In this tutorial, we are going to talk about another trade example.

The SPX is the S&P 500 Index. It’s a very large, high-priced underlying. There’s just something a little different about trading a stock index that I want to make sure that you understand. That way, if you run into this when you’re placing trades, you’ll know what to do.

Let’s go ahead and jump right in!

In trading individual stocks and stock indices, a lot of times you will run into something called “Put Skew”.

All that means, is that the Puts are priced higher than the Calls. This is because the risk is usually to the downside when trading options on a stock or an index. The velocity in which the market moves down, for the most part, is much quicker than when it goes up.

The analogy that you’ll hear is, “the stock market takes the stairs up, but the elevator down”. To account for that, the Puts are priced higher to account for that downside potential velocity.

Let’s take a look at an example, and I’ll show you what I mean.

Platform Example

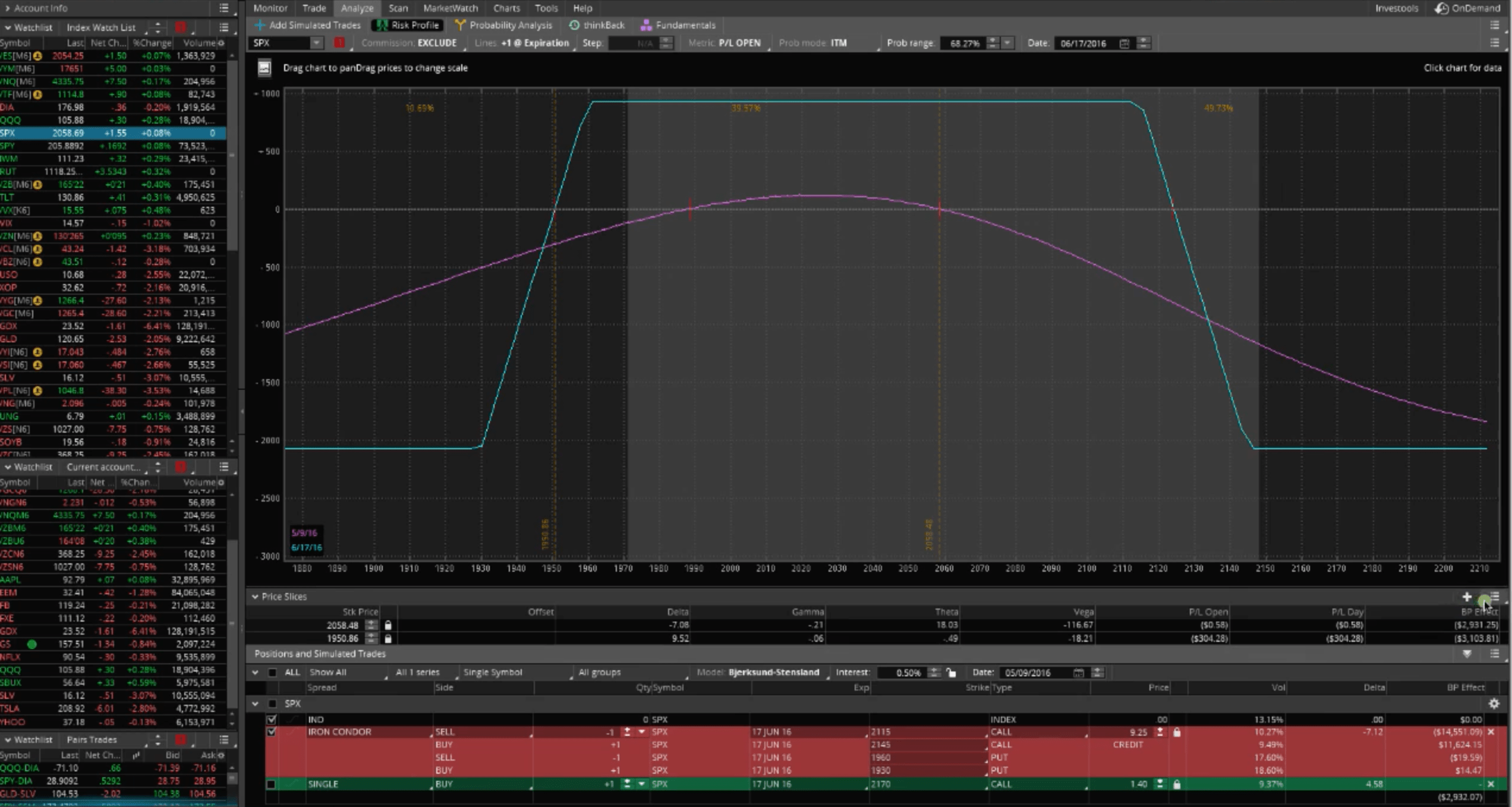

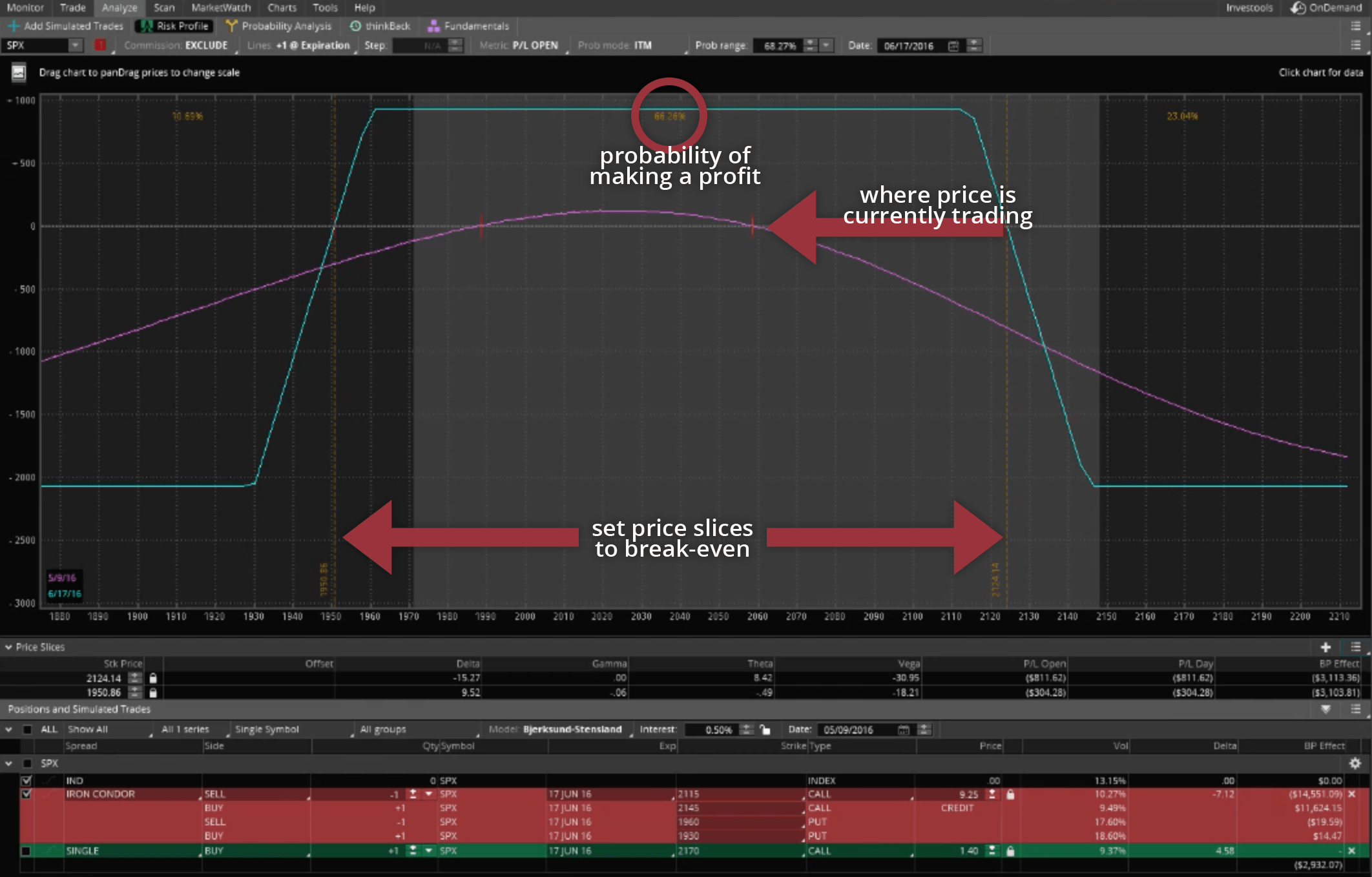

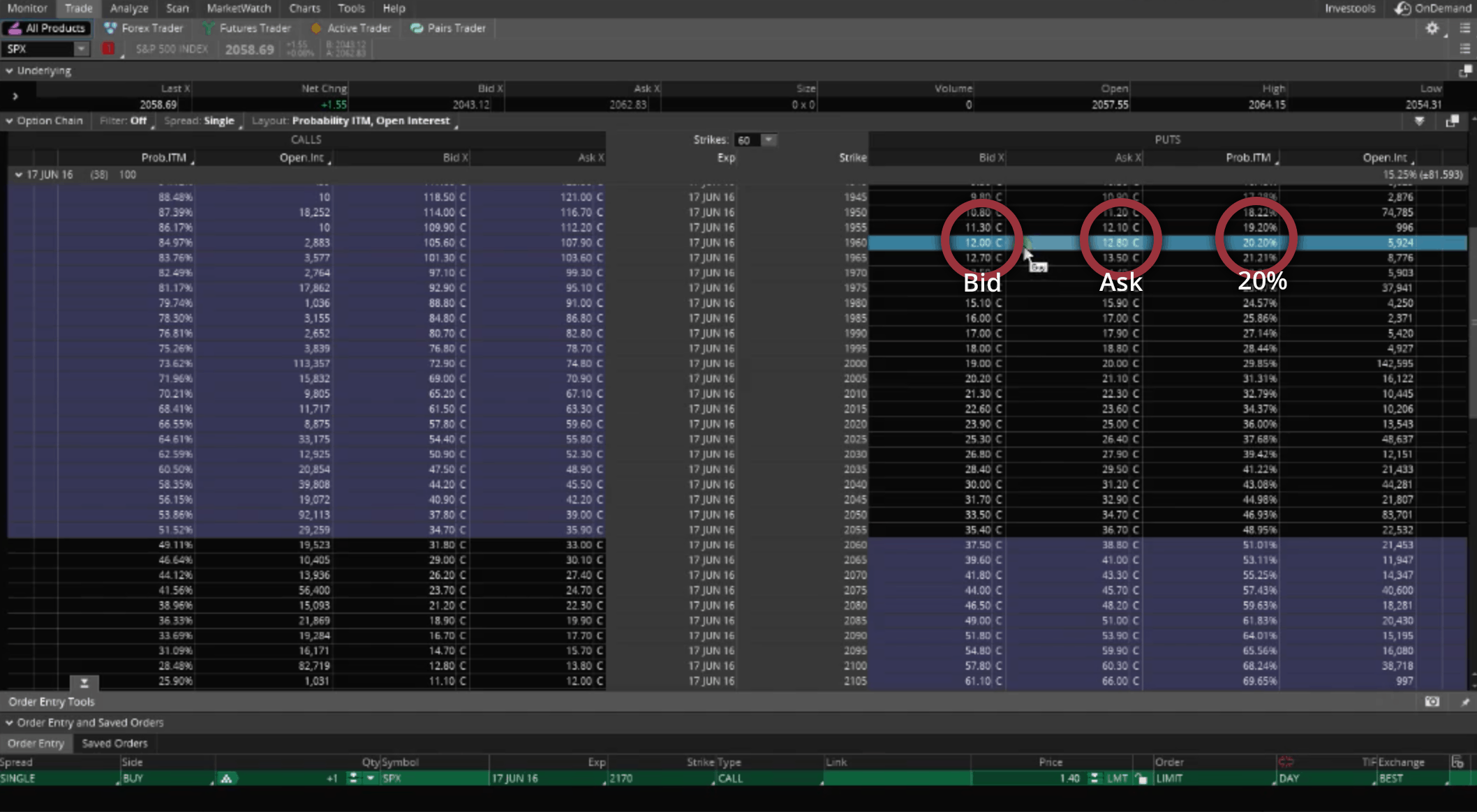

