Call Option Basics

Check out this short and informative video! If you are new to trading, this video is sure to teach you something!

Happy Trading!

Transcript

Hey everyone, welcome to NavigationTrading’s Call Option Basics lesson! This should be an introductory lesson, meaning that no prior experience or knowledge of options trading is needed. A basic understanding of trading stocks and the markets should be a good foundation to get you started. With many of these lessons, this will provide you a nice basis for you to go back and refer to as you continue to learn and build on the knowledge started here.

What are we going to go through today? We’ll start with the basics. What are call options? How do they work? We’ll go through some key terminology, look at buying a call option versus buying a stock and what that looks like. We’ll look through a profit and loss scenario, take a look at some factors affecting call option prices on the market, and go through some risks and considerations that you should know before getting started in trading stock options and buying call options.

What are call options? For the situations we’ll be looking at today, we’ll be talking about buying a call option. You can always sell a call option based on a certain number of factors, but buying a call option will be more straightforward for a beginner’s understanding. So what is a call option? It’s a contract that gives the holder the right to buy a specified quantity of an underlying asset at a predetermined price within a specified period.

I’ve underlined some of the terms here that are related to the definitions that we should learn. The first one being a financial contract. That relates to the premium. The buyer of an options contract pays a premium for that right that we talked about. The term “paying a premium” comes from this. The premium is going to be influenced by a number of factors… One of ’em is the underlying asset’s current price, its past price, price movements, the volatility of the equity or the stock, and the time to expiration.

The underlying asset: That’s going to be the financial instrument or security on which the stock options value is placed. This could be stocks, commodities, futures, or indices.

The strike price: A predetermined price at which the holder of an option can buy for a call option or sell for a put option for that underlying asset.

The expiration date of that specified period: That’s the date at which the option contract becomes invalid. After which, that option holder loses or no longer holds the right to buy or sell that underlying.

Let’s talk about call options or just buying options instead of buying stocks themselves. With options, we talked about the right for the holder, but not the obligation to buy shares of an underlying asset at a certain strike price. With buying a stock itself, owning stocks and buying them actually involves purchasing shares of the company, which make you a partial owner and give you certain rights for the company, such as voting rights. Also for certain stocks gives you the rights to dividends.

As we talked about, all options have a limited lifespan and that is until the expiration date on the contract. With options, the time horizon of your investment is really up to you. As long as you hold shares in that company and it’s in operation, you remain a partial owner in that company.

Looking at risk and reward and the differences between a call option and stocks… In buying a call option, your risk is limited to the premium paid for the option, but the potential for your reward can be huge, especially if the underlying assets price is going to rise significantly in that time period. We’ll talk about that in the next couple of slides here.

Risk and reward for stock ownership… You sink and swim with the company itself. When the company profits, so do you but if the company goes bankrupt, you are liable for everything that you put up into that stock. Not only is your risk and reward tied to the performance of the company, but also the market conditions themselves.

Why do we use call options? Why are we teaching them today? They provide investors a strategic alternative to taking a traditional long stock position and you can benefit from market movements in a short period of time without that long term commitment.

It is worth pointing out before we go further that each call option, or each option contract, represents one hundred shares of the underlying asset. What does this mean for you as a call option buyer? Well, call options give you more leverage than going long on a stock. That means that you are controlling a larger position with less capital requirement, and it can allow you to capitalize in the swing of 100 shares without buying them outright.

Another advantage of call options would be making a short term play versus a long term investment. In buying call options, this is a common use for them, the short term speculative plays. There isn’t an indefinite time commitment for options as contracts go in daily, weekly, and monthly cycles that allows you for more dynamic decision making. How long do you want to try to make this play for? A day, a week, months? etc. This differs from stock ownership, which obviously implies a long term commitment to the company’s success.

Call options and options themselves… They appeal to more sophisticated investors that are seeking those speculative opportunities we talked about. Investors that want to capitalize on volatility or price fluctuations. That said, mastering options does require a deep understanding of market dynamics, and it’s more suited for more dedicated traders who have had time to see market dynamics play out over time and have invested the time to continue to learn and refine their tactics.

