Welcome to another lesson from NavigationTrading!

In this video, I want to show you how to roll a Short Call Vertical Spread from one expiration cycle to the next.

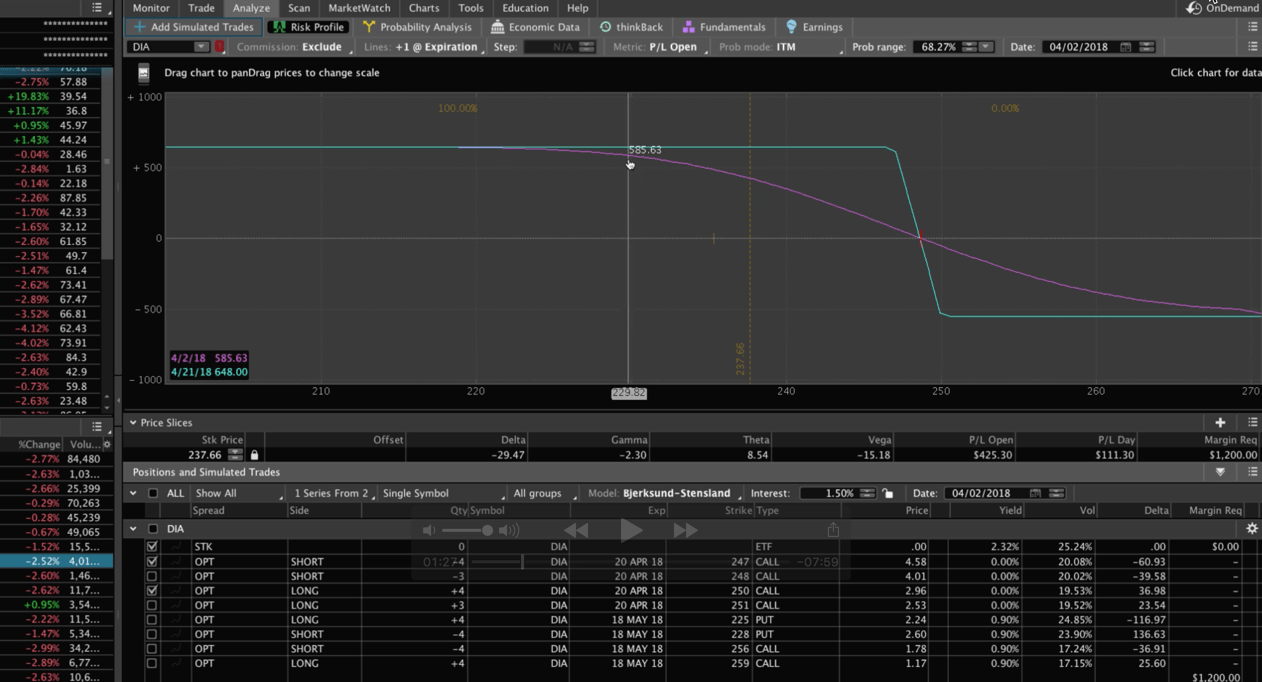

The symbol that we’re looking at right now is DIA, the DOW Jones ETF. We have several different positions on currently. We’ve got an Iron Condor, which is in the May cycle at the time of this recording which is April 2nd. It’s well within range, so nothing to do there. But we’ve also got a couple of Short Call Vertical Spreads, one with three contracts and the other with four contracts. These were originally put on as separate trades and so I keep their strikes just one strike different for tracking purposes.

What I’m looking to do now is to roll these trades. We’re in April, and if I take a look at the trade tab, I can see there’s 18 days left to expiration. We’ve got a little bit of time, so we’re not necessarily pressured as far as time goes, but if you look at the amount of profit that we’ve got in this, $484 out of a possibly $648, you can see the profit line kind of starts to flatten out a little bit. It’s not as steep as you see it right here. So if the market were to continue going this way, if it were to continue going lower, then we’re not making as much profit.

So, we want to keep this trade on, but we want to get a little bit better bang for our buck, as opposed to this flattening out of the profit curve. With this being in April, we’re going to roll this spread from April to May and then we’re going to adjust the strikes a little bit closer to price.