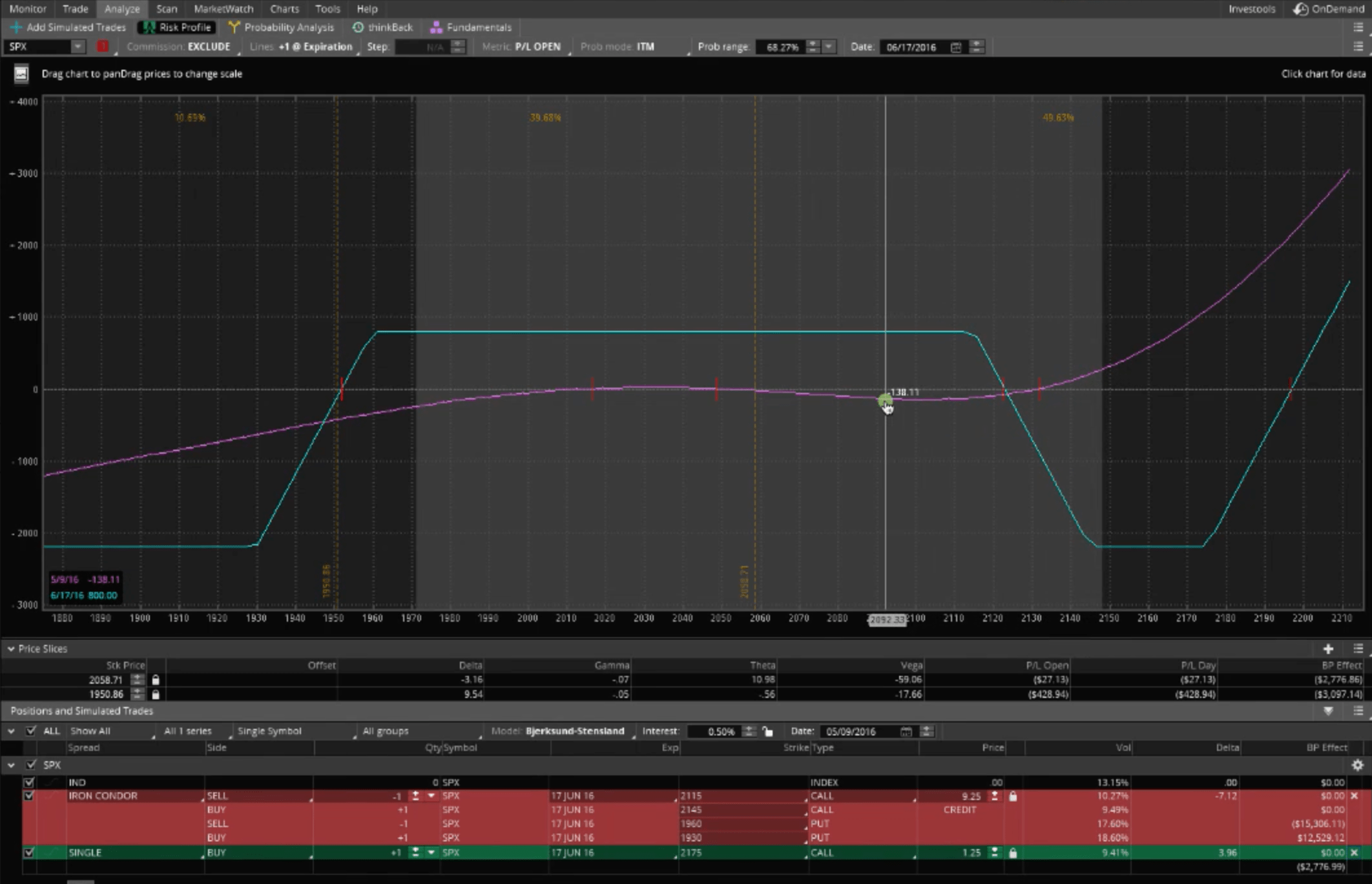

I’ve gone through and I’ve set my short strikes at 20% probability of being in the money. Here’s the visual graph of our trade in the SPX, S&P 500 Index.

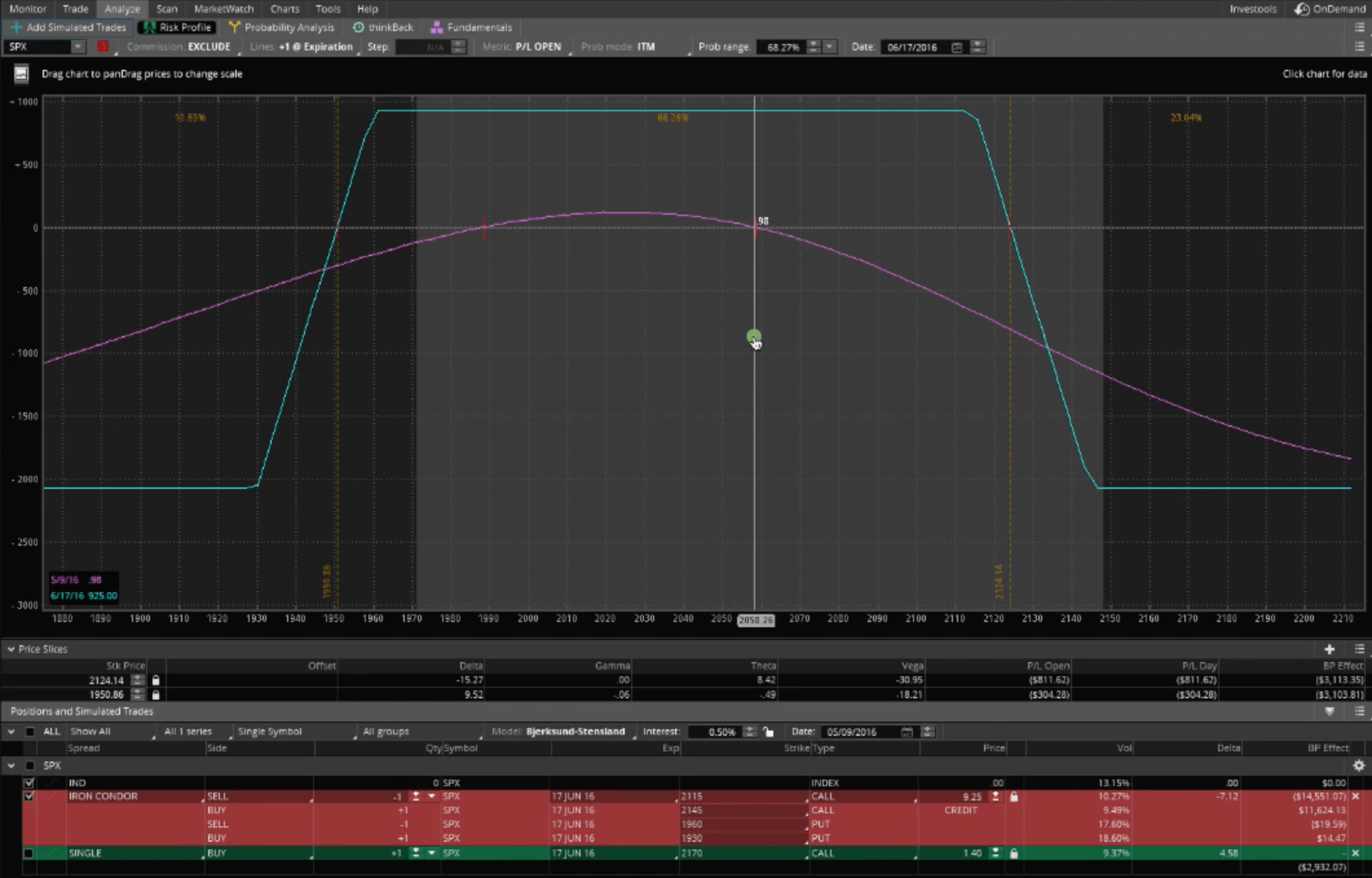

Let’s go ahead, and set our slices to break-even. 6/17 is expiration, so we’ve got a little over 60% probability of profit.

