Welcome back to another lesson form NavigationTrading!

In this lesson, I want to talk to you about delta, and more specifically, how to delta hedge your portfolio.

First of all, what is delta?

What is this so called delta that we speak of?

At NavigationTrading, there’s really two specific ways that we reference delta. The first of which, is delta as the probability of an option expiring in the money.

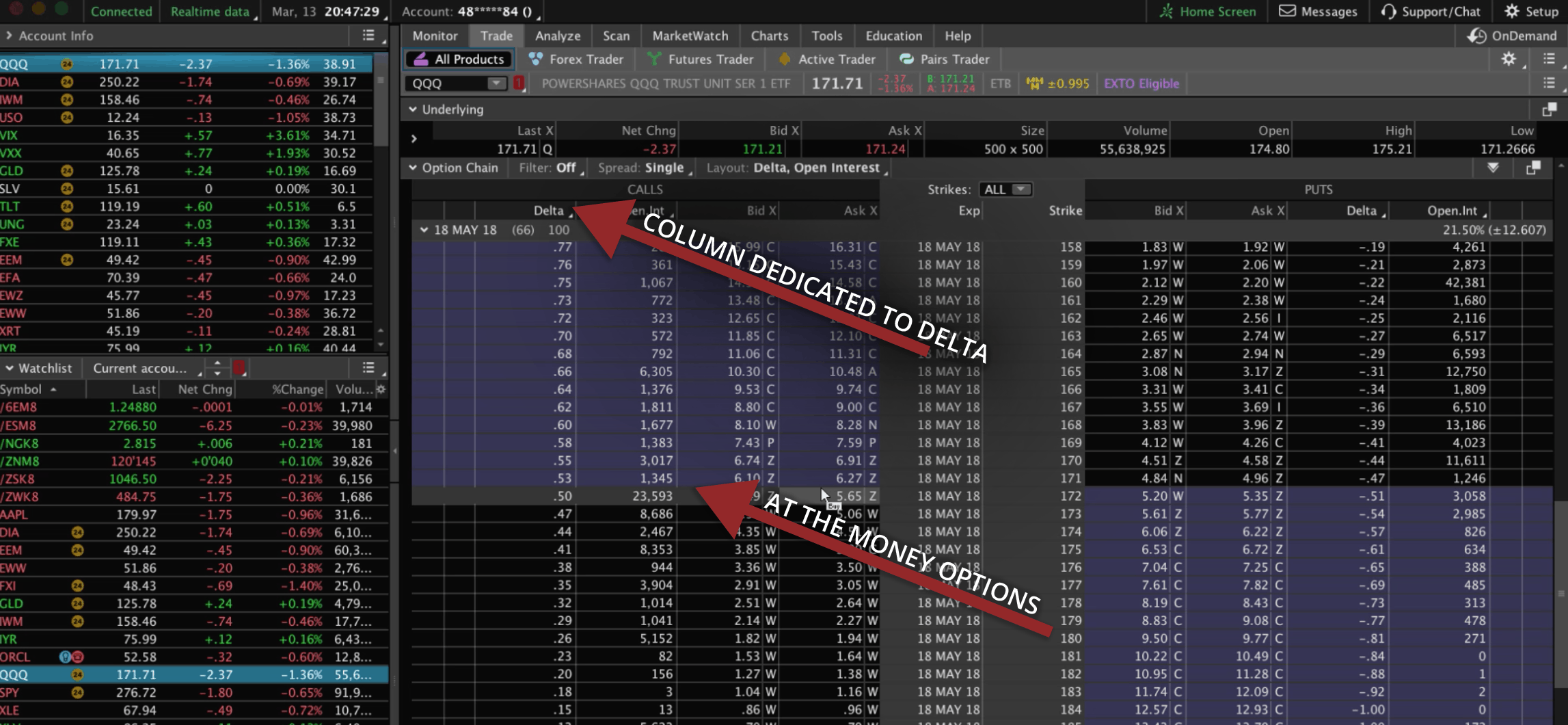

Let’s go the platform and show you an example, and then we’ll come back and talk about the second reference to delta.

