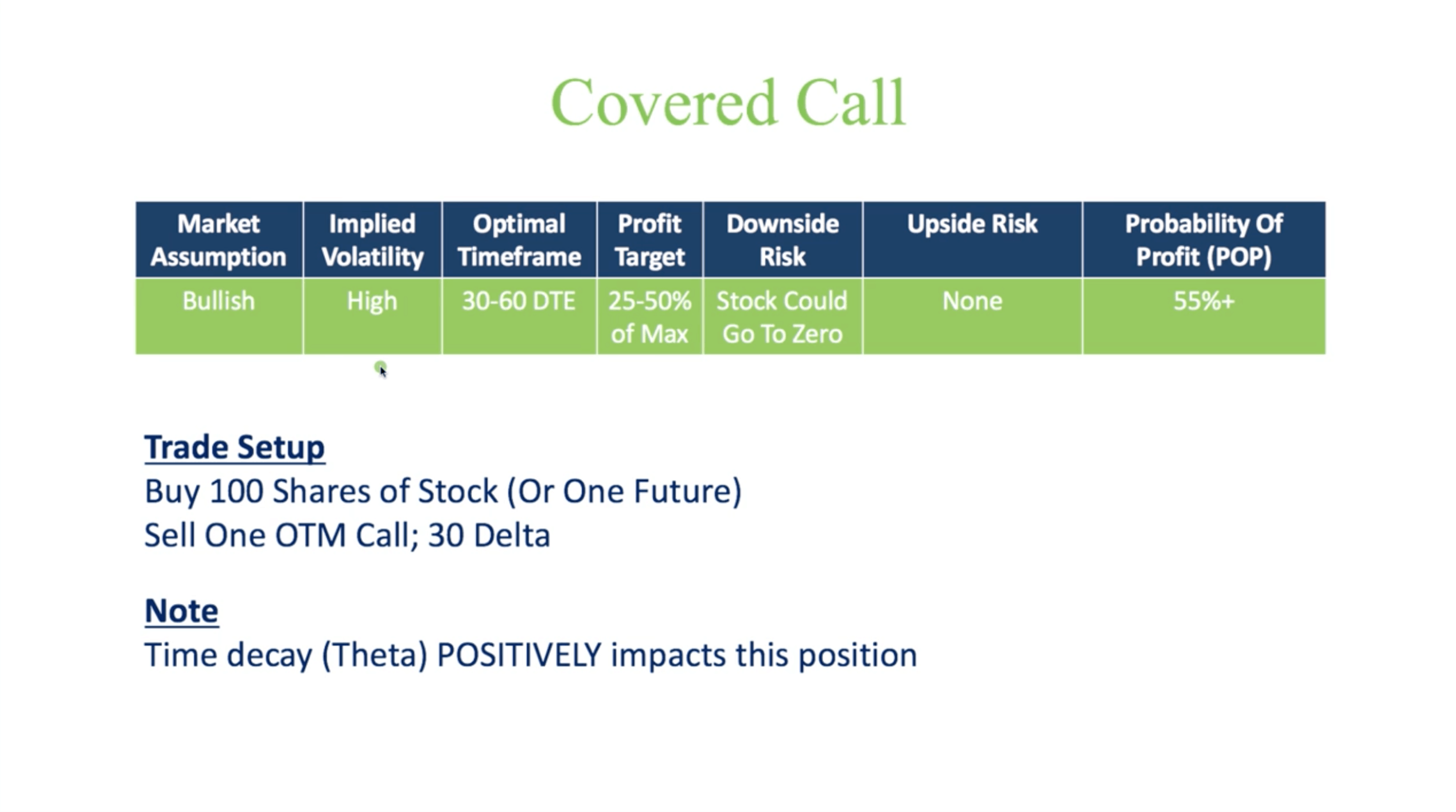

For a Covered Call, you want your market assumption to be bullish. That just means you want the stock to go up.

You want implied volatility to be relatively high.