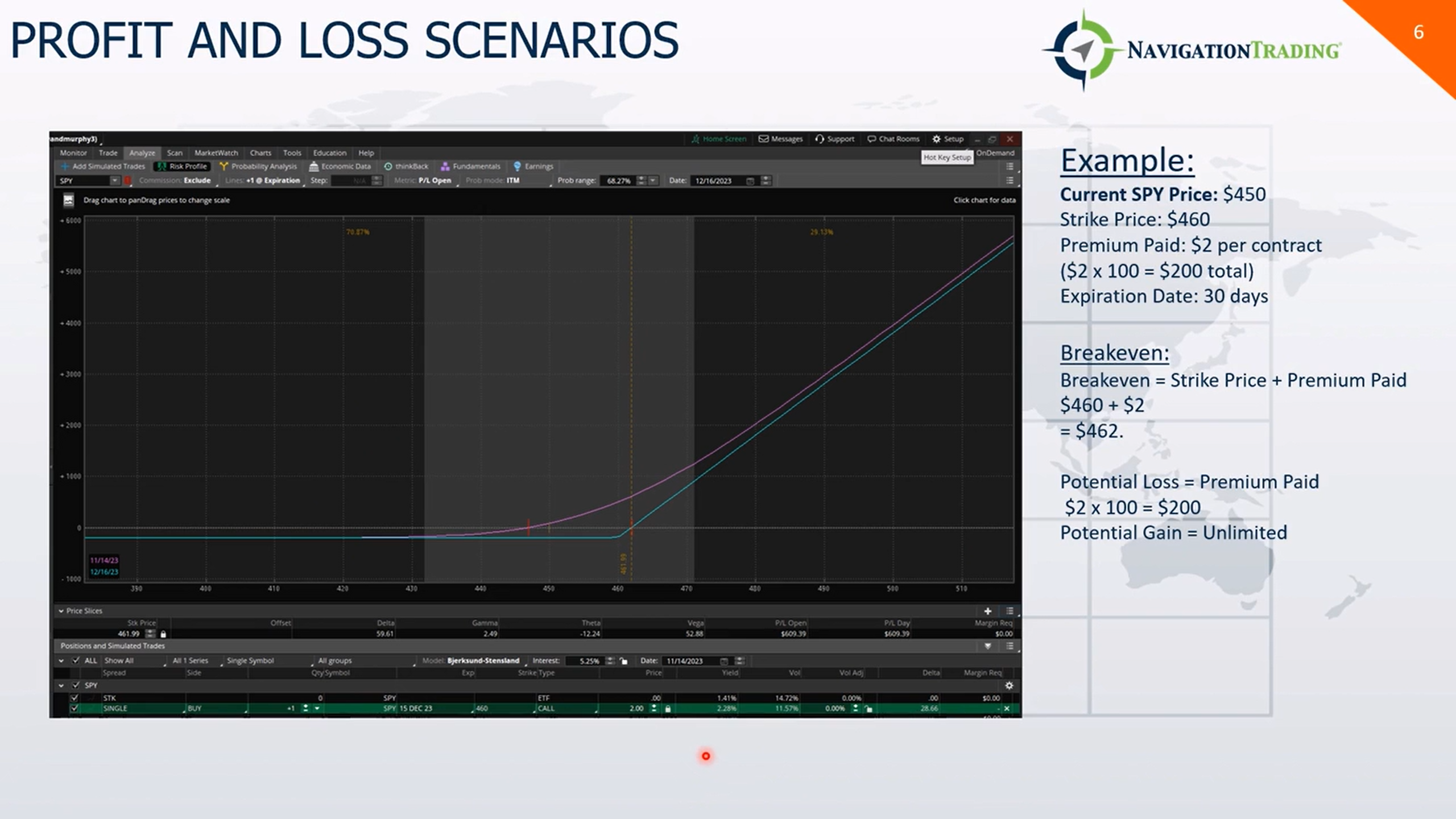

What we’re looking at on the left here is a risk profile graph from the analyze tab in TD Ameritrade’s thinkorswim tool, which we use pretty frequently here at NavigationTrading. This is graphing out the risk profile of buying a call option at a $460 strike price for a $2 premium paid per contract, which comes out to $200 total for a debit for your account. The expiration date is 30 days from today on this graph. The X axis here is plotted out with the SPY trade price, which correlates to strike price, obviously. Profit and loss is on the left denoted in the thousands. This teal line here represents your profit and loss over time. This is looking at once the contract expires on 12-16-2023 and the purple line here represents a graph of the current price at the date of expiration here.

Let’s look at the math on the right before we go back to the chart on the left. So the breakeven price is your strike price plus the premium paid. So 460 plus 2, that’s 462. That’s mapped out here with this dotted line. That is your break even price at the expiration date of the contract, the 16th of December, 2023.

Your potential loss for this contract is equal to the premium paid for the contract. $2 premium times 100 shares, that’s $200 total. You can see that mapped out on the left here with this teal line. However, your potential gain, you can see noted by the teal line going up and to the right, is unlimited and continues to grow by the thousands as your strike price goes up to 470, 480, 490, and at 500, you’d be making about $3,700.

Let’s look at some of the factors that affect call option prices and options in general. First values to look at would be intrinsic value and time value. Intrinsic value is actually going to be the tangible value that an option holds at the current time if you can exercise it profitably. If an options contract has a positive intrinsic value, that means there’s potential profit right away.

In most cases, it’s going to be the difference between the current market price of that underlying stock and the strike price at that moment. Time value is the additional value that’s kind of left over after the intrinsic value and it’s a representation of the probability or likelihood that that option will become profitable before expiration.

Both of these values are important to understand and assess. I think they help you make an informed decision about entering, exiting or holding an options position, and they both help investors kind of figure out if an option is fairly priced, overvalued or undervalued.

