Hey Everyone!

Welcome to another lesson from NavigationTrading!

In this video, I want to talk to you about the debate of buying vs. selling options. We’re going to debate this by doing a couple of back-tested studies.

This blog post isn’t my opinion of what I think is better. These studies are raw data, numbers, statistics, and back-tested data going back five years.

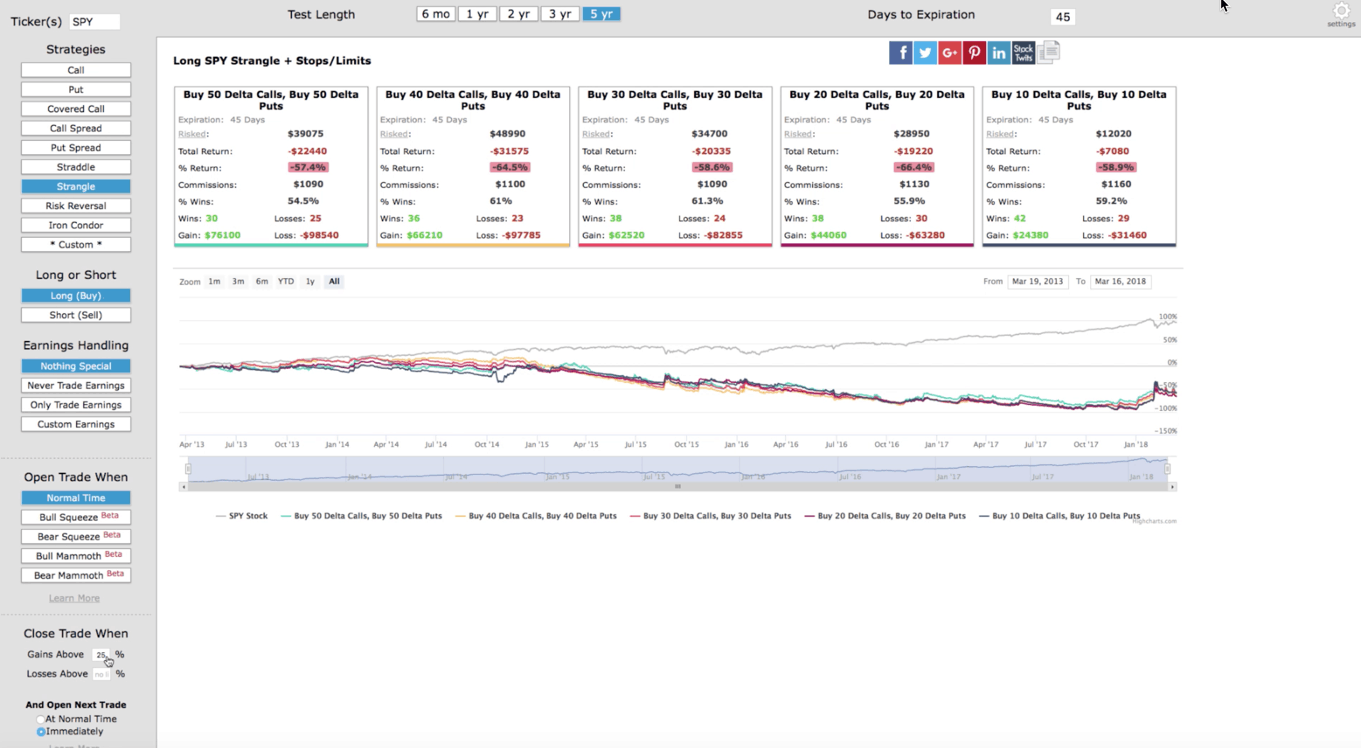

In our first back-tested study, we’re taking a look at SPY (SPY 500 Index). We utilize SPY because we don’t want to use an individual stock. If we did that, we’d have to take into consideration earnings announcements, dividends etc. We’re looking at a broad-based ETF. SPY is the most liquid ETF out there.