You’ll notice this trade is a little different from some of the other trades that we’ve set up. Look at where price is trading right now. Look at where it is in relation to the rest of the graph. It’s further over to the right hand side than it is to the left. Because the puts are more expensive, when we look at the 20% probability of in the money Puts, they’re much further away from where the price is currently trading, than are the Calls.

The Calls are closer, because they’re cheaper. Again, that’s to account for the downside velocity. So, you have a lot more protection going to the downside.

When I place the trade, I take into account Put Skew. Meaning, I place it based on 20% probability of in the money, because that’s how the probabilities actually do play out over time.

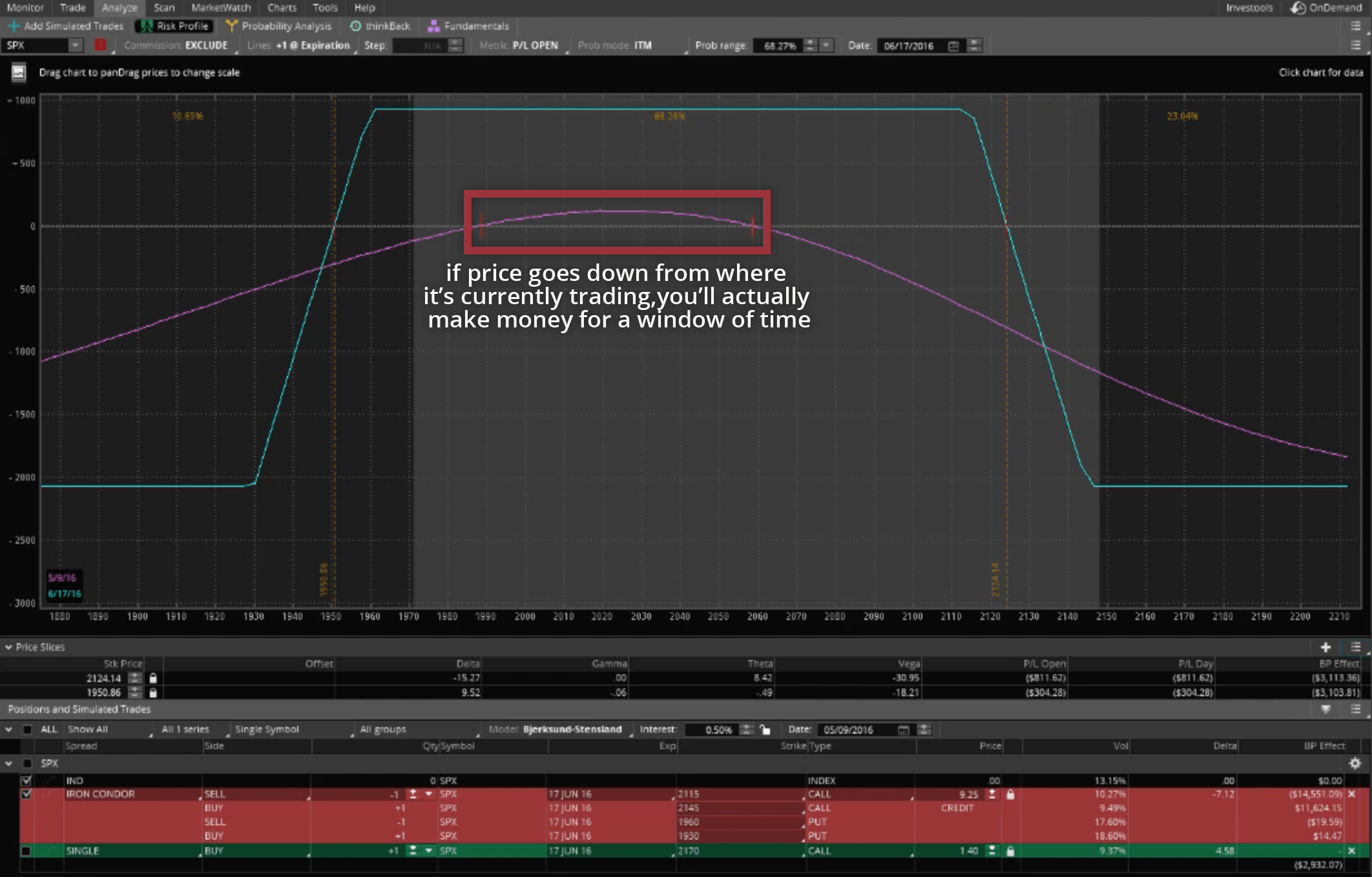

I like to keep a bit of short delta, or downside protection on my trade. That way, if we do see a major downturn in the market, it’s not going to hurt you as bad. In fact, if it starts to go down, you’ll actually start to make money right away, as you see below with the profit line.