Let’s Set Up A Theoretical Position

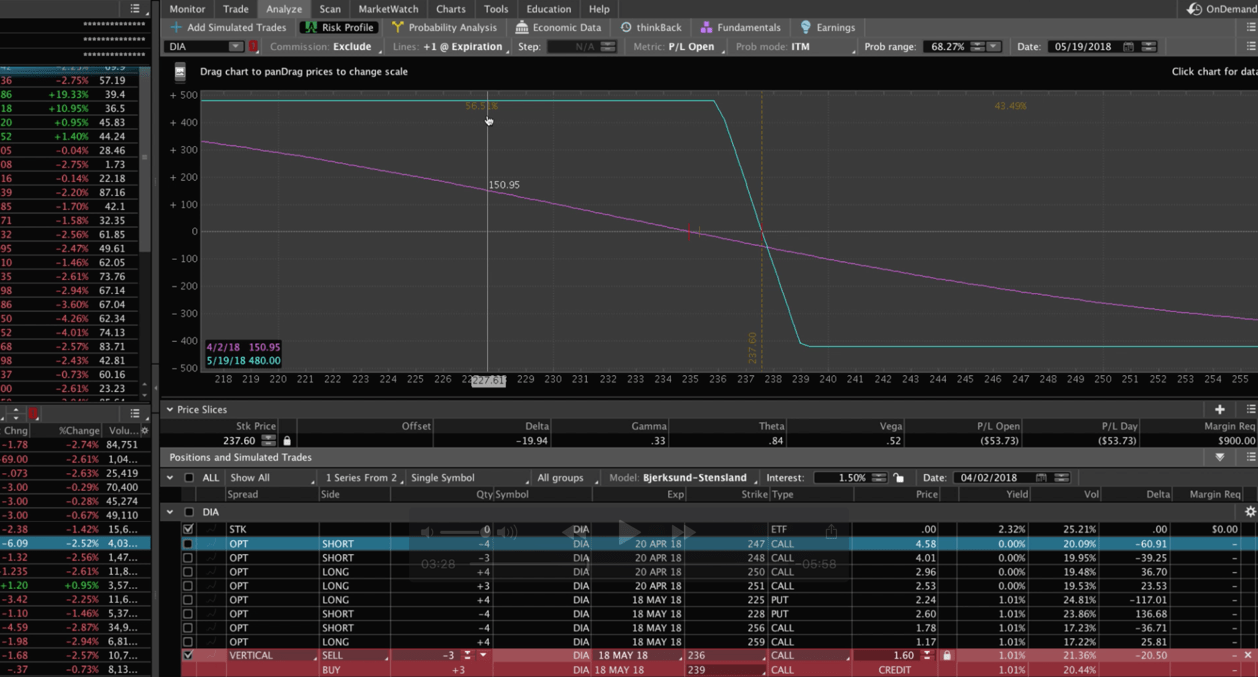

Before you do the roll, what I like to do, is go to the trade tab and go to the expiration that you’re looking to roll the spread to. In this case, It’s May. Let’s set up a theoretical position to see if it’s where we want as far as the strikes are concerned. Just go with one strike out of the money, in this case, the 236. We can right-click and then click “Sell Vertical”. We want to keep the strike width the same, so we’re going three points wide, so that’d be the 236/239. Then we can take this over to the analyze tab. Make sure we uncheck our current position. This gives us an idea of what it will look like after we roll. Let’s make the contracts the same, so it’d be four contracts.

You can see where price currently is at. We put on our price slice right on the breakeven point. Make sure we change our calendar to the expiration cycle, which in this case is May 19th. That gives us a probability of profit a little over 56%. It’s putting the odds a little bit in our favor, it’s giving us a positive theta number, and it’s giving us that short delta that we want to keep in our portfolio. That just gives us an idea of what that’ll look like when we roll. I like those strikes, and so now we can go back and do the roll.

Highlight the strikes that you want to trade. Create rolling order and sell vertical roll. We’re selling out the 247/250, so it’d be the top one. We’re exiting the 247/250, but remember, we need to change the expiration cycle to the next monthly, which in this case is May 18th. Then we want to change the strikes to the ones that we set up on the theoretical. That should be four. So we’re exiting the 247/250 and we want to re-enter it as the 236/239. Change this to the 236 because that’s the one that we’re selling, change this to the 239 because that is the one that we’re buying. This is indicated by the minus for sale and plus for buy. You can see, by doing this, not only are we kind of locking in the profit from the other trade, but we’re re-entering it. Overall we’re picking up a credit for doing that, so that’s the whole basis of this type of trade.