We’ll be looking at 5 years of back-tested data. In this first study, we’re going to buy both calls and puts. We’re not looking to get directional, because obviously, in a bull market, the bullish strategies would perform better. In a bear market, the bearish strategies would perform better. We want to enter these trades as a delta neutral strategy. That way we can see which is better, buying options or selling options. So, we’re going to buy both sides.

We’re going to look at several different option deltas. We’re looking at the 50, 40, 30, 20 and 10. We’re going buy both a 50 delta on the call and put. We’re going to buy the 40 delta calls and the 40 delta puts, the 30 delta calls and puts, the 20 delta calls and puts, and the 10 delta calls and puts.

We’re entering the trade with 45 days left to expiration, or the closest to 45 days to expiration. We’re going to close the trade out when it reaches a profit of 25% of the debit paid, or expiration, whichever comes first.

If the trade makes a profit of 25%, we’re going to take the trade off, or if it never reaches that profit target and it expires, we’re going to take that into consideration.

Lastly, we’re going to enter a new trade immediately after the trade closes. If a trade hits that 25% of profit, we’re out of that trade. We’re immediately going to put on a delta neutral trade after that trade closes.

Now in back test number two, we’re basically going to do the exact opposite. We’re still using SPY and looking at five years of data.

But in this case, we are going to sell both the calls and the puts, using the exact same deltas of 50, 40, 30, 20 and 10. The timeframe is the same, 45 days to expiration. The way we manage our winners is the same.

We’re going to close our winners at 25% of the initial credit received, or at expiration, whichever comes first. Then we’re going to enter a new trade immediately after a trade closes.

Let’s go to the Option Strategy Backtester and take a look.

Focusing on the left hand side of the Options Strategy Backtester, you can see we’re looking at SPY. Under “Strategies”, we’re doing a Strangle, or in this case, a Straddle as well. Where it says “Long or Short”, we’re buying. There’s obviously no earnings because this is an ETF.

We’re going to open the trade “Normal Time” and we’re going to book profits with gains above 25% or expiration, whichever comes first. We’re going to open the next trade immediately. So, as soon as one closes, we’re immediately going to open a new trade.

At the top of the backtester, you can see we’re looking at five years of back tested data, and the days to expiration is 45 days.

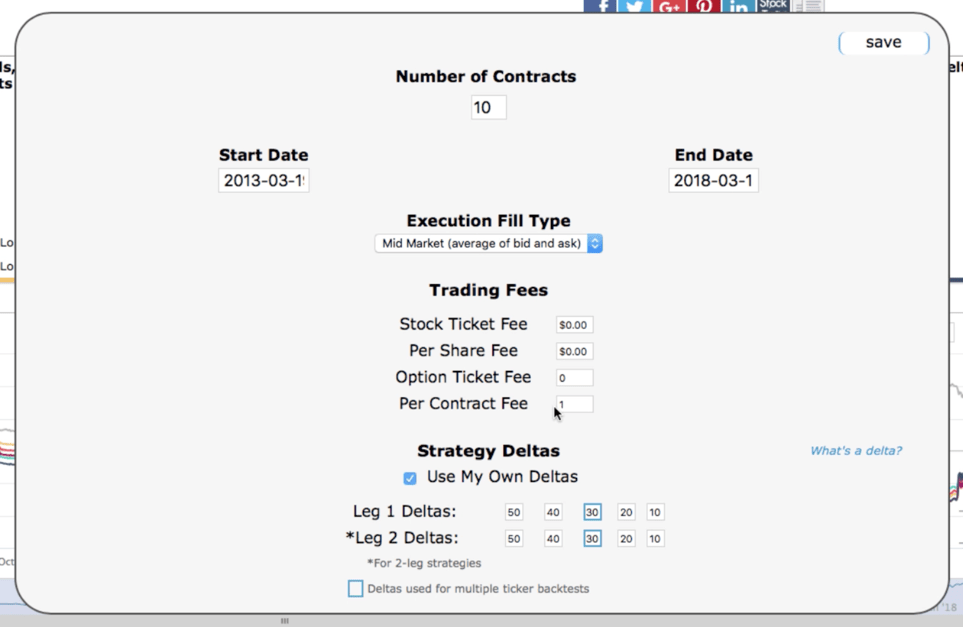

If we open up our settings, I’m looking at the example of using 10 contracts per trade. We’re looking at a commission of $1 per trade, because that’s the amount that we can get our members at ThinkorSwim. Tastytrade has no closing commissions, but we’re looking at $1 to open and $1 to close.