Delta As A Probability

I’ve just pulled up an option chain, this is in QQQ, the Nasdaq ETF. What you’ll see, is that I always have one of my columns set to delta.

Think of it this way…the delta that you trade has about that amount of probability being in the money at expiration.

So, if we are selling the 20 delta call, that means there’s about a 20% probability of that option expiring in the money at expiration.

You can see where the shaded line meets the black, and that is the at the money options.

As you can see, those deltas are always right around 50, both on the call side and on the put side. That’s because there’s about a 50/50 probability of those options expiring in the money. They’re right there at the money already.

The further away you get from the current price, the lower the probability of that option expiring in the money.

Just remember when you’re looking to enter a trade, that delta is the probability of an option expiring in the money.

Delta Hedging Example

Let’s talk about the second reference to delta, and this is the one that we’re going to focus more on for the rest of the tutorial.

The second way we reference delta, is that it is the “directional bias” of a position or group of positions. Just think of delta as direction. If you’re long delta, you want that stock to go up, to benefit your position. If you’re short or negative delta, you want that stock to go down to benefit your position.

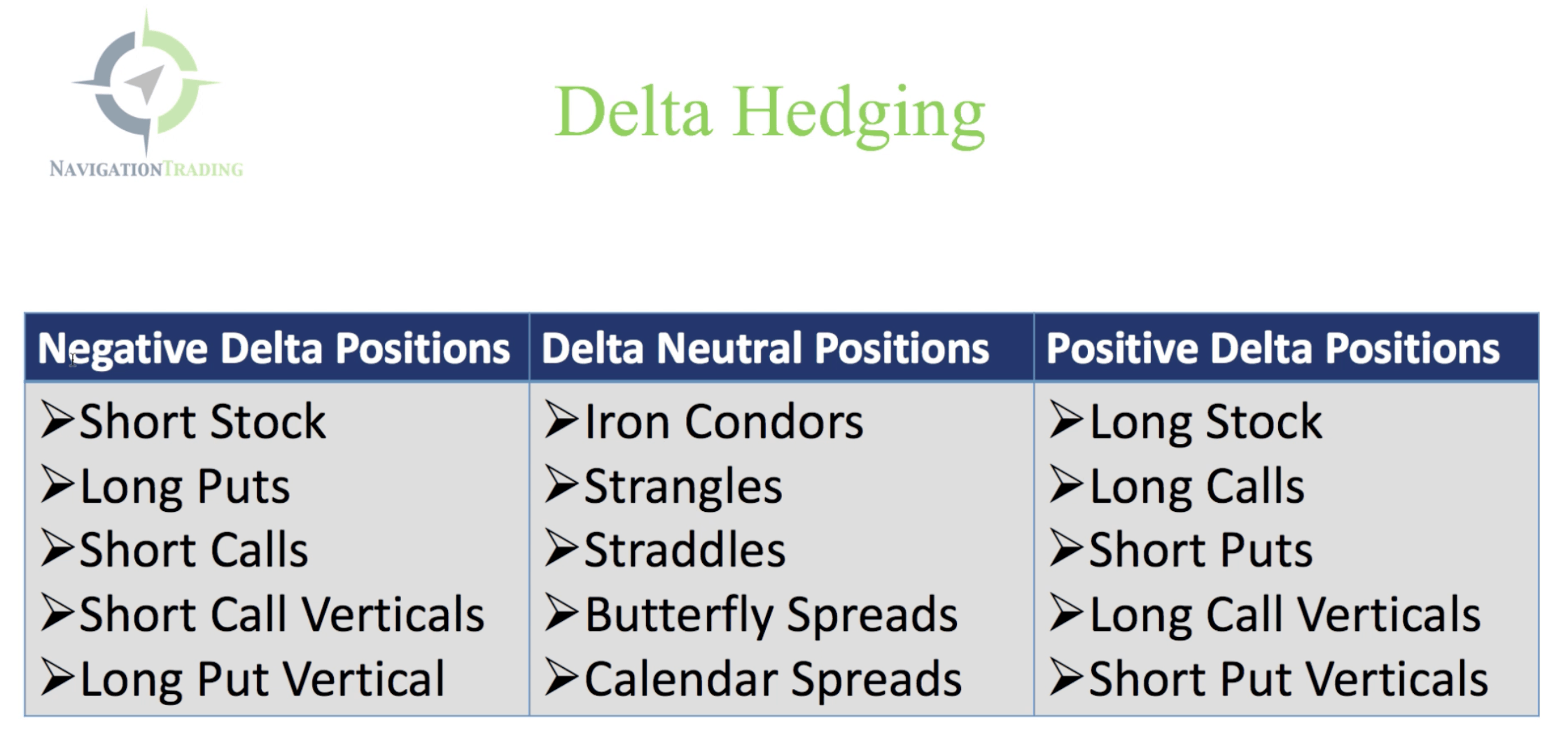

Let’s take a look at some of the different positions and how the delta or direction of these positions is affected.