Trade Tab

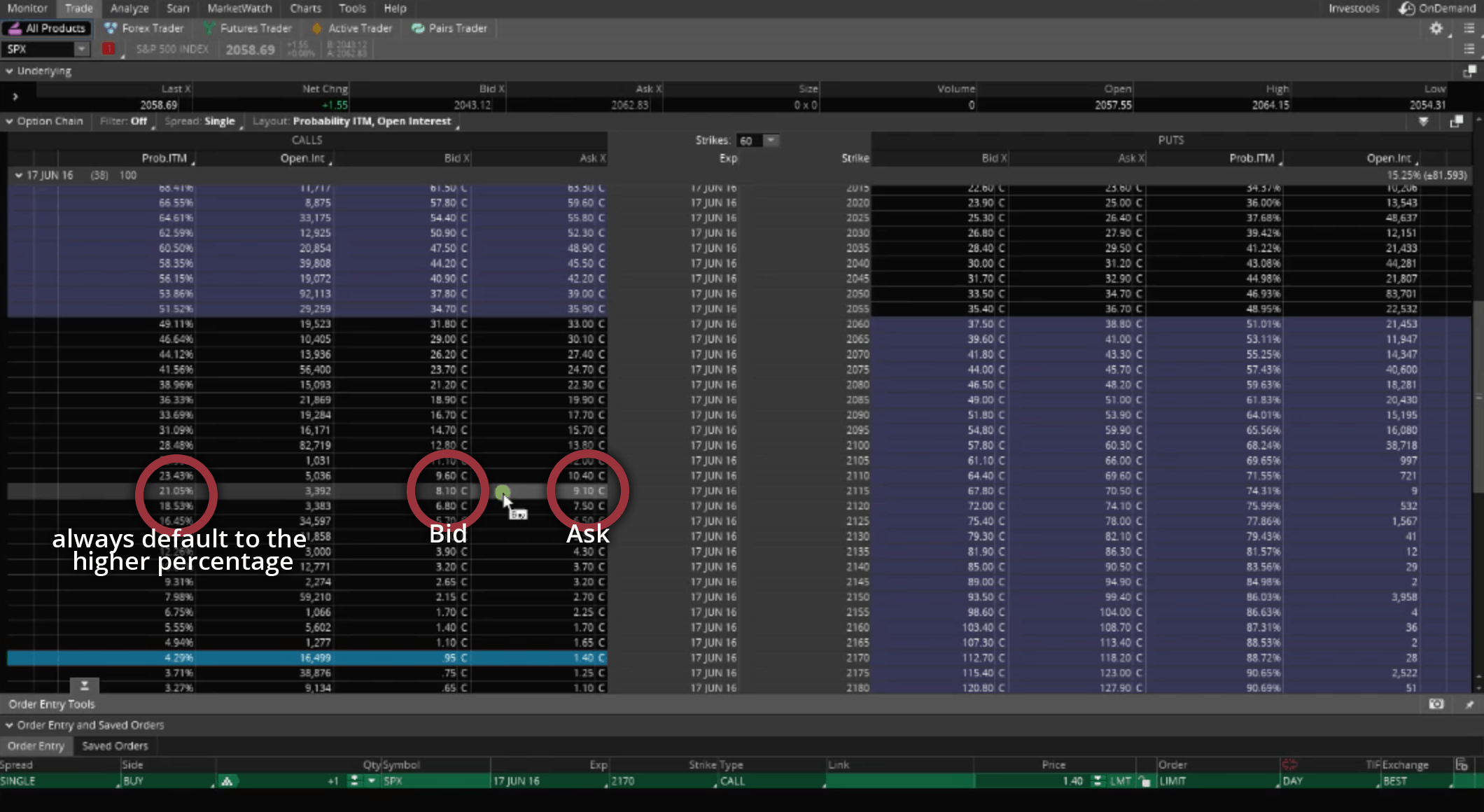

Looking at the call side, we want the closest we can get to 20%. We always default to the higher percentage. In this case, it’s a little over 21%. In the columns to the right, you’ll see the bid and the ask. These calls are trading at an 8.10 bid and a 9.10 ask. For the purposes of this tutorial, let’s just round and say they’re trading between eight and nine.

If we look at the 20% probability on the PUT side, these are trading between 12 and 12.80. So, about 12.50 is probably where you would get filled. 12.50 versus eight, that’s quite a bit of difference.

That’s what’s reflected on the graph below.

You can place the trade just like this, and that’s what I do. And, there’s no problem with doing that. You’re just giving yourself a little downside room to do so.

Buying A Single Call to Cut Down Directional Delta

If price does start to really move up, you see that the profit line slopes down pretty quickly on the right side of graph below. To account for that, some traders will simply buy a Single Call to cut down that directional Delta.