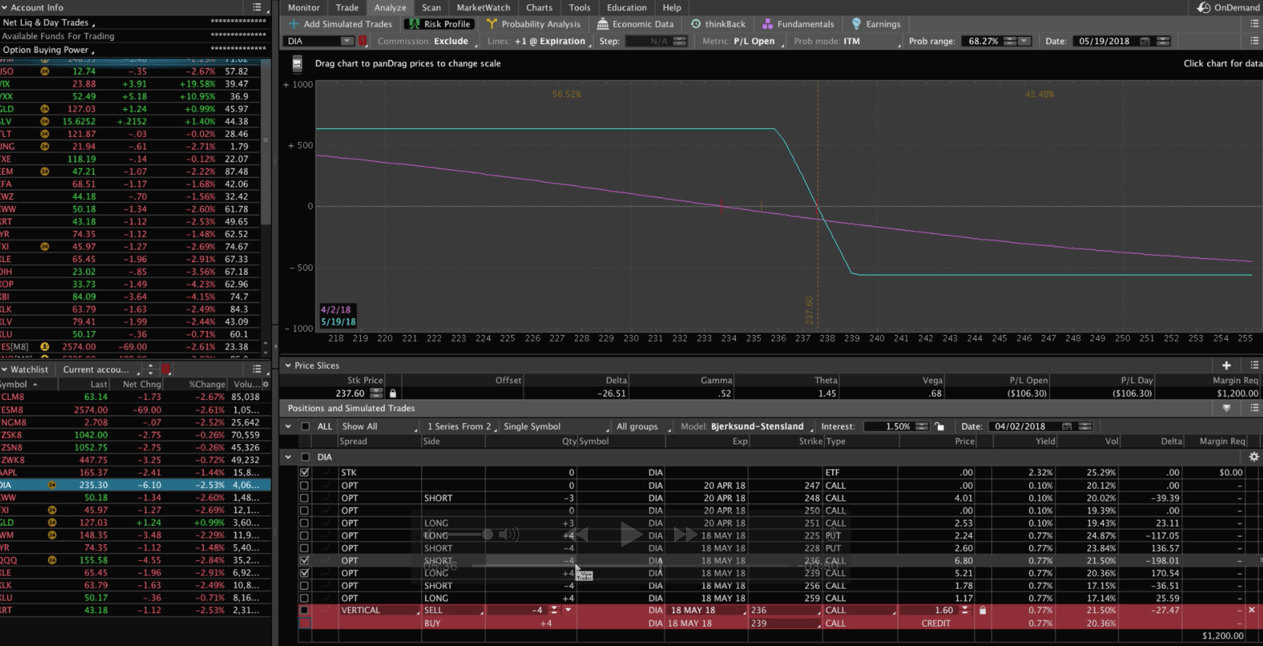

We got filled at 1.20, so price improved a little bit. Then if we click off of our theoretical, you can see the checked boxes are representing the 236/239. Now we are in that trade. It’s been rolled from April to May. You can see the April position is zeroed out because we closed that one and re-entered it in the next expiration cycle.

If we take a look at that one, it’s a very similar position. Like I mentioned, it was just one strike different, and so we want to do the same thing. We’ve got the same situation; the profit curve has started to flatten out, so we want to roll our current strikes closer to the money; as well as, roll it from April to May to give us more time in that trade.

Let’s go ahead and delete this theoretical position and do the same thing that we just did.

We’ll just use one strike different to keep our tracking simple. Instead of doing the 236, let’s sell a vertical at the 237, go three points wide, so that’d be the 240 we would buy.

Then we can take this over to the analyze tab the same way.

Let’s uncheck our current position and look at the theoretical, then kick that up to three contracts so it matches what we’re rolling.

Very similar here; the probabilities are going to be a little bit better because we’re going a little bit further away from the money. So about 58% probability of success on this trade.

Then we can go back and roll the trade, very similar to what we just did with the other one.