As I mentioned, we’re looking at the deltas of 50, 40, 30, 20, and 10, both on the calls and the puts.

You can see, buying options in this way is a loser across the board.

If you look at the 50 delta calls and 50 delta puts, you’re essentially buying a straddle. Over five years, you have a win percentage of just over 54%, which is a little surprising. Before I did this study, I thought that it would be a little lower than that. That equates to the 30 wins and 25 losses. Looking at the 40 delta calls and 40 delta puts, again, a loser over five years with a 61% winning rate.

The 30 delta calls and puts, again, a loser with percent wins. A little over 61%, but still not profitable. The 20 delta calls and puts, over 66% loss over this period. A little over almost 56% win rate, but losing proposition overall. Same story with the 10 deltas. A losing proposition with a win percentage just over 59%.

Now let’s look at the opposite study on the Option Strategy Backtester. Remember, we’re changing from buying these options to selling them. Everything else is staying exactly the same.

On the left sidebar of the backtester, click on the “Sell” option under “Long or Short”.

On both the put and the call side, we’ve got a profit of about 103% with a win rate of 80%. We’ve got 52 wins and only 13 losses. So obviously, a very profitable trading strategy.

Going down the line with the 40 delta puts, 40 delta calls, you can see a total return of now 179%. Win rate of over 84%, giving you 64 wins and 12 losses.

With the 30 delta, there’s a total return of 141%. The win rate is even higher at 89.1%. 82 wins and only 10 losses.

If you look at the 20 delta calls and puts, this is our wheelhouse where we sell premium. In this case, we’re looking at 109% return with over a 90% win rate. 100 wins and only 10 losses for the 20 delta.

The interesting thing about this, is when you put on a 20 delta Strangle and you sell a 20 delta Strangle, your probability of profit when you initiate that trade is over 60%. This is if you were to hold it all the way to expiration.

You’ve got 20% probability of being in-the-money on the call side. And, 20% on the put side.

That’s a total of 40. So, you take the inverse of that, and that’s about a 60% probability of success. But, look at the win rate…it’s over 90%.

There’s a couple key things to understand about why that is.

- We are managing trades at 25% of max profit. We are not holding all the way to expiration, so of course you’re going to have a higher win rate.

- Implied Volatility is overstated almost 85% of the time. The majority of time, fear is overstated. Uncertainty is overstated, and that’s why selling options works. I talk about this all the time at NavigationTrading, and that is why selling options versus buying is such a huge factor.

You can see, as you go down the line, if you’re selling the 10 delta calls and puts, it’s still over an 85% win rate. The profits are less, but the win rate is 131 wins with just 6 losses.

Just to recap, selling options significantly outperforms buying options. At NavigationTrading, we talk a lot about selling options in periods of high implied volatility. The one thing I want to note, is that in this study, no implied volatility filter was used. We were selling options and buying options, whether implied volatility was high or low. We were putting on the trade no matter what, but you can see that selling options significantly outperforms buying options.

If we were selling options only in periods of high implied volatility, then the performance would have improved even further for selling options. This is the power of using statistical data to show and prove different concepts and different trading strategies. We used the CML Backtester. You can get the CML Backtester to do your own studies. You really owe it to yourself to do this research and statistical data mining to understand the concept behind the strategies that you’re trading.

I hope this was helpful, we’ll talk to you next time!

tastytrade, Inc. (“tastytrade”) was previously known as tastyworks, Inc.

Follow