Next up is implied volatility, which reflects future price expectation and kind of helps gauge the market’s anticipation of a future price movement either way. It’s also a measurement of the expected level of the fluctuation of the underlying assets price over that options lifespan until expiration. When you see high implied volatility, that’s going to raise option premiums because when IV or implied volatility is high options are perceived as a riskier play. Because of that, investors are willing to pay more for options during times of uncertainty. Looking at IV before you make a decision is going to help you understand the potential profit opportunities and also just overall gauge the market’s perception of risk.

Theta decay… This is important to understand and something that we don’t expect you to grasp right away, but we will continue to build on this in further installments. Theta decay is a measurement of the value of an option’s erosion over time. Theta decay itself is options losing value each day, that is the rate of decay or Theta decay. Theta decay itself accelerates more and more as the expiration approaches and you’ll see that Theta decay accelerates somewhere between the 45 days to expiration and 30 days to expiration. As it goes on, the closer to expiration, the faster that erosion of time value or theta decay is going to happen.

Risks associated with call options. Well, there’s always the market risk, right? You’re looking at SPY in that last case, that’s tied to the, to a broad index of 500 or so different assets and just how the market is doing in general. If you’re buying a call option, you should watch out for economic events, big earnings, announcements, and things like that, that may trip up what your expected move or what you want to see happen.

If the market doesn’t move the way that you want it to, there’s that risk that the options are going to expire worthless and you lose your investment, which is the premium you paid.

Time decay risk and theta decay risk. We talked in the last slide about options losing value over time and theta decay accelerating as expiration nears. You’ll see in the weeks and days before the end of an options contract or the expiration of your contract, if your stock, SPY in this case, is not above the strike price or trending above the strike price, things will be starting to look dismal. Time decay is going to be a risk you’ll need to be aware of when you’re buying call options.