Delta As A Directional Bias

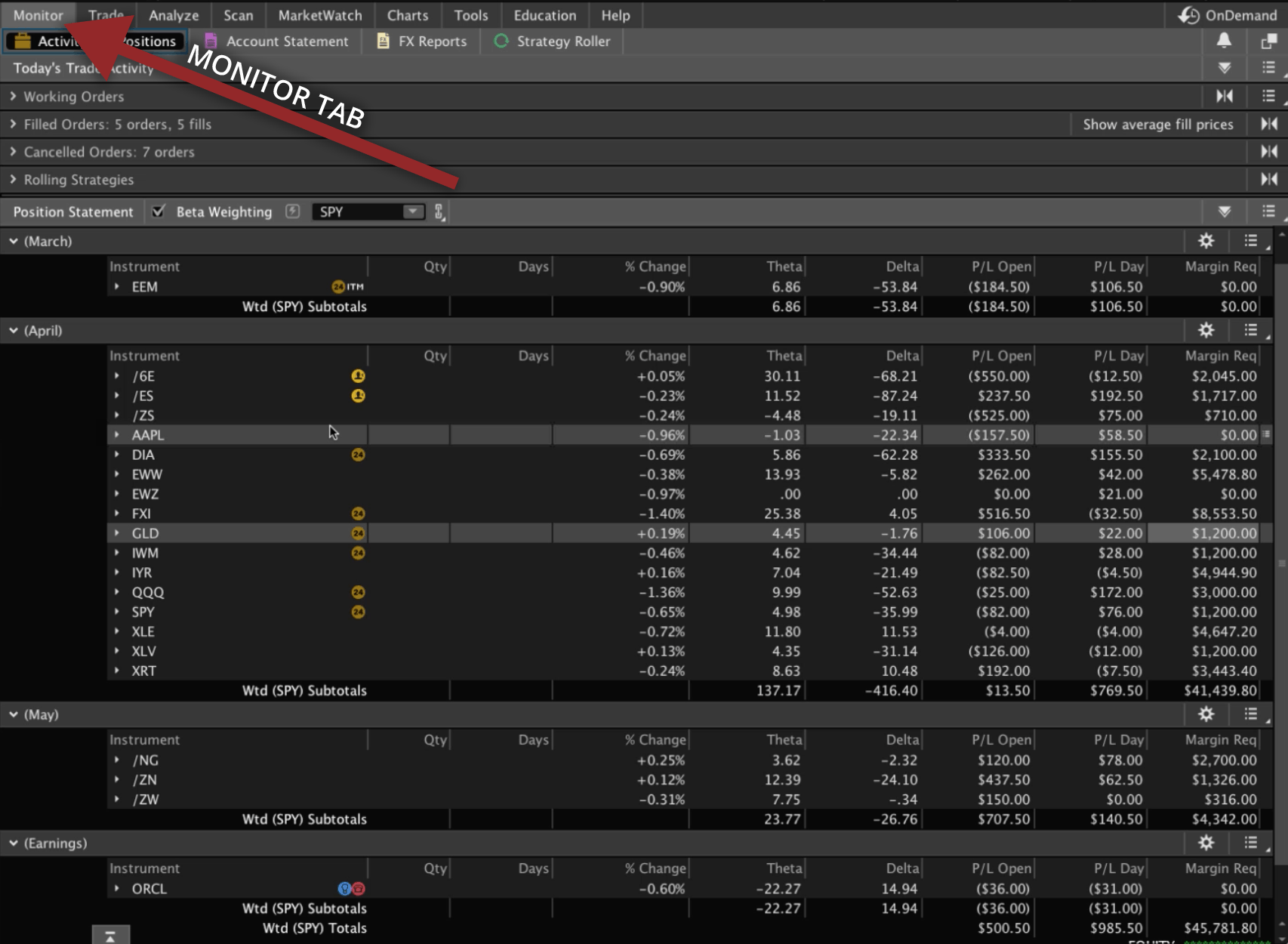

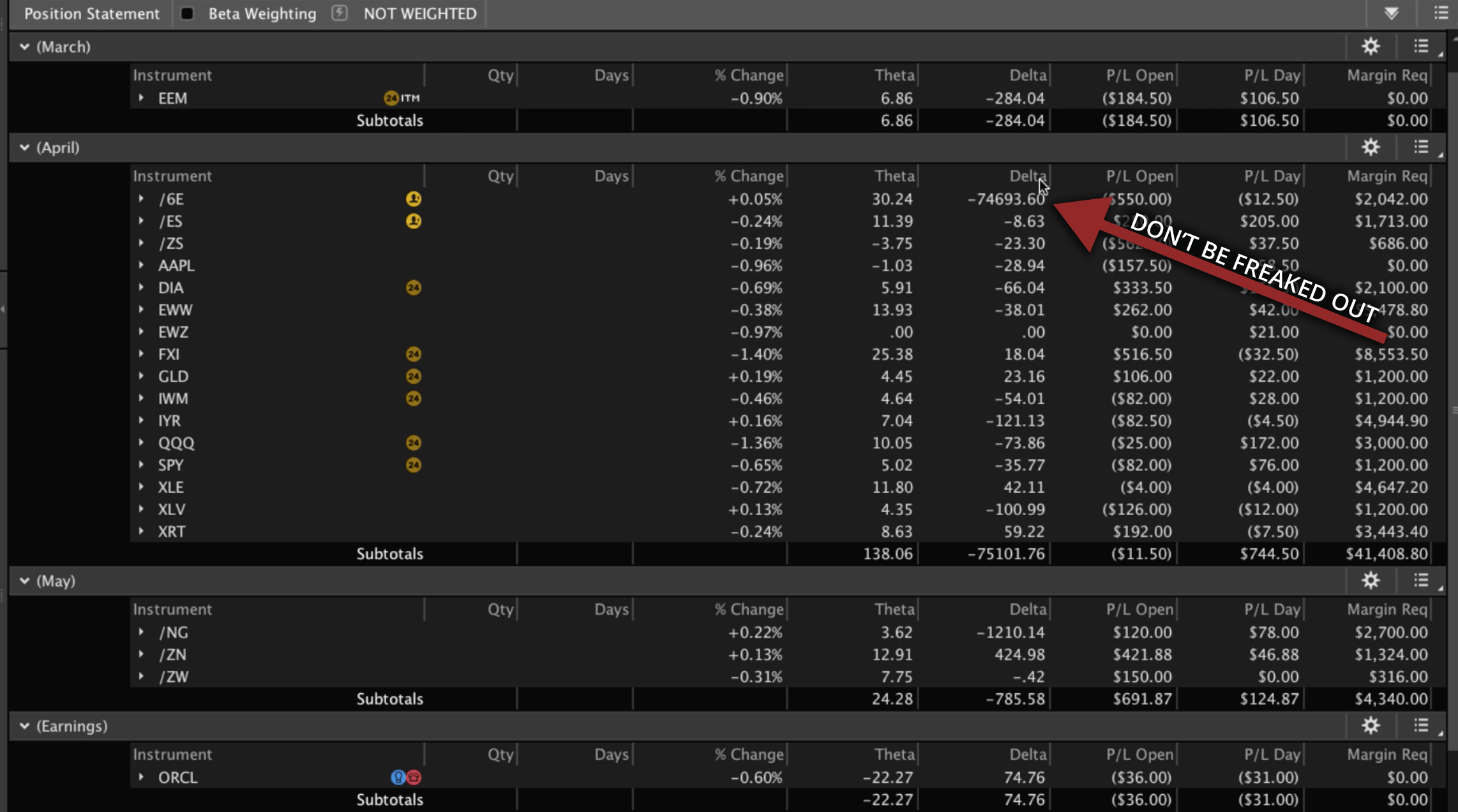

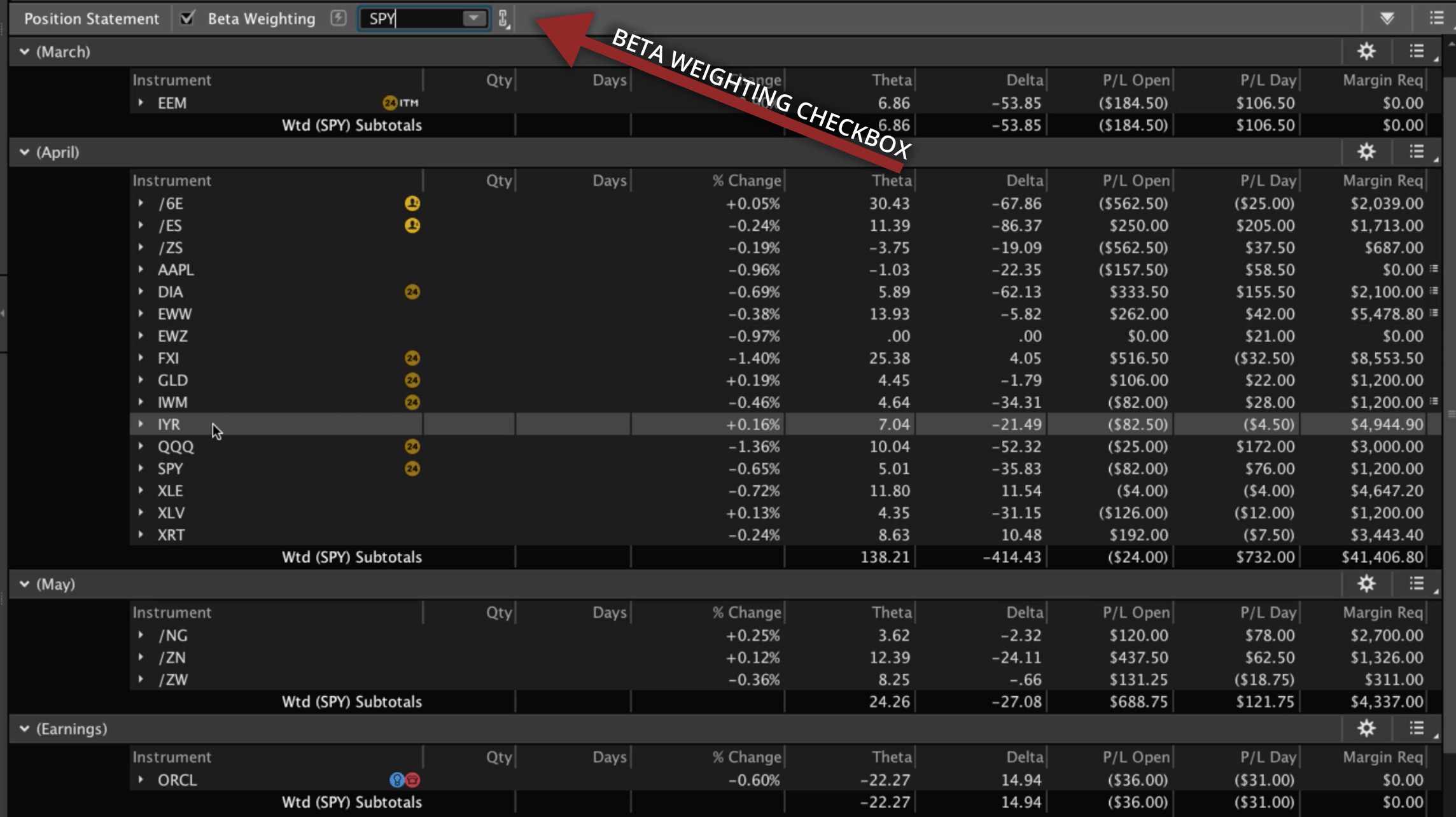

Let’s take a look at the delta of this portfolio. I’m going to uncheck the “Beta Weighting” checkbox before I do anything.

If we take a look at the delta of each position, you’ll see in EEM we’ve got a negative delta of -284. That’s a directional bias. We are short EEM. We want the price of EEM to go down. For every dollar EEM moves down, we would make $284. For every dollar EEM moves up, we would lose $284. That’s the directional bias and what that delta number means.

It works a little bit different on futures so don’t get freaked out by that big number. But you can see the different deltas for each of these positions.