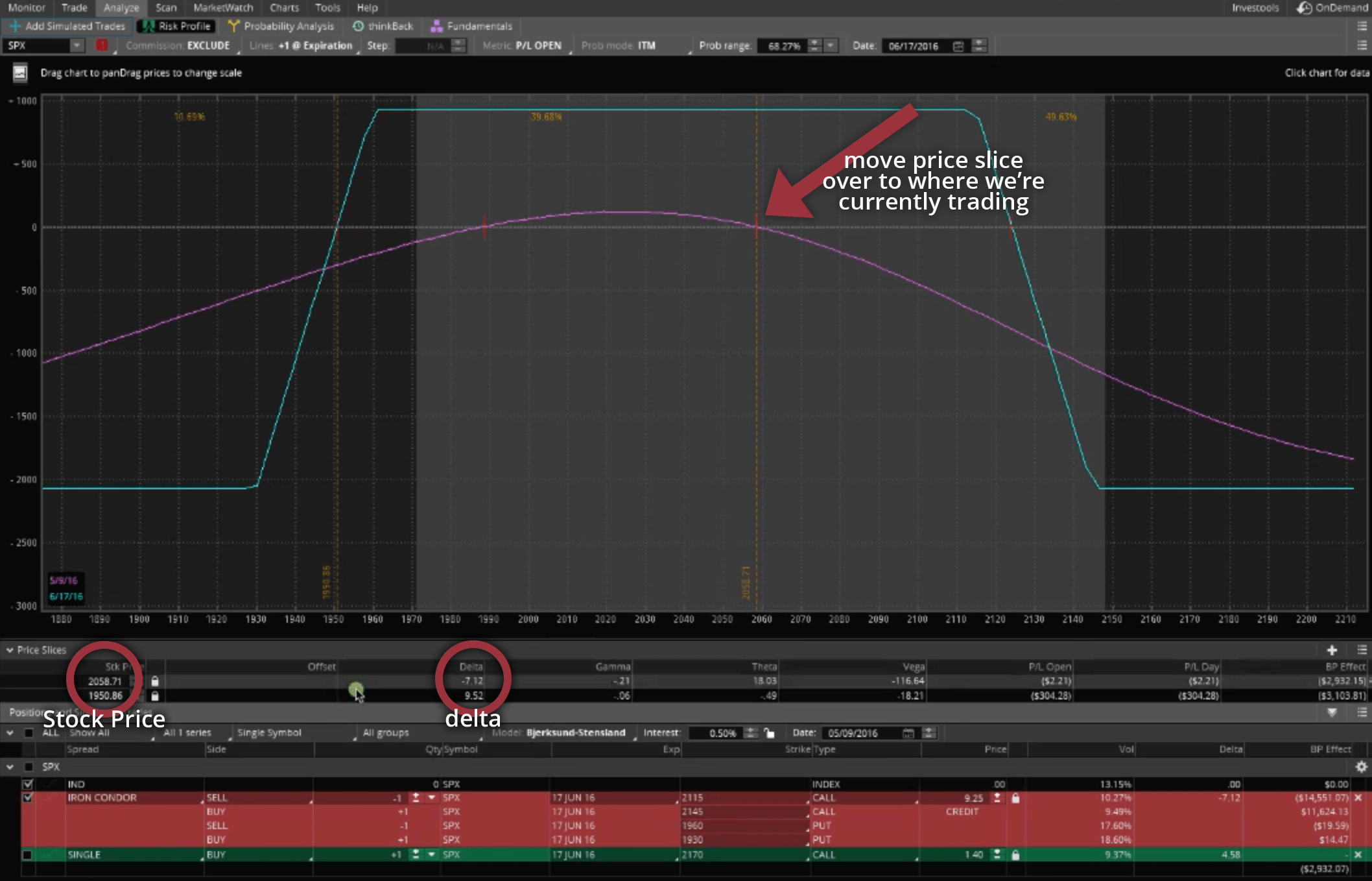

Let’s take one of these price slices and move it over to where price currently is. Down at the bottom of your price slice, you can see stock price is at $2058.71. The delta, where price is right now on this trade, is a negative seven. What that means is that for every point the market moves down, we’ll make $7.00 on this trade.

Some traders don’t like to have that negative delta. They want to set up a trade, and they want it to be what’s called “delta neutral”.

You still can account for the skew and set up the graphs, so that they’re at the 20% probability of being in the money on each side. Then, you can buy a Single Call. What we really want to do is cut that delta in half. Right now, it’s a little over negative seven. So, we want to get that down to about negative three, or even a less.