Finally, leverage. We talked about leverage amplifying the potential returns in situations where you buy a call option, because in that situation, you’re looking to take advantage of the move of 100 or hundreds of shares of a stock. As you buy more options, your leverage increases, but your premium you’re paying is also going to increase. You’re risking more in general, the more shares you buy, or the more call options you buy.

Let’s talk about the research and some of the due diligence you should do when you’re looking at buying call options either for stocks, futures, or ETFs, index funds, and the like. The first one might seem to go without saying, but you should have some understanding of that underlying asset. If it’s a stock, look into the company’s financial health, read up on what analysts are saying about it, but do your own due diligence and your own research. Look into their 10K, look into their cash flow statement, figure it out for yourself, but also consider trends in the industry and around that stock and their space that might impact the success of buying a call option and the market conditions.

Looking at market conditions… Look at volatility, look at economic indicators, potential events, earnings for this stock and for similar stocks as many times, the health of a similar company can also kind of tell you where a certain company may go or more importantly, what the market thinks it’s going to do.

A negative earning in a company like Microsoft can have implications on other tech companies and hardware companies, Google, AMD, things like that in that space, right? Especially when you’re dealing with a speculative play on a derivative, right? Options are derivatives of that stock itself so definitely be aware of the space it’s in and the market conditions.

Continue to learn about options pricing and more about the Greeks. Theta we talked about, but there’s also Delta, Gamma, Vega. Go back to the slides about option pricing, but continue to learn about it yourself and apply your knowledge. Start paper trading. Start understanding when and why options are priced the way that they are.

Risk management… There are a ton of risk management strategies in there, but you got to have something that you’re comfortable with. You got to stick to it, right? It is very important for protecting your capital and mitigating potential losses. Don’t risk more than you’re willing to lose.

Position size… One thing with options is that you can position size exactly what you’re willing to risk or to expose you to the risks that you’re willing to take. That’s one of the beautiful things about options so definitely use that to your advantage.

Going through some of the key points here… Flexibility. Call options provide options and give you a strategic approach to say, “I think that this asset is going to do this over a certain period of time and I’m willing to risk X amount over a certain period of time to do that.” With traditional stock ownership, as we talked about, that’s a long term investment and you don’t know how long that’s going to take. Options give you the flexibility of daily, weekly, monthly contracts to make these plays.

Leverage, we talked about this… Amplifying risks and returns. For buying call options, really, it only amplifies your potential returns. Your risks are spelled out in buying a call option, but you can take advantage of the movement of hundreds of shares on a stock for a premium that is defined by option pricing and the market conditions, as we talked about.

Call options provide you that short term play versus a long term investment. This frees up mental capital for you to go and research new options. As your call option may be expiring the next week, you can look at what’s after that, right? You can continue to learn what works for you and try out different things time and time again, versus having your money tied up in a long term investment, like buying stocks.

Finally, understanding what you’re doing comes down to option pricing. You need to grasp those concepts there, intrinsic value, time value, implied volatility, and expected price move for that contract that you have. A lot of those things are shown in thinkorswim and many other trading platforms and research tools, but you need to be able to access those and assess those in order to trade call options effectively.

Closing this out, what are some options for further exploring and learning? In itself, you’ve got to know that the stock market is dynamic in nature. All financial markets are… Things are always changing. You need to dedicate time to continue to learn about strategies, what’s working, what’s not working, and different things that are going to continue to impact the market and the trades you make.

Not only do you have to stay updated on market trends, like we talked about, but continue to learn and build on your ability to make informed decisions about options and the marketplace.

Before you get started, practice with paper trading. Many brokers give you the option to place hypothetical trades and monitor how those trades would perform over time. If you’re using a new broker, a new platform, new software, if you’re trying new approaches, before you commit to using real capital for those options, get comfortable doing it. Get comfortable executing, get comfortable scoping out those trades and do it with less risk at first.

It is important to stay updated on the market trends as a whole. If you start to get into certain strategies, don’t have blinders on. Continue to stay informed with what’s happening with different markets in different parts of the world, indices, specific stocks, specific sectors, and just continue to dedicate that time to stay updated!

Follow