If you’re trading positions like: EEM (an emerging markets ETF), /6E (the euro currency), /ES (the S&P 500), Soybeans, Apple, DIA, EWW (the Mexican ETF), EWZ (the Brazilian ETF), FXI (the Chinese Large-Cap ETF), GLD (gold), IWM (small-caps), IYR (real estate), QQQ (Nasdaq), SPY, XLE (energy), XLV (health care), XRT (Retail), Nat Gas, 10 Year Notes, Wheat, and Oracle stocks, it may seem like the symbols don’t really correlate.

So the question is, how do you use delta to look at your entire portfolio because you’re trading things that are completely different? It’s like comparing apples, oranges, pineapples, bananas, grapefruit, and all these different things.

How do you compare apples to apples when you’re trading so many different and uncorrelated symbols? I’ll show you!

In thinkorswim, you can check the “Beta Weighting” checkbox. We like to beta weight to SPY (the S&P 500). If SPY moves down a dollar, you can see how it effects EEM. Look at the delta, it’s minus 53. We would make $53.

How would that affect the /6E (the euro) if SPY moved down a dollar? We would make $67. If SPY moved up a dollar, we would lose $67.

So that’s how you can use delta and hedge your positions. You can just beta weight your portfolio to SPY, so that you’re comparing apples throughout all your different types of positions.

On the left I’m showing examples of negative delta positions. You can see that short stock is listed.

If you’re shorting a stock, you want that stock to go down. You’d benefit from that stock going down, and so that’s a negative delta position.

Then, there’s long puts. If you buy a put, again, your directional bias is to the downside. If price goes down, your position is going to benefit.

With short call verticals and long put verticals, these are all short bias or negative delta positions.

On the right side, we have positive delta positions. Long stock, long calls, short puts, long call verticals, and short put verticals are long biased or directionally positive bias, so they’re positive delta positions. We benefit when the stock goes up and that’s what makes money on these trades.

In the middle of the chart are some of our core strategies that we teach at NavigationTrading. These are what we call delta neutral positions, meaning we don’t care which direction the stock goes as long as it stays within a specific range.

That would be like iron condors, strangles, straddles, butterfly spreads, and calendar spreads.

When we put these on, price is typically very centered within that range, giving us what we call a delta neutral position.