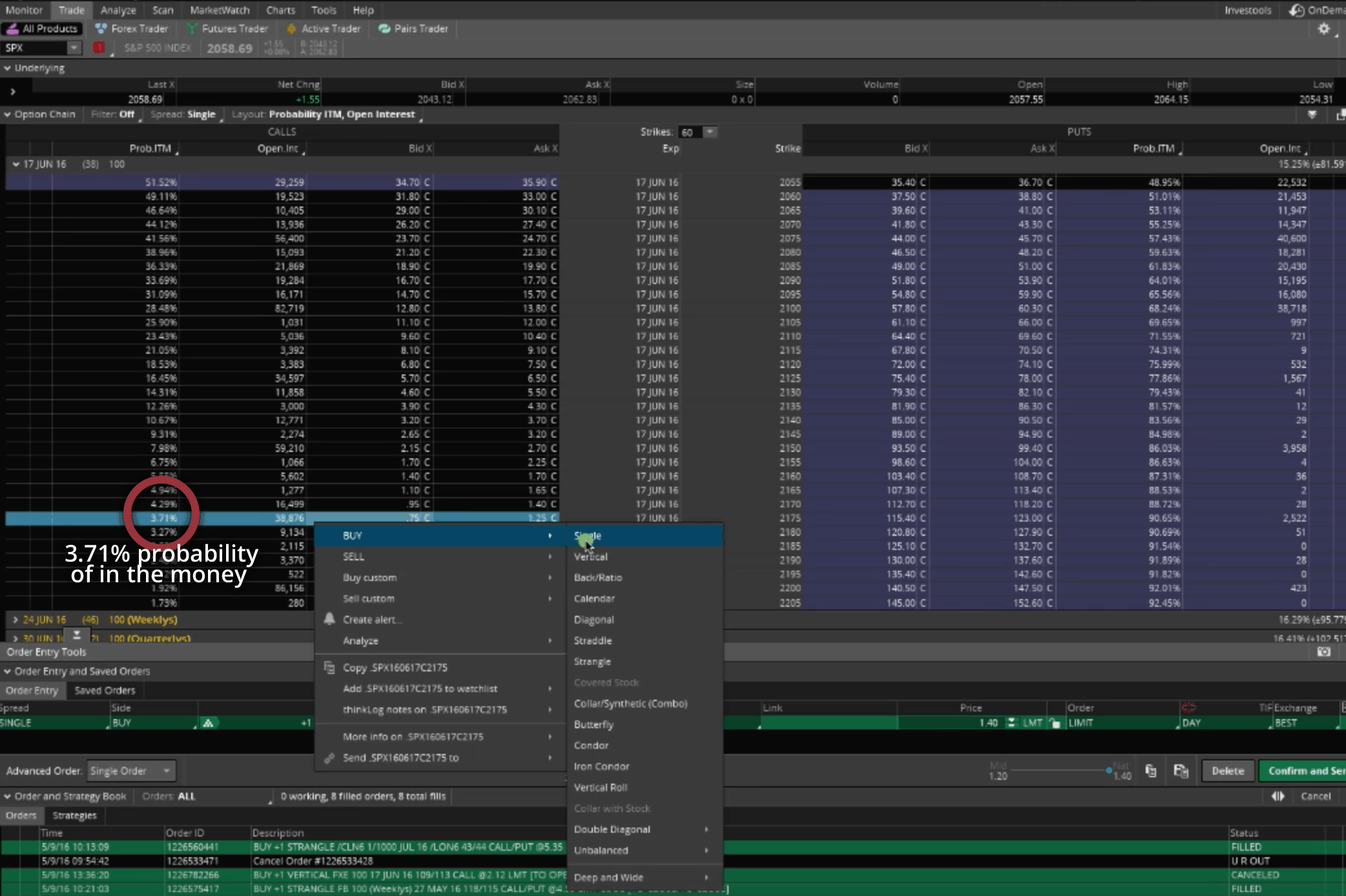

Delta is a term that’s synonymous with probability of in-the-money. If we’re looking at a negative seven delta, and we want to cut that in half, we’re looking for a probability of in the money percentage of about 3.7%. By buying this Call, that is going to help neutralize our delta. This will help make our trade more delta neutral, as opposed to skewing to the downside.

All you have to do is right click on that Call, select “BUY”, and then select “Single”.

It’s then going to populate down at the bottom under the “Order Entry” tab. Then, just right click the symbol, and select “Analyze Trade”.

Look what happens to our graph. The pink line, our profit line, doesn’t continue to slope down like it had before. It actually flattens out and starts to curve up, outside of our graph.

By simply buying the Single Call, it flattened out that delta, and took away some of that directional bias that is included with the trade by just setting it up in our normal fashion. Plus, it gave us a little more protection if SPX were to continue to the upside.

I’m showing you two different ways to do this, because some people prefer to have a little downside bias, while others would prefer to put it on trades extremely delta neutral.

Let’s go over what this actually does to our trade. When we have the Protection Call on there, our max profit is $800, and our max loss would be $2200. If we were to take that Call off, now our max profit goes to $925, and our risk is $2075. So, it takes away some of our profit potential, but it gives us protection if it continues to move up.

There’s no right or wrong way to do it. I typically tend to put the trade on just like we’ve walked through every other trade. I won’t worry about that skew, and I’ll deal with the trade if it gets to where it’s at break-even. But, some people like to have that extra protection. It’s just a matter of your preference.

I just wanted to show you this nuance that can help you build your trade and help guide you in the best direction that you want to go, depending on what your assumption is.

If you think there’s more room to the upside, you probably want to add the Call.

If you’re okay with the skew, and you think it may be going to the downside, then you can leave it as is. Nobody knows what the market is going to do. There’s no magic, it’s just a matter of preference.

I hope this tutorial has been helpful!

Happy Trading!

-The NavigationTrading Team

Follow