Just highlight the trade, create rolling order, and sell vertical roll. Then remember, you’re going to change the expiration cycle to the one you’re rolling to, which in this case, is May. Then we want to change our strikes to the one that we just set up, which would be the 237. Change that to 237/240.

Again, we’re giving ourselves more time, we’re moving our strikes closer to the money, and in the process, collecting another nice credit. Then we hit confirm… and get filled at 1.21.

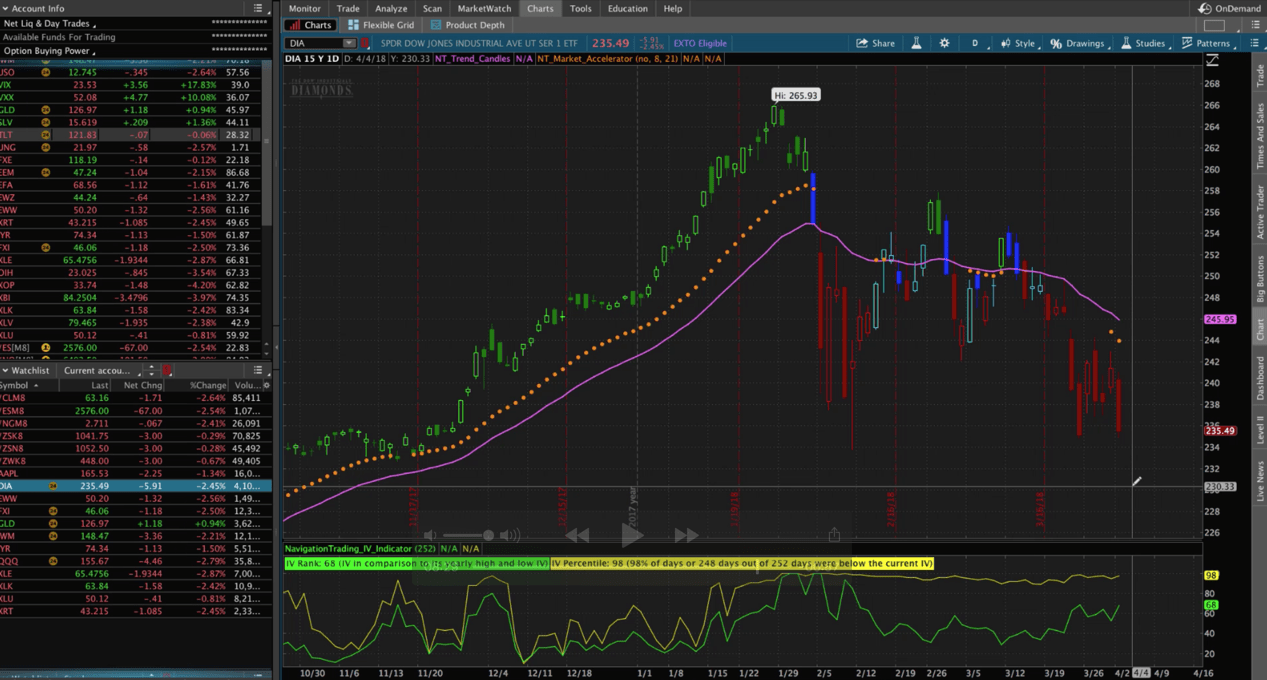

If we uncheck the theoretical, you can see we have all of our positions now in May. Our April positions are zeroed out because we went ahead and rolled those out. Now we are in that trade as well, exactly like we want it. We have a max loss of $429 with a max potential profit of $471. This keeps that short delta, that short bias in our portfolio, and gives us a chance to make some more money if stocks continue downward.

Which in this case, that’s our assumption and it fits into our overall portfolio. It has to fit into the rest of our portfolio; as well as, satisfy the assumption that we have. Our assumption is stocks going lower in the near term.

Happy trading!

If you’d like to learn more about how we’ve taught over 10,000 members how to trade options for consistent income, just go to our site NavigationTrading.com, click on the big orange button, and we’ll give you immediate access to our flagship course, “Trading Options for Income”.

We’ll also give you the NavigationTrading Implied Volatility Indicator that you see on our charts along with the watch list that we use to trade the most profitable symbols day in and day out. All this is yours, no cost; just go to our site NavigationTrading.com and we look forward to seeing you on the inside.

Follow