So again, just think of delta as the direction of your strategy or the directional bias of your portfolio.

Delta Hedging Your Investment Portfolio

Going back to the initial question, how do we hedge our portfolio using delta? How do we delta hedge? You’ve probably heard that term before, “I’m going to delta hedge my portfolio”. How does that work and how do you do it?

Say you have a bunch of long stock, long calls, or short put trades on, and your overall portfolio is long delta (positive delta), meaning the way that you make money is if the market or the underlying stock goes up, but you are nervous that there might be a correction or some downside in the market. What you can do is add in some negative delta positions. Then you can short some stock, or you can buy some puts, or short some calls, and you can add these positions in to help neutralize your delta.

Obviously, you can enter the trades with delta neutral positions like iron condors, strangles, straddles, and so forth.

Those are the ways you can kind of work these different directional bias positions against each other to help neutralize your overall portfolio.

Let’s go to the platform and take a look at a real life example with a current portfolio.

I’m going to go to my “Monitor” tab. I have several different positions on, and they’re categorized by month that they expire.

So I’ve got one position left in March at the time of this recording, I’ve got a bunch of them in April because that’s the main active month in the options, we’ve got a few that are futures out in May, and then we’ve got one in earnings that expires next week.

Trading Position Example

We’ve got -53 delta in March, we’ve got -414 delta in April, -27 in May, and about 15 in Earnings. Just by looking at it super quick, I can see if I add those up, I have about 470 delta. Is that too much? In other words, I have a short bias in the market, so I want my overall portfolio to have short delta, or to have negative delta. Meaning, I benefit if the market moves down.