Optimal time frame is 30-60 days to expiration.

Your profit target is 25-50% of max.

The downside risk is that the stock could go to zero, just like if you owned a stock outright. There is no upside risk because you’re making money if it goes up.

And then the probability of profit is 55% or greater.

So, the trade setup is simple. You’re simply buying a hundred shares of stock (or one future). And, then you’re going to sell one out of the money Call around the 30 delta.

Let’s say that you have an IRA, or maybe you have a portfolio that’s already made up of some individual stocks. You can then sell the 30 delta Calls against your stock positions that you already own and collect this premium. This adds an income component to your stocks that you already own.

That’s what I see a lot of traders using this strategy for. Time decay (Theta) works positively with this strategy. That just means it works in your favor.

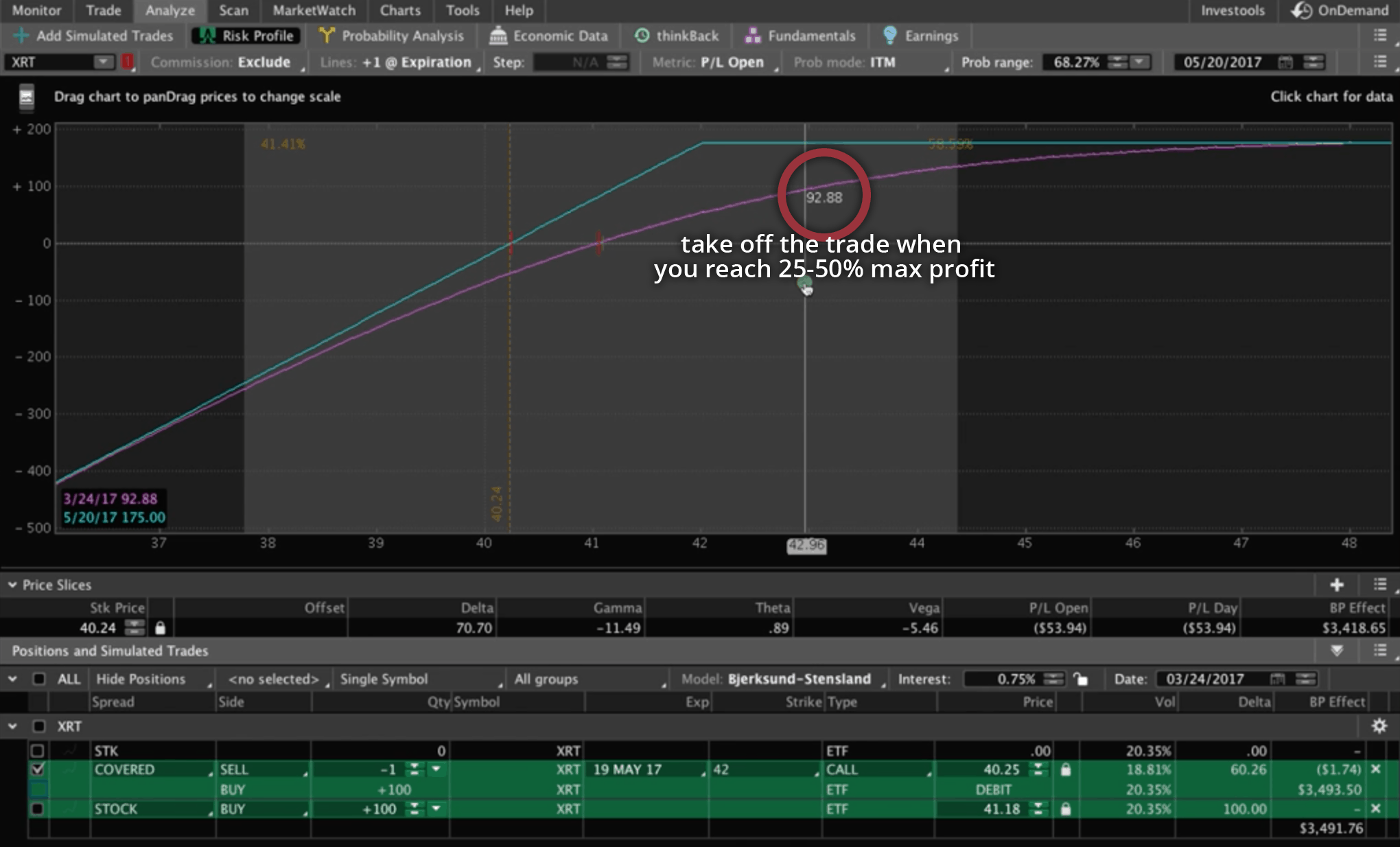

Platform Example

Let’s go to the platform and take a look at an example using XRT (Retail ETF). At the time of this artocle, it’s one of the only symbols out there with high implied volatility over 50. IV percentile is currently at 54.

The other reason I would look at this as a potential candidate, is because we’ve seen a downside move in XRT. So, I like to buy things when they’ve gone down and sell things when they’ve gone up. Kind of a contrarian methodology. So XRT would be a good candidate for a covered call.

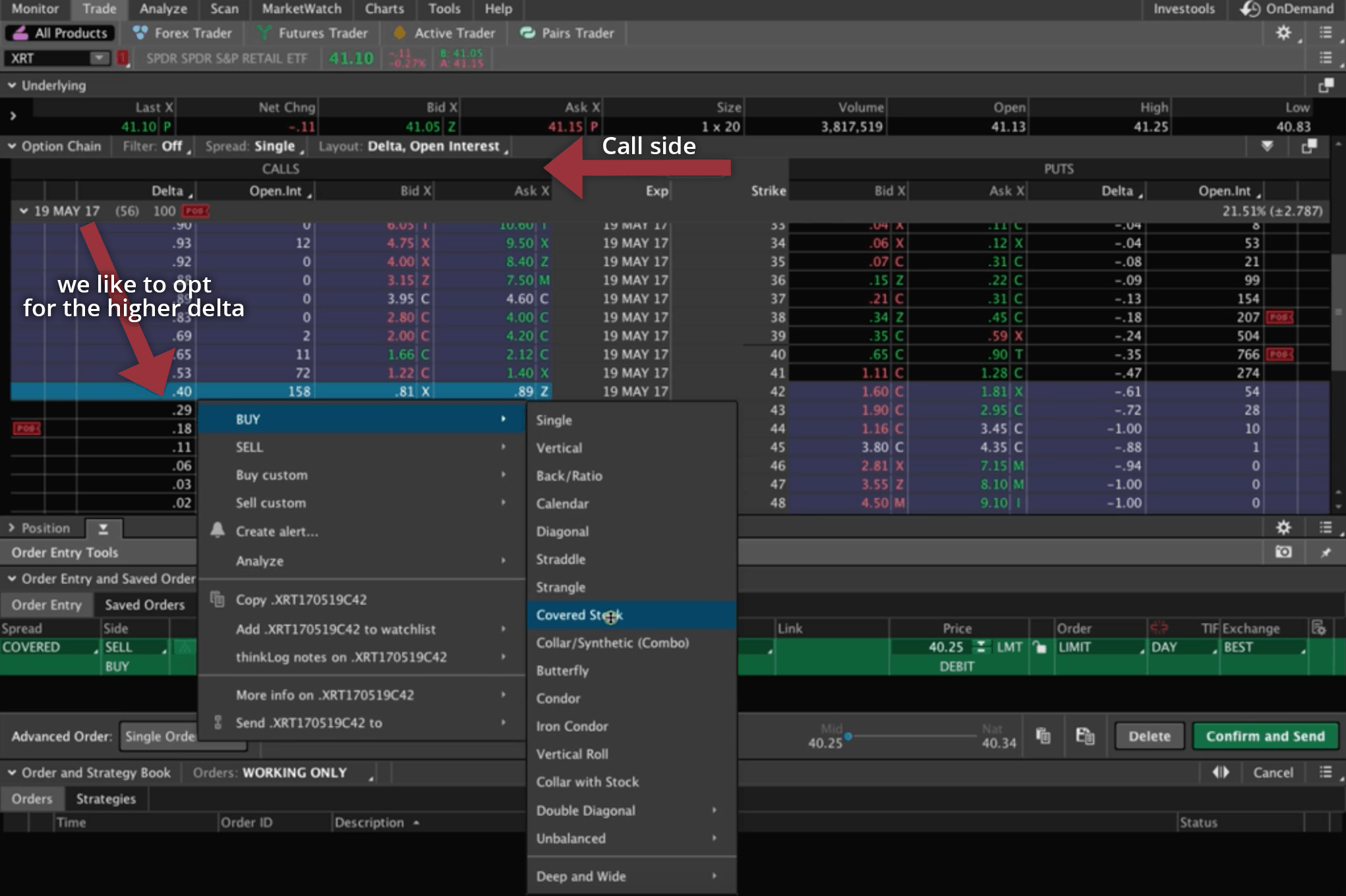

We’re going to navigate to the “Trade” tab and then view the Call side. And remember, we want to be around that 30 delta Call. Right now we’ve got .29 or .40 to choose from. I always like to opt for the higher one. You can do .29; it’s actually a lot closer to 30, obviously. But, as a practice, I like to go .30 or above, and so I would choose the .40. The difference is you’re going to give up a little bit of profit potential for a little bit higher probability of success.

To enter the trade, you’re going to right-click on that call that you want, and then select “BUY” and then “Covered Stock”. Thinkorswim calls it a Covered Stock, but it’s the same thing as a “Covered Call”.

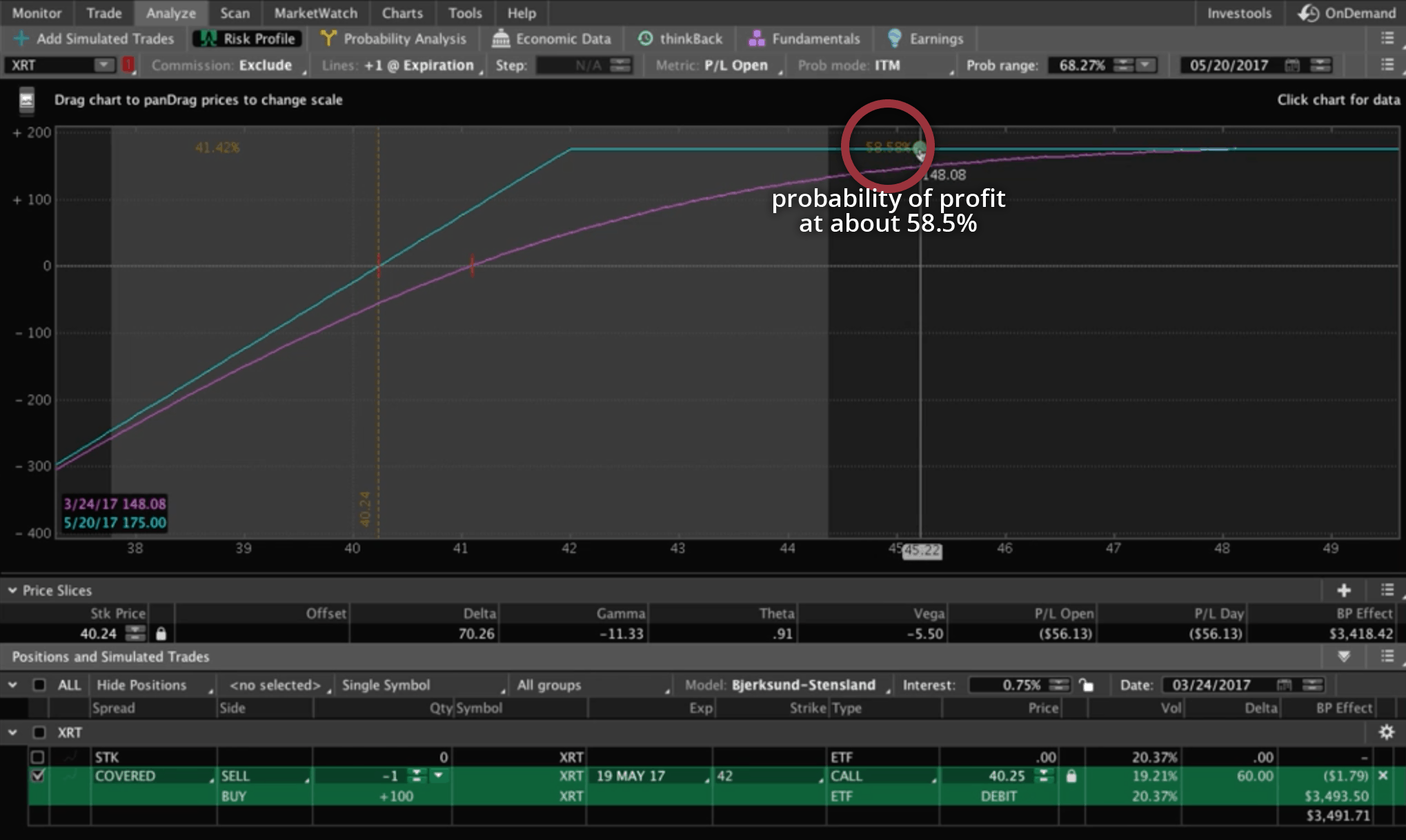

After selecting the Covered Stock option, it’ll populate down below in the order entry area. Then, we can just right-click it and select “Analyze trade”. That’s going to populate a visual representation on our Analyze tab. We can move our dotted line to the break-even point to see what the probabilities are.

As you can see, the probability of profit on this trade between now and expiration is a little over 58.5%.

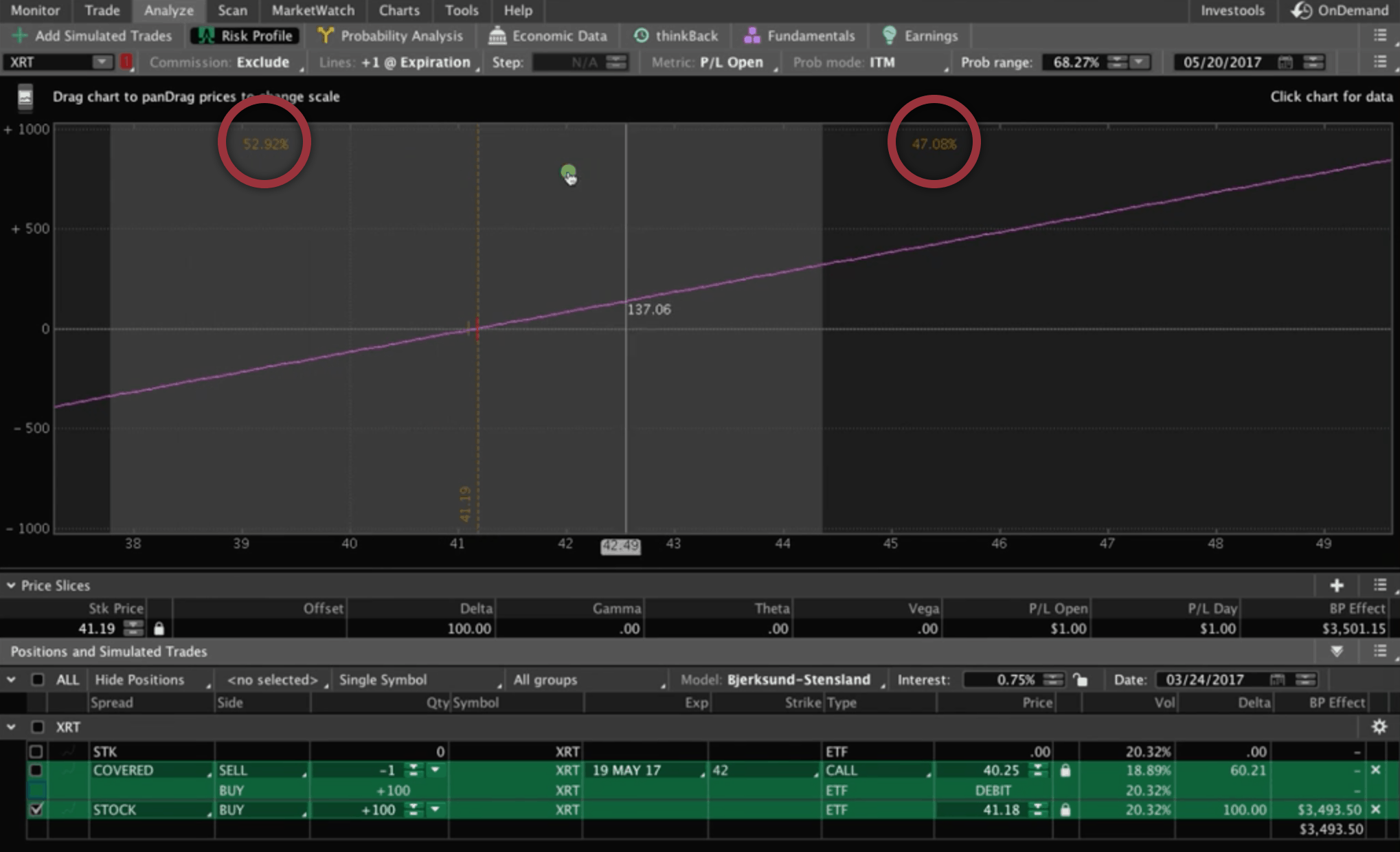

Why is that important? What if you just bought the stock, without the Covered Call?

Let’s take a look…

Let’s buy only the stock and analyze that. I’ve clicked off the Covered Call order down at the bottom, so we’re just looking at the stock. I’ve moved our price slice to the break-even point. Look at what our probabilities of just buying the stock are. It’s about a 50/50 bet, give or take a little bit one way or the other.

By putting on the Covered Call, we’re limiting our upside, but our probability of profit goes from 50% up to over 58.5%. That’s the value of this strategy. You’re adding that time decay component (theta), and over time, you’re going to outperform just buying the stock.

What else does this strategy look like?

One of the other strategies is a Short Naked Put. The risk profile looks almost exactly the same, right?

Why would you trade one over the other? If you’re selling a Put, you’re going to use a lot less capital.

But, as I said before, one of the key reasons why you would use a Covered Call, is if you already own the stock. Let’s say you already own stock in XRT. Then you could come in and sell the Calls against it to add that theta component. You’d limit your upside, but you’d get that positive time decay in your favor.

Taking Off the Trade

When you reach between 25-50% of max profit, it’s a good time to take off the trade. In this case, our max profit is $175. So, once you reach 25-50% of that, take this off, and redeploy that capital into another trade.

The only caveat on that, going back to the example of already owning the stock. Let’s say it’s a stock that you want to own long-term, and you’re not looking to buy or trade that stock. You’re looking at a one-year to ten-year investment kind of thing, but you like the idea of selling the calls against it to give you a buffer to the downside as well as collect that theta.

If it gets to that 25-50% max profit, then you could get out of that Call and sell another one. You could hold the stock in place and continue just to sell these Calls against that stock position every month to collect that theta.

I hope this tutorial was helpful. We’ll see you in the next lesson.

Happy Trading!

-The NavigationTrading Team

Follow