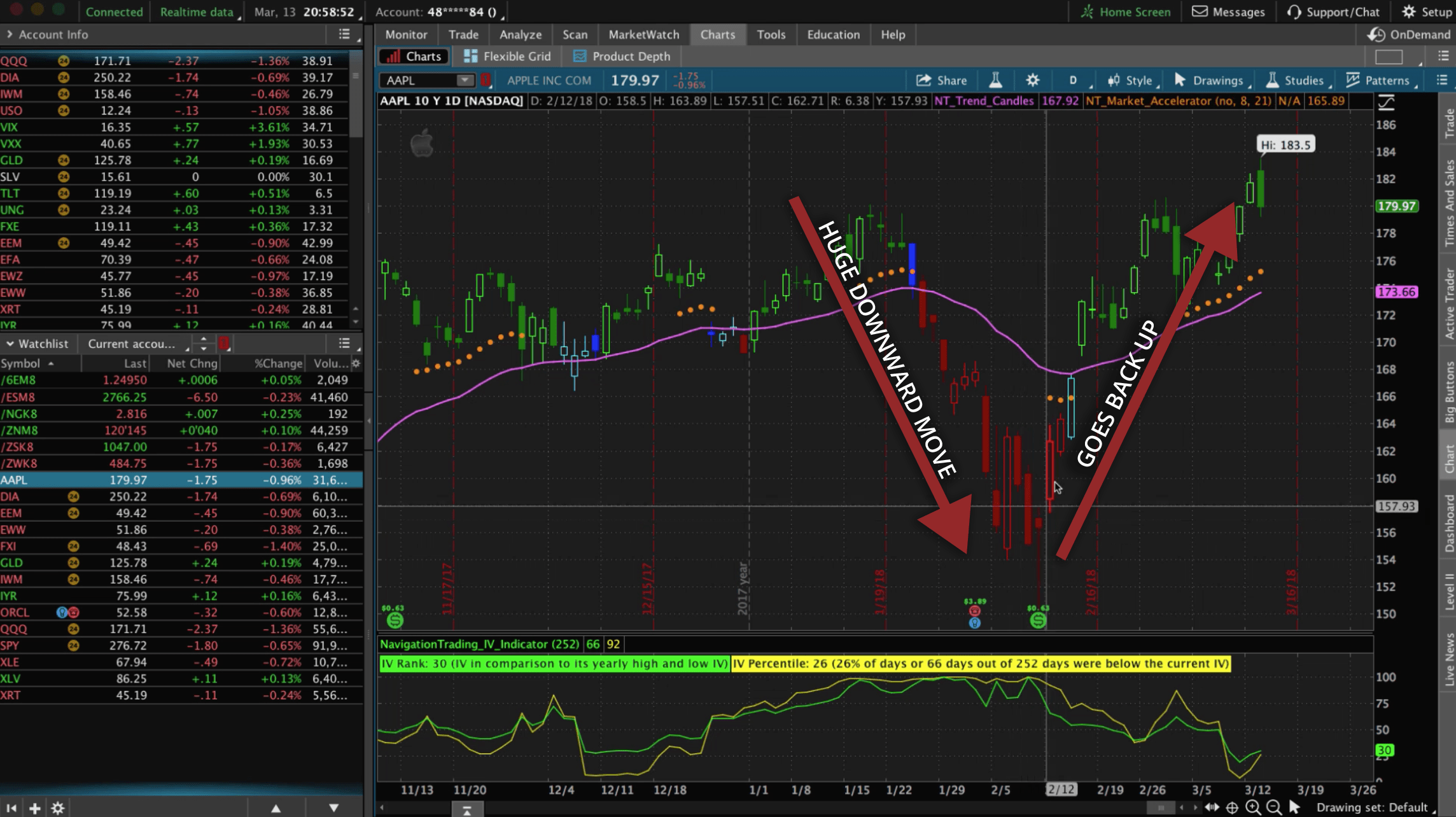

And the reason we have a short bias, is to protect ourselves from the downside when we’re doing these delta neutral strategies, these range bound strategies. If the market starts moving down, sometimes the velocity of a downward move can be much greater than the move of the market going up. We saw that in February at time of this recording, a huge downward move.

The market then continued to go back up. It almost looks like it moved up just as quick, in this case. But, the velocity of a downward move is much quicker and more violent many times than that of an upward move.

You’ve probably heard the phrase “the market takes the stairs up but the elevator down”? That’s why we keep short delta or negative delta in our overall portfolio to protect ourselves from that type of move.

How Much Short Delta Should You Have?

The question is though, how much delta should I have? If I’m biased to the short side, how much delta is enough? That’s kind of the magic question.

There is no right or wrong answer. We don’t want our negative delta to get over four or five times what our overall theta is.

Theta is basically the amount of money that we’ll make each day if price and volatility stayed exactly the same. That’s our time decay. That’s our daily paycheck. That’s how much the options decay on a daily basis.

We’re selling premium and doing different strategies in all these different symbols, and we’re giving ourselves positive theta overall to take advantage of that time decay.

We look at the difference between theta and delta to determine those values.

There’s about 140 theta if we add the totals from each month. We’ve got about 470 negative delta. That delta number is between 3-3.5 times our theta. We have about three and a half times the amount of short delta as we do positive theta, and that’s kind of right in line where we want to be.

If the market has a huge sell off, we’re going to have a lot less short delta, because now the market has moved down and taken away some of that short delta.

If the market continues to climb higher, it’s going to add some short delta. But as long as we stay within that one to one, or one to five times the amount of short delta relative to the theta, that’s how we can measure our portfolio. That’s how we utilize delta to help hedge our portfolio and manage our overall directional risk.

I hope that was helpful! We’ll see you in the next lesson.

Want Our Full Strategy on Trading Options for Income?

If you’d like to learn more about how we’ve taught over 10,000 members how to trade options for consistent income, just go to our site navigationtrading.com, click on the big orange button and we’ll give you immediate access to our flagship course, Trading Options for Income.

We also give you the NavigationTrading Implied Volatility Indicator that you see on our charts, along with the watch list that we use to trade the most profitable symbols day in and day out. All this is yours at no cost. Just go to our site navigationtrading.com, and we look forward to seeing you on the inside